Cytokinetics: Estimating a Potential 2025 Price Target of $172 Based Only on the Potential for Omecamtiv Mecarbil and Ignoring Tirasemtiv and CK-107 (CYTK, Buy, $13.00)

Key Points:

- Amgen and Cytokinetics have begun enrolling the phase 3 GALACTIC-HF trial of omecamtiv mecarbil in congestive heart failure (CHF). Topline data is not expected until January 2021. However, in the event of strong efficacy, the trial could potentially be halted at an interim look in 2020. Between now and then there will be no meaningful clinical data on the trial.

- GALACTIC-HF is a massive CHF trial that will enroll 8000 or more patients at 95 centers throughout the world. It has been reported that Novartis may have spent as much as $1 billion on a similarly sized CHF trial for Entresto. Based on this, I estimate that Amgen may also be investing as much as $1 billion in this clinical trial. This is powerful external validation in the promise of omecamtiv mecarbil.

- The investment firm Royalty Partners recently invested $90 million to gain the rights to a portion of omecamtiv mecarbil royalties that will not begin until 2021 or 2022. This is also a powerful external validation.

- In this report, I estimate a 2025 price target of $172 for CYTK based only on omecamtiv mecarbil and ignoring any contribution from tirasemtiv, CK-107 or other potential pipeline product. This is based on an assumption of 10% penetration of the worldwide CHF market in 2025. This would represent a 38% CAGR in stock price over the 2017 to 2025 time period.

- I believe there is a strong possibility that Amgen could acquire Cytokinetics in 2020 or 2021 when data from GALACTIC-HF becomes available if the data is positive. My analysis suggests that Amgen at that time might pay $82 per share just for omecamtiv mecarbil. Potentially, tirasemtiv and CK-107 could increase this price significantly if they produce promising clinical results.

- While this report focuses only on omecamtiv mecarbil, I think that both tirasemtiv and CK-107 can provide enormous additional value. In a report structured similarly to this, I estimate that tirasemtiv alone could justify a stock price of $220 in 2025.

- I want to caution readers that while these price targets give the appearance of great precision, they represent what I think could occur if the phase 3 trials of omecamtiv mecarbil and tirasemtiv are successful. These price targets are meant to convey a sense of the magnitude of the possible impact on the stock price.

- There can be no guarantee that any of the three CYTK drugs in human development will be successfully developed, but CYTK has three powerful shots on goal. If any one of these three are successful, this could be a very, very good stock and if all three are successful, it could be an absolute moonshot of a stock.

Overview of Omecamtiv Mecarbil

The Unmet Medical Need

There is a great unmet medical need in the treatment of congestive heart failure (CHF) for a drug that can improve cardiac output through the new mechanism of action that is the basis for omecamtiv mecarbil. CHF is a life threatening condition that usually results from prolonged hypertension or heart attacks. While simplistic, it is useful to compare the cardiovascular system to a pump (the heart) and the pipes (blood vessels). CHF is a condition in which the heart is not pumping enough blood because it has been damaged and/or the pipes or blood vessels are clogged up making it harder to pump blood. Blood can pool in the body causing shortness of breath, swelling in the limbs and exercise intolerance. An already damaged heart muscle is asked to pump harder and this causes the heart to enlarge and become flabby and increasingly less functional. This creates a downward spiral in heart function that eventually leads to death.

Congestive Heart Failure is a Major Driver of Health Care Spending

Congestive heart failure has a very profound health effect on national healthcare spending. It occurs in 2.4% of the US population (overwhelmingly in older patients) and because of the aging baby boomer population this percentage will increase. It is a chronic disease that patients may live with for some years but short term exacerbations often lead to acute hospital stays. CHF is the most frequent cause of hospitalization for people over 65 in the US and there are about 1 million hospitalizations and discharges from the hospital in which CHF is determined to be the primary cause. There are an additional 1 million hospitalizations in which CHF is listed as a secondary cause.

The cost to the health care system for a hospital visit of a Medicare patient is constrained by that program’s cost containment regulations to $10,000. Non-Medicare patients can cost up to $30,000 to treat. About 18% of CHF discharges are readmitted in 30 days and it is estimated that this costs Medicare $15 billion each year. It is estimated that if effective drug therapy could prevent readmissions, Medicare could save $12 billion per year. It is this unmet medical need that is the goal of omecamtiv mecarbil. Readmission within 30 days can be a major cost problem for hospitals as Medicare will not pay more fees beyond those for the original admission. A hospital can be on the hook for $10,000 or more of additional costs if the patient is readmitted. If omecamtiv in its clinical trials can establish that it can meaningfully reduce hospital readmissions, it should quickly gain formulary acceptance.

