Alimera Sciences: Will The Launch of Iluvien Be Disappointing to Investors? (ALIM, Neutral, $5.53)

Investment Issues

The investment outlook for Alimera (ALIM) is completely dependent on the commercialization of Iluvien, an ophthalmic implant for the treatment of diabetic macular edema (DME); there is no pipeline. Alimera licensed this product from pSivida (PSDV) and is commercializing it on a worldwide basis. The product has been launched in Germany, the UK and Portugal; sales have been modest so far but they are building. The US launch of Iluvien will begin in 1Q, 2015 and the progress of that launch will be absolutely critical to the performance of the stock of Alimera and quite important to pSivida. The initial launch faces significant hurdles and while I believe that Iluvien is destined to become an important part of the DME treatment paradigm, the initial launch will be affected by issues which I am about to discuss that could meaningfully slow the uptake and perhaps result in investor concern.

How Does Iluvien Fit Into the Treatment Paradigm for Diabetic Macular Edema?

At this early date, there are uncertainties on how Iluvien fits into the clinical paradigm for the treatment of diabetic macular edema. There is universal acceptance that steroid therapy is very effective in DME, but the question is does this benefit outweigh the risk and where does it fit in the treatment paradigm? There is a growing hypothesis based on results on the FAME phase 3 results which were the basis for Iluvien’s approval that the early stages of diabetic macular edema are characterized by leaky blood vessels that can be treated with photocoagulation and the anti-VEGF drugs Lucentis, Eylea and Avastin. However, after about three years, the disease seems to evolve into an inflammatory condition that will only respond to steroids. If this is so, this would be a significant segment of the market with unmet need where Iluvien’s benefit meaningfully outweighs risk.

There are two risks. The most alarming one is that steroids like Iluvien can cause an increase in intraocular pressure which results in glaucoma that can damage the ocular nerve and lead to vision loss. There is no specific level of elevated eye pressure that definitely leads to glaucoma and glaucoma can occur in patients with normal pressure. However, an increase in pressure definitely increases the risk. The other risk is cataracts, but this is not as big an issue. Surgery is the only way to remove a cataract; it works well and improves vision. Surgery is often not needed or can be delayed for months or years as many people with cataracts get along very well with the help of eyeglasses, contacts, and other vision aids.

Steroid injections with a hypodermic needle have never been clinically tested and approved for DME and of course, the ocular implants Ozurdex and Iluvien were only recently approved. Hence, there are no guidelines on how to use these steroid products in DME. Based on a small sample of ophthalmologists, I get the very strong impression that they are reluctant or scared to use steroids because of the side effect issues. The fear of side effects is probably more acute with a long acting implant like Iluvien than with hypodermic injections or the shorter acting Ozurdex implant.

Allergan’s (AGN) Ozurdex was approved for DME in June 2014 and the question is how will physicians view it against Iluvien? Once a physician has made the decision to go with a steroid, it is likely that he will choose either the Ozurdex or Iluvien implant. I have seen in my research that Ozurdex injections are given at anywhere from 3 to 9 months intervals with a mean of 6 months while 75% of patients given Iluvien require only one injection every three years. Iluvien based on my research seems a little more effective. The less frequent administration requirement for Iluvien is a very meaningful benefit for patients and care givers. On the other hand, if side effects occur the patient remains at risk much longer with Iluvien. Ozurdex is biodegradable whereas Iluvien is not. Later in this report, I discuss this competition in more depth.

The FDA has given Iluvien a broad and favorable label that says that it can be used in patients who have previously been treated with corticosteroid therapy and did not experience an increase in intraocular pressure. Alimera believes that based on results in the phase 3 trials of Iluvien that 62% of DME patients do not experience an increase in intraocular pressure. I have great confidence that the decision by the highly risk adverse FDA to give Iluvien this positive label will eventually overcome the reluctance of ophthalmologists to use steroids and will lead to an important role for Iluvien in DME. However, this may take some time.

As Always with New Products There Are Reimbursement Issues

It is increasingly the case that new products in the earliest stages of a launch fail to meet investor expectations in the first year or two due to barriers put in place by managed care. Alimera’s management has said that at the expected price of $8,000 per three year course of therapy and because it initially will be used on a limited basis that Iluvien will not be closely watched and hindered by managed care in its launch phase. I am skeptical of this view.

Managed care through experience has developed a game plan to purposely slow product launches Managed care likes to take its time in putting a product on formulary at which time, if the product is prescribed in accordance with the label payment is routine. In the time before formulary approval is obtained, physicians must jump through documentation hoops in order for the product to be reimbursed. This discourages prescribing. Negotiating contracts to get Iluvien on formulary will be time consuming and frustrating and could take many months in some cases. Some insurers as a hard rule won’t put a new product on their formulary for six months following launch.

