Repligen: Looking At 2014 and Beyond- Potential for EPS Growth (RGEN, $12.78) (Subscribers Only)

Investment Thesis

I think that Repligen's (RGEN) bioprocessing businesses is one of the best business models that I have seen in my many years as an analyst. Products used in bioprocessing have very long product lives because changing the manufacturing process for a biological product once it is approved or after it has completed phase III trials can change the characteristics of the product. Hence, a change in the manufacturing process at virtually any level can create troublesome regulatory issues as the FDA will require assurance that the product is unchanged. The agency may request new studies, possibly including clinical trials in humans that demonstrate that there is no change in the product.

The economic benefits of any change in manufacturing efficiencies are trivial in comparison to lost profits if output is interrupted by the need to validate a change in the biomanufacturing process or if in the worst case it changes the product characteristics. This means that once Repligen's products are incorporated into a manufacturing operation at the commercial level they are likely to be used through the life of the product. As a result, its products enjoy very long life cycles and have minimal vulnerability to competition; Repligen's products are like annuities.

I think that Repligen is classic buy and hold stock; however, in 2014 there is a very significant but. Based on technology developed by Repligen when it was an emerging biotechnology company and prior to the focus on bioprocessing, it gained patent rights to technology that was used to develop Bristol-Myers Squibb's (BMY) $1 billion blockbuster drug Orencia. As a result, BMY has been paying a royalty to Repligen and because there are no offsetting costs these royalties drop straight to operating income. In 2013, I think that Repligen will report operating income of $23 million of which $5 million comes from the bioprocessing business, $17 million from Orencia royalties and $1 million from a milestone payment from Pfizer.

The but in the Repligen story is that the Orencia royalty ends as of December 31, 2013 and will contribute nothing to operating profits thereafter. In 2014, all operating profits will come from the bioprocessing business which I project at $10 million. In terms of fully diluted EPS, I am projecting $0.52 for 2013 but with the loss of Orencia royalties, there is a sharp drop to $0.25 for 2014 followed by a 25% increase to $0.32 for 2015. If one focuses only on EPS, the P/E ratio for 2013 is 25 times but based on 2014 EPS, it is 52 times and for 2015 EPS it is 40. This is based on the recent price of $12.91. As I will discuss shortly, Repligen's value cannot all be captured by only considering reported EPS. Still, this is the easiest thing to focus on and for someone looking at the company for the first time this looks to be a pretty hefty valuation.

In trying to assess the potential for the stock in 2014, the question that investors have to wrestle with is whether the market will focus just on EPS in which case, the P/E ratio seems high. However there are other aspects to the Repligen story that add value and may mean that the total focus of the market may not just be on 2014 reported EPS. The "bottom line EPS in 2014" are an important part of the valuation assessment, but it is much more complicated than just that.

Let me start the analysis of Repligen by giving you my view of the growth prospects of the bioprocessing business as it now stands. I think that growth in EPS from 2014 through 2016 could be exceptional. Over this period I am estimating sales per annum growth of 16% and per annum EPS growth of 31%. The business is neither capital nor marketing intensive so that I expect gross margin to increase over this period of time and for S.G& A to decrease as a percent of sales. This is what provides the leverage to allow profits to grow much faster than sales.

Repligen is a strong generator of cash. Cash on the balance sheets of emerging biotechnology companies is destined to be consumed by operations and has minimal value for creating shareholder value in other ways. However, Repligen is cash flow positive which means that cash on the balance sheet does have incremental value for shareholders. It is available for other purposes such as acquisitions, share buybacks or dividends. In the near term, it will almost certainly be used for acquisitions. By yearend 2013, the cash per share of Repligen is projected to be about $70 million or $2.19 and is on track to rise to $79 million by yearend 2014.

Repligen also has three biotechnology assets that it is monetizing. Two of these are orphan drugs that could have very significant potential. It is very hard to estimate the value of these assets. However, as a rough stab I think that if these assets were the basis of a standalone biotechnology company, based on the valuations of comparators, they might be valued at $50+ million or $1.55 per share. Some investors place the value as much higher, but I am trying to be conservative. Bear this in mind as you read the next paragraphs.

