Cytokinetics: Phase 3 Trial for Tirasemtiv About to Begin with Topline Results Possible in 2H, 2016; Successful Outcome Could Make the Stock a Homerun (CYTK, $6.35, Buy, For Paid Subscribers)

Introduction

Management has recently provided details of the upcoming phase 3 trial of tirasemtiv in the treatment of ALS; this trial is named VITALITY- ALS which is short for Ventilator Investigation of Tirasemtiv and Assessment of Longitudinal Indices after Treatment for a Year in ALS This trial will begin any day now and could report topline results in 2H, 2016.This note discusses why I think that the chances for success are quite good and could have a dramatic effect on the stock price. Let me start by giving you an idea of what success in VITALITY could mean to Cytokinetics shareholders. I think that the price target discussion in the next section should get your attention.

Key Points About Cytokinetics:

- The phase 3 VITALITY trial in ALS will begin any day now and management is indicating that topline results could be available in 2H, 2016.

- The endpoint of the trial is sustained vital capacity; in a phase 2b trial tirasemtiv showed highly statistically significant improvement in 178 patients treated with tirasemtiv as compared to 210 patients in the control arm (these numbers exclude dropouts.)

- If phase 2 results are replicated in VITALITY, it is highly probable that tirasemtiv will be approved in the US in late 2017 or 1H, 2018.

- Assuming meaningful clinical benefit is shown in VITALITY comparable to that suggested by the phase 2 results, I think US sales could reach $625 million by 2022.

- US sales at this level could potentially create value that might translate into $51 to $87 per share by 2022. Note that this is based only on tirasemtiv sales in the US and there are other value drivers

- Other value drivers for the Company are: (1) international partnering of tirasemtiv, (2) omecamtiv could potentially begin phase 3 trial in congestive heart failure in 2016, and (3) CK-107 is entering phase 2 trials in the orphan disease spinal muscular atrophy.

- The Company ended 1Q, 2015 with $108 million of cash. This is sufficient to last the Company through the period when topline results for VITALITY are available. It also has the potential to receive up to $50 million in milestone payments in the near term from omecamtiv and CK-107. It has no imminent (next year or so) need to raise more money.

- The current market value of Cytokinetics is $318 million. Possible peer companies identified in this report are trading in the $1.4 to $2.4 billion range. At a market capitalization of $700 million, the CYTK stock price would be $14; it seems significantly undervalued relative to peers.

Price Target Potential if the VITALITY-ALS Phase 3 Trial of Tirasemtiv is Successful

There have been no drugs approved for ALS since Riluzole in 1995 and the ALS community is desperate for new therapies. Riluzole is marginally effective and may improve survival by three months in some patients although the data supporting this is weak. Despite this, it is estimated that Riluzole is used by 2/3 of the 25,000 ALS patients in the US. For the time being, let’s assume that results for tirasemtiv are shown to produce clinically meaningful benefit. In this event, what might be the potential sales of the drug and the resultant potential effect on the stock price? The potential for the stock price can be dramatic based on what I think are modest assumptions?

ALS qualifies as an orphan disease and orphan drugs can be priced at anywhere from $100,000 to $300,000 depending on their effectiveness in the disease. However, to be conservative, let’s assume that tirasemtiv is priced at $50,000 and penetrates 1/2 of the of the US market in 2022 which could be four years after potential introduction in 2018. (Remember that Riluzole has modest effects in a small part of the ALS population, but even so is used in 2/3 of the ALS population.) This would lead to sales of $625 million in 2022. If someone wanted to assume that tirasemtiv could be priced at $100,000 or higher and could penetrate 2/3 of the market in that time frame, I wouldn’t argue. As a point of interest, Vertex just received approval for Orkambi for the treatment of F508del homozygote cystic fibrosis patients. This product produces a very significant clinical benefit in a US population that numbers about 8,500 patients; Vertex priced the product at about $259,000 which comes down to $210,000 after discounts.

