Agenus: Its Market Leading Position in Immuno-Oncology Makes it A Compelling Investment Story (AGEN, Buy, $3.69)

Investment Thesis in Brief

I continue to recommend Agenus for its impressive technology platforms in immuno-oncology. It is difficult to assign a price target because of the early stage of its pipeline. A principal driving force behind my recommendation is that many large biotechnology and pharmaceutical firms are far behind in the checkpoint modulator and therapeutic cancer vaccine spaces. If they were to acquire Agenus, they could vault to a leadership position. I see a parallel with the Bristol-Myers Squibb decision to acquire Medarex in 2009 for $2.1 billion which led to Bristol becoming the leading factor in the development of checkpoint modulators. My most likely scenario for Agenus is that it is acquired within the next three years and potentially at a Medarex type of valuation. In per share terms this would be $25 which compares to the current price of $3.69.

Immuno-oncology is one of the most dynamic areas of research in the world pharmaceutical industry. I think that Agenus has put together a cutting edge model for an immuno-oncology focused company. Agenus has a platform that almost any large company would covet. It has an antibody drug development capability that makes it a leading player in developing checkpoint modulators. The Company also has over 20 years’ experience in Prophage cancer vaccines and is building strong bioinformatics capabilities that will be important for effective use of its immuno-oncology drugs. I also see considerable potential for combining Prophage with checkpoint modulators. In my view, the immuno-oncology platform of Agenus has meaningfully more potential than the engineered T-cell platforms of Juno and Kite. Yet, Agenus only has a market value of $312 million versus $4.5 billion for Juno and $2.4 billion for Kite.

The most notable risk for Agenus is that the first of its checkpoint modulators is just entering phase 1 trials. There is no human clinical data on these products. My enthusiasm is based on the breadth of the Agenus pipeline which provides many shots on goal and the proven medical benefit of checkpoint modulators developed by Bristol Myers and Merck. An extensive collaboration with InCyte and licensing agreements with the afire said Merck also provides important external validation of the promise of Agenus’ technology. To carry the hockey metaphor further, there are a lot of pucks flying but at this point none are in the net.

The next point to ponder is how long will it take for this broad product portfolio to create clinical data that will begin to define the medical benefit of its many products. Later in this report, I discuss why I think that we could see clinical data within one to two years from the beginning of phase 1 that if positive could move the stock. I also discuss the strategy used by Merck in which it was able to gain approval for Keytruda just three and one-half years after the first patient was dosed in phase 1.

In 1Q, 2016, the FDA approved an IND for AGN 1884, an antibody against the checkpoint CTLA-4; this product is fully owned by Agenus and the first patient was recently dosed. An IND was also approved for INCAGN 1876 which is targeted at GITR. This is part of the InCyte collaboration on five antibodies in which economics will be split 50/50. Agenus expects to begin additional trials of checkpoint modulators in 2016.

In regard to Prophage, Agenus expects to begin a randomized trial in newly diagnosed glioblastoma later this year in combination with a PD-1 checkpoint modulator, either Opdivo or Keytruda. Agenus is continuing to evaluate the best path forward for a potential registrational trial of Prophage in newly diagnosed glioblastoma and will provide an update in the third quarter based on regulatory deliberations and business considerations.

Agenus ended 1Q, 2016 with $148 million of cash and cash equivalents. This balance alone should allow the Company to fund operations through 2H, 2017. There are likely to be cash inflows (perhaps substantial) from licensing or partnering deals during this time frame, but Agenus is not providing any guidance.

Agenus’ Technology Platforms

Agenus has three distinct immunotherapy technology platforms:

- The QS-21 Stimulon adjuvant used in preventative vaccines being developed by other companies, primarily Glaxo,

- The heat shock protein therapeutic cancer vaccine program, which recently augmented with the AntiSynVax program and

- Monoclonal antibodies for T-cell checkpoint modulation.

Agenus monetized the stream of royalties from QS-21 use in two Glaxo preventative vaccines in a deal that brought in $100 million last year. See my report Royalty Deal for QS-21 Adjuvant Use in Two Glaxo Vaccines for more details. There are a broad number of other vaccines in development that use QS-21. This is an interesting and valuable asset, but the more compelling investment pieces are the therapeutic cancer vaccines and checkpoint modulators.