This exercise suggests that cash on the balance sheet and the biotechnology assets are worth about $3.75 per share. If so, this means that investors are paying $9.16 for the core bioprocessing business. The 2014 and 2015 P/E ratios based on this adjusted $9.16 price are 36 and 29. These multiples in comparison to the projected 30% growth for EPS are not that much out of line for multiples paid for companies with this level of EPS growth, quality of earnings and sustainability of earnings. Finally, there is also the significant potential that bolt on acquisitions can be made that could significantly increase the rate of EPS growth. The Company has the manufacturing and marketing infrastructure to support significant acquisitions.

To illustrate the potential impact on EPS of an acquisition, let me hypothesize what an acquisition might look like. Let's assume that Repligen has the opportunity to buy a company or product with $10 million of sales and that it can buy this asset for three times sales or $30 million. Let's further assume that this business has gross profit margins of 50% like Repligen's current bioprocessing business and that the asset can be manufactured in Repligen's facilities and that the incremental marketing expense would be adding five salesmen which would cost about $1 million. With all of these assumptions, the operating profit contribution would be $4 million and the aftertax contribution would be $0.09 per share. Obviously, one or two acquisitions like this could dramatically improve the growth rate of the company.

You can sense my dilemma. I am nervous in the short term that some traders will jump on what appears to be a high valuation combined with the 47% decrease in EPS that I am projecting for 2014 EPS and exert pressure on the stock. Yet, I think that this is an exceptional company and will reward "buy and hold" investors handsomely over the next decade.

Rather than telling other investors what they should do, let me tell you what I am doing. Based on life experience, I think that when you are invested in a company like Repligen which offers exceptional stability and growth potential, you don't trade in and out. The risk is that you get out and never get back in. I will hold my stock, but I am not adding to my position. I want to see how the market reacts to the 2014 EPS decline. I think that the company will issue formal EPS guidance for 2014 in the 4Q, 2013 conference call in February or March of 2014. This guidance will certainly make the 2014 EPS decline crystal clear to the market. It may be the case that the market is placing a much higher value on the biotechnology assets than I am and has totally factored in the EPS decline. We shall see.

Sales and Earnings Outlook for Bioprocessing

The foundation of the bioprocessing business is protein A, which is used to purify monoclonal antibodies during their manufacturing process. Repligen supplies over 98% of the world market for Protein A. The major macroeconomic force driving protein A sales is the clinical development and commercialization of biological products, especially drugs based on monoclonal antibodies. Monoclonal antibodies are a $57 billion global market growing at 8% or more per year; there are about 35 approved products and 350 new products in development. The projected 8% growth in sales for monoclonal antibodies is a proxy for future growth of Protein A sales.

Protein A is 64% of bioprocessing sales and in order to achieve the faster growth of bioprocessing revenues as a whole of 10% to 20% which is management guidance, other areas must grow faster. These are the OPUS disposable chromatography business and the growth factors business. Growth factors are about 20% of the bioprocessing business and can probably grow at 15% to 20% per year. This is a solid opportunity for Repligen, but it is OPUS that can really be the dynamic factor for growth. OPUS is currently about 5% of sales and could increase by 50% to 100% in 2014. Longer term, Walter Herlihy, CEO of Repligen, has said that OPUS could reach the same level of sales as Protein A; he did not specify when this would happen.

OPUS Update

Repligen has just completed a 9,000-square-foot facility expansion, which includes a new suite of clean rooms for the manufacture of its disposable and pre-packed disposable columns. This build out is a sign of management confidence in the OPUS business and can support anticipated growth for the next several years. The Company's goal is to be the world leader in disposable columns and disposable pre-packed columns.

Mr. Herlihy is exhibiting increased confidence in OPUS. He said that a year ago the Company knew that OPUS was a good product. However, they were unsure as to what the rate of uptake would be from competitors. They are now seeing encouraging signs from the ten or so early adopting, blue chip biopharma companies that they are going to use OPUS in pilot plants and clinical manufacturing facilities. The major reason for this increased confidence is that they are seeing two to three reorders from a single customer, which he considers as the single most important lead indicator. This suggests that the initial evaluation on the part of early adopters is now translating into sustainable, recurring sales.

