Antares: Undeterred by the Poor Stock Performance I Continue to Pound the Table (ATRS. Buy, $1.30)

Upcoming Catalysts

This is a detailed note updating my thinking on Antares and discussing how I come up with my 2017 price target range of $3.25 to $10.00; the latter is based on Antares being acquired (probably by Teva). Additionally, I wanted to make you aware of three catalysts that could bolster investors’ confidence.

- There was an action data of December 11th for Teva to hear from the FDA on the status of its AB rated generic version of EpiPen; Teva has signaled that they expect a Complete Response Letter that will point to a 2H, 2016 introduction. In the CRL, the FDA should reveal its position on whether it believes this product should be AB rated. Tt is the most important profit driver for Antares over the next two or so years if it is given an AB rating but there has been uncertainty on whether the FDA will indeed grant an AB rating as Teva expects. Teva is expected to be asked about this at the JP Morgan conference healthcare conference (or before) during January 11 through 14. If it is confirmed that the FDA has given its blessing to an AB rating this could be a substantial catalyst for the stock. I estimate that this product could contribute $47 million to pretax profits on an annualized basis.

- Antares has just received FDA approval for an AB rated generic to Imitrex (sumatriptan). Teva will distribute this product, Antares will book all sales and profits will be split 50/50. I estimate that this could contribute $2.5 million to pretax profits on an annualized basis.

- Antares has also signaled that it expects imminent FDA action on an AB rated generic version of Byetta (exenatide). This also will probably be a Complete Response Letter, but will show investors that there probably will be an approval in 2016 followed by introduction in 2017. I estimate that this could contribute this could contribute $4.5 million to pretax profits on an annualized basis.

Investment Overview

I believe that the stock of Antares has excellent (perhaps spectacular) investment potential and yet the stock has been a dismal performer. In 2014, the stock decreased from $4.54 on January 4 to $2.57 at yearend, a 43% decrease and year to date the stock has decreased from $2.59 to $1.30, a further 50% decrease. While this dismal stock performance suggests that there could be severe problems ahead for the Company, I disagree. In order to explain my contrary view, let’s go over the reasons for the decline which I lump into three categories (1) issues specific to the Company, (2) the dramatic effect that short sellers can wreak on a stock like Antares and (3) current investor attitudes toward emerging biotechnology stocks as a class.

Company specific issues:

- The Company’s first proprietary product Otrexup has been a disappointment following its launch in early 2014. Analysts’ sales projections have continually fallen short. This has been due to stiff price competition from Medac’s comparable product Rasuvo and managed care pushback.

- The Company’s second proprietary product QST is a testosterone replacement product. In early 2014, the whole testosterone market came under a cloud because of a retrospective study that suggested cardiovascular risk with drugs in this class. Prompted by this safety issue, there arose criticism about overprescribing due to aggressive promotion (recall low T television commercials).

- The AB rated generic version of EpiPen under development t with Teva has been viewed as the most significant near term commercial opportunity. Investors were initially expecting approval by December 2015. Then Teva announced that it expected a Complete Response Letter that will delay introduction until 2H, 2016. The delay was disappointing and although Teva continues to believe the product will be AB rated, there is concern that it won’t receive this critical designation from the FDA.

- With the uncertainties swirling around the three key lead products, investors have paid little attention to the Company’s burgeoning pipeline.

As I look at these situations, I think that Otrexup peak sales will certainly be meaningfully less than initial expectations, but it should still be a driver for Antares sales and profits. At one point I viewed peak sales potential as $100+ million and I am now at $50 million. In my view, the peak sales potential of $150+ million for QST has not been meaningfully affected and the product has only been delayed. In the case of the AB rated generic to EpiPen, again I view this as a one year delay. Interestingly. EpiPen prices have been increased enormously by Mylan in anticipation of Teva’s entry. Based on price increases the annualized retail market for EpiPen has increased from about $1.4 billion earlier this year to about $2.0 billion. Although there appears to be a one year delay, the commercial opportunity is now 43% greater than earlier this year!

Impact of Short Selling

For those of you who follow my writing, you will understand that I believe that there is a well-coordinated cartel of hedge funds who prey on small biopharm companies. They use a trading strategy (referred to as walking a stock down) that combines shorting (both legitimate and naked), lack of transparency afforded by dark pools and high frequency trading. This cartel can exert enormous impact and even control of the stock price for some stocks. Antares came in the crosshairs of this cartel with the issues on Otrexup, QST and the AB rated generic to EpiPen disappointments and delays.

