Cytokinetics: Estimating a Potential 2025 Price Target of $220 Based Only on the Potential for Tirasemtiv (CYTK, Buy, $13.00) and Ignoring Omecamtiv Mecarbil and CK-107

Key Points:

- Cytokinetics is likely to report results from the phase 3 VITALITY-ALS trial in early December 2017. I believe that this trial has a good chance of hitting the primary endpoint of sustained vital capacity (SVC) and gaining approval. The economic consequences for CYTK shareholders are enormous.

- In this report, I estimate a 2025 price target for CYTK based only on tirasemtiv and ignoring any contribution from omecamtiv mecarbil, CK-107 or other potential pipeline product. Based on an assumption of 70% penetration of the ALS market, my target price for CYTK in 2025, as explained in this report, is $220 per share which would represent a 42% CAGR in stock price over the 2017 to 2025 time period.

- While this report focuses only on tirasemtiv, I think that both omecamtiv mecarbil and CK-107 can provide enormous additional value.

- In a just published report, using a similar analysis, I estimate that omecamtiv mecarbil alone could result in a $172 per share in 2025.

- I want to caution that while these price targets give the appearance of great precision, they represent what I think could occur if the phase 3 trials of omecamtiv mecarbil and tirasemtiv are successful. In the event of success, these price targets are meant to convey a sense of the magnitude of the possible impact on the stock price.

- There can be no guarantee that any of these compounds will be successfully developed, but CYTK has three powerful shots on goal. If any one of these three are successful, this could be a very, very good stock and if all three are successful, it could be an absolute moonshot of a stock.

Obvious Unmet Medical Need in ALS

Amyotrophic lateral sclerosis (ALS), also called Lou Gehrig's disease, is a progressive, always fatal, neurological disease that affects about 25,000 Americans with 6,500 new cases reported each year. It is a disease that inexorably destroys motor neurons in the spinal cord. These neurons project their axons from the spine to control voluntary and involuntary muscle contractions throughout the body. ALS progressively damages and kills motor neurons leading to a progressive loss of control and atrophy in muscles throughout the body.

The major effect of ALS is loss of control over bodily functions involving muscles. It usually does not affect cognition or the sensations of sight, touch, smell and taste so that mentally alert patients are trapped in a dysfunctional, dying body. About 75% of patients first lose control of voluntary movement in the arms and legs. Others may initially experience problems in swallowing and chewing and a few start with breathing problems. Regardless of where symptoms originate, the disease inexorably spreads. Effects on swallowing and chewing can cause choking and aspiration of food into the lungs. In the terminal stages of the disease, most patients are maintained on feeding tubes and mechanical ventilators. The principal cause of death from ALS is respiratory failure or pneumonia, usually within three to five years of diagnosis.

Rilutek (riluzole) is the only drug approved for the treatment of ALS. Its controversial approval was based on two clinical trials. The primary endpoint was the need for tracheostomy or death. Based on the log rank statistical test, Rilutek failed to reach the primary endpoint on either study with p=0.12 and p=0.076. However, combining results of the studies and analyzing them with the Wilcoxon statistical test produced a p value of 0.05 and the FDA approved the drug on this basis. Rilutek appeared to increase median survival by 90 days. It is widely used in ALS but only because there is nothing else.

SVC is the Key to the VITALITY-ALS Phase 3 Trial

VITALITY-ALS builds on the previous phase 2b trial BENEFIT-ALS conducted by CYTK. This trial failed to reach the primary endpoint of improvement in the ALSFRS-r scale which is based on a composite score for 12 important measures that affect the lives of ALS patients. FDA has required this as the endpoint for all phase 3 ALS trials, but no drug, including tirasemtiv, reached this goal. CYTK in connection with key opinion leaders took an exhaustive look at the BENEFIT-ALS data and came up with two key hypotheses. One was that some of the measures in ALSFRS-r change so slowly that improvement cannot be seen in the course of the ALS trials that industry had undertaken which were for a year or less. The second was based on the observation that there was a highly, statistically significant improvement in the prospectively defined secondary endpoint of SVC, a widely used measure of respiratory function.