Another tactic favored by managed care is the use of a co-pay and I wouldn’t be surprised if it places a 20% co-pay on Iluvien. Because DME is not a rapidly progressing disease, physicians and patients faced with a $1,600 or so co-pay may not have the urgency to immediately begin treatment. This was cited by Regeneron as a reason that the launch of Eylea in DME last year was disappointing relative to expectations.

Most insurers require step therapy which requires the use of available, cheaper therapies if they are available. However, this is a problem for managed care in that steroids given by hypodermic needles are not approved for DME while the anti-VEGF’s are more expensive. Also, Ozurdex carries about the same price as Iluvien. These issues may actually work in Iluvien’s favor.

Alimera’s Balance Sheet is Strained

Alimera ended 3Q, 2014 with $61.4 million of cash. In December, they raised $50 million through a convertible debt offering with Deerfield Management. I estimate that the 4Q, 2014 cash burn will be about $7.8 million so that Alimera could start 2015 with about $103 million of cash.

In the final section of this report, I have presented my sales and earnings projections for 2015, 2016 and 2017 that are the basis for the comments I am about to make on cash burn. Please read that section carefully as it goes into great detail on how difficult it is to make projections and management of Alimera is not providing sales guidance. At this point in time, I have low confidence in my projections. The medical acceptance and reimbursement issues as just outlined make projections extremely difficult, but these are my best guesses.

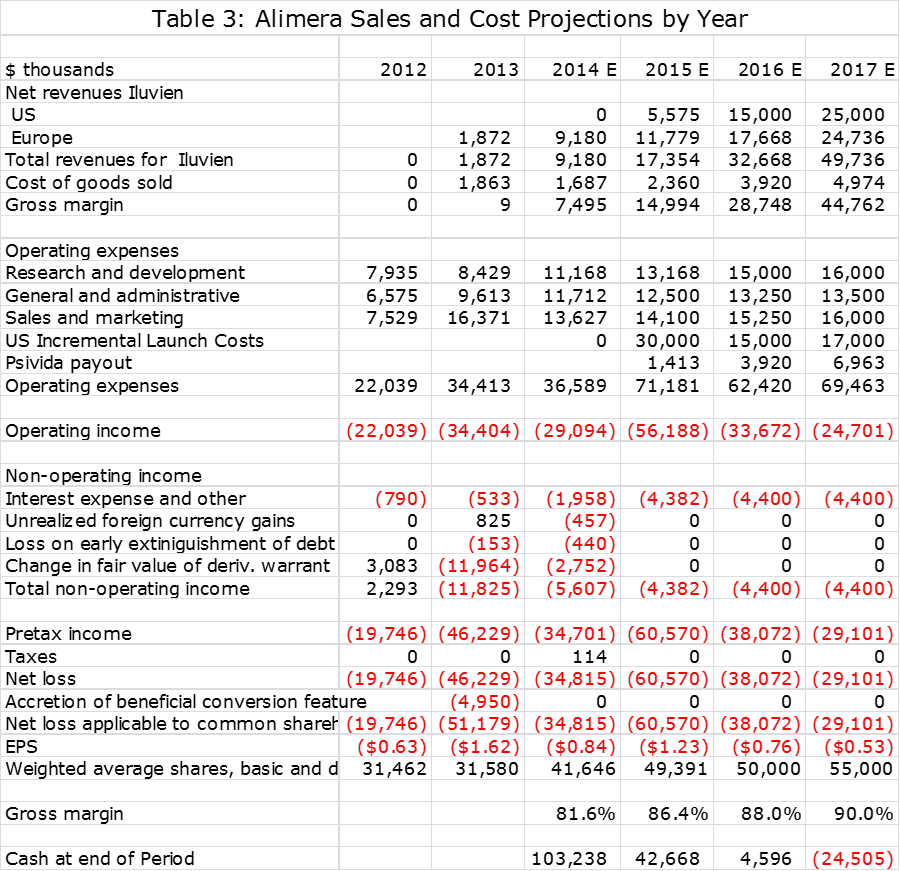

I am estimating that Iluvien will achieve $17 million of worldwide sales in 2015, $33 million in 2016 and $49 million in 2017. Based on my sales and cost projections I think that Alimera will burn through $60 million of cash in 2015 resulting in a yearend 2015 cash position of about $43 million. I further project a cash burn of $38 million in 2016 resulting in yearend 2016 cash of $5 million.

