Novocure: First Report on this Dynamic Growth Stock with Important Similarities to Northwest Biotherapeutics (NVCR, $78.77)

Investment Overview

My reason for first looking at Novocure in depth was that it provided important comparative information versus Northwest Biotherapeutics’ DCVax-L. Those of you who have followed my research know that I believe that there are very good reasons to believe that DCVax-L will be approved in 2020 or 2021 for newly diagnosed glioblastoma. Novocure’s medical device Optune was approved in 2015 for newly diagnosed glioblastoma. In this report, I look at the clinical data that led to Optune’s approval and its impressive commercial success as a guide to the commercial potential for DCVax-L. I have previously only followed Optune from afar so that this is my first deeper dive into the Company. I have come away impressed that its fundamental prospects are quite impressive.

As we near the unblinding of the DCVax-L phase 3 trial, I am doing a series of reports on what the outlook for the stock price of NWBO might be if the results are positive and lead to regulatory approval. This is a highly binary event and if the trial fails there is a strong probability that the company could go out of business or in a best case sell for just a few pennies. Based on blinded data released from the phase 3 trial there are very good reasons to hypothesize that the unblinded results will establish that DCVax-L provides a therapeutically meaningful improvement in survival and could be a major advance, initially in the treatment of glioblastoma and ultimately in a broad array of solid tumors. So, what does this portend for commercial prospects for DCVax-L?

In trying to answer this question I have taken a close look at Novocure as a peer company. Over the last 15 years, the FDA has only approved one drug and one medical device for the treatment of newly diagnosed glioblastoma. In 2005, it approved the chemotherapy drug temozolomide and it became part of standard of care (SOC) in combination with radiation. Ten years later in 2015, it approved Novocure’s medical device Optune for newly diagnosed glioblastoma to be used in conjunction with SOC (radiation plus temozolomide). Analyzing how Optune has performed commercially and how that has translated into a dramatic increase in Novocure’s market capitalization is instructive. In a future report, I will go into some detail in comparing the clinical trial results (principally median overall survival) that led to the approval of Optune with the unblinded data from the DCVax-L phase 3 trial. My reading is that the unblinded data suggests that mOS for DCVax-L is as good or better that that for Optune.

I am not making any recommendation of NovoCure at this point in time, but this is not to say that I am negative. I am much intrigued by Optune’s cancer treating technology that is driven by biophysics rather than biochemistry with which I am most familiar. Based on my initial assessment, Optune is a highly effective therapy for newly diagnosed GBM and its pipeline potential is staggering as its technology can potentially address all solid tumors. The fundamentals look extremely promising. It could be the case that I might recommend the stock at some future date, but not at this time for two reasons. This is my first look at NovoCure and I have learned from hard experience gained over 30 years is that it takes time to really understand the fundamentals of a company and how these drive the stock price. At this point, I don’t enough of a view of the positives and negatives that influence the stock price to be comfortable with a but recommendation.

Also, the market capitalization does reflect considerable enthusiasm for Optune’s prospects. Based on current trailing twelve months sales of $322 million the market capitalization is $8.1 billion or 25 times sales. However, let me give you my prejudice. If I were absolutely forced to make a decision between buy and sell, it would be buy. However, at this time my primary purpose is to compare and extrapolate clinical data and commercial success from Optune to project regulatory and clinical outcomes for DCVax-L.

