Thoughts on the Market Correction in Biotechnology Stocks

This Has Been a Tough Correction

The recent sharp market correction and rotation out of growth stocks like biotechnology and technology has had a major impact on the small biotechnology names that I specialize in. The correction has been stomach churning for me even though I have been through this many times before. I am not a market timer and even if I were, I could not have predicted the timing and severity of the correction.

I want to emphasize that the sharp price declines have not affected the fundamental reasons driving my recommendations. I think it is important to review why I am recommending the stocks that I am involved with and to focus on the issues that could determine stock price trends in 2014 and beyond.

As people lose confidence in the market or the biotechnology sector of the market, small emerging biotechs are most affected. Investments in them are made on the assessment of probable future outcomes in events like clinical trials or product launches. There is no base of earnings or revenues to fall back on to make valuation judgments so that they are more dependent on investor confidence about events off in the future.

All stock prices and especially stock prices for small biotechnology names are reliant on confidence and in the immediate term this confidence is most importantly influenced by the price trend of the stock on the prior day or days. A series of down days then feeds on itself and can raise self-doubt and shatter confidence. Hence in market corrections, the small biotechs that are so dependent on investor confidence are disproportionally hit.

My investment focus is almost always based on a company reaching significant events like clinical trial outcomes or product launches that can lead to dramatic stock price movements. Even though Warren Buffett’s style precludes him from investing in biotechnology and technology names, I think we can still apply some of his long term investing principals to this volatile sector. In my own thinking this involves finding companies that have unique product development opportunities and then remaining with those companies until the time when I can judge that I am wrong or right and living through periods of volatility.

Over the years, I have been unsuccessful when I try to interweave the fluctuations of the market with my recommendation on stocks. Generally, a market correction like the one we are involved in arrives quickly and leaves quickly. I find that investors initially think this is just a day to day fluctuation and almost no one can determine that we are in a correction until it is well underway and often investors are unwilling to act until the correction already has run its course. This means that most investors will sell well after the correction is underway and not infrequently at the bottom. The most important danger is that we sell a stock we like at a depressed price and never get back in.

My research and recommendations are based on an in-depth research of a company. However, there is no certainty in drug development and unexpected events can occur that suddenly change the outlook. Phase 3 clinical trials by both large and small companies fail with some frequency and even big companies with great resources and product development knowledge can make big mistakes. I like to site the example of Bristol Myers Squibb (BMY) acquiring Inhibitex for $2.5 billion to obtain access to a hepatitis C drug; nine months later the entire investment was written off due to a toxicity issue with that drug. If BMY could make that kind of a mistake, it is a certainty that something like this can also happen to small investors.

The question may cross your mind as to why anyone should invest in biotechnology with the risks that I have outlined. The reason is that the stock prices incorporate the high risk of failure so that when the companies are successful, the returns are extraordinary and extended over many years. Early in my career, I recommended Marion Laboratories at $1 and continued with a buy for eight years as it went to $48 (62% compounded annual growth rate); this experience was formative in my investment thinking.

I was not involved in Pharmacyclics (PCYC) but it is also an example of a stock that had the type of dramatic move we are all looking for. In April of 2009, PCYC sold at $1.25 and it closed recently at $91.86 (compounded annual growth rate of 136%). It is the extraordinary returns with these stocks that draw investors. While the odds of finding stocks like these may be comparable to drilling a wild cat well (drilling in an unproven area) and striking oil, those who are successful reap extraordinary returns.

The near term volatility of stocks can be related to the market trend, issues fundamental to the company or a combination. Perceptions of biotechnology companies can vary widely and sometimes the market in the short term comes to a different conclusion than we do. We have to have courage in our convictions. Let me site the example of Cadence Pharmaceuticals. I recommended the stock in May 2011 at $7.10 on the basis of its new product Ofirmev. However, one year later due to concerns about a slow launch and a patent challenge to Ofirmev, the stock was at $2.72. I remained convinced in my fundamental judgment and was proven right when Mallinckrodt acquired the company for $14.00 earlier this year. This shows how volatile biotechnology stocks can be; even in a market that overall was quite positive for biotechnology stocks. I site this example because such challenges frequently arise and I try to be resolute in my convictions.

Asymmetric Investing Applied to Biotechnology

Investing in emerging biotechnologies is high risk. There are any number of ways that companies can stumble in the process of developing and commercializing a drug. The most common, of course, is a failure in clinical trials. I have seen estimates that 50% of late stage phase IIb and III clinical trials that are intended to show proof of concept and pave the way to regulatory approval, fail. Hence biotechnology investing requires a strategy that takes into account the frequency of clinical trial failures.

I call my approach asymmetric investing which is based on the observation that some hedge funds have made enormous returns by looking for asymmetric investment opportunities. These stem from finding upcoming events that are not well understood and which have the potential to cause dramatic stock movements in the case of a positive outcome. The chance for such a positive outcome may be modest, but if it does occur the potential reward dramatically offsets the risk of being wrong. Perhaps the upside opportunity is a several fold increase in the stock price and the downside is often losing 50% or more of one’s money. Critical to this approach is that one winner may potentially offset several losers.

