Northwest Biotherapeutics: Blinded Data from Phase 3 Trial Strongly Suggests that DCVax-L is a Major Advance in the Treatment of Newly Diagnosed Glioblastoma Multiforme; It Looks Like NWBO Has Hit a Therapeutic and Commercial Home Run (NWBO, Buy, $0.25)

Investment Hypothesis on Dendritic Cell Cancer Vaccines

I have no academic background in immunology so that you should take that into account as you read this hypothesis. You must recognize that mine is the view of a layman. That said, here is my hypothesis on the potentially breakthrough role for DCVax-L and dendritic cell cancer vaccines to follow in the treatment of many types of cancer.

As a very brief background, the immune system uses two powerful weapons to naturally defend against cancer. B-cells produce antibodies that are specifically targeted at an antigen that appears on cancer cells. The antibodies hone in on, attach to and initiate an attack on the cancer cell in combination with other cells of the immune system. The immune system also uses killer T-cells that hone in on an antigen on cancer cells allowing the T-cell to attach to the cancer cell and produce proteins which attack the cancer cell.

Monoclonal antibodies have been used extensively as anti-cancer drugs starting with the development of Rituxan in 1978; they target one specific antigen on a tumor. Numerous drugs based on monoclonal antibodies are now mainstays of many cancer therapies. However, attempts to enhance or mimic the T-cell response to cancer were less successful until the development of checkpoint inhibitors that started with the introduction of Yervoy in 2011. Cancer cells often develop mechanisms to turn off the activity of naturally occurring T-cells effectively putting the brakes on T-cell responses. Checkpoint inhibitors are antibodies that target specific molecules on T-cells and allows the restoration of the function of natural T-cells (takes the brakes off). Since 2011, annual worldwide sales of checkpoint inhibitors have soared and now exceed $9 billion.

In 2017, the CAR-T products Kymriah and Yescarta were approved. These are T-cells that have been genetically engineered to express a molecule (receptor) on their surface that like an antibody directs the T-cell to a cancer expressing a particular antigen. These are made by removing T-cells from the body, engineering a surface receptor ex vivo and then returning it to the body. These products are just in their introductory stage and have minimal sales. However, the two leading small biotechnology companies involved in CAR-T research were recently acquired even before they recorded any product sales: Gilead paid $10 billion for Kite and Celgene paid $9 billion for Juno.

I believe that Northwest has come up with a breakthrough technology in immune-oncology with its dendritic cell cancer vaccine. In the body, dendritic cells are a critical part of the first line of immune response as they recognize cancer cells and essentially eat and digest them into individual molecules. They then display on their surface antigens from the cancer cell which causes the body to produce multiple types of different T-cells and B-cells that attack multiple antigens on cancer cells. This is the natural way that the body fights cancer. However, cancer cells can blunt this immune response.

Northwest’s cancer vaccines are designed to restore and enhance the role of dendritic cells. The process starts with obtaining monocytes from a patient through a blood draw. These are progenitor cells that differentiate and mature into dendritic cells. Outside the body, differentiation of monocytes results in newly created dendritic cells which are exposed to tumor tissue obtained from a patient during surgery. These dendritic cells ingest cancer cells and display multiple cancer antigens. They are then returned to the body and reinvigorate the immune response to the cancer.

To me, this is an elegant, powerful and more promising approach than checkpoint inhibitors and CAR-T cells. Each cancer differs from patient to patient and even within a patient there may be different types of tumors. DCVax-L is essentially a shotgun against cancer while CAR-T cells and monoclonal antibodies are rifles. Here is how one of the lead investigators in the phase 3 trial, Dr. Keyoumers Ashkan, sees this. Dr. Ashkan is the clinical lead for neuro-oncology at King's College Hospital in the UK. He has an active research interest in brain tumors and movement disorders and heads the Neuroscience Clinical Trial Unit. Dr. Ashkan is one of the most respected neurosurgeons in the UK and Kings College is the premier teaching hospital in the UK. For more information on Dr. Ashkan, click on this link. You might also want to refer to my January 9, 2018 report “Two Lead Investigators on DCVax-L Phase 3 Trial Believe That It Could be a Major Therapeutic Advance in Treating Glioblastoma Multiforme”

