Northwest: Analysis of a Coordinated Short Selling Attack Against the Stock (NWBO, $4.69)

A Suspect Plunge in Price

On Friday October 16, 2015 a day in which the Dow Jones and S&P averages increased 0.4% and 0.5% and the Biotechnology Index was flat, Northwest Biotherapeutics’ stock plummeted 30%. The stock opened at $5.97, traded up to $6.06, then crashed to an intraday low of $3.82 and closed at $4.19. Volume for the day was 3 million shares which was 10 times the average daily trading volume for the 11 previous trading days of October. The Company did not issue any press releases and I am not aware of any negative brokerage reports or blogs. There were no new headlines on Yahoo. There is only one reasonable explanation for the decline and that was a coordinated short selling attack on the Company.

The Hedge Fund Conspiracy in Brief

Northwest has been an ongoing target of a group of hedge funds who operate as a wolfpack to launch shorting attacks on not just Northwest, but a broad number of emerging biotechnology companies (and also companies outside of biotechnology). Of the 15 companies that I write on conversations with management and my research convinces me that 12 of 15 have also seen their stocks manipulated. This appears to be a very broad conspiracy. The wolfpack’s playbook is to induce bloggers (friendly to them or employed by them) to write articles which attack and put a negative spin on every aspect of the targeted company. A cornerstone of this blogging is to allege that management is unscrupulous, duping investors and running a pump and dump scheme.

Essential to the wolfpack is to attack any news release (especially one containing good news) with blogs and simultaneously, aggressively short the stock. The objective is to make good news appear bad by causing the stock to decline. I can’t tell you how many times I have seen this with not only Northwest, but a broad number of other companies. Another important touch is a coordination with tort lawyers who cite the stock decline to bring class action suits alleging misconduct and misrepresentations by the Company. Ironically, these tort lawyers usually cite negative blogs or research written friends or employees of the hedge funds.

I have no direct proof on which hedge funds are involved. However, it is pretty easy to deduce who the ringleaders are and the techniques that they use. The circumstantial evidence is extremely convincing. It comes from speaking with companies who have been attacked and traders knowledgeable about their manipulation schemes. I believe there is a core group of at least 10 to 15 hedge funds (could be much larger) who are the key players in the scheme and there are many other hedge funds and individual traders who latch onto their coattails. Two of the most important leaders are based in New York City and Greenwich. Connecticut and have been linked relatedly to stock manipulation. Many or most of the hedge funds are based in New York and Connecticut and trace their lineage to David Blech; he was one of the earliest, innovative and most famous manipulators of biotechnology companies; he is now in jail for stock manipulation. One way or another, almost all the hedge fund leaders involved in this scheme are tied to him.

This Was Only One of an Ongoing Series of Attacks

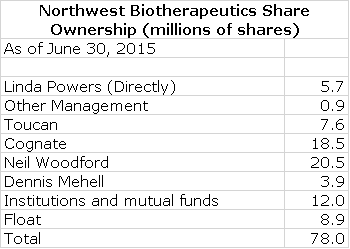

The short selling attack against Northwest has been long going; it began in late 2013 and has been unrelenting and it continues to build in intensity. By August 31, 2015 NASDAQ indicated that there were 10.4 million shares shorted and by the end of September this had increased to 12.8 million. This is a very large number in relation to the float. Much of the stock is held by Linda Powers directly, Toucan Venture Capital Funds (controlled by Linda Powers), Cognate through its manufacturing agreement and Neil Woodford. Using company regulatory filings and stock holdings as estimated by Yahoo, I estimate that the float of Northwest was about 9 million shares as of June 30, 2015. All of these estimates are shown in the following:

The above numbers have some degree of error, but I think that the order of magnitude is roughly correct. Unless I have made some major error, the short position exceeds the float (I’ll touch on this shortly). Many investors over the past year in looking at similar numbers have suggested that the shorts have exhausted their ability to continue to attack the stock and yet time after time, they have mounted extremely strong attacks to deflect good news. Friday’s attack is an example. So where do they get the stock to short- they counterfeit it through illegal naked shorting?

