Northwest Biotherapeutics: Takeaways from Marnix Bosch’s Presentation at ASCO (NWBO, Buy, $0.27)

Overview

Marnix Bosch, Chief Technical Officer of Northwest Biotherapeutics, discussed three broad topics at ASCO on Sunday June 2, 2019.

- Factors that will determine when we might see the all-important topline data from the phase 3 trial of DCVax-L in newly diagnosed glioblastoma multiforme (GBM).

- The hypothesized mode of action of DCVax Direct and plans to begin two small phase 1 trials in coming weeks or months.

- An update on the information arm of the DCVax-L phase 3 trial. This relates to patients excluded from the trial because their tumor was thought to be progressing after radiation treatment (roughly six weeks after surgery). Because the vaccine already had been prepared, they were treated under the same protocols and followed in the same manner as patients included in the trial.

This report focuses only on the issues that will determine when topline data for the phase 3 trial might be released.

I consider the dendritic cell based approach of DCVax Direct to be a novel approach to immunotherapy which could be as promising as checkpoint inhibition or CAR-T therapy. Dr. Bosch gave an interesting overview on the hypothesized mode of action of DCVax Direct. I will address DCVax Direct in a later report.

I first wrote on results with the information arm of the DCVax-L trial in a July 7, 2017 report. Dr. Bosch provided an update on that data and I would refer you to my earlier report for more background information. The data on the information arm then and now appears promising

Investment Thesis

The gating factor for the release of topline data from the phase 3 trial will be the completion of a Statistical Analysis Plan (SAP). Northwest will present this plan to the FDA and other regulators who could approve the plan outright, suggest changes or reject it (I think the chances of outright rejection are small, but not zero.) Until this is determined, the Company cannot confidently give guidance on the release of topline data. I am guessing it will be September of this year.

The presentation on the timing of the topline data was helpful, but didn’t really bring any new information to investors. I regard the information on DCVax Direct to be extremely interesting, but we are not yet at the proof of concept stage and it is early in the clinical development stage. As noted, the data from the information arm was and is promising. Overall, I think that Dr. Bosch’s presentation was at the very worst neutral and more likely positive. Predictably the stock traded down sharply on the day after the presentation.

I say predictably because I believe that NWBO has been and remains the target of an extensive, sophisticated stock manipulation scheme. NWBO is not uniquely targeted as I believe that manipulating stock prices of many small and not so small companies is a routine business practice on Wall Street. However, the attack on NWBO has been one of the most intense. I would suggest that you go to my website where I have written blogs (now up to seven with more to come) on how illegal naked shorting is widely used to manipulate stock prices.

I think that at this point that we just have to accept stock manipulation as part of the investment equation for NWBO and literally hundreds of small and not so small companies. One of the key strategies of the manipulators is to make good news or in this case somewhat positive news appear to be disappointing by ferociously launching an illegal naked shorting attack. Ask yourself what was disappointing about the presentation? It was well known that the SAP was key to unblinding of the phase 3 trial and most investors were and are thinking that topline data might be released around September. So no change there. There was no expectation of data being released on the phase 3 trial as it remains blinded. The data on the information arm of the DCVax-L phase 3 trial and DCVax Direct is modestly positive. I don’t see how anyone could believe that investors were disappointed and this was the reason the price declined sharply.

The overwhelming investment catalyst for Northwest is the release of topline data on DCVax-L which I am guessing will be in September or so. The aim of the stock manipulation scheme had been to bankrupt NWBO before they could complete the trial. Against enormous odds, NWBO has been able to complete the trial and we will see the topline results to the distress of the bad guys. Clinical trial outcomes are notoriously unpredictable and until the phase 3 trial is unblinded we can’t confidently predict results. However, I have written frequently in the past that the blinded data strongly suggests that there is a medically important survival tail. If so, DCVax-L will be a major advance in the treatment of newly diagnosed GBM and the stock should have explosive upside potential. We will know if I right relatively soon.

When Might Northwest Unblind the Phase 3 Trial?

