NovaBay: Data from Phase II Trial of Auriclosene in Urinary Catheter Blockage and Encrustation is Imminent (NBY, $1.40)

Company Overview and Purpose of the Report

NovaBay (NBY) will be reporting the results of three Phase II clinical trials involving its first in class "non-antibiotic", anti-microbial agent auriclosene (NVC-422) over the next three quarters. The mechanism of action and previously conducted phase I and II trials indicate that it has broad spectrum activity against bacteria, viruses and fungi, while not giving rise to resistance that inevitably arise with other anti-microbial agents.

Auriclosene is being developed: (1) for the dermatological condition- impetigo- as a gel formulation in partnership with Galderma, the world's leading company focused exclusively on dermatology, (2) by NovaBay as an eyedrop for adenoviral conjunctivitis and (3) by NovaBay as an irrigation solution for treating urinary catheter blockage and encrustation (UCBE). NovaBay has not yet developed oral or intravenous dosage forms.

The impetigo and adenoviral conjunctivitis trials are phase IIb trials and the UCBE is a phase II proof of concept trial. NBY has also begun marketing a related product, NeutroPhase®, through a series of global partnerships. This is a proprietary wound cleansing solution composed of pure hypochlorous acid, which was cleared by the FDA through the 510(k) regulatory process.

Topline results for UCBE will probably be reported shortly, impetigo in Q4 2013, and adenoviral conjunctivitis in the first half of 2014. The Company has scheduled an analyst day in New York on September 17 which will focus on UCBE and I think it is fair to assume that data from the recently completed phase II trial will be discussed. This report focuses only on the UCBE indication so that readers can put the forthcoming topline results in perspective; it is not an in-depth review of the Company. For a fuller discussion of the Company and my views on its technology and the potential rewards and risks of its products, the reader should refer to reports published on my website.

This report attempts to put perspective on the UCBE trial design, the possible results and how to interpret them. Understanding clinical trials is more than reading a headline that says the trial was or was not successful. There are more than a few cases in which favorable topline results did not mean that there was a high probability for commercial success. Conversely, negative topline results aren't always a death knell. Apparently failed trials can sometimes provide the evidence needed to conduct future trials that are successful.

In order to assess the outcome of a clinical trial, investors have to understand what the product does, the conduct and design of the trial, the endpoints (clinical results) being studied and how meaningful those endpoints are from both a medical and commercial perspective. The purpose of this report is to discuss these issues as they relate to the UCBE trial, but first I want to review my investment thesis on the Company and my thinking on the value of its pipeline, which I have written about extensively in previous reports; again my previous reports must carefully be read in order to understand my investment thinking on NovaBay and to understand the risks associated with the stock.

Investment Thesis

NovaBay fits my asymmetric investment strategy; its current market capitalization of approximately $77 million. This is based on a current price of $1.40 and fully diluted share count of 55.1 million which assumes that every warrant and option outstanding is exercisable. This seems to me to be a modest valuation for a company that will report out data on three important Phase II trials (two of which are phase IIb) in the next three quarters. I think that success in any one of these trials could lead to NovaBay being a successful investment from the current price level. To reiterate, more detailed analyses on the Company and its products appear in my prior reports that are available on Seeking Alpha and my website and this report focuses only on the UCBE opportunity.

There are several things that appeal to me about the UCBE trial and potential commercialization. Auriclosene is a novel "non-antibiotic" anti-microbial agent that has demonstrated advantages over traditional, resistance-prone, antibiotics and other current agents as I explain shortly in my discussion on the Company's technology platform. I also like the indication of UCBE that is largely off the radar screens of both biotechnology companies and investors. There is a high unmet medical need and yet NovaBay is the only company that I am aware of that is in late stage clinical trials with a new agent in this indication. This is in stark contrast to areas like cancer where literally hundreds of small and almost all large biopharmaceutical companies have active programs.