The Medical Need Addressed by Omecamtiv Mecarbil

Any drug that can help patients stay alive and remain out of the hospital, reduce length of stay and reduce costs of hospitalization would be deemed a significant breakthrough. The morbidity and mortality associated with congestive heart failure dwarfs that of most cancers. If a patient is discharged today after hospitalization, there is a 28% chance of dying within six months and they have a 30% to 40% chance of being readmitted to a hospital within six months. There is the opportunity to do better with safer and more effective medicines.

Patients entering the hospital are choked with the blood pooling in the extremities and organs and are short of breath. Acute therapy in the hospital is aimed at reducing the amount of fluids with diuretics which cause the patient to excrete more water in the urine. In addition, a variety of well-known anti-hypertensive agents are used to help dilate the blood vessels. This is effective therapy in both the hospital and outpatient setting.

Current treatment then is focused on reducing the amount of blood and widening the arteries and making blood flow more easily. The missing element in the current treatment regimen is a drug that can make the heart safely pump more blood. There are drugs available, but they have serious safety issues that sharply limit their use.

Digitalis is a naturally occurring substance found in the Foxglove plant that has been used to treat the symptoms of CHF by increasing the contractility of heart muscle. More recently a class of drugs called phosphodiesterase inhibitors, the best of which is milrinone, has been introduced to therapy that does the same thing. The mechanism of action of digitalis and milrinone causes the heart to contract with more force. In an already badly damaged heart, this increase in oxygen consumption and increase in calcium can cause life-threatening irregular heart rhythms. Even though these drugs probably lead to decreased time of survival, many patients and physicians are willing to take the risk because their quality of life improves so dramatically with their use.

Pharmaceutical companies have spent many years trying to develop a drug that increases the amount of blood that the heart pumps with each beat without dangerous side effects. The mode of action of omecamtiv is that it can increase the stroke volume (amount of blood pumped) and ejection fraction (amount of blood ejected from the left ventricle) without increasing the oxygen consumption (measure of how hard the heart is working). It is hoped that this will avoid the life threatening side effects of digitalis and milrinone. Essentially, omecamtiv causes the heart to contract longer and without the violent contractions that are the mechanism of action of digitalis and milrinone. If omecamtiv is found to be effective without limiting side effects, it can have a profoundly positive effect on CHF outcomes and lead to a major reduction in healthcare spending. Phase 2 results have indicated that omecamtiv mecarbil has comparable side effects to placebo.

Amgen Provides External Validation for the Potential of Omecamtiv

One of the leading causes of drugs failing in phase 3 trials is that companies rush through phase 1 and 2 and don’t have a thorough understanding of the drug as phase 3 trials are designed. This can lead to trial design flaws that can result in failure. No one can accuse Amgen and Cytokinetics of rushing the development of omecamtiv. It has been studied in many phase 1 and 2 trials for over ten years. This is more than double the time that might be expected. This slow development shouldn’t be taken as uncertainty on the part of Amgen, but rather a recognition that omecamtiv mecarbil represents a mega-blockbuster opportunity and they wanted to minimize the potential for failure.

Amgen seems extremely pleased by the results of the phase 1/2 program. At the Cowen conference in March 2016, Sean Harper, Executive Vice President of Research and Development for Amgen, said and I quote “Amgen has shown the phase 2 data to heart failure experts from all around the world. It has been quite unique in my experience to see such a uniformly enthusiastic response to the phase 2 data. In one way or another each expert has essentially said that they see this as the most compelling heart failure data set of all the drugs they have ever seen.” See this link for more details on that presentation.

The phase 3 GALACIC-HF trial will enroll approximately 8,000 symptomatic chronic heart failure patients in approximately 900 sites in 35 countries who are currently hospitalized for the primary reason of heart failure or have had hospitalization or admission to an emergency room for heart failure within a year prior to screening. The trial is scheduled to report topline data in January 2021. This is an enormously expensive investment for Amgen. While Amgen has not commented on the costs of this trial it is similar in size and scope to the phase 3 PARADIGM-HF trial for the CHF drug Entresto (Entresto and omecamtiv mecarbil have different mechanisms of action and will be used in combination). It is reported that Novartis spent up to $1 billion on that trial. It seems reasonable to conclude that Amgen may also spend $1 billion on GALACTIC-HF. Even by drug company standards, this is a staggering amount of money.

The Investment Firm Royalty Partners Provides Additional Validation

A second powerful external validation of the potential of omecamtiv is the deal that was struck with Royalty Partners. In connection with the Amgen deal, Cytokinetics is entitled to royalties in the US and abroad. Royalty Partners has agreed to pay Cytokinetics $90 million for a part of this royalty stream and also bought $10 million of stock.