Cytokinetics and key opinion leaders came to the conclusion that SVC is a better measure of respiratory function and this is the primary endpoint of VITALITY-ALS.I discussed the data and thinking that led to this decision in an earlier report and I would urge you to click on this link for much more detail. .

There is some degree of risk to VITALITY-ALS in that the FDA has not yet officially endorsed SVC as a primary endpoint. It is a surrogate measure, not a hard endpoint like death or need for mechanical ventilation. CYTK believes that if the SVC primary endpoint is reached that the FDA will likely accept the result and approve tirasemtiv providing that some of the key secondary endpoints are reached. This previously published report describes the secondary endpoints of VITALITY-ALS

Cytokinetics Provides Guidance for Tirasemtiv Sales Potential in the US in 2025

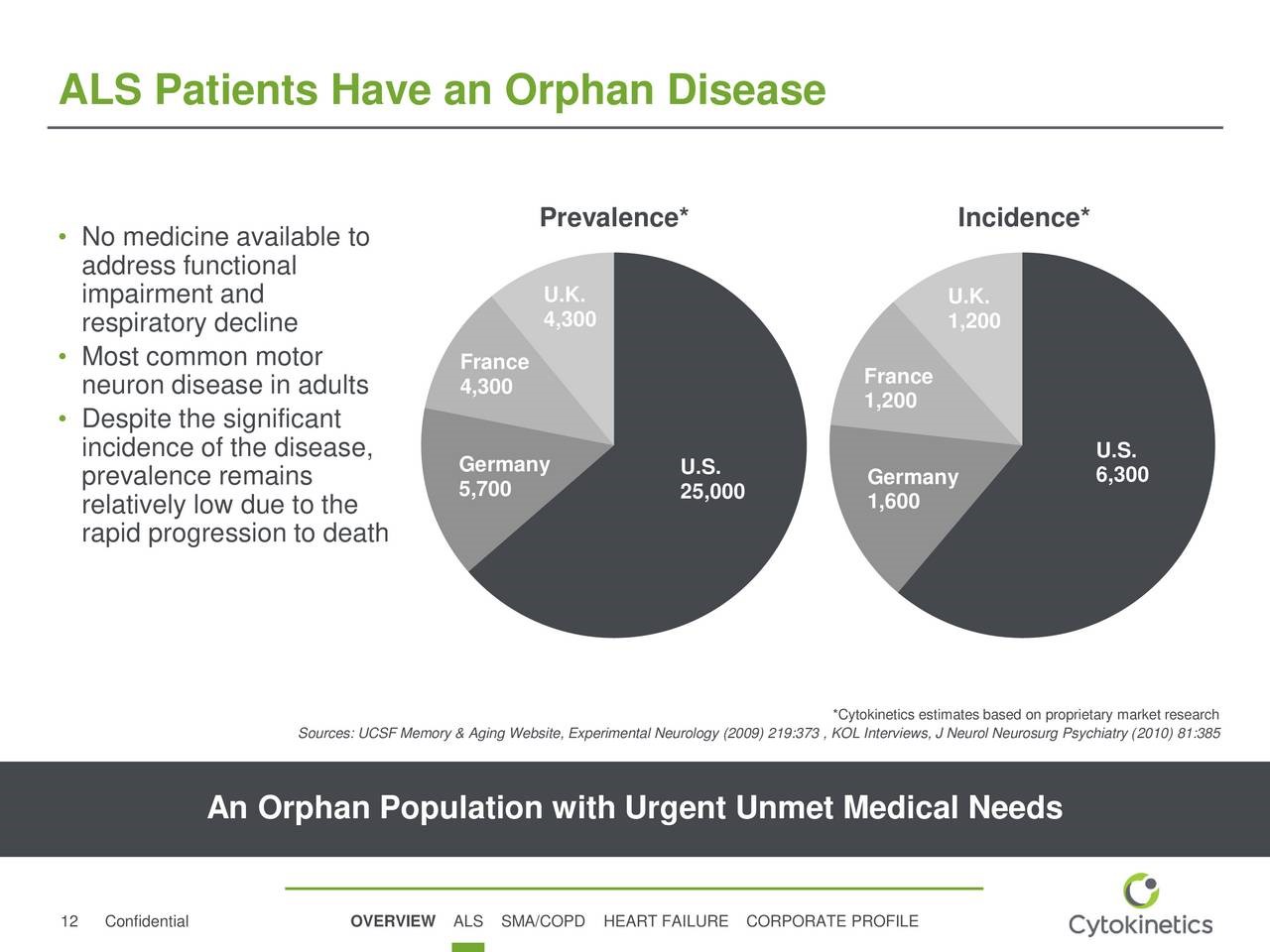

Cytokinetics in a recent presentation provided useful information on the prevalence and incidence of ALS in the US, UK, Germany and France. It is an orphan disease with an incidence of 6300 in the US and combined incidence of 4000 in the UK, Germany and France. The respective prevalence numbers are 25,000 and 14,300 respectively. This is shown in the following table.

