Antares Pharma: Quick Take on Implication of 3Q Results for Future Growth (ATRS, Buy, $3.70)

Key Points:

- Xyosted launch continues to impress. Projecting sales of $22 million in 2019 and over $50 million in 2019

- AB rated generic to EpiPen royalties estimated at $6.2 million in 3Q.

- AB rated generic to Forteo could be launched this year. Potential is greater than AB rated generic to EpiPen.

- I predict that FDA will not take Makena off the market and that its revenues will remain roughly flat. I am in the minority on this view. Royalties from Makena in 3Q are estimated at roughly $2.2 million.

- Without Makena royalties, I estimate that Antares would have been about breakeven on an operating income basis in 3Q. If I am wrong and Makena is taken off the market, it would be only a modest setback.

- Burgeoning pipeline and potential to acquire products from other companies could bolster outlook

- Company is guiding to sales of $115 to $120 million in 2019 which is an increase from the previous range of $100 to $110 million. On a preliminary basis, I think 2020 revenues could exceed $170 million, which would be about a 47% increase,

- Antares should be nicely profitable in 2020 but I am working on my estimate and don’t yet have a number for EPS.

- I remain very positive on the stock.

Overview

Antares blew the doors off the barn with its 3Q, 2019 sales and earnings report. I am updating my spreadsheets for 2020 projections, but I wanted to put out a quick comment on the just reported 3Q results and their implication for explosive future growth. Sales in the quarter were $34.3 million which compares to $17.9 million in 3Q, 2018, an increase of 92%. The company is now profitable on an operating income basis for the first time as operating income reached $2.0 million. The company generated positive cash flow from operations of $1.7 million. Antares has now jumped over the hurdle from a small emerging company operating at a loss to a fast-growing profitable business. I believe investors will increasingly come to view Antares as a dynamic growth stock. With a cash reserve of $42 million and positive cash flow, the days of needing to fund operations with equity financings are in the rear-view mirror.

Sales guidance for 2019 was increased from $100 to $110 million to $115 to $120 million. This implies 4Q revenues of $ 32 million which would be a67% increase over 4Q, 2018. No guidance was given on profits for 4Q, 2019 nor was sales guidance given for 2020. I don’t want to comment much at present on my still in progress 2020 sales projections, but on a preliminary basis, I think we could see sales exceeding $170 million in 2020 which would be a 45% or so increase from 2019. I am currently working on a detailed sales and earnings model which I will publish in the immediate future.

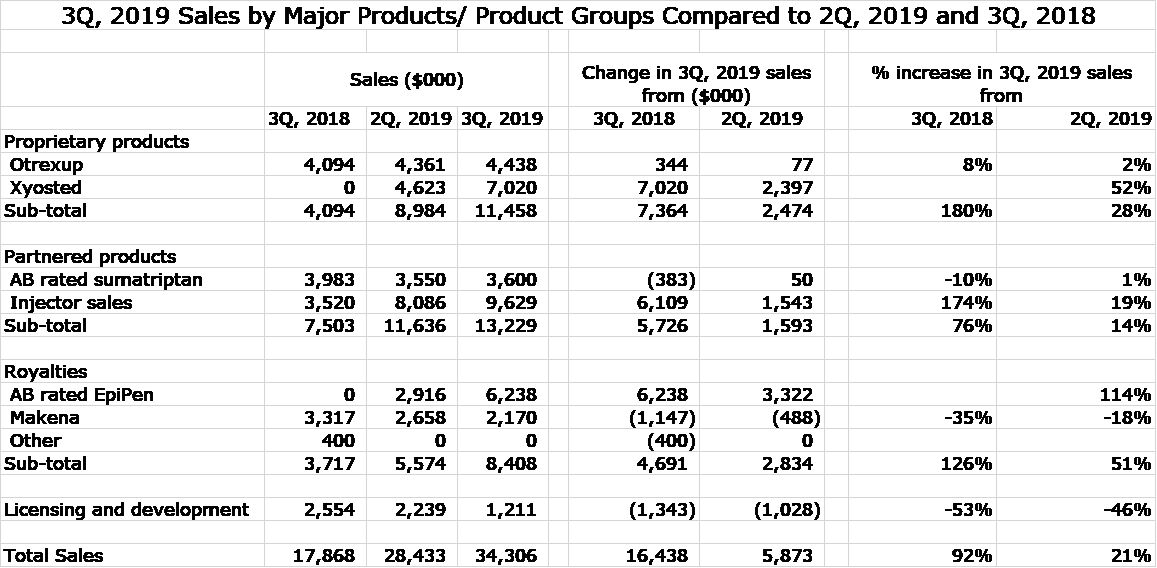

The following table shows sales of major product categories in 3Q, 2018, 2Q, 2019 and 3Q, 2019. This shows that year over year gains were driven by sales of Xyosted, royalties from EpiPen and injector sales associated with AB rated generics to EpiPen and Forteo.