In order to try to determine what the impact $625 million of US sales might have on the stock price of Cytokinetics, let’s look at the current multiple of sales for the leading large cap biotechnology companies: Alexion sells at 11.9 times 2015 sales estimates, Celgene 9.8, Biogen 8.0, Gilead 6.0 and Amgen 5.9. I think that it would probably be the case that Cytokinetics would sell at a higher ratio of market value to sales in 2022 because its growth would be dramatically greater at that time than that currently being seen for these more mature companies. However, let’s look at the potential market value if we use a ratio of 6 to 10 on 2022 sales of $625 million; the result is a market value of $3.8 to $6.5 billion. There are currently 38.7 million shares, 4.4 million options and 6.7 million warrants outstanding or roughly 50 million fully diluted shares. It is possible that milestone payments for omecamtiv and CK-127 and a partnering deal for tirasemtiv outside of the US could obviate the need for issuing any more shares, but let’s assume that there are 75 million shares outstanding in 2022 when tirasemtiv sales in the US might hit $625 million.

Doing the math indicates that the projected $625 million of US sales could lead to a price per share of $51 to $87 in the 2022 time frame. This is before assigning any value to international sales of tirasemtiv or potential success with its two other drugs in human development, omecamtiv and CK 107. We are talking home run potential. I know that tirasemtiv could fail, but when I look at the incredible upside I keep scratching my head. The reward/ risk ration just seems so favorable.

Let’s take another tack and look at the current valuation of Cytokinetics which is about $330 million on a fully diluted basis and compare this to somewhat comparable companies that I follow: Chimerix, Celldex and ZS Pharma. Both Chimerix and Celldex have drugs in phase 3 development that will report out results in 2016 and could be approved in 2017. I think that Chimerix’s lead drug brincidofovir has similar or less potential than tirasemtiv and that Celldex’s lead drug, the cancer vaccine Rintega (rindopepimut), has less potential. ZS Pharma’s ZS-9 has already completed a successful phase 3 trial and should be approved in 2016; it has more sales potential greater than tirasemtiv. The pipeline of Cytokinetics is better than that of Chimerix and ZS Pharma and comparable to Celldex.

While none of these companies are exact comparables to Cytokinetics (there are none really), they are as close as I can get. Celldex has a current market value of $2.4 billion, Chimerix is $2.1 billion and ZS Pharma is $1.4 billion. If the market were to believe as I do that Cytokinetics should have a comparable current market value of $1.4 to $2.4 billion like these three comparables, the current stock price would be $29 to $54. There is an obvious disconnect on current valuation if my price target analysis is anywhere near correct. I think there are understandable reasons for the market apparently having serious doubts about the potential for success of the VITALITY trial. The rest of this note goes into why I think the market is missing the point and why I think Cytokinetics has asymmetric upside potential.

Tirasemtiv Failed to Reach the Primary Endpoint in the Phase 2b BENEFIT ALS Trial Causing Legitimate Concern about the VITALITY Phase 3 Trial

Cytokinetics announced on April 22, 2014 that the BENEFIT-ALS trial of tirasemtiv in ALS which enrolled 711 patients failed to reach the primary endpoint of slowing progression in the rate of decline of function for ALS patients as determined by the ALSFRS-r scale. (In the appendix of this report, I give a description of the ALSFRS-r scale. For those who are not familiar with this scale, you might want to take a quick look at it now or later.) The failure of a clinical trial, while crushing psychologically, does not always mean that a drug is ineffective. Failure can be due to the trial design, dosing of the drug, incorrect powering of the trial and other issues. Sometimes a careful analysis of the results of a failed trial can point the path forward for another trial that may be successful and Cytokinetics believes this is the case with tirasemtiv.

