An Overview of Companies with a Major Presence in CAR-T Research

Investment Opportunity

One of the areas that I want to focus my investment research on is CAR-T therapy. I believe that this is one of the most significant opportunities for new drug development over the coming decades and will produce some outstanding investment opportunities. The first two CAR-T drugs, Novartis’ Kymriah and Gilead’s Yescarta, were introduced in 1Q, 2018 and I am projecting combined sales in 2020 of around $1 billion. There is enormous potential to expand usage of this therapy. On a very preliminary basis, I think that sales could reach $5 billion by 2025 perhaps $15 billion by 2030. This will be achieved due to:

- Expanding indications beyond certain relapsed/ refractory B-cell cancers (r/r ALL and r/r DLBCL) currently addressed by Kymriah and Yescarta, into earlier disease stages of those diseases and also into different hematological cancers. Somewhat later in development are clinical programs targeted at solid tumors.

- Kymriah and Yescarta are autologous cell products which require that T-cells be isolated from a patient to begin a long and complex manufacturing process that it can be as long as two weeks from the start to the actual infusion of cells. Allogeneic cell therapy can change CAR-T to an off the shelf product.

- Severity and incidence of sometimes life threatening side effects is a major drawback at present. The combination of technological innovation and better treatment procedures should result in much improvement. Right now, managing side effect issues largely limits usage to major medical centers but an improvement in the safety profile could expand treatment to the community setting and greatly enlarge the addressable market.

- CAR-T cells cost about $325,000 on average (within a wide range) and in some cases the all-in treatment cost can be $1 million. In the early stages of any product launch, reimbursement hurdles take a year or two to negotiate and smooth out. Given the cost involved, this has been even more of an issue for CAR-T drugs. In some cases, providers have lost significant amounts of money on CAR-T drugs due to inadequate reimbursement. The probable implementation by CMS of a CAR-T specific DRG later this year could have a very positive effect by clarifying the process of reimbursement and providing greater certainty for payment.

There are two broad platforms that use engineered T-cells of which the most clinically advanced is CAR-T; somewhat further behind is T cell receptor (TCR) therapy. I will address CAR-T primarily in this report. Almost of the initial data that has excited investors is based on CAR-T products which address a particular antigen (CD19) which is applicable to hematological tumors. Most solid tumors express their key antigens internally and this requires a different T-cell engineering approach that is known by the acronym TCR. This technology is less advanced than CAR-T. At the earliest, I would not expect a TCR product before 2022 or 2023. Unlike CAR-T, this technology can be directed against intracellular antigens in cancer cells which could potentially allow broad use in solid tumors. There are potentially much greater opportunities in solid tumors than hematological cancers. I will discuss the outlook for TCR products in a subsequent report.

How I See the Investment CAR-T Landscape Unfolding

I believe that much of the cutting edge innovation will come from entrepreneurial biotechnology companies as so often has been seen in the past. Making this even more the case is a new fundamental variable at play. In the past, emerging biotechnology companies have often been cash-starved so that in order to fund development they had to do a series of dilutive equity deals; form collaborations with larger companies who held most of the negotiating cards; or just be acquired. There is now an important change to this equation in that Wall Street is showering some emerging biotechs with cash. For example, two of the companies that I believe will emerge as leaders in CAR-T research and drug development are Allogene and CRISPR, neither of which likely will be at commercial stage of development until 2022. They currently have staggering cash balances of $1.1 billion and $890 million respectively. This means that in addition to their entrepreneurial edge that may very well have more cash to spend on CAR-T research than larger companies who spread research dollars over a far broader spectrum of drug development efforts.

Not all biotechnology companies are as well funded as Allogene and CRISPR, but it is surprising how many have cash that position them exceedingly well. This cash dynamic argues that emerging biotechnology companies can move more rapidly and broadly on building their pipelines while minimizing dilution to stockholders from equity offerings or collaborations that give away a good part of future economics or to sell out before they have maximized the value of the company. I want to hasten to add that I am not saying that there will be no new collaborations or acquisitions. In fact, they are likely to accelerate. However, the terms will be much more advantageous to emerging companies.