In this UCBE indication, auriclosene potentially could receive orphan drug designation as the market is about 100,000 patients (more on this later). Assuming success in the phase II trial, success in the subsequent phase III trial and FDA approval, I have put together a model that suggests that NovaBay with adequate financial resources can market this drug with a relatively small proprietary sales force and I project that auriclosene could be approved for UCBE in 2017, reach sales of $53 million in 2020 and contribute $35 million to operating profit; I estimate peak sales at $150 million. The basis for these projections is shown in my initiation report.

I do want to reiterate the risks of investment in NovaBay. The first is that, while each of the trials in impetigo, adenoviral conjunctivitis and UCBE has already shown evidence that the drug could be effective in those indications, there is the possibility that all three trials may ultimately not succeed. There is substantial risk in clinical development and prior positive trial results do not assure success in subsequent trials. However, all three programs have reported successful phase I safety trials and phase II proof of concept trials in the impetigo and adenoviral conjunctivitis trials have given encouraging signals of efficacy.

An important perspective to keep in mind is that NBY's area of drug development, anti-infectives, has historically been the area with the highest clinical success rate. This is because companies focused on topical anti-microbials, such as NBY, know before they begin the first human clinical trial that their compounds kill the pathogens they are targeting. In NBY's case, they have already confirmed auriclosene's anti-viral capabilities against the adenoviruses that cause conjunctivitis, the staphylococcus aureus and MRSA bacteria implicated in impetigo and also the gram negative Proteus mirabilis bacteria that cause urinary catheter blockage and encrustation. Therefore, success in clinical trials is a matter of safety, concentration, formulation and dosing regimen.

There is also a financing risk. NovaBay has not yet been able to attract the following of Wall Street analysts and large number of major institutional investors. This has resulted in a low market capitalization that has made it difficult to attract large amounts of capital for product development. Management has been able to consistently raise enough capital to keep development on track, but not to provide financial comfort. There is no capital required for the impetigo indication that is totally funded by Galderma, but both the UCBE indication and adenoviral indication would require substantial cash outlays if their trial results are encouraging and the programs are taken forward.

Given the substantial market opportunities these products address, it seems reasonable to think that the Company could secure partnerships, if it chose, with major pharma companies for the adenoviral conjunctivitis and UCBE indications that would fund all or most of the clinical and commercialization costs. Obviously, this assumes success in the soon to be reported phase II trials. Management has been conscious of minimizing shareholder dilution. Over the course of its history, NBY has raised a total of $53 million in capital from various financings while corporate partners have invested an additional $100 million in developing NovaBay's technology.

Valuation Methodology for NovaBay

NovaBay is a complex company to value because of the three product opportunities associated with auriclosene (NVC-422) and the additional opportunity of NeutroPhase. Each of these has differing commercial prospects. In order to frame the potential value of each of these assets, I have started with the hypothesis that each of auriclosene clinical trials now underway will be successful and result in approval. I then built a sales model for use in impetigo, viral conjunctivitis and UCBE.

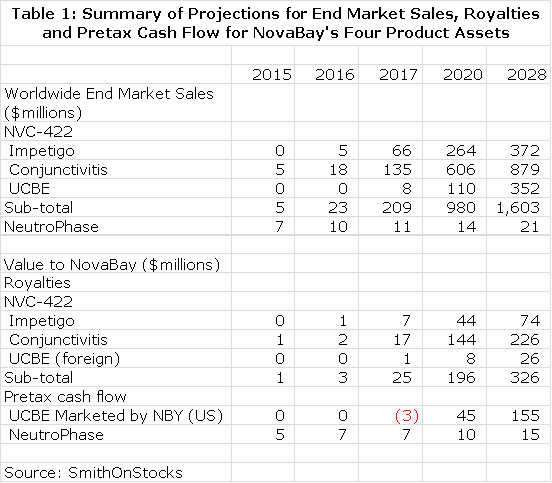

In order to have meaningful confidence in these projections, the phase II trials must be successful as well as the subsequent phase III trials. My assumptions are shown in detail in my basic report of October 30, 2012 and do not appear in this report. I have then estimated what the resultant royalty stream or operating income stream could be over the patent life of the products. This is summarized in Table 1.