What Is Going On?

I can’t tell you precisely how it is done but it is obvious to me that this can only be attributable to the use by hedge funds of naked shorting, high frequency trading techniques and dark pools. Dark pools are run by brokerage firms such as Goldman Sachs, Morgan Stanley and other trading institutions. They were originally formed to facilitate block trading for institutional investors, who did not wish to impact the markets with their large orders. Unlike stock exchanges, dark pools are not accessible by the investing public and as their name indicates there is a complete lack of transparency. At last count, there were 48 dark pools and they account for perhaps the majority of stock trading in the US. It is not unusual for dark pools to account for 70% of daily volume even for a small company like Northwest.

Another troublesome phenomenon has been the rise of high frequency trading. For a good review of both dark pools and high frequency trading I recommend that you read Michael Lewis “Flash Boys: A Wall Street Revolt”. Mr. Lewis is a well-respected financial writer who believes that Wall Street harbors predators who are manipulating stocks and the markets. (After reading his well-researched book, I find it hard to disagree.) This book doesn’t focus on naked shorting, but it does give a good insight into how high frequency trading combined with dark pools facilitate insider trading and stock manipulation. One of the startling numbers about high frequency trading is that the advanced computers used can do 150 trades in the blink of eye according to Mr. Lewis! The blink of an eye takes about 300 milliseconds so that this can translate into over 500 buy or sell trades per second.

The speed of computers and the lack of transparency from dark pools is the foundation that allows hedge funds to implement a key strategy which is called walking a stock down. Using sophisticated algorithms, the hedge funds when attacking a stock on the short side first take out offers for the stock and then enter a large number of small volume sell orders at progressively lower prices. I have had numerous managements describe how hedge funds used this tactic to try to crash stocks of companies they are attacking.

Dark pools and high frequency trading facilitate naked shorting, but isn’t naked shorting illegal? Yes it is. When an investor shorts a stock his broker has to borrow the stock shorted from accounts which are long the stock. The broker charges interest on this. When the short is ultimately covered by buying the stock, this stock is returned to the broker to cover the stock that was loaned to the short seller. The original owner of the stock does not know if their stock was loaned. In the case of naked shorting, the short seller sells the stock in a dark pool without borrowing it or even intending to borrow it. As explained by Mr. Lewis in his book, most dark pools ignore naked shorting and don’t report it. It is a lucrative source of income for owners of the dark pools.

If a short seller cannot borrow a share and deliver that share to the person who purchased the (shorted) share within the three days allowed for settlement of the trade, it becomes a fail–to–deliver and hence a counterfeit share; however the share still is transacted by the exchanges and the DTC as if it were real. Regulation SHO, implemented in January 2005 by the SEC, was supposed to end wholesale fails–to–deliver, but all it really did was cause the industry to exploit other loopholes, of which there are plenty. For a more detailed discussion please read my article Illegal Naked Short Selling Appears to Lie at the Heart of an Extensive Stock Manipulation Scheme.

The consequences of having a fail–to–deliver are inconsequential, so it is frequently ignored. Enough fails–to–deliver in a given stock will get that stock on the SHO list, (the SEC’s list of stocks that have excessive fails–to–deliver) – which should (but almost never does) see increased enforcement. Penalties amount to a slap on the wrist, so large fails–to–deliver positions for victim companies have remained for months and years. This explains why the NASDAQ estimate of shares shorted exceeds the float of Northwest. Some of the counterfeit shares created by naked shorting have been traded (probably several times) and are seen by the system as legitimate.

Naked short selling can be incredibly lucrative. The hedge funds sell the stock and collect the proceeds. If short sellers acting in concert are able to drive the stock down and keep it down, they may never have to cover and there is no borrowing cost as would be the case with legal short sales. There is a very powerful incentive for hedge funds to destroy a stock price using all of the techniques I have described and more. The Holy Grail is to force a company into bankruptcy. I believe that in the case of many health care hedge funds this is their major mode of investing.

