Antares: Although it is Still Early, I Think That Otrexup Launch is Going Very Well (ATRS, Buy, $2.93, Paid subscribers)

Investment Thesis

The broad based business model of Antares results in its receiving revenues from numerous products that are marketed by other companies and it is also developing a deep pipeline of new drugs for its own account and for licensing to other companies. These products make Antares an interesting story in the long term without considering the contribution of their recently released drug Otrexup that is used to treat rheumatoid arthritis.

In the span of the next year or possibly longer, however, the performance of Otrexup following its launch in January 2014 will be the major factor in determining the stock price performance. This report deals exclusively with the early returns on the Otrexup launch. For those of you who would like a refresher on the rationale for the product’s development, I would recommend that you refer to my March 20, 2014 report entitled Antares: Why I Think That the Otrexup Launch Will Be a Success.

The stock has been weak since I published that March 20 report as the price has decreased about 24%. This was in part because of the sharp market correction that small stocks and particularly emerging biotechnology stocks went through. The price behavior also reflects investor concern that the launch will be disappointing if for no other reason than the majority of recent launches by small companies have been disappointing or slow to develop. This reflects the strong and increasing power of managed care in the early launch phase. In many cases, payors set up early barriers to prescribing as they carefully evaluate the benefit to cost ratio of a new drug.

It is still very early in the launch as Otrexup was just introduced in early January and we have only three months of early data to think about. However, based on my analysis, I think that the Company can exceed Street consensus estimates of $12 million of sales in 2014. Later in this report I show what I think is a reasonable and probably conservative sales estimate for Otrexup for 2014 of $16.4 million.

Another uncertainty that is affecting the stock price is the potential for a competitive product to enter the market late this year or early next. Otrexup is a sub-cutaneous injection of methotrexate and Medac has been marketing such a product in Europe for some years with good success. Medac has indicated that they expect approval in late 2014 for their product. Antares is suing for patent infringement and attempting to get an injunction to prevent the launch.

In the event that the Medac product is launched, I do not see this as a major negative. Otrexup has first mover advantage and in most pharmaceutical categories, there are generally two or more similar products competing. The market opportunity in rheumatoid arthritis and psoriasis is large and oftentimes having two or more companies promoting a particular type of product can expand the market to the benefit of all participants.

Some investors have raised the concern that there will be price competition. I just don’t see that Medac would compete on a price basis. If they come in at a significantly lower price than Otrexup that forced Antares to match the price, Medac would gain no advantage in unit market share and would suffer on sales because of the lower price. Based on experience with past launches of similar or me-too products, I would expect the Medac product to be priced at the same, a slightly lower or a slightly higher price.

Management has given guidance that Otrexup could achieve $200 million of peak sales. However, this estimate was made before the potential for approval of the Medac product in 4Q, 2014 was taken into account. For the sake of illustration, let’s assume that this is now to be split 60/40 between Otrexup and the Medac product. With this back of the envelope logic, Otrexup would achieve $120 million of peak sales.

Antares has estimated that Otrexup breaks even at about $24 million of sales so that at $120 million, the pretax profits could be $95 million or so. Tax affecting this at a 30% rate and dividing by 130 million outstanding shares, this leads to a $0.50 EPS contribution from Otrexup when it reaches peak sales in perhaps 2019. Then putting a 15 P/E on these EPS suggests that the stock price solely due to Otrexup in 2019 could be $7.50. I hope that you take these numbers for what they are intended to be, i.e. giving magnitude and trend and not being ball bearing precise.

The Launch Is Underway

Otrexup was launched by Antares in late January for the treatment of rheumatoid arthritis with a 40 person commercial team. Its 28 sales reps in this team began detailing rheumatologists in February 2014. The Company’s partner Leo started marketing Otrexup to dermatologists in mid-March through 85 sales reps.

A Look at Early Trends

During a conference call on May 9th, the Company released some metrics on the launch that I have used to make some rough calculations to determine how the potential sales from the launch are tracking against Wall Street consensus expectations for 2014 sales of $12 million.