These characteristics are similar to an option, but have the advantage that there is much less of a time element. One can be right on thinking that leads to an option investment and still lose all or much of one’s money if the option expires prior to an anticipated event. Asymmetric investing is not devoid of time risk, but it is much less than with an option.

For an asymmetric opportunity to exist there has to be lack of awareness or extreme skepticism that a positive outcome can occur. Small biotechnology companies fit this approach because most Wall Street analyst coverage in biotechnology is focused on larger biotechnology names that are earnings driven. In addition, the large number of trial failures conducted by small biotechnology companies has produced a pervasive skepticism as to whether any clinical trials will succeed. Asymmetric investing does not mean that an investor is smart enough to predict with certainty clinical trial outcomes. The premise is that the event has a reasonable chance of occurring, is unexpected, and if it does occur the upside potential dramatically offsets the risk of losing much or all of the investment if the outcome is negative.

The other key part of my strategy is diversification. I believe that each of these companies that I follow has the potential to be a great investment, but experience tells me that some will run into problems and their stocks will react quite negatively. My experience is that one winner can more than offset two or three losers.

Highlighting My Recommendations

In my own portfolio, I use emerging biotechnology as a high beta component. It is about 12% of the portfolio and I am invested in all of the names that I follow. A problem with any one stock won’t lead to an impact on my portfolio that would cause me emotional distress and yet in the aggregate my biotechnology selections have the potential to meaningfully affect my portfolio. Remember, one winner may offset multiple losers.

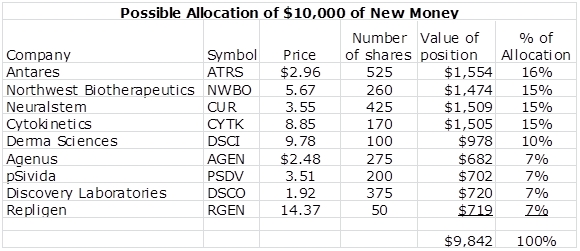

Some subscribers have asked me to provide a clearer overview of my recommendations. Writing a blog is different than running a portfolio. There are so many decisions that go into a portfolio that just don’t go apply to a list of stocks. However, I have put together a list of how I might invest around $10,000 if I had no positions and I was putting the money in the market today. The money is diversified among nine names; ideally I would like to have a somewhat higher number. Anyway, this gives some sense of my current emphasis among the names I follow.

Cytokinetics (CYTK, Buy, $8.85) has two very novel drugs that are in late stage development and each has blockbuster potential. These are omecamtiv for congestive heart failure and tirasemtiv for ALS; they are two of the more exciting new drugs in biotechnology and there is significant upside to the stock if either of these products is successfully developed.

The phase 2b results for the BENEFIT-ALS trial of tirasemtiv in ALS will be presented at the American Academy of Neurology meeting in Philadelphia on Tuesday April 29th at 4:15 PM. I previewed this in a recent blog. http://smithonstocks.com/cytokinetics-the-critical-phase-2b-results-for-tirasemtiv-should-be-released-on-april-29th-cytk-8-88-buy-paid-subscribers-only/

The key event for omecamtiv is a decision by Amgen (Cytokinetics” partner for this product) to begin phase 3 trials. Amgen (AMGN) will make that decision later this year and I expect them to go ahead. I think that the financial returns to Cytokinetics from omecamtiv and tirasemtiv in the event of successful commercialization are of the same magnitude.

If BENEFIT-ALS results are so positive that CYTK files for approval of tirasemtiv, I think we are looking at a $20 stock, although some subscribers have suggested that it might more likely be $40. If it is a complete failure and the trial results are so bad that the product is dropped, I think that the stock drops in the short term to $3 to $4. I think this would be a buying opportunity as after the initial bitter reaction, focus would shift to omecamtiv which I believe has equal commercial potential to tirasemtiv if both are successfully commercially developed.

I put the odds of an outright success at 20% and outright failure at 10%. The other probabilities range over a number of scenarios in which the results of BENEFIT-ALS are positive, but another phase 3 trial is required to confirm the results; this is the base case of Cytokinetics management. I could see the stock trading at around $5 if the trial doesn’t achieve p=0.05 and some secondary endpoints are equivocal, but management decides to go ahead with a phase 3 trial. I could see the stock hitting $14 if the results are close to p=0.05 and with the secondary endpoints all pointing in the right direction. To complicate matters there are all kinds of in-between scenarios.

I will hold my stock through the announcement on April 29th. Like everyone else I am nervous that Murphy’s Law will prevail and some unexpected variable will cause the trial to fail. However, I view the probabilities for a big win versus a big loss as being in my favor.

Northwest Biotherapeutics (NWBO, Buy, $5.67) in obtaining approval of DCVax-L in Germany under the hospital exemption early access law was a major validation of its dendritic cell cancer vaccine technology and should lead to meaningful revenues in 2015 and beyond. However, investor focus on what I think is one of the most significant announcements in biotechnology this year has been obscured. Based on a bearish argument promulgated by Adam Feuerstein, investor focus has been shifted to an interim review of data from the phase 3 trial of DCVax-L.