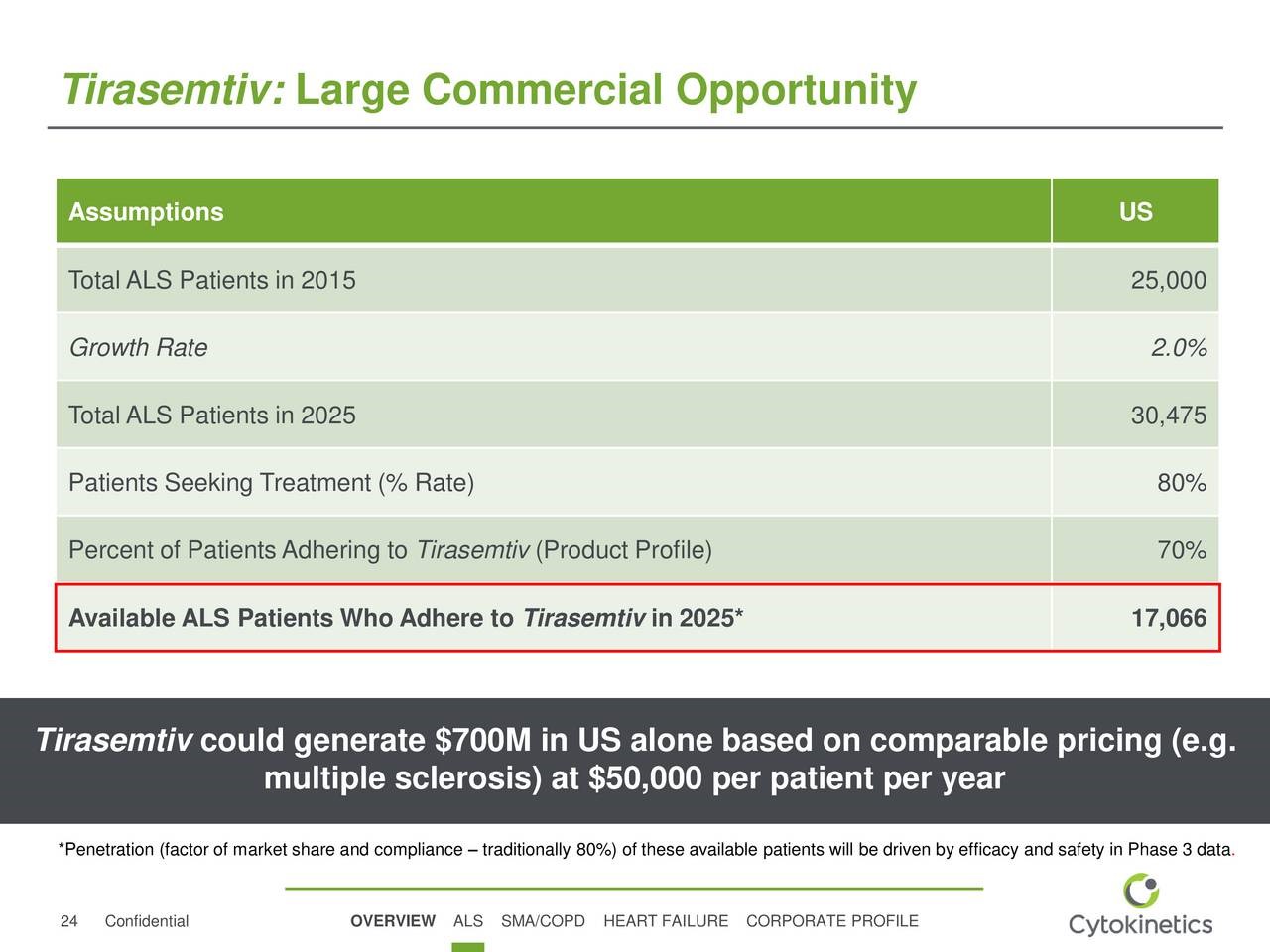

Cytokinetics Estimates for Potential Sales of Tirasemtiv in the US

CYTK has presented an estimate for potential sales of tirasemtiv in the US if the VITALITY-ALS trial leads to approval. Management suggests that it could be used in 70% of the 30,475 patients projected to have ALS in the US in 2025. Using a price of $50,000 per year of treatment, which is low in comparison to most other drugs for orphan indications, this would result in tirasemtiv sales of $700 million. Sales potential in Europe as a whole is generally comparable to the US ($700 million in this case) and sales in the remainder of the world are generally 20% of the US ($140 million). With these assumptions, tirasemtiv would record US sales of $700 million in 2025 and foreign sales of $840 million.

How Much Could Tirasemtiv Contribute to Cytokinetics Net Income in 2025?

For the sake of answering this question, I am going to do a calculation that translates tirasemtiv sales into net income for Cytokinetics in the US. Remember that Cytokinetics has retained all rights in the US and Europe and has given Astellas an option to market tirasemtiv in the remainder of the world.

At $700 million of US sales in 2025, here is how I see the cost structure:

- Cost of goods sold would probably be 10% of sales or less,

- S,G & A would be 30%, and

- Ongoing R&D efforts to expand clinical usage of might be 10%.

Based on these assumptions, the operating margin would be 50% of sales and based on $700 million of sales, this would amount to $350 million of US operating profits. Using a Trump-like tax rate of 23%, this could contribute $270 million to net income.

Cytokinetics might elect to market tirasemtiv on its own outside of the US, but I am assuming that they will license it. I think that they could command a royalty rate of 25% or higher as they would be delivering an approved product. If so this would produce $210 million of operating income. Again using a 23% tax rate, this would result in $162 million.

The total contribution to net income in 2025 from tirasemtiv would be $432 million based on these assumptions.