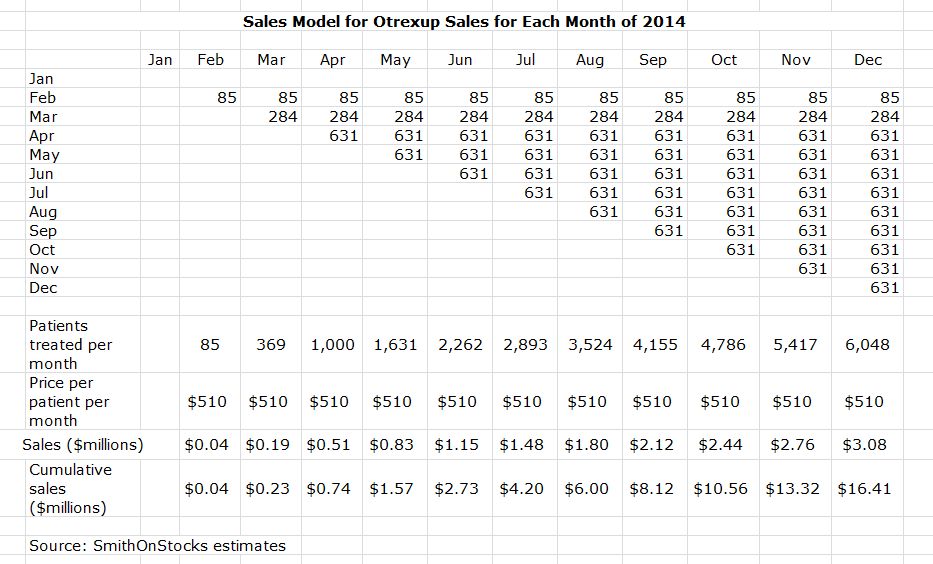

The Company estimates that 85 patients started treatment in February, 284 in March and 631 in April. One month’s use of Otrexup results in about $510 of monthly revenues so that annual revenues are about $6,000 per patient. If all of these 1000 patients who received Otrexup stay on the product, it would result in annualized sales of $6 million. Of course, some percentage of these patients may not continue on Otrexup.

As one of many possible models for Otrexup sales in 2014, I have constructed a model based on the following assumptions: (1) there were 631 Otrexup patients added in April and let us assume that there are 631 new patients added in each of the months from May through December of 2014, (2) no patients drop out of therapy, and (3) patients receive four injections per month at a net price of $510 per month. I think that it is probable that the number of patients treated increases on a month by month basis so I consider this assumption conservative. There will be some dropouts although I expect it will be a small percentage. The net price of $510 per patient month of treatment is explained later. With these assumptions, the quarterly sales of Otrexup would be 1Q (0.2 million), 2Q ($2.5 million), 3Q ($5.4 million) and 4Q ($8.3 million). Full year sales would come in at $16.4 million. The annualized run rate in 4Q, 2014 would be $33.2 million. This is shown in the following table.

Through the first 3 months of the launch, the Antares sales reps have made more than 8,500 calls on rheumatologists and have reached 76% of targeted customers. They have reached 93% of the high methotrexate prescribing rheumatologists who represent the greatest potential for driving Otrexup sales. Antares has had orders for than 6,000 samples. The Company is limiting samples handed out so that they are only given to physicians who intend to actually treat a patient with Otrexup and for whom reimbursement can be obtained. If each of these samples translated into annual Otrexup use, this would translate into $36 million of annualized sales. Of course, some patients may be given more than one sample and some might discontinue after the sample, but still this suggests pretty significant sales potential.

In the 3 months ended March 31, 2014, the company shipped $2.7 million of Otrexup to wholesalers and recognized net product sales of $200,000 from sales of Otrexup based on prescriptions dispensed. At this point in time, the Company only recognizes sales on prescriptions that have been filled. Eventually, they will shift revenue recognition to sales to distributors.

The Company does not see an acceleration of sales until the second half of the year. The reasoning is that patients usually see their physicians on a quarterly basis and Antares believes that Otrexup will have to go through two cycles of physician visits in which the physician is educated on how to position the product and how patients can be reimbursed. A patient coming in once a quarter may not receive a prescription for his first two or three visits as the physician is coming up the learning curve. Since they started selling in February, this points to the July/August timeframe for acceleration in sales. This is why I think that patients started on Otrexup will be more than 631 patients per month which I used to come up with the $16.4 million sales estimate in my earlier example.

With respect to Leo, Antares will be recording all of the revenues from sales of Otrexup, whether it’s in psoriasis or in rheumatology. They will be able to identify the breakdown by specialty later on in the year in order to make sure they provide Leo with the correct compensation for the work that they’re doing. My previous rough estimates for 2014 sales based on patients started and samples distributed omitted any contribution from Leo’s efforts.

Wall Street analysts will be publishing and investors will be closely watching prescription data, but at this stage of the launch it is difficult to read. We are only 12 weeks into the launch and the prescription data for a new product such as Otrexup is not always consistent with respect to the length of each prescription and the refill data. Management believes that some rheumatologists are writing a prescription for one month and are not authorizing refills. They then ask the patient at the next visit about their experience before writing the next prescription which could either be for the same dose with a refill or they may choose the next highest dose again with no refills. In both cases, this would count as a new prescription and not as a refill. It's still too early to project refills based on current prescribing trends.