Dr. Ashkan believes that immunotherapy is the way forward in the treatment of brain tumors. He believes that DCVax-L may be an important advance in the treatment of brain tumors. He says that there is nothing more clever than the ability of the immune system to cope with variation. He goes on to say that brain tumors are notoriously hard to treat because they are extremely heterogeneous. Because of rapid mutations that characterize GBM, no tumor in one individual is the same as a tumor in another person. Indeed, the mutations in one part of a tumor in the same person may make it a different type of cancer from another part. He is very hopeful about DCVax-L because it picks up the several antigens specific to each patient’s tumor. It them primes the immune system to attack the cancer cells characterized by these different mutations.

Here is what Dr. Ashkan had to say about the newly published results from the DCVax-L phase 3 trial.

“The interim results of this phase 3 trial give new hope to the patients and clinicians battling with this terrible disease. Although definitive judgment needs to be reserved until the final data is available, the paper published today hints at a major breakthrough in the treatment of patients with glioblastoma.”

Theoretical physics is highly predictive of outcomes but because of the staggering complexity of the human body this is less the case with theoretical biology. Hence, it is necessary to be skeptical and to demand data from clinical trials to support a hypothesis. With the release of interim data from the phase 3 trial of DCVax-L we now have the first strong evidence (not yet conclusive) that dendritic cell vaccines not only work but may be a major breakthrough. Investigators and key opinion leaders involved in the phase 3 trial and who authored the manuscript that is the subject of this paper are now saying that DCVax-L may be a major breakthrough in the treatment of glioblastoma multiforme. I think that in coming weeks, months and years we will see more and more excitement about DCVax-L in particular and dendritic cell cancer vaccines in general.

Here is my hypothesis. Dendritic cell cancer vaccines more closely approximate nature’s way of combatting cancers than either checkpoint inhibitors or CAR-T cells. I think that dendritic cell cancer vaccines are more promising than CAR-T drugs and could be more promising than checkpoint inhibitors. This is a pretty heady statement from a layman, but I am just calling it as I see it. If I am only a wee bit right, Northwest Biotherapeutics has an incredible future. Now on to a discussion of the manuscript.

Manuscript on Interim, Blinded Data from Phase 3 Trial Is Published

Northwest Biotherapeutics has just put out a press release discussing interim, blinded results from the phase 3 trial of DCVax-L in newly diagnosed glioblastoma multiforme. The data presented in this manuscript was as of March 2017. Hopefully, we may see another update sometime in 2018 although management has made no comment on this that I am aware of. This press release summarizes data from a peer reviewed article in the Journal of Translational Medicine which was co-authored by 69 clinical investigators involved in the trial. The interpretation of the data as presented in the press release is that of the authors who are experts in the treatment of glioblastoma are.

I have just received and scanned for the first time a copy of the manuscript and based on this and the summary of data in the press release, I have put together my initial observations. Bear in mind that I have been anticipating the publication of this article for over six months. I was prepared for the release of this manuscript and I have previously published reports in anticipation of this data in order to put results in perspective. Much of the text in this note comes from my January 4, 2018 report “Issues to Focus on in Pending Manuscript Dealing with Blinded Data from Phase 3 Trial of DCVax-L in Newly Diagnosed Glioblastoma.” You might want to take a look at this report before going farther. I wanted to publish a quick interpretation of the data in this note. As I have time to go through the manuscript in more detail, I will likely publish additional reports on specific issues.