In coming back to Northwest Biotherapeutics, my calculations suggest that there may be more reported shorts than the float of the stock. This is not a concern for naked short sellers. They can literally counterfeit as much stock as they want. There is no limit to the amount of naked shorts that can be put in place. I have no way of knowing, but people with some insight into this practice and putting it in perspective with Northwest Biotherapeutics trading patterns over the past two years, suggest to me that there could be as much as 20 to 50 million naked shorts outstanding. This may sound preposterous but consider the case of Global Links.

Global Links Corporation is an example of how wholesale counterfeiting of shares can decimate a company’s stock price. Global Links was a company that provided computer services to the real estate industry. By early 2005, the stock price had dropped to a fraction of a cent. At that point, an investor, Robert Simpson, purchased 100%+ of Global Links’ 1,158,064 issued and outstanding shares. He immediately took delivery of his shares and filed the appropriate forms with the SEC, disclosing he owned all of the company’s stock. His total investment was $5,205. The share price was $.00434. The day after he acquired all of the company’s shares, the volume on the over-the-counter market was 37 million shares. The following day saw 22 million shares change hands — all without Simpson trading a single share.

Northwest Has Become Especially Vulnerable to Shorting over the Last Two Months

Naked selling by hedge funds can and does exercise enormous control over a stock even if the Company reports good news. However, in cases where there is concern or uncertainty, the effect can be devastating. In periods in which investors are either alarmed or uncertain causing buying demand to slacken, hedge funds can literally drive the stock almost anywhere they want. Remember, they can literally counterfeit as much stock to sell as they dare.

Over the last month, Northwest has unfortunately been caught in a situation that has created significant uncertainty and concern based on two prominent issues. I have been consistently critical that the Company has never raised enough money to make itself able to see its way through the clinical trials. Instead of biting the bullet and raising enough cash to give them a long cash runway, management has tended to raise smaller amounts of cash that has left them in the continual position of needing to raise cash in the immediate future (one, two or three quarters down the line).

Playing a large part in this financing strategy has been the ability of hedge funds to negate promising clinical news with their strategy of making good news look bad. Northwest has presented promising clinical data on DCVax-L and DCVax Direct as well as the very encouraging news of the German and UK early access program for DCVax-L. Management could reasonably expected that this would have a very positive effect on the stock price and allow them to finance at attractive prices, but instead the stock price was forced down (good even great news was made to look bad by pressuring the stock).

This hedge fund strategy was to prevent Northwest from raising enough money to completely fund the clinical trials of DCVax-L and DCVax Direct. The goal was also to force the Company to raise money on disastrous terms for shareholders. The very same hedge funds who lead short attacks are usually the principal investors in distressed offerings. They buy stock on the offering to cover shorts. This is illegal but the lack of transparency in dark pools and the coordinated trading of the wolfpack allows this to be done.

Northwest was very fortunate to find the large U.K. investor Neil Woodford who became convinced of the promise of the Company (possibly because of the early access program for DCVax-L in the U.K.). Starting in November 2014 he has accumulated 21 million shares both through buying newly issued shares and also in the open market. This dependable source of financing encouraged investors for the first time that Northwest would have access to enough capital to see them through the completion of the phase 3 trial of DCVax-L and phase 2 trials of DCVax Direct. This drove the stock price to over $11.00 in early August.

Uncertainty Prevents Northwest from Raising Badly Needed Cash

I think that the Company was in the position for the first time last summer to do a large financing with Woodford as the anchor that could have put enough money on the balance sheet to provide a year or more of cash. Before the Company could implement this big offering strategy, the biotechnology gods frowned on the Company and gave rise to uncertainty. In an August 21 news release the Company made the following statement which I reproduce in italics:

“The phase 3 trial of DCVax®-L for newly diagnosed glioblastoma multiforme (GBM) is ongoing and the patients enrolled in the trial are continuing to be treated per the protocol. Over 300 patients have been recruited for the trial. The total anticipated enrollment is 348 patients.

The only change in status of the trial is that new screening of patient candidates for the trial has been temporarily suspended while the Company submits certain information from the trial for regulatory review. Such screening involves the initial evaluation of patient candidates to determine whether they meet eligibility criteria for the trial (e.g., whether they are within the eligible age range, do not have certain viral diseases, etc.)