Not all Otrexup sales will be captured by a prescription. Otrexup is also dispensed by specialty pharmacies which do not typically show up as a script. At this point, based on their analysis of product revenue and prescriptions, management believes that they may under estimate revenues until they start to book revenues based on sales to distributors. This will likely happen when the shipments to distributors are more aligned with the level of prescription sales value, which they estimate will be towards the end of 2014.

Reimbursement and Formulary Status

Antares is relying on an organization called MMIT for information on reimbursement and formulary status of Otrexup; this company has a database on drug formulary status for 4000 commercial plans. Their data as of the May 9th conference call showed that of the commercially covered lives, Otrexup has a preferred status with 7% which means that it has tier 3 status and reimbursement approval. With about 41% it has a restricted status; this is essentially a tier 3 status that may require prior authorization to prescribe Otrexup, but for which reimbursement is set.

The data just cited shows that Otrexup generally has the reimbursement status that is appropriate for the product in 48% of covered lives. MMIT estimates that another 42% are still going through the process of determining the appropriate formulary status but are allowing access if there is a prescription request and documentation on how Otrexup will be used. As of the end of April, only 10% of commercially covered lives did not have access. This is largely because some big plans such as Kaiser will not reimburse any product in the first 6 to 8 months of the launch. I would expect formulary coverage to broaden and become more straightforward in coming months. A check with the Company before I published this report indicates that the reimbursement status has improved since the 4Q, conference call on May 9th.

The sales force continues to educate rheumatologists, on identifying the right patients medically and financially. They are also instructing nurses and office managers on the use of free insurance verification and benefits investigation service. This is to assure as much as possible that patients will be able to initiate treatment with Otrexup without any prior authorization or copay surprises.

Antares has engaged 22 key opinion leaders in a nationwide speaker bureau program to educate rheumatologists, physician assistants, nurses and pharmacists on the value of Otrexup. This should help build champions for Otrexup in the formulary access process.

Intellectual Property and Medac Litigation

Antares already had seven orange book-listed patents covering Otrexup before Medac received its patent, and additional Otrexup patents were issued in April. Management is optimistic that Otrexup has strong patent protection and are optimistic about winning their patent suit with Medac.

The Otrexup patents are directed towards devices, combination products including drugs, and methods for delivering injectable drugs. In terms of the litigation with Medac, they have been advised by an outside counsel not to comment on, or speculate on the outcome or timing of this litigation.

Recent Key Publication

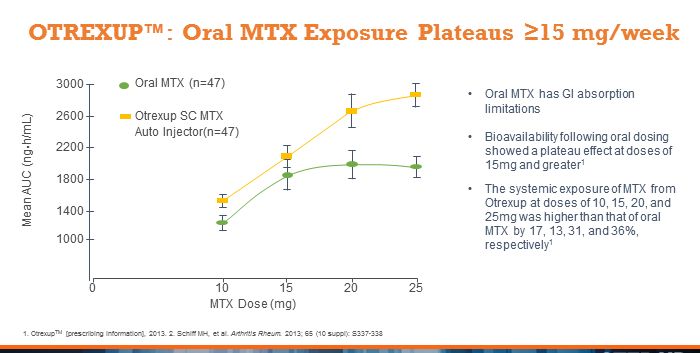

An important article was published in the April 17 issue of the Annals of the Rheumatic Diseases on an open-label study that compared blood levels of Otrexup to oral methotrexate for various dosages. Patients enrolled in the study had been on methotrexate therapy for at least three months. They were given Otrexup or oral methotrexate at one of four doses, 10 mg, 15 mg, 20 mg, and 25 mg weekly in a random sequence of three treatments: oral, subcutaneous Otrexup into the abdomen and subcutaneous Otrexup into the thigh.

Blood samples were collected to measure drug levels. Forty-seven patients completed the study and the results showed that the systemic availability of methotrexate following oral dosing plateaued at 15 mg and greater. Following administration of Otrexup, the systemic availability increased proportionally at every dose. This study showed for the first time that plasma levels of oral dosed MTX are no greater for 20 mg or 25 mg doses than for 15 mg dose whereas higher blood levels could be obtained with Otrexup. Higher systemic methotrexate exposure experienced with Otrexup was not associated with meaningful increases in or severity of adverse events.

This article lends great support to the central argument behind the development and commercialization of Otrexup. If a patient fails to respond to 15 mg of methotrexate orally, they should be switched to Otrexup rather than continue to raise the oral dose. This allows the patient to stay on methotrexate therapy longer before progressing to much more expensive biologics therapy. This article adds credibility to the Otrexup sales message.

