Cryoport: Details of My Model for Sales for 2018 to 2024 (CYRX, Buy, $16.88)

Key Points:

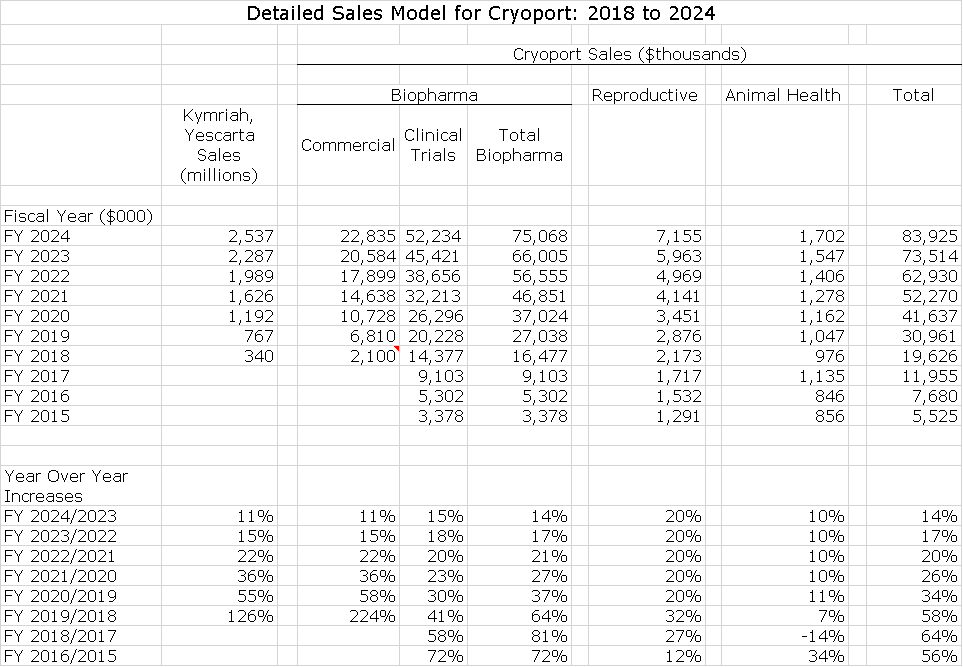

- I am projecting that total sales will increase from $19.6 million in 2018 to $31.0 million in 2019 and $83.9 million in 2024. This is a fourfold increase in sales over the 2018 to 2024 period.

- Even though these numbers appear to be aggressive, I have tried to go out of my way to be conservative. There could be considerable upside to these estimates as explained in this report.

- Cryoport is an undiscovered growth company with little institutional following. As it grows, it could (should) become a darling for growth stock investors.

Background Information

I think that most investors who are familiar with my research know that I have been and remain all-in with my Buy recommendation on Cryoport. When I initiated coverage in April 2017, the Company was a tiny micro-cap company with trailing 12 month sales of only $8.8 million. At that time my recommendation was conceptual, based on the view that Cryoport had a promising business model that uniquely positioned it to capitalize on the explosion in research taking place in the newly emerging regenerative medicine space which encompasses gene therapy and cell therapy. Cryoport had developed a unique and innovative service critical to research and commercialization efforts that could provide highly reliable cryogenic shipping far superior to any alternatives. Remember that regenerative medicine is dealing with living cells that usually must be shipped at cryogenic temperatures. CYRX was so small and unproven (based on the sales level) that it didn’t appear on the radar screens of almost all institutional investors. Also, the uniqueness of its business model meant that there were no peers to which it could be compared.

One of the most appealing aspects of Cryoport’s business is that its service is incorporated into regulatory filings for the products it is supporting. This means that, if for whatever reason, a drug developer wanted to shift to another form of cryogenic shipping, the FDA would likely require new clinical trials to assure that there was no change in the characteristics of the product. This is an extremely strong deterrent and will almost alwaysresults in a recurring revenue stream lasting through the life cycles of the products that are supported.

