InSite Vision: Initiation of Coverage on Promising Late Stage Ophthalmology Company (INSV, $0.30)

Report Overview

The core technology of InSite Vision is its DuraSite delivery system that delivers drugs more effectively to the eye. The continual blinking of the eye can quickly wash out topical formulations and in order to retain effective drug levels in eye tissue, most drugs have to be given four to eight times per day. It is often difficult for patients to comply with this difficult schedule and missed doses can lead to reduced effectiveness or

ineffectiveness of the drug. The pharmaceutical industry recognizes the importance of a simple dosing schedule and most current drugs are based on once or twice a day dosing, but this has been difficult to achieve with drugs used in ophthalmology. The important commercial differentiation of DuraSite is that it requires only one to two applications per day for proven ophthalmology drugs.

InSite has the key advantage that it is usually working with drugs that are known to be effective and safe. This speeds development time and has allowed InSite to develop and gain approval for two drugs: AzaSite and Besivance for bacterial conjunctivitis. It also has three products in phase 3 development that could gain regulatory approval in the 2014 to 2016 timeframe: AzaSite Plus and DexaSite for blepharitis and BromSite for relief of pain and inflammation after cataract surgery. InSite does not have the financial resources at present to build its own commercial infrastructure and will partner its three new products as it has done with AzaSite and Besivance. Almost all revenues arise from royalties on out-licensed drugs.

It is unusual to see such breadth of product opportunities in a small company, but this leads to great complexity in coming up with a sales and earnings model. Forecasting sales (and royalties) of each product requires numerous assumptions on such difficult to predict issues as clinical trial outcomes, regulatory approvals, partnering deals and the ultimate clinical role of the drug. The range of potential outcomes for the ultimate sales and royalties of each product is wide.

The sales model in this report is based on what I believe is the most likely outcome for each product. I would frankly be shocked if I was right on any single product, let alone the company as a whole. Forecasting sales is an art and not a science and the purpose of this report is to provide a logical framework to follow InSite over time. As events unfold, they can be put in perspective and the sales model adjusted. While the numbers that I present in this report give the appearance of great precision, this is not actually the case. I am generally trying to capture magnitude, trend and time.

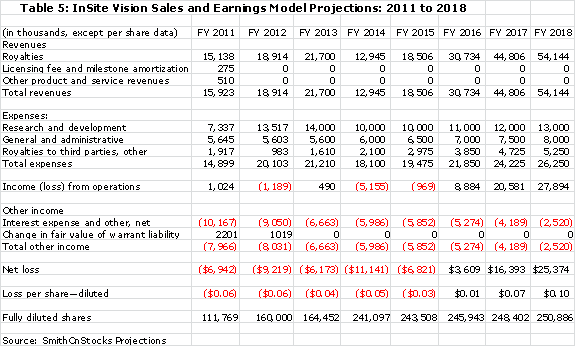

Investment Opinion

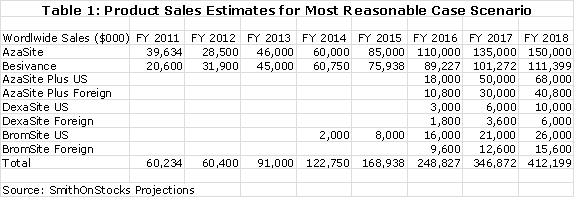

The model that I have developed projects that sales of InSite's five current products will reach $412 million of revenues in 2018. InSite has no plans to establish a commercial operation and will receive royalties from these products which are projected to be $54 million in 2018. The model projects EPS of $0.10 per share in 2018. If achieved, this earnings level in conjunction with a continual build in the pipeline based on DuraSite could lead to an above average price earnings ratio of 17 to 25 times giving a potential price target of $1.70 to $2.50 in 2018, which compares to the current price of $0.30. I would again emphasize that the precision implied by these numbers is deceiving, but I think that it does illustrate the considerable potential of InSite.

