Agenus: Update on Drug Development Programs (AGEN; Buy, $5.65)

Investment Thesis

This report focuses on product development efforts discussed in Agenus’ 2Q, 2016 conference call. My most likely investment scenario for Agenus is that it is acquired within the next three years and potentially at a valuation of as much as $25 per share. The reasoning behind this is discussed in my May 3, 2016 in-depth report called Agenus: Its Market Leading Position in Immuno-Oncology Makes it A Compelling Investment Story.

Overview of This Report

During the call, management outlined an impressive range of development efforts on checkpoint modulator antibodies for its own account and also in collaboration with Incyte and Merck. These products are in initial stages of clinical development and in an optimistic scenario, BLAs on lead candidates might be filed in three years. Significant data could be created in 2017 and certainly 2018, but Agenus cautions that it likely will be reticent in publishing data because of the highly competitive development field and suggests that much of its data will be presented at key scientific meetings where it achieves maximum impact.

The vaccine area is also quite interesting. A trial of Prophage in combination with Agenus’s PD-1 modulator could begin in early 2017 in newly diagnosed glioblastoma. Prophage has generated strong signals of activity in phase 2 trials in newly diagnosed and recurrent glioblastoma. The addition of a PD-1 antagonist has shown significant synergy in animal models. This is an intriguing trial.

One of the most interesting discussions on the call from my standpoint is that Agenus has also begun to push into the development of neoantigen cancer vaccines. Some believe this could be a significant advance over older cancer vaccine technologies. I provide some ground on neoantigen vaccines in this note that I hope you will find interesting.

Checkpoint Modulator Programs

CTLA-4 agonists

Agenus has placed a major development focus on two CTLA-antagonists. AGEN 1884 is the lead compound and Agenus also has a second product AGEN 2041 in development. In January of 2016, AGEN 1884 was advanced into human trials. Dosing in the first cohort of patients has been completed and dosing in the second cohort should begin shortly.

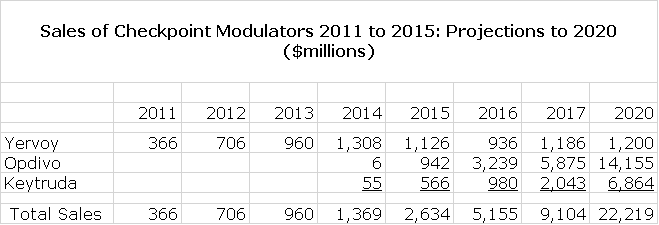

Bristol-Myers Squibb’s Yervoy (ipilimumab) is a CTLA-4 antagonist and in 2011 was the first checkpoint modulator to be approved. However, the PD-1 antagonists BMY’s Opdivo and Merck’s Keytruda produced better clinical results and have soared past Yervoy commercially as can be seen in the following table. The spectacular success of Opdivo and Keytruda came partly through cannibalizing Yervoy.

Why then is Agenus so interested in CTLA-4 antagonists. Management believes that one of the biggest shifts in thinking about immuno-oncology following this year’s ASCO was that CTLA-4 antagonists have risen to real prominence again. Data at ASCO provided important validation of checkpoint modulator combination approaches with CTLA-4 as an important part of the backbone. Regimens involving lower and less frequent dosing of Yervoy in combination with PD-1 and PDL-1 inhibitors yielded a more pronounced clinical efficacy than either agent alone.

Both of Agenus’ CTLA-4 agents will be combined with Agenus’ PD-1 antagonist. The first combination trial is planned for 1Q, 2017.Management believes that companies wanting to compete in immuno-oncology (and who doesn’t) are going to need a CTLA-4 antagonist and a PD-1 antagonist as a backbone. For example, this combination will likely be combined with other checkpoint modulators such as GITR and OX-40 which are emerging as probably important but maybe not so powerful single agent drugs in some settings.

In the competitive arena for CTLA-4 antagonists, Agenus believes that it is third in clinical development behind BMY’s ipilimumab and AstraZeneca’s tremelimumab. Since ASCO management says that they have received significant interest from companies with regard to the CTLA-4 program. If Agenus partners this program, they anticipate retaining certain rights and will choose a partner(s) who shares its strategic vision for the evolving immuno-oncology ecosystem.

InCyte Relationship on Checkpoint Modulators for GITR and OX-40

GITR and OX-40 are checkpoint modulators that enhance T-cell activity as opposed to CTLA-4 and PD-1 which dampen the immune response. InCyte dosed the first patient with INCAGN1876, a GITR an agonist antibody, in June. It will begin clinical studies with an OX-40 agonist in 2H, 2016.

Merck Collaboration

Agenus has a collaboration with Merck in which Agenus will develop antibodies for proprietary (and undisclosed) checkpoint targets discovered by Merck. Agenus recently delivered antibody candidates to Merck which triggered a milestone in the agreement. This involved the discovery of a lead antibody candidate and backups to an undisclosed novel target. Merck plans to move its lead candidate into IND enabling studies this year.