I speculate that Northwest could probably have locked the data base and unblinded the data on the phase 3 trial of DC-Vax-L as long as two years ago if they had chosen to use median progression free survival (mPFS) as a primary endpoint and overall survival (mOS) as a secondary endpoint. These were the endpoints specified in the original trial design. Northwest concluded and I agree that this would have been a mistake. Here’s why. The trial was initiated 12 years ago. At that time, the endpoints chosen were broadly accepted endpoints for chemotherapy drugs in which the mode of action is to attack and shrink the tumor; for this mPFS is a meaningful endpoint. Things have changed. As time progressed, immunotherapy led by checkpoint inhibitors and then CAR-T emerged on the scene as a promising new way to attack cancer.

Immunotherapy acts differently than chemotherapy. The onset of effect can be much slower and it has been observed that immunotherapy can deliver a survival benefit even if the cancer initially progresses as measured by an increase in the size of primary tumor(s) being measured. Above all, the most exciting thing about immunotherapy is that it is characterized by a clinically meaningful percentage (perhaps 15% or so) of patients surviving much longer than what would be expected with chemotherapy. This is now referred to as the survival tail. Awareness that there was a survival tail with checkpoint inhibitors began around 2014 and by 2017, had become widely accepted in the oncology community.

By 2017, I speculate that the DCVax-L trial probably had reached the number of median progression free survival and median overall survival events needed to unblind the trial. However, management decided not to unblind the trial and it remains blinded still. Somewhat before this, the lead and other investigators on the trial observed that patients seemed to be living longer than expected. See this link. This strongly suggested that there was a survival tail. This was further supported by an analysis of the still blinded data for 331 patients in the trial, which was strongly suggestive of a survival tail. See this link. Faced with all of this encouraging data, management made the decision to let the data mature before unblinding the trial in order to define the survival tail.

Known Information about the DCVax-L Phase 3 Trial

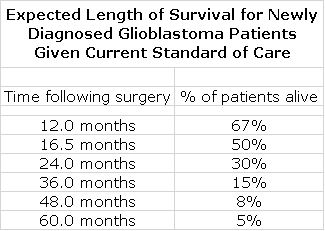

The trial of DCVax-L was a struggle for NWBO to complete because as a small company it encountered financial issues that slowed enrollment. The trial began in 2007 and median enrollment occurred in May 2014. The last patient was enrolled in November 2015. While this was a painfully long period of time for the Company and investors, it may prove to be extremely important to the regulatory evaluation of DCVax-L. Data from other trials in GBM suggests that 50% of patients treated with standard of care (SOC) are alive at 16.5 months after treatment and that only 15% are alive at three years.

We will be able to very meaningfully compare the actual time of survival for all patients in the trial versus expected survival time based on these historical results. Even with the last patient treated (a little less than four years ago), there is less than a 15% chance of survival at the time of unblinding as judged by this data. On each and every patient, we can get an insight into what the effect of treatment was relative to historical benchmarks. This should give a clear insight into whether there is a survival tail and if so how meaningful it is.

What does this mean for DCVax-L? Well, what we really want to know with a cancer drug is what it does for the survival of the entire population. The endpoints of mPFS and mOS are only indicators of ultimate survival for the population as a whole. The median is the point at which 50% of events, either PFS or OS, have occurred. It is unlikely that these endpoints will capture the survival tail which is by definition made up of patients who live longer than the median patient. Because of this, no matter what the characteristics of the survival tail may be, it will have no effect on mOS. The long running DCVax-L trial now works to the advantage of the drug. There should be actual survival data on all patients, both before and long after median survival, that should define the survival tail.

A New Statistical Analysis Plan was Needed

The decision by management to change the focus of the trial to defining the survival tail probably means that mPFS and mOS as endpoints are not that informative. Hence the original Statistical Analysis Plan (SAP) may not be appropriate and a new plan may be necessary. If so, what should be the endpoint (s)? Northwest said that it hired some time ago three highly skilled and independent statisticians to come up with a new SAP that will propose to regulators a plan on how to analyze the data in order to define a survival tail.