These issues obviously should have produced some weakness in the stock. However the overall impact was disproportionate if you agree with my assessment that in regard to these three situations the peak sales potential for Otrexup was diminished but still quite meaningful and that peak sales were not diminished, just delayed for QST and the AB rated generic to EpiPen. So why the enormous impact? One of essential strategies of the hedge find cartel is to try to destroy investor confidence. In walking Antares’s stock down, they methodically took out bids for the stock and created ever lower prices. Investors became more and more discouraged as the stock inexorably drifted lower.

Investor Attitudes toward Biotechnology Stocks

Investor attitudes toward the universe of biotechnology stocks is perplexing. The large companies like Gilead, Biogen, Amgen etc. have enjoyed an enormous stock price run fueled by excellent earnings growth over the last few years and strong pipeline outlooks. The IPO market also has been amazingly robust. Companies in very early stages of development (phase 1 and even pre-clinical) routinely are brought public with $400 to $800 million valuations and are showered by investors with money. It has been a great market for these two sectors of biotechnology.

There is a third group of companies that are in a profound bear market. These are companies that have been public for a number of years and like most emerging biotechnology companies have encountered delays in product development, disappointments or failures. Persevering, they have still pushed their technologies forward to approval or are in late stage development with promising drug candidates. In my coverage universe, I would point to companies like Antares, Cytokinetics, Northwest Biotherapeutics and Neuralstem as examples. I believe that with their current investment credentials and if they were private companies, they would be brought public at multiples of their current market capitalizations. In the case Of Antares, the current market capitalization is about $190 million and I think that as IPO it could command in excess of $500 million.

I think that this relative undervaluation can be attributed in large part to the impact of the short selling cartel. Let me relate a story to support my point. A CEO of a small company was on a non-deal roadshow to familiarize institutional investors with his company. An appointment was set up with a healthcare portfolio manager at a major mutual fund company. The CEO was told he could have ten minutes. However the portfolio manager was intrigued by the story and the CEO spent over an hour with him and the PM was obviously attracted to the story. At the end of the meeting, the CEO asked him about whether he would buy the stock. His answer was that he would not invest at this time because the shorts were active in the stock and would drive the stock lower regardless of fundamentals. This is not a unique story.

Price Target Thinking

I guess that you have concluded that I remain very positive on the stock. I am basing much of my price thinking by comparing Antares to valuations of other specialty pharmaceutical companies. Because Antares is in an early stage of corporate development and is spending heavily on R&D and marketing infrastructure, valuing the company on the basis of applying a P/E ratio to 2017 estimated EPS of $0.27 is not a good way to value the company. I think that looking at the ratio of market value to sales may be a better approach. This is not a rigid valuation approach for an emerging biopharma company (there are none that I am aware of) but it is a way of thinking about the price target.