Optune Has Resulted in Impressive Sales Growth for Novocure

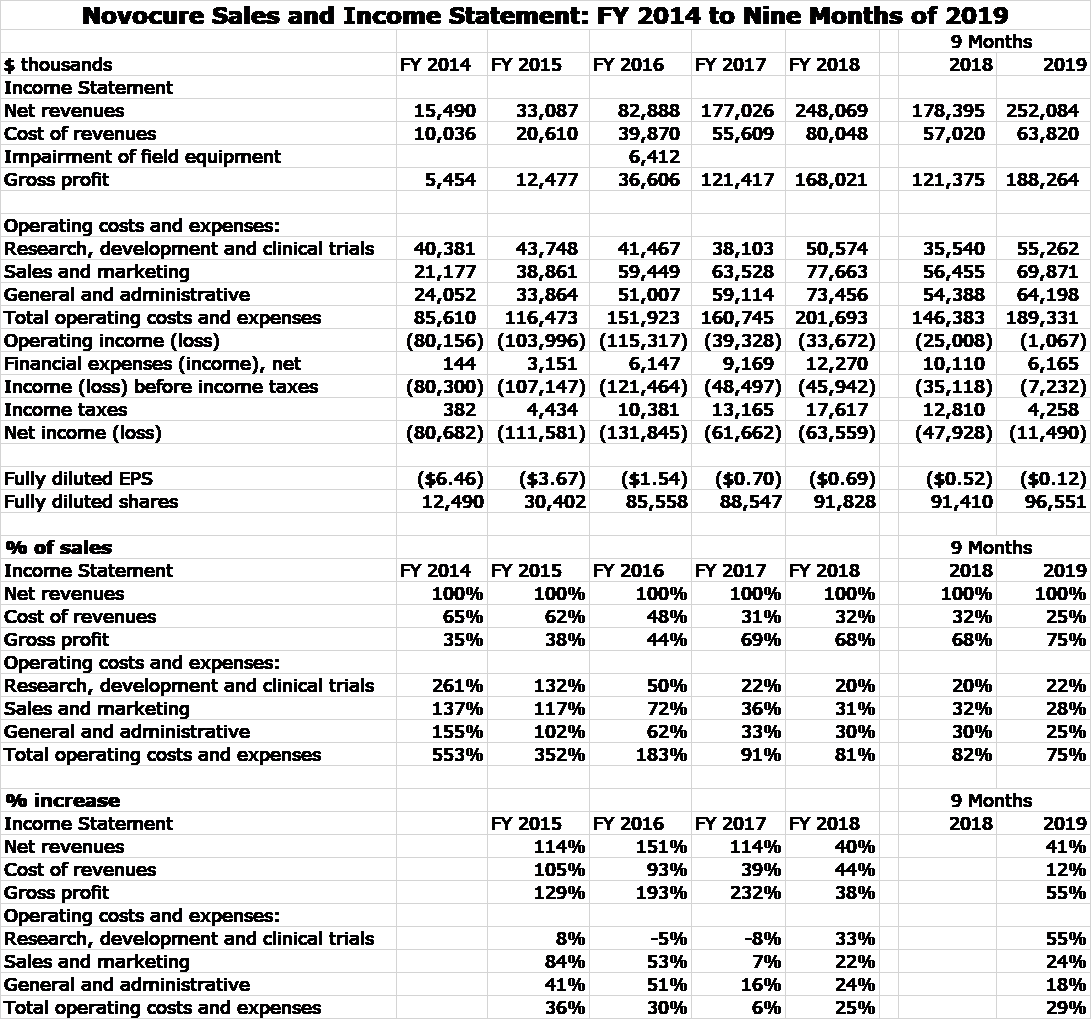

Optune was approved for the treatment of recurrent glioblastoma in 2011 and by 2014, this indication led to all of Novocure’s $16 million of sales. In 2015, Optune was approved for newly diagnosed glioblastoma and this caused sales to explode. Optune was approved for mesothelioma in 2019, but this indication is not expected to make a measurable contribution to sales until late 2020. The following table shows the impressive growth of Novocure over the 2014 to 2019 time span, almost all of which stems from its approval for newly diagnosed glioblastoma.

Market Valuation of Novocure

The above P&L clearly shows that Novocure has been and continues to invest heavily in research to develop its pipeline and also to build a global infrastructure. Clearly, the Company is not being run to generate near term profits. This makes valuing the stock on the basis of profits difficult so how should we approach this. One conventional valuation approach used Wall Street analysts is to make five year sales and profit projections, assume a terminal P/E ratio applied to EPS and then assume a discount rate to determine present value. While this approach looks impressive, it requires so many arbitrary assumptions that it has very little value in actuality.

Sales for an emerging company like Novocure are difficult to project, but are still more predictable than profits. I usually prefer to project sales and then guess at the ratio of market capitalization to sales that the market has awarded Novocure in the past as a guide to what this ratio might be in the future. Then using my sales projection, I can come up with a target price. I am not quite willing to make these sales and resultant market capitalization projections at present, but I think it might be useful to look at historical market capitalization to sales ratios.

