Northwest Biotherapeutics: Transformed from an Ugly Duckling Bulletin Board Company to a Promising NASDAQ Company (NWBO, $3.20)

Investment Update

In my July 19, 2012 report Northwest Biotherapeutics' DCVax Cancer Vaccines May Be a Game Changer in Cancer Therapy, I recommended purchase of Northwest Biotherapeutics (NWBO). I felt that the company represented an asymmetric investment opportunity for investors willing to risk losing much or even all of their investment for a chance to realize extraordinary returns. I believe that the fundamentals of the company have strengthened meaningfully from the time of my initial report and I am reiterating my Buy recommendation. The essential element of my recommendation is the belief that the phase III trial in glioblastoma multiforme for NWBO's lead product DCVax-L has a reasonable chance to succeed; topline results will probably be reported in 1H, 2014.

It is not the intent of this report to discuss NWBO's clinical trials, products or commercial potential; this was discussed in detail in the July 19th report. In addition to the potential for DCVax-L, a key element of my initial recommendation was the belief that NWBO could recapitalize a precarious balance sheet, raise capital through an equity offering and change its trading status from a bulletin board to NASDAQ listing. This would allow for the first time in nearly a decade for mainstream institutional investors to consider an investment in the company. In turn, this would also provide easier access to capital. The purpose of this report is to discuss the dramatic improvement in the balance sheet since I issued my July report and the number of shares and share equivalents outstanding updated for the balance sheet recapitalization, recent equity offering and reverse stock split.

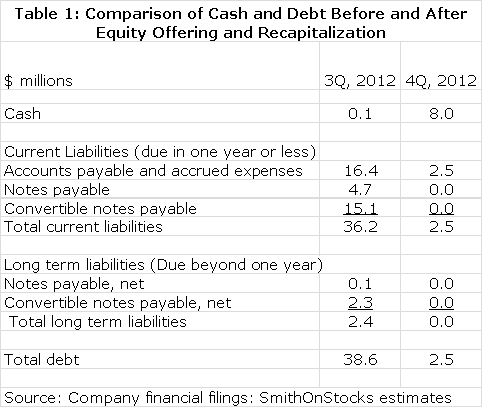

On September 26 the stock went through a reverse 16:1 stock split and the company announced that it planned to raise up to $25 million through an equity offering. On December 7, 2012 it completed a stock and warrants offering that with the exercise of the Green Shoe raised gross proceeds of $13.8 million. As or more importantly, the company has been able to recapitalize its balance sheet by issuing equity or cash for all convertible notes, all notes payable and most accrued short term operating expenses. All that is left is a small amount of trade payables needed for support of the ongoing clinical trials. I estimate that the company has effectively reduced outstanding short and long term debt from about $39 million at the end of 3Q, 2012 to $2-$3 million by the end of 4Q, 2012. On Tuesday, December 18th management rang the opening bell to celebrate NWBO's listing on NASDAQ.

Through a series of misfortunes which are not unprecedented with small biotechnology companies, Northwest throughout the last eight years has been an undercapitalized company whose bulletin board status created great problems in raising capital and attracting quality investors. Since 2007, it has gone through a series of "near death" experiences. It was living from quarter to quarter with cash balances that could fund only one or two quarters of operational cash burn. With capital from the equity markets unavailable, the company was only kept alive because of investments from the company's CEO Linda Powers, venture capital funds controlled by her and non-traditional investors. Without her belief in the company and willingness to invest her own money, there is a high probability that Northwest would have gone out of business. Ms. Powers and entities which she controls own about 40% of shares outstanding. Another 20% is owned by parties who have participated in the financings since 2007 and have close ties to management.

The stock has been quite volatile in the period since my report. From July 19 until September 26th the stock generally traded in a price range of $3.50 to $5.50. The announcement of the reverse stock split for reasons that I don't quite understand caused a short squeeze so that the stock had a closing price of $10.95 on September 28. It then traded down but settled into a range of $5.50 to $6.50. The closing of the equity offering was announced on December 7th and caused a quick $2.00 drop in the stock price to $3.50. Subsequently, the stock has continued to drift down to around $3.20 per share.

Upcoming Catalysts

The key considerations or catalysts that may impact the stock over the next several quarters are as follows:

- The expected reporting of phase III topline results from the pivotal trial phase III trial of DCVax-L in 1H, 2014 is far and away the most critical upcoming event for the company.

- There could be an interim look at this phase III trial in 3Q, 2013, but I would expect that the information at that time would relate only to safety and assuming there are no safety issues will result in a recommendation to continue the trial. I don't expect any explicit data on efficacy.

- The German drug regulatory agency equivalent of FDA could approve the phase III trial and compassionate use of DCVax-L in Germany in 1Q, 2013.

- The German equivalent of the Center for Medicare and Medicaid Services or CMS could issue reimbursement guidance for compassionate use of DCVax-L in 1Q, 2013.

- There could be some information by 3Q or 4Q, 2013 on the trial of the company's third cancer vaccine product, DCVax Direct, which could begin enrollment in March, 2013.