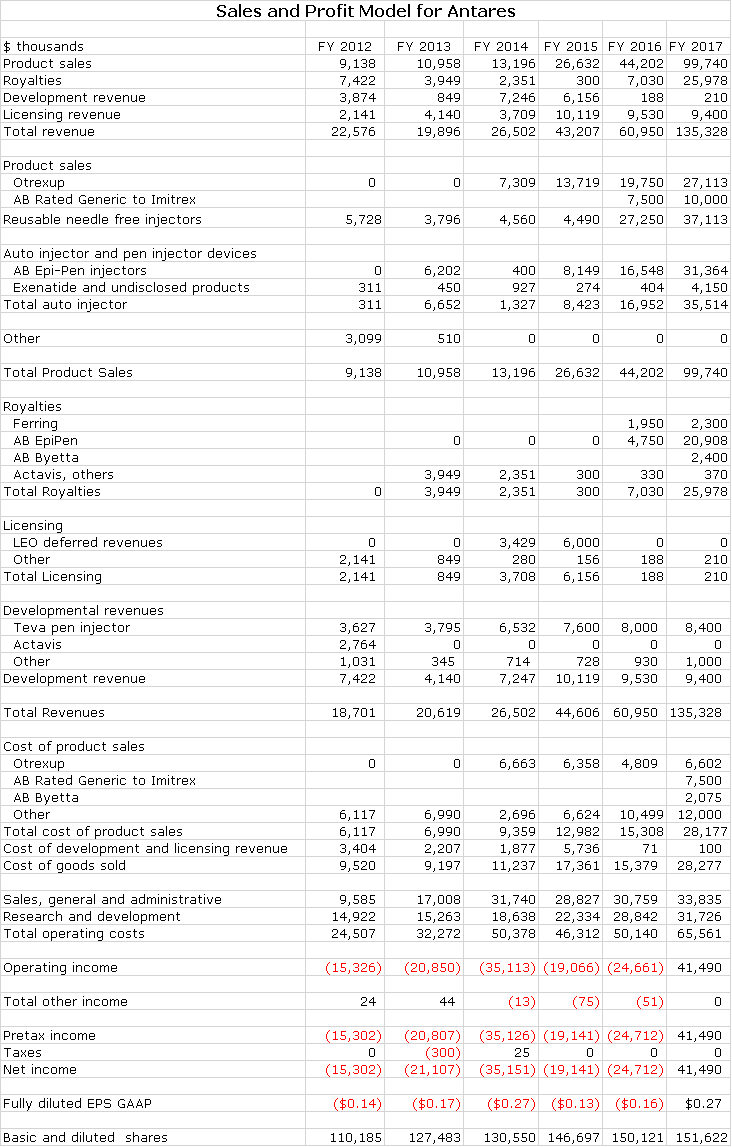

My detailed estimates are shown in the next table and show sales of $45, $61 and $135 million in 2015, 2016 and 2017. Let me start by looking at what I think might be the most positive and most negative outcomes based on the market value to sales ratio.

The most positive case is that Antares is acquired in 2017; let’s look at the example of Avanir to judge what a takeover price could be. Avanir launched its only product, Nuedexta for pseudobulbar affect in 2010. The sales growth due to Nuedexta was as follows: $10 million in 2011, $41 million in 2012, $75 million in 2013 and an estimated $111 million in 2014. This is not dissimilar to the sales trajectory I am forecasting for Antares from 2014 through 2017. Avanir was acquired by Otsuka in December 2014 for $3.5 billion which was 32 times expected 2014 sales. There are many differences between Avanir and Antares of which the most striking are that Nuedexta has a much better patent position than the products of Antares, but Antares has a much, much broader array of product candidates. The 32 times market capitalization to sales purchase price paid by Otsuka seems extremely high, but even half that price (as judged by multiple of sales) would be very rewarding. After cutting out redundant costs, Antares could be an accretive acquisition for one of many specialty pharmaceutical companies with Teva probably being at the top of the list. At 11 times market capitalization to sales, the stock price would be $10.00.

At the other extreme of valuation is the multiple of sales accorded mature specialty pharmaceutical companies which is roughly 2 to 3 times sales. This seems as extreme on the lower end of valuation as the Avanir acquisition on the high end. Still Antares currently sells at 2 times 2017 sales which is a “mature company” multiple of sales. I think that if the story unfolds as I am projecting the multiple could be 5 to 9 times sales (or more) resulting in a stock price of $3.25 to $6.00.

Otrexup Update

The Value Proposition

Oral methotrexate is the gold standard treatment for rheumatoid arthritis; I am always struck by how comfortable physicians are with this drug. However, one of the limitations of methotrexate is its pharmacokinetic profile. As rheumatoid arthritis inexorably progresses in severity, physicians boost the dosage from a starting dose that may be 2.5 to 5.0 mg/week to 7.5 and then 10.0 mg. However, the pharmacokinetic profile of oral methotrexate is that at doses of about 15.0 mg/week and higher, blood levels (and effectiveness) flatten out. This requires switching patients to a biologic drug like Humira, Enbrel and others. Otrexup (also Rasuvo) has a different profile that results in blood levels increasing proportionally as the dose is increased to 15.0 mg/week and higher. This allows physicians to keep patients on methotrexate longer before switching to a biologic.

In addition to the therapeutic benefit, there is also a cost benefit as Otrexup costs about $6,000 per year versus $20,000+ for biologics. This combination of being able to maintain patients on the methotrexate (gold standard drug) for a longer period of time at a much lower price strikes me as being a powerful marketing message not only for physicians but also for managed care.