| Novocure’s Historical Valuation Based on Sales | |||||

| 2015 | 2016 | 2017 | 2018 | Sept 2019 | |

| Stock price at period end | $22.36 | $7.85 | $20.20 | $33.48 | $83.90 |

| Shares (millions) | 30.4 | 85.6 | 88.5 | 91.8 | 96.6 |

| Market capitalization ($millions) | $680 | $672 | $1,788 | $3,073 | $8,105 |

| Trailing 12 months sales ($millions) | $33 | $83 | $177 | $248 | $322 |

| Market capitalization/ sales | 20.5 | 8.1 | 10.1 | 12.4 | 25.2 |

Optune’s Technology Is Based on Tumor Treating Fields

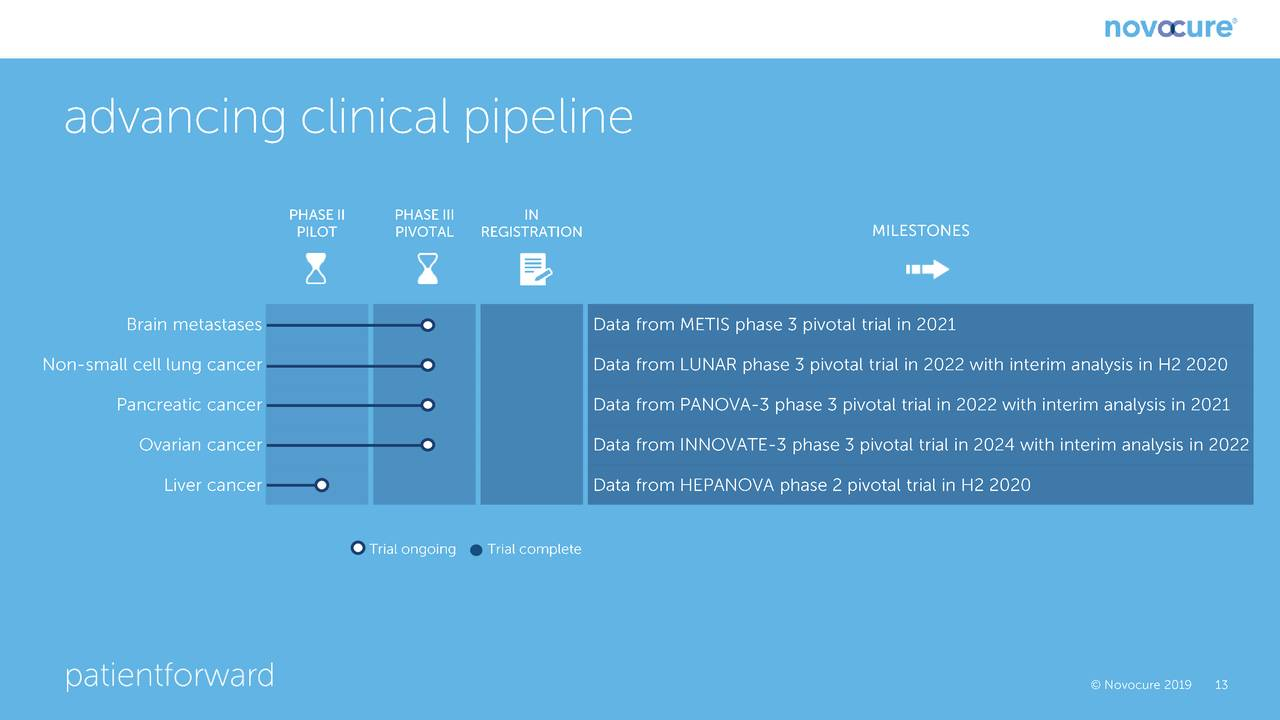

Novocure’s technology for cancer treatment is based on an understanding of the electrical properties of tumors; its approach is based on biophysics rather than biochemistry. It uses low intensity electric fields that Novocure describes as Tumor Treating Fields (TTF) which hold the promise of broad applications in oncology. So far, TTF has been tested pre-clinically in 19 different types of solid tumors and was first approved for relapsed glioblastoma in 2011 and for newly diagnosed glioblastoma in 2015 and then mesothelioma in 2019. It is in phase 3 clinical trials for treating ovarian, liver and pancreatic cancers and also brain metastases caused by non-small cell lung cancer.

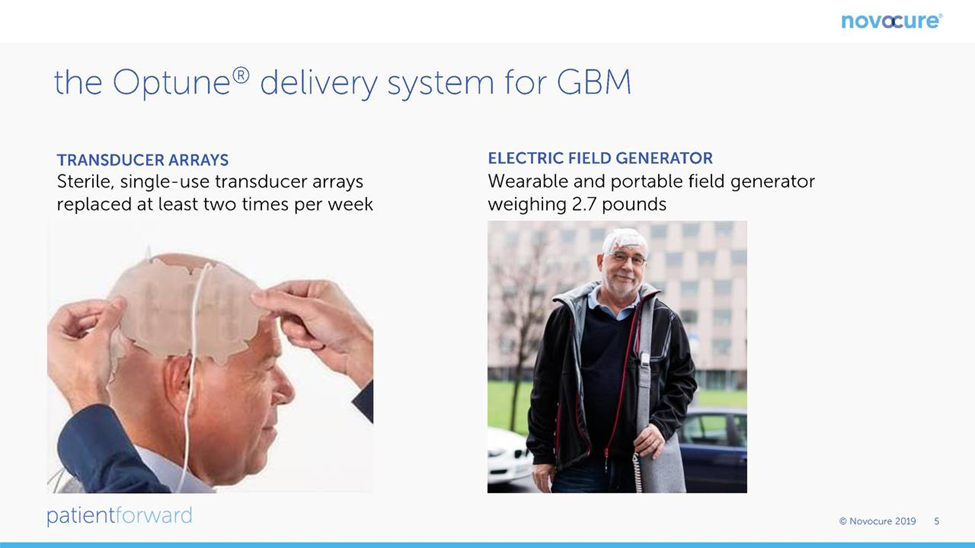

The intensity of TTF needed is dependent on tumor cell size. In the case of Optune which was developed for glioblastoma, TTF is delivered through 4 transducer arrays with 9 insulated electrodes that are placed on the shaved scalp and connected to a portable device that generates 200-kHz electric fields. The scalp must be shaved and the transducer arrays attached via an adhesive patch. Transducer array layouts differ by patient and are determined using a TTFields mapping software system to optimize field intensity within each patient’s treated tumor. All treatment is delivered on an outpatient basis. Therapy must be delivered continuously throughout the day and night and efficacy is strongly correlated to time on therapy. The device should be on for 18 to 22 hours per day and virtually every day. If the device is not on, the patient is not being treated.