The science upon which the cancer vaccines and checkpoint modulators is based is extremely complex molecular biology and it overstretches my layman’s ability to try to comprehend, let alone explain. Importantly, we are in an early stage of understanding the role of immunotherapy as there is little clinical data. There are all kinds of theoretical predictions, often contradictory, on the potential role of checkpoint modulation, cancer vaccines and other technologies (such as CAR-T) on how they will evolve and interact.

From long experience, I have learned to listen respectfully to key opinion leaders, but to have a high degree of cynicism when they hypothesize on particular drugs before there is meaningful clinical data. Actual clinical results very often confound prevailing dogmas. The one thing that I can say with confidence is that immunotherapy (in the aggregate) while in a nascent stage promises to dramatically reshape and significantly improve drug therapy especially in cancer.

Checkpoint Modulation Drugs

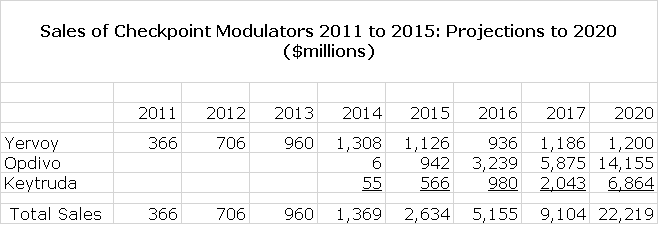

As a starting point, let’s look at Agenus’ position in checkpoint modulator development from a 30,000 foot view. Investors have totally bought into the promise of checkpoint modulation and for good reason. The first checkpoint modulator, Bristol Myers Squibb’s Yervoy was only introduced in 2011 and Bristol-Myers Squibb’s Opdivo and Merck’s Keytruda followed in 2014. Sales of these products have exploded as shown in the following table reaching combined sales of $2.6 billion in 2015 and consensus Street estimates for just these three products is projected to rise to $22 billion in 2020. Street estimates for checkpoint modulators as a class are about $30 billion. For perspective, the current market for cancer drugs is about $80 billion and could reach $140 billion in 2020.

It is important to understand that drug technologies have very long life cycles even as individual drugs within the category come and then go generic. For example, the development of chemotherapeutic agents began over 60 years ago and they remain the backbone of standard of care regimens in many cancers. I suspect that checkpoint modulators will have a similar life span and could become the backbone of cancer therapy over the next 30 years or perhaps much sooner. Probably, they will replace a substantial part of chemotherapy usage in coming years and decades.

The point I am trying to make is that development and commercialization of checkpoint modulator and cancer vaccine drugs could remain vibrant for the next 30 years and we are just at the beginning of their story. Almost all of the major biopharmaceutical companies will want to gain a meaningful position. However, the large companies tend to be slow moving leaving the paradigm changing innovation to smaller, more entrepreneurial companies. They are more likely to be acquirers or licensees of products developed by companies such as Agenus. The central point of my investment thesis on Agenus is that its leading position in drug development in these areas will result in lucrative licensing deals and very likely an outright takeover of the company in the next few years.

Overview of Immuno-Oncology

Agenus has a very promising position in immuno-oncology through its checkpoint modulation and cancer vaccine technologies. If you want some background on immuno-oncology you may want to refer to a report I wrote in January 2015 called Immuno-Oncology Promises to be the Next “Big Thing” In Biotechnology This provides perspective on checkpoint modulation, therapeutic cancer vaccines and other technologies that address immuno-oncology.

