Repligen Promises To Be a Cash Flow Machine (RGEN, $6.88)

Investment Overview

Repligen (RGEN) has gone through a metamorphosis that has dramatically changed its business model and investment outlook. For many years, its primary focus was on high risk drug development, but it was also building a high quality bioprocessing business that provides consumable products used in the manufacturing of biological products. The acquisition of a major competitor, Novozymes (now Repligen Sweden), in 2011 provided the critical mass for a standalone business in bioprocessing. Management and the board decided to exit the drug development business to focus on bioprocessing.

The bioprocessing business has outstanding investment characteristics:

· In manufacturing biological products, companies are reluctant to alter even small components of the process once the product is approved. Even a slight change has the potential to cause changes in product characteristics that can lead to clinical effect issues and regulatory problems. Once manufacturers decide on a manufacturing process, subsequent changes are rare. The result for Repligen is that Protein A and most other components of its product line are likely to be used for the life of the products whose manufacturing they are used in.

· Repligen's most important business area is manufacturing Protein A which is used to purify monoclonal antibodies during their manufacturing process. Repligen supplies over 98% of the world market.

· The major macroeconomic force driving Repligen's business is the clinical development and commercialization of biological products, especially drugs based on monoclonal antibodies. Monoclonal antibodies are a $57 billion global market growing at 9% or more per year; there are about 35 approved products and 350 new products in development. The projected 9% growth in sales for monoclonal antibodies is a proxy for future growth of Protein A sales.

· The company has two smaller and related business areas. Its other chromatography products are used in the same manufacturing purification setting as Protein A. Its growth factor products for cell cultures are used during fermentation further upstream in the manufacturing process to increase yields. I project that these businesses could grow at 15% to 20% per year.

· Long term, multi-year contracts to supply Protein A and other products give even more stability and predictability to sales and earnings.

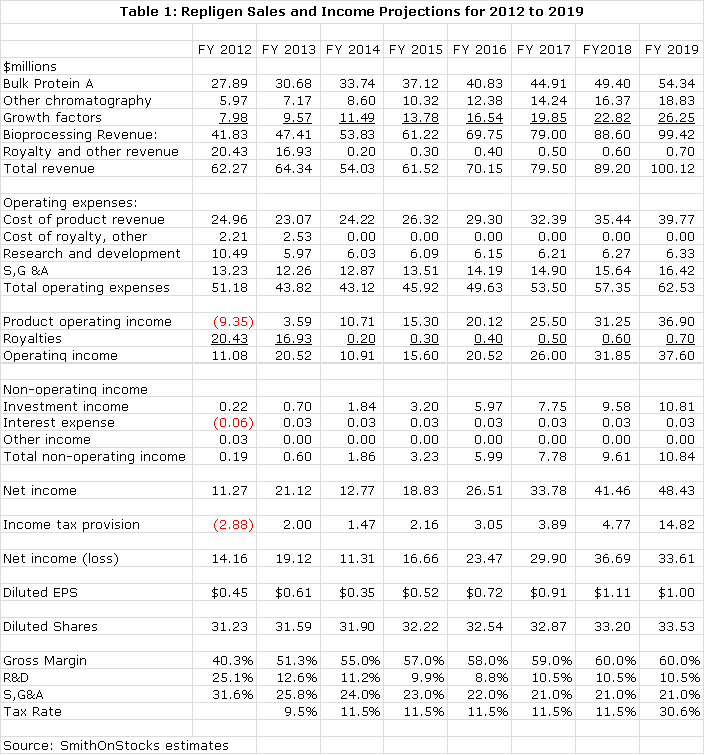

With its exit from drug development, Repligen's stock price will be based primarily on earnings. I am projecting fully diluted EPS of $0.61 in 2013, up from $0.45 in 2012. Investors must understand that EPS for 2014 are projected to decline sharply to $0.35 because of the expiration on December 31, 2013 of a royalty related to Bristol-Myers Squibb's (BMY) Orencia, a $1 billion drug. Orencia royalties will drop from about $14 million or $0.43 per share in 2013 to nothing in 2014. Beginning in 2014, the Company will derive all revenues and profits from bioprocessing. I am estimating revenue growth for the core business of 13% per year over the 2014 to 2019 period and EPS growth of 22%. I think that acquisitions have the potential to increase these rates of growth.