The Data Monitoring Board (DMB) began the first interim analysis of the phase 3 trial over six weeks ago. The safety analysis was completed and the DMB recommended that the study should continue, but it made no comment on the status of the efficacy analysis. Feuerstein seized on this and in the course of eleven negative blogs in the last six weeks has raised investor concerns that either; (1) the data was so messed up by NWBO that the DMB can’t find it (an unlikely argument as the data is handled by independent contract research organization whose business is data handling and gathering for clinical trials) or (2) that the DMB will stop the trial for futility.

I admit that the delay in reporting efficacy results is unusual. However, in the absence of F-stein most investors would think that it is more likely that this delay means the trial will be stopped because it has successfully reached its endpoint. This would be a more reasonable explanation for the delay. Indeed, in a recent article that I published on Seeking Alpha, two contributors to the comments section, who display considerable understanding of statistics and trial design, argue that the long delay means that the trial will be stopped because it has reached the efficacy endpoint.

Even if the data were not tracking toward reaching its endpoint, it is highly improbable that the trial would be stopped for futility at this point. All patients are getting standard of care and there is no safety issue with DCVax-L. Second, we know that immunotherapy can be slow to take effect so that there might be no widening of the Kaplan-Meiers curves for progression free survival and overall survival until later in the trial. Third, with the phase 1 results, only Adam would argue that the drug has no biological effect. The action by PEI, which is the German equivalent of the FDA, clearly shows that it beleived the drug has biological activity. Fourth, there would be an incentive to let the trial run its course to see if it could determine if DCVax-L could benefit a subgroup of patients even if the primary endpoint for the whole population is not reached. I see almost no chance for the trial being stopped for futility at this point.

There will be an abstract published on the Company’s second product, DCVax-Direct on April 22; this then will be presented as a poster at ASCO in late May. The acceptance of this abstract by ASCO on the phase 1/2 trial of DCVax-Direct has caught investors’ attention as the trial is still in an early stage and it is unusual to see such preliminary data presented at ASCO.

Subscribers have asked me what I think about DCVax-Direct, but it is difficult to respond without seeing any human data. I would like to defer until we see the abstract in a little over a week. I believe that in some patients, radiation or chemo was used to try to de-bulk the tumor. Regardless of the outcome, bears probably will attribute any improvement to chemo and radiation. Also, it may be too early to see actual shrinkage of the tumor; we may just see dead tumor tissue.

The key is whether DCVax Direct over time can result in partial or complete tumor shrinkage. In patients like these that are not resected surgically, chemo and radiation produce almost no partial responses (PRs) and no complete responses (CRs). I don’t know if we will see evidence of PRs and CRs in the abstract (actually kind of doubt it) although the investigator might have an anecdotal comment.

Looking down the road, with evidence of PRs and CRs in a life threatening inoperable cancers, I don’t think the FDA would ask for long complicated trials to gain approval. This could be the start of a significant new component to the NWBO story, but I am a bit concerned that expectations for results in this abstract may be too high.

In looking at the balance of 2014, the controversy over the delay in reporting the efficacy analysis will eventually be resolved (days, weeks or perhaps a month) and I am highly confident that the trial will continue. This would be a major positive. I am also looking for positive news from Germany on patient enrollment under the German hospital exemption early access program and also positive news on German reimbursement. This could give investors some sense of the revenue potential in Germany.

Remember that DCVax-L is approved for broad use in gliomas in the UK as well as Germany, the difference is that national health insurance will reimburse for DCVax-L in Germany while the UK is all private pay. NWBO probably has already treated patients in the UK with DCVax-L, but has been waiting for the German approval (which is more important and better documented) before saying much about the UK. I think news about enrollment in the UK could be a positive in coming months.

Like everyone else, I have been disappointed in the stock behavior. The Company announced a deal to raise $15 million to buy more manufacturing capacity for Europe. I took this as evidence that the Company is preparing for substantial demand in Germany and the UK. Instead, the market took it as just dilution and the stock dropped over 10%. Management clearly has a credibility gap in that the very significant positives that the Company has registered over the last half year-German hospital exemption early access for DCVax-L, UK compassionate use for DCVax-L, rapid advancement of the DCVax Direct program and a very positive restructuring of the balance sheet-have been ignored. This can’t go on forever and I think that investors will come to realize these major benefits; I continue with my Buy recommendation.

Antares (ATRS, Buy, 2.91) is now launching Otrexup, the first product that it has launched on its own. There have been a number of disappointing launches of new biotechnology products in recent years and this raises the concern that the Otrexup launch might also be disappointing. I think Otrexup will be different as it is a superior dosage form of methotrexate, the “gold standard” therapy for rheumatoid arthritis. Otrexup is making a good drug much better and that should be a convincing sales message. I look for a solid launch which should give investors confidence.

Otrexup is the first of a deep pipeline of products in which the Company hopes to launch one “Otrexup like” product each year beginning in 2016. There is a concern with the product projected to be launched in 2016; this is QS, T which is a superior injectable formulation of testosterone.