At this very early stage there are two companies marketing CAR-T drugs-Novartis and Gilead. Novartis clinically developed Kymriah and Gilead acquired Kite to obtain Yescarta. The next competitor should be Bristol-Myers Squibb which through its acquisition of Celgene entered the CAR-T field. Celgene had established a presence by acquiring Juno and through a collaboration with bluebird bio. I expect BMY’s liso cel, which is a comparable product to Kymriah and Yescarta, to be approved in 2020. Johnson & Johnson through a collaboration with Legend Biotechnology should be the fourth company to bring a CAR-T product to market. In 2021, I expect BMY and JNJ to gain approval for a new category of CAR-T therapy targeted at multiple myeloma (not addressed by Kymriah, Yescarta and liso cel) which targets B-cell malignancies.

Biotechnology Companies Involved in CAR-T Research

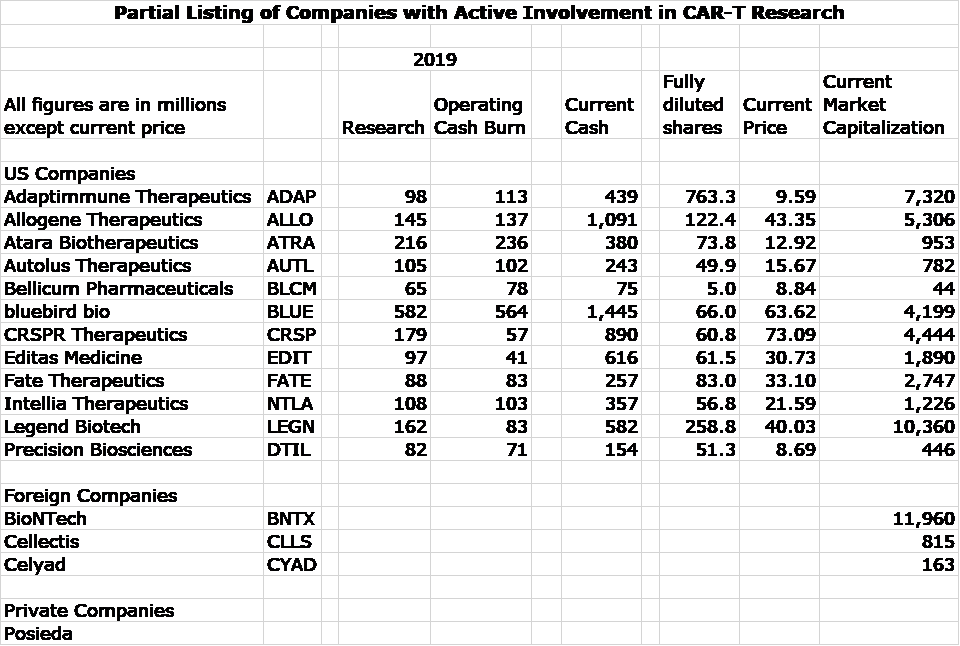

I have been screening for emerging biotechnology companies involved in CAR-T and TCR research and have put together a list of some of the most prominent companies. I don’t think that it is comprehensive as I will probably find others in coming weeks. The ones I have uncovered so far are 12 companies listed on US stock exchanges, 3 foreign and 1 private are listed in the following table. For the US companies, I show:

- Research spending in 2019

- Operating cash burn in 2019

- Current cash position which includes offerings done in 2020

- Current fully diluted shares which includes offerings done in 2020

- Market capitalization based on closing price on June 24

It is more time consuming to find this data on three foreign companies who trade ADRs in the US. Because of time constraints, I only show market capitalizations as presented on Yahoo.

Some of these companies are involved to varying extents in other areas of research so that the research spending and cash burn are not just for CAR-T development efforts. The take away message is that companies are very well funded and spending aggressively on product development.

This report is part of my initial screening effort and I can’t offer any meaningful conclusions on which of these companies I think are the best investment opportunities. On some companies, I have done a little research and on some none at all. At this point, I am most interested in doing further research on Allogene, Autolus and CRISPR. Allogene and Autolus are pure plays on CAR-T and it is a major part of CRSPR’s broader clinical development program.

- Allogene was founded by the same management team that founded Kite Pharmaceutical and sold it to Gilead. It is focused on allogeneic therapy and has $1.1 billion of cash. My best guess is that this company, like Kite, could be sold to a major pharmaceutical company by 2025.

- Autolus’ lead program, unlike Allogene and CRSPR, is focused on improved autologous CAR-T drugs. Its allogenic development efforts are pre-clinical. My interest in the company stems from my confidence in its CEO, Christian Itin. I dealt closely with him when he was at Micromet, which pioneered the development of bi-specific antibodies. Of the many CEOs of emerging biotechnology companies that I have met, he is one of the best. Micromet was sold to Amgen and I think that Autolus could be sold to a major pharmaceutical company by 2025.