If my projections prove correct, Alimera will probably have to raise more capital by mid-2016, perhaps as much as $50 million. If the launch goes slowly as I fear, this fund raising might be done under duress; also, the balance sheet is quite strained. The Company has $34 million of debt and $50 million of preferred stock that has preference over equity. This could result in a dilutive equity offering or taking on even more debt.

Investment Conclusions for Alimera and pSivida

There are just too many near term uncertainties with Iluvien for me to recommend purchase of Alimera. I am quick to admit that I have low confidence in my sales and earnings projections, but if they are anywhere in the ballpark, I can’t see Alimera’s stock performing well and the overhang of the need to raise capital could weigh further on the stock. This causes me to take a wait and see position on the stock.

pSivida is in a different position than Alimera. I am estimating that even with the modest sales projections that I am using for Iluvien that it will receive revenues of $1.4 million in 2015, $3.9 million in 2016 and $7.0 million in 2017; these revenues are tantamount to pretax profit. Also, it does not have the financing issues that Alimera faces. Any funds needed to fund the launch of Iluvien are the responsibility of Alimera. Finally, pSivida’s pipeline with Medidur and the Tethadur technology is quite promising.

I do believe that Iluvien has the potential to be an important product for the treatment of diabetic macular edema and in my latest report, I estimated that worldwide sales could reach $100 to $200 million in both the US and Europe by 2020 which could translate into $30 to $60 million of pretax profits for pSivida. I like the stock for the long term, but feel that the stock will be hindered in the near term by the issues weighing on Alimera. I am not recommending new purchases at this time but if I held the stock in my portfolio I would retain it. I anticipate upgrading the stock at some future time after the course of the Iluvien launch becomes clearer and is reflected in the stock price of pSivida.

Iluvien’s Worldwide Commercial Status

Iluvien is now approved for marketing in Austria, Belgium, Denmark, France, Germany, Ireland, Italy, the Netherlands, Norway, Portugal, Spain, Sweden, the United Kingdom and the United States. Iluvien has received regulatory approval in 12 countries in Europe. However, commercialization in Europe also requires negotiating reimbursement from national health systems, which can be a long and laborious process.

Alimera was successful in gaining adequate reimbursement levels and began selling Iluvien in Germany and the UK in 2013; it recently began selling in Portugal. In other key markets, notably France, it is still in reimbursement discussions. Iluvien was approved in the US in September 2014 and will begin marketing in 1Q, 2015.

What Is Diabetic Macular Edema (DME)?

The retina is a thin film at the back of the eye which captures the images that humans see. The macula is a tiny oval-shaped pigmented area near the center of the retina with a diameter of about 5.5 mm. Near the macula’s center is the fovea, a small pit that contains the largest concentration of cone cells in the eye. Cone cells are photoreceptor cells that are responsible for color sensitivity and vision. There are about six to seven million cone cells in a human eye and most are concentrated in the macula.

A serious complication of diabetes is that chronically elevated levels of blood sugar can cause structural damage to the inner lining of blood vessels in the retina leading to blood vessel permeability (leakage).This leakage can result in a breakdown of the blood-retina barrier and allow fluid and proteins to leak into the retina. This causes the macula to swell and bulge, distorting nerve cells and causing a decrease in visual acuity and sometimes blindness. Roughly 8% of the U.S. population is diabetic, and I have seen studies that suggest that 7% of diabetics develop DME; however, not all of these cases are clinically significant and demand immediate treatment.

Treatment Options for Diabetic Macular Edema

The first treatment option for DME is usually laser photocoagulation that uses an intense beam of light to burn small areas of the retina and the abnormal blood vessels beneath the macula. The burns form scar tissue that seals the blood vessels, keeping them from leaking. If vision continues to deteriorate, physicians usually add or switch to the drugs Lucentis, Eylea and Avastin which are referred to as anti-VEGF products. Vascular endothelial growth factor (VEGF) is a naturally occurring family of growth factors in the body that contribute to the vascular disruptions and leakage that characterize DME, as well as the formation of new blood vessels (angiogenesis). As the name implies, the anti-VEGFs block this process.

Laser photocoagulation and the anti-VEGF products are both aimed at preventing leakage from the blood vessels into the eye and in the case of the anti-VEGFs also blocking the creation of leaky new blood vessels. The third treatment option is steroids which address another cause of DME which is inflammation. Steroids have widespread actions that affect gene expression pathways involving inflammation as well as angiogenesis, oxidative stress, and apoptosis. Steroids are often the most effective therapy, especially in later stage disease, but their propensity to cause an increase in intraocular pressure and increase the rate of formation of cataracts means that most physicians reserve their use until patients begin to progress following laser photocoagulation and anti-VEGF therapy.

What Is the Size of the DME Market?