Otrexup Launch Has Been Disappointing So Far

In the new world in which managed care is so dominant, it seems that most new product launches prove to be disappointing relative to expectations, but the launch of Otrexup has been especially so since its February 2014 introduction. At the time of launch, Antares had expected that they would be the only product in the market. They were surprised when the private company Medac launched Rasuvo, a comparable subcutaneous auto injector methotrexate product, in October 2014.

Medac chose a price competitive strategy to introduce Rasuvo in the market. As a privately owned company, it did not have to worry about showing sales and profits and chose to concentrate on maximizing unit market share. Their initial strategy was based almost entirely on a lower price. Otrexup launched at a WAC price of $548 for a prescription that contained four injectors or a one month’s supply. Rasuvo was launched at a $100 lower price of $448.

Managed care refused to enter into negotiations with Antares on Otrexup until Rasuvo was launched so that they could play Otrexup against Rasuvo. This meant that 2014 was a lost year for Otrexup in that they did not have any managed care engagement. This and the lower price allowed Rasuvo to get their foot in the door. Antares has now lowered the price so that they are at parity when competing for most managed care contracts.

To my surprise, managed care has not bought into the thesis that by extending the amount of time that patients are maintained on methotrexate that treatment outcome is improved while saving many thousands of dollars of cost by delaying usage of high priced biologics. This situation brings out the dark side of managed care. The use of biologics increases the cost dramatically for the corporation or entity that is contracting with managed care to manage prescription costs. However, the biologic manufacturers offer substantial rebates to managed care to use their products. Hence it is much more profitable for managed care to authorize biologics. This is a decision driven solely by bottom line impact on managed care. Managed care is saying that until there is a paradigm change in prescribing guidelines that they are not going to initiate any changes that would favor Otrexup over biologics.

Looking Ahead

Otrexup is at parity with Rasuvo on price and they are slugging it out in the market place for market share. Rasuvo and Otrexup now split the market and it would seem to make more sense for them to work on expanding the market to the benefit of both. Still, progress in the market may be slow and gradual as has been the case with other rheumatology drug launches against which Otrexup has been benchmarked. Rheumatoid arthritis is a slow and steady disease so that physicians only change therapy gradually over time and are not that quick to adopt new therapies. Patients are more interested in new therapies and in 2016 the Antares marketing message is going to be much more directed at patients primarily using. social media. The Rasuvo device is generally believed to be inferior to Otrexup and all things being equal Otrexup is preferred over Rasuvo.

Antares has implemented a policy that buys down a patient co-pay for Otrexup of up to $125 so that the out of pocket cost to the patient below this level of co-pay is zero. Co-pays for generic oral methotrexate can be $25 or more so that from a patient standpoint Otrexup is in an excellent price position. Patients actually save money when they switch from generic, oral methotrexate to Otrexup. By the way, managed care pockets the co-pay buy down so that there is the incentive to allow Otrexup to be used over generic oral methotrexate. Managed care is is a convoluted world.

There Remains Significant Potential

I strongly believe that Otrexup and Rasuvo offer highly meaningful therapeutic and cost benefits that will eventually be reflected in the market. Annualized sales of Otrexup in 3Q, 2015 were about $14.7 million. Management’s faith in the prospects for the product were shown by increasing the sales force to 36 reps. The breakeven sales level for Otrexup is in the low $20 million of sales, a level that could be reached on an annualized basis in the latter part of 2016. My 2016 full year sales estimate is $19.8 million and my 2017 estimate is $27.1 million. Thereafter, I would expect good, steady sales growth for both products. Otrexup may not be the home run that many initially expected but it should be a solid contributor to sales and profits.

In the dermatology space where methotrexate is used to treat psoriasis, Antares is currently marketing selectively to high prescribing physicians. They were left without a partner when Leo decided to exit the US market and ended the marketing agreement on Otrexup for dermatology. Antares is looking for a new partner. This commercial opportunity is 1/10 or less of that in rheumatoid arthritis.

QST Injectable Testosterone Update

A Scare about the Testosterone Replacement Market Raised Questions about QST

The testosterone replacement market was thrown into upheaval in early 2014 when the FDA reacted to findings in retrospective studies that suggested an increased risk of cardiovascular side effects (with all testosterone products). This also heightened an ongoing FDA concern that there was overprescribing of these products for non-approved indications. The outlook became unsettled for a broad array of existing gel formulation and injectable testosterone products and of course those in development like QST. In the aftermath, sales of gel based products plunged on this controversy and have continued weak but interestingly the injectable market has showed stability and some growth. Over half of the prescriptions in the testosterone replacement market are for injectables.