The Company has tax loss carry forwards of $45 million from its biotechnology business that will offset US taxes until 2018 by my projections. I estimate the about half of the Company's pretax profits come from the US where the combined state and federal tax rate is about 38%; the other half comes from Sweden where the tax rate is 23%. Until 2018, I am projecting a corporate tax rate of 11.5% as the tax loss carry forwards offset the requirement to pay most US taxes. In 2019, the corporate tax rate should climb to and stay at about 30.6%. This low tax rate adds a powerful tailwind to profits and cash flow. Sometimes, investors in a situation like this might choose to normalize the tax rate to 30.6% in order to estimate EPS on a fully taxed basis. If they were to do this with Repligen, pro forma EPS for 2014 would be $0.26 instead of the $0.35 that I am estimating they will report. I may be wrong but because the tax rate is expected to continue at a very low and recurring 11.5% until 2019, I think that investors will value the Company on the basis of $0.35 for 2014 EPS.

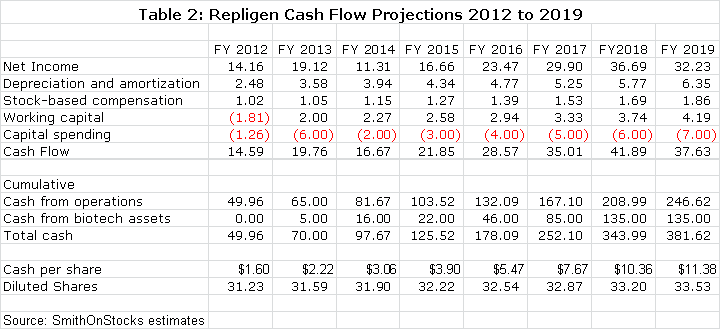

In any event, the valuation of Repligen should not simply be based on applying an estimated P/E ratio to estimated EPS. I project that The Company will show exceptional free cash flow generation. In most biotechnology companies, whose ranks Repligen has now left, cash on the balance sheet is destined to be consumed by operational burn and provides no other value for shareholders. However, Repligen can use this cash solely to enhance shareholder. Repligen has guided that it will end 2013 with at least $65 million of cash. Beyond 2014, I expect the Company to create an enormous amount of cash over and above what it needs to funds its operations. Let me give some examples on how this free cash flow can be used to benefit shareholders.

· Repligen could use the $65 million of 2013 yearend cash to pay a special dividend of about $2.10 per share.

· It could use the $65 million to buy back stock and at current price levels could repurchase nearly 10 million of the 31 million shares outstanding. If it did this, it could result in reported EPS of $0.52 per share in 2014 as opposed to $0.35.

· It is highly unlikely that the Company would use this cash to pay a special dividend or buy back stock. More likely, it will use the money to acquire companies or products through acquisitions. This should have the potential for higher returns to shareholders.

· Through 2019, I project that the Company could have $246 million of cash on its balance sheet if it chose to just let the free cash generated from operations accumulate on the balance sheet. This would be roughly $11.38 of cash per share. This is extremely unlikely to happen, but it does drive home the strong cash flow generation capability of the Company. At current stock prices it could buy back all of its outstanding stock out of free cash flow by 2018 if it so chose.

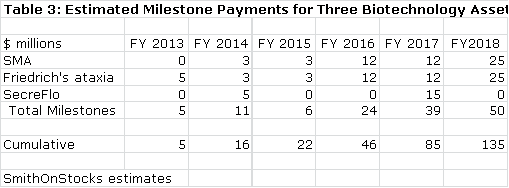

· The Company also has one biotechnology asset that it has monetized through a partnership with Pfizer and two others it is looking to partner. These could potentially bring in $135 million of milestone payments by 2018 if everything breaks right. In addition, Repligen may receive mid to high single digit royalties on these products if they are successfully commercialized. However, I would caution that these potential milestones carry much higher risk of not being achieved than estimates for free cash flow from bioprocessing operations.

Sales and Earnings Model and Valuation

I have put together a sales and earnings model that summarizes my projections for how Repligen may be able to grow its existing business. This takes into account the tax loss carry-forwards which will offset much of US profits until 2018. The model assumes that the Company will passively let its cash accumulate on the balance sheet instead of investing in new businesses or returning the money to shareholders through dividends or stock buybacks. This is obviously not going to happen, but it provides an insight into the strength of the current business.

The cash on the balance sheet would accumulate significantly in the above model. The following table shows the annual buildup in cash on the balance sheet from free cash flow generated by operations. This is combined with estimated milestones from monetizing the biotechnology assets.