Some blogs and social media comments have noted that the EudraCT trials database in Europe states that there is a “Temporary Halt” of the trial in Germany. In actuality, the trial status in Germany is that the trial is ongoing as noted above, and the Company has only undertaken a temporary suspension of new screening.”

This interpretation of this news as originally reported by bloggers working with hedge funds was that the trial had been halted. At a later time, some corrected their statements (others didn’t) to say that only screening had been temporarily halted, not the trial itself. However, the impression that the trial had been halted remained in the market and in any event, the reason for the halt of screening of new patients raised concern in the minds of most objective of observers. This was certainly the case for me.

What Does the Suspension of Screening Mean?

I must admit that I cannot understand the reasons for and implications of this halt in screening and management has not provided any details other than saying that regulators (presumably the FDA) are involved in some way. If the FDA is involved as I think likely, the Company can’t really comment or even hint at what the agency is looking at until their work is completed. Hence, investors have been operating in a news void that has created major uncertainty and this coupled with the weak balance sheet and need to raise capital has been devastating. On August 3, 2015 the stock closed at $11.21. The news of the halt in screening was known for a few days before August 21 (the day of the news release) by some hedge funds and the stock traded down beforehand and closed on August 21 at $6.96. Since then the stock has been under continual attack by the hedge funds culminated by the 30% price drop last Friday to $4.34 per share at the close.

I have no explanation for the halt in screening and the involvement of the FDA and I have not heard any explanation that I find convincing. Let me give you the thought process I used in trying unsuccessfully to come up with a plausible explanation. One possibility is that this information revolves around an interim look at the data. There have been over 300 patients enrolled in the trial and the trial is scheduled to end when there are 248 disease progressions occur (I think). There might be an interim look at a lesser number.

It could be the case that the criteria for the interim look hasn’t been met given that only 300 patients have been enrolled and the Company has not announced an interim look. But what if there has been an interim look? Let’s consider the possibilities in this event. In an interim look, the Date Monitoring Committee (DMC) unblinds and analyzes the data while the Company and everyone else remain blinded. There are three possible recommendations that the Data Monitoring Committee can make.

The first is that the trial is unlikely to meet its primary outcome measure and should be stopped. However, the Company does not have to follow the recommendation of the DMC and can continue the trial after consultation with the FDA. In the case of immunotherapies, there is a sound reason for continuing the trial as improvement in patient outcomes (survival) occurs later than with other therapies. We have certainly seen this with Provenge and the checkpoint inhibitor. Also, patients in the trial are being given standard of care plus DCVax-L so they are receiving the best available therapy even if DCVax-L provides no benefit.

I think that everyone involved would want to continue the trial in this event. There is much to be learned about possible activity in subsets of patients and looking back at Dendron’s Provenge in metastatic a survival benefit was found even though the primary endpoint of progression free survival was not reached. I don’t place much of a probability on the scenario that the DMC has concluded that continuing the trial is futile, but it is a possibility. Moreover, even if this scenario is correct, I don’t understand why there would be a halt in screening or FDA involvement.

The second possible recommendation of the DMC at the time of an interim look could be that there are no safety issues and the trial should continue. In this event, I can’t come up with any scenario in which screening would be halted.

The third possible recommendation of the DMC is that the trial has reached its primary outcome measure for efficacy and the trial should be halted and control patients switched to standard of care. Again, this would not explain a halt in screening. However, it would explain FDA involvement.

At this point, we have no information that an interim review by the DMC has been performed. Even if the interim review has been performed, as I have just pointed out, I can see no reason for FDA involvement and no reason for halting of screening. Also remember that while screening has been halted enrollment has not and the company suggests that there have been new enrollments since the screening halt. If so, there are now more than 300 patients enrolled in the trial that were cited in the press release of August 21.