The portable Optune device includes an electric field generator, transducer arrays, rechargeable batteries and accessories. The electric field generator can be run from a standard power outlet or with a battery. It is carried in a backpack and rechargeable batteries are carried at the waist to power the generator when the patient leaves or moves around the house. Transducer arrays are changed when hair regrows or when water or some other substance reduces adhesion to the skin; change is generally done twice a week. Patients and care givers are trained to operate the device independently, replace transducer arrays, and troubleshoot any alarm conditions, e.g., disconnected cables. Software tracks and records the length of time Optune is used each day.

There is no clear understanding on how long Optune should be used. It is generally used on an ongoing basis unlike radiation, chemotherapy or targeted therapy which are used to induce a remission and then stopped. Right now, patients should probably expect to wear it for the duration of their life. Treatment can be and usually is delivered during sleep. Optune records how much time per day treatment is being delivered. Over time, knowledge will be gained on whether treatment holidays could be acceptable, but right now prudence would suggest wearing the device for the life of the patient.

The following chart from Novocure’s corporate presentation shows a patient outfitted with Optune.

The Optune device is extremely intrusive. The arrays are attached to the shaved scalp which causes much unwanted attention and patients generally attempt to cover the head with a cap, scarf or wig. Words really can’t describe the discomfiture of wearing Optune. I think that it is best understood by this you tube video that shows a young woman suffering from recurrent GBM and how Optune affects her daily life. Quite frankly, Optune is a horrible intrusion on a patient’s quality of life. However, this has to be weighed against its demonstrated ability to extend survival. I heard an anecdote from one woman who said “I am not going to my grave with a shaved head, wearing that helmet and being gawked at by everyone I see”. So, what would you do if you had to make the choice?

Commercial Results for Optune

Medical devices like Optune usually have a business model in which significant sales arise from selling the device and additional revenues come from selling disposables. Novocure disdained this approach and priced Optune like a drug. It charges about $21,000 per month although after discounts the price realized by Novocure is probably more like $15,000 per month. There is no defining data on how long Optune should be used, but at this time most physicians recommend wearing it for the life of the patient.

At a cost per year of $21,000 per month the full year price to the health care system is about $252,000 and over a five year period the cost would be around $1.25 million. For comparison, the CAR-T products, Kymriah and Yescarta are considered to be extremely expensive and have a list price of about $400,000 and a net price of about $325,000. They are given only once as a single infusion. However, costs associated with administering the CAR-T agents and dealing with side effects can drive the price to $1 million in some cases. There are few such treatment related costs with Optune.

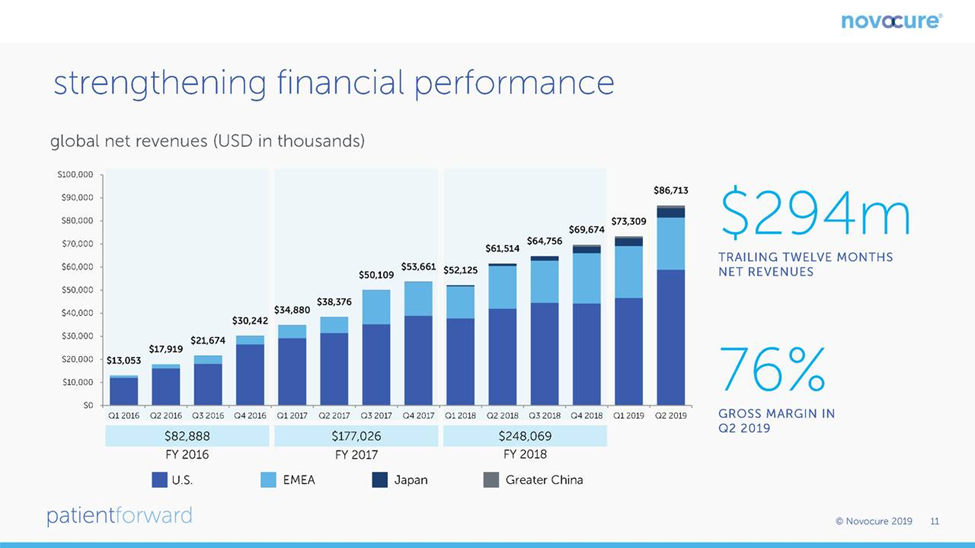

Optune was first approved for the treatment of relapsed glioblastoma in 2011 and by 2014, sales were a modest $15 million. The approval for newly diagnosed glioblastoma in late 2015 led to an explosion in sales so that for the twelve month period ending with 3Q, 2019, sales were $294 million which was all stemming from treating glioblastoma. This slide from the Novocure corporate presentation shows this growth on a quarterly basis through 2Q, 2019.