The Price of Otrexup

The wholesale acquisition cost for one monthly prescription that has four single dose injectors is $548. Other than the required discounts for Medicare, Medicaid and VA, they are not discounting the product to any third party payers yet. They pay a 7% discount to distributors for distribution services. Hence the price received per monthly prescription is about $510. The net price is also reduced by 2% for quick payment.

They will eventually have to enter into contracts with some third party payers that don’t allow access without a contract such as Kaiser. They will have to see what happens to the balance of the plans.

The gross margins on the product are typical for a branded product or about 90%. They are spending about $5.5 million per quarter on sales and marketing. This suggests that with the current commercial operation they can break even with $23 to $25 million of sales.

They believe that there is no meaning inventory build on the product. The buying in April and May has been to replace inventories that have been sold. They don’t see an inventory build.

Leo Pharmaceuticals

Almost all current prescriptions are for rheumatoid arthritis as Leo only started detailing the product in mid-March. It looks like there were 15 prescriptions written by dermatologists in March. Eventually they are estimating that the breakdown will be 70% rheumatoid arthritis and 30% psoriasis.

There are 7 million psoriasis patients in the US and about 10% or 700,000 have severe recalcitrant, or debilitating, psoriasis, which is the current label. Leo Pharma has a large data base, some 50,000 psoriasis patients. They will be using 85 sales reps to target approximately 7,000 dermatologists.

On March 12, Antares received a $5 million milestone payment that was tied to Leo reaching a certain (undisclosed) percentage of lives covered by commercial insurance plans.

How Big Is The Subcutaneous Methotrexate Market?

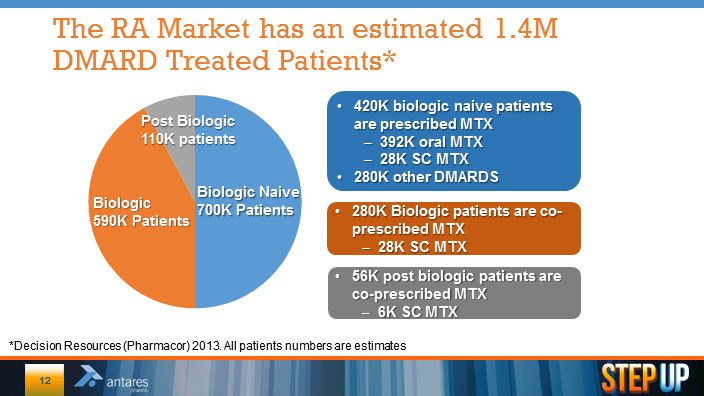

During a recent presentation at the UBS conference, Antares presented the following slid that showed the breakdown of DMARD (disease modifying anti-rheumatic drugs) usage in the US. The biologic naive market is patients who are just starting on DMARDS and this graph shows that there are 420,000 patients in this category. Most of these patients receive methotrexate sometimes in combination with other DMARDS. The biologics category is 590,000 patients who are no longer controlled with methotrexate and move on to drugs such as Enbrel, Humira and Remicade. Finally, there are 56,000 post biologic patients who receive methotrexate.

The presentation is a bit surprising and confusing to me in that it shows that in these three categories there are 62,000 patients who are receiving subcutaneous methotrexate. There is no approved subcutaneous methotrexate product so this represents an off-label formulation that uses injectable methotrexate delivered with an insulin syringe. In addition it is estimated that about 5% or 38,000 of all methotrexate injections are delivered with intramuscular products. If these numbers are correct, the current injectable market is 100,000 patients and at $6,000 per year, this represents an injectable market of $600 million potential.

I am both confused and somewhat skeptical of these numbers. This is the first time that I have seen estimates of off-label use of a sub-cutaneous form of methotrexate. Intuitively, the number seems high. I am not willing to endorse these numbers, but I thought I would present them anyway for you to look at.

Tagged as Antares Pharma Inc., ATRS, otrexup, subcutaneous methotrexate + Categorized as Company Reports

11 Comments

Trackbacks & Pingbacks

-

Antares Pharmaceuticals: An Update on Key Issues (ATRS, Buy, $2.14) | Expert Financial Analysis and Reporting | Smith on Stocks

[…] With this back of the envelope logic, Otrexup would achieve $120 million of peak sales. In a recent report, I have suggested that the US addressable market may be $600 […]

Comment

You must be logged in, or you must subscribe to post a comment.

Excellent presentation as always.

What is the cost of generic IM methotrexate that patients currently use sq.

This would be the primary source of competition to Otrexup.