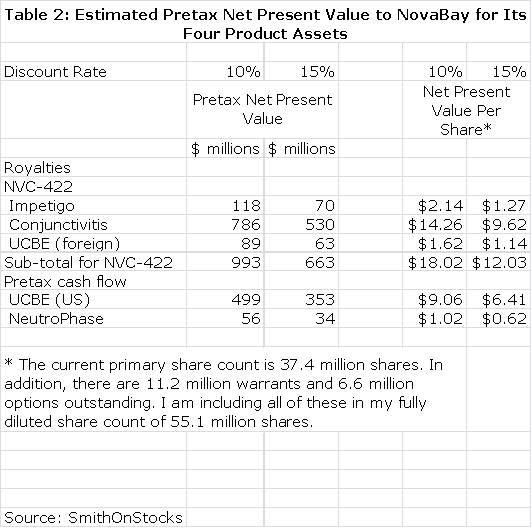

I then discounted the future stream of royalties and operating cash flow to determine a net present value for each product using discount rates of 10% and 15% which again is based on the assumption that the products are successfully commercialized. This seems a reasonable range of discount rates to use as compared to current risk free bond yields of about 3%. This is shown in Table 2. Please note that all calculations of net present value are on a pretax basis.

This should not be taken to imply that this is estimated value of these products at this stage of development as the discount rates applied to these opportunities would be much higher owing to the uncertainty of the clinical trial outcomes of current and future trials. These estimates assume success in the clinical trial programs and approval by the FDA. Although I would not be writing this report if I thought that it was the case, there is the possibility that none of these products are successfully developed.

The above calculations highlight the commercial potential of the NBY's four products and suggest that success in both the conjunctivitis and UCBE indications are potential homerun opportunities for the Company. I want to re-emphasize however, that trials in the impetigo, adenoviral conjunctivitis and UCBE indications have not yet provided outcomes that can give investors a high level of confidence that these products will be successful. This is why the Company trades at a microcap valuation. However, over the next three quarters, clinical trial results should enable investors to make much better assessments of these product opportunities.

In the event that all three product development efforts are unsuccessful, I think there is some downside protection from NeutroPhase which is approved and is being rolled out on a global basis through several partnerships, but the stock would obviously experience a sharp selloff.

Perspective on NovaBay's Technology Platform and Its Products

Over hundreds of millions of years, the immune system has evolved to defend humans from the non-stop attack of pathogens such as bacteria, viruses, fungi and yeast which see the human body as a luxuriant feeding ground. Exponential growth in understanding the functioning of the human immune system is leading to the development of new and novel therapeutic advances. One of the most promising research approaches in biotechnology is immunotherapy and NovaBay is a leading participant. This is how I became interested in the Company.

NBY's technology base stems from an understanding of the action of neutrophils in the body. The first line of defense against pathogens is the barrier formed by skin and mucous tissue. When a pathogen breaches this barrier and causes an infection, the immune system springs into action and the first immune cell encountered by the pathogen is usually a white blood cell called a neutrophil. The neutrophil surrounds and ingests the pathogen and then produces chemicals that act to kill the pathogen and inactivate toxins produced by it. Unlike antibiotics and other anti-microbial agents developed by man, pathogens have not been able to evolve resistance to the mechanism of action used by neutrophils.

The technology base of NovaBay is based on an understanding of toxic molecules that neutrophils produce to kill bacteria and inactivate their toxins. It is specifically focused on hypochlorous acid (HOCl) and its derivative molecules, N-chlorotaurine (NCT) and N,N-dichlorotaurine (NNDCT). In their natural state, all three of these molecules are very short lived so that they must be delivered by the neutrophil to the site of the infection; this short half-life renders them incompatible with large-scale commercialization. NovaBay has discovered how to stabilize these molecules allowing for their use in drugs that can be delivered topically as solutions and gels for the treatment of diseases caused by infectious pathogens while maintaining the critical characteristic of very low likelihood that the pathogens will develop resistance to them.

The key product for NovaBay is auriclosene (NVC-422) which is a stabilized form of NNDCT. This molecule is actually the basis of three distinct drug candidates as it is being developed for dermatological applications as a gel formulation, as an eye drop for adenoviral conjunctivitis and as an irrigation solution for treating urinary catheter blockage and encrustation. While the molecule is the same within each indication, the disease states are quite different, and so are the formulations and dosing regimens. Each of these formulations represents a unique and promising commercial opportunity. The remainder of this report focuses on UCBE.

