Antares: Teva Offer to Buy Mylan Should Have No Effect on Launch of AB Rated Generic to EpiPen (ATRS, $2.76, Buy)

Overview

Subsequent to my posting of my recent update on Antares, I have seen that Teva has made an offer to buy Mylan; Mylan, of course, markets EpiPen. My first reaction to this news was alarm suggesting that Teva would abandon the AB rated product and focus on the branded product. However, this is highly unlikely because in order to make this acquisition, Teva has to gain FTC approval. The FTC would view abandoning the AB rated product as a restraint of trade and a reason to block the merger. It would probably require Teva to sell either the branded EpiPen or the AB rated generic to EpiPen as a condition for approving the merger. Hence, I see the outcome of this takeover offer as a matter of indifference to Antares.

Price Target Thinking

Let’s assume for the time being that you accept my sales and earnings projections. How might the stock be valued in 2016? Using a P/E based on EPS is not really meaningful as the company would just be emerging into profitability. Valuing the company on the basis of sales may provide more insight into a possible valuation.

Let’s look at the example of Avanir (AVNR). This Company launched its only product, Nuedexta for pseudobulbar affect, in 2010. The sales growth (mostly due to Nuedexta) has been as follows: $10 million in 2011, $41 million in 2012, $75 million in 2013 and a projected $111 million in 2014. The stock currently sells at $13.88 and there are 160 million shares outstanding giving it a market capitalization of $2.2 billion. The ratio of market capitalization to 2014 projected sales is 20. Avanir is expected to lose about $50 million in 2014 and become profitable in 2015.

Based on my model, Antares may develop sales on a comparable trajectory. Projected sales are $26 million in 2014, $47 million in 2015 and $93 million in 2016. I am projecting full year profitability in 2016. While there are substantial fundamental differences between Avanir and Antares, the sales trajectories are pretty similar as is the manner in which they are projected to become profitable. They are also both thought of as specialty pharma companies.

I think that we can look at the possibility of Antares being valued similarly to Avanir. If Antares were to sell at 20 times 2016 sales its market capitalization would be $1.86 billion and based on say 150 million shares outstanding (allows for some share issuance as current share count is 136 million), the price per share would be $12.40. If it were to sell at ten times sales the price per share would be $6.20. I think that this price target range of $6.00 to $12.00 probably captures the range of possibilities, but doesn’t pinpoint the most probable outcome. My best judgment is that it will be in excess of ten times sales or $6.00 per share with a reasonable chance of something greater.

Just for the Heck of It, What Would Antares Look Like Without AB EpiPen?

Without any basis in fact, the only negative I could conceive is that the launch of the AB rated product might be pushed back although I suspect that this would also be viewed very negatively by the FTC. In any event, I see the launch of the AB rated generic as inevitable if the FDA grants its approval. I understand that Teva filed the last amendment to the ANDA in December so the ball is in the FDA's court. Both Teva and Mylan have previously issued sales and earnings guidance for 2015 that assume that the AB rated generic to EpiPen will be launched in 2015. This indicates that they believe FDA approval and a launch is highly probable.