- There have been a number of patients who have received DCVax-L on a compassionate use basis in the US, Israel and Europe, some of whom have been on the drug for several years. The company has been very quiet about results in these patients, but we could see some case reports in 2H, 2013.

- Investors may recall that NWBO conducted a phase I/II trial with its dendritic cell cancer vaccine DCVax Prostate that treated 22 patients with metastatic prostate cancer and 14 with non-metastatic disease. In the metastatic group, the number of patients alive at three years was 64% for DCVax Prostate which compares to 33% for Dendreon's Provenge in its phase III trials, which enrolled many more patients. I have previously written that I believe that the superior manufacturing process of Northwest Biotherapeutics hypothetically could produce a superior product to Provenge. DCVax Prostate was approved some time ago to begin phase III trials, but potential partners who will be needed to fund and conduct the trials have held back to await results for Zytiga and Xtandi in metastatic prostate cancer. Results are in and the median survival improvement in this disease setting was 4.9 months for Zytiga and 5.0 months for Xtandi, which is about in line with the 4.9 months seen with Provenge. For NWBO's product the increase in median survival was 18 months, but remember that this was only in 22 patients treated which compares to the several hundred in the Zytiga, Xtandi and Provenge trials. The information that Zytiga and Xtandi results were in line with Provenge has rekindled partnering interest in DCVax Prostate and it is possible that a partnering deal could be consummated in 2013 or early 2014. I think that in the event of such a deal that the upfront payment could be $20 million to $40 million based on a look at comparable deals.

- I project that the company will end 2012 with a little under $8 million of cash. In addition, it will have access to $5.5 million of German government grant money. The quarterly burn rate with the phase III trial in full swing is about $6 million per quarter, but will probably decline as that trial completes enrollment. The company clearly will have to raise more capital, but not necessarily right away. If the company raises equity, it might turn to European investors who because of NWBO's operations in the UK and Germany may view it as a European biotechnology surrogate (there aren't that many publicly traded European biotechnology firms). The recent equity offering was delayed by Hurricane Sandy and the company did not have time to do the European leg of the roadshow. The company has also filed an S-3 registration statement that will allow it to do shelf registrations and equity line or at the market types of transactions; these are much less dilutive and more quickly done than roadshow public offerings. There is also the potential for non-dilutive sources of capital such as a partnering deal on DCVax Prostate, revenues from compassionate use and potentially more grants from the German government. Through some combination of these sources of capital, I see the company as being able to fund operations reasonably comfortably through the release of topline results for DCVax-L which I project for 1H, 2014. In a Titanic scenario in which all of these options are unavailable, I think that the company could fall back on the investment strategies used to finance the company in the last eight years.

Investors always worry about being diluted by equity offerings. However, for a development stage biotechnology company with a significant burn rate necessitated by the conduct of clinical trials, this is inevitable. Raising money is not a bad thing for shareholders if it creates value and in the case of NWBO this is definitely the case as it will be spent on the phase III clinical trial of DCVax-L. What investors must consider is that management's interests are in line with shareholders. If management owns little of the stock, their primary interest may be in getting as much money as possible for clinical trials to get more shots on goal (even if they are not good shots) and to pay their salaries. In the case of Northwest, the CEO Linda Powers and entities affiliated with her own over 40% of the stock so that her interests are aligned with shareholders.

Aside From Financial Issues, What Else is Going On?

Before getting into the financial discussion, I wanted to list fundamental events that have occurred over the last half year. My judgment is that all of these announcements were quite positive and improved my fundamental outlook for the company and its stock. I attribute the recent price weakness almost entirely to the reaction to the financing.

- May 6 The German government gave Northwest a $5.5 million grant for the manufacturing and conduct of the phase III trial of DCVax-L in Germany; this can cover about half of the trial cost in that country.

- July 21 Fraunhofer was approved by the German equivalent of the FDA to manufacture DCVax-L in Germany. Having local production in Europe is a significant positive. Perhaps of more importance, some investors believe that it will be necessary to have European based manufacturing to gain European approval. This local manufacturing is also critical to the compassionate use program in Europe. The phase III trial in Germany and the compassionate use program will proceed in parallel.

- August 23 Regulatory approval was received in the UK for the beginning of the phase III trial there. Through King's College, the manufacturing facility for the phase III trial of DCVax-L was already approved in the UK. The phase III trial in the UK and the compassionate use program will proceed in parallel.