Price Target Thoughts

I think that the business model of Repligen is not well understood on Wall Street in part because it is relatively unique and also because the Company may still be thought of as a biotechnology company. Over time, if I am correct, I think that the promise of predictable growth and strong cash flow generation will lead to a premium price earnings ratio for the stock. Based on the 22% EPS growth rate that I project for 2014 to 2019, I think that the P/E ratio could be in the range of 20 to 25 times projected one year forward EPS. This would suggest a $7.00 to $8.35 current price target based on core operating EPS of $0.35 in 2014.

As I previously mentioned, investors should also attribute independent value to the cash on the balance sheet as it is largely not needed to fund ongoing operations and can be used to benefit shareholders through a cash dividend, share buybacks or accretive acquisitions. If the $65 million of cash were returned as a special dividend in 2013 it would create $2.10 of value for shareholders; this would increase my price target range to $9.10 to $10.45 per share. If the $65 million were used to buy back stock at current prices, my projection for 2014 EPS would increase to $0.52 in 2014. Applying a 20 to 25 P/E ratio to this estimate would result in a price target of $10.40 to $13.00.

In the above examples, I have not attributed any value to the partnering of biotechnology assets. As I have noted, this could potentially bring in $135 million of milestone payments by 2018. This is roughly $4.25 per share of cash. Starting around 2018, these products could also begin to bring in mid to high single digit royalties. While there may be very significant potential for shareholders, for the time being I am just going to look at these assets as providing unquantified upside to the value of the core bioprocessing business.

Having gone through all of these calculations on the core business let me now tell you why I think that stock dividends and stock buybacks are unlikely to happen. I think that most of the cash will be deployed in making product and company acquisitions. Repligen with its strong market position in bioprocessing and strong cash flow will be viewed as a desirable acquirer by entrepreneurs looking to monetize their investments in products or companies. Repligen at this stage of its development is still a small company with only $47 million of bioprocessing revenues projected for 2013. Even a small acquisition could have a very meaningful impact on the sales base.

I think that most of the cash flow will be used to make acquisitions. If the acquisitions are successful, they could be highly accretive. Let's take the hypothetical case of an acquisition of a $4 million product with gross margins of 75%. Let's assume that it can be folded into the current product line with no need to have a separate sales force. In this particular case, the contribution to pretax profits would be $3 million and tax affecting this at 11.5% would result in EPS contribution of $0.08 per share. Let's assume that the product is bought for three times sales or $12 million. If the $12 million were invested in money market funds at a 1% rate, its contribution to EPS would be $0.0024 per share.

The above example illustrates quite vividly why the cash is not going to sit on the balance sheet in this low interest rate environment. It also shows the dramatic potential for even this small hypothetical acquisition to increase the EPS base from $0.35 in 2014 to $0.43 in 2014. A well-executed acquisition strategy can add enormous value to shareholders. It also brings forward the risk of making a bad acquisition. However, Repligen management has shown considerable acumen with its acquisition of Novozymes. Also, the Company does not have to make acquisitions to grow because its core business is strong. It can be patient and management can pick and choose their targets.

Company Overview

Repligen has a unique and highly attractive business model that is directly tied to the rapidly growing global market for biologic drugs, especially monoclonal antibodies. The core of its current business is the manufacture of five different forms of bulk protein A that I estimate to have accounted for $28 million or roughly 67% of the $42 million of bioprocessing sales in 2012. The remainder of product sales comes from other chromatography products that were roughly $6 million in 2012 and growth factors with estimated sales of $8 million in 2012. I project that Protein A sales will grow at an 8% to 11% per year through 2019 with the other two segments growing at perhaps 15% to 20%. For a detailed analysis, I would refer investors to my initiation report.

Protein A

Protein A is used in the manufacturing of virtually all monoclonal antibodies and Repligen has over 98% of the current world market. I believe that Repligen's commanding position is virtually unassailable. For perspective, there are about 35 commercially approved monoclonal antibodies and some 350 in clinical trials. While the majority of these 350 new products may fail, if 10% reach the market, it could have a substantial impact on the demand for protein A by doubling the number of commercialized products using Protein A.

