NovaBay Swings for the Fences with NVC-422 Trial In Viral Conjunctivitis

Investment Thesis

Although NovaBay is a small company as judged by its $43 million market capitalization, it is complex to analyze. It is developing one molecule, NVC-422, for three separate indications, impetigo, viral conjunctivitis and urinary encrustation and blockage. While the molecule is the same, the disease states are quite different as is the formulation: NVC-422 for impetigo uses a topical gel, for viral conjunctivitis it is an eye drop and for urinary encrustation and blockade, it is a liquid instillate. Each of these opportunities requires a separate, distinct analysis. And to complicate matters further, NovaBay has just launched a second product, NeutroPhase, for wound cleansing. Analyzing NovaBay requires the same effort as analyzing four individual companies

I have just written an extensive report (over 40 pages) on my website called NovaBay's Robust Clinical Pipeline Approaches Critical Clinical Trial Results in 2013. Because of the complexity of this report, I first published on Seeking Alpha a report that summarized my sales projections and investment conclusions. I noted in that report that I would follow-up with four shorter reports, each focusing on one aspect of the company. For perspective, I would urge readers to refer to my Seeking Alpha summary piece or my website report.

My first follow-up report was on the use of NVC-422 to treat impetigo. This second follow-up is on NVC-422 development in viral conjunctivitis. There are no approved drugs for treating viral conjunctivitis resulting in a significant unmet need and a huge market opportunity. Success in this indication would be a homerun for NovaBay.

NovaBay is now conducting a phase IIb/III trial that began in May 2012 and could report topline results in 4Q, 2013 or 1Q, 2014. I am cautious on the potential for success in this trial. The product was previously licensed to Alcon which conducted a phase II proof of concept trial. The trial had design issues that affected enrollment and Alcon stopped the trial at a time when only 81 patients were available for evaluation with 42 on NVC-422 and 39 on control. In this limited sample size, the trial did not meet its primary endpoint and Alcon decided to give the product back to NovaBay.

NovaBay has carefully analyzed the data and found some encouragement from sub-set analysis. There was a particularly positive signal in a subset of 30 patients with epidemic keratoconjunctivitis or EKC. Many forms of viral conjunctivitis resolve on their own, but it is EKC that usually drives a patient to a physician; it is also highly contagious so that infections can spread quickly between family members or members of a group. NovaBay also came up with an enrollment process that should lead to quicker and more extensive enrollment. The company decided that a new phase IIb/III trial would have a reasonable chance of success.

If this trial is successful, NovaBay could probably partner this product in quick order. I would expect that the terms of the deal, including the upfront payment could be substantial, perhaps on the order of $25 to $50 million. Bear in mind that the current market capitalization is only $37 million. I believe that if this first trial is successful, NovaBay's partner would have to do a second confirmatory trial to gain approval. If both trials are successful, I think marketing in the US and Europe could start in 2016. There is some chance that Brazil might approve the product on the basis of one trial that would result in marketing in 2015.