A complication in designing the new SAP is that that 331 patients were randomized to the trial in a ratio of 2:1, DCVax-L plus SOC versus SOC. Importantly, patients who progressed on the active arm of the study could choose to stay on drug and those in the control group were allowed to switch to DCVax-L. Based on blinded data, we know that

- About 221 patients initially received DCVax-L plus SOC and 110 received SOC.

- Around 297 patients received DCVax-L at some point in the trials, which indicates that about 76 patients started on SOC were switched to DCVax-L.

- Approximately 34 patients received only SOC

- Until unblinding, we cannot know how many patients progressed on DCVax-L plus SOC but elected to remain on therapy

Most clinical trials compare the active arm to the control arm. However, in this case only about 34 patients are in the SOC control arm. There is unlikely to be enough data from the control arm to meaningfully compare DCVax-L plus SOC to SOC. If so, the data for DCVax-L plus SOC might have to be compared to historical data from other trials. There is a large body of data from other trials that gives a good insight into expected results for SOC, but taking this approach is not a great thing. The SAP will also want to evaluate results for patients who:

- started on DCVax-L plus SOC and remained on therapy,

- stayed on DCVax-L plus SOC after their disease progressed,

- started on SOC and switched to DCVax-L plus SOC when their disease progressed

Within each group, there will be patients who dropped out or who were lost to follow-up. The data for each group also will need to be analyzed for risk factors, notably methylation status, degree of resection and ICH status. Coming up with a new SAP is an extremely complex and difficult exercise.

When will the Statistical Analysis Plan be Presented to Regulators and When Will investors See Topline Data?

The Company in conjunction with its statistical consultants will present this new SAP to regulators in the US and possibly Europe. There was no guidance on how soon this might be, but the Company seems to indicate it is wrapping up and this could be in a fewweeks or months. NWBO wants regulators to evaluate, comment on and hopefully buy in to the SAP before they lock the data base on the phase 3 trial, but will they? The most negative case would be that the FDA would view this as an unacceptable, retrospective change in the design of the trial and not accept a new SAP in any form. In this case they might insist on the trial being evaluated on the basis of mPFS and mOS as originally specified. I think the chances of this are quite low but not zero. Even in this case, the long running survival data gives a unique and highly informative view into survival of GBM patients that has never been seen before in any other clinical trial. Because of the importance of the survival tail, it would be desirable to have five to ten years of data on trials of all new immunotherapy drugs. However, it may not be medically or economically possible to design such trials. The DCVax-L trial may be one of a kind for duration.

As I said before, the new SAP will be presented to the regulators in the foreseeable future. We will then have to await the assessment of regulators. Will they agree with the new SAP and if so how long will this take? Will they make suggestions that need to be incorporated in the SAP and if so, how long will this take? Will they take the rigid view that the original endpoints of mPFS and mOS should be adhered to?

Whatever the case, this appears to be the gating factor. The trial data sits with the CRO and remains blinded to the Company, investigators and regulators. The CRO has had to collect an incredible amount of data on this trial. There are literally millions and millions of data points to collect. In doing so, there are innumerable queries that have to be looked into and evaluated. The Company offered as an example a case in which it was reported that a patient took 200 Advil tablets when in actuality they took a 200 mg Advil. They have had to go through perhaps several thousand inquiries, but are down to a few hundred which should be completed shortly. This is not the gating factor for reporting topline data. Once the SAP is determined they should be able to quickly lock the data base and analyze the results.

I think we are looking at topline results for the phase 3 trial of DCVax-L being reported in a few months, perhaps in September. However, this is an outright guess. To repeat, the gating factor is the response of regulators to the new SAP.

Tagged as Marnix Boscg comments at 209 ASCO, Northwest Biotherapeutics Board of Directors, Northwest Biotherapeutics Inc., Statistical analysis plan for DCVax-L phase 3 trial + Categorized as Company Reports, LinkedIn

Great report