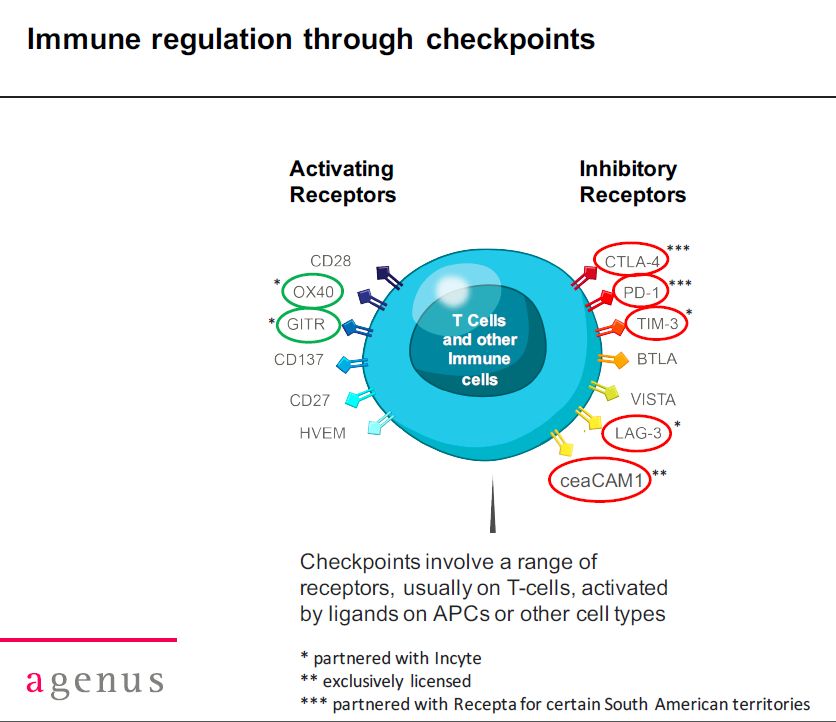

Checkpoint modulation takes advantage of mechanisms used by the human body to regulate the T cell response to cancer; some enhance T-cell activity while others turn down activity. You can think of checkpoint modulations as a thermostat that turns up the heat when it receives a signal and then when the heat reaches a certain levels responds to another signal and turns down the heat. T-cells, of course, play a critical role in defending the body against cancer.

Some T-cell checkpoints (these are cell surface receptors on T-cells) such as CTLA-4 and PD-1 when activated turn down the immune response. Many cancers have found mechanisms that activate these receptors which has the effect of putting a brake on the immune system’s response to cancer. Yervoy is a monoclonal antibody that binds to the CTLA-4 receptor and in doing so prevents it from being activated. Opdivo and Keytruda have a similar effect by binding to the PD-1 receptor. This prevents proteins produced by some cancers from binding to these receptors and turning the immune response that is trying to destroy them.

Drugs against CTLA-4 and PD-1 are checkpoint inhibitors which you can think of as taking the brake off of the immune response. There are other checkpoint receptors that when activated enhance the body’s immune response to cancer which is like hitting the accelerator for the immune system. The result is increased T-cell activity against cancer in both cases. There are many checkpoint modulators that potentially may be therapeutic targets.

Some of the better understood checkpoint modulators are shown in the table below; these are categorized as either activating or inhibitory. The receptors for which Agenus has developed antibodies are encircled. Currently, Agenus has disclosed that it has developed monoclonal antibodies for five inhibitory receptors and two activating receptors. It is also developing two or more antibodies for Merck and I suspect that it is also developing antibodies for (many) other targets. I am not sure if any other company (large or small) can match the breadth of this development effort. This is why I feel Agenus would be so coveted as a licensing partner or as an acquisition.

I want to point out two other issues when thinking about the above table. From a lay perspective, one might think that if you have seen one antibody against a target you have seen them all, but this is incorrect. Antibodies and the receptors they bind to are composed of hundreds, thousands or more atoms and the way they attach to each other can result in a very different drug effect. For example, Agenus has developed two different antibodies to CTLA-4 which are very different from one another and the currently marketed Yervoy which also targets CTLA-4.

Another very important issue is that it is very likely that there will be numerous combinations of checkpoint modulates that provide synergy when combined. We have already seen this in the case in which Yervoy has been combined with Opdivo in treating malignant melanoma which provides better efficacy than either drug alone. Rapid drug development capability is an important medical and commercial advantage in evaluating combinations. At the risk of repeating myself, the breadth and rapidity of Agenus’s development effort is a key strategic advantage.