Given the uncertainties and errors inherent in long term forecasting, investors (me included) will initially be wary in accepting that InSite will achieve the sales and earnings that I have laid out. Investors need to establish a check list of the most important events that will validate or invalidate my assumptions and adjust my model accordingly. The single most important event on the horizon is topline data from the phase 3 DOUBle trial which will be reported in late 2012 or early 2013. I project that the results will be supportive of approval of AzaSite Plus, DexaSite and potentially AzaSite in blepharitis. However, I am projecting that the FDA will require a second confirmative phase 3 trial before granting approval for AzaSite Plus and DexaSite and that this will delay introduction until 2015 or 2016.

There are no approved drugs for blepharitis and AzaSite Plus and DexaSite have a clear first mover advantage. This along with their superior dosing schedule should lead to very high penetration in a market that is now treated with off label prescribing of drugs indicated for other disease conditions. AzaSite Plus is the key feature of the InSite Vision story and could be the primary driver of sales and earnings growth in the period beyond 2016 and I see it as having $150+ million of sales potential in the US five years after introduction. It has a supporting cast with BromSite, which could be approved in 2014, and DexaSite. I see these products as having $25 to $50 million of sales potential in the US five years after introduction. International sales for each product could approach 60% of US sales and are additive to the US numbers cited above.

I have listed below the critical events that will shape the investment scenario over the next few years. They are in chronological order as follows:

-

- I expect that the results of the DOUBle trial will be positive and reported out in late 2012 or early 2013. It is possible that the FDA could grant approval if the results are positive and result in a possible introduction of AzaSite Plus and DexaSite in 2014, but I believe that it is more likely that the FDA will request a second confirmatory trial so that ultimate approval will not come until late 2015 or early 2016.

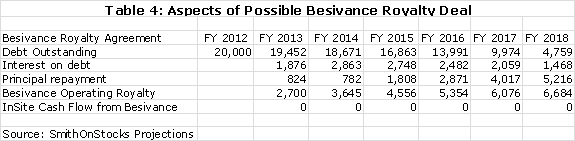

- I think that the execution of a royalty deal on Besivance could be completed by yearend 2012 and raise on the order of $20 million of non-recourse debt. Investors will probably view this as non-dilutive capital that reduces the need for a future equity or at least the amount needed to be raised.

- AzaSite (not AzaSite Plus) was licensed to InSpire Pharmaceuticals and under that company achieved strong sales of $43 million in 2010. However, much of this was achieved for the off-label indication of blepharitis and not the approved indication of bacterial conjunctivitis. When Merck acquired InSpire in 2011, it ceased off-label promotion in blepharitis and sales are now at a $25 million run rate. Merck has said that it views AzaSite as an important product for the company and if it chooses to aggressively promote AzaSite for bacterial conjunctivitis, I think that AzaSite could return to a rapid sales growth trajectory. I am waiting for a sign that will indicate what Merck intends to do.

- The BromSite phase 3 trials should report results in late 2012 or early 2013. I expect that will be successful and lead to approval and a licensing deal in 2014. BromSite does not have the large opportunity of AzaSite Plus is but it has reasonable potential and the upfront payment from a licensing deal could further reduce the need for an equity offering.

- I am projecting an equity offering of $15 million in 2014 to top off the cash balance. I consider this to be conservative as it is possible that partnering deals could obviate the need for an offering.

- If a second phase 3 trial is required to confirm DOUBle, its results could be available in late 2014 and lead to approval of AzaSite Plus, DexaSite and potentially AzaSite for blepharitis in late 2015 or early 2016. This would be a major plus for the stock.

- Approval or anticipation of approval of AzaSite Plus and DexaSite in 2015 could lead to licensing deals with upfront payments that could put InSite into a strong cash position and eliminate the need for equity offerings.