The regulatory view on testosterone replacement therapy has quieted from this initial hysteria. Other retrospective studies actually point to a cardio protective effect of testosterone replacement therapy. There is now visibility on where the FDA is going in terms of what it will request from manufacturers. In order to clarify the cardiovascular issue, the FDA is having all manufacturers align to create a large data base that will help establish the long term safety of testosterone replacement. In the meantime, there don’t seem to be any draconian measures planned.

Regulatory Path Forward for QST Is Clarified

Investors feared that there would not be a clear path forward for development of QST. However, the regulatory pathway for QST was clarified when FDA only requested more safety data for QST that could be met with one more study. This allowed investors to determine a timeline for regulatory action on the product. Antares will complete the safety study in 1H, 2016 and is now on track to file an NDA in 4Q, 2016.

QST’s Value Proposition

QST is the first subcutaneous injectable formulation of testosterone as other injectables are given intramuscularly. Importantly, the pharmacokinetic profile of QST shows that it produces much more stable blood levels for testosterone than gel formulations and intramuscular injections. In clinical trials there were no excursions above the maximum or below the minimum targeted blood levels which are desired for testosterone replacement. Intramuscular injections are very subject to excursions outside of both the upper range of the desired level of testosterone in the blood (causing side effects) when first injected and over the course of a week drop below the lower range (sub-effective). The PK profile of QST results in testosterone levels being in the desired range the whole time. Because of this, QST could be the best in class for injectable and perhaps all testosterone products in terms of safety and efficacy.

The viscosity of testosterone is very high and this means that it has not previously been possible to deliver testosterone in fine gauge needles in a subcutaneous injection. Consequently, current testosterone injections require a large gauge needle and intramuscular injections that require 20 to 30 seconds for administration which leads to pain and discomfort. A great advantage of QST is that it is delivered with a fine gauge needle subcutaneously in 5 to 10 seconds that is virtually painless. Its once a week dosage is ideal for a patient administered medication allowing QST to be given at home whereas intramuscular injections often require a physician visit. Patient acceptance throughout the clinical review program has been outstanding.

Commercial Launch of QST

The experience gained with Otrexup on handling reimbursement and managing a marketing infrastructure will be invaluable if Antares decides to co-market or market QST on its own. The physician audience will be quite different and require a separate and much larger sales force that is capable of reaching general practitioners as opposed to just rheumatologists. Antares is open to out licensing QST and there is a lot on interest from larger pharma companies but Antares says their assumption is they will market QST on their own. I think they will either co-promote or partner.

AB Rated Generic to EpiPen

Why the Delay?

Teva had been giving guidance throughout 2015 that it expected approval of its AB rated generic to EpiPen in 2H, 2015. However, on its quarterly conference call of October 29, Teva’s management withdrew this guidance. My interpretation of comments made on that call was that they were now expecting a Complete Response Letter (CRL) instead of an approval at the end of the year. This caution on the part of Teva’s management apparently does not stem from any new or recent communication with the FDA. It seems to have been based on Teva’s long experience in dealing with the generics division of the FDA and “reading the tea leaves”.

The most likely explanation is that the FDA has fallen behind on the review process and is buying some time by issuing a CRL. An overworked FDA (especially in the generics division) frequently uses this tactic. Remember that the FDA is judged on the number of drugs that it approves in line with targeted dates for approval. A CRL resets this date. If this is the case, the delay could be as long as 6 months for approval, which would push the approval to mid-2016. Antares is steadily shipping injectors to Teva so that upon approval there would almost certainly be enough on hand to launch the product. However, filling of the syringes won’t start until approval.

I know that the key question in your mind is whether there might be something happening at the FDA that could have persuaded them not to grant an AB rating. The AB rating is critical because it allows the Teva/ Antares product to be substituted even if the prescription is written for EpiPen. Without an AB rating the Teva/ Antares product would have to be sold as a differentiated product that couldn’t be substituted for EpiPen. In this case, the economic return is much less. Investors can’t rule this scenario out with the information we have although as I said, my best judgment is that the Teva/ Antares product will be AB rated. Antares reiterates that this product meets all of the criteria for an AB rating and Teva has said the same. Teva has said that they have seen no reason why they can’t get an AB rating.