BENEFITS-ALS Points the Way Forward to a Phase 3 Trial That Could Be the Basis of Approval

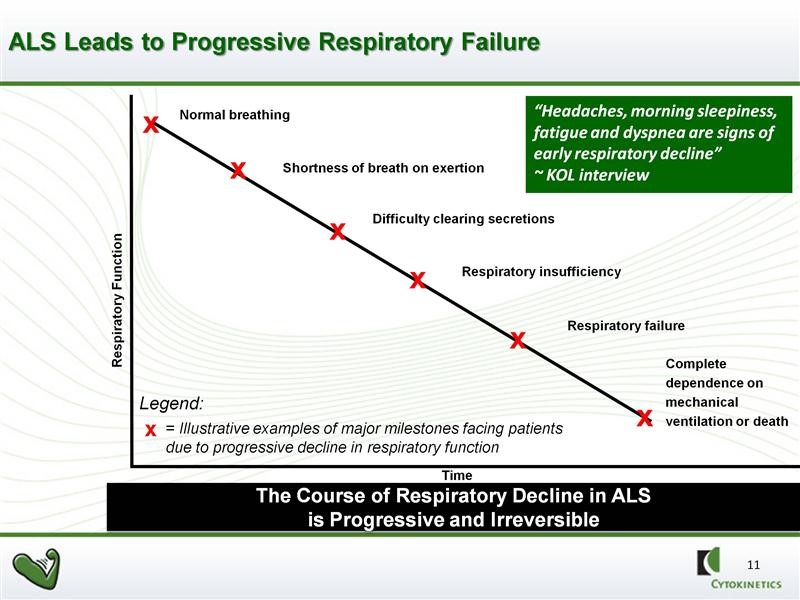

In BENEFIT-ALS, tirasemtiv failed to achieve the endpoint as determined by ALSFRS-r. However, it resulted in a highly statistically significant reduction versus placebo in the rate of decline of slow vital capacity (SVC), which was a proscribed secondary endpoint of that study. SVC is an indicator of the strength of the skeletal muscles responsible for breathing. There is a consensus among key physician opinion leaders (KOLs) that the rate of the decline in pulmonary function as measured by SVC strongly predicts mortality. In a clinical setting, patients with ALS are evaluated in a variety of ways, however respiratory function is especially important to assess because patients with ALS usually die from respiratory failure. This is illustrated below:

Improvements in SVC in BENEFIT-ALS Were Striking

SVC is measured by inserting a tube into the patient’s mouth and having them take a deep breath and exhale normally. A spirometer determines the amount of air exhaled (in liters). An algorithm is then used to compare this reading to what would be expected from a normal person with comparable physical characteristics such as sex, weight, age, etc. The most striking result of BENEFIT-ALS was that treatment with tirasemtiv resulted in a strongly, statistically significant reduction versus placebo in the decline of SVC at each assessment over 12 weeks of double blind treatment.

In clinical practice, referrals to hospice, recommendations regarding feeding tube placement and prescription of noninvasive ventilation are all based on SVC measurement. Third party payers also make decisions about funding such interventions based on SVC. The absolute level of SVC and the rate of decline are very important to patient care. ALS patients know their SVC scores like most people know their social security numbers. SVC is universally used to make important clinical decisions and prognosis in the treatment of ALS patients.

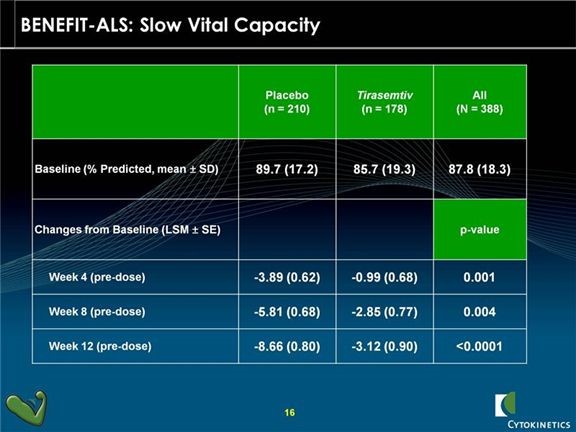

Tirasemtiv showed statistically significant decreases in the rate of decline of SVC as compared to placebo at each of the week 4, 8 and 12 week time points with very impressive p values. A p value of 0.05 is generally accepted as evidence that there is positive effect; in statistics it means that the probability that the effect occurred by chance is 5 out of 100. A p-value of 0.001 means that the probability that the effect occurred by chance is 1 out of 1000. The p-values for SVC in the phase 2 trial were 0.001 at the four week measurement, 0.004 at 8 weeks and <0.0001 at twelve weeks.