Monoclonal antibodies are generally produced in living cells that are grown in fermentation tanks. These cells have been genetically engineered to incorporate a gene that expresses a desired monoclonal antibody. This protein must then be separated from the cellular debris and other unwanted molecules in the fermentation broth. Separation starts with centrifuging and straining the contents of the tank to remove solid contents. The remaining liquid solution contains the monoclonal antibody as well as unwanted proteins. It is next pumped through a chromatography column that contains porous beads which allow the liquid to pass through. Attached to the chromatography beads is protein A which has an unusually high affinity for monoclonal antibodies. The monoclonal antibody binds to the protein A while other molecules in solution pass on through. The column is then chemically treated to release the monoclonal antibody from the protein A.

Other Chromatography Products

Repligen sells other products for chromatography. It has an ELISA diagnostic test that is used to determine if protein A has leached from columns during the process that separates monoclonal from Protein A; this test is required by FDA. It also provides tests to manufacturers to determine if the column is performing in line with specifications and if the manufactured product remains free of microbes and endotoxins.

Co-development efforts funded by its strategic partners are an increasingly important business. As an example, the company was funded by GE to develop a new affinity ligand (protein L), which is being used to purify antibody fragments. This product was recently launched by GE/ Amersham. It is comparable to protein A, but more specific for antibody fragments, which offer advantages over larger monoclonal antibodies in parameters such as improved tissue penetration.

Repligen receives revenues from R&D contracts performed for life sciences companies. There has been an uptick in interest in doing such projects. In January of 2010, Repligen entered a new segment of chromatography through the acquisition of patented technology from BioFlash Partners. It allows drug developers to use Repligen pre-packed disposable chromatography columns called OPUS; it is intended to be used in clinical trials and small scale niche commercial products such as orphan drugs in which only small amounts of drug are being produced.

The OPUS columns can be plugged into the manufacturing process and allow manufacturers to focus more on drug development and less on manufacturing issues. Repligen can pack specially designed columns with any media, not necessarily protein A media, from a variety of vendors. The OPUS columns are designed to offer customers a flexible, pre-packed chromatography solution that enables customers to choose the media, column size and column bed height. These columns are made in a controlled environment and shipped by UPS to the manufacturer.

Growth Factors

Through the Novozymes acquisition, Repligen acquired fermentation growth factor products that are essential for proliferation and maintenance of cell lines used in the manufacturing of cell based therapies such as stem cells, monoclonal antibodies and recombinant DNA products. Growth factors, like chromatography products, are a fast growing component of bioprocessing. It is estimated by Repligen that the current market size is $100 million. This gives Repligen a foothold which it plans to expand through internal development and acquisition.

The most important product is LONG R3 IGF-I which is ten times as potent as recombinant insulin and native IGF, which are currently the most widely used growth promotants. It is sold under a distribution agreement with Sigma-Aldridge which extends to 2021 and is now used in nine commercial biopharmaceutical products. Key customers include Amgen , Roche, and Chugai The other growth promotant products acquired were long epidermal growth factor (LONG EGF), transforming growth factor alpha (LONG TGF-a) and recombinant transferrin (rTransferrin) which is as an iron supplement for cell culture and supplements for serum-free or low serum cultures.

Financial Guidance for 2013

In the recently reported fourth quarter results, Repligen gave some very detailed guidance for 2013 income statement and balance sheet items. The company expects total revenues to range between $63 and $65 million, which compares to $62.3 million in 2012. Note that 2012 revenues contained a $5 million milestone payment. Total revenues are a bit misleading as this contains a significant contribution from royalties and other revenues, almost all of which will be lost with the expiration of the Orencia royalty agreement on December 31, 2013. The key operating factor to focus on is the trend in bioprocessing revenues. The Company estimates they will approximate $46 to $48 million in 2013, a 10% to 15% increase over the $41.8 million reported in 2012.

The income statement is going through significant structural changes as the company is eliminating its research intensive drug development effort and focusing resources on its unique bioprocessing business model, This will result in R&D spending decreasing from $10.5 million in 2012 to 6 million in 2013. S, G & A is expected to be down slightly from $13.3 million to $12.3 million. The catalyst for the decision to focus on the bioprocessing business was the acquisition of the Swedish company Novozymes in 2011.