Hopefully, when Teva receives and processes the CRL (actually at this time we are only guessing they will get a CRL) we will be better able to understand the situation better. Teva had an action date for this product on December 11.The resultant communication with FDA if they issue a CRL on December 11 is expected to give more than a hint as to whether the Teva/ Antares product does quality for an AB rating. It is not clear as to when Teva will speak about the FDA action, but it is possible that this could be at the 2016 JP Morgan conference on January 11 through 14. This should assure investors that a launch with an AB rating is when rather than if.

With the Delay, the Commercial Opportunity Has Significantly Increased

Mylan has been instituting huge price increases for EpiPen in anticipation of the Teva launch. At the retail level sales are approaching $2 billion and at WAC, it might be $1.8 billion. The biggest competitor to EpiPen was Sanofi’s Auvi-Q which is not AB rated. On October 28, 2015, all Auvi-Q injectors were recalled due to a possible dosing error. This kind of manufacturing issue is likely to take a long time to address and correct (year or years) so that EpiPen should pick up most of these sales. This suggests that the annualized sales of EpiPen are close to $2 billion as compared to a $1.4 billion run rate in mid-2015.

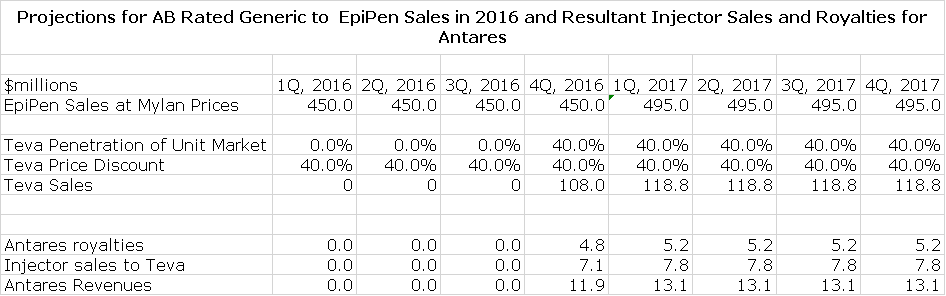

Teva is probably the leading player in the generic space and has the muscle to maximize market share for an AB rated product. I am assuming that Teva comes into the market with a 40% price discount and captures 40% of the market. On an annual run rate of $2.0 billion for EpiPen, Teva’s sales could reach $475 million. I am assuming that the product is launched on the first day of 4Q, 2016.

Commercial Opportunity for Antares

Antares has given guidance that through sales of the auto-injector to Teva and royalties that it will achieve sales equivalent to roughly 10% to 12% of Teva’s sales or roughly $52 million if Teva’s sales reach $475 million. Antares has not given guidance, but I estimate that 60% of these revenues or roughly $31 million will be due to product sales and 40% or $21 million will come from royalties. Assuming a gross margin of 50% on product sales, this would result in a gross profit of $26 million. The combination of $26 million of gross profits and $21 million of royalties would produce $47 million of annualized pretax profits for Antares.

AB Rated Generic to Imitrex (sumatriptan) Injector

Antares received approval an AB rated generic to the Imitrex (sumatriptan) injector. Imitrex was the leading migraine product before it was genericized. The market now has two AB rated generics and the Antares product will be the third. The market is about $100 million currently. Teva will distribute the product, Antares will book all sales and profits will be split between the two companies. I estimate that this product could capture 10% or more of the market creating $10 million of sales for Antares. There are very few marketing costs so that essentially gross profits will fall right to pretax income. I estimate the gross profit margin will be about 50% and taking into account the 50/50 profit split, this could contribute $2.5 million to pretax income on an annual basis.

AB Rated Generic to Byetta (exenatide)

Antares is estimating that Teva will hear shortly on the possible approval of an AB rated version of AstraZeneca’s Byetta, which has US sales of about $225 million. Antares’ economics are similar to those for EpiPen which I estimate at about 4-5% of sales and injector sales which I estimate as 10% of sales. It looks like the Teva product will have first to file basis so that this could result in obtaining a 40% market share at a 40% discount. On an annualized basis, Teva’s sales could be $54 million. Antares’s injector sales could be $3.5 million with a gross profit of $1.8 million and royalties would be $2.4 million resulting in a $4.2 million contribution to pretax income. I am assuming that Teva initially will receive a Complete Response Letter (similar to EpiPen) and marketing will begin at the beginning of 2017.