I next tried to think outside the box on why screening might be halted. One possibility is that the very positive results seen in the 51 patient information arm has prompted Northwest to seek approval for DCVax-L in recurrent glioblastoma based on this data. In this event, the FDA would certainly get involved and would want to make sure that the rapid progressors (recurrent GBM patients) in the information arm were indeed rapid progressors and not psuedoprogressors. This doesn’t explain the halt in screening but it does explain FDA involvement.

Another possibility is that DCVax-L has been given early access approval in Germany and the UK for all types of primary brain cancers. GBM is the most aggressive of brain cancers and there are others that are more treatable and have much better outcomes. Could it somehow be the case that there was a mix-up between patients treated in the early access programs and the phase 3 clinical trial so that there might have been some patients enrolled in phase 3 who had milder types of brain cancer. This might explain the halt in screening and FDA involvement. However, I find this scenario highly unlikely.

The final scenario I can come up with is foul play. Could the hedge funds have found a way to hack into the data bases of the CRO conducting the trial and manipulate the trial outcome or could they have paid off employees of some participating centers to sabotage the trial. Before you scoff at this let me point out that there are massive amounts of money involved for the shorts. If it is the case that combined legitimate and naked shorts could amount to 30 to 60 million shares short, each $1.00 decline in the stock could amount to $30 to $60 million of profits and the decline since the early August high of nearly $7.00 could have given rise to profits of $210 to $420 million. There is a huge amount of profit potential for the shorts and remember that they readily embrace illegal activities such as fomenting, walking s down stocks and naked shorting. There might be no limit to their activities.

Again I can see some people scoffing at my suggestion of such broad based criminal actions but consider the following. Martin Martola of SAC Capital was sentenced to 9 years in prison because he had paid one of the primary investigators in the phase 3 trial of Elan’s bapineuzumab in Alzheimer’s disease to learn of results before they were made publicly available. The clinical trial investigator tipped Martola that the phase 3 trial was unsuccessful and Martola and his employer SAC Capital executed trades that resulted in $275 million of profits. SAC’s founder Steve Cohen was charged with the same crime, but Martola refused to testify against Cohen and he was not indicted. However, SAC made a $1.8 billion settlement for criminal and civil settlements and agreed not to manage outside money.

I am aware of another case involving a small company in which a phase 3 trial failed. The drug in the trial performed as expected, but the control arm of the trial (which involved an active drug) did exceptionally well and far better than ever been seen in numerous prior trials. Curiously, two large centers were responsible for the strong placebo effects. Also curious was that their placebo results were quite comparable and at odds with other centers in the trial. A few weeks before the phase 3 results were known, a hedge fund manager bragged openly to the CEO of the company that he was sure the trial would fail and was heavily short the stock. This suggests that the CRO or the investigating centers were compromised allowing the control arm data to be manipulated. Again if you scoff, think of the money that Martola made. This is not simply insider trading that might result in a few hundreds of thousands of ill-gotten profits. We are talking hundreds of millions of dollars.

Where Does Northwest Go From Here?

After all of this discussion, I have essentially told you that I don’t have a good explanation for the halt in screening in the DCVax-L trial. The Company at the time of its August 21 press release stated “The Company is in the process of preparing the trial information for regulatory review and anticipates submission within the next couple of weeks.” The Company has not stated whether this was achieved nor has it given a timeline for when we might hear an explanation for the halt in screening and hopefully a resumption in screening. Meanwhile the Company is in a serious cash bind.

Northwest ended the second quarter with $19 million of cash. The use of cash for operations averaged $22 million for the first and second quarters of 2015 so that at this rate, the Company is about out of cash. The Company won’t comment on its current cash position until the 10-Q comes out for the third quarter. The Company can take some measures to reduce cash burn by asking Cognate to accept stock instead of cash for producing DCVax-L for clinical trials. They might also use some non-traditional financing technique to give them breathing room. I think that Neil Woodford may ultimately be called upon to provide more cash. He has invested probably over $120 million in the Company so far. If it comes to investing another $20 to $40 million to keep the clinical trials going in the short term, it is hard to see him not making the commitment.