This is not quite the correct way of looking at the potential for Otrexup.

Oral methotrexate costs a few hundred dollars per year, Otrexup costs about $6,000 and the biologics (Humira, Enbrel, Remicade) cost $20,000 or more. Oral methotrexate should always be used until it fails. The issue is that rheumatoid arthritis progresses and the physician has to keep upping the dose. Hence patients may start at 5mg per week of methotrexate and move up to 10 and then 15. Above that level there is a problem because above 15 mg, the blood level (and thereby the effectiveness of methotrexate) levels off. Prior to Otrexup, physicans would then have to add a biologic drug at a cost of $20,000. Physicians love mehtotrexate and would like to keep patients on mehtotrexate after the oral dose is no longer effective. Otrxup does this. In terms of cost, the payors see the use of Otrexup at $6,000 per year as opposed to the biologics at $20,000. Otrexup fits nicely between oral methotrexate and the biologics.

Hi Larry,

I’d appreciate your thoughts on the just announced departure of Paul Wotton, former Antares CEO. He took a CEO position with a development stage company based in Massachusets.

Thanks

Larry,

As an “add on” to the initial message, If interested, I spoke with Jack Howarth (VP of Investor Relations at Antares) earlier today (long conversation). Short version – Per Jack this was a “friendly” parting, and unexpected. “The dance” between PW and his new employer started a couple of months ago. They contacted (recruited) PW. PW became interested due to the other company being a “developmental” pharma (what attracted him to Antares 5 years ago). PW would rather spend his time building a developmental pharma than managing a commercial pharma – what Antares has now become. No red flags, PW was not forced out, no warning signs as the result of this change. PW simply chose to leave and do what he would rather do, and leave the commercializing of Antares to those who want to do that sort of thing. Antares has a strong succession plan in place, so naming Paul’s successor with an internal hire was a fast and simple process. PW’s successor has a similar vision for Antares, and all existing programs are still and “go”. The transition to the new CEO is expected to have virtually no disruption to the execution of their business plan. So there you have it.

Jack has known PW for 20 years. They are personal friends. I have no reason to doubt what Jack said (maybe I’m being naïve, but I have no reason to doubt what Jack said).

Thanks for the input. I will see Jack today.

Thanks, Larry. I brought up with Jack that I subscribed to your website. Jack then mentioned that he has known you for quite some time.

Beyond what I stated in my earlier post, I can’t help but wonder if Paul was butting heads with the board of directors. Jack made no such insinuations, nor did I ask. Still, my instincts tell me there may be more to this story. Hoping to see a new blog or report from you soon that offers your perspective on the Antares situation.

Thanks

Larry;

Well, I’ve now lost over half the money I put into this stock…

Earnings released today… in part:

“…Product sales were $3.4 million in the second quarter of 2014 compared to $4.5 million in the second quarter of 2013. For the six months ended June 30, 2014, product sales were $5.2 million compared to $7.0 million in the first six months of the prior year.”

Now the stock down 6% more just today… thoughts?

Regarding the Q2 report comments,

On a plus note Antares Q2 2014 revenues were above Q2 2013 revenues. Antares Q1 2014 revenues were also above Q1 2013 revenues. Q3 of this year will show the same verses Q3 of last year.

As Otrexup sales continue to build and do so nicely month over month, come Q4 we have an outside chance of being profitable that quarter contingent on how many pen injector and/or EpiPen pre-commercial injectors are shipped that quarter. Come Q1 2015, life should be quite good from an Otrexup sales standpoint and we should be profitable (or very, very close to being profitable) depending on how many development dollars are being spent at that time for other pipeline programs. Then, EpiPen kicks in the second half of the year, plus Teva’s NDA Pen product (so it appears at this time – they’re supposed to submit their NDA at any time).

Hi Larry,

It’s still appears that the dispensed rate is only around 50% for new Otrexup patients. The numbers of new users you deduced above is probably accurate, if not conservative. Unfortunately, only about half of those have been able to stay on the drug due to the issues of getting a new drug seated within the bureaucracies associated with insurers and pharmacies. I personally had hoped the insurer/pharmacy aspect would move along quicker than it has, but for now it’s moving along slower than hoped.

Hi Larry,

I’ve been advised by a friend that after poking around on the internet, It appears that Rasuvo will be priced around 10% lower than Otrexup. The best price he found for Rasuvo was $487.50 for a 4-pack. Otrexup is around $548 per 4-pack. This seems very much in line with your expectations (i.e. somewhat higher or lower than Otrexup, but not “generic” pricing). This would fall within the same bandwidth as the with the numerous RA biologics, e.g. $18K vs. $20K per year, and so forth.