- I think that CRSPR’s focus on crspr cas 9 technology may allow it to move more quickly to incorporate new scientific discoveries into its products than other companies. One of its current major focuses is on allogeneic CAR-T, but it is involved in a number of other drug development classes. It is well funded. I see CRSPR as potentially developing into a fully integrated pharmaceutical firm.

At this point, I have no investment recommendations. As I do further research, I am anticipating that there will be several.

Don’t Forget About Cryoport

One of the best recommendations in my career has been Cryoport which I first recommended on April 12, 2017. See this link. CAR-T drugs are living cells which must be transported at cryogenic temperatures. Cryoport provides logistical support for cryogenic shipping. It holds a dominant market position and is supporting or will support many of the CAR-T companies. Its success will be driven by success of CAR-T drugs as a class rather than by any single drug. If I am correct on my revenue forecast for CAR-T drugs growing from $1 billion in 2020 to $5 billion in 2025 and $15 billion by 2030, Cryoport should achieve commensurate growth in sales.

CAR-T Therapy is A Major Advance

The approval and commercialization of chimeric antigen receptor T cells or CAR-T cells promises to be one of the most important advances ever in oncology. The idea behind CAR-T cells is to genetically alter T-cells to express an antibody single-chain variable fragment on the T-cell surface which recognizes an antigen on tumor cells. This directs the CAR-T cell to cancer cells. This combines the honing properties of an antibody with the killing power of a T-cell, which is the body’s primary cancer killing cell. We are very early in the development of CAR-T therapies as the first two products-Novartis’s Kymriah and Gilead’s Yescarta- were just introduced in 2017. These products demonstrated that they could treat very advanced stages of two hematological cancers-diffuse large B-cell lymphoma (DLBCL) and acute lymphoblastic leukemia (ALL). These patients usually had failed four to five prior treatments and usually had exhausted treatment options. They faced a grim prognosis with expected median survival of just 6 to 8 months.

CAR-T therapy led to complete or objective responses in as many as 80% of patients and also achieved durable, ongoing remissions lasting two to three years in 30% to 40% of patients. This was a home run clinical result from an efficacy standpoint. Combined sales of Kymriah and Yescarta were $340 million in 2018 and $734 million in 2019. The effects of COVID on sales in 2020 are difficult to gage, but I am guessing that they will come in at just under $1 billion. However, we will have to see 2Q results in order to get a better handle. These results are impressive in an absolute sense, but given the efficacy they have been viewed as disappointing by some Wall Street analysts given the efficacy. Why is this?

CAR- T Cells Involve a Complex Manufacturing Process

These are living cells and the manufacturing process is long and complex taking around two weeks. It begins by collecting blood from the cancer patient. Then, in a procedure called leukapheresis, T-cells are separated and collected and the remaining blood is returned to the body. The T-cells are then shipped to a laboratory where they are genetically altered to express the chimeric antigen receptor (an antibody single-chain variable fragment) as well as other properties that enhance their expansion when infused into the patient. They are then expanded exponentially in a cell culture.

The resulting CAR-T cells are cryogenically frozen and shipped back to the patient’s treatment site. This cryogenic shipping is in most cases executed by Cryoport, one of my long standing buy recommendations. Shipping delicate cells at cryogenic temperature requires sophisticated technology and logistics for which Cryoport is the dominant and highly trusted service provider. After arrival, the T-cells are thawed and infused back into the cancer patient. A single infusion constitutes the entire course of drug treatment. The patient is, of course, receiving their own genetically altered T-cells which is called autologous cell therapy.

Conditioning Chemotherapy Adds Complexity to Treatment

Prior to the T-cell infusion, the patient is given a course of conditioning chemotherapy which depletes the number of the patient’s T-cells. This depletion is necessary to allow the CAR-T cells room to expand throughout the body after they are infused. Certain chemotherapy drugs have the side effect of destroying T-cells, which in this case produces a therapeutic benefit. This process is called lymphodepletion.