Cryoport had established a first mover advantage giving it a powerful advantage over would be competitors. At the time I initiated coverage, I thought the biggest competitive threat might be drug developers deciding to take this service in-house. However, the most prominent companies in the rapidly emerging space of regenerative medicine-Novartis, Kite (now owned by Gilead) and Juno (now owned by Bristol-Myers Squibb Celgene) all were using Cryoport. This strongly indicated that it was offering a service that was difficult to replicate even for the big companies and that the risk of losing business to in-house competition was not that great. Subsequently, my conviction has only increased as the number of clients and clinical trials supported has exploded. Cryoport is clearly the first mover and has a dominant position in cryogenic shipping. It supports the two most important approved products-Kymriah and Yescarta- and currently supports 53% of the 93 phase 3 trials under way and 35% of the 1,006 phase 1/2 trials.

Cryoport’s annualized sales by 1Q, 2019 exploded to $22.3 million on a trailing 12month basis and my full year 2019 sales estimate is $31.0 million. Even so, it remains in micro-cap country and has not yet been discovered by large investors. I think this will change as the explosive growth has just begun to attract analyst and investor attention. Although close to profitability, CYRX is not quite there and over the immediate future, the company will not likely be evaluated on the basis of earnings; the focus will be on the level of sales and growth in sales. If I am correct, the explosive sales growth will attract numerous new growth investors who are not currently aware of the Company auguring well for continued strong stock price appreciation.

Sales Projections Through 2024

The next table summarizes my sales projections through 2024 for the company’s three end markets-biopharma, reproductive and animal health. For perspective on just how fast Cryoport is growing, I also provide historical results from 2015 to 2018. The biopharma segment is further broken down into support for commercial products and those in clinical trials. A key focus of investors is growth in commercial sales stemming from the CAR-T products-Kymriah and Yescarta- the only commercial biopharma products serviced by Cryoport. Commercial products offer much greater sales potential as CYRX estimates that they can create $2 to $20 million of revenues annually which compares to $150,000 to $250,000 for a phase 3 product, $50,000 to $125,000 for a phase 2 and $15,000 to $75,000 for a phase 1.

Cryoport is currently supporting 49 products in phase 3 trials. Not all of trials will lead to an approval, but success with only a handful could have major positive implications. Note the column showing my total sales estimate is in the far right column. I am projecting a fourfold increase in 2024 sales to $83.9 million which compares to $19.4 million in 2018. Given this dramatic increase, I understand that you will find this difficult to believe, but I have tried to be conservative in my projections as I will explain.

Projecting Commercial Biopharma Sales

The first two and only commercial biopharma products for which Cryoport provides cryogenic shipping services are the CAR-T products Kymriah and Yescarta. They are currently approved for certain type of relapsed/refractory (r/r), B-cell leukemias and lymphomas. Both products were only launched at the start of 2018 so they are quite early in their launch cycle. On a trailing 12 month basis Kymriah has recorded $109 million of sales and Yescarta $320 million. Almost all of these sales are attributable to the treatment of r/r pediatric, acute lymphoblastic leukemia (ALL) and r/r diffuse B-cell lymphoma (DLBCL) in the US. There appears to be significant growth potential for these products:

- I estimate that r/r DLBCL addressable market in the US is 5,500 patients (Kite management estimated a larger 9,000) and r/r ALL is 850. Based on my estimate that the net selling price of these products is $375,000 per patient, we can estimate the number of patients being treated. This indicates that these products could treat 2,360 patients in 2019 which is about 37% of the US addressable market for these two diseases.

- There are several other relapsed/ refractory B-cell lymphomas and leukemias for which these drugs may receive approval. The addressable patient population is of the same magnitude as the current market addressed.

- There may be potential for Kymriah and Yescarta to expand from usage in relapsed/ refractory disease to earlier, less aggressive stages of B-cell lymphomas and leukemias. If so, the addressable market could be expanded several fold.

- Almost all sales to date have been recorded in the US: European sales are just starting. The European addressable markets is comparable in size to the US.

- Novartis has had production problems that has limited sales. As it corrects these production issues, its sales should accelerate.

These factors suggest that there is very substantial growth ahead for these two drugs. I note with interest that Novartis has given guidance that Kymriah sales will exceed $1 billion in 2024 which compares favorably to my estimate of $1.2 billion.