Results for Median Overall Survival Are Extremely Encouraging

The blinded analysis performed for all 331 patients enrolled in the trial showed median overall survival (mOS) of 23.1 months from time of surgery. The manuscript states that the 23.1 months compares favorably “with the mOS of 15-17 months from surgery typically achieved with standard of care (SOC) in past studies and clinical practice.”

Let me add further perspective. Of the 331 patients, 232 were initially given DCVax-L and 99 were given standard of care (SOC). The trial protocol allowed patients who progressed on SOC to receive DCVax-L. In the manuscript, it stated that 86.4% of patients (286) in the trial were shipped DCVax-L. From this we can infer that of the 99 SOC patients, probably 54 were switched to DCVax-L when their cancer progressed. We know the median overall survival for the 331 patients was 23.1 months. We don’t know what mOS was in the 232 patients initially given DCVax-L plus SOC nor in the 99 patients initially given SOC. For the latter group, it might be the case that DCVax-L increased survival over the expected 15.0 to 17.0 months.

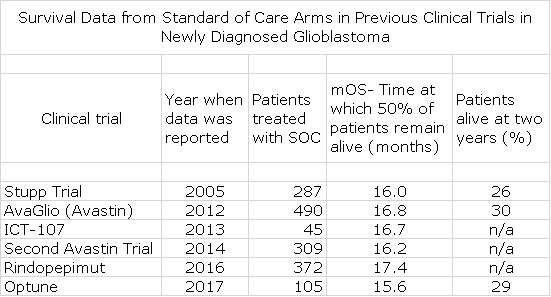

The next table looks at mOS for the SOC control arm in six randomized trials in GBM for perspective.

The above table indicates that mOS for these six trials showed a tight range of 16 to 17 months. However, the DCVax-L trial measures survival from the time of surgery while the Stupp, Avastin trials, rindopepimut and Optune are measured from the time of randomization. In the case of the DCVax-L, the time from surgery to randomization was 3.1 months. This time from surgery to randomization was not reported for the other trials, although in the case of Stupp, one key opinion leader suggested that it was a few weeks. This makes an “apples to apples” comparison between the DCVax-L trial and the other six randomized trials more diffficult. If it was the case in all of the above trials that the time between surgery and randomization was 3.1 months as in the case of the DCVax-L trial, the mOS from time of surgery would be 19 to 20 months. Remember that the authors in the manuscript clearly state that the mOS for SOC from time of surgery is 15 to 17 months month based on historical data and clinical experience. At this point, I can’t resolve the difference.

Based on the manuscript, the difference between the mOS for DCVax-L and SOC is 6 to 8 months. The adjustment I made in the above tables would suggest a lesser but still highly impressive 3 to 4 months. I would also remind you that this data is for all 331 patients. Unless there was a never before seen substantial improvement in mOS for the 99 patient SOC group, the mOS for the 232 patients randomized to DCVax-L would almost certainly be higher than 23.1 months.

What is the Regulatory and Therapeutic Importance of a 3, 4, 5, 6 or 8 Month Improvement in mOS?

To put this potential 3, 4, 6 or 8 month improvement in mOS in perspective, the chemotherapy drug temozolomide was approved and became part of SOC based on a 2.5 month improvement in mOS. If upon unblinding of the data, DCVax-L is indeed shown to result in a 3 months or greater improvement in mOS, it would seem highly liklely that it would become part of standard of care for treating newly diagnosed, surgically resected glioblastoma patients. It is estimated that each year in the US, there are 11,000 newly diagnosed glioblastoma multiforme patients.

In dealing with aggressive cancers like newly diagnosed gliobllastoma, key opinion leaders generally consider a 4 month improvement in mOS to be a significant therapeutic advance and 8 months to be a makor breaktrough. However, this rule relates to traditonal cancer therapies. Immunotherapy is viewed somewhat differently. These therapies have been seen to provide a long term survival tail and this has excited oncologists. While the suggested improevemnt in mOS of DCVax-L is impressive, its suggested long term survival tail is extremely impressive.