Side Effects are a Major Drawback for CAR-T

The CAR-T treated patient is hit with a double whammy of side effects caused by the conditioning chemotherapy and then the CAR-T cells themselves. The chemotherapy can cause the common side effects of neutropenia (low white blood cell count) and anemia (low red blood cells). The side effects particular to CAR-T cells are cytokine release syndrome, which is similar to flu-like symptoms (headache, fever and chills), severe nausea, vomiting, diarrhea; severe muscle or joint pain, shortness of breath, low blood pressure and fast heart rate. These symptoms are tolerated in many patients but can be serious and life threatening in some. Neurologic events include encephalopathy (brain malfunction), confusion, aphasia (difficulty understand or speaking), drowsiness, agitation, seizures, loss of balance and altered consciousness. These side effects also can be life threatening in some patients.

Let me interrupt this narrative at this point with an anecdote. My cousin is an oncology nurse at a major medical center and we were talking about the side effects of CAR-T. She said that it was frequently the case that following treatment patients were distraught and screaming due to the CAR-T side effects. I can’t quantify the extent to which this occurs.

Patients often have to stay in a hospital for a week or more after CAR-T treatment to manage the side effects. This is an important reason why CAR-T therapy is currently only delivered in major medical centers and not in the community setting. This means that some patients have to travel a considerable distance to reach a major medical center and then stay there for several days. This is obviously difficult for the patient and family.

Reimbursement Has Been Extremely Difficult but Should Get Better

There have significant reimbursement issues. Although this is to be expected with any new product launch, they are heightened. CAR-T therapy costs about $325,000 for a single infusion of cells. This does not include the costs that are incurred with hospitalization and treatment of side effects. In extreme cases, the all-in cost can approach $1 million. In the case of drugs that are given in repeat treatments, the therapy can be withdrawn if the drug is not effective and limit the cost. However, in the case of the one time infusion of CAR-T cells the cost is the same for effective or ineffective treatment.

In the early stage of virtually all drug launches, establishing eligibility and gaining reimbursement is a slow and laborious process which generally takes a year or two to smooth out. In general, reimbursement can vary widely depending on the geographical region and the setting where the drug is administered: the payer; and the type of insurance benefits the patient is entitled to. Payment for CAR-T therapy is divided between the government programs, Medicare and Medicaid, and private insurance companies. This creates an overall tangled web of reimbursement procedures. The whole process of verification of benefits and dealing with denials or appeals can be a nightmare

CAR-T is an in-patient (hospital) treatment in which Medicare and Medicaid typically use Diagnosis-Related Group (DRG)-based payment methodology for billing. Under a DRG patients with similar conditions are classified into specific groups. Under a DRG, all products and services are paid for as a bundle and not individually. The early issue for CAR-T therapy is that it has no DRG and the Centers for Medicare & Medicaid Services (CMS) is still working on this two years after introduction. Without a DRG, hospitals treating Medicare and Medicaid patients seek reimbursement under different procedures and codes that vary meaningfully from Medicare region to region. CAR-T therapy is estimated to have a net selling price of about $325,000 although this varies significantly from payor to payor. Without inclusion in a DRG, hospitals have no assurance that CAR-T treatment will be reimbursed. Many are reluctant to take on patients and incur the high cost when there is a good chance that they won’t be reimbursed or won’t receive full reimbursement.

In May 2020, CMS proposed a DRG that would cover CAR-T therapy. CMS has noted that due to the COVID-19 pandemic, the 2021 final rule may not be released until September 1, 2020, with the final rule’s provisions going into effect October 1, 2020. I think that this is a big deal as it will give much greater assurance to providers for Medicare and Medicaid patients that they will receive reimbursement. Private insurers, of course, are not covered by the DRG but many often take their cues from CMS so that the DRG has positive implications for private pay as well.

New Indications for CAR-T Therapy Should Significantly Increase the Addressable Market

At the present time, there are two approved CAR-T drugs, Kymriah and Yescarta. Both target the CD-19 antigen on the surface of some B-cell lymphomas and leukemias. The initial indications were in relapsed/ refractory diffuse large B-cell lymphoma (r/r DLBCL) and relapsed/ refractory acute lymphoblastic leukemia (r/r ALL). The initial usage has been in very late stages of these cancers. There is an opportunity to move treatment into earlier stages that would expand the addressable market many fold. There is also the opportunity to expand into other types of B-cell cancers such as mantle cell lymphoma, chronic lymphocytic leukemia and non-Hodgkin’s lymphoma. A major new opportunity beyond B-Cell lymphomas and leukemias is emerging in multiple myeloma. The target antigen for B-cell lymphomas and leukemias is CD-19 while the target for multiple myeloma is B-cell maturation antigen (BCMA).