In my current projections for commercial products, I include estimates only for Kymriah and Yescarta. This is intended to introduce extreme conservatism as there are now 2 BLA regulatory approval filings in the US and 4 comparable MAA filings in Europe pending for products supported by Cryoport. These could produce meaningful revenues in the 2020 to 2024 time frame. In particular, I am not including any sales for CAR-T products targeted at the BCMA antigen in multiple myeloma. I expect approval in 2020 in the US for one or more such products and think that peak sales potential is comparable to combined sales of Kymriah and Yescarta. Celgene has guided that its product KarMMa could be approved in 2H, 2020 and achieve sales in excess of $2 billion in 2030.

Celgene is also developing a CAR-T product, Liso-cel, very comparable to Kymriah and Yescarta, i.e. targeted at the CD-19 antigen on B-cells. Celgene says that this product is best in class and will reach peak sales of $2 billion in 2030. It is difficult to assess this claim, but from a Cryoport standpoint this would be neutral if all of the sales were cannibalized from Kymriah and Yescarta and positive if this expanded the market as seem most likely. There is no allowance for this in my sales model.

Finally, a nearly impossible to determine number of the 49 products in phase 3 development could be commercialized in this time frame. The key point to take away is that my sales model for commercial sales is intended to be and is very likely conservative. There is a meaningful failure rate for drugs in phase 3 development, but I would be flabbergasted if a number of these drugs now in phase 3 were not approved and commercialized before 2024. Again, to build some conservatism into my model, I do not include any such products in my sales model.

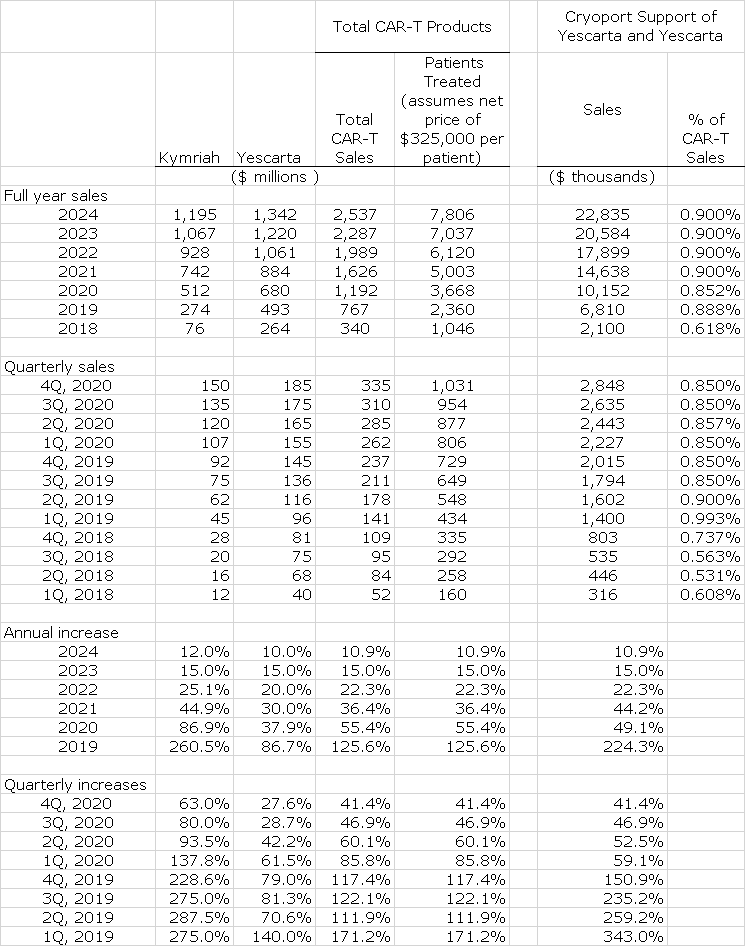

The following table shows my full year sales estimates for Kymriah and Yescarta over the 2018 to 2014 time frame. I have also included my quarterly sales estimates for 2019 and 2020. Also shown is a column in which estimates of the number of patients that Kymriah and Yescarta treat. This is calculated by dividing estimated sales by an estimated net sales price of $325,000 per patient.

But what does this mean for Cryoport revenues. Here is how I approach this question. I looked at the ratio of Cryoport commercial sales to combined Kymriah and Yescarta sales in the last five quarters. This ratio was 0.618% in 2018 and 0.993% in 1Q, 2019. Going forward, I am estimating that Cryoport’s revenues will be about 0.900 % of sales of Kymriah and Yescarta. I then applied this ratio to projected sales of Kymriah and Yescarta as shown below.