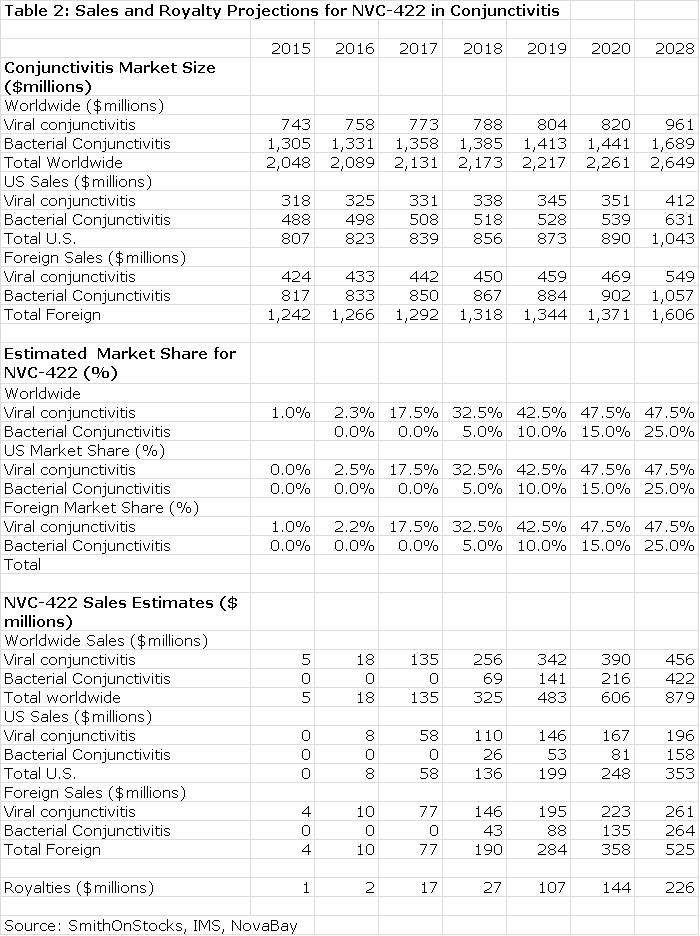

In this report, I outline my assumptions that result in projections for worldwide sales of $16 million in 2016, $606 million in 2020 and $879 million in 2028; this obviously assumes success in the clinical trials. I have assumed royalty rates similar to the Galderma deal. I then discounted the royalties using a 10% to 15% discount rate to arrive at a net present value of $520 million to $786 million on a pretax basis. Again, the current market capitalization for NovaBay is $43 million on an after tax basis.

What Is Conjunctivitis?

Conjunctivitis is an infection of the conjunctiva, the membrane that lines the whites of the eye and the inner eyelids. It is about equally caused by bacteria and certain serotypes (variations) of the adenovirus family. More commonly known as pink eye, conjunctivitis usually starts in one eye as watering, itching and irritation. Most cases resolve on their own using only treatments that rinse and cleanse the eye.

Bacterial conjunctivitis can be treated with antibiotic eyedrops, but there is no approved treatment for adenoviral conjunctivitis. Primary care physicians do not have the time or capability to conduct the tests needed to accurately determine whether the infection is caused by bacteria or adenovirus so they must treat empirically based on their clinical judgment. As a consequence, adenoviral conjunctivitis is often mistakenly treated with antibiotics which are ineffective.

Conjunctivitis sometimes involves the cornea; the transparent membrane that covers the iris, pupil, and anterior chamber of the eye. Adenoviral infections involving the cornea are a more severe type of infection that is called epidemic keratoconjunctivitis or EKC. Symptoms include red eye, blurred vision, tearing, discharge, eyelash matting or crusting and the sensation of a foreign body in the eye. EKC is highly contagious. One eye is usually infected first with the infection spreading to the other eye within two to three days in about 60% of cases. Moreover, half of people in close proximity such as family or sports team members usually become infected.

EKC can result in severe vision impairment in infected patients. In approximately 20-50% of patients, corneal opacities are developed due to sub-epithelial infiltrates (SEIs) which can cause blurred vision. Epidemic keratoconjunctivitis is commonly associated with adenoviral serotypes 8, 19 and sometimes 37.

A Prior Trial of NVC-422 Conducted By Alcon Failed To Achieve the Primary Endpoints

Alcon, a division of Novartis, licensed NCV-422 for use in ophthalmology. It then designed and conducted a trial aimed at gaining approval in adenoviral conjunctivitis. The presumed mode of action of NVC-422 suggests that it would be effective in conjunctivitis whether caused by bacteria or adenoviruses. However, the great unmet medical need is for a treatment for adenoviral conjunctivitis and running a trial designed to show efficacy for all types of conjunctivitis would have been prohibitively large and complex.

The trial that Alcon designed allowed physicians to enter all patients that they clinically diagnosed as having adenoviral conjunctivitis. After the patients were enrolled, precise PCR technology was used to determine if patients actually had adenoviral infections and the serotype causing it. The study was planned to identify and evaluate 220 patients with confirmed adenoviral infection.

After enrolling 452 patients, an interim analysis showed that only 81 patients (42 on NVC-422 and 39 on control) had adenoviral infections confirmed by PCR. The primary endpoint of the trial was to show a 20% difference between NVC-422 and control in eradication of adenovirus at day 18 after treatment. The trial showed only a 7% difference and did not meet its primary endpoint. Alcon ended the trial and shortly afterwards returned the product to NovaBay.

NovaBay is Conducting a New Trial on Its Own

Experienced biotechnology investors have seen that the failure of a clinical trial does not always spell the end of a drug. Sometimes, careful analysis of the trial data will point out flaws in the trial design and identify subsets of patients who benefitted from the treatment. This can lead to the design of a new trial with a reasonable chance of success.