Alimera estimates that there are 575,000 patients with clinically significant DME in the US and that the incidence of new cases of clinically significant diabetic macular edema is more than 115,000 new cases per year. They believe there is a similar number in the 17 countries in the EU. The price of Iluvien is $8,000 to $9,000 per implant; one could model any amount of penetration and it would suggest a pretty exciting opportunity. A 1% penetration of the US market would lead to $46 million as would 1% penetration in Europe. Later in this report, I will address DME patients for whom the benefit to risk ratio of steroid therapy may be most favorable.

Drug Delivery to the Back of the Eye

As with the brain, the eye is protected by barriers from systemic blood circulation. This makes it difficult to deliver anti-VEGF drugs and steroids for diseases that affect the posterior or back of the eye (most importantly the retina) at effective dose levels and with acceptable side effects. Eye drop formulations have also been unsuccessful in delivering adequate amounts of drugs into the vitreous fluid of the eye and then further back to the retina. This means that the anti-VEGF products and steroids must be given by an intravitreal (directly into the eyeball) injection sometimes as often as on a monthly basis.

Iluvien is an implant containing the steroid fluocinolone that is delivered through a small 25 gauge needle that can be administered in a physician’s office. The Iluvien insert is a tiny cylindrical tube, 3.5 mm (9/64 0f an inch) in length and 0.37mm (1/64 of an inch) in diameter. The eye is anesthetized and the doctor injects the implant about halfway back in the eye. After the needle is pulled out, the sclera (the supporting wall of the eyeball) seals on its own without the need for stitching. The implant holds about 190 micrograms of the steroid fluocinolone and releases about 0.23 micrograms each day giving the product about a two to three year life. The implant is not bioerodible and remains in the vitreous bed. The material used in Iluvien is poyimide, the same material used in intraocular lenses and which are, of course, permanent. Lens using this material have been used for over 70 years and are inert and quite safe. If absolutely required, the implant can be removed by surgery.

There are other branded steroid products that are used in DME. Ozurdex is a biodegradable implant acquired by Allergan that was approved for DME in June 2014. In its clinical trials, the mean length of time between implants was about 8 to 9 months. Some key opinion leaders have commented that in actual clinical practice that Ozurdex is often given at intervals of six months or as frequent as 3 to 4 months. Alcon introduced Triescence, a branded version of triamcinolone given by hypodermic needle, in 2007 and Allergan introduced a similar product called Trivaris in 2008. They are not approved for DME although they are used off-label. Triescence and Trivaris require three to six injections per year.

Comparing the Ozurdex and Iluvien Implants

There were two phase 3 trials of Iluvien called the FAME trials which showed that about 29% of patients on Iluvien achieved a 15 letter improvement as compared to 16% in the placebo group; this was highly statistically significant at p=0.002. The control group in this trial was actually not a true placebo group as they had been treated with lasers or anti-VEGFs. Approximately 65% had received laser photocoagulation and another 37% had laser photocoagulation plus an anti-VEGF (usually Avastin) or an intravitreal triamcinolone injection.

For comparison, in the Ozurdex phase 3 trials, the high dosage implant containing 0.7 mg of dexamethasone resulted in the percentage of patients achieving ≥15-letter improvement at the end of three years was 22% the high dose of 0.7 mg and for the low dose 0.35 mg was 18.2%. This compares to 29% for Iluvien high dose that Alimera will market.

Unlike Ozurdex, Iluvien is not biodegradable. Iluvien uses the steroid fluocinolone and Ozurdex uses dexamethasone. The mean length of time between implants was 8 to 9 months for Ozurdex (I previously pointed out that in actual clinical practice it may be administered more frequently) and 75% of patients required just one Iluvien implant in the three year trial.

Here is how I stack up the differentiations between the products:

- Iluvien seems somewhat more effective as 29% of Iluvien patients had ≥15-letter improvement at the end of three years versus 22% for the high dose Ozurdex and 18% for low dose. This is a 31% to 64% improvement in efficacy.

- If side effects develop, the length of time that the patient is exposed and must be treated is shorter for Ozurdex and this might be an advantage. Some physicians might worry that with Iluvien drug will be released and if side effects will occur they must be treated for about three years. The side effects are similar between the two drugs but there is less time of exposure with Ozurdex

- The requirement to come back to the physician’s office for new Ozurdex implants every 3 to 9 months is a greater burden on care givers and patients than Iluvien in which 75% of patients require just one implant over three years.

- I am not sure as to whether there are any advantages to using dexamethasone versus fluocinolone.

- In terms of price, Ozurdex is priced at about $2,000 per dose. If dosed every nine months, its cost per year would be $2,700 per year or $8,100 over three years. If Ozurdex has to be given at four month intervals, it would cost $6,000 per year or $18,000 over three years.