Very Importantly, There appears to be an Extremely Impressive Long Term Survival Tail

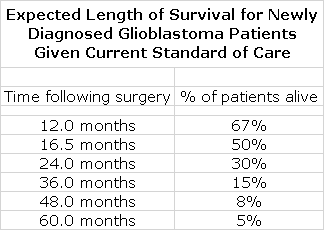

The press release and manuscript also focused on a long survival tail. The top 100 patients (30%) of the total 331 patients in the trial showed particularly extended survival, with median survival of 40.5 months from surgery. To put this in perspective, I estimate that at 36 months, only 15% of newly diagnosed GBM patients treated with SOC are alive and at 48 months only 8% are alive. Extrapolating between 36 and 48 months suggests that only 12% of patients treated with SOC would be expected to be alive at 40 months.

I have out together a table showing expected length of survival for newly diagnosed glioblastoma patients given SOC. See my report of January 4, 2018 “Issues to Focus on in Pending Manuscript Dealing with Blinded Data from Phase 3 Trial of DCVax-L in Newly Diagnosed Glioblastoma” for details on how this table was put together.

A long survival tail in certain cancers was the reason for the medical and investor excitement with the checkpoint inhibitors, the two leading products being Opdivo and Keytruda. The ultimate survival tail for DCVax-L could likely be the most important data point in the trial from a regulatory, medical and commercial standpoint.

Again let me try to put this survival tail in perspective by looking at results for the checkpoint inhibitor Opdivo in the CHECKMATE-017 and CHECKMATE-057 trials in second line, non-small cell lung cancer. The results in non-small cell lung cancer so far appear to have been the best of any cancer treated with Opdivo. Obviously, newly diagnosed glioblastoma and advanced non-small cell lung cancer are very different but they are similar in that both are very aggressive cancers. The data indicates that 15% of newly diagnosed glioblastoma patients are alive at three years post-surgery. The non-small cell lung cancer patients in CM-017 and CM- had been previously treated with surgery and chemotherapy and relapsed. Then Opdivo was started and from that time point survival was calculated and at the end of three years roughly 10% of these patients were alive.

Here is a summary of the results in CHECKMATE-017 and CHECKMATE-057.

- CM-017 enrolled patients with squamous NSCLC: 16% of Opdivo patients were alive at three years (21/135) versus 6% on docetaxel (8/137) (HR 0.62). Put another way, out of every 100 patients treated, 10 more Opdivo patients would be expected to be alive at three years than if they were treated with docetaxel.

- CM-057 enrolled patients with non-squamous NSCLC: 18% of Opdivo patients were alive at three years (49/292) versus 9% of docetaxel patients (26/290) (HR 0.73). Out of every 100 patients treated, 9 more Opdivo patients would be expected to be alive at three years than if they were treated with docetaxel.

With all of the caveats listed above, the 30% survival rate for the 331 patients in the DCVax-L phase 3 trial at three and one third years versus an expected 12% for SOC compares extremely favorably to Opdivo. It indicates that out of every 100 patients treated with DCVax-L 18 more DCVax-L patients would be expected to be alive than if they were treated with SOC.

Again, I assume that these results were driven by DCVax-L because as many as 86.4% of the 331 patients received DCVax-L at some point in the trial. It is the long survival tail that has caused such great excitement with the checkpoint inhibitors Opdivo and Keytruda. It is exciting that this data suggests that DCVax-L displays an (even more) impressive survival curve although we must await the unblinding of the data to be certain that DCVax-L has such survival curve, but I am highly confident that this will prove to be the case.

The manuscript says that this extended survival was not fully explained by known prognostic factors such as age younger than 50 years, methylated MGMT gene status and complete resection (surgical removal) of all of the tumor. Only 8% of these 100 patients had the favorable status on all 3 of these prognostic factors.