Price Target for Cytokinetics in 2025 Based Only on Tirasemtiv Penetrating 70% of Worldwide ALS Market

At this point in time, CYTK has 40.6 million shares outstanding, 3.7 million options and 2.0 million warrants. The potential share count then is 46.3 million shares. At the current stock price of $12.90, the fully diluted market capitalization is $597 million.

What kind of multiple might the market place on $432 million of net income in 2025? Under the assumptions I have used, tirasemtiv growth would likely be moderating to 10% to 15% on an annual basis because of the high rate of market penetration assumed. I would estimate that it would be awarded a P/E of about 20 if today’s market conditions apply in 2025. This would result in a market capitalization of $12.1 billion.

The next question to ask is how many shares might be outstanding in 2025. Cytokinetics has a strong balance sheet with cash and equivalents of $164 million at yearend 2016 and the subsequent receipt of $100 million of cash from Royalty Partners. Management indicated that this will fund operations for at least 24 months. Will CYTK issue more shares between now and 2015? They probably will, but there are many different scenarios that will govern this and it is very difficult to make any meaningful estimate. I am arbitrarily assuming that there will be 55 million shares outstanding in 2025.

Based on an estimated market capitalization of $12.1 billion in 2025 and 55 million shares outstanding, I calculate a price target of $220 per share in 2025 for Cytokinetics based only on tirasemtiv alone and ascribing no potential for any other products. I think that omecamtiv mecarbil and CK-107 are also potential blockbusters. I just wanted to isolate the effect of tirasemtiv. This represents a 42% compounded annual increase in stock price per year over the next 8 years and supports my contention that CYTK is extremely attractive based only on the potential for tirasemtiv.

Tagged as cytk, Cytokinetics, tirasemtiv + Categorized as Company Reports, LinkedIn