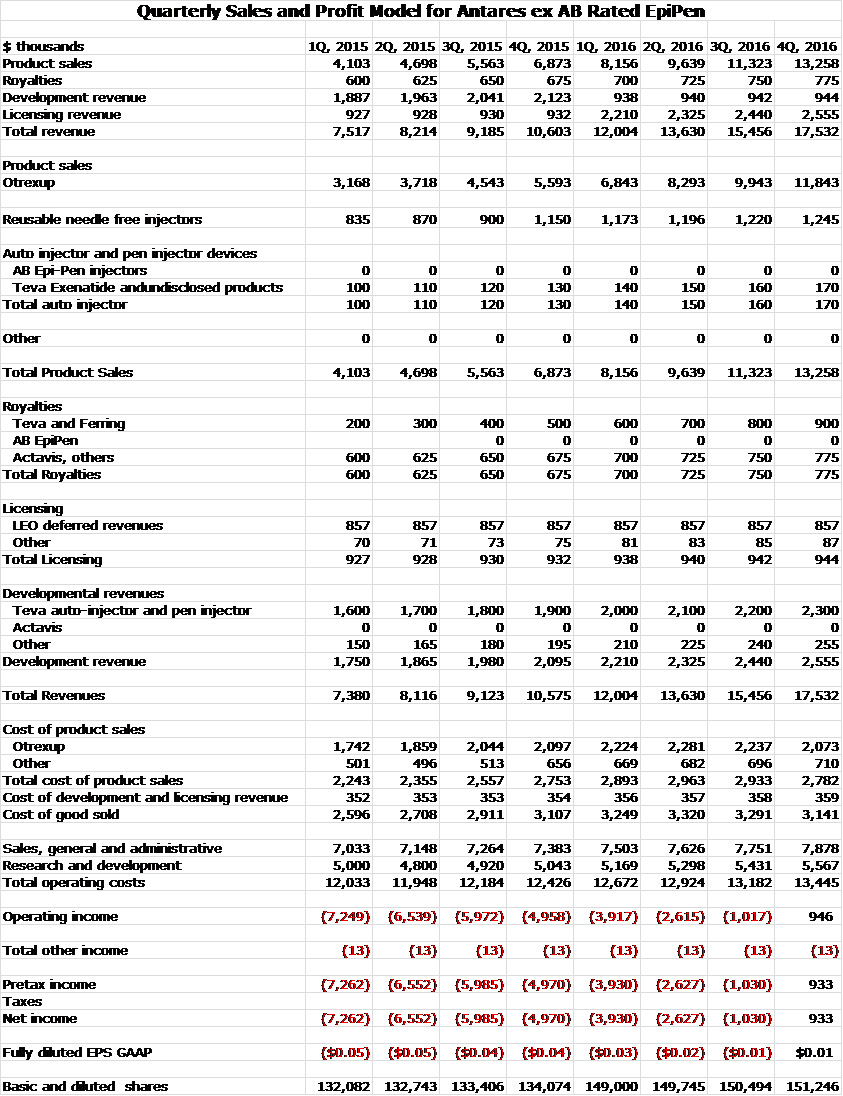

I see no reason to change my sales and earnings model for 2015 and 2016. However, just as an exercise, I have constructed a model to show what Antares might look like without the launch of an AB rated generic. Here is the quarterly sales and profit model for Antares ex AB rated generic EpiPen.

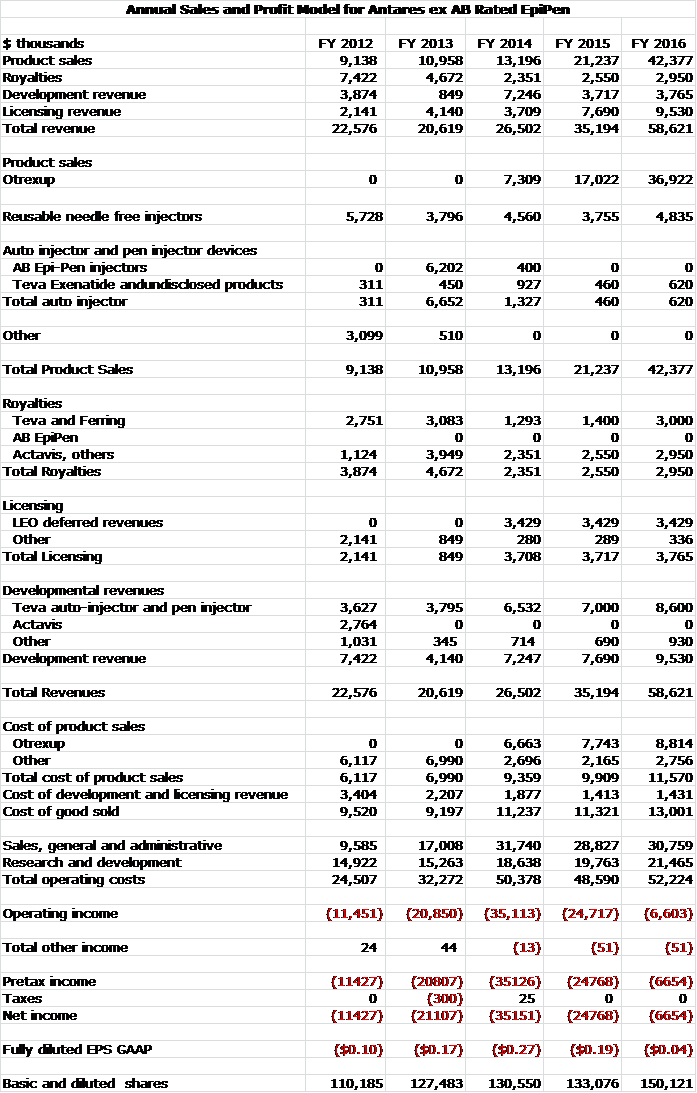

My annual sales and earnings model would look as follows:

Tagged as Antares Pharma Inc., ATRS, MYL, Mylan, otrexup, teva + Categorized as Company Reports

4 Comments

Trackbacks & Pingbacks

-

Comments on Antares, Kite Pharma and Northwest Biotherapeutics | Expert Financial Analysis and Reporting | Smith on Stocks

[…] The Company now is in a very strong cash position. Without the offering, the projected cash balance of $17 million at yearend 2015 would have left the Company perilously exposed to setbacks which we know are not infrequent with emerging biotechnology stocks. As for the impact to shareholders, let me direct you to my price target thinking in my April 23 report. Antares: Teva Offer to Buy Mylan Should Have No Effect on Launch of AB Rated Generic to EpiPen (ATRS…) […]

Comment

You must be logged in, or you must subscribe to post a comment.

Hi Smith,

Will FDA’s ruling tell the public that Teva will or will not have to launch AB rated generic? Or is that information between just Teva and FDA court. Also what would be an estimated time on finding out about this ruling?

The FDA only approves the product. However, once it is approved, I believe that any effort on the part of Teva to not market or delay the introduction of the AB rated generic in order to protect the branded EpiPen would be viewed by FTC as restraint of trade. There will be a requirement by FTC to dispose of either the branded EpiPen or the AB rated generic to allow this deal to go through.

Larry,

I just read that a new stock offering may be in the works, apparently due to a delay with epipen (August is when Teva expects to hear from the FDA, not June). If Antares only needs to buy time (e.g 6 month safety net of cash to keep their later in year cash balance above $20M or higher or until they receive their milestone and settlement payments), why wouldn’t they obtain a credit line or one of a dozen other forms of short term financing to accomplish that task? They are so close to the finish line with Suma and Epi. I realize I’m being presumptuous about Epi and Suma, but if the goal is to buy time until the FDA acts, why a stock offering instead of some other form of financing?