- The cost for more offices visits increases the price for Ozurdex relative to Iluvien.

- The biodegrability of Ozurdex may be a small advantage. Each implant of Iluvien leaves a device the size of thick false eyelash. However, there is not that much concern about interactions with the immune system as Iluvien uses the same inert material that is used in artificial lenses.

As an additional comparison, the injectable triamcinolone (steroid) products, Triescence and Trivaris require 3 to 6 injections per year and cost $500 to $1,000 per year and $1,500 to $3,000 over three years. This suggests a lower price than Iluvien, but with the burden of frequent eye injections and office visits. Also, these drugs have not been approved for diabetic macular edema, although they are widely used off-label.

What is the US Addressable Market for Iluvien?

Alimera will launch Iluvien in the U.S. during the first quarter of 2015. The indication is for the treatment of diabetic macular edema in patients who have been previously treated with a course of corticosteroids and did not have a clinically significant rise in intraocular pressure. Alimera says that based on its data that 62% of patients who use corticosteroids have no increase in intraocular pressure and of those who did, the vast majority were controlled by intraocular pressure lowering (IOP) medications. Alimera suggests that doctors may want to use Ozurdex or the injectable steroid products as a diagnostic to see which patients experience an increase in intraocular pressure and then switch those patients who don’t experience increased intraocular pressure to Iluvien.

Obviously, the immediate market for Iluvien is the bolus of patients who have received previous steroid therapy and have not experienced an increase in IOP as per the label. These would be patients whose vision was deteriorating even with laser photocoagulation and anti-VEGF therapy. Alimera believes that 40% to 50% of patients who have been treated with VEGF will fall into this category. It seems logical that physicians would add steroid injections to their therapy and monitor the effect on intraocular blood pressure. If IOP did not increase it would be logical to switch to Ozurdex or Iluvien. It might also be the case that physicians might start with Ozurdex and switch to Iluvien. I don’t have good estimates for the size of this market.

There is a very interesting hypothesis that is gaining in acceptance that DME is not just mediated by VEGF and that the etiology progresses or shifts over time in much the same way as diabetes. It transitions to more of an inflammatory disease that involves additional cytokines. If this is the case, the use of steroids that address this broader inflammatory process become more important as the disease progresses. The clinical trials of Iluvien indicate that corticosteroids uniquely address the multi-factorial nature of the disease. If so, it would mean that over time, most patients would need steroids.

This was shown in the two phase 3 FAME trial of Iluvien in which results were better for those patients who had been diagnosed with DME for three years or more at baseline. In one phase 3 trial, 31.8 % of patients in this sub-group of patients had 15 letters improvement after three years versus 13.6% in the control group for a p value of 0.01. In the second phase 3 the corresponding results were 36.4%, 13.2% and p=0.004. For the subgroup of patients who had been diagnosed with DME for less than three years at baseline, there was no statistically significant difference of Iluvien from control patients. If this hypothesis becomes widely accepted, it would mean that patients with a three year or greater diagnosis of DME should have steroid therapy.

It is important to understand that the control group in FAME phase 3 trials was actually not on placebo. Approximately 65% had received laser photocoagulation and another 37% had laser photocoagulation plus an anti-VEGF (usually Avastin) or an intravitreal triamcinolone injection. This is much closer to real life experience of therapy currently being given to patients whom Iluvien will be targeting and suggests a clear superiority to current standard of care.

Alimera’s Plans for its Iluvien Commercial Team

Following US approval, Alimera hired the field sales management team and the majority of the medical affairs team, which includes medical science liaisons and have brought aboard key members of our managed market teams. This round of hiring was completed by mid-November. They have identified and are in the process of recruiting 32 sales reps who will report to four regional sales directors. They expect the incremental cost of the commercial launch in the U.S. to be about $30 million on an annual basis to account for the sales force incremental marketing dollars, back-office support and other associated costs.

Looking to the Eylea Launch in DME for Insights into the Iluvien Launch

Eylea was approved in July 2014 for DME and Regeneron incorporated estimates for DME in its sales guidance. In early November, for the first time in its history Regeneron had to lower sales guidance because Eylea was not performing as expected in DME. Regeneron said that compared to wet AMD there is less urgency to treat patients and that there is a high degree of satisfaction with laser therapy. Physicians have a sense of urgency in treating wet AMD as it is a very aggressive disease and after diagnosis, physicians quickly treat patients to preserve visual acuity. There is less urgency with DME whose course is more chronic. On the other hand, physicians know that diabetic patients are at risk of DME and they are routinely screened for this. In the aging population in which AMD is found, there is not as much routine screening. Alimera feels that the chronic nature of DME plays very well to a long-term steroid like Iluvien.