What is Urinary Catheter Encrustation and Blockade or UCBE?

Urination involves the release of urine from the bladder through the urethra to outside of the body. In normal healthy humans, urination is under voluntary control. However, for some patients such as the elderly and those suffering from neurological damage due to disease or trauma, urination becomes involuntary. The main organs involved in urination are the urinary bladder and the urethra. In males urine is ejected from the bladder via the urethra and through the penis while in females the opening of the urethra is in the vulva.

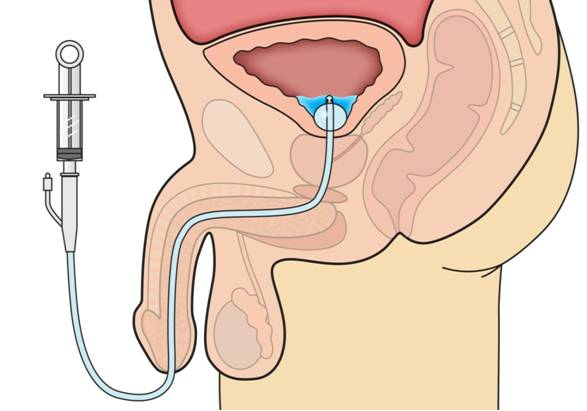

Patients who have lost voluntary control of urination often require the insertion of a catheter to void the bladder of urine. This can be achieved with an intermittent catheter which is inserted when it is desired to void the bladder. However, transurethral catheters are usually used in chronic conditions. These can be inserted into the urethra through the penis or vulva or a surgical opening can be made above the pubic bone to insert a suprapubic catheter into the urethra. The most commonly used transurethral catheter is the Foley catheter which has one tube that empties urine and a second with a balloon at its end through which saline is instilled to inflate a balloon which holds the catheter in place in the bladder.

The following image shows the basis of the Foley catheter. In the lower right hand corner, the components of a Foley catheter are shown. The catheter is inserted through the urethra which in the male runs through the penis and into the bladder. Once inside the bladder, the balloon is inflated to hold the catheter in place. Urine in the bladder flows through eyeholes in the catheter above the balloon and is collected in a bag attached to the leg of the patient. At the upper right hand corner of the image, the balloon and the eyeholes through which the urine drains are shown in closer detail. Pay attention to the eyeholes as they are important to UCBE. In the upper, middle part of the image is the cross section of the catheter; the larger opening is for urine to flow through (or to irrigate the catheter) and the smaller is used to inflate the balloon. The image on the left depicts urine flow as the catheter becomes encrusted.

A major problem with catheter use is that it provides easy access for bacteria to migrate upwards from skin and external surfaces into the bladder. Also, the retention balloon of the Foley catheter creates stagnant urine pools around it in the bladder. This provides bacteria a luxuriant environment for growth so that in a matter of a few hours, rapid replication sometimes can result in millions of bacteria which are adept at adhering to the bladder surface. Once attached, they multiply very rapidly and some species, especially Proteus mirabilis, cover themselves with a protecting gel or biofilm. This leads to the formation of large colonies that can contain as many as one billion bacteria per centimeter.

This can lead to urinary tract infections which are known as catheter-associated urinary tract infections (CAUTI). Particles containing bacteria can flake off of bladder stones and pass into catheters where they readily adhere to the catheter surface and create new biofilm colonies that cause urinary catheter blockage and encrustation.

Who Is At Risk of UCBE

Industry estimates and supporting research by NovaBay suggests that there are over 335,000 patients in the US that have permanently implanted catheters and that approximately 100,000 of these patients are chronically affected with UCBE. UCBE can lead to urine being blocked in the bladder and causing it to distend. If the catheter is not replaced, the urine can back-up into the kidney and cause an infection.