Rapid Drug Development is Key Advantage for Agenus in Checkpoint Modulation Drug Development

In my judgment, Agenus is not far behind and might be ahead of industry leader Bristol Myers in the sheer number of checkpoint modulators that it has in clinical development. Yes, you read that correctly. This is based on a powerful technology platform that allows for the rapid development of monoclonal antibodies against checkpoint targets. It is one thing to identify a key therapeutic target and quite another to develop an effective antibody. Agenus far surpasses most of the large companies in its ability to create new antibodies against checkpoint targets.

CEO Garo Armen and his management team have made a number of brilliant moves to build this formidable position. In February 2014, Agenus acquired 4-Antibody, a privately owned, European company to obtain its Retrocyte Display platform. This is a proprietary antibody discovery platform designed for the rapid discovery and optimization of fully-human and humanized monoclonal antibodies against a wide array of molecular targets. This platform uses a high-throughput approach incorporating human antibody libraries expressed in mammalian B-lymphocytes. This was complemented by the acquisition of the SECANT yeast display antibody discovery platform from Celexion in April 2015 and then an exclusive license to a phage display library in September 2015. This has resulted in a broad, integrated and highly productive antibody discovery platforms.

Few investors and certainly not I can evaluate the science involved in this antibody development strategy. It is important to look at the external validation by sophisticated third parties (companies) who have turned to Agenus for help in product development. Agenus first announced in April 2014 that it was collaborating with Merck to develop an antibody for an unspecified checkpoint target. Merck expanded this agreement in June 2015 to develop antibodies for other undisclosed targets. In January 2015, an agreement was reached with InCyte, a highly respected, rapidly growing mid cap biotechnology company focused on oncology to develop seven antibodies on a 50/50 economics basis.

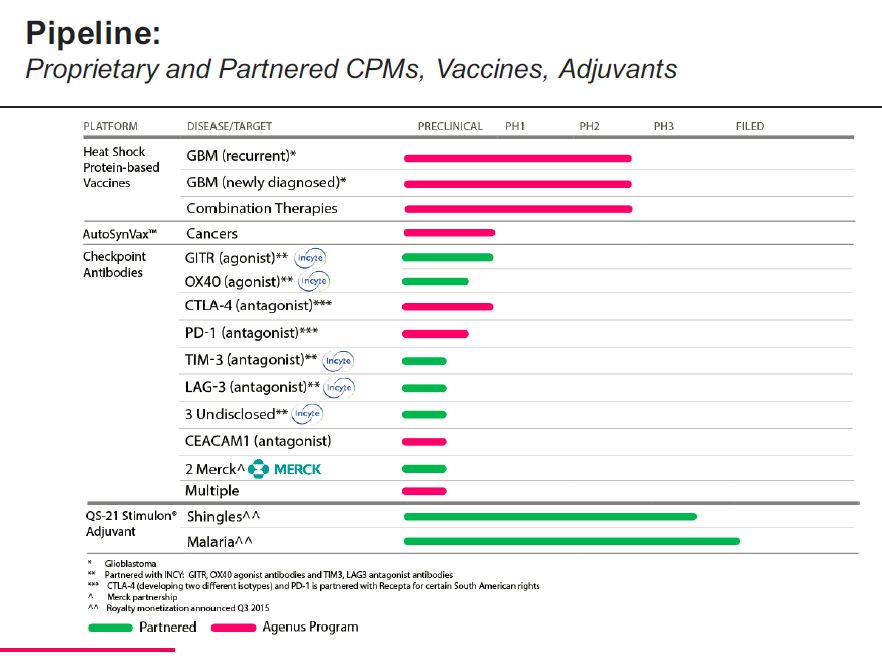

The disclosed pipeline of Agenus is shown in the following table. It also includes the Prophage heat shock cancer vaccine for glioblastoma which I will talk about shortly and the QS21 Stimulon products which I will not talk about.

The above table shows that Agenus is developing four disclosed and three undisclosed checkpoint modulators in an extensive collaboration with InCyte. It also is developing drugs for two undisclosed targets with Merck. For its own account, Agenus is developing two antibodies against CTLA-4, one against PD-1, one against CEACAM and multiple undisclosed targets. This is impressive.

