Cryoport: Quick Take on 2Q Results (CYRX, $20.18, Buy)

Cryoport reported a very strong quarter as sales increased by 83%. The key biopharma segment increased sales by 81%. This was led by a 326% increase in sales stemming from support of the commercial CAR-T products, Kymriah and Yescarta. Some $600,000 of incremental sales were recorded from the acquisition of Cryogene which closed on May 14, 2019. For the first time the Company reported positive non-GAAP EBITDA of $300,000. The Company is only a few quarters away from reaching profitability. The cash position is very strong with $94.7 million at the close of 2Q, 2019.

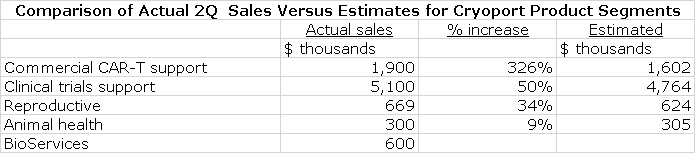

Results in the second quarter were a smidgen better than my estimates as shown in the following table. I will be updating my sales model in the near term and will be raising sales and earnings estimates somewhat.

The stock was very strong on August 8th as a result of the announced decision that Medicare will now reimburse for CAR-T therapy. This is really positive news and should have a very significant impact on the use of CAR-T therapy although I don’t have an estimate right now for the impact. It will likely be a few months before this reimbursement goes active so I wouldn’t expect much of an impact until 2020.

I look for extremely strong growth in sales over the next five years or so and I expect the Company to be profitable in 2020 and the years beyond. I could very well have a continuous buy on this stock for several years. I think it will come to be viewed as a premier growth stock.

Tagged as Cryoport, Cryoport 2Q sales + Categorized as Company Reports, LinkedIn