The new indications for earlier stage treatment and in other B-cell lymphomas and leukemias as well as use in multiple myeloma will all be commercialized in 2020 and 2021. This should expand the addressable market several times. Further down the road are potential indications in certain solid tumors which could even more dramatically expand the addressable market.

At this point only two companies are marketing CAR-T drugs, Novartis and Gilead. Bristol-Myers Squibb is expected to launch its CAR-T drug liso-pro this year. It is a CD-19 targeted product that is comparable to Kymriah and Yescarta. BMY claims that liso-cel has a much better safety profile than these drugs. The patient data base is too small to judge this claim but the entry of another major player in the market will expand the market meaningfully. If indeed, liso-cel is safer than Kymriah and Yescarta this should also be a boost to usage. BMY and JNJ are expected to launch CAR-T drugs targeted at the BCMA antigen on multiple myeloma cells in 2021. This indication is in the relapsed refractory setting and as a market opportunity is probably as big or bigger than the initial indications for Yescarta and Kymriah in r/r DLBCL and r/r ALL.

There is significant opportunity to expand the usage of CAR-T cells beyond the treatment of hematological tumors to solid tumors. There are some major hurdles to overcome in addressing solid tumors which I won’t go into at this time. One of the major problems has been finding an antigen that occurs primarily on cancer cells. CAR-T cells only recognize an antigen and will vigorously attack healthy cells as well as cancer cells if they express the targeted antigen. I have no doubt that over time, challenges will be overcome and CAR-T therapy will be widely used in solid tumors. Already, there are phase 1 trials being conducted in renal cell carcinoma.

Improving on Kymriah and Yescarta with Allogeneic Therapy

The first generation CAR-T products, Kymriah and Yescarta, leave much room for improvement in terms of manufacturing and safety. These have been significant hurdles that have slowed uptake despite their outstanding efficacy. There are major efforts underway to overcome these problems. One of the most important efforts is the development of allogenic CAR-T therapy. Instead of using the patient’s own T-cells to manufacture CAR-T drugs, allogeneic therapy uses T-cells donated from a healthy person. The donor T-cells are genetically altered and then expanded in a cell culture as in autologous therapy. The cells are then cryogenically frozen and ready for use. One donor may be able to provide a hundred of so doses. The advantage of this is that instead of having the long drawn out manufacturing process needed for autologous CAR-T therapy, allogenic cells are an off the shelf product.

The biggest concern with allogeneic therapy is an immune reaction of the donor CAR-T cells against the tissues of the host; this is known as graft versus host disease (GVHD). It could also be the case that the host immune system attacks the donor cells. There are mechanisms available that help to mitigate these type of immune reactions. Early clinical trials with allogeneic CAR-T cells have been encouraging that GVHD can be safely handled. There are also efforts underway to better manage or reduce the severity of side effects. This is being approached by the development of better lymphodepletion approaches and further genetic alteration of T-cells.

How Will Bispecific Antibodies Compete with CAR-T Therapy?

In today’s biotechnology environment, change is exponential and just as many companies are focused on improving CAR-T treatment, many others are developing bispecific antibodies that will be targeted at many of the same indications as CAR-T. I am closely watching this technology and will address it in a future report. Bi-specific antibodies, aka T cell engagers, are antibodies in which one of the Fab arms is specific to a cancer antigen and the other is specific to a molecule on the surface of the T-cell. The bispecific brings the T-cell into direct contact with a cancer cell. The T-cell kills the cancer cell; the bispecific then disengages and goes on to lead an attack another cancer cell.

It is a little too early for me to hypothesize on how the two technologies compare on safety and efficacy. My impression is that CAR-Ts are somewhat more effective and bi-specifics are somewhat safer. At this point in time, the bi-specifics are off the shelf products which is an enormous advantage over autologous CAR-T therapy. However, the advent of allogeneic CAR-T therapy will level the playing field.

So how will this all play out? I can only look to historical examples of what happens when one effective drug class is targeted by another effective drug class. It seems always to be the case that there are still many differences which create niches for each and allow both to enjoy wide usage. I suspect that will be the case here. I will be watching this closely in coming years.

Tagged as Allogene, Autolus, CAR-T Therapy, CRSPR, Cryoport + Categorized as LinkedIn, Smith On Stocks Blog