I find it extraordinary that an investment firm would invest $100 million on a drug that will not have phase 3 topline data until 2020 or 2021. Obviously, Royalty Partners did extensive due diligence and potentially had access to non-public information before making this investment and this provides another powerful source of external validation. After a recent conversation with CYTK management, I inferred that Royalty Partners won a competition with other investment firms for this deal. For more details, follow this link.

Cytokinetics Provides Guidance for Omecamtiv Mecarbil Sales Potential in the US

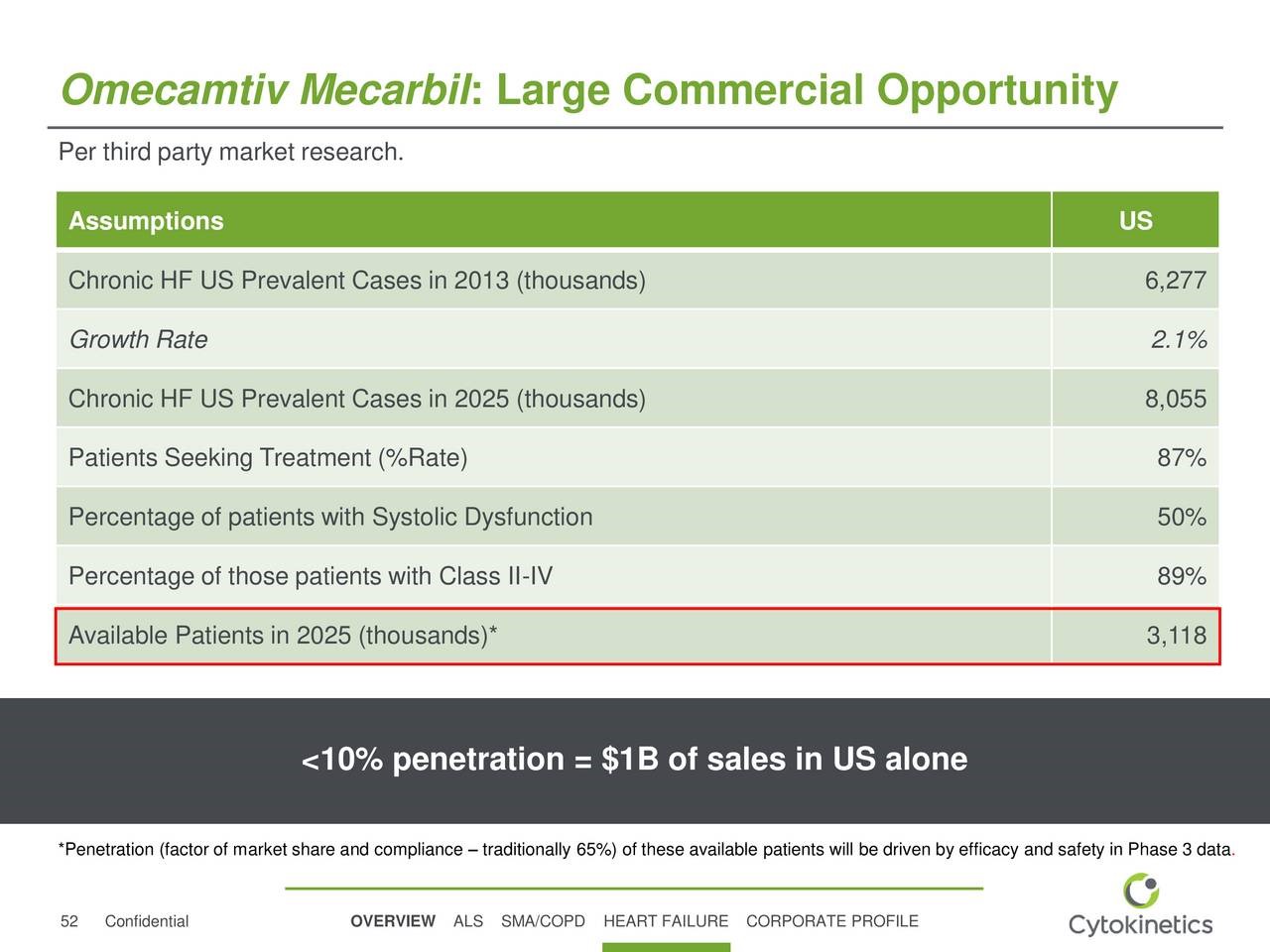

Cytokinetics in a recent presentation provided a valuable insight into the sales potential for omecamtiv mecarbil in the US as shown in the next table. Based on this analysis, which is in line with my thinking, the addressable patient population in the US in 2025 is estimated at 3.1 million. Cytokinetics further estimates that <10% penetration of this market could product $1 billion of omecamtiv sales in the US. This implies an annual price of about $30,000.