The initial marketing focus has been on the 30 or so largest biopharma companies. They are evaluating the product in smaller 1000 to 2000 liter fermentation facilities that are used in pilot manufacturing to support products in the clinical development stage. However, part of the marketing plan for 2014 is to move down toward smaller companies. The Company believes that the current market for chromatography materials and columns used in this setting is $100 million per year. With innovation, this market can be significantly expanded.

OPUS sales will be driven by innovation and the company is most excited about its new 45-centimeter diameter OPUS column which has two to four times greater capacity than the largest disposable column size currently available. The development of this product was based on requests from customers who were running increasingly larger fermentations in their pilot plans that required larger purification columns. This product is going to be introduced in 1Q, 2014 and several quotes have already been made to potential customers.

The manufacturing of OPUS columns, particularly the large 45 centimeter columns require considerable manufacturing and materials expertise. Ordinary plastics are not strong enough and Repligen employs composite materials first developed by the aerospace industry. Also, the columns require exacting tolerance to maintain a uniform diameter along the length of the column.

The 45 cm columns are all pre-packed for the customer, either the end user or the contract manufacturer. Revenues depend on whether Repligen purchases the chromatography media for the columns or the customer supplies it. It is generally the case that Repligen purchases the customer's choice of media and that cost is passed along to the customer at a small markup. If the customer purchases the chromatography media, there is a small packing charge. Revenues are much higher if Repligen purchases the media, but most of the profits in either case are due to the column. The 45 cm column sells for about $50,000 and has a gross profit margin of about 50%.

One of the important initiatives of Repligen is to develop their own media for some specialized applications. This would significantly improve the profits from a 45 cm pre-packed column but would not have much of an effect on revenues. Another research effort centers on multi-column chromatography and a number of customers are investigating this application. This is another effort aimed at increasing the purification potential. In particular, they are working with a large biopharma company on a research project that completes in mid-2014. This will point the direction for what the next steps should be. The goal is to extend the use of disposable columns from clinical to commercial stage. If this application takes off, they want to be the vendor of choice.

This will be a more competitive market than Protein A. The large manufacturers of chromatography media have limited offerings and a small European company is in the market. The strategy of Repligen is to offer the greatest diversity of columns and chromatography media. The large companies-GE, Millipore and Life- can only offer their own media. Repligen hopes to use its first mover advantage to become the dominant supplier. Also, the large companies are focused on the much larger sized media market. For them, Repligen may be a competitor in disposable columns but in terms of media can expand their media sales as a reseller.

Growth Factors Update

Repligen believes that its growth factors business, particularly IGF-1 is gaining increased acceptance in the market place and that it can expand usage by increased promotion. It is expanding its direct marketing efforts in 2014 through hiring additional sales and marketing personnel. This investment will enable them to co-promote IGF-1 with its distributor Sigma-Aldrich and to access a broader range of potential customers.

Comments on Acquisitions

Repligen states that it is active on the acquisition front. However, they caution that they can never be certain as to if or when an acquisition may be completed. Their business development group has had a number of intermediate and early stage discussions with acquisition candidates. Repligen is committed growth through acquisitions as well as organic growth. I think that there is a realistic chance for a meaningful acquisition in 2014.

Guidance for 2013

Repligen increased its revenue guidance for 2013 to $67 million to $68 million which compares to prior expectations of $65 million to $67 million. This upside all reflects better than expected royalties from Orencia and a $1 million milestone payment from Pfizer attributable to the SMA program. Guidance for bioprocessing revenues remains unchanged at $46 to $48 million, a 10% to 14% increase from 2012.

Bioprocessing gross margins are expected to be 50% to 51% which compares to 40% in 2012. The effective U.S. GAAP tax rate for 2013 will be between 25% and 27%. However, actual tax payments will be substantially lower due to the benefit derived from our U.S. net operating losses carry-forwards. The 2013 cash income tax payments are expected to be approximately 13% to 14% of pretax income; this is a significant factor in the strong cash generation of the Company. The projection for year-end cash is between $68 million and $70 million.

Goals for 2014

The objective in 2014 is to increase bioprocessing revenues by 10% to 15%. Based on remarks made in the 3Q, 2013 conference call, the Company anticipates Protein A sales growth of 8% although 2013 was somewhat better. Growth factors sales could increase by 15% to 20% and OPUS sales could increase by 50% to 100%. It anticipates an increase in gross margins due to the continuing program to improve manufacturing efficiencies. The Company has not given precise sales or earnings guidance, but plans to do so in the 4Q, 2013 conference call in early 2014. This could be meaningful inflection point for the stock as it will highlight the decrease in 2014 EPS due to the loss of Orencia royalties.

