Relypsa: It Is Early Days in the Launch of Veltassa but the Momentum Seems Quite Strong (RLYP, Buy, $13.46)

Investment Perspective

Investors are closely watching the launch progress of Veltassa follwoing its December 2015 introduction. Medicare and managed care have set up barriers to prescribing that makes getting a prescription filled for a new drug laborious and time consuming and sometimes futile. With very few exceptions, most new product launches have disappointed investors to the point that many hedge funds routinely short companies like Relypsa that are launching new products. I initiated coverage of Relypsa with a Buy in February 2016.

Analyzing the Monthly Data

In my report An In-depth Analysis of Early Results of the Veltassa Launch I explained Relypsa’s well thought out strategy to lessen the impact of managed care and I urge you to read that report. Relypsa is releasing monthly data pertaining to the launch that adds some transparency. Let me briefly explain the data being released:

- New patients who started taking Veltassa with a free starter supply: Relypsa makes sure that every patient who for whom a doctor writes a prescription receives a starter supply of ten days while the Company works with the patient to secure reimbursement and to get the prescription filled.

- Outpatient prescriptions reimbursed and dispensed (retail Rx): These are prescriptions that have been approved by payors and filled by pharmacies.

- Hospital/ institutional setting: These are sales made directly to hospital and institutions.

- Relypsa gives data on both a monthly and weekly basis for these three sets of data.

Let me provide some additional information that is useful in understanding this data.

- Obviously, there are no revenues associated with the free starter supply. The key issue for Relypsa is turning these into paid prescriptions. This does give some insight into physician enthusiasm for the product.

- The list price of each retail prescription for a one month supply is $595 and this is generally discounted by 15% so that the realized price is about $506 per prescription.

- The hospital units contain only a 10 day supply so the realized price per unit is about $169.

- The above assumptions allow the calculation of monthly revenues for both the retail and hospital/institutional settings.

- I have annualized revenues for Relypsa by multiplying estimated monthly sales by 12.

All of these numbers and calculations are shown in the following table.

Conclusions:

It is still early days for the launch and it is difficult to put this data in perspective. Here is what I see so far.

- By all of these measures, the sequential growth is extremely impressive: (1) the number of patients given starter supplies almost doubled for February over January, (2) outpatient prescriptions filled more than tripled and (3) units sold in the hospital/ institutional setting more than doubled.

- These are early days of the launch so that the actual retail prescriptions and institutional units are still small. My calculations suggest that February revenues were just $196,000 which translates into an annualized revenue revenue run rate of $2.4 million; this was over triple the level of January.

There is certainly great momentum in the launch, but the numbers are small and it is very hard to make projections. The key will be watching the data to see the rate of monthly sequential increases as the year progresses. The sequential increase of annualized revenues for February over January was 330%. I can’t imagine this rate of sequential increase remaining at the same level for each of the remaining months of 2016. As the number of prescriptions increases, so will the three-fold monthly rate of increase slow just because of the law of large numbers.

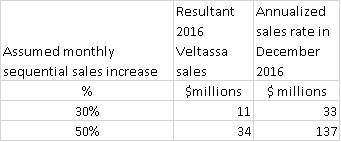

In trying to model the potential sales for the year, we will certainly see a decrease in the rate of sequential increases but this is impossible to predict at this point. It is certainly incorrect to assume a stable rate of increase in quarterly sales of say 30% for each remaining quarter of 2016, but just for illustrative purposes let’s do this anyway. The resultant sales for Veltassa for 2016 would be $11 million and the annualized sales rate in December 2016 would be $34 million. If we assume a 50% increase for each remaining month of 2016, sales for 2016 would be $34 million and the annualized sales rate in December would be $137 million. I want to re-emphasize that the assumption of stable monthly sequential increase is highly flawed.

The Wall Street consensus estimate for Veltassa sales in 2016 is about $30 million.