The U.S. commercial price for Iluvien will be between $8,000 and $9,000 per injection. Alimera believes that as long as the product is priced below $10,000, it's not going to get great scrutiny from managed care because the DME market is only a small portion of the budget of large commercial payers and for the Medicare budget. This could be wishful thinking. Regeneron mentioned challenges with private payers because many DME patients are not on Medicare. Alimera estimates that 45% of patients will be Medicare patients, and another 45% will be commercial payers, and then the other 10% will fall into Medicaid and DOD, et cetera. Their discussions with the private payers indicates that in the vast majority (perhaps 90%) of those payers, they will pay based on usage that is in accordance with the FDA label right out of the gate, because of the severity of the disease.

What About Guidelines for Steroid Use?

There are now two long acting steroid implants approved with Ozurdex and Iluvien. This raises the question as to whether there might be new guidelines for beginning steroid usage. There is currently no work going on with this issue in the US as these are recent product approvals. Some retinal specialists have been using steroids off-label for quite some time. This makes it a bit less concerning that these guidelines are not in place. There is also a lot of discussion in medical conferences about anti-VEGF therapy and concern about the number of injections. Alimera believes that there is also discussion around inflammation in DME and its multi-factorial causes.

Physicians may try to determine the effect of one intravitreal injection of 4 mg of triamcinolone contained in Triescence and Trivaris, which is a large dose. If no meaningful rise in IOP is seen, this might make them more comfortable with Iluvien or Ozurdex. Ozurdex might also serve an indicator; if physicians can manage the IOP with Ozurdex, they might be more inclined to use Iluvien. Alimera hopes that discussions and interactions amongst the doctors versus some formal guidelines may make physicians more comfortable with using Iluvien.

A lot of the outcome may be driven by patients who have already lost the ability to drive, and may not be mobile. Moreover, the caregivers who must take their parents or their grandparents to see the doctor to treat retinal disease on a monthly or bimonthly basis with anti-VEGF therapy could be a factor. If there is a strong case to be made to the care giver that they are not seeing a good response with an anti-VEGF therapy, they may look for another therapy like Iluvien that does not disrupt their lives as happens when they bring patients under their care in on a monthly or bimonthly basis.

Looking at European Sales of Iluvien

Alimera began marketing Iluvien in the UK and Germany in 2013. The label in Europe is more restrictive than the US as it is approved for chronic DME. This means that patients must have failed other therapy before going to Iluvien. Getting through the reimbursement process was a challenge as was the establishment of marketing organizations in those two countries. Sales are quite small in each of these markets. Initially sales were almost totally in Germany, but the UK has recently become larger and faster growing. Alimera announced on January 15, 2015 that sales have also started in Portugal.

In Germany, Alimera is relatively unknown to physicians. Unfortunately, they did not have a lot of onsite investigators in Germany for the FAME phase 3 trials so that many German key opinion leaders are not knowledgeable about Iluvien. The Company has had to build relationships from scratch. It has been painfully slow and they have not seen the uptick that they were expecting before Iluvien was introduced.

In the second quarter of 2014 they hired a country manager with ophthalmic experience, who has initiated a shift from a contract sales force with Quintiles in Germany to a direct sales force. They found that many of the reps that they wanted to hire would not work for a CSO; this seems unique to Germany. They expect to complete this transition by the end of the year.

As they initiated this restructuring in the second quarter, they operated with a fractional team in the field. Despite being short staffed, they were able to maintain the existing user base and reported flat to down sequential sales in 2014. They entered September with a complete team that will target key physicians across Germany.

The use of injectable treatments for DME in the UK is far behind the US where both anti-VEGF and corticosteroid therapy have been used off-label for several years. Initially, Alimera could not get a favorable reimbursement decision to be included in the national health insurance system, but this changed with a favorable decision from NICE and Iluvien is seeing very strong sequential sales growth although off a small base.

Alimera reported in January 15, 2015 that Iluvien was launched in thrird European country, Portugal. An agreement was reached in July of 2014 for pricing and reimbursement of Iluvien for the public sector in Portugal. Pricing is on a par with Germany.

Alimera had hoped to launch Iluvien in France in late 2014, but has not been able to reach an agreement on price. Alimera is trying to maintain a consistent price level across the EU. They have been disappointed by reimbursement discussions in France that have delayed the launch from the previously expected October 2014 time frame. They want to have a price that protects the public pricing in the U.K., Germany and Portugal. This is £5,500 in the U.K. and approximately €7,900 in Germany. They are hopeful that they will reach an agreement with the pricing authorities in the France, but until then there are no launch plans.