Xyosted

It has become an axiom that the first year of launch for a new product disappoints investors, mainly due to reimbursement hurdles, but also the need to educate prescribers. The first year is a challenge for even the biggest of companies, but the risk is compounded for a small company like Antares that has a small sales force and is not a recognizable name for most prescribers. Xyosted sales in 3Q, 2019 were $7.0 million which translates into an annual run rate of $28 million. My 2019 full year sales projection is now roughly $22 million. Going into 2019, the Street consensus was about $15 million. At $15 million of sales, the launch expenses associated with Xyosted were expected to result in the product being unprofitable. Needless to say, Xyosted results have been a pleasant upside surprise for the Street.

Xyosted is at the very early stage of its life cycle and Street estimates for peak sales are around $200 million. I am working on my estimates for 2020, but on a preliminary basis, I think that sales will easily double 2019 projected sales of $20 million and could surpass $50 million. In 2019, I think that Xyosted will be profitable in 2020 and beyond then, it should be very profitable. Here are key items I am considering in my 2020 Xyosted projections:

- Prescriptions are on a strong trend: Following the 1Q, 2019 launch prescriptions were 4,032 in 1Q; 11,310 in 2Q; and 19,043 in 3Q. I expect this strong trend to continue.

- Gross to net: Pharmaceutical companies must offer rebates to managed care and also assist patient’s ability to pay for Xyosted with marketing strategies such as free samples, coupons and co-pay buydowns. This means that the gross or list price of Xyosted is not what the company ultimately receives. Hence investors focus on how much of the gross price is discounted or the net price. In the case of Xyosted, the net price is about 50% to 55% of the gross price. Going into 2020, Antares anticipates that it will reduce some of its marketing incentives so that the net price as a percentage of gross (list) price is anticipated to improve. No guidance was given on how much.

- Covered lives: As I just mentioned, gaining reimbursement is the major challenge for a new product launch. Going into 2020, the goal of management was to achieve reimbursement for about 2/3 of managed care lives. As of October, Xyosted reached 70%. Management does not expect it to go much above this level.

- Who is prescribing Xyosted? Currently about 60% to 70% of prescribing is from endocrinologists and urologists with the remainder from general practitioners. In the testosterone class, GPs usually account for around 50% of prescriptions. Management expects Xyosted to eventually reach the 50% level.

- Who is being prescribed Xyosted? About 50% of new prescriptions are from new patients. Much of the remaining 50% comes from patients switching from the more painful IM generic products; this switching should increase substantially.

- Persistence of treatment: Testosterone replacement is in part a quality of life product; it is not being used to treat a life-threatening disease. It has been the case with IM and testosterone gels that a significant number of patients drop out of therapy after one or a few prescriptions. Management says that at this early date it is pleased with the persistence of patients, but didn’t (can’t) quantify this. Management did say that many of the dropouts resulted from lack of insurance coverage.

AB Rated Generic to EpiPen

The long wait for the launch of this product is finally over. I originally expected it to be launched in 2014 or 2015, but the FDA approval process was much drawn out largely due to machinations from Mylan, the marketer of EpiPen. Management did not directly break out royalties related to EpiPen. Third quarter royalties of $8.4 million were due to Makena and EpiPen and my estimate is that EpiPen royalties were $6.2 million and Makena were $2.2 million.

- Market share of EpiPen: Teva’s launch of EpiPen has been extremely successful. The full-scale launch began earlier in 2019 and currently about 31% to 34% of EpiPen prescriptions are being filled with the Teva AB rated generic. The key is that an AB rated generic can be substituted for EpiPen prescriptions at the discretion of the pharmacist. There are other epinephrine injectors on the market, but these can’t be substituted. The goal of Teva is to reach 50% market share of EpiPen prescriptions.

- Seasonality of EpiPen sales: The 3Q is the biggest sales quarter of the year for EpiPen driven by kids going back to school. Hence combined 4Q prescriptions for EpiPen and Teva’s AB rated generic will be lower in 4Q versus 3Q. In the 4Q, we have the dynamic of seasonally lower prescriptions written for EpiPen versus 3Q and the positive dynamic of increased market share for the AB rated generic. Management didn’t make a guess on how this will work out. Of course, year over year comparisons will be strong in 4Q, 2019, 1Q, 2020 and 2Q, 2020.