A meta-analysis has suggested that current testosterone products might be linked to cardiovascular side effects. The FDA is looking into the issue and we have to be somewhat concerned that something could come out of this. In the disaster scenario in which the use of testosterone supplementation is deeply curtailed or the products are taken off the market (highly unlikely), I would still be a buyer of the stock. In general, the FDA has been unwilling to accept a retrospective analysis like this one as the basis for regulatory action as they are notorious for producing spurious and incorrect results.

Watch for approval to launch a generic equivalent to EpiPen; this could be announced before mid-2015 and this is a big deal. The key is for FDA to give the drug an ANDA rating. From a profit standpoint, this is more important than Otrexup in the 2015-2016 timeframe.

The key issue for 2014 stock performance is how investors view the Otrexup launch. Street estimates for Otrexup sales in 2014 range from $11 to $17 million. I think that if it achieves the mid-point of this range, analysts would consider the launch as very successful. A wild card for 2014 could be the FDA ruling on whether Antares’s generic competitor to EpiPen receives an ANDA rating.

Neuralstem (CUR, Buy, $3.55) showed in the phase 1 trial of the Company’s NSI- 566 neural stem cells in ALS, a strong signal of efficacy was seen in five out of five patients who are most likely to be the types of patients who will receive the drug in phase 3; these are ambulatory patients whose disease does not start with bulbar symptoms. The number of patients for which we have data is uncomfortably small, but the signals of efficacy are too strong to attribute to chance. This was discussed in detail in my recent report of April 11.

There is a lot of clinical trial activity going on with this small company. Topline results for the Phase 2 trial in ALS should be available in late 2014 or early 2015. This is obviously the most important event in the next year. Phase 1 trials with the same neural stem cells should be started in chronic spinal cord injury in the US, acute spinal cord injury in South Korea and ischemic stroke in China. Data on these will emerge in late 2014 or 2015. In addition, phase 1 results for the novel small molecule drug BSI-189 in major depressive disorder should be available in 2Q, 2014. These are discussed in more detail in my January 8, 2014 report.

Possible catalysts for the stock through the balance of 2014 are reports on patients in the phase 2 trial. We already know through April’s blog, that one patient in the trial is reporting positive results. There could be others in 2014 as the trial is unblinded. Results for the small molecule drug were supposed to have been reported by now. This raises the possibility that the results have been delayed because they might be presented in an upcoming conference. This is speculation on my part. However, as I believe that there are almost no expectations for NSI-189, it could produce an upside surprise.

Derma Sciences (DSCI, Buy, $9.78) is an under the radar stock that is not well covered by Wall Street. It is a little off the beaten track with its emphasis on wound healing products for diabetic foot ulcers. However, I like this uniqueness and scarcity value of the story. They will have about $92 million of sales in 2014 and have a potentially big new drug, DSC-127, in phase 3 development. I have had little response from subscribers to this stock. I would urge you all to read my interview with Ed Quilty, Derma’s CEO, to get a better understanding of this Company. It was published on April 3, 2014.

We won’t see topline results on DSC-127 until late 2015 so that the stock in 2014 will respond to the strength of sales in the wound healing business. I expect that sales of Advanced Wound Care products, which are the driver of the business, could advance at the higher end of a 30% to 40% increase in sales in 2014. The Company has made three major product acquisitions in the last seven years and two in the last three. DSCI has a strong cash position and I would not be surprised to see another major acquisition this year that could be a catalyst for the stock.

The year 2015 will be the pivotal year for the stock with the reporting of data on DSC-127 in 2H, 2014. However, I think that the stock is attractive for the long term solely on the basis of its wound care business.

pSivida (PSDV, Buy, $3.51) developed Iluvien for chronic macular edema and then licensed it to Alimera (ALIM). Iluvien has gone through a tortured course in which it received two CRLs from the FDA. It looks like Alimera finally has settled issues with the FDA and the agency now seems ready to approve the drug; the PDUFA date is September 26, 2014 and will trigger a $25 million milestone payment to pSivida from Alimera.

PSDV has a profit sharing arrangement that is essentially tantamount to a royalty of around 15% of sales. In Europe Iluvien has been approved and is being marketed in Germany and the UK, should soon be marketed in France and eventually in all of Europe. The European launch was slow and initially disappointing, but now seems to be picking up momentum.

Key opinion leaders have consistently believed that Iluvien is an important product in chronic diabetic macular edema (DME). If the product can obtain around 25% of the chronic DME market, it could reach $400 million of US sales potential and $300 million of European potential by 2020. This translates into about $85 million of pretax income for PSDV. I have focused on PSDV as a way to play Iluvien rather than Alimera because Alimera is going to require substantial financing to launch Iluvien in the US and new European markets. It also has to pay pSivida a $25 million milestone payment upon US approval of Iluvien. I would rather look at Alimera after it has the necessary financing in place and the stock reflects this.

For a while, it looked like Iluvien was not going to be approved in the US and pSivida began a phase 3 trial using the exact same product in posterior uveitis, which is a more serious disease of the eye with a more dramatic need for new therapeutic options. This is a therapeutic indication that has commercial potential of the same magnitude as Iluvien for chronic DME in the US. I think that PSDV and ALIM will reach an agreement that will give ALIM rights to the phase 3 trial of Iluvien in posterior uveitis to the benefit of both companies.