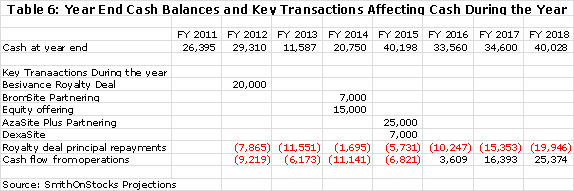

One of the deterrents to purchasing small capitalization companies like InSite is that they usually have to undertake large stock offerings in proportion to their market capitalization to fund clinical development and this can result in significant dilution. At first glance, InSite seems to be fall in this category as it ended 1Q, 2012 with $22 million of cash. I am projecting a cash burn of $13 million for the balance of 2012 so that without new sources of cash, the company would end the year with $9 million of cash. However, InSite has the potential to execute a deal to monetize the royalties of Besivance that I think could bring in $20 million of non-recourse debt in 2012 or 2013 and in 2014, I think that upfront payments in conjunction with partnering of BromSite could bring in another $7 million or so. It is possible that InSite will not have to raise more equity, but my model suggests that they could raise a moderate $15 million or so in 2014 to top off their cash position.

Investors have come to understand that successful clinical trials don't always lead to quick and predictable approvals. The FDA has issued a large number of complete response letters over the last few years relating to chemistry, manufacturing and control issues. These usually result in one to two year delays in approval. I think that the experience that FDA has had with the DuraSite drug delivery system and the fact that they are dealing with drugs that have a long history of clinical use and that the DuraSite delivery system has been validated by prior approval sharply reduces this risk for AzaSite Plus, DexaSite and BromSite.

I want to point out that there are significant risks in the InSite story. I think that the DOUBle trial and the BromSite trials will be successful, but clinical trials are by their nature high risk undertakings. Failure in the DOUBle trial would be a critical blow to my scenario and lead to a sharp drop in the stock price. The outcome of the BromSite phase 3 trials is less important. My biggest concern with the DOUBle trial is that the endpoint of time to recurrence that is critical to showing superiority of AzaSite Plus to DexaSite has not been validated in a phase 2 trial and is untested.

Assuming that all of my projections come to pass, I can see a steady appreciation in the stock price through the end of 2014 followed by a significant jump in late 2014 or early 2015 with favorable results in the confirmatory phase 3 trial to DOUBle followed by another strong jump with approval in 2016. Thereafter, the transition of the company to an earnings driven story could lead to very strong stock price appreciation.

There is the potential that InSite might be a potential takeover candidate. There is growing interest in big pharma in acquiring assets that may lead to several hundreds of millions in sales as opposed to their traditional strategy of going for blockbusters with several billions of sales potential. This stems from the growing difficulty in coming up with blockbusters. With AzaSite Plus, DexaSite and BromSite, InSite could be viewed as a compelling building block on which to build a meaningful ophthalmology business. However, I can only see this happening if the results in DOUBle are very positive.

The acquisition of InSpire by Merck for $430 million in May of 2011 and ISTA Pharmaceuticals by Bausch & Lomb for $500 million in June of 2012 gives credence to this viewpoint. At the time of acquisition, InSpire had product sales of about $43 million and co-promotion and royalty revenues of $63 million and ISTA had about $160 million of net product sales. Both had an established commercial infrastructure and sales forces, which InSite lacks. However, InSite's pipeline potential is much greater. How this might balance out in the mind of a potential acquiror depends on the company. However, I could see a potential offer for InSite to get AzaSite Plus, DexaSite and BromSite and the pipeline beyond. The later in the product development process, the higher the likely bid, but I could see a bid of perhaps $150 million ($0.62 per share) in 2014 and perhaps $300 million ($1.23 per share) in 2015. Please note that these numbers are based on a share count that includes a projected equity offering of $15 million in 2014.

