Cytokinetics: The Critical Phase 2b Results for Tirasemtiv Should be Released on April 29th (CYTK, $8.88, Buy, Paid Subscribers Only)

Phase 2b Data on Tirasemtiv will be Presented on April 29th

Cytokinetics has an extremely important binary event upcoming as the data on the phase 2b trial of tirasemtiv in ALS will be presented at the American Academy of Neurology meeting in Philadelphia on Tuesday April 29th at 4:15 PM. The data comes from a 711 patient trial that has completed enrollment. The outcome of this trial could have a dramatic effect on the stock. I go through my thoughts on what might happen to the stock under scenarios ranging from outright success to outright failure and some in-between outcomes at the conclusion of this report.

The CRO is in the final process of collecting and locking down the data and while there is always the chance of some delay, the topline analysis of the data should be completed before April 29th. I wrote a detailed report on tirasemtiv on February 18, 2013 and for those who want more detail, I suggest that you refer to that report.

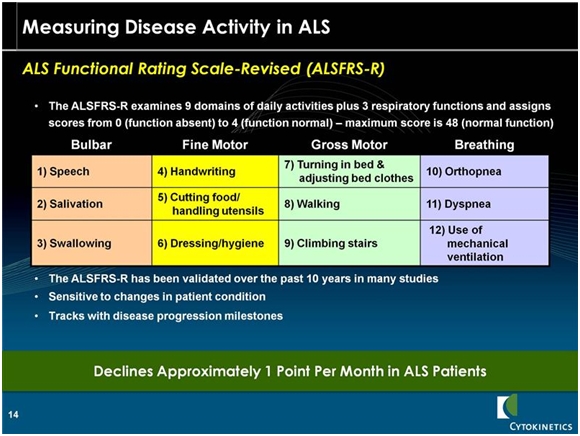

To remind you, the endpoint of the study is a scale that measures the decline in bodily function. This is done by a physician assessing 12 different functions and assigning a value of 4 (normal) to 0 (function is absent). A normal person would score 48. The components of the scale are shown below:

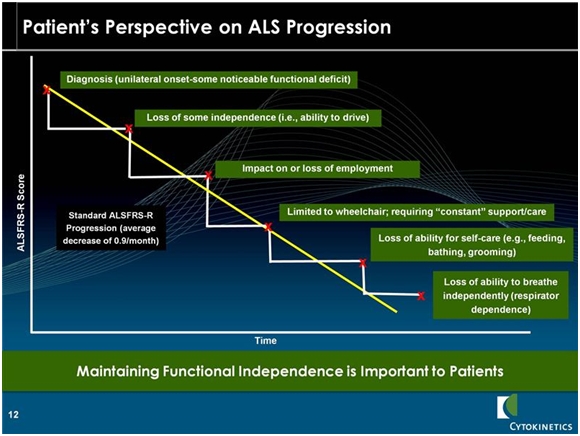

At the time of diagnosis most patients have a score of around 36. Historical data shows an inexorable decline in the ALSFRS-r scale of 0.9 points per month. Patients usually die with as the ALSFRS-r score declines to the high single digits. The key opinion leaders I have listened to say that occasionally patients may stabilize for a month or two, but the decline in ALSFRS-r is inexorable. What this does to patients is graphically illustrated in the following chart.

Blinded Data from the Phase 2b Trial is Encouraging

Dr. Jeremy Schefner, the lead investigator on BENEFIT-ALS provided updates on tirasemtiv in December 2013 at the international symposium on ALSMMD. These included blinded results from BENEFIT-ALS on 670 patients treated through November 2013 and some double blind data from earlier phase 2 trials.

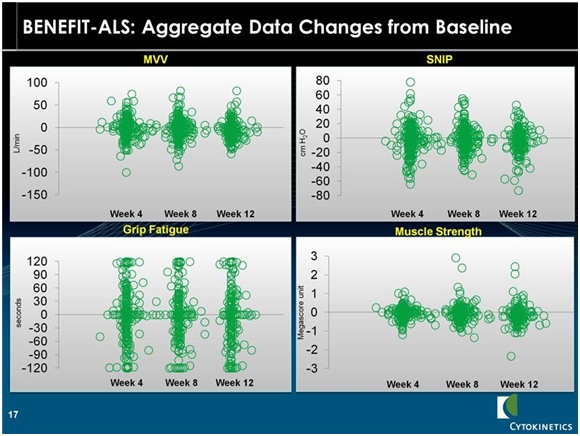

The following slide shows the change from baseline for four secondary endpoints that are objective measures of bodily functions. Each circle represents the change in status for one patient. We don’t know whether these patients received the drug or placebo nor the dose or length of time that patients were on tirasemtiv.