I see pSivida as attractive based on the royalty steam from Iluvien. I think the upside surprise to the story can come from Tethadur. This is an interesting new technology that is aimed at providing sustained release of biological drugs that would reduce the number of injections required and improve their therapeutic profile. There is speculation that we might see collaboration with Roche later this year on Lucentis which could be a big catalyst for the stock.

Discovery Laboratories (DSCO, Buy, $1.92)

The fourth quarter of 2014 was a watershed for Discovery Laboratories. Surfaxin was approved by the FDA, the launch of Surfaxin began in the fourth quarter and the Company’s first commercial sales were achieved. The key new aerosolized surfactant Aerosurf began a phase 2a trial and the balance sheet was substantially strengthened through an equity issuance and the payment of $30 million of debt from Deerfield so that DSCO ended the year with $86 million. This should carry the Company through the latter part of 2015 when phase 2b results for Aerosurf could be available; success would be a transformational event.

DSCO has indicated for some time that the launch of Surfaxin would be slow and deliberate and guidance was that sales in the first 12 months of marketing could fall in the $8 to $10 million range and $40 million after four years. The launch has been slower than expected so that the Company withdrew its guidance. The issue seems to be that the process of gaining formulary acceptance has taken longer than expected. This may be due to the slow bureaucratic process involved, but clearly DSCO had expected a better take off. The weather may also have played some role as it caused delays in meetings for pharmacy and therapeutics committee meetings that are the key part of the formulary acceptance process.

Street analysts have reduced their 2014 sales estimates for Surfaxin to $4 to $5 million. Clearly, investors will be watching the Surfaxin launch very carefully. Management may wait until the end of 2Q, 2014 to give new guidance. I think that if Surfaxin can approach $40 million of sales in four years that this could make DSCO an interesting investment based on Surfaxin alone and with no consideration of the potential for Aerosurf. The Company has the ability to use its proprietary sales force as leverage to acquire other neonatology products and build the company using the specialty sales model that has been so successful for other companies. I think this limits downside risk if Aerosurf is disappointing.

The key to the stock being a big winner is the development of Aerosurf. This product uses a proprietary capillary aerosol generator to deliver Surfaxin as an aerosol instead of its current distillate form. This would be a paradigm changing event for neonatology if the product is successful. In judging the potential for success, we know that the active ingredient works because it is Surfaxin. There is not the risk that is involved with developing a new molecular entity.

For Aerosurf to be a successful product, the two keys are being able to deliver the product safely and to deliver therapeutic amounts of Surfaxin. This has been done in animal models and human trials started in 4Q, 2014. The phase 2a part of the trial has the primary goal of showing that Aerosurf is safe; results will be reported in 3Q, 2014. Management has said that safety is the main objective of the trial. I don’t know if we will see signals of efficacy. The all-important phase 2b trial of Aerosurf is a proof of concept trial for which results may be available in 2H, 2015. This is the key event.

With the slow launch of Surfaxin and with Aerosurf data still being some time off, investors are now in a wait and see attitude.

Agenus (AGEN, Buy, $2.48) has been pummeled lately in the aftermath of the failure of GSK’s MACE A-3 cancer vaccine in non-small cell lung cancer and GSK’s subsequent decision to terminate the program. Most investors had very low expectations for MAGE A-3 after its failure in melanoma last fall. My interest in AGEN has been importantly strengthened by its recent acquisition of 4-Antibody which makes Agenus a player in the checkpoint inhibitor arena.

This acquisition is transformational for Agenus in several ways. There is growing thought that perhaps the frequent failures of cancer vaccines in the past has been because the cancer has hijacked the immune system to the extent that the immune system response is blunted; a strong immune response is necessary for efficacy of cancer vaccines. If so, the combination of the checkpoint inhibitors which counter this tumor effect with cancer vaccines is a natural combination that could be highly synergistic and unlock the promise of cancer vaccines.

I think that Agenus has one of the most broadly developed capabilities to combine checkpoint inhibitors with cancer vaccines (their own heat shock vaccines and other types). This has enormous theoretical potential for all types of cancers. Agenus is in the valley of the giants with Bristol-Myers Squibb, Merck and Roche all aggressively advancing checkpoint inhibitors. However, the bigger companies have no cancer vaccine expertise. I think that the most likely road to success for Agenus (from an investor’s standpoint) is that some big drug company wanting to join the hunt acquires the Company and this is the basis for my recommendation.

A major capital raise has taken away the financing overhang that has plagued the Company for years. It has had to conduct small financing after small financing over the last five or so years to keep afloat. It now has cash resources that can carry it into 2016 and beyond and enable it to do some internal programs. I estimate that the cash balance at the end of 1Q, 2014 will be roughly $70 to $75 million. Hence, I don’t anticipate the need for any equity financing in the next year. A potential catalyst for the stock is that at a recent conference, management indicated that it could enter collaboration for one of its checkpoint inhibitors in 2014 with a major company.