Side Effects of DCVax-L are Amazingly Benign

There were well over 2,000 administrations of DCVax-L in the trial. It showed an excellent safety profile as only 7 or 2.1% of patients in the trial reported grade 3 or 4 adverse events. There were 3 cases of cerebral edema, 2 seizures, I nausea and 1 lymph gland infection. It is important to understand that GBM is a rapidly growing tumor in the confined space of a skull. As it expands, it begins to infringe on normal brain tissue so that 5 cases of cerebral edema and seizures might be attributable to the cancer. Non serious side effects that probably were attributable to DCVax-L were injection site reactions, fatigue, low grade fever and night chills. The authors of the manuscript said that the rate of serious adverse events of DCVax-L plus SOC was comparable to SOC alone. DCVax-L looks to be a cancer drug with placebo like side effects.

Comparing DCVax-L to the CAR-T Products Kymriah and Yescarta

In order to frame the commercial potential of DCVax-L, let’s look at the CAR-T products, Kymriah and Yescarta, which address relapsed/ refractory B-cell based hematological cancers; DCVax-L addresses the solid tumor glioblastoma. These are very different tumors but they are similar in that they are very aggressive cancers so that patients have short life expectancies. We can use CAR-T pricing to estimate the price that DCVax-L can justify in the market. The discounted (from list) price of the CAR-T products, Kymriah and Yescarta, is about $325,000 per treatment. The CAR-T products are given as a single injection while DCVax-L is a series of injections. We don’t know if NWBO will price each injection separately or charge a lump sum for all injections, but just for illustration let’s assume the ultimate price per patient is $250,000.

The addressable market comprised of 11,000 patients in the US and using a price of $250,000 would be $2.8 billion; Europe and the rest of the world would be a similar $2.8 billion. Hence, the addressable worldwide market would be $5.6 billion. I would expect rapid penetration and very high penetration rates of greater than 50% in a few years, but even at 50% peak penetration, worldwide sales of DCVax-L would be $2.8 billion. Unlike the CAR-T products where Novartis and Gilead are going head to head with essentially the same product and Juno and a score of other companies are also developing a similar product, DC-Vax-L would have no competitors. Also, the r/r DLBCL and r/r pediatric ALL markets which Kymriah and Yescarta now address has a lesser 7,000 or so patients in the US versus 11,000 for newly diagnosed GBM. I focus on the CAR-T products because this was the primary reason that Gilead acquired Kite for $10 billion and Celgene acquired Juno for $9 billion. If I am correct, DCVax-L has significantly greater sales potential than Kymriah and Yescarta combined.

While we are on the subject of CAR-T, it is informative to look at the phase 2 ZUMA-1 trial that was the basis for approval of Yescarta. This was a trial that enrolled 51 patients with r/r DLBCL and 21 with either r/ r PMBCL or tFL. The end point of the trial was objective response rate or how much the tumor shrinks. There was no control group; the results were compared to a retrospective analysis of other studies that suggested that this type of patient had a median life expectancy of 6 to 7 months. The percentage of CRs for r/r DLBCL was 31% and for r/r PMBCL was 50%. There was little information on how durable the responses were then or now. I have not yet seen mOS for this trial in order to assess the degree extension of life. For a more in-depth discussion of ZUMA-1 see my March 5, 2017 report Analysis of Six Month Data from ZUMA-1 That Led to 40% Price Increase.

The DCVax-L trial will have information on 232 patients who were initially given DCVax-L and on as many as 54 patients who were started on SOC and then received DCVax-L if their cancer progressed. The trial has been ongoing for a decade which gives an unprecedented insight into lone term survival that I have never seen. At the time this data was collected the last patient had been treated over two years before and the median patient had been xx months.

The phase 3 trial of DCVax-L is much more data rich than the ZUMA-1 trial that resulted in Yes carta’s approval. The data on survival is extensive and impressive for the DCVax-L phase 3 trial and not yet available for Yescarta ZUMA-1 trial. The incidence of grade 3 or 4 side effects due to Yescarta and the chemotherapy conditioning program needed before administration is on the order of 40% to 50% or more versus less than 2.1% for DCVax-L.