Pipeline

Antares has a broad base of partnerships headed by its alliance with Teva. There is another product with Teva that has not been disclosed and which Antares refers to as Pen 1. It may be comparable to the AB rated generic version of Byetta in terms of economics. Beyond Teva they have a number of other alliance projects that they have not disclosed due to the desire of their partner to not alert competition. An example would be the development of a product to extend the life cycle of a major drug or they are developing a new drug and want to keep the development status hidden.

Antares has a third proprietary product under development that will follow Otrexup and QST. The active drug ingredient has not been disclosed, but will probably be revealed in 2016. It is referred to as QSM. Antares hopes to launch a new proprietary product every year or two.

Financial

They ended 3Q, 2015 with $50 million of cash and continue to burn cash on a quarterly basis. As Otrexup sales build to the low $20 millions it will cease to be a drain on cash and will contribute to cash flow. The launch of sumatriptan AB which could be shortly would be a boost to cash flow and the launch of AB epinephrine would make Antares very strongly cash flow positive.

Tagged as AB rated generic to Byetta, AB Rated Generic to EpiPen, AB rated generic to Imitrex, Antares Pharma Inc., ATRS, Otrexuo, QST + Categorized as Company Reports, LinkedIn

I am long Anteres….thank you for your excellent article, as,always….off topic, will attend the annual meeting of NWBO later this week???? So many questions surround this non-transparent company…I wish I could be there and ask for a REAL update on so many issues that are hanging fire or just burned out…..what is the meaning of the screening “halt”????? Will it be lifted???? How many are currently enrolled in “L”????I could easily a dozen more…Hope you will give us an update sometime soon…..thank you Larry….cheers

Rasuvo is a concern to me. It seemed to come out of nowhere and has dramatically impacted the profitability of Otrexup (revenue per incremental prescription was $248 in 3Q15 and $244 in 2Q15 based on the November 5, 2015 slides).

How did that happen? First, it seems that their injector technology is inferior to Antares but as you describe it is merely a tie-breaker when all other factors are equal. Was their application with the FDA public information? If so, how could ATRS not know about it? If not, shouldn’t we expect that there will be multiple similar generics in every market they enter?

Sumatriptan would seem to be just such an example. Along those lines, it seems surprising that you would project that Teva will get 10% unit share in sumatriptan as the 3rd generic? It that due to Teva’s size? Does the Antares injector have some minor advantages over the other generics that will more meaningfully impact sales than those of Otrexup?

The bottom line is that current ATRS investors will essentially be wiped out if the company doesn’t get the A/B rating for epi-pen.

Also, on the subject of NWBO, I’m very, very concerned. It looks like NWBO will run out of money before it can finish the investigation. That report, assuming it exonerates Linda Powers, will presumably be a prerequisite to any new fund raising. I’m also very disappointed in Neil Woodford. Personally, I assumed he investigated the Cognate relationship and was satisfied. FT referred to him as the leading biotech investor in the UK. Sounds like he doesn’t really know what he is doing.

Larry, did he or anyone on his staff talk to you? You’re obviously a proponent of the stock, but it would seem to me you are the first person on the investing side that anyone interested in NWBO should want to contact.

Thank you Larry. Could you please explain why Teva needs to wait until an analyst meeting in Jan to disclose the results of the FDA correspondence? Why not just issue a pr now?