Repligen (RGEN, Buy, $14.37) I just wrote a report on Repligen in which I said that it has the best business model that I have seen in my long experience as an analyst. The valuation is a little rich at this point and I am reluctant to recommend buying aggressively at this level. However, I think that even from this level it is a great long term investment and you couldn’t pry it out of my portfolio with a crowbar.

For the stock to get moving in 2014, I think that the Company would have to make a major and well thought out acquisition of a product line that meshes with its business. It has a strong cash flow and a strong cash position that could allow it to make meaningful acquisitions. In a recent report, I went through a scenario in which Repligen might acquire a company with $10 million of sales and gross profit margins of 50% for perhaps $40 million. This could increase base earnings power from $0.20 to $0.29. Repligen has over $80 million of cash so that it potentially could make two such acquisitions.

Celldex (CLDX, Not rated, $13.73): I began coverage of this stock last October when it had soared to over a $2 billion market capitalization based on a $22.79 stock price. While I was intrigued by the technology base, this was a little too rich for my blood. The stock is down 33% from when I issued my report and I could revisit the stock in the future, but the Company still sells at hefty market capitalization of $1.2 billion.

Chimerix (CMRX, Hold, $19.45): I began coverage of this stock with a hold on March 13 at a price of $25.48. I wrote the report with the intention of recommending the stock, but it ran up while I was writing the report. I am contemplating moving to a buy, but there is a complication. With almost all of the companies that I am recommending, I try to have access to the CEO. I knew Ken Mock, the CEO when I wrote the report very well. However, he recently left the Company probably due to the way that he handled a request for compassionate use for their key new drug brincidofovir. I want to see if I can have the same type of access to the new CEO, Michelle Berrey.

Heron (HRTX, Not rated, $11.33): I first recommended this stock in April 2012 on the anticipation that it could receive approval for and launch its first drug Sustol in late 2013. I was disappointed by a complete response letter received on March 28, 2013. This delayed the filing of the NDA and management is now guiding investors to look for a launch in early 2015. There is a new management team at the Company that is well respected and I am planning to revisit the Company.

ImmunoCellular (IMUC, Not rated, $1.14): The failure of the phase 2 trial of ICT-107 to reach its primary endpoint was a major disappointment for investors, most of whom have written the stock off. While I am not active in the stock, I could see that the Company’s expertise in dendritic cell cancer vaccines could be of interest to a Company looking to develop a combination of a check point inhibitor and a dendritic cell cancer vaccine. The situation is dire, but not hopeless. I continue to monitor the Company.

NovaBay (NBY, Not rated, $0.99) has one molecule, auriclosene that is being tested in three quite different indications: urinary catheter blockage and encrustation (UCBE), impetigo and viral conjunctivitis. Phase 1/2 date in UCBE suggests to me that this could be effective in this indication, but finishing the phase 3 clinical trials could take until 2017. The phase 2b trial in impetigo failed and while management talks of doing another trial they lack the cash resources. Success in the phase 2b trial in viral conjunctivitis would be a home run, but I am cautious on the potential for success and I think that failure could have a big impact on the stock. The cash position of the Company is strained. With a more solid cash position, I would probably recommend the Company on the basis of the UCBE indication.

Senesco (SNTI, Not rated, $3.30): I wrote an introductory report on the Company in which I concluded that its lead drug SNS01-T has not yet shown efficacy in its initial testing to give me confidence that it can be effective in multiple myeloma. This is an interesting drug with a novel mechanism of action which could be important in multiple myeloma and hematological tumors. I am waiting for results from the latest cohort of patients to make a better judgment; this data could be available in 4Q, 2014. The buying of stock in the Company by the legendary biotech investor Phil Frost is something to watch.

InSite Vision (INSV, Not rated, $0.17) was a company that I recommended based on the asymmetric upside potential if the DouBLE trial of AzaSite Plus in blepharitis had been successful; unfortunately it missed the primary endpoint. I have been watching the stock as I think that management, while unsuccessful with the DouBLE trial, is quite competent. The Company has an approvable drug in BromSite and the Akorn acquisition of AzaSite through the acquisition of InSpire from Merck could open up new avenues for AzaSite Plus. However, the lack of financial strength keeps me on the sidelines.

Tagged as AGEN, Agenus, Antares Pharma Inc., ATRS, Celldex Therapeutics Inc., Chimerix, CLDX, CMRX, CUR, cytk, Cytokinetics, Derma Sciences, Discovery Laboratories Inc, DSCI, DSCO, Heron Therapeutics, HRTX, ImmunoCellular Therapeutics LTD, IMUC. Senesco, Inc., InSite Vision, INSV, NBY, Neuralstem, Inc., Northwest Biotherapeutics Inc., Novabay Pharmaceuticals, NWBO, PSDV, pSivida Corp, Repligen, RGEN, SNTI + Categorized as Smith On Stocks Blog

Many thanks for this update. Skimmed through it quickly but will read it carefully over the long weekend.

Hopefully the worst is now over but only time will tell.