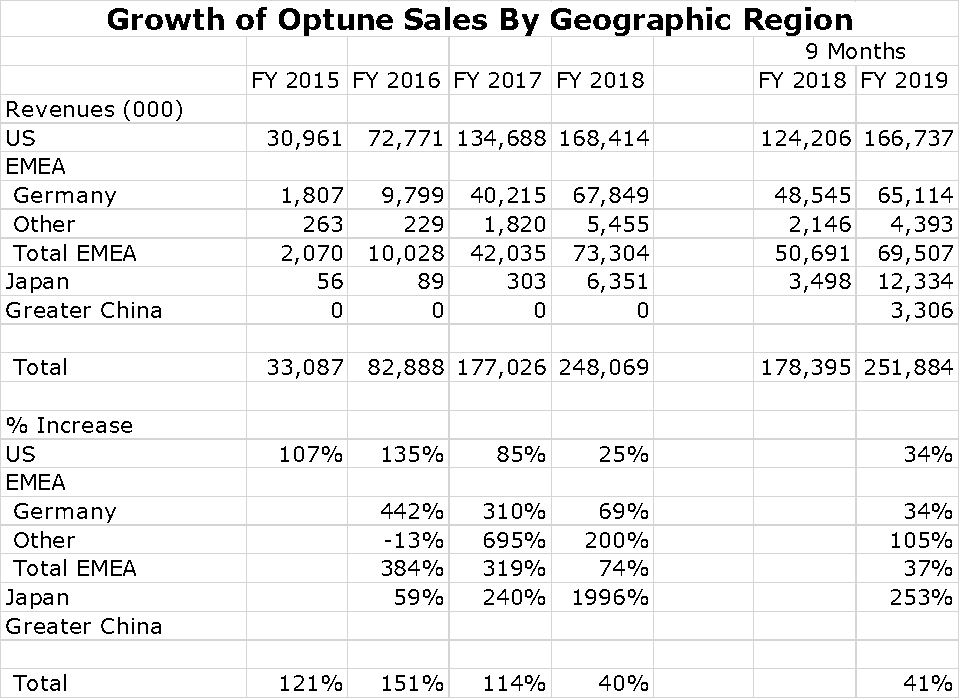

For a small company, Novocure has been successful in building a global sales presence. Its most important market is, of course the US, which is followed by Germany and Japan. However, sales are growing rapidly in Japan and a collaboration with Zai Lab in China resulted in impressive sales in 2019. It also has a small but growing presence in other countries of the Europe. Middle East and Africa Region (EMEA). Switzerland, Austria and Israel are small but meaningful countries for sales. Growth of Optune sales by region is shown in the following chart.

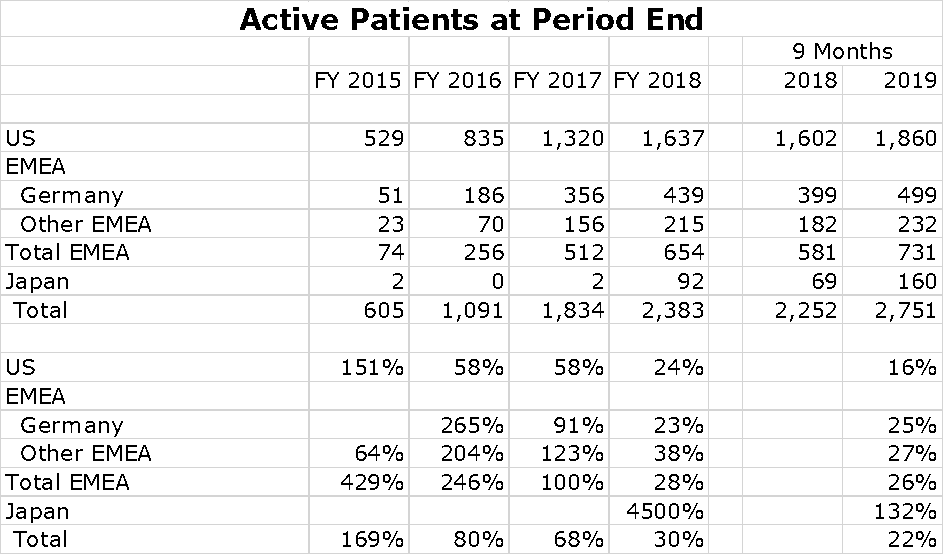

There are about 14,000 cases of newly diagnosed glioblastoma in the US each year and probably a similar number in Europe. China is estimated to have 40,000 new cases per year. Optune provides data that shows the number of patients being treated in each global region at the end of the year for the period 2015 to 2018 and at the end of 3Q, 2019. This is shown in the following chart at the end of 2Q, 2019. You can see that the penetration is still modest.

I have put together an Excel spreadsheet showing patient growth per region over the last five years. The US and Germany seem to be slowing although still showing impressive rates of growth. No patient treatment numbers are shown for China, but sales seem to be exploding.

Clinical Trial Data That Led to Optune Approval in Newly Diagnosed Glioblastoma

Attempts to develop treatments for newly diagnosed glioblastoma have been frustrating. The only new drug approved is the chemotherapy drug temozolomide that was approved in 2005 on the basis of the Stupp trial in which temozolomide was added to the then standard of care that was surgical resection followed by radiation. Optune was approved in 2015 by showing that its addition to surgical resection followed by radiation and temozolomide improved survival.