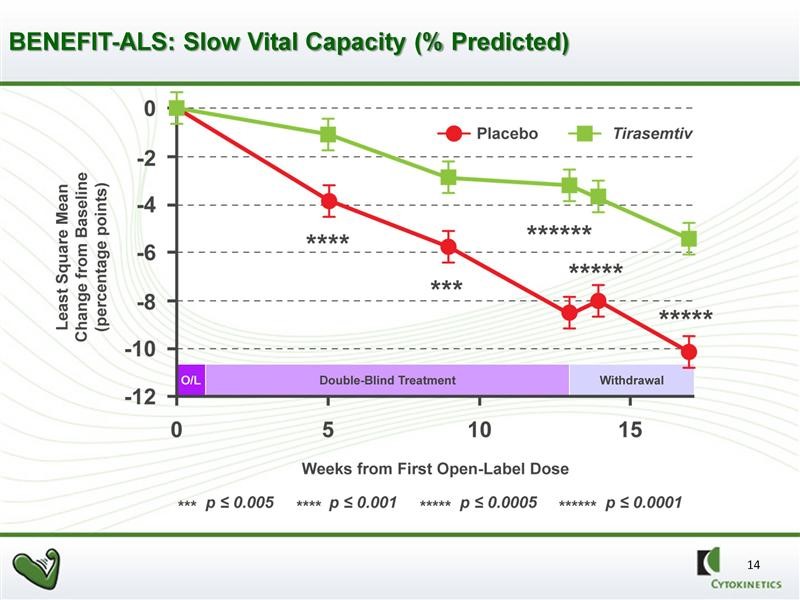

The graphical presentation of the same data is shown in the next chart. This gives a better visual representation of the slowing of decline in SVC in ALS patients.

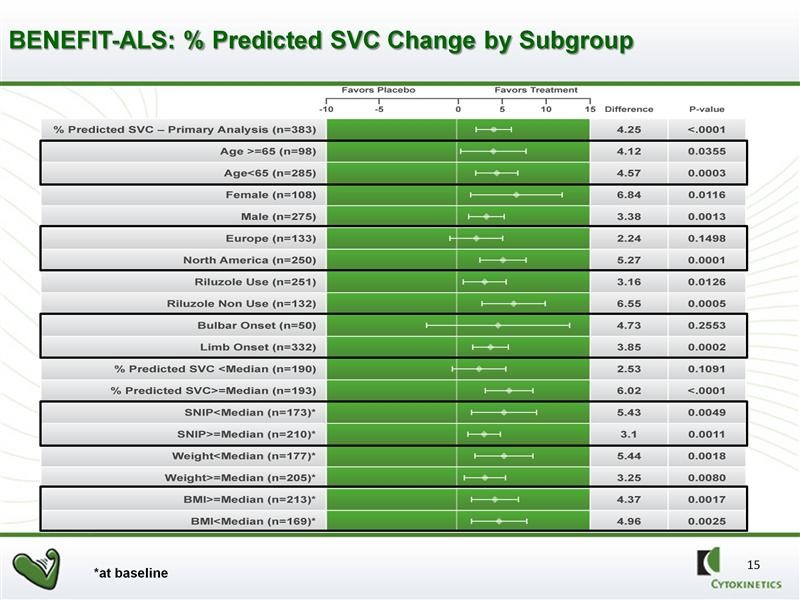

Further analysis showed that there was a powerful and consistent statistically significant effect on all but two of 16 pre-specified sub-groups. FDA likes to see positive data across a broad range of sub-populations of patients when it analyzes data. This is highly encouraging and supportive of the activity of the drug. Note the strong p values in 14 of the 16 sub-groups.

Will The FDA Accept SVC as the Primary Endpoint of a Phase 3 Trial?