Makena

I estimate that Makena contributed about $2.2 million of royalties in the 3Q which compares to $3.3 million in 3Q, 2018 and $2.2 million in 2Q, 2019. I have written extensively about the failure of the Prolong trial to confirm the efficacy of Makena and the implications for Makena sales and the royalties Antares receives from this product. A recent FDA AdCom meeting on PROLONG resulted in 9 of 16 members voting to remove Makena from the market. However, 5 of 6 practicing gynecologists on the panel voted to keep Makena on the market and conduct another study.

I believe that a meaningful majority of investors have concluded that Makena will be removed from the market. I said before the AdCom vote that I thought that the chance of Makena being pulled from the market was 5%. After the negative AdCom vote, I reiterated this view and received some caustic comments. The principal reason for my stance is that I feel that the PROLONG trial was performed in a patient population at less risk of preterm birth than MEIS, which was the trial that was the basis for the widespread acceptance of the active ingredient in Makena (17-P) as being effective and resulted in FDA approval. Bear in mind that the MEIS trial, which was conducted by the NIH, was a positive trial, that there is no approved alternative to Makena and that Makena has been shown to be safe.

I am just a humble analyst so why should anyone listen to me. I agree with this, but I do think that investors should weigh the fact that 5 of 6 practicing gynecologists on the AdCom voted to keep Makena on the market. As importantly, the two major professional groups in this area are the American College of Obstetricians and Gynecologists (AGOG) and Society for Maternal-Fetal Medicine (SMFM). Both of these groups considered the results of the PROLONG study and decided to keep Makena in their guidelines for prevention of preterm births in women with singleton pregnancies who previously delivered preterm. Here are some excerpts on notes they recently published:

- American College of Obstetricians and Gynecologists: ACOG is not changing our clinical recommendations (on 17-P) at this time. In comparing the discordant results of the PROLONG and Meis trials, one consideration is the different populations studied, especially with respect to the baseline risk for PTB. See this link for more detail.

- Society for Maternal-Fetal Medicine: Based on the evidence of effectiveness in the Meis study, which is the trial with the largest number of US patients, and given the lack of demonstrated safety concerns, SMFM believes that it is reasonable for providers to use 17-OHPC in women with a profile more representative of the very high-risk population reported in the Meis trial. The lack of benefit from 17-OHPC seen in the PROLONG trial raises questions regarding the efficacy of 17-OHPC, and additional studies are needed to identify populations in which administration of 17-OHPC may provide needed benefit in the reduction of recurrent sPTB. See this link for more detail.

I think that the FDA will not go against the opinions of key opinion leaders and remove Makena from the market. The FDA will probably want a trial to be run that will attempt to identify women who are most likely to benefit from Makena, i.e., a population similar to that of the MEIS trial. If this is the case, it will take some time (probably years) to design and execute such a trial. In the meantime, given the recommendations of ACOG and AMFM, I do think that we will see a precipitous drop in prescribing of Makena. I think that sales could be flat or slightly up or down in the next few years.

If I am correct, this removes a cloud from the Antares investment story. However, if I am wrong and Makena is removed from the market, it is only a modest part of the P&L in 2019 and will be an even smaller part going forward. I can be comfortable with my Buy recommendation even in the event of Makena’s withdrawal.

Forteo (teriparatide)

During the 3Q conference call I was surprised by the lack of questions on Forteo. Teva has said that it believes that it can introduce its AB rated generic to Forteo this year. The US market for Forteo is about $750 million which compare to about $700 million for EpiPen before the AB rated generic was launched. The royalties on Forteo as a percent of sales are in the high single digit to mid-teens range which is higher than for EpiPen. The key here is that Teva will have the only AB rated generic to Forteo. Antares says that the US opportunity is larger than for EpiPen. In addition, Teva will be marketing their product in the rest of the world where Forteo sales are also about $750 million. The marketing dynamics are different than in the US so that it is difficult to size the opportunity, but it is significant.

Other Key Issues

Antares has a burgeoning pipeline, but investors are largely ignoring it. This is because the Company has not disclosed in any cases the drug candidate that is being developed with its injectors. Management promises more disclosure in 2020.

With a sales force of 80 reps and 10 sales managers, Antares has a valuable asset. It has the potential to acquire products from other companies to market alongside Xyosted. There could be some meaningful upside surprises from this new avenue of growth in 2020 and beyond.

Tagged as Antares Pharma Inc. + Categorized as Company Reports, LinkedIn