The Stupp Trial That Led to Approval of Temozolomide

In 2005, the chemotherapy drug temozolomide was shown to improve survival when added to then standard of care which was surgical resection followed by radiation. The Stupp trial compared results of 278 patients treated with temozolomide combined with radiation to 286 patients treated with radiation alone. The primary end point was overall survival; secondary end points were progression-free survival, safety, and the quality of life.

Median overall survival was increased by 2.5 months and this led to its being added to standard of care.

- mOS was 14.6 months (95 percent confidence interval, 13.2 to 16.8) with radiotherapy plus temozolomide and 12.1 months (95 percent confidence interval, 11.2 to 13.0) with radiotherapy alone. The p value was <0.001 by the log-rank test and the hazard ratio was 0.63 (95 percent confidence interval, 0.52 to 0.75

Median progression-free survival was increased by 1.9 months.

- mPFS was 6.9 months (95 percent confidence interval, 5.8 to 8.2) with radiotherapy plus temozolomide and 5.0 months (95 percent confidence interval, 4.2 to 5.5) with radiotherapy alone. The hazard ratio for death or disease progression was 0.54 [95 percent confidence interval, 0.45 to 0.64]; P<0.001 by the log-rank test)

Optune Phase 3 Data Leading to Approval in Newly Diagnosed Glioblastoma

Optune (TTF) was initially approved for the treatment of recurrent glioblastoma in October 2011. This was followed by a phase 3 trial in newly diagnosed glioblastoma which was successful and led to FDA approval in October, 2015. That trial enrolled 695 patients of whom 466 received Optune plus SOC versus 229 on SOC. Standard of care was surgical resection followed by radiation and temozolomide. The primary endpoint was median progression free survival and the secondary endpoint was median overall survival. Both endpoints were successfully met:

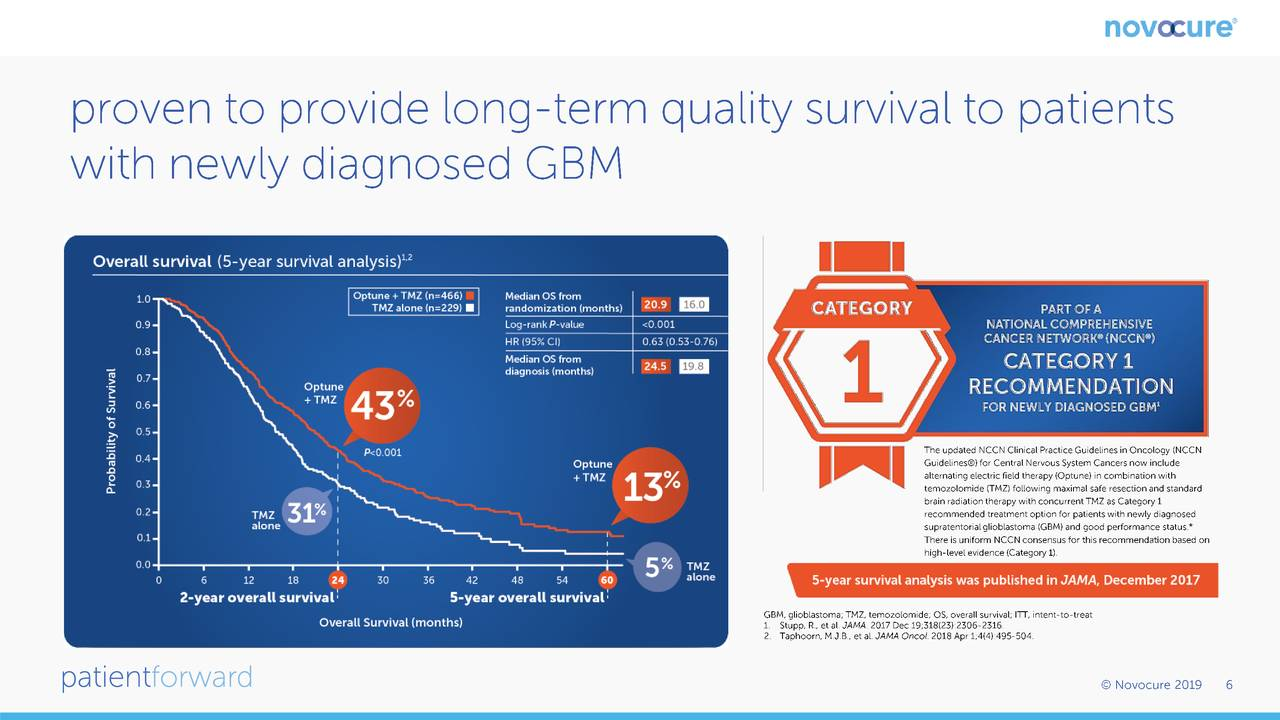

Median overall survival was increased by 4.9 months.