We as investors are faced with a conundrum. The two dendritic cancer vaccines, DCVax-L and DCVax Direct, have shown significant signals of activity in difficult (impossible?) to treat solid cancers that are suggestive that they could be a major advance in cancer therapy. Based on the data created so far they seem to have produced signals of clinical efficacy data as dramatic as the CAR-T cells of Juno and Kite while showing they are safe and not facing potentially life threatening side effects as do the CAR-T cells. In my judgment the data base for Northwest is of the same promise and yet Juno has a $4.9 billion market capitalization and Kite has $3.0 billion. Investors have also showered money on these companies. Northwest has a market capitalization of $374 and is cash starved. This shows the scary power of the hedge funds to manipulate investor views and stock prices. However, an important takeaway is that if the hedge funds are defeated or just neutralized, the upside potential could be enormous for Northwest.

What should you do with the stock? I can only tell you that I have never sold a share in Northwest since I first purchased shares over three years ago and I do not intend to do so now. However, like everyone else, I am extremely perplexed and uncomfortable with the position that we investors find ourselves in and angry at the hedge funds that I believe are manipulating the stock. I am hopeful that the question on halting screening in the trial will be satisfactorily answered and that the backing of Woodford and other measures will allow the Company to raise the money needed to complete its clinical trials, but this is not a certainty. The hedge funds have an enormous amount at stake and time and again in the face of positive news from Northwest have doubled down on their bet. They are enormously exposed.

I also think that there is a potential that the brazen actions of the hedge funds could lead to action by criminal and regulatory agencies. Their actions are thinly veiled and even casual investors recognize that manipulation is ongoing. It is hard to think that the SEC, FBI and state’s attorney generals have remained oblivious to manipulation that is so blatant. If there is ever a criminal or regulatory move against the wolfpack, we would see a rally of unbelievable proportions for NWBO and other small biotechnology companies. However, this is a tough case to build and there can be no certainty that the hedge funds involved will ever be brought to justice.

Final Comments

I started developing my website and its content about four years ago. My whole career has been spent in stock research and I felt that small companies were not well covered by Wall Street. I thought that there was a good opportunity to create a product that produced in-depth and objective research on small companies. As I gained more experience, I was startled to find that there was another very important force at work on these companies that was apart from the fundamentals that I was focused on. One would expect a high level of volatility in the high risk stocks in which I specialize. However, this could not always explain the demoralizing collapse of a meaningful number of stocks that I am involved with following some news event. Suddenly and without a major change in the fundamental outlook, I would see stock prices cut in half in a short period of time. During this time there was invariably a steady day by day price erosion (naked shorting at work) accompanied by an unending stream of contrived negative news flow that was demoralizing to me and other investors. This has led me to do extensive research on what I have since concluded is a massive stock manipulation scheme.

I have been attacked by hedge fund sponsored bloggers as a shill for Northwest Biotherapeutics because of the large number of articles I have written about them. However, a major reason for my writing has been my outrage at the vicious attack that has been launched against the Company. I see Northwest as a very high risk high reward situation in which there is a very real risk that their clinical trials could fail and investors could lose all of their money. Of course, this outcome is not unique to Northwest. Still, the Company has reported promising data that indicates that it may have a new technology that can change the cancer treatment paradigm.

I am truly outraged that greedy hedge fund managers are trying to drive the Company into financial distress or even bankruptcy without regard to the potential medical value of the dendritic cell cancer vaccines. This is why I have been so staunch in defense of Northwest. I want the trials of DCVax-L and DCVax Direct to be funded; this is in the interest of society. My small role in this may be helping all interested parties understand the depth of the hedge fund conspiracy.

For those of you who think that this note is just reflective of my experience with Northwest, let me share some other conversations I have had. A small company that I know well had just recently put out a positive news release on clinical trial results. The stock traded up at the opening and then a negative blog appeared in mid-morning accompanied by a barrage of short selling leading to a price decline for the day-a predictable outcome. I asked the CEO about the short selling attack and whether he was going to try to bring it to the attention of regulators and law enforcement. He first said that these hedge funds shorting the stock were criminal enterprises but quickly went on to add that his board would not let him confront them for fear that they would become even more aggressive. The idea was to give the hedge funds a pound of flesh and perhaps they would leave the Company alone. They haven’t.