Prophage Cancer Vaccines

In the development of cancer vaccines, Agenus has been one of the pioneers and has the scars to show for it. Because of a long string of failures reaching back over 15 years, cancer vaccines until recently have been written off by investors. For those of you who would like an historical perspective on investor negativism, you might want to read an article I published in 2013 which refuted a blog attack on Agenus by Adam Feuerstein entitled Rebuttal To Attack By Adam Feuerstein on the Company In that article, Feuerstein and his sources (probably short sellers) laughed at Agenus’ work in cancer vaccines. Feurerstein argued that management was deceiving investors and wasting their investment just to keep their jobs. In my interactions with Feuerstein, I have come to believe that he has only a minimal understanding of biotechnology, but he often represents the consensus view of short sellers.

In early 2014, Agenus’ key phase 3 trials of Prophage for the treatment of melanoma and non-small cell lung cancer failed to reach their primary endpoint. See Thoughts on the Stock and Company in the Aftermath of Trial Failure of MAGE-A3 Cancer Vaccine This represented the low point for Prophage, but shortly thereafter the pendulum began to swing the other way as a phase 2 trial of Prophage in glioblastoma gave renewed hope. See my article Encouraging Data on Prophage, But What is the Path Forward This data clearly suggested a highly meaningful improvement in median overall survival and median progression free survival.

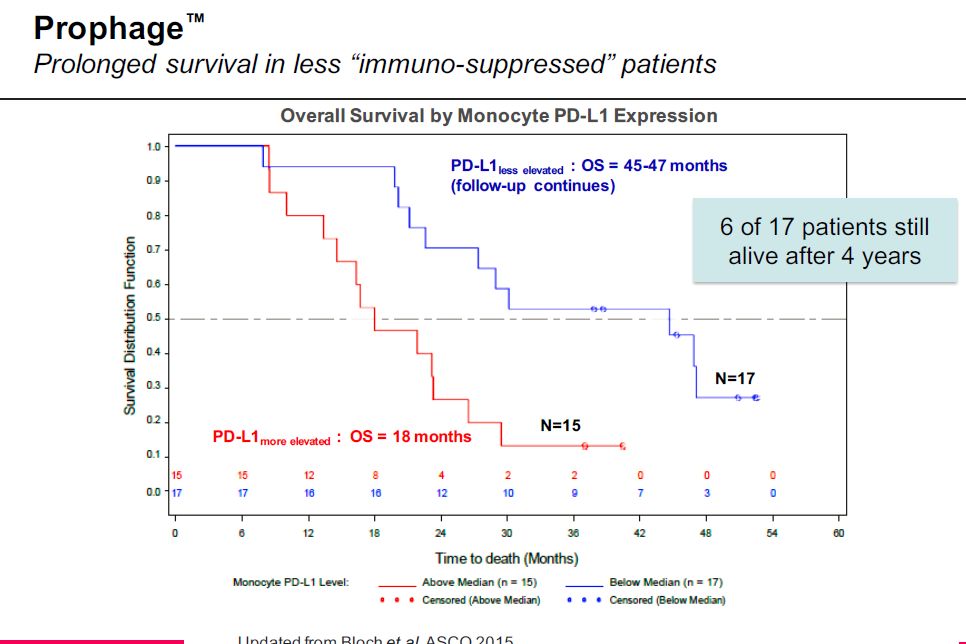

While the Prophage phase 2 data is encouraging, what promises to really capture investors’ attention is the potential synergy between Prophage and checkpoint modulators. In looking at the phase 2 data in glioblastoma, Agenus looked at results for patients with different levels of PDL-1. This data was extremely encouraging that there could be great synergy between Prophage and a checkpoint modulator.

Let me put this in perspective. Certain cancers have found a way to activate the PD-1 receptor and in doing so to turn down the immune response. These cancers produce a protein called PDL-1 (this designates it as the ligand to PD-1). Opdivo and Keytruda block the effect of PDL-1 by occupying the PD-1 receptor and preventing PDL-1 from binding to it.

The Kaplan Meiers curves for the phase 2 data for Prophage as can be seen in the next table showed that when PDL-1 in treated patients is less elevated that survival increases dramatically. This strongly suggests that using Opdivo or Keytruda to block the binding of PDL-1 could be very synergistic with Prophage. Animal data for Northwest Biotherapeutics’ DCVax-L has suggested the same synergy.