- mOS was 20.9 months in the TTF-temozolomide group vs 16.0 months in the temozolomide-alone group (HR, 0.63; 95% CI, 0.53-0.76; P < .001).

Median progression free survival was increased by 2.7 months

- mPFS was 6.7 months in the TTF-temozolomide group and 4.0 months in the temozolomide-alone group (HR, 0.63; 95% CI, 0.52-0.76; P < .001).

The results are summarized below:

| Results of the Optune Phase 3 Trial in Newly Diagnosed Glioblastoma | |||

| TTF + temozolomide | Temozolomide alone | Improvement | |

| mOS | 20.9 months | 16.0 months | 4.9 months |

| mPFS | 6.7 months | 4.0 months | 2.7 months |

Methylation of the MGMT gene is the strongest predictor for outcome and benefit from temozolomide chemotherapy. If the gene is unmethylated, it produces an enzyme that blocks the effects of temozolomide. The results for MGMT methylation versus MGMT non-methylation in the Optune phase 3 trial are shown below. It is important to note that methylation status was not available for all patients.

| Results Broken Down by Methylated and Non-methylated MGMT Gene | ||||

| TTF+temozolomide | Temozolomide alone | Improvement | ||

| Methylated MGMT gene (mOS) | 31.6 months (CI 21.1-48.5) | 21.2 months (CI 12.3 -37.9) | 10.4 months | |

| Unmethylated MGMT gene (mOS) | 16.9 months (CI 9.7-28.2) | 14.7 months (CI 9.8-24.8) | 2.2 months | |

| All Patients | 20.9 months | 16.0 months | 4.9 months | |

Systemic adverse event frequency was 48% in the TTF-temozolomide group and 44% in the temozolomide-alone group. The greatest incidence of and most troubling SAEs are almost certainly attributable to temozolomide. Mild to moderate skin toxicity underneath the transducer arrays occurred in 52% of patients who received TTF+ temozolomide vs no patients who received temozolomide alone. The side effects seem to be quite mild with Optune

Comparison of Survival in Stupp 2005 Trial to Optune Phase 3

A five year follow-up to the Stupp trial was published in Lancet in 2009 with the following results. Overall survival was 27.2% at 2 years, 16.0% at 3 years, 12.1% at 4 years, and 9.8% at 5 years with temozolomide. In 2019, a follow-up to the Optune trial was published in JAMA and showed results as follows:

| Survival Results of Optune Phase 3 Survival Results with Stupp Trial Follow-Up in 2009 | ||||

| 2 Years | 3 Years | 4 Years | 5 Years | |

| Optune Phase 3 Results | ||||

| TTF + temozolomide | 43% | 26% | 16% | 13% |

| Temozolomide alone (SOC) | 31% | 16% | 6% | 5% |

| Stupp Trial SOC Follow-up 2009 | 27.2% | 16.0% | 12.1% | 9.8% |

In looking at the above results, keep in mind that the Stupp trial follow up is an actual percentage for each year. In the Optune trial, the two year and three year data are also actual but years 4 and 5 are based on Kaplan-Meier projections. Comparing across trials is always circumspect, but nevertheless I am going to do so. The Optune phase 3 trial suggests a significant benefit at each of the four time intervals, two, three, four and five years. The 10% increase in survival in year 4 and the 8% increase in year 5 in the Optune trial are impressive. However, when compared to the Stupp trial follow-up the increase of 4% in year 4 and 3% in year 5 are less impressive. Apparently, the SOC groups in the Optune trial did not due as well as the SOC group in the Stupp trial.

In its corporate presentation. Novocure shows the following Kaplan Meier plot. As shown, we see a divergence throughout all timepoints which indicates that Optune is providing a survival benefit in comparison to SOC. Novocure emphasizes the divergence at five years in which 13% of Optune patients are alive as compared to 5% of those on SOC. This indicates that in comparison to SOC, 8 more out of every 100 patients treated with Optune would be expected to be alive at five years. This is the type of benefit that has been seen with checkpoint inhibitors in other aggressive cancers and that has resulted in their huge commercial success. I want to re-emphasize that comparing results from one clinical trial to another can be very misleading. That said, if we compare the 13% survival of Optune patients at five years to the 10% seen with the Stupp trial, the results are more pedestrian. Also, remember that the Optune number is a Kaplan Meier projection and the Stupp number is actual.

Novocure Has an Extremely Impressive Pipeline

Over the last 20 years, Novocure has done preclinical research in 19 different cancer types. The field generator technology used in Optune can be applied to other solid tumors by tuning to the appropriate frequency which is determined by tumor cell size. Output power is then adjusted to treat tumor tissue volume. Transducer arrays for Optune are applied to the skull to target glioblastoma. Other devices have been developed to apply to the chest as in the case of lung cancer or the abdomen as in the case of treating ovarian, pancreatic and liver cancer. In addition to developing devices to treat other solid tumors, the Company is concentrating on engineering efforts to improve ease of use for patients. Making the device less intrusive could be a major commercial breakthrough.