Projecting Sales for Clinical Trials of Biopharma Products Supported by Cryoport

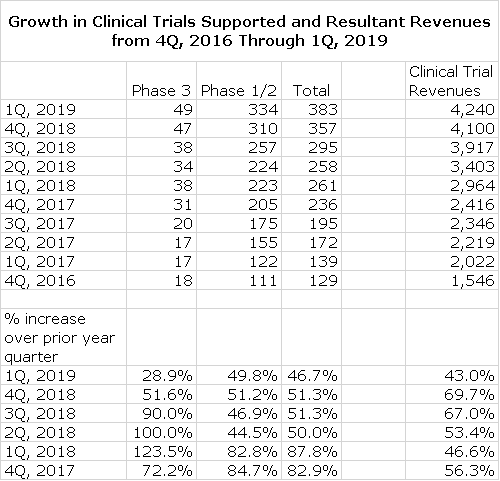

In projecting biopharma clinical trial revenues, I decided to extrapolate the strong sales trends that have been seen. Recognizing the law of large numbers, I am estimating a slowing rate of sales growth in the out years of the model. Clinical trial revenues increased 58% in 2018 and 43% in 1Q, 2019. I am estimating a 41% increase in 2019, 30% in 2020, 22.5% in 2021, 20% in 2022, 17.5% in 2023 and 15% in 2024.

I considered trying to build a microeconomic sales model based on projecting the number of clinical trials supported in phase 1, 2 and 3 and then using the guidance provided by Cryoport on sales potential in each phase. Cryoport has given guidance that a phase 3 trial can produce $150,000 to $250,000 of revenues annually; phase 2, $50,000 to $125,000; and phase 1, $15,000 to $75,000. I quickly dismissed the idea because there are just too many variables and I would have little confidence in the projections for the number of clinical trials.

There has been extraordinary growth over the last ten quarters as shown in the following table which shows the number of clinical trials in phase 1/2 and phase 3 and total clinical trial revenues. Quarterly growth in the number of clinical trials has been about 50% over the last four quarters and revenue growth has been 43% to 70%.

There are some very powerful macroeconomic drivers of Cryoport’s clinical trial business. I believe and there is widespread agreement in the industry that regenerative medicine will emerge as the predominant focus of biopharma research in coming years and decades. A strong parallel can be drawn with the history of monoclonal antibody research. Commercialization began slowly in the late 1970s, but built steadily over the next 40 years to become the driving research and commercialization force for the biopharma industry. I see the same potential for regenerative medicine over coming decades.

One of the striking things about monoclonal antibodies was that the big pharma companies initially stood on the sidelines as they were slow to recognize the potential. In the early years, they watched as small companies like Genentech led the research effort, but eventually came to recognize the potential and they are now all in. It is these big companies that have the money to explode research spending. They are not there yet. Only three large biopharma companies have gone all in on regenerative medicine. Novartis has been a pioneer while Bristol-Myers Squibb Celgene has established a major presence with the acquisition of Juno and Gilead through the acquisition of Kite.

I think this factor is the most powerful argument that suggests we are in for decades of strong growth. Cryoport should grow alongside because of its dominant position in cryogenic shipping. The Alliance for Regenerative Medicine estimated that there were 93 phase 3 clinical trials underway worldwide in 1Q, 2019 and 1,006 phase 1/2 trials with Cryoport supporting 53% of the phase 3 and 35% of phase 1/2. The lower penetration of phase1/2 reflects that trials may be done with a small number of patients at a single site and may not require cryogenic shipping.

Other Businesses

Sales to reproductive and animal health customers are relatively small and not likely to affect the magnitude or rate of sales growth for Cryoport as a whole. I am extrapolating recent sales trends for these business.

Acquisitions

I think that acquisitions could be quite important to future sales growth, but I have not included any sales estimates for acquisitions in my model. Cryoport just announced its first acquisition of Cryogene, whose business is focused on the area of biostorage. The strategy driving the acquisition is that biostorage will be critical for supporting allogeneic trials which surprisingly accounts for about 33% of currently supported trials. No details were given on sales or earnings of Cryogene other than management saying that the deal would be accretive. I will have more to say on this later.

Tagged as Cryoport, Cryoport sales model through 2024, Kymriah sales projections, Yescarta sales projections + Categorized as Company Reports, LinkedIn