As a rule of thumb, the European addressable market is generally the same as the US and the remainder of the world is 20% of the US. If so, the worldwide sales potential for omecamtiv mecarbil based on <10% penetration of the market would be $2.4 billion. I would point out that omecamtiv mecarbil has a differentiated mechanism of action that would allow it to be used in combination with other drugs so that it would be added to a patient’s drug package as opposed to replacing a drug already being used. If omecamtiv mecarbil is successfully developed and meets the expectations of Amgen, Cytokinetics and Royalty Partners, the ultimate penetration of the market should be much higher, probably in excess of 50%. At a 50% level, worldwide sales would be $12 billion.

How Much Could Omecamtiv Mecarbil Contribute to Cytokinetics Net Income in 2025?

For the sale of answering this question, I am going to do a calculation that translates omecamtiv mecarbil sales into net income for Cytokinetics. At $1 billion of sales in 2025, here is how I see the cost structure for omecamtiv mecarbil:

- Cost of goods sold would probably be 10% of sales or less,

- S,G & A would be 30%, and

- Ongoing R&D efforts to expand clinical usage of omecamtiv might be 10%.

Based on these assumptions, the operating margin would be 50% of sales and based on $1 billion of sales, this would amount to $500 million of US operating profits. I estimate that Cytokinetics might be entitled to 40% of operating profits or $200 million. Using a Trump-like tax rate of 23%, this could contribute $154 million to net income.

Assuming that international sales in 2025 bear the relationship to US sales as previously noted, they could approximate $1.4 billion. Cytokinetics will receive a royalty of 15% or more on these sales which amounts to $210 million of operating profit which with a tax rate of 23% would contribute $162 million to net income.

These assumptions indicate that omecamtiv could contribute $316 million to net income of Cytokinetics in 2025.

Price Target for Cytokinetics in 2025 Based Only on Omecamtiv Mecarbil Penetrating 10% of Worldwide Congestive Heart Failure Market

At this point in time, CYTK has 40.6 million shares outstanding, 3.7 million options and 2.0 million warrants. The potential share count then is 46.3 million shares. At the current stock price of $13.10, the fully diluted market capitalization is $606 million.

What kind of multiple might the market place on $316 million of net income from omecamtiv mecarbil in 2025? Under the assumptions I have used, omecamtiv mecarbil would likely be growing quite rapidly (30% to 40% on an annual basis) and investors might be projecting that it could penetrate 30%, 50% or more of the CHF market so it would be awarded a very high P/E. Let’s assume a P/E of 30, which I think would be quite conservative if today’s market conditions apply in 2025. This would result in a market capitalization of $9.5 billion.

The next question to ask is how many shares might be outstanding in 2025. Cytokinetics has a strong balance sheet with cash and equivalents of $164 million at yearend 2016 and the subsequent receipt of $100 million of cash from Royalty Partners. Management indicated that this will fund operation for at least 24 months. Will CYTK issue more shares between now and 2015? They probably will, but there are many different scenarios that will govern this and it is very difficult to make any meaningful estimate. I am arbitrarily assuming that there will be 55 million shares outstanding in 2025.

Based on an estimated market capitalization of $9.5 billion in 2025 and 55 million shares outstanding, I calculate a price target of $172 per share in 2025 for Cytokinetics based only on omecamtiv mecarbil and ascribing no potential for any other products. I think that tirasemtiv and CK-107 are also potential blockbusters. I just wanted to isolate the effect of omecamtiv mecarbil. This represents a 38% compounded annual increase in stock price per year over the next 8 years and supports my contention that CYTK is extremely attractive based only on the potential for omecamtiv mecarbil.

Will Amgen Acquire Cytokinetics?

I think there is a very high probability that Amgen will acquire Cytokinetics, probably around the time (2020 or 2021) if data from the GALACTIC-HF trial validates the potential for omecamtiv mecarbil that I have laid out. Here is why I am inclined to think so.

One of my major concerns as to whether Amgen would decide to go forward into phase 3 was its potential share of omecamtiv mecarbil profits. In the US, Cytokinetics will receive about 40% of profits. In Europe, Servier has marketing rights to omecamtiv and will pay Amgen and Cytokinetics a royalty. As it now stands, Amgen is receiving around half of profits in the US and Europe. While this is not unsubstantial, I think that it is plausible to think that Amgen plans to acquire Cytokinetics in 2020 or 2021 to increase its share.

How much might Amgen pay? If we assume that the stock price of Cytokinesis at that time reflects expected value in 2025 for omecamtiv of $172, discounting this rate at an arbitrary 20% rate would results in a price of $83 that Amgen might comfortably pay for omecamtiv alone. There might be potential value in addition from tirasemtiv, CK-107 and pipeline products.

Tagged as cytk, Cytokinetics, omecamtiv mecarbil + Categorized as Company Reports, LinkedIn