They gained marketing authorizations in late July through early September 2014 for Norway, Denmark and Sweden. They hope to gain marketing authorization in Ireland, the Netherlands, Belgium, Luxemburg, Finland, Poland and Czech Republic in coming quarters. In each case, marketing authorizations have to be followed by an acceptable reimbursement decision before the product can be launched.

Australia and New Zealand

In April, Alimera announced an exclusive 5-year agreement with Specialized Therapeutics Australia, or STA, for the distribution of Iluvien in Australia and New Zealand. STA will handle all regulatory and commercial activities for Iluvien in those countries.

The approval process and the path to reimbursement probably will take at least 2 years. In the meantime they are evaluating options to pursue a special patient access program that they hope will be able to start generating some sales and some royalty revenue in 2015. The market is not a huge market; it is probably on the order of 20,000 patients. Hence, the decision to license out the product.

Broadening the European Label for Iluvien

The US labeling is more favorable is more favorable than in Europe as Iluvien is indicated for the treatment of diabetic macular edema in patients who have been previously treated with a course of corticosteroids and did not have a clinically significant rise in intraocular pressure. In Europe, it is indicated for patients who no longer respond to other treatments. The Company hopes that the US labeling may be eventually taken up by Europe. This would move the product up in the treatment paradigm.

European Sales Projections

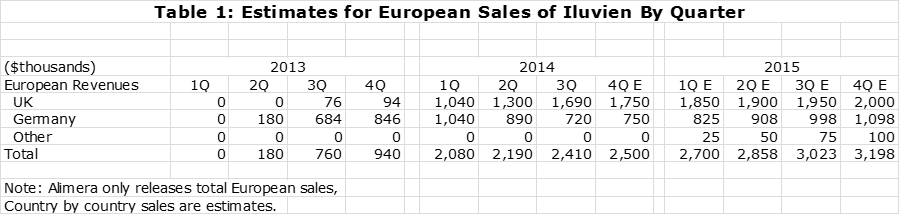

The following table shows my estimates of sales in Europe over the past six quarters and my projections for 4Q, 2014 and each quarter of 2015. The projections are based primarily on extrapolating sequential quarterly sales increases.

US Sales Projections

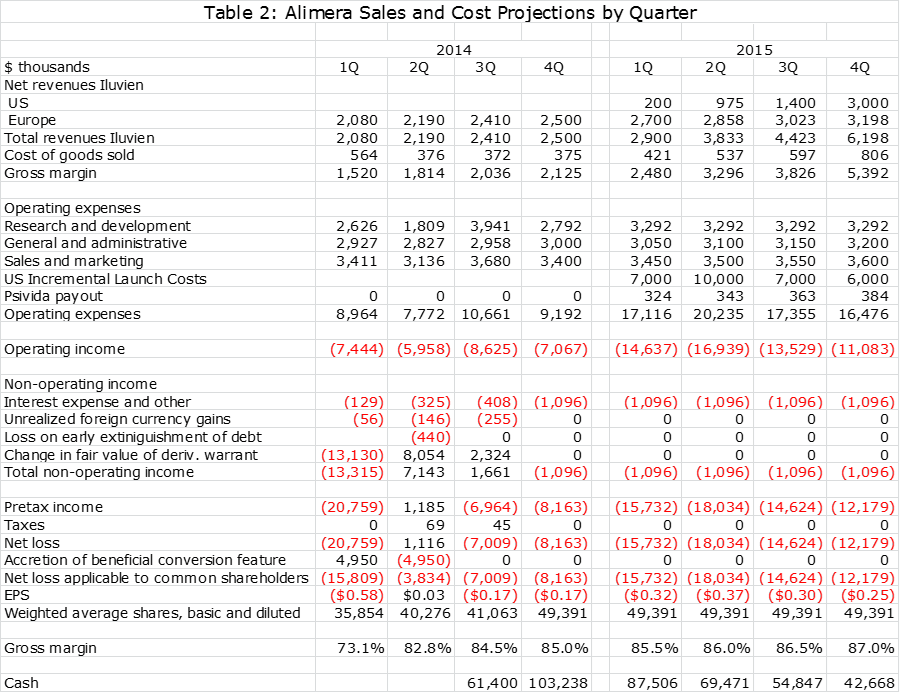

I went to great length earlier in this report to lay out the issues that will affect the launch of Iluvien. It is extremely difficult to try to account for all of these complex variables. I have put together my estimates in the following tables in part based on the uptake of products launched by other small companies. Unfortunately, these were in different disease states and different physician populations. I will readily admit that at this point my sales estimate are just guesses. Sometimes an analyst can get input from management guidance, but Alimera is not giving guidance on the Iluvien launch in the US.