The company is rationalizing its protein A manufacturing operations between its US facility in Waltham, Massachusetts and the newly acquired plant in Sweden. This is expected to increase gross margins from 40.3% in 2012 to 50% in 2013. This improvement is the result of specific R&D efforts to improve manufacturing yields in the fermentation and purification of several high-volume products, as well as higher capacity utilization in Sweden. The Swedish facility is a high tech and capital intensive, which results in high fixed cost. As Repligen improves capacity utilization, incremental profits are substantial. The Company is guiding to an increase in operating income of $20 to $22 million in 2013 versus $11.1 million in 2012. Finally, the Company will be spending $5 to $6 million on upgrading its Waltham plant in 2013.

Repligen ended 2012 with about $50 million of cash equivalents and expects to end 2013 with $65 million or more of cash. This is after an anticipated significant increase of $5 to $6 million of capital spending at the Waltham plant. This cash guidance does not include potential additional out license agreements for remaining clinical assets, potential bioprocessing acquisitions or fluctuations in foreign currency exchange rates.

One of the significant assets of the company is $45 million in net operating loss carry-forwards and other tax credits available to reduce future US income taxes. The tax liability in 2013 is expected to be approximately $2 million in 2013 or roughly 10% of pretax income. This is primarily from income in Sweden for which the tax loss carry forwards do not apply. Swedish income is taxed at about a 23% rate.

Monetizing Three Remaining Biotechnology Assets

Remaining from the biotechnology business are thee product assets. SMA and Friedrich's Ataxia are Orphan drugs in early development. SecreFlo is a later stage asset that received a Complete Response Letter from the FDA last year. All three products will be partnered and with the exception of completing enrollment in a second cohort of a small phase I trial in SMA, Repligen will not be required to spend more money on research.

The Spinal Muscular Atrophy (SMA) Program

On December 28, 2012, the SMA program led by RG23039 was licensed to Pfizer, which will assume responsibility for clinical trials and commercialization. SMA is an inherited neurodegenerative disease in which a defect in the survival motor neuron gene results in low levels of the protein SMN, which leads to progressive damage to motor neurons, loss of muscle function and, in many patients, early death. Repligen is required to complete enrolling a second cohort of an ongoing phase I program in 1H, 2013 before turning the program over to Pfizer.

Repligen received a $5 million upfront payment in 2012 and may be entitled to an additional $65 million of milestones. About half of these milestones would be received before commercialization based on progression through clinical trials necessary for registration. Upon commercialization, Repligen is then entitled to mid to high single digit royalties on sales. Assuming a four year period until approval, I would estimate that the Company could receive milestone payments of about $3 million in 2014, $3 million in 2015, $25 million in 2016 and 2017 and perhaps $33 million upon approval in 2018.

Friedrich's Ataxia

The next clinical development program is targeted at the Orphan disease Friedrich's Ataxia and is based on RG2833, a class I histone deacetylase (HDAC) inhibitor. It has received Orphan Drug designation from the FDA and European Commission. Repligen initiated a single, ascending dose Phase 1 study of RG2833 in Friedreich's Ataxia patients in Italy in the fourth quarter of 2012 and expects to complete this trial in the first half of 2013. The results will be important for future partnering discussions.

Following the phase I completion, Repligen will be collecting safety and pharmacology data and also biomarker data, looking at whether there's any biological response to the single-dose drug treatment. The Company will then be looking to partner the program.

SecreFlo

Repligen's most advanced product candidate is the imaging agent RG1068. It is a synthetic human hormone that is used in combination with MRI to improve the detection of pancreatic duct abnormalities in patients with pancreatitis and potentially other pancreatic diseases. Repligen submitted an NDA to the FDA and a MAA to the European Medicines Agency (EMA) in the first quarter of 2012. The FDA sent the Company a complete response letter in 2Q, 2012 asking for additional clinical efficacy and safety data. Repligen then withdrew the MAA. Repligen is working with the FDA on details for a new phase III trial that would meet FDA requirements. If this is successful, they will then try to partner the product.

Potential Milestone Payments for the Three Biotechnology Assets

The Pfizer deal for SMA is a reasonable proxy for what investors might expect for the Friedreich's ataxia asset. We could see a deal involving a $5 million upfront this year and payments similar to SMA over the next few years culminating in a 2019 launch. Although a later stage product, SecreFlo may have the least value of the three. Assuming Repligen and the FDA reach agreement on the new Phase III trial necessary to refile the NDA, I think the Company might receive a $5 million upfront payment from a partner followed by perhaps a $15 million payment upon approval.

These rather crude assumptions suggest that the Company might receive milestone payments a shown in the following table if everything goes according to my projections.

Tagged as Repligen + Categorized as Company Reports