Investment Perspective

This report starts with an analysis of the two approved products: AzaSite was licensed to InSpire Pharmaceuticals which was subsequently acquired by Merck in 2011 and Besivance was licensed to Bausch & Lomb. Both are topical formulations for bacterial conjunctivitis. In 2011 AzaSite reached net sales of $40.2 million and this resulted in $13.9 million of royalties while Besivance had estimated sales of $20.6 million and resultant royalties of $1.2 million.

AzaSite Outlook is a Major Uncertainty

Under the marketing aegis of InSpire, AzaSite sales rocketed from $18.3 million in 2008 to $42.7 million in 2010. In 2008, InSite monetized the royalty stream of AzaSite by selling the rights to its royalties in return for $60 million of non-recourse debt. The agreement requires that interest on the debt and royalties owed to third parties on AzaSite be covered by the royalties and that the principal of the debt to be paid down to the extent those net royalty payments exceed interest expense. The trend of revenues going into early 2011 for AzaSite raised the hope that the principal could be paid off as early 2014 and the royalty stream would then revert to InSite. The Merck acquisition of InSpire bolstered this viewpoint as most investors concluded that the marketing muscle of Merck would accelerate sales growth of AzaSite. Hence, in mid-2011, the investment thinking on InSite was that the debt would be repaid in 2014 and InSite would get back the royalty stream of AzaSite.

This scenario came to a jarring halt in the second half of 2011 when AzaSite prescriptions began to decline. Under InSpire, two thirds of prescriptions for AzaSite were for the unapproved indication of blepharitis as opposed to conjunctivitis for which it was approved. Merck must have known this when it bought InSpire as the FDA had issued a warning letter to InSpire about off-label promotion, but after the acquisition of InSpire, Merck ceased this off-label promotion. Merck and other big pharma companies have been prosecuted by state and federal regulators for off-label promotion of products and this has resulted in sizable financial penalties and blows to their images. Merck was not about to risk continuing off-label promotion of AzaSite in blepharitis. It may have thought that because no other products are approved for blepharitis that physicians would continue off-label prescribing of AzaSite.

Whatever Merck's thinking, the pullback on promotion has led to a sharp slowing in sales. Sales under InSpire reached $43 million in 2010, dropped to $40 million in 2011 as Merck acquired InSpire and are currently at a run rate of about $25 million. An important investment issue is the course of action that Merck will take with AzaSite. This is not an immediate issue as Merck is contractually required to pay the greater of a royalty of 25% of net sales or a guaranteed annual royalty in 2012 and 2013. A royalty of 25% on the current run rate of $25.0 million is $6.3 million. The guaranteed royalty from Merck is $17.0 million in 2012 and $19.0 million in 2013 and nothing thereafter. If AzaSite sales continue at current levels or decline further, there will not be sufficient royalties to repay the $60 million debt. In this event, InSite has no obligation to repay the debt, but it could lose all rights to AzaSite in North America in 2014 to the debt issuer.

InSite wrote a letter in early 2012 to Merck CEO Kenneth Frazier asking for an explanation of Merck's plans for AzaSite. This was passed down to the ophthalmology division manager ultimately responsible for AzaSite marketing plans. He responded that AzaSite was considered to be an important product and Merck "was committed to its success". However, prescriptions continue to fall in the meantime and Merck's intentions are not clear.

I think that Merck may elect to promote AzaSite more aggressively. Merck is dependent on partnering to supplement its R&D pipeline. It wants to retain a reputation as a strong partner and leaving AzaSite high and dry would stain its reputation. InSpire was promoting AzaSite to ophthalmologists who were using it primarily for blepharitis, but conjunctivitis is a disease that is usually treated by pediatricians or general practitioners. I think that Merck would need to change its marketing emphasis and sell this product through a primary care sales force to pediatricians or general practitioners.

Taking Merck at its word that it views AzaSite as an important product that it intends to support, I can come up with a very positive scenario for InSite. The topical antibiotic market for bacterial conjunctivitis market is about $600 million in the US. AzaSite is highly differentiated because it needs to be applied only twice a day a day for the first two days of treatment and once a day thereafter versus four to six times per day for competitors. This dosing advantage is a strong differentiation leading to better compliance and better efficacy, especially in children.