I also spoke with the CEO of another company which had recently reported a delay in a clinical trial. This was a bit disappointing but within the context of biotechnology not uncommon or alarming. However, the stock collapsed from $7.00 to $2.50 which was out of all proportion to the news flow. The CEO said that he watched with amazement and despair as the shorts walked the stock down methodically by taking out every offer and then barraging the market with short sells at ever lower prices. The shorting was done by a group of 10 to 15 hedge funds acting in concert according to him.

One company I have done a great deal of work on was doing a tour of major institutions to inform them about his company. He met with the portfolio manager of a huge mutual find who specialized in growth stocks. The portfolio manager was interested in the story and spoke with management for over an hour. At the end of this time, management asked him if he was considering buying the stock. His answer was that he was intrigued with the story, but knew that hedge funds had targeted the Company. Because of this, he said that he could not invest. This shows that the short manipulation game can be a deterrrent to real investors which is of course their goal.

These are only a few of the many stories that have molded my conclusions on what I believe to be a criminal conspiracy of massive proportions. I could go on and on, but I hope that I have made my point. If you are convinced by my arguments and want to do something, I suggest that you write to attorney generals in your state and to representatives in government. I think there is no purpose in writing to the SEC as I believe they have already been deluged with letters. I think that on a national level, I would suggest writing to Senator Elizabeth Warren of Massachusetts who has spoken strongly about greed and manipulation on Wall Street. She is most likely the person in Congress who might seize on this issue.

I live to see the day that certain hedge fund employees do a perp walk like SAC’s Matthew Martola.

Tagged as illegal naked shorting by hedge funds, Northwest Biotherapeutics Inc., NWBO + Categorized as Company Reports

NWBO still badly needs a commanding CFO-and-team who can better communicate with the Street, better communicate financial policy (particularly liquidity) and Cognate arrangements in the regulatory filings, and have the freedom to raise money to maintain the cash runway knowledgeable biotech investors know is essential to their survival. Until that happens or the FDA says something extremely positive, the company will continue to be enslaved by the hedge funds and their chicanery. I hope Mr. Woodford, and perhaps Mr. Mehiel, can be a little more activist with management and make this a demand in the next capital raise.

I understand

I think this is a simple case of “no new is bad news” , and somebody lost patience and liquidated (hedge fund?). When is the last time we received good news on progress of trials, that was interpreted by everyone as good news?

Larry, you mentioned 248 events needed for the interim analysis to be conducted. I believe that number if for the end-point measurement of the revised trial, not the interim analysis. Here is the paragraph that supports that from their August 11, 2014 new release on the trial revision:

“The current trial plan involves counting 110 “events” from among the 312 total patients in the trial to evaluate whether the primary endpoint is met. Under the enhancements of the trial, 248 “events” will be counted from the 348 total patients in the trial to evaluate whether the PFS primary endpoint is met.”

The original trial had interim analysis points set at 60% and 80% of the event. So, by my calculations, the new first interim trigger would be at 148 events. Isn’t it conceivable that they have reached that interim analysis point and the evidence is overwhelmingly positive (based on what we have seen in the information arm)? Wouldn’t accelerated approval possibly be in discussion if that were the case?

Hi Larry and again, and again, thank you for your research, your considered opinions and your encouragement to contact different officials with the demand to get someone to look at what is happening on Wall Street that is clearly manipulation at the least, and illegal at the worst….

Just a few questions from me to thee (or anyone that wants to chime in)

1. What is the difference between “enrolling” and “screening”??? How can you enroll someone if you can’t screen them????

2. As a retail investor, should I call my brokerage and somehow instruct them not let my shares be borrowed???? Seems to me it would be pointless, because of all these “dark pools” and naked shorts, but what do you think???

3. When do think we should start looking for the 3rd Quarter report????

Guess that is plenty for now….hope they are worth answering and thank you for

writing this article for me and anyone who reads it….Glad you posted it where anyone can read it..