Profit and Loss Projections for Alimera

In terms of economics, pSivida is entitled to receive 20% of net profits of Iluvien on a country by country basis. (This is initially reduced to about 16% until Alimera recovers launch expenses.) Net profit is defined as net sales minus cost of goods sold minus sales force expense minus launch expense. This profit sharing formula is obviously difficult to assess. In the early phases of a launch in a new country, I would expect operating profit to be negative as sales are building. At some point, sales hopefully rise to the point at which operations are profitable. This is impossible for an investor to analyze on a country by country basis.

I have put together some estimates on what percentage of Iluvien revenues pSivida might receive after Iluvien is firmly established and is profitable in a given country. I present two examples as an illustration. In the first example, I estimate that the gross margin on Iluvien is about 85% or phased differently cost of goods sold is about 15% of sales. I don’t know how to estimate selling expenses directly related to sales. If we were to assume that it is 30% of sales for example, the operating profits would be 60% of sales and 20% of those profits work out to 12% of revenues. In a second example using other assumptions, if gross margin is 90% and selling expenses are 20% of sales, the operating profit margin would be 70% and 20% of that translates into 14% of sales.

The above examples which seem reasonable from my standpoint suggest that pSivida will receive about 12% to 14% of revenues once Iluvien reaches profitability in a country. Remember this is a country by country basis and is not applied to worldwide sales. pSivida has indicated that this ratio would be more like 15+% of sales as Iluvien sales mature.

The following tables show my sales and operating cost estimates. Alimera has indicated that R&D expenses will increase by 20% in 2015 over 2014 after adjusting for a $2 million payment made in 2014 to a consultant for aid in gaining FDA approval. It has also indicated that the incremental cost of the Iluvien launch in the US in 2015 will be about $30 million. These are incorporated in my projections.

In working on my sales and earnings model, I think that it will be difficult for Alimera to show a positive operating profit on Iluvien in the US in 2015. I am assuming that pSivida will receive no revenues from US sales in 2015, but based on the escalation of sales levels will receive 12% of sales in 2015, 12% of sales in 2016 and 14% of sales in 2016. For European sales, I am assuming that pSivida will receive 12% of sales in 2015, 12% in 2016 and 14% of sales in 2017.

Alimera is not giving guidance on sales of Iluvien in Europe or the US for 2015 or 2016 and they are obviously not giving guidance on what percentage of revenues pSivda will be paid in each year. They also refused to comment on my projections as is to be expected since they have not issued guidance. I am not faulting management for being cautious given the complexities involved, but it means that I am absolutely flying blind on these critical numbers. This leads me to try to be conservative on both the sales and operating expense numbers in 2015 and beyond.

I present the sales and earnings model that I have come up with in the following two tables. One gives quarterly sales and profit estimates through 2015 and the other gives annual sales estimates through 2017. The table gives the appearance of precision that is just not possible with the amount of information that I have available. Still, an analyst has to start somewhere and these are my best guesses at this time. I will adjust these estimates as more information becomes available in coming quarters.

Please take my projections with a grain of salt. They show that Iluvien will reach worldwide sales of $17 million in 2015, $33 million in 2016 and $49 million in 2017. pSivida revenues based on these Iluvien sales estimates are $1.4 million, $3.9 million and $7.0 million. Keep in mind that for pSivida, sales and pretax profit are about the same. With these sales estimates, my net loss estimate for Alimera in 2015 $61 million, $38 million in 2016 and $49 million in 2017.

Tagged as Alimera, Alimera Sciences + Categorized as Company Reports

I still believe your numbers are low. My theory is that Iluvien will do well because of FEAR. There are two components of fear. Of course, the first is the patient’s fear of going blind. Many patients will demand the use of Iluvien regardless of cost if the fear of going blind is great enough. The second fear, particularly in the United States, is the eye care specialist’s fear of being sued because of failure to discuss Iluvien with the patient/client and allowing a patient decision of use. No one willing lets a doctor allow them to go blind especially for a mere cost of $8-10,000. I am with you on the slow start, but once the product shows solid results it will take off. These are my main reasons for believing this will be a huge success. I also recognize there is a third fear and that is taking a needle in the eye. I believe this fear will be much less than the fear of going blind and will be mitigated by the use of other eye inject-able steroid products that some of the patients will already have experienced. I hope my thesis is correct as I am financially committed both companies mentioned in your article.

You make very good point and I hope that you are right. However, DME is a chronic slowly progressing disease unlike wet AMD which can progrss rapidly to blindness.