Novocure states that Tumor Treating Fields have not exhibited systemic toxicity. The most common side effect is mild to moderate skin irritation at sites at which the transducer arrays are attached. TTF can be used in combination with other cancer treatments without concern over exacerbating side effects and will likely be continued after other therapies are ended.

The following chart shows the most important near term human trials and the estimated timing for release of data. The most important trial for which near term results are pending is a phase 3 trial in patients suffering from brain metastases due to non-small cell lung cancer (NSCLC). It is estimated that there are 80,000 patients who suffer brain metastases from NSLC as compared to 14,000 patients diagnosed each year with newly diagnosed glioblastoma. SOC is a gamma knife followed by watchful waiting; there is no real therapy. There will be an interim look at the data in this trial in 2H, 2020. Management is guiding that it expects that the recommendation will be to continue the trial, it does not believe that it will be stopped for efficacy as was the case with the phase 3 trial in newly diagnosed glioblastoma which was stopped for efficacy at an interim analysis. As shown below, the other important data readouts for pivotal phase 3 trials occur in 2021 and 2022.

Financial

Novocure enjoys high gross margins and despite aggressive spending on research and development and building a global marketing structure nearly broke even on cash flow from operations in 2018 and has become cash flow positive from operations in 2Q, 2019 and 3Q, 2019. Its business requires only minimal capital spending requirements to grow its business. This is shown below:

| Novocure’s Cash Flow from Operations and Capital Spending | ||||

| $ millions | 2018 | 1Q, 2019 | 2Q, 2019 | 3Q, 2019 |

| Cash flow from operations | ||||

| Net income | (63.6) | (12.2) | (1.3) | 1.9 |

| Depreciation and amortization | 9.0 | 1.9 | 2.1 | 1.9

|

| Stock based compensation | 39.8 | 9.6 | 13.7 | 14.3 |

| Other | 12.9 | (3.6) | (5.4) | (3.2) |

| Total cash flow from operations | (1.9) | (4.3) | 9.1 | 14.9 |

| Capital spending | (6.7) | (1.8) | (2.3) | (2.7) |

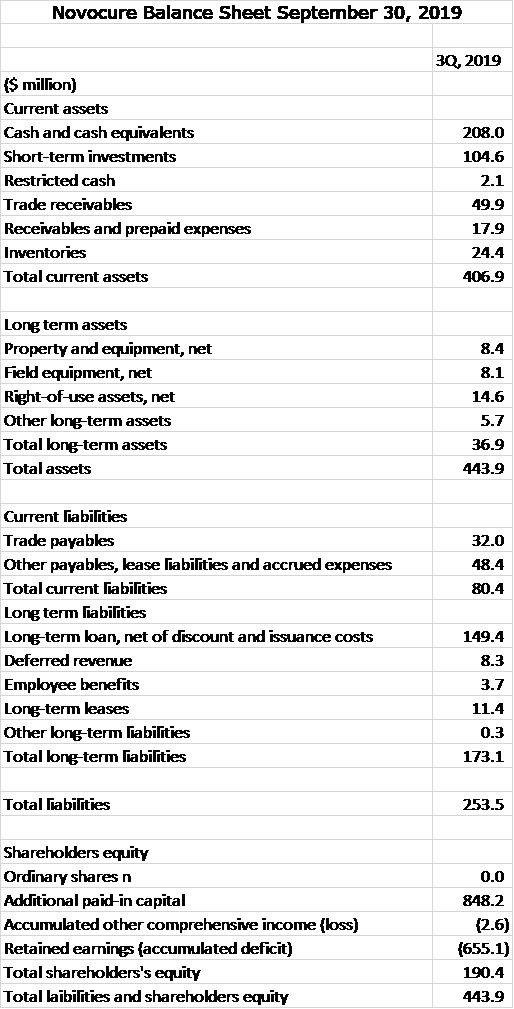

Given the strong sales growth, Novocure should begin to generate very significant cash flow in upcoming years.

Novocure also has a strong balance sheet with $313 million of cash equivalents and short term investments. Its business does not require large inventories or receivables. Its working capital is $327 million. Total long term liabilities are $173 million. Given the cash position and emerging strong positive cash flow from operations, this leverage is quite modest. The balance sheet is strong.

Tagged as Clinical data for Optune in glioblastoma, Comparing Novocure and Northwest Biotherapeutics, Northwest Biotherapeutics Inc., Novocure + Categorized as Company Reports, LinkedIn

Larry, the above chart titled “Proven to provide long term quality….” indicates that the control group in the Optune trial was treated with TMZ alone; not with TMZ and radiation. Would this impact your analysis at all. Can Optune and radiation not be used with each other? The box to the right side of the chart described above seems to indicate that radiation is now recommended with Optune? If the original Optune trial did not use radiation, could the delta between control and drug have been duplicated by using radiation and not using Optune? Is it possible Optune works best in cases where radiation is not available. Like you I am primarily interested in NWBO, but I find this information about Optune to confuse the implications for NWBO. Any light you can shed would be appreciated.