Patients most at risk for UCBE come from diverse conditions that cause neurological damage such as spinal cord injury, stroke, multiple sclerosis or just old age. It is a large and diverse group ranging from young paraplegics who have suffered a sports injury to immobile bed ridden elderly men and women.

History of NovaBay's UCBE Program

Because auriclosene can only be applied topically, NovaBay had to develop applications suitable for topical dosing such as the gel used in the impetigo program and the eyedrop in adenoviral conjunctivitis program. Another possibility that the Company looked at was an irrigating solution that could be used to treat CAUTI. The impetus for this program was a call from a UCLA professor who questioned whether auriclosene could be used in the bladder to eliminate the bacteria that caused biofilm colonies to form in the urine. The question was whether auriclosene could prevent this biofilm formation.

This led to studies that were conducted at Baylor to study auriclosene in CAUTI. These studies began in 2008 when the first patients were enrolled in the urology phase of auriclosene development. Data from a small study with results in two patients was reported in 2010. These suggested that auriclosene could significantly reduce bacteriuria or the number of colony forming bacterial units. The hypothesis was that by reducing the bacterial count, auriclosene could prevent CAUTI.

After discussions with the FDA, NovaBay came to the conclusion that the CAUTI indication was a non-starter. The FDA would not accept the surrogate marker of reduced colony forming units as an endpoint in a trial. They informed NovaBay that a trial with auriclosene for CAUTI would have to show actual reductions in the occurrence of urinary tract infections as compared to standard of care through a non-inferiority or superiority trial. This would have required a large clinical trial far beyond the resources of NovaBay to conduct.

NovaBay was searching for a different approach to use the anti-microbial activity of auriclosene versus bacteria in the urine. At the time they received a call from a physician who was treating a catheterized patient with NeutroPhase for a wound the patient had suffered. The patient was also catheterized and the physician reported that there were sand-like particles coming out in her urine.

Ron Najafi, CEO of NovaBay, went to see the patient who had since been discharged from the hospital and was at home. He looked at the catheter which was translucent and saw the "sand" in the urine. He sent the material to an NBY microbiologist who determined that the "sand" was material that was flaking off from stones in the bladder. They then deduced that this sand-like material was the cause of encrustation in the catheter that could lead to blockage. The bladder stones are actually crystalline bacterial films. They are a source of infection in the bladder and that can actually break off from the stone in the bladder, attach to the catheter and block it. There are multiple sizes of particles and some could cause blockage around the eyehole of the catheter. The following image shows this.

Current Treatments for UCBE and the Potential Role of Auriclosene

An intermittent catheter is a tiny catheter that is inserted periodically through the urethra into the bladder. Indwelling catheters are either transurethral or suprapubic in which the catheter is inserted through the skin above the pubic bones into the urethra. The suprapubic catheters are bigger and are believed to be less subject to blockage and infection.

The current standard of care for treating UCBE involves removing the problematic catheter and replacing it with a new one. The patients most at risk of UCBE are those with bladder stones and in these patients the catheter should be changed weekly, bi-weekly or monthly. This generally requires the patient going to a clinic or if there is blockage to an emergency room. Urologists try to keep the catheter in as long as possible and hopefully for a month or more. The cost of replacing a catheter in the clinic or emergency room can be approximately $350. Also, the insertion and extraction of catheters can cause damage to the urethral tissue.

Irrigation of the catheter while it is in place is another option, but there are significant limiting issues. Renacidin is the only FDA-approved agent for UCBE. It is a citric acid solution that dissolves calcium which is the main structural element of bladder and kidney stones. It has no effect on the bacteria which cause the stones to form. The product label recommends two to three rinses per day. Saline and mildly acidic rinses such as vinegar are also used to irrigate catheters. Because these are not approved for this indication, there is no label recommendation on how frequently they should be used, but optimum use would likely require one to three irrigations per day.

In actuality, it is extremely difficult for patients (who often have severe neurological impairment) and even home health care nurses to rinse the catheter even once a day. As a result, catheters are most often irrigated two to three times per week instead of two to three times per day. This is sub-optimal at best and ineffective at worst.