Financial Projections

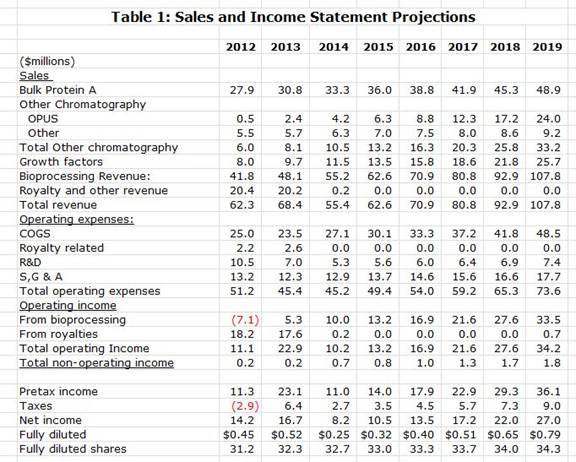

I try to do comprehensive projections on key income statement and cash flow items which are summarized in the following tables. Table 1 provides a summary of my estimates of sales for the key product areas of bioprocessing. Note the steady dependable growth of Protein A which is the backbone of the Company and the rapid growth projected for OPUS. Growth factors should also be a major contributor. Also shown is the dramatic plunge in royalty income as a result of the loss of Orencia revenues.

The key factor to note on the cost side is that operating costs should grow much slower than sales. This business is not capital intensive and does not need significant expansion in plant and equipment to reach sales targets. Nor is the business marketing intensive. The targeted customers are relatively few, about 30 major biopharm companies currently, and can be efficiently reached with a small sales force.

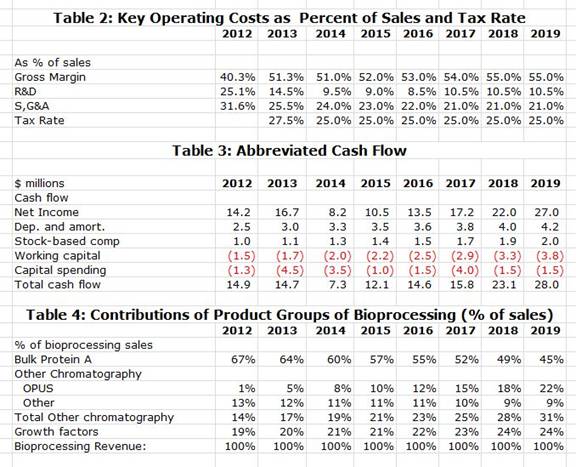

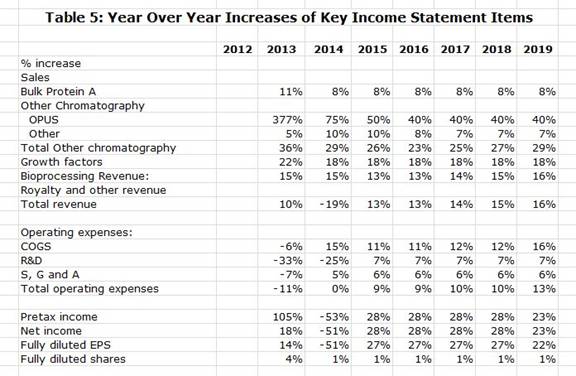

Table 2 shows some key income statement items as a percentage of sales. Table 3 shows the key contributors to cash flow. You can see why I call Repligen a cash flow machine. Table 4 shows the importance of Protein A, OPUS, growth factors and other items to the sales of the Company. Note the increasing importance of OPUS and growth factors to total sales in the out years. Table 5 shows my growth rate projections for the key components of bioprocessing.

These estimates do not include any assumptions for sales of products that are in-licensed or acquired from which, I believe that the Company will achieve very significant sales. I would not be surprised to see sales from in-licensed or acquired products equal 50% or more of sales of existing products in 2019. Hence, there is considerable potential for upside in my estimates.

Tagged as Bristol-Meyers (BMY), FDA, OPUS, Orencia, Repligen, RGEN + Categorized as Company Reports