If Merck were to choose to put its considerable marketing prowess behind AzaSite, it is very possible that sales could reach $85 million by 2015 and $150 million by 2018. If so, according to my financial model, InSite would be able to repay all of the royalty debt and regain full ownership of AzaSite in 2018 which is projected to have annual royalties of $22.5 million at that time. On the other hand, if Merck is insincere in its assurances and chooses to continue to neglect AzaSite, InSite could forfeit ownership of AzaSite in North America to the royalty trust. AzaSite is not approved in Europe because its phase III clinical trial design did not compare against an approved product for bacterial conjunctivitis as is required in Europe. There is a possibility that the DOUBle trial (to be discussed shortly) could lead to the approval of AzaSite in Europe for blepharitis. If so, InSite would have all rights in Europe.

There is yet another part of the AzaSite story that has to be addressed. In 2011, Sandoz launched a generic challenge to five patents covering AzaSite that deal with methods of use and formulation and which protect the product until 2018 or 2019. There are five issued patents covering AzaSite and it is likely a high hurdle for Sandoz to overturn all five. However, if it overturns just one it will be entitled to six months of exclusivity when all five patents have expired and the motivation may be to attack the weakest patent with this objective. InSite believes that the patents will hold. However, an outsider has limited information to judge patent disputes and it could be the case that Sandoz has a stronger position that could lead to a settlement allowing Sandoz to enter the market before 2018. In addition, InSite is pursuing life extension strategies such as AzaSite incorporated in a second generation DuraSite delivery vehicle and/or using a higher concentration of AzaSite.

Besivance is a Solid Product Opportunity

The second approved and marketed product is Besivance, which is licensed to Bausch & Lomb. Both AzaSite and Besivance are based on incorporating an antibiotic in the DuraSite drug delivery system. AzaSite uses azithromycin and Besivance uses the flouroquinolone, besifloxacin. Bausch is putting a lot of effort behind Besivance and is launching it worldwide. I project that sales could reach $32 million in 2012 and $122 million by 2019. There are not the uncertainties that surround AzaSite as Bausch is clearly committed to the product. However, the royalty rate is only about 6% versus the current 25% for AzaSite.

Very Promising Pipeline

The pipeline story of InSite Vision is exciting but like all pipeline stories is dependent on a successful outcome for phase 3 trials of three products that should report results in late 2012 or early 2013. Of the three products AzaSite Plus is the most important; it is AzaSite combined with the steroid dexamethasone. The second product is DexaSite which is based on the steroid dexamethasone and the third is BromSite which uses the non-steroidal anti-inflammatory agent bromfenac to reduce pain and inflammation following cataract surgery.

AzaSite Plus is the Key New Pipeline Product; DexaSite is a More Limited Opportunity

AzaSite Plus failed to reach the primary endpoint of a phase III trial in 2008 in which it was studied for blepharoconjunctivitis. In this trial, AzaSite Plus (azithromycin plus dexamethasone) showed superiority over AzaSite (azithromycin) but not against DexaSite (dexamethasone). FDA requires that a combination product like AzaSite Plus establish superiority to each of its components in a phase 3 trial. The patient cure rate for Azasite Plus was 27% as compared to 14% for AzaSite which carried a statistical p value of 0.02. Azasite Plus versus DexaSite was 27% versus 25% for a p value of 0.52, indicating no difference in the two drugs.

The hypothesis of new management is that azithromycin takes a longer period of time to be effective in blepharitis and was relatively ineffective for the 14 day length of this trial. Hence, the activity of AzaSite Plus was almost all due to the dexamethasone over the first 14 days and would not be expected to be better than DexaSite. The new trial is designed to show that AzaSite Plus is superior to DexaSite when viewed over a longer period of time.