NovaBay's analysis of the 81 patients with adenoviral infections in the Alcon trial revealed that 30 had EKC. In this subgroup there was a 15% difference in viral eradication at day 18, which was close to the 20% proscribed endpoint. In addition, 92% of EKC patients treated with NVC-422 reported resolution of blurred vision versus 50% in the control group and 60% of NVC-422 patients experienced resolution of SEIs versus only 30% on control. These were encouraging findings as EKC is the condition that is most likely to result in severe damage to the vision of infected patients, and is of primary concern to the ophthalmology community.

Based on these findings, NovaBay decided to go forward with a second trial, which began enrollment in May 2012. This is designed to enroll 450 patients in the US, India and Brazil. One important difference in this second trial is that patients entering must be confirmed as having adenoviral conjunctivitis through a test that takes about ten minutes to perform. This diagnosis must later be confirmed by a more precise PCR test, but it should result in almost all enrolled patients having adenoviral infections as opposed to only 18% in the Alcon trial.

This second trial is also designed to show that NVC-422 is effective against those serotypes that cause EKC and the goal is to get this included in the package insert. In actual clinical practice, physicians will not know if they are treating adenoviral conjunctivitis caused by serotypes that lead to EKC or for that matter if the infections are caused by bacteria or adenovirus. They will elect to treat empirically and in order to make sure that they are covering all possibilities they will probably use a combination of a drug approved for bacterial conjunctivitis and NVC-422 to make sure that they cover EKC.

Enrollment for the new phase II trial called BAYnovation started in May of 2012 and could complete in mid-2013. Topline results from the trial could be released in 4Q, 2013 or 1Q, 2014. If the results are positive, this trial could be considered a pivotal trial, but the FDA will almost certainly require a second confirmatory trial. Assuming timelines similar to the first trial, results from the second trial could be available and an NDA filing made in 2H, 2014. Again assuming success in the second trial, NVC-422 could be approved and marketed in 2016.

The Market Opportunity in Conjunctivitis

The addressable market for NVC-422 in conjunctivitis could be huge although current data on the size of the market is sketchy. If efficacy against EKC is established in the current trial, it would be particularly important. Because conjunctivitis is a disease that resolves most often on its own, it is not a reportable disease to the CDC and this also prevents reporting of EKC, which often requires treatment.

In Japan, EKC is considered a reportable disease and there are 1 million cases recorded annually. Extrapolating this incidence to the US, suggests that there could be as many as 3.7 million cases in the US. Because of the epidemic nature of EKC, an infection in one member of a family could lead to other members of the family being treated resulting in a multiplier effect on the first prescription. The same reasoning applies to military personnel, sports and other activities in which there is close physical contact.

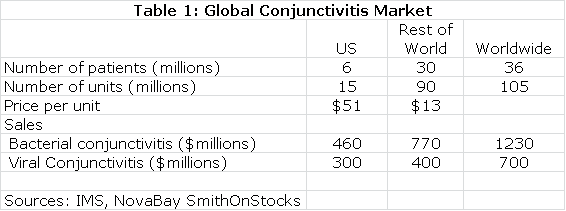

Estimates on the size of the global market for conjunctivitis are shown in the following table:

The next table summarizes my sales and royalty projections for the US and International markets. It is possible that there will be enough patients treated in the Brazilian segment of the phase IIb/III trial to allow for regulatory submission based on just one trial and this could lead to a launch and an estimated $5 million of sales in Brazil in 2015. I think that Japan will require trials in Japanese patients that would result in commercialization in 2017. In the US, Europe and all other markets, I am assuming launches in 2016. This, of course, assumes success in the clinical trials.

Because there are no approved products for viral conjunctivitis, I think that there would be rapid penetration in both the US and international markets. I also would expect NVC-422 to be used widely for treating bacterial conjunctivitis as well because there is no easy way to determine whether the infection is viral or bacterial and NVC-422 is probably effective in both.

The Value of NVC-422 Used to Treat Conjunctivitis

Table 2 assumes that NVC-422 will be partnered in both the US and international markets. Currently, NovaBay controls all worldwide rights. I estimate that the royalty rate will be comparable to that paid by Galderma for the impetigo indication; it starts at 10% and escalates to 30% on sales above $300 million.

The royalty stream for the period 2016 through 2028 can be discounted to arrive at a net present value. Using a discount rate of 10%, the net present pretax value of the royalty stream is $786 million which compares to the current market capitalization of $37 million. Using a discount rate of 15% produces a net present pretax value of $530 million.

Tagged as NovaBay + Categorized as Company Reports