Patients at risk of catheter blockage often have no sensation that lets them know that the catheter is blocked and the bladder is being choked with urine. This can lead to serious medical complications as the urine carrying bacteria backs up into the kidney. This can lead to an infection and also autonomic dysreflexia, a serious condition that is characterized by a sharp rise in blood pressure and multiple headaches. Chronic sufferers of UCBE live in dread of this.

Renacidin and saline irrigation solutions work primarily to dissolve and wash away encrustations but have no effect on the bacteria, principally Proteus mirabilis that produce the crystalline biofilms that create bladder stones. Auriclosene has the potential to prevent the growth of urinary pathogens, including Proteus mirabilis, which is the root cause of encrustation, as well as rinsing away the encrustations.

Auriclosene has the potential for keeping the catheter patent longer, resulting in fewer catheter changes and potentially lower incidence of urinary tract infections and improved quality of life. The goal of auriclosene is to reduce the number of irrigations to somewhere between one and three times per week which would be a significant improvement and commercial advantage.

Phase II Study Has Been Completed But Not Yet Reported

The phase II study in UCBE has been completed and the final part is now in the process of being unblinded; it was conducted in three parts. Part A was a double blind, placebo controlled crossover study that included patients with both transurethral and suprapubic catheters. The cross-over study means that patients were initially randomly treated with auriclosene or saline rinses without patients or physicians knowing whether the patient received auriclosene or saline. The patients received 7 treatments over the two week interval. At the end of two weeks or if the catheter became blocked before then, the catheter was removed and examined for encrustation. The patients were then switched to the other treatment.

There were 20 patients enrolled in Part A and 13 of these patients incurred blockage. Of these 13 or 80% did not get blockage while on auriclosene. This indicates that 7 of the 20 patients were adequately treated with both saline and auriclosene. In the 13 patients who did experience blockage, 10 were blocked on saline but not auriclosene and 3 were blocked on both auriclosene and saline. Saline does show some effectiveness with three irrigations per week, but is significantly less than auriclosene.

The Company then moved on to Part B of the study. This essentially replicated part A, but was done with a different, stronger formulation of auriclosene. Data from this part of the trial has not yet been disclosed.

The final section of the study, Part C, used the improved formulation employed in Part B. The catheters were left in place for four weeks or until they became blocked. The 40 patients received 8 treatments over four weeks or two per week versus three per week in Part A and Part B. NovaBay believes that there is a sharp increase in catheter encrustation if catheters are left in place for four weeks instead of two.

The data from Part C will be from the 80 catheters used in the trial. Each patient will contribute one catheter used while on auriclosene and one while on saline. Analyses such as a Kaplan-Meier plot will track the number of days to blockage on auriclosene as compared to saline resulting in an endpoint of median time to catheter blockage that will hopefully favor auriclosene.

Another data point that will be looked at is the mean area of encrustation. In a Foley catheter, a balloon that is inflated with saline holds the catheter in place in the bladder. Immediately above the balloon is an eyehole opening in the catheter that drains urine from the bladder to a collection bag outside the body. (These eyeholes can be seen in the previous image.) The two pre-selected cross sectional areas to measure obstruction of the catheter due to encrustation are at the eyehole and an area about 2 millimeters below the eyehole. Experience has taught urologists that these are the two most frequent areas at which blockage and encrustation occur.

One of the two cross sectional areas will be more encrusted than the other and will determine the rate of urine flow. The amount of cross sectional area blocked at that site will be included in the primary outcome measurement in the trial. For example, the cross sectional area blocked at the eyehole might be 75% and the area below at 55%. The 75% would be the area defined as cross sectional blockage included in the final analysis. Of course, complete blockage at one of the two sites would be 100% and could occur before the end of the treatment period.

As an additional secondary endpoint, the Company will also report the number of catheters that had to be removed when patients were on auriclosene and then on saline. This is an indicator of effectiveness, but there is a possibility that catheters are removed for some reason other than blockage (such as kinking).

What Are the Chances for Success?

Results from earlier in vitro and human studies are encouraging and suggest that there is a good potential for success. In vitro studies with auriclosene have shown that it is capable of penetrating a biofilm and effectively killing the contained microbes. With anti-bacterial agents, efficacy in laboratory models is a good predictor that the drug will be effective in humans if it can be delivered in sufficient amounts to the site of the bacterial infection.