I hope both yourself and my fellow subscribers have an enjoyable Easter weekend.

Kind Regards

Peter

Thanks for this commentary Larry. It`s comforting to read your steady-hand analysis during the correction that has likely affected all of your blog readers.

By the way, I see that Repligen is going to be added to the S&P Small Cap 600 after the close of trading Thursday, April 17th. That might be why it is showing strength in the past few days.

Hi Larry,

have you ever looked at ACAD? do you have any opinion on it?

Robert

you wrote:

“Over the years, I have been unsuccessful when I try to interweave the fluctuations of the market with my recommendation on stocks. Generally, a market correction like the one we are involved in arrives quickly and leaves quickly. I find that investors initially think this is just a day to day fluctuation and almost no one can determine that we are in a correction until it is well underway and often investors are unwilling to act until the correction already has run its course. This means that most investors will sell well after the correction is underway and not infrequently at the bottom. The most important danger is that we sell a stock we like at a depressed price and never get back in.”

I am surely less experienced than you but I have arrived to the exact conclusion.

And one last thing,

I think CLDX is an absolute buy at this depressed value. I would really appreciate if you revisited this stock soon. 🙂

I have known ACAD management for many years as I first called on them over ten years ago. They have shown enormous tenacity as the failure of the first phase 3 trial with pimavanserin led the market to believe that this was the death knell for the company.In May of 2012 they sold for $1.38. They persevered and now we are at $19.00. This teaches that a failure in a phase 3 is not always fatal. They identified the flaw in the tria design and here we are. I can’t answer your question on the stock as to whether it is attractive as I am not current, but obviously pimavanserin is going to be an approved.

Hi Larry,

Appreciate your thoughts on the market and your stock recommendations. Have you ever looked at SGYP?

Thanks

Larry,

Regarding your comments on NWBO, I agree that the upcoming ASCO abstract release on May 14 (Nor this coming Monday’s abstract “title” release) is not going to move mountains. However, the full abstract release will give us some insight into why the committee “accepted” it for presentation at ASCO.

.

The title release and abstract itself are based upon data accumulated through early February. However, to the best of my knowledge, the actual poster or oral presentation at ASCO can contain data gathered all the way through May 19, 2014.

.

As Linda Powers explained, in early February of this year, the DCVAX-Direct trial was still in its slow “first-in-human” phase. Thus, for initial safety purposes, there were likely only a handful of treated patients by February 4, 2014.

.

However, at some point since that time enrollment skyrocketed. As you know, DCVAX-Direct should work extremely fast to achieve tumor necrosis and regression — if it is to work at all. Still, with ASCO slated for the end of May, the bulk of treated patients will likely only have 2 to 2.5 months under their belts.

.

Consequently, by May 19, while there is likely a great deal more Vivek Subbiah will know about the early “handful” of patients (i.e., partial v. complete response, t-cell infiltration and systemic effect on nearby or cross body tumors — if it occurs), the bulk of tumors treated after the initial “first-in-human” protocol are likely to demonstrate only rudimentary confirmed observations. (i.e., primary tumor necrosis and size reduction percentage).

.

I believe Mr. Subbiah will not hold back data unnecessarily at ASCO, but we must accept he will temper his presentation with conservative medical conclusions and refrain from “irrationally exuberant” speculation.

Flipper. Thank you very much for your very good insights. I think that comments like yours that add more and better information than is contained in my report add enormous value. I work very hard, but I can’t possibly know or think of all the important points. Comments like yours add great value and help all of us make better judgments.

Thank you Larry. For my purposes, this was a very useful publication.

I read ALL of the comments to Larry’s recent Seeking Alpha post on NWBO. It took several hours. After I finished I had a headache, needed a drink and laid down to take nap. Geez!!!! Here are some of my take-aways, although I would appreciate any contray or confirming thoughts Larry or any other members of our SoS community have:

1. Progression Free Survival (PFS) v. Overall Survival (OS). Does it really matter whether the FDA has ever announced that PFS can be an important end point. The entry at http://www.Clinicaltrials.gov for this trial says that PFS is an endpoint. Are we being asked to believe that somehow NWBO management designed their trial with this endpoint without ever discussing it with the FDA as P Man may be suggesting? If you have even a hint of this belief then, to my mind, you believe management and all NWBO major investors are incompetent and you should not own this stock. (You probably also would have to believe that the PEI is incompetent and if that is the case you should probably not own any biotech stock).

2. If the DCVax-L trial is designed so that any patient in the group that gets standard of care (SOC) plus placebo and whose cancer starts to progress after surgery is able to receive DCVax-L once the progression becomes evident, then even I can understand that OS could not be an appropriate endpoint in this trial. The placebo group can end up getting treated with DCVax-L which will clearly distort the OS number for the placebo group. I am not a statistician, but this seems clear to me. (I looked but could not find whether the trial is in fact designed so that placebo patients that progress can receive DCVax-L. The commentsto the SA article indicated this was so, but I could not find it in the clinical trial description).