If the FDA could approve Yescarta on the basis of ZUMA-1, it staggers the imagination to think that they would not approve DCVax-L on the data seen in the phase 3 trial in the extremely likely event that the unblinded data is what is predicted by the blinded data.

Tagged as DCVax-L interim results from phase 3 trial in glioblastoma, Northest Biotherapeutics, Northwest Biotherapeutics Inc. + Categorized as Company Reports, LinkedIn

Hi

I capitulated and sold my NWBO shares months ago at about three times current prices. My main reason was what I considered to be the opacity of the ownership capital structure. Who owns what and what will be left over for the shareholders in the event this is successful. Amongst the many issues, were the relatively huge payables and downward adjustment protection clauses for shares and warrants issued or to be issued to LP’s company and frankly the 10Ks I reviewed at the time were less than clear on all this. I came to the conclusion that she could pull the plug on the company and leave the shareholders hanging, or dilute them to zero. Your article has raised my interest but I dont have the energy and the time to go through all of their filings again.

Cheers

I suspect that you are working for the one of the wolfpack firms. I get lots of this stuff from the wolfpack and usually just delete it. I decided to leave this up because your comments are BS and ridiculous.

Cheers

NWBO remains one of the oddest pharma scenarios I’ve personally witnessed, at least over the past 4 years or so. As a speculative cancer pharma, it went through some very rough periods prior to 2015, as in two large reverse splits and the typical ups and downs associated with development companies such as this. Then, first half 2015 the stock seemed to gaining traction, then I think it was July…POW…here comes a mega-hit article from Seeking Alpha that was obviously penned to destroy the stock. The stock began to be ruthlessly shorted at that time. To add insult to injury, the unexplained (still to this day) stop that was placed on their key clinical trial enrollment in August did major damage. Signifant dilutions were needed to keep the train going. Throughout that time, NWBO has been ruthlessly shorted. And now the seemingly positive (very positive) trial results, which frankly were not a total surprise, which again begs the question for why they stock has been so ruthlessly shorted and hamered for so long? And why again has the company remained silent for why the trial enrollment was stopped 3 years ago? In all honesty, given the recent history, is there a credibility gap with the management team? If I’m thinking this so are others.

Certain very well known hedge funds are in collusion with market makers (including some very well known brokeage firms are active participants) work together to manipulate stock prices through illegal naked shorting. This is a massive criminal enterprise that targets many, many small firms not only in biotechnology but also in every other industry that has emerging companies. The attack upon NWBO has been unusally severe. I think that when we ultimately find out the cause of the enrollment halt, which I remind yoo was lifted, you will see that it will also be linked to the wolfpack. My fervent hope is that Trump catches on to this crimianl activity. I thonk that management is a profile in courage.

Hi Larry, Thank you for another insightful article. At least the two incredibly bad actors who posted above had to pay a subscriber fee…..touché on the “cheers” response…had a good laugh.

I have interacted frequently with TD on Anatares. He is very credible and his is an honest opinion. Milou2 is almost certainly a hedge fund operative. If he provides credentials that show he is something else, I will apologize and publish who he actually is.

Larry,

I’m very aware the trial halt was lifted. The context of my ‘trial halt’ comment was that still to this day, no explanation by management has been given as to why the halt occured. Was it due to hedge fund corruption? If so why the silence from NWBO management? Whatever the cause, management’s silence has not helped clarify what’s going on and that’s my broader point. And I’m not an “actor” as accused by another poster, nor am I passive. I refuse to be a static bystander who’s willing to give management teams a free pass without transparency and accountability and especially when a trial gets halted. NWBO management may indeed be courageous in their ‘bring the drug to market’ fight, but their seemingly passive stance against the short attacks and associated corruption from multiple fronts makes me question their commitment or even their concern regarding the associated damage done to long investors or potential long investors. I wish NWBO investors well and hope the drug trials prove successful. However, I also wish that NWBO management would help clarify the unanswered questions.