Part A of the Phase 2 study also produced encouraging signals of efficacy. However, it was a two-week study primarily intended to determine safety and this was not sufficient time to demonstrate meaningful efficacy. Still, investigators found that in the saline patients who were experiencing catheter blockage, auriclosene was subsequently successful in preventing blockage in 80% of those patients. These results encouraged the Company to move on to a new more potent formulation in Part B and in Part C and to extend the study to 4 weeks instead of 2 weeks and reduce the frequency of irrigation from 3 to 2 irrigations per week.

This was by no means proof of concept, but it does seem to indicate a reasonable chance for successful results when Part C top-line results are released. There is risk in this trial as in all trials. Past attempts to treat UCBE with antibiotics and catheters coated with antibiotics have not been successful although one would think that this should be an effective approach. This may be due to the dynamics of urine flow and bacterial encrustation in the catheter that makes it difficult to get a drug to or in the site of encrustation. If so, auriclosene might be proven ineffective for the same reasons. In any event, this trial will provide the signal of activity or lack of activity to determine the next step.

Path Forward

If the Company does indeed receive encouraging data, it likely will be able to meet with the FDA to discuss the next steps for approval. The trial would likely use the same study design as was used in Part C of the Phase 2 study. The FDA might want complete blockage of the catheter as an end point. The number of trials required (one or two) and the number of patients involved in each trial will be dependent on the data from Phase II and FDA direction. In the best case, the Company believes that it might be possible to establish efficacy in one trial involving 100 patients based on a rough extrapolation of the data from Part C of the Phase II study.

Beyond trials for establishing efficacy, there are also two other important issues to deal with. It is unclear how many patients the FDA might want to have treated to establish safety but it could be substantially greater than that required to establish efficacy. Another uncertainty is that NovaBay will have a commercial manufacturing process in place for most of the trial although they might start a phase 3 trial with material from a compounding pharmacy. Even though this means that material for the trial will come from two manufacturing sources, most of the product would come from the commercial process. NBY feels that they could bridge and show the material is comparable from both process but this is a risk.

The combination of positive data and a successful interaction with the FDA possibly could lead to a New Drug Application with the FDA possibly as early as 2016, which could lead to commercial sales in 2017 as shown in my model. However, there is the potential for the NDA filing and possible FDA approval to slip a year or two for reasons such as the manufacturing issue just cited.

Commercial Potential

I have made some projections in my initiation report for the commercial opportunity in treating UCBE in the United States. I assume that there are currently 100,000 long-term catheter use patients who experience chronic UCBE that would require twice-a-week treatment. At a retail price of $15 per treatment this represents an annual addressable market of $156 million. The price per treatment could be meaningfully higher; it all depends on how the product performs. Regardless of any other potential future uses of the drug, I think that this would be a significant commercial opportunity for NovaBay.

Although it has not announced its plans for commercialization, I believe that NovaBay could form its own sales force to market auriclosene in the US. About 80% of potential U.S. sales for spinal cord injury (SCI) are concentrated in 50 clinical sites so that a small sales force of 20 salespeople could reach the majority of the SCI market. The cost per salesperson would be about $200,000 annually and the cost of goods sold would be about 5% of sales. At a sales level of $4.2 million, auriclosene could cover the cost of goods sold and the cost of the sales force.

For the year ended December 31, 2012, NovaBay's selling, general and administrative expenses were approximately $6.0 million. Research & development spending for the same period was an additional $9.3 million. Just for the sake of illustration, let's assume that these expenses remain constant through the launch of auriclosene and beyond. This suggests that auriclosene sales of $20 million in the US could bring the company as a whole to breakeven. At $20 million of auriclosene sales, this would represent just 8% of the addressable market. At $100 million of sales or 40% of the market, auriclosene could produce pre-tax profits of nearly $80 million.

Tagged as Auriclosene, clinical trials, Galderma, NBY, NovaBay, Novabay Pharmaceuticals, UCBE + Categorized as Company Reports