Cancer Vaccine Programs

Prophage Vaccines

Agenus has shown in pre-clinical models evidence of enhancing anti-tumor responses through combining Prophage with CTLA-4 or PD-1 blockade or both. Prophage as a single agent has generated strong signals of activity in phase 2 trials in newly diagnosed and recurrent GBM. The addition of a PD-1 antagonist has shown significant synergy in animal models. They expect to begin a controlled study of Prophage plus PD-1 against newly diagnosed glioblastoma in late 2016.

Background on Neoantigen Vaccines

There have been numerous attempts to develop autologous cancer vaccines over the last two decades which incorporate antigens that are specific to a patient’s own cancer cells. To date, none of these approaches has led to a commercially approved drug although some clinical trials have produced encouraging signals of activity. Agenus has been one of the pioneers in this field with its Prophage heat shock-70 protein vaccines. Phase 2 results for Prophage in newly diagnosed and recurrent glioblastoma have been encouraging. Phase 3 trials of Prophage in melanoma and lung cancer failed to achieve primary endpoints, but gave signals of activity in some patient subsets.

Skeptics are quick to hypothesize why cancer vaccines development efforts have been unsuccessful so far. One potential problem they cite is that cancer cells often express the same antigens as normal cells which gives rise to the issue of central tolerance. Nature has designed a mechanism to recognize and eliminate in the thymus (autoreactive) T-cells that target antigens found on normal cells. Hence killer T-cells created by a cancer vaccine which target molecules found in normal cells as well as cancer cells may be eliminated before they can launch an attack against cancer cells. You may wonder why vaccines against pathogens can bypass central tolerance. This is because the pathogen presents only foreign antigens not found in normal cells.

A second problem is peripheral tolerance. This is another process designed by nature in which mature T-cells are controlled by regulatory mechanisms that can upregulate (increase) T-cell activity or downregulate (depress) it. T-cells have molecules on their surface called checkpoint modulators that serve this function. Cancers can sometimes highjack this regulatory system to suppress the T-cell response that is trying to eliminate the cancer. The recent development of checkpoint modulators such as antagonists to the checkpoint modulators CTLA-4 and PD-1 block the ability of cancer cells to downregulate the immune system.

Much of this is biological theory at this point and unlike physics where theory is highly predictive of outcome, scientists are constantly confounded by the failure of biological hypotheses to predict outcomes in vivo. That said, if the detractors are correct we need a way of finding neoantigens that are specific to each patient’s cancer cells and are not present in normal cells. This could lead to a much more therapeutically effective product that could avoid central and peripheral tolerance issues. This is what the excitement about neoantigen vaccines is all about.

So how are neoantigens found and then incorporated in a drug? Scientists first collect tumor tissue through biopsy. They then sequence the DNA of cancer cells and compare this to the DNA of normal cells and use complex algorithms to identify gene mutations in cancer cells. Only a small percentage of mutated genes may actually produce neoantigens that can be targeted. These neoantigens are then synthesized in the laboratory and loaded into a vaccine. The hoped for result is that neoantigen vaccines may overcome the problem of central and peripheral tolerance and be exquisitely effective against cancer cells.

This would be a truly personalized vaccine. However, it is not an easy process. It starts with sequencing a cancer cell’s genome and comparing it to the DNA of a normal cell. The antigens must then be synthesized and loaded into a vaccine. The entire process currently takes two to three months although some scientists believe this can be shortened to as little as one month. Some early stage clinical trials are now underway at Washington University, MD Anderson and Dan Farber.

AutoSynVax Neoantigen Vaccine

Agenus has gained considerable expertise in cancer vaccine development with its heat shock-70 peptide (Prophage) vaccine platform and with its proprietary QS-21 Stimulon adjuvant. This enabled Agenus to develop AutoSynVax, an autologous vaccine targeting cancer neoantigens. The Company expects to enter into a phase 1trial in the next nine months.

Phosphopeptide Neoantigen Vaccines

At the end of 2015, Agenus acquired the private company PhosImmune, which brought an entirely new class of neoantigens to the Agenus portfolio. Through a regulated biochemical function, cancer cells can give rise to phosphorylated non-mutant proteins which present antigen to trigger immune recognition and an attack by the immune system. .

Unlike most neoantigens arising from mutant proteins that are specific to a cancer patient, the phosphopeptide neoantigens are found in many patients with similar tumor types. Agenus is developing various methods of generating immune responses to get a selected proprietary phosphoryl peptide neoantigens. These vaccines would be off the shelf products unlike AutoSynVax and competitive neoantigen vaccines under development which are autologous vaccines.

Tagged as AGEN, Agenus, Agenus development of checkpoint modulators, Agenus development of neonantigen cancer vaccines, Prophage + Categorized as Company Reports, LinkedIn