Following discussions with neuromuscular and pulmonary opinion leaders, Cytokinetics felt that SVC might be a more appropriate primary endpoint for a new phase 3 trial. However, the key issue is whether the FDA and other regulatory agencies also believe this. Regulatory agencies for some time have considered ALSFRS-r to be the one validated primary endpoint that should be used for ALS trials. However, no significantly sized phase 2 or 3 trial has ever been successful using ALSFRS-r as the primary endpoint. This could be attributed to the difficulty in treating the disease but perhaps it is a problem with the endpoint itself-at least in the context of 12 weeks of treatment as in BENEFIT-ALS.

Cytokinetics has had extensive meetings with the FDA and EMA to discuss the findings of BENEFIT-ALS and to discuss the possibility that they could change the primary endpoint of the trial to SVC instead of ALSFRS-r. Regulatory agencies do not give contractual guarantees that they will approve a drug if it reaches the endpoint of a study. This is true even with a Special Protocol Agreement in which the FDA indicates that the end points of the trial, if successfully reached, could be the basis for approval. However, detailed interaction and guidance from the regulators can give a Company an understanding of how regulators think about and probably will view an endpoint and whether the drug might be approved if that endpoint is reached. Cytokinetics believes that regulators will accept slow vital capacity or SVC as an endpoint, but there is no guarantee.

Side Effects Are a Worrisome Issue with Tirasemtiv-This is Another Serious Concern about the VITALITY-ALS Trial

Tirasemtiv crosses the blood brain barrier and as a result can cause central nervous system related side effects in up to 50% of patients, the most prominent (troublesome) of which is light headedness/dizziness. Inability to tolerate the side effects of tirasemtiv in BENEFIT-ALS was a significant problem that led to a meaningful number of patients dropping out of the study. There were 90 early terminations on tirasemtiv versus 45 on placebo even though the trial was randomized 1:1. Based on accepted statistical practices for determining trial outcomes, these patients were treated as trial failures.

In looking at the data from BENEFIT-ALS, Cytokinetics believe that there are things that can be done in the phase 3 to better address side effects and keep people on the drug. They will alert sites to monitor, watch for and react to side effects more quickly and more urgently. This will be made easier as they will be going back to the same sites that participated in BENEFIT-ALS and have experience with the drug. There will also be better instructions on nutritional supplements and medications that may improve tolerability. And very importantly, the phase 3 trial has enhancements that could reduce dropouts due to side effects.

Design of the Phase 3 VITALITY-ALS Trial

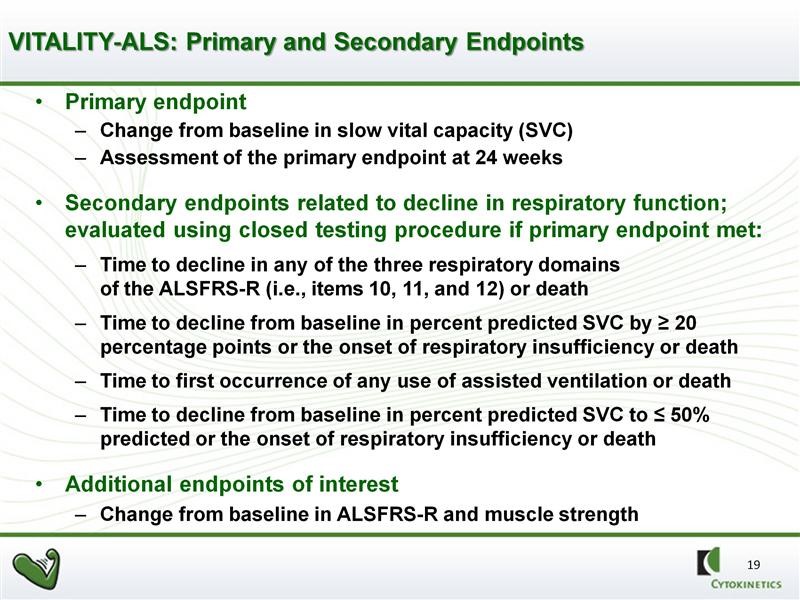

The VITALITY-ALS trial has important differences (enhancements) from the Phase 2b BENEFIT-ALS trial. Obviously, using SVC as the primary endpoint is huge. Nearly as important, there are measures being taken to try to prevent patients from dropping out of the trial due to side effects. Remember that a dropout is a trial failure. The primary and secondary endpoints of VITALITY are shown in the next table. The FDA will closely analyze results and trends in secondary endpoints to determine if they are supportive of the primary endpoint of SVC.