I’ve read your articles on short hedge funds who work together as wolf packs and in conjuction with equally corrupt MMs to create counterfit shares for naked shorting, and due to hedge funds being virtually unregulated, those corrupt groups have been allowed to work their ‘beat down’ programs unchecked. In spite of the piles of evidence that point to this, no action has been taken to regulate the actions of the hedge funds. Institutions have to report long positions quarterly, but short positions go unreported. This makes no sense and never has but this sort of double standard has allowed the funds to do their damage cloaked in darkness.

Dear Bad Actor #1: Since you are doubling down on your already weak hand, please get the facts straight: it was not a “trial halt.” They halted the screening of new patients. The trial was never halted. They (as well as Larry) CLEARLY explained that patients already enrolled were being treated per protocol without interruption. So why do you need more information from management if you clearly don’t understand what they’ve already put out?

I’m not going to perpetuate a war of words. The context of my comments was all within the context of unanswered questions regarding trial aspects. The trial wasn’t halted, no, but the enrollment was. My apologies for the lack of clarity for those who didn’t understand my broader implication. Still, my question remains why did enrollment stop? And why hasn’t NWBO offered an explanation? Do you have an answer for this that’s factual and shared by NWBO management?

NWBO management may be stellar and honest as the day is long. Their plight may be the total result of short hedge fund targeting and manipulation for corrupt gain. In fact a very strong argument can be made for that conclusion for the many reasons Larry has stated in the past. Still, “honest management” in the biopharma sphere can be an oxymoron. Yes, I’ve seen well managed compainies run by competent, honest people. I’ve also seen the opposite, a lot of it, an unfortunate but sad reality. The stopping in trial enrollment made no sense then and it still makes no sense now. That nothing has been offered from the company still leaves me shaking my head.

If Larry is vouching for you then I retract my bad actor remark.

Your mix up of words brings me to my broader point: Any news from mgmt has been rewarded with slander, confusion and straight up hatchet jobs. They release this amazing, data heavy paper that took God knows how long to organize and your response is? What about that enrollment issue that was resolved months ago? What would be the point of releasing anything more on the resolved enrollment halt other than the governing bodies lifted the halt? That is a factual response. Getting some context would be fine but considering all the malice to everything the company does, sticking to those facts is probably the best course.

Larry

re: “Milou2 is almost certainly a hedge fund operative. If he provides credentials that show he is something else, I will apologize and publish who he actually is.”

You are dead wrong and you do owe me an apology. I am a retired Canadian securities lawyer with over 40 years experience. I actively followed the company (and lost a lot of money doing so). You can review my many postings on Investors Hub to confirm this. I have also occasionally dealt with their in house counsel (Les Goldman), notably to point out errors in their SEC filings and I have worked with other IH members to update the IH’s Nwbo cap table, which was a dog’s breakfast.

Like my colleague Bad Actor#1, I am shaking my head at what I perceive (maybe erroneously, but still) as management’s lack of candor, but more specifically the opacity and the conflicts of interest (at least back then, maybe corrected by now) concerning the financial arrangements between Linda Powers’ personal companies and NWBO. The ratchet clause they created to adjust retroactively the price of already issued shares and warrants (actually investigated and shot down by Nasdaq) is a good example. That is why I decided to cut my losses and in retrospect it was a good decision.

Your attitude makes me think you are a paranoid about NWBO and unwilling to entertain opposing views. Having my comments called “BS and ridiculous” is enough to make me cancel my subscription.

Cheers

You seem legitimate and I offer my apology. However, I think that your implication that Linda Powers and Cognate are somehow scamming money out of NWBO is totally wrong. By my calculations, Linda has lost somewhere between $25 and $40 million on her investment. The cost of manufacturing is huge for living cells and Cognate has accepted stock at much higher prices in lieu of cash. Their balance sheet is loaded with NWBO stock. If Cogante were a public company, they would have insisted on cash and NWBO would be bankrupt.

