Relypsa: Analyzing April Results of the Veltassa Launch (RLYP, Buy, $14.00)

Investment Overview

Investors are closely watching the launch progress of Veltassa following its December 2015 introduction. Medicare and managed care have set up barriers to prescribing that makes getting a prescription filled for a new drug laborious and time consuming and sometimes futile. With very few exceptions, most new product launches have disappointed investors to the point that many hedge funds routinely short companies like Relypsa that are launching new products. I initiated coverage of Relypsa with a Buy on February 2016. My 2016 sales estimate for Veltassa remains essentially unchanged at $16.3 million which is close to Street consensus and I continue to recommend purchase

In this note, I give some thoughts on April numbers. As in March and February the numbers are small but retail prescriptions and hospital units filled are showing strong sequential monthly sales increases. It is still mostly guesswork in projecting full year sales but I present my working case estimates and an optimistic scenario. There is one point that is causing some concern with investors in regard to the April numbers: the number of patients receiving free starter supplies of Veltassa declined slightly from March to April. This may have been caused by an increase in number of days supplied in free starter kits increasing from 10 days to 15. Because some patients receive multiple kits as they wait for reimbursement, this has the effect of reducing the number of kits supplied. It could also be the case that some prescriptions are being filled more quickly. I find it difficult to believe that this is a signal that the launch is stalling, but some investors could interpret it that way.

In looking ahead, the Veltassa numbers are not likely to excite investors for some time. However, there is a major catalyst aside from this and that is the May 26th PDUFA date for ZS-9. The potential of the hyperkalemia market is huge and I beleive that it is not a zero sums game between Veltassa and ZS-9 so that both products have blockbuster potential in the market. However, the mechanism of action of ZS-9 exchanges sodium for potassium and sodium can cause an increase in blood pressure. Many or most of the patients eligible for potassium lowering drugs have high blood pressure and it is possible that ZS-9 could exacerbate this. There has been an enormous amount of speculation and I emphasize the word speculation that this will be an issue for FDA and in the worst case, ZS-9 might only be indicated for acute use. This would be a disaster for ZS-9 as hyperkalemia requires chronic treatment. In this scenario, Veltassa would own the market and this could trigger a major upward move in the stock.

Analyzing the Monthly Data

In my report “An In-depth Analysis of Early Results of the Veltassa Launch” I explained Relypsa’s well thought out strategy to deal with the impact of managed care and I urge you to read that report. Relypsa is releasing monthly data pertaining to the launch that adds some transparency. Let me briefly explain the data being released:

- New patients who started taking Veltassa with a free starter supply: Relypsa makes sure that every patient for whom a doctor writes a prescription receives a starter supply of ten days while the Company works with the patient to secure reimbursement and to get the prescription filled.

- Outpatient prescriptions reimbursed and dispensed (retail Rx): These are prescriptions that have been approved by payors and filled by pharmacies.

- Hospital/ institutional setting: These are sales made directly to hospitals and institutions.

- Relypsa gives data on both a monthly and a per weekly basis for these three sets of data.

Let me provide some additional information that is useful in understanding this data.

- Obviously, there are no revenues associated with the free starter supply. The key issue for Relypsa is turning these into paid prescriptions. This does give some insight into physician enthusiasm for the product.

- The list price of each retail prescription for a one month supply is $595 and this is generally discounted by 15% so that the realized price is about $506 per prescription.

- The hospital unit contains 4 single packs and each unit is prices at $119. Assuming a discount of 15%, the realized price per unit is $101.

- The above assumptions allow the calculation of monthly revenues for both the retail and hospital/institutional settings.

- Annualized revenues for Relypsa can be calculated by multiplying estimated monthly sales by 12.

April 2016 Update

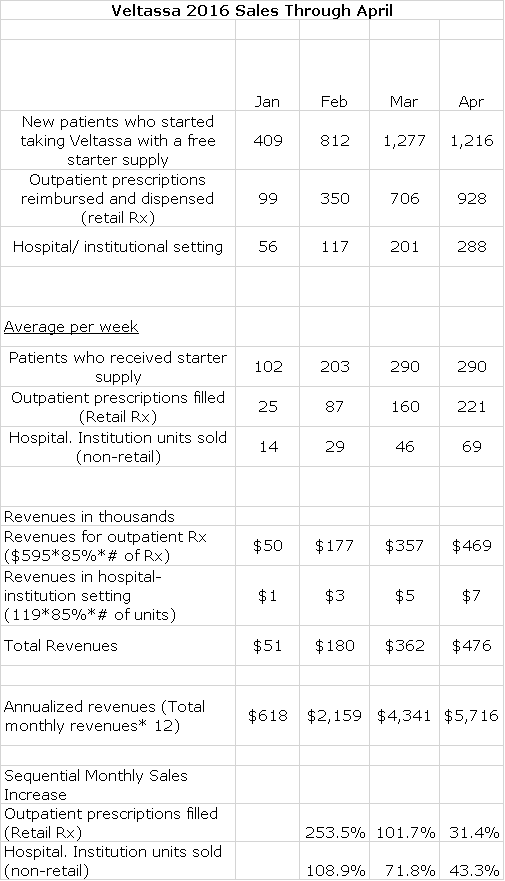

Relypsa released results for April in an 8-K released on May 16, 2016. In the following table, I have shown the April results in comparison to March, February and January.