The side effect issue (particularly dizziness or light headedness) had been anticipated and planned for in BENEFIT-ALS. Patients were given tirasemtiv at a dose of 125 milligrams twice a day for a week before they were randomized to either tirasemtiv or placebo. Light headedness or dizziness is an issue with tirasemtiv that usually goes away after 5 to 7 days. The objective was to identify those patients who could tolerate side effects and remain in the trial. Hence, patients were treated with tirasemtiv for one week and if they tolerated the side effects, they were then randomized to the trial. With perfect hindsight, management thinks that the one week period was too short. As a result, some patients who could not tolerate the side effects or were not prepared to cope with them dropped out shortly after beginning the trial and were counted as failures.

Because of the side effect issue, patients in BENEFIT-ALS were started at two doses of 125 mg given as one dose in the morning and one in the evening. They were then titrated up with the objective of getting as many people as possible to the dose that they thought would be most effective which was 250 mg twice a day. In VITALITY, there will not be the same degree of emphasis to titrate quickly to 250 mg BID. Patients in VITALITY will be titrated at roughly two week intervals instead of the one week as in BENEFIT-ALS. Moreover, if patients are titrated to a higher dose and can’t tolerate the side effects they will be allowed to move back to the previous dose which was tolerated. In addition, in BENEFIT-ALS there was no plan for using other medications or psychological support to help patients cope with side effects, which tend to go away or diminish with time. Such steps will be taken in VITALITY.

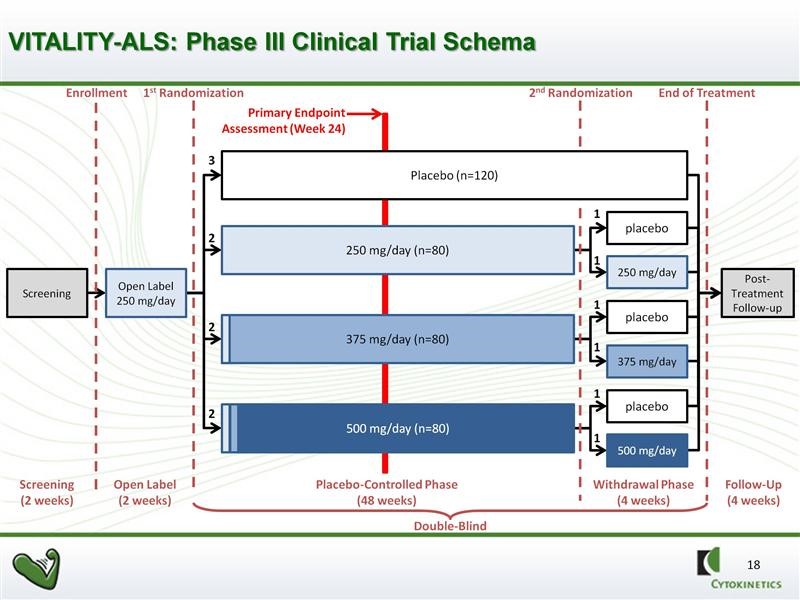

The VITALITY trial design calls for four arms in the study. There will be one control arm and three drug arms: (1) 125 mg of tirasemtiv in the morning and 125 mg in the evening, (2) 125 mg in the morning and 250 mg in the evening, and (3) 250 mg in the morning and 250 mg in the evening. Because of the titration strategy just discussed not every patient assigned to the higher dose groups may actually get to their assigned dose. This will complicated the interpretation of results.

The trial will be double blinded and randomized for 48 weeks as opposed to 24 weeks in BENFIT-ALS. However, the primary efficacy endpoint will be SVC at 24 weeks. This sounds a bit odd, but there are solid statistical reasons for doing this as the variability increases dramatically as time goes on with the result of reducing the powering of the study. The 48 week time frame will give an insight into duration of effect and will also provide more meaningful data on secondary endpoints. There will be a second randomization of patients receiving tirasemtiv at 44 weeks in which they will remain of the dose of drug or reassigned to placebo. This is intended to provide insight into the effects of withdrawing tirasemtiv.