The slide is a visual representation of the data. The blob of green in the middle of the following displays is because of the overlay of numerous circles (patients). This is a mishmash of data and that cannot be assessed with statistical techniques due to the wide variation in the data. Take a look at the following table.

MVV is maximum voluntary ventilation. It provides an estimate of the ventilatory reserves that a patient has for physical exercise such as walking or climbing stairs. SNIP is sniff nasal inspiration pressure. This is a simple way to measure breathing function other than with a spirometer. Qualifying hand fatigability is a measure of limb muscle strength unlike MVV and SNIP which measure respiratory function.

Interpreting the Data Shown above Suggests Tirasemtiv is Effective

If we look at MVV as the first example, it appears to me that the chart suggests that the population as a whole does not experience much change. It looks like half of the patients got better and half got worse. Historical data suggests that MVV deteriorates fairly steadily at a rate of 3% to 4% per month. If this is correct, we would expect all placebo patients to show deterioration in MVV. This would suggest that the patients in the above table who showed improvement were on tirasemtiv. Otherwise all of the patient dots would be below the zero line that indicates no change in MVV. The same conclusions could be drawn for SNIP, grip fatigue and muscle strength. If tirasemtiv had no effect on ALS, we would expect all of the circles to be at or below the 0 line in each of these four measures.

Thinking About the Trial Outcome and Effect on the Stock

I intend to hold my CYTK stock through the presentation of the phase 2b data on April 29th. However, I wanted to lay out possible scenarios that may help you decide what you want to do.

I think that there is a reasonable chance that the results of the trial will be an outright success. I also think that if the primary endpoint is not reached with p=0.05 or less, that the data could be sufficiently encouraging that the Company still would move on to a confirmatory phase 3 trial. The base case of the Company is that they will have to do another, confirmatory, phase 3 trial, but in the event that the results in BENEFIT-ALS are spectacular that they could potentially file for approval.

If BENEFIT-ALS is a success, I think we are looking at a $20 stock. If it is a complete failure and the trial results are so bad that the product is dropped, I think that the stock drops in the short term to $3.00 to $4.00. There are many in-between scenarios depending on the data in which the Company sees enough encouragement that it proceeds to phase 3. In the latter case, I think there would be significant initial pressure on the stock as the market absorbs the news that the primary endpoint was not reached with statistical significance, but the stock could then bounce back after more careful analysis.

Cytokinetics has another major asset with omecamtiv mecarbil that is being studied in heart failure. If omecamtiv is successful in phase 3, it meets one of the largest unmet medical needs in medicine and I see it as a multi-billion dollar drug. One interesting aspect of this investment situation is that Amgen, the licensee of omecamtiv mecarbil, is committed to paying Cytokinetics $300 million or so of milestones before commercialization. Much of this will probably relate to the filing of the NDA and approval of the NDA, but there could be a substantial in-flow before then. I would speculate that there could be milestone payments based on the decision to move into phase 3 and perhaps when the first and last patient is dosed. I can only guess at the amounts, but they could be in the $50 to $75 million range in 2015 and give CYTK a solid financial footing into 2016 and perhaps 2017.

If tirasemtiv fails and the stock go to $4.00 or some such price, I would view it as a buying opportunity based on the potential for omecamtiv mecarbil. If Amgen takes omecamtiv mecarbil into phase 3 in 2015, I could see the stock at $15.00 on this basis alone and with no value attributed to tirasemtiv. If omecamtiv mecarbil is then successful in phase 3, it could be a multi-billion product and Amgen probably buys the Company for $25 to $30 per share. This is a complex investment scenario but it is an excellent asymmetric upside investment. I suspect that I will be doing a lot of writing on CYTK in 2014.

Tagged as BENEFIT-ALS, cytk, Cytokinetics, tirasemtiv + Categorized as Smith On Stocks Blog

Hi Larry – Probably too soon to ask, but in your opinion, do you think CYTK might still move on to a phase three trial for tirasemtiv?

Thanks

Dave

Yes. I think there is a very good chance.