Key Points from Previous Table:

- The sequential increase for April versus March for both outpatient prescriptions filled and resultant sales was 31%.

- The sequential increase for April versus March for both hospital units sold and resultant sales was 43%.

- New patients who started taking Veltassa with a free starter supply decreased from 1,277 in March to 1,216 in April. This number at first glance appears disappointing and perhaps it is, but it is difficult to interpret at this time. Because of the slow conversion of patients from free drug to paid prescriptions, Relypsa decided to provide free drug for longer duration (it is now a 15 day supply from a prior 10 day supply). If it is the case that some (many) patients are receiving multiple starter packs while waiting for reimbursement, this increase in days supply would reduce the number of free starter packs distributed. It might also be the case that Relypsa is being more successful in getting prescriptions filled without the need for starter packs.

- I estimate that total revenues in April were $476,000 and on an annualized basis, this would be $5.7 million.

How is Relypsa Doing? Guesses at Full Year Sales

The impact of managed care in restraining uptake of new products grows with each new product launch is more disappointing than the last relative to investor expectations. In looking at the above table, you can see that if we annualize April results, annualized sales for Veltassa are now at about $5.7 million. Prior to the launch, analyst expectations were around $50 million of sales for the full year 2016. My working estimate for 2016 sales of Veltassa is now $16.3 million which I believe is close to Wall Street consensus.

I think that analysts have been slow to catch up with the new realities of managed care in which I believe that much of the first year is spent adjusting to managed care restraints on usage and reimbursement. In the early stages, it is not just about how physicians feel about the product. The only thing I can say right now is that the momentum is strong on every measure of product performance, but the numbers are small. I continue to believe that Relypsa has enormous long term potential, but I am struggling to project sales this year and next. In estimating full year sales, my model allows me to plug in various estimates for sequential increases in monthly sales for outpatient prescriptions and hospital units and come up with sales estimates. In the next sections, I present two possible sales scenarios for 2016.

Working Case Scenario

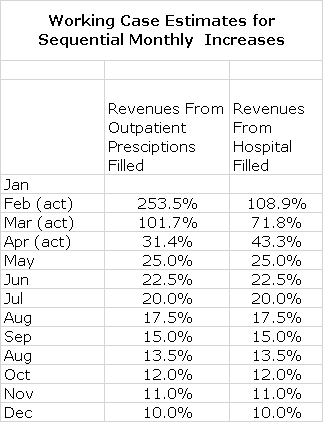

This scenario is the one I am currently using to project full year sales. It assumes decreasing rates of sequential increases for coming months as the base increases. These assumptions are shown below.

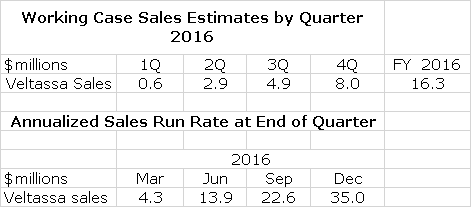

Using those estimates I can then project quarterly sales rates and annualized sales rates at the end of each quarter as is shown in the following table. This set of assumptions results in a full year sales estimate of $16.3 million and the annualized run rate at the end of 2016 would be $35.0 million.

More Optimistic Case Scenario

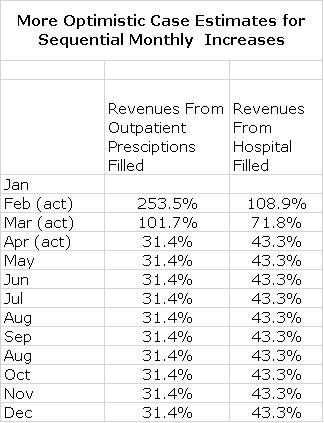

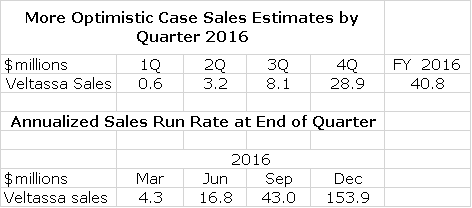

A more optimistic scenario assumes that sequential increases in each of the remaining months of were the same as the 31.4% increase in outpatient prescriptions filled that was seen for April over March and the 43.3% seen for hospital units. This is shown below:

This optimistic scenario would result in full year sales of $40.8 million and an annualized run rate of $153.9 million as of December 2016.

Tagged as Relypsa, RYLP, Veltassa, Veltassa Launch + Categorized as Company Reports, LinkedIn

From a site called “Bidness Etc.”,

“While ZS Pharma’s hyperkalemia drug has not even reached the market yet, it is not expected to carry the FDA’s black-box warning.”

The author names no sources for his claim. Just shaking my head….