The full design of the study is as shown in the next chart. We should see the topline results of this phase 3 trial in 2H, 2016. If successful, this data in combination with results from the phase 2b BENEFIT-ALS trial should be sufficient to file for approval in 2017 with possible approval in late 2017 or 1H, 2018.

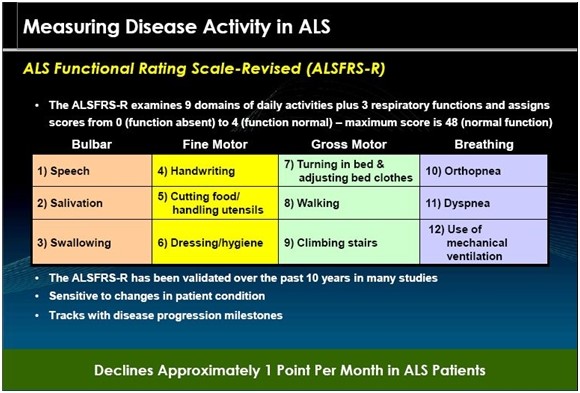

An Explanation of ALSFRS-r Scale

The ALS Functional Rating Scale revised or ALSFRS-r is the most important measure of the degree of impaired functionality caused by ALS and can also track the progression of the disease. It combines nine criteria involved with daily activities and three involved with respiratory function. It is based upon a subjective measurement by the physician or patient for each function. A score of 0 indicates that there is an absence of the function and a score of 4 means that there is normal functionality. The 12 elements of the scale are shown below:

A normal person would score 48 and a person with ALS would score about 36 to 40 a year or so after diagnosis. There is a fairly steady decline in the ALSFRS-r score of about 0.8 to 0.1 point per month in the ALS. Key opinion leaders state that while there can sometimes be a period of stability of a month or two, there is an inexorable decline and sustained improvements just don’t occur. Death usually occurs when ALSFRS-r reaches 15 to 20. Death is almost always the result of respiratory failure or complications such as infections that can occur when breathing must be assisted by mechanical ventilation.

Tagged as CK-107 in spinal muscular atrophy, cytk, Cytokinetics, omecamtiv in congestive heart failure, tirasemtiv, tirasemtiv in phase 3 VITALITY-ALS Trial + Categorized as Company Reports

2 Comments

Trackbacks & Pingbacks

-

Cytokinetics: Phase 3 Trial of Tirasemtiv Has Begun (CYTK, Buy, $7.17) | Expert Financial Analysis and Reporting | Smith on Stocks

[…] Note that this is based only on tirasemtiv sales in the US and there are other value drivers such as international sales of tirasemtiv, omecamtiv and CK-107. I think that CYTK is dramatically under-valued within the biotechnology universe of emerging companies. It has a market capitalization of about $350 million. I just published a more detailed report on the Company entitled Cytokinetics: Phase 3 Trial for Tirasemtiv About to Begin with Topline Results Possible in 2H, 2016;…). […]

Comment

You must be logged in, or you must subscribe to post a comment.

Good morning Larry,

I checked clinicaltrials.gov and it looks like the enrollment has not started yet. They are planning, at of July 2015, for the following:

“Estimated Primary Completion Date: March 2017 (final data collection date for primary outcome measure)”

Which may push out the NDA process.

A tidbit of potentially interesting information under :Contacts and Locations

“Health Authority:

United States: Food and Drug Administration

Canada: Health Canada

Germany: Federal Institute for Drugs and Medical Devices

France: Agence Nationale de Sécurité du Médicament et des produits de santé

Ireland: Irish Medicines Board

Netherlands: Medicines Evaluation Board (MEB)

Spain: Agencia Española de Medicamentos y Productos Sanitarios

United Kingdom: Medicines and Healthcare Products Regulatory Agency”

It looks like they are at least thinking of a US + EU Ph III for approval in those two markets. That’s how I read it anyways.

Best regards,

Libouban