Not Larry, but I may be able to some insight to the FDA correspondence expectation. When Teva said they were expecting a CRL from the FDA in order for them to buy more review time, be aware that TAD (Target Action Dates – the 12/11/15 date that Siggi Olafsson referenced) are only soft internal action dates for the FDA. TAD dates are not like GDUFA dates, dates on which the FDA is graded. TAD dates are for internal FDA reference purposes only. For pre-cohort ANDAs (those submitted prior to the FDAs fiscal year 2013, which Gx Epi was), there is no gradable date to which Gx Epi applies. When Siggi mentioned the TAD date, frankly I’m not sure why there was an inference that a CRL was expected other than when the FDA is behind on an ANDA review, they often use the CRL tactic to buy more review time. It is possible that a CRL was given (indeed, minor CRL’s are common for ANDA filings), but simply missing a TAD date would not out of necessity trigger a CRL even if the FDA required more time to complete the filing. Again, because TADs are for FDA internal purposes only (they are good intentions dates only, like when you hope to paint your bedroom walls), and because Gx Epi was originally filed before the 5-year cohort program initiated, they can be missed without consequence to the FDA. Based on what I know about the FDA and how they operate, I agree with Larry that the FDA missed this TAD because they’re trying to do to much with to little resources and overpromised on their TAD date of 12/11. More than likely, once the FDA’s fiscal Q4 hit (July thru September), they shifted internal resources to get closure on the filings on which they’d be graded for cohort year 2015. The FDA has a long history of shifting resources to meet their own internal priorities so this was not a total surprise. A little more about TAD dates. Per the FDA, all TAD dates are supposed to be assigned to a date between March and September. That the FDA gave the Gx Epi a 12/11 date leads me to believe they were already buffering the date at the time they assigned it (read: they knew they were overloaded and Gx Epi was not an ANDA or NDA on which they would be graded).

What we do know is this. A year ago December, Teva made it clear that they had now given the FDA everything they had asked for to complete the Gx Epi review. Be very aware that that FDA guides ANDA filings for approval. They want to see them get approved to help fulfill the affordable drug act initiative. In fact their supposed to prioritize big first generics in getting them approved. In late July, Siggi Olafsson publically stated that due to the hard work that had take place between Teva and the FDA, he “felt fairly good about approval the second half of 2015”. If you listen to the dialog, Siggi mentioned “approval” four times within about 25 seconds, all within the context of Gx Epipen. Prior to that Teva management had been guarded (as their lawyers always coach them to be regarding any drug filing) in how they answered anything related to Gx Epi. To go on record with such strong language, and stating this only 4.5 months from the TAD date (though still not disclosed publically at that time) pretty much tells you the steadfast conviction that Teva has in getting Gx Epi AB approved. Then, in late October, Siggi let us know that the FDA review of Epi had slowed to the point where he didn’t see it possible to complete the review this year, and he thought the FDA would issue a CRL to buy more time. He reiterated that nothing negative had come from the FDA regarding the filing and they anticipated no roadblocks to getting AB approval. Siggi appeared somewhat flustered when he said all this for obvious reasons. He’s worked with the FDA for more than two decades so he knows the routine, but he still sounded flustered and understandably so. When the FDA has been guiding you for approval, you’ve given them all they’re asked for and the review is going so well that you publically state you feel fairly good about approval (not just that the filing review would be completed but approval of that filing), then you are highly confident all the pieces are in place for inevitable approval. It’s probably a given that Teva has met and conversed with the FDA multiple times since the late October announcement from Siggi. That no bad news has come from Teva since that time is, in my opinion, a strong positive that reinforces all of the good indicators for approval that have been building. We may learn soon the next steps in the process.

Again, not Larry, but here’s what I know about the Sumatriptan situation. Initially this was Teva’s project. Teva gave it to Antares (literally) when they found out that more injector work would be needed before approval would occur. Still, Teva will be the marketing partner. Teva has the best distribution and clout within that channel versus any other generic. Gx Suma will offer a doage strength the other two currently available generics do not offer. That alone is worth 10% market share. Teva’s superior distribution will snag a good percentage of the other generic dosage strength business as well. That said, the real key for Gx Suma is it’s another approved injector for Antares and it’s for a complex generic drug. Let me rephrase this, those two aspects are a big deal for Teva as they continue to build their drug/injector plans for Antares injector IP. As Larry said in his writeup, Teva is probably the eventual acquirer of Antares. In one of Teva’s recent R&D presentations, the Gx Suma injector (along with three other unique Antares injectors) were all highlighted as “internal device technology” for Teva with no mention of Antares whatsoever. In my opinion, Exenatide will be approved soon enough. In my opinion, Ditto for Epi. By the way, those were two of the other three injectors featured as “in-house device technology” in Teva’s R&D presentation.

Teva received Complete Response Letter on February 23, 2016

Generic EpiPen further delayed

Teva’s notice states: “Teva received a complete response letter on February 23, 2016 relating to its epinephrine ANDA in which the FDA identified certain major deficiencies. Teva is evaluating the CRL and intends to submit a response. Due to the major nature of the CRL, Teva expects that its epinephrine product will be significantly delayed and that any launch will not take place before 2017.”

Larry, what is your thinking?