- September 23. It was announced that Northwest had received regulatory approval in the US to begin a phase I/II trial of DCVax Direct in solid, inoperable tumors. This is a different product with different cancer targets than DC-Vax-L and DCVax Prostate; the latter are being used in glioblastoma and prostate cancer and are based on loading autologous dendritic cells with tumor antigens obtained from lysed tumors. DCVax Direct involves the direct injection of autologous dendritic cells locally in a tumor where the dendritic cells pick up the tumor antigens. There is a great deal of industry interest in intratumoral cancer treatments that create both a localized and systemic immune response. Amgen (AMGN) acquired BioVex earlier this year for an upfront amount of $425 million and $450 million of potential additional payouts to gain control of T-Vec, an oncolytic cancer vaccine that is in phase III trials in metastatic melanoma and in phase II for head and neck cancers. Vical's (VICL) release of phase III data on Allovectin-7, a locally injected product being tested in metastatic melanoma, is much anticipated by investors; it is scheduled for release in 1H, 2013. The small company OncoSec Medical (ONCS) is also drawing attention for ImmunoPulse which uses electroporation and a plasmid that expresses IL-12 to treat skin cancers and head and neck cancers.

Looking Back at the Financial Condition before Recapitalization and the Equity Offering

The balance sheet shown for the 3Q, 2012 period was beyond precarious. It showed cash of only $110,000 for a company with a projected quarterly burn rate of about $6 million. The company had current assets of only $297,000 versus current liabilities of $36.1 million and additional long term liabilities of $2.4 million. Included in current liabilities were convertible notes of $15.1 million and notes payable of $4.6 million. In addition, the company was floating suppliers to the extent that it had accounts payable of $8.3 million and accrued expenses of $8.2 million. At first glance, the company looked to be insolvent.

Before I wrote my report, I was obviously aware of the financial issues. However, after a long discussion with management I came to the conclusion that the company could recapitalize itself by issuing shares in exchange for the convertible notes and notes payable. These were largely held by investors well known to the company and who believed in it, as well as Linda Powers and her venture capital funds. Similarly much of the notes payable and accrued expenses were owed to Cognate BioServices which was closely controlled by Ms. Powers' venture capital funds. I thought that the company's plan to recapitalize its debt and to raise as much as $25 million through an equity offering had a good chance for success and that this would reshape the investment image of the company.

Financial Condition after Recapitalization and Equity Offering

I projected in my initial report that an equity offering of $25 million would be done at $3.52 (this is adjusted for the stock split) and that there would be 50% warrant coverage. The actual offering was for $13.8 million with conversion of the green shoe and was done at $4.00 with 50% warrant coverage. Hence the term of the equity offering was slightly better than I projected, but the amount of money raised was $11 million less. As was previously discussed, the company has multiple opportunities to raise additional capital through issuance of shares or through non-dilutive sources of capital.

I assumed that most of the convertible notes, notes payable and some of the other short term liabilities would be converted into equity at $3.52 per share. Most were converted at $4.10 to $5.10. After all is said and done, there will be no long term liabilities and after using $4 million of proceeds from the deal to pay off the remaining investor debt, the remaining trade liabilities will be about $2 to $3 million. The company now has a very clean balance sheet. It should end the year with a little under $8 million of cash. The transformation in the balance sheet is extremely impressive as shown in the following table which compares cash and debt elements of the balance sheet on September 30, 2012 with my projections for December 31, 2012.

Number of Shares Outstanding

The company has undergone a 16:1 reverse stock split and has issued shares and warrants in the equity offering and recapitalization. There are now about 26.3 million shares outstanding. There are an additional 11.7 million warrants at an average strike price of about $7.00 and 1.5 million options at an average exercise price of about $10.20. If all warrants and options are exercised there would be about 39.5 million shares. Assuming that the company does not raise money from potential non-dilutive sources such as partnering DCVax Prostate, receiving more grants or from compassionate use revenues, it might need to raise another $18 million over the next year through issuing equity. Arbitrarily assuming that this would be done at $3.20 per share, there could be around 45 million shares outstanding by 1H, 2014. Potentially the number of options and warrants in this calculation could be less as some options and warrants may expire out of the money and some capital may be raised without share issuance.

The current market capitalization based on a share price of $3.20 and fully diluted shares of 39.5 million is $123 million. The prospective one year forward market capitalization is $140 million if we use the 45 million share estimate which is the most conservative way of estimating the number of shares that will be outstanding in one year. Remember that this assumes that all cash needed by the company comes from an equity offering and ignores possible non-dilutive capital from partnering, government grants and compassionate use programs. It also assumes that all of the warrants and options are exercised in full and do not use cashless exercise, which some warrants are entitled to. I think that the actual shares outstanding in one year could be considerably less than 45 million.

Report Summary

Northwest Biotherapeutics (NWBO) underwent a dramatic, successful and positive restructuring in the fourth quarter of 2012, changing its balance sheet from precariously debt laden to virtually debt free in an impressive example of financial transformation. This allows investors to focus on the promise of its products as opposed to pondering whether it can remain in business. It still needs to raise cash to finance its operations through the reporting of topline data in 1H, 2014 on its critical phase III trial of DCVax-L in glioblastoma multiforme. However, the significantly strengthened balance sheet should make it easier to access equity if it chooses to do so and it also has access to potential non-dilutive financing such as partnering milestones, government grants and revenues from compassionate use. The successful restructuring has significantly strengthened the investment case for Northwest Biotherapeutics.

Tagged as Northwest Biotherapeutics Inc. + Categorized as Company Reports