Keep up the fine work and maybe someday, we will know “the rest of the story”….

PS….Linda’s and Les’s press release said they were going after some bad people…hope they get them….cheers

Larry:

Thanks a ton for your efforts ! I hope SEC sits up and takes notice.

In the Michael Lewis book, he estimates that 2/3 of SEC lawyers go on to jobs in the financial industry including hedge funds of course.

I was a stock owner of this company for 2 years. I bought in at $6.12 and sold at $10.58 of this summer making $300,000. Don’t get me wrong I love this company and the science behind it. I left because I remember last time NWBO shot up to $10 from the news of German exemption being accepted than knocked down by short sellers and Adams blogs. Law suits flew around back than as well. History repeated like I expected it might. Back than NWBO went to $3.12 a share before recovering because of the news of IMUC failing its phase 2 in December. I can’t find the stomach to buy back into this company with the screening put on halt and no reasonable explanation. Even though the company looks cheap at $4.70 a share right now, I feel the risk is too high from recent news of the screening. I would love to get back in if I could know what caused this pause in screening. Good luck to those still in the company.

Going off of my comment of selling NWBO at $10.58. Right now I feel that best stock from Larry Smiths choices are AGEN because of the cash they have at hand and the possible home runs they could potentially have. Also I like Celldex at its current price. Good luck everyone

In this trial… patients are first screened for eligibility. If found eligible, they enter the 3 month screening pipeline. What is halted at this time is the ability to enter the 3 month screening pipeline.

While in the 3 month screening pipeline, the patient receives surgery and is treated with SOC – radiation and temozolomide. Some patients may falsely show progression and some patients may actually progress during this 3 month period – either of which makes the patient ineligible to enter the main arm of the trial.

Those patients found ineligible are entered into the Expanded Access Protocol trial to receive their vaccine (as it was made for them when they initially entered this 3 month screening pipeline).

Those patients not showing pseudo progression or a return of their tumor based on the established criteria… are “ENROLLED” in the main arm of trial. There were 300 patients ENROLLED in this at the time of the press release (August 21). That means there are patients in this pipeline that are continuing to enroll into the main arm of the trial at this time.

Larry,

I was crunching some numbers and feel that NWBO must be at some analysis point currently, which is why the quiet front particularly with the shorting activity. I think thats also why there has been such an aggressive short movement to get the share price down for the shorts to reduce their exposure. I was thinking of writing an article on this but thought I would send you what I had found prior to:

I added the 25 modest progression from the information arm to the 20 Phase I/II data, and I even shortened the longest living data in the phase I/II to 41.5 months. It provided a p value of 0.0361 from a normal distribution. This is using the SOC mean value from the 119 patients. By adding 25 more patients, it reduces the difference necessary to show statistical significance greatly.

Looking at an interim analysis of 148 events and therefore 148 patients (taking 100 patients with vaccine), the trial would potentially have enough patients to show that if the OS difference was 1 month, there would be a statistical significance. This is using a standard deviation of ~35 months when in actuality, it would be more like 18 months.

Anyways, what I am trying to get at is if there is any correlation to the data from the info arm, and ph I/II data, even it its only 30% of the patients living 36 months or more, there is a good chance statistical significance may already be met at 148 events. And if its PFS that is the primary endpoint, since it has seen amazing results with immunotherapy (even ICT-107 showed good PFS results), I have a feeling NWBO’s silence could turn out to be a positive one.

In the Q&A on Woodford’s Whiplash Blog,

PB says:

October 19, 2015 at 5:16 pm

You have a relatively important position in NWBO, which has had very unusual trading activity on Friday. The company has issued a press release this morning stating that it is unaware of any substantial reason for the decline in the stock price. Do you have any comments on this type of trading activity which seems to be a curse for several junior biotechs listed in the US.

MITCHELL FRASER-JONES says:

October 21, 2015 at 1:03 pm

Hi PB – we have explained our attraction to the long-term potential of Northwest Biotherapeutics elsewhere on this website – nothing has changed in this regard. It would be inappropriate for us to comment further ***at the moment***.

Kind regards

Mitch