The magnitude of the short attack has been staggering and only a courageous person line Linda could have stood up to this and keep the company afloat. You seem like an intelligent person but you seem to have bought into the wolfpack propaganda. The phase 3 interim data is stunning and yet we came so close to the wolfpack succeeding in bankrupting NWBO. Eventually, the details of the the wolfpack attack will become known – I have many details and am contemplating a book- you will shake your head in disbelief at the massive criminality.

Larry and others,

I guess I’m the accused bad actor #2? I am not an NWBO antagonist. From all I’ve read by Larry (who I consider extremely trustworthy), Linda Powers is a credible, capable person and evidently nerves of steel the fortitude of a warrior. I’m not a passive person by nature. If someone would try and attack someting of great value to me (e.g. like my family) may God have mercy on their soul because I won’t. The “shaking my head” comments above were rooted in what appears to me an orchestrated campaign of destruction against NWBO by short hedge funds. My related comments were the result of me thinking, “is NWBO fighting against these attacks in some manner”? If management is being bullied, do they stand up and fight and in part do so on behalf of their shareholders? In a nutshell that’s it. When the seeking alpha attacks started, the trial enrolement stopped, and Adam Fstein repeatedly bashed the company, what else does someone need to know in order to confirm that a massive short hedge fund assult was under way. I’m guessing management was confronting this (?) behind the scenes, but the silence on topics like the trial enrolement stopping was against my nature.

I truly hope that you, Larry, publish your findings in a book. I like seeing corrupt organizations called out for what they are. I’ve learned enough about short hedge funds to know that they have sold their souls to make the almighty dollar. All said my apologies to those who thought I was piling on NWBO, that was not my intent.

I know many of these hedge fund players as a result of my years as a sell side analyst.I would have to characterize them as quite smart. In addition, they can hire experts in virtually every field that touches on a small, publicly traded biotechnology company-scientists, lawyers, accountants, ex SEC employees, etc. They can spin any issue in a negative way. I am especially bothered by the fact that they are already very wealthy. Their personal decsions revolve around isssues like selling thier $5 million home in the Hamptons to buy a $15 million home. What really bothers me is that they have been intent on destroying NWBO, not just driving the stock price down, but bankrupting the Company. And now we see that DCVax-L almost certainly had a medically significant effect against brain cancer. And still they attack. They have evolved from investors to criminals without souls. As have bloggers who have been their front men.

Right on Larry. It seems their latest tactic on message boards is to soften up their stamce a bit. Less the AF route and more the “concerned long” or “concerned former long.” Something like: Hey I hope the company succeeds but boy o boy, that Linda Powers…or what about the enrollment halt? All in an attempt to detract from this earth-shattering paper. Another sign is when they say they have no skin in the game yet they post frequently, no spelling or syntax errors….effort like that usually means they’re invested one way or another.

I have some background in boxing: sometimes an opponent will come out fast and try to turn the match into a brawl. Throwing a lot of hard punches right out of the gate. Their goal is to get you to fight “their fight” “their style.” If you’re able to get through the initial onslaught, a lot of times…as the rounds go on, their output starts to drop, their punches don’t have as much steam, they start breathing through their mouth, hold their hands lower…till the point where the’ve punch themselves out…which if you’re good enough is when you turn the fight around and get the W..hopefully a KO. Very difficult strategy to pull off.

I feel NWBO is coming into the championship rounds and they just landed a huge shot with this paper The shorts have thrown a lot of punches, are still fighting, but their shots are losing steam and don’t seem as effective. NWBO is smart for fighting their fight with data and facts. Smart for not getting sucked into the shorts fighting style….here’s to the hope they will get to the end with their hand raised.