Tagged as Relypsa, RLYP, Veltassa + Categorized as Company Reports, LinkedIn

Larry,

It seems that RLYP insiders agree with you, and expect higher prices ahead. For the first time ever, 2 company insiders bought shares in the open market on 3/15 & 3/16. The CFO, Kristine Ball, bought 7,000 shares at $12.15, and a Director, Thomas Schuetz, bought 30,000 shares at $13.39. These are fairly significant buys totaling $486,000. In CFO Ball’s case this was an increase of 33% in her holdings, and for Director Schuetz, the increase was a huge 757%. I owned RLYP prior to your initial report on it ( and thanks to your ZSPH report), and intend to add to my position.

Rich Dagley

Thanks Larry. RLYP continues to be an interesting saga as it unfolds.

The insider buys are worth noting. Obviously the insiders know more than we do, and one would think that when the CFO ponies up a large chunk of his own cash to buy stock at these price levels, something is peculating behind the scenes.

I do wonder what will happen with ZS-9. Though it may be approved, I remain quite doubtful that it will have a clean label due to the sodium concerns. I also question the trial structure for ZS-9. The May PDUFA date will be an interesting one to watch. Will a CRL occur, or, will it get approved but with a label warning similar to RLYP?

Also, I’m curious where things stand regarding RLYP getting preferred status with Medicare. To make it affordable to the senior masses, the drug needs to achieve preferred status or RLYP needs to have a very strong co-pay assistance program for folks on Medicare. Doing so would obviously cut into their margins since 60% of their targeted audience is on medicare. Obtaining preferred status would be the ideal.

I think the point that ZS-9 nay bot get a good label due to sodium retention if it breaks the right way (from Relypsa’s standpoint) could be a major catalyst.

Is their cash position of reason to be concerned? They will need to raise cash for 2017 unless they’re bought later this year. We need to keep watching their dispensed prescription trajectory and see how it grows month over month. Hard to speculate until we see March and April’s dispensed rate (at least those months) and until we learn of ZS-9’s fate. I agree with your earlier article that the coming months could be quite volatile for RLYP.

The expected operating expenses for Relypsa in 2016 are about $285 million and the gross profit margin of Veltassa is about 60%. At this level of operating expenses, Veltassa would have to achieve about $475 million of sales to reach breakeven. The Company had $285 million of cash on hand at the beginning of 2016. I estimate that it will have to raise about $200 to $250 million of cash in 2016.

Larry, great reports. I think the potential hypertension benefit of Veltassa (once either anecdotally or clinically proven) compared to the potential hypertension problem apparently inherent in ZS9 (due to sodium) could be a significant factor. One point I didn’t see mentioned as I skimmed your various articles (forgive me if I missed it) is the fact that the ZS9 long term studies did not have meaningful participation so results are yet to be conclusive. The edema and hypertension issues were hinted at but unfortunately enrollment was nowhere near the total expected at last report. Since then, AZN has gone radio silent on these studies. This silence of course gives strength to the rumor that the long term studies have not progressed well as respects significant issues (edema and/or HPT?), as does rumors that AZN is now focusing only on acute market as their target and has reconfigured the studies to accomplish this, perhaps foregoing chronic market for now (essentially abdicating chronic market to Veltassa). Would really appreciate if you could give any color to this, especially as respects the long term studies (zs0004 completed but data not released and zs0005 low participation and may not be completed by PDUFA date?)

Separately, regarding cash raise/dilution, I believe that if prescriptions continue to grow exponentially, and even more so if ZS9 approval/market is compromised, RLYP will have no trouble raising non-dilutive or minimally dilutive bridge financing to fund them into 2h 2017, at which point a much higher stock price will afford an easier-to-swallow equity raise/dilution. Orbimed already has a large equity stake, and has a division that specializes in funds that provide debt financing, etc. in fact in late 2015 they just closed on a 975M raise for their latest fund. In the worst case I expect a convertible debt deal like Klarman/Baupost did for KERX last fall.

Look forward to your commentary on the ZS9 study data.

I might not have recommended Relypsa, but for the issues that you raise. I might have waited for the launch to progress and for the Company to put the financing behind them. However, like you I suspect that the sodium issue could be a significant issue for the FDA’s view of ZS-9. If this is the case, it could result in a huge change in investor perception as Veltassa would be viewed as having the entire chronic use market to itself.