Antares: Tracking Report on Xyosted Prescriptions (ATRS, Buy, $2.88)

Introduction and Overview

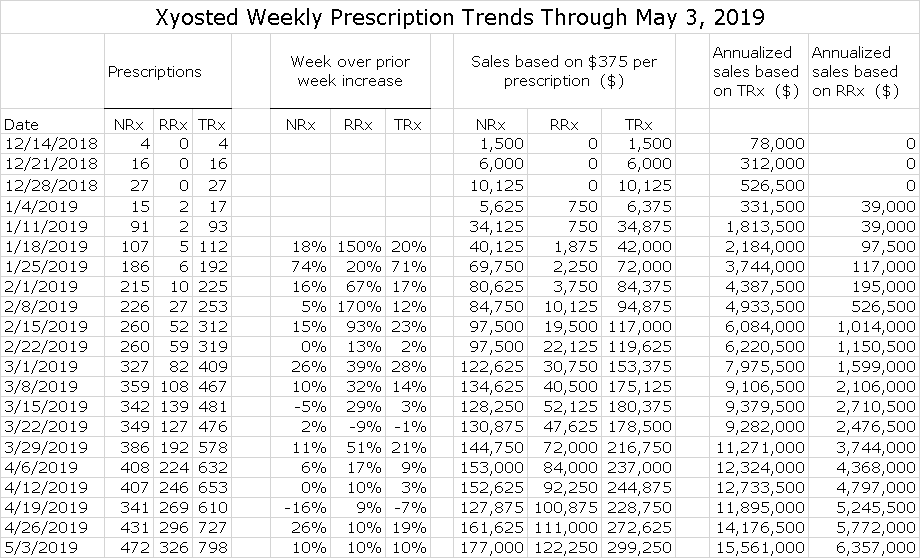

I have obtained access to weekly prescription trends for Xyosted which I will publish periodically. Marketing began on December 14, 2018 and the data in this report runs through the week ending May 3, 2019. This audit data reports prescriptions as follows:

- NRx- the number of new prescriptions filled

- RRx-refilled prescriptions

- TRx- the sum of NRx and RRx is total prescriptions filled

The wholesale acquisition cost (WAC) of Xyosted is $475 for a prescription that has four injectors or a month’s supply. Managed care plans will demand rebates so that I estimate that the realized price to Antares will likely be in the $375 range although management has not issued guidance. This is roughly in line with the price of many injectable generics. However, it is important to understand that the first prescription or each NRx is being given away free so that Antares is only realizing revenues on RRx.

I have put together the table shown below as a format that investors can use to track the launch. This table has the following data:

- Weekly numbers for NRx, RRX and TRx,

- Week over prior week sequential increases in NRx, RRx and TRx,

- Estimated sales for NRx, RRX and TRx based on multiplying each by $375. This is incorrect because as I noted above, each NRx is being given away so only RRx are priced at this level. Still, I think it provides some insight into potential sales,

- I have calculated an annualized sales rate that = TRx X $375 x 52. Because the NRxs are being given away currently, this is incorrect. However, I think it does give some insight into the progress of the launch.

- I have similarly calculated an annualized sales run rate only for refills. In the immediate future, reported sales will be largely dictated by RRx.

Discussion

It will take some time to really gage the curve of the launch so I am hesitant to draw strong conclusions. That said, here are my early thoughts.

- There seems to be strong and consistent momentum to the launch. Do not put too much credence into data for any one week. These are only estimates and past experience teaches that prescription audit trends can be erratic from one week to the next. For example NRx for the week ended 4/19/2019 were down 16% only to be followed by 26% and 10% increases in the next two weeks.

- New product launches are generally slow and disappointing as companies have to negotiate for reimbursement, a slow and difficult process. Generally, the sales curve becomes stronger in the second and third year as these issues are put behind. From my viewpoint, the Xyosted launch is exceeding my expectations.

- Antares is not a well-known company and has a modest sized sales force as it has hired 60 new reps to focus on Xyosted and will also have 30 reps who are currently promoting Otrexup also detailing it. A larger, more well-known company might have several hundred or more reps detailing.

- The estimate for annualized sales number for the week ending May 3, 2019 of $15.6 million is pretty impressive. I want to emphasize that the weekly sales numbers are not reflective of what Antares is actually realizing. Remember that the NRxs are being given away for free. My annualized sales number includes both NRx and RRx so it significantly overstates revenues actually being received.

- There is uncertainty as to what the effect might be on new prescriptions if the Company eventually stops the practice of making the first prescription free. Solely on the basis of refills, the annualized run rate is $6.4 million, but I am not quite sure what this means other than being a proxy for reported sales.

- I think that 1Q, 2019 sales of Xyosted will be de minimis. The audit data indicates that there were about 3,155 NRx and 739 RRx. The actual sales for the NRx will be zero and the estimated sales for RRx could be around $277,000.

Price Target

There is reasonably broad consensus that Xyosted could reach peak sales of perhaps $200 million in a five to seven year period and I think this is a realistic expectation. The early launch data certainly doesn’t dissuade this view. I think that these peak sales might be capitalized at around five time revenues or more which would suggest that by itself Xyosted could account for a market capitalization of $1 billion or around $6.00 per share. Very importantly, Otrexup, the Makena subcu formulation and the AB rated generics to EpiPen and Forteo could add quite meaningfully to the stock price. And finally, the highly productive research program could turn out several other new products in this time frame, some of which could be commercialized. I obviously continue with my Buy recommendation.

Tagged as Antares Pharma Inc., Tracking Xyosted Prescriptions + Categorized as Company Reports, LinkedIn

The Antares baseline is 2 free weeks from the prescribing doctor and no free NRx scripts:

Concerning free NRx, Fred Powell stated (the quarterly conf. call transcript, Seeking Alpha) that free prescriptions have always been below 40% and are dropping.

“So we’ve seen that percentage (of free scripts) continue to decrease over the first quarter and going into the second quarter. I can tell, you know it is certainly below 40%. It is lower than that percentage for the entire time”

But NRx has always been higher than RRx. Thus it appears that a substantial portion of NRx’s are paid. And Bob Apple said as much (these quotes of from Seeking Alpha transcript):

“… and in that process (of giving patient a free XYosted shot in the office and one free XYosted to bring home, equals 2 weeks free), the physician has probably written an e-script … and if there is any kind of an adjudication time to get it approved for the patient we hope that two weeks is sufficient to get that through the process”

“… If there is commercial insurance and there’s initially a rejection because it’s not covered, we then provide one month free of drugs …. “

From your table: RRx based annualized sales (AS) is 6.36 million out of TRx based AS of 15.56 million. That is a sales percentage of 6.36/15.56=40% of total scripts. But Antares states that unpaid scripts are less than 40% which implies paid script have exceeded 60%. Therefore Annualized Sales should be:

( >.6*)15.5 = (>9.3)million, greater than $ 9.3 million. Lower limit annualized sales should be 60% of annualized sales base on TRx, not sales of RRx. Hopefully we will see that 60% minimum, increases as the Antares two week window, for insurance coverage to kick in, becomes more effective.