If the combination of cancer vaccines with checkpoint modulators emerges as promising which I think is entirely possible, Agenus is at the forefront. I might add that Bristol-Myers Squibb has only recently become vocally positive on cancer vaccines and probably is far behind Agenus in understanding the role of these drugs.

Development of Agenus Products Could Be Quick

The first checkpoint modulator developed by Agenus just entered its first phase 1 human study. The critical question is how long will it take to get these products approved or to the stage of development that investors can assign a reasonable probability for success. Because of the efficacy of Yervoy, Opdivo and Keytruda was signaled in phase 1 trials, I think that if the various drugs in development by Agenus provide signals of efficacy in phase 1 that this will begin to be reflected in the stock price. From the beginning to release of phase 1 results could take one to two years. In the case of Keytruda, it was actually approved in only three and one-half years after it entered phase 1 trials.

The Merck strategy that led to this rapid approval involved an extensive phase 1 program in which the drug was given to 3,500 patients with a variety of different cancers. The approval was based on 173 patients with advanced melanoma who had failed all available treatments. The FDA expedited approval by not insisting on survival as the primary endpoint. Approval was granted on the basis of tumor shrinkage. The results showed that 41 of these 173 patients saw their tumors shrink with a response lasting from 1.4 months to 8.5 months.

The rapid approval of Keytruda is a results of initiatives of the FDA that began in the 1990s which were intended to speed patient access to new cancer therapies. The FDA implemented a two-tiered approval system, providing an accelerated approval track to get new therapies to the market prior to completion of longer-term survival benefit studies. This is followed by a full approval designation when those studies are completed and reviewed.

The FDA also began accepting clinical endpoints other than improvement in survival for accelerated approval, enabling shorter clinical trials and easier enrollment. Surrogate endpoints included response rates (tumor shrinkage as in the case of Keytruda), progression-free survival (time to tumor progression), and quality-of-life benefit. In oncology, the FDA often grants accelerated approval on the basis of a single pivotal trial.

Legislation also was enacted to approve drugs intended to treat serious life threatening medical conditions and address unmet medical needs on a fast-track basis at the request of the product innovator. Provisions of the Fast Track designation include the ability to submit NDA data on a rolling basis and the ability of many cancer drugs to qualify for Priority Review (six-month PDUFA clock). In 2012, FDA introduced the Breakthrough Therapy designation, intended to expedite the development and review of drugs for serious or life-threatening conditions that have shown compelling early signals of clinical efficacy. Breakthrough Therapies benefit from all the Fast Track benefits, as well as intensive FDA advice and communication on the optimal path through development. Numerous cancer drug candidates have won Breakthrough designation, including 18 new designations granted in 2015.

The FDA has also shown readiness to approve oncology drugs for salvage settings with high unmet need based on uncontrolled single trials. Coupled with the accelerated approval timelines established by the FDA, unprecedented efficacy has resulted in a rapid pace of cancer drug approvals. From 2013 through 2015, 18 of the 69 new approvals or label expansions in oncology were based on single-arm trials. These approvals were supported by robust efficacy data, but also by the fact that large, randomized trials were already ongoing.

The ability to identify and target specific molecular and immunological pathways has driven the last five years of cancer drug approvals. The question of what the FDA considers unique diseases or where there a very, very high response rate appears to be very much case dependent. Cases with high unmet need and robust durable responses on a surrogate marker seem best positioned for accelerated approval. In 2015, the FDA approved 20 new drugs and granted 13 label expansions in oncology.

Tagged as AGEN, Agenus, Agenus and InCytre, Agenus checkpoint modulators, Prophage therapeutic cancer vaccines + Categorized as Company Reports, LinkedIn

Another very promising immuno/oncology company that uses killer T cells is called Affimed AFMD Some people feel this is the best immuno cancer technology. Why is Agen a Better bet? Some predictions have AFMD being worth a 1000 dollars per share in 3-4?yrs. Please comment.

Amgen is already doing this with its Bite technology and approved Blincyto for ALL.