3. The entire discussion about IMUC and their use of OS as an endpoint seems to me to be white noise. Their trial was their trial; it was designed some time ago and things change. To me a trial has to be pretty much self-contained. It is not scientific to start mid-trial to compare cross trial or to change one trial based on what is happening in another trial. However, once a trial is completed, then information gained from any other trial can be used to inform or modify the next trial for that drug.

4. News to me, if in fact I understand correctly, is that the FDA is able to authorize the unblinding of trial data for the benefit of another regulator (such as the German regulator PEI), subject to certain confidentiality rules, etc. If this is true, then I think you almost have to believe that the PEI got some unblinded data on this trial and used that information in making its decision on the hospital exemption. While we don’t know for sure, it seems like a very logical conclusion. (Having some experience with regulators in other areas I can tell you that it goes very much against the DNA of a regulatory to make a major decision when the regulator knows there is relevant information available that they can obtain. Regulators are afraid of being second guessed and will almost always wait to get the additional information.) Presumably the German reimbursement agency, also being a qualified regulator, must have had the same information. I thought the hospital exemption was huge when I first heard of it (bought more stock that morning). The more I come to understand about it, the more significant it seems to be.

5. As to the decision of the DMB to continue the trial without reviewing efficacy, I have no idea what this might mean. It could be quite positive; it could be negative (although I doubt it is highly negative). To me the most likely scenario is that it is either positive or does not mean anything at all.

6. After writing the above I reviewed the FDA publication called “Guidance for Industry; Clinical Trial Endpoints for the Approval of Cancer Drugs and Biologics”. It talks extensively about using PFS as an endpoint. After reviewing that I can honestly say I don’t know what P Man on Seeking Alpha was talking about. My guess is that he may have some sort of agenda and he is acting as an advocate for that agenda. I just don’t know what it is.

I write the foregoing more as an attempt to organize my thoughts. I am not all certain that I got everything correct. If Larry or anybody else has further thoughts or thinks I am wrong in some way, please let me know.

Larry, Thanks for all your the work you do and don’t let AF, PMan or others get under your skin!!!

1.Progression free survival is about six months for GBM and overall survival is about 16 months. GBM is a rapidly growing tumor. It can actually push parts of the brain down the brainstem and kill people that way. This is why physicians immediately surgically resect newly diagnosed and recurrent GBMs. Hence, delaying the regrowth of the tumor is extremely important. In some slower growing cancers such as some types of breast and prostate, overall survival is more important. Also bear in mind that the secondary endpoint is overall survival. Check this link for a discussion as to how six month progression free survival strongly correlates with overall survival in GBM.

http://www.researchgate.net/publication/41486452_Six-month_progression-free_survival_as_an_alternative_primary_efficacy_endpoint_to_overall_survival_in_newly_diagnosed_glioblastoma_patients_receiving_temozolomide

2. Cross over of patients who progress on control is always a problem. Control receives SOC and drug arm gets SOC plus DCvax-L. This confounds the long term survival analysis amd is an issue with the overall survival endpoint..

3. ICT-107 and DCVax-L are very different products manufactured in different ways. Remember that ICT-107 was statistically significant for progression free survival in its trial and showed a non-statistically significant increase in OS .

4. Here is some information on the interaction of PEI and FDA on non-public data.

http://www.fda.gov/InternationalPrograms/Agreements/ConfidentialityCommitments/ucm094119.htm

I am not sure, but there seems to be a possibility that PEI saw data from the phase 3 trial. It is hard for me to believe that PEI granted such broad approval on just the 20 patients treated in phase 1. There is also data in compassionate use in some 20 compassionate use patients (not all were GBM). Also 33 prostate cancer and 11 ovarian cancer patients. I don’t think that PEI would act on just this data to potentially expose any German with gliomas (not just glioblastoma multiforme) to DCVax-L Also remember that it is approved for the same use in the UK; however it is not government reimbursed in the UK as in Germany. This all supports the idea that the German and English regulators were looking at something more. That more could be 33 patients (probably 22 on drug) who were initially treated in 2008 and maintained on treatment and under observation. This data would show how patients fared over a four to five year period. As a German or UK regulator, I don’t know that I could have acted without this data.

5. The delay could be due to resizing of the trial. If resized, the trial may not have hit its endpoint. There is almost no chance this trial is going to be stopped for futility. It is early in the trial and we know that immunotherapy is slow to act and there is no safety issue. Without the negative spin that F-stein and the hedge funds who do his research put on this, I think that investors would be speculating that the trial had already reached its efficacy endpoint.

6. The weakness of P-man’s argument is that he doesn’t understand the disease. See point 1. His ego also gets in the way.

What is getting me down is that I am seeing in several other companies showing the same pattern as NWBO. F-stein comes in with a negative article(s) (always unbalanced and often factually incorrect) to spread fear and concern. This is followed by a barrage of well coordinated short selling to knock the stock down.

Larry

Questions regarding DC Vax-L

1. Is it possible that the efficacy for the first interim analysis has been accepted already and NWBO has not release it yet or are they required by law to inform us in a short period time when DMC reaches it’s decision?

2. Due you or NWBO have any idea when to expect the second interim analysis? I know the first one was right on target with NWBO expectations in early 2013.