It is not unusual for drugs to fail because the trial design was flawed or the trial was improperly executed and this may very well have been the case in the 2008 trial. InSite went through an intensive process including extensive interaction with the FDA to understand what went wrong in the 2008 phase 3 trial and to design a new trial that would have a high probability of success. This has led to the design of a new phase 3 trial called DOUBle that is now enrolling patients and should report out results later this year. DOUBle has an elegant trial design that includes new techniques for enrolling patients, new measurement scales determining patient outcomes and a new innovative trial endpoint. The disease target itself has also been changed from blepharoconjunctivitis which is a condition in which blepharitis and conjunctivitis occur concurrently to just focusing on blepharitis.

The target of AzaSite Plus, blepharitis, is a disease that affects the eyelids. It is one of a number of diseases that affect the front of the eye which are treated with antibiotics, steroids or anti-inflammatory agents. There are no products approved for blepharitis despite numerous clinical trials that have been conducted over the years. Although the exact size of the blepharitis market is hard to estimate, it is almost certainly a large potential market. The Center for Disease Control estimates that the number of blepharitis sufferers at 8 million while InSpire commissioned a study that placed the number at 34 million.

Blepharitis is not a dangerous disease that can threaten vision although it is painful and discomforting. Many patients can treat the disease with good hygiene that involves scrubbing the eyelids twice a day for two weeks or so. If this doesn't work, physicians turn to drugs. There are no approved drug treatments for blepharitis; current treatment is based on off label prescribing of antibiotics, steroids and combinations of the two. In addition to developing AzaSite Plus for blepharitis, findings from the 2008 trial indicated that the steroid component dexamethasone was also effective in blepharitis. The DOUBle trial is designed to demonstrate efficacy of DexaSite as well as AzaSite Plus in blepharitis.

If the DOUBle trial is successful, AzaSite Plus would be the first combination product approved for blepharitis and DexaSite would be the first single agent approved. Single agent antibiotics and steroids and combinations of the two are now used broadly off-label to treat blepharitis. However, formal approval would be a major advantage because the sales force can aggressively promote the advantages seen in the phase III trials and also because products used on label make it easier for patients to gain reimbursement. These factors combined with the dosing of twice per day provide major competitive advantages for both products versus four to six times for competitors. I think that AzaSite Plus could gain a major share of the blepharitis market.

Blepharitis is a chronic, low grade condition that can flare up and cause an annoying painful attack. This indicates that the 8 million sufferers (I am using the CDC estimate) are going to require treatments at recurring times in their life. I have seen no good estimates of how many of the 8 million sufferers can be treated with lid scrubbing alone, but I think it is the great majority. In addition to this issue another factor to consider is that steroids should only be used for a short period of time (two weeks or so) because serious side effect issues can occur with long term treatment. This means that AzaSite Plus and DexaSite would be used only for a two week dosing period to resolve a flare-up.

I can't give a precise estimate for the size of the blepharitis market nor the penetration that AzaSite Plus might make in the market. However, sample calculations suggest that it is a sizable opportunity. If we assume that each patient is treated with one prescription per year at a price of $120 per prescription (a price level realized by antibiotic-steroid combinations for other diseases), each 10% of the market translates into roughly $100 million of sales. A critical variable is the number of steroid containing treatments that could be safely given in a year. InSite believes that AzaSite Plus could safely be given three or four times per year and thus the $100 million estimate based on just one use per year would be a conservative estimate. I would think that with their first mover advantage, AzaSite Plus and DexaSite would command a large market share in blepharitis patients that seek drug treatment.

Another way to judge the market size of the blepharitis market is to look at a comparable market like bacterial conjunctivitis that has annual sales of $600 million; I suspect that the blepharitis drug market is of the same magnitude. I also think that the rapid uptake of AzaSite, from $18 million in 2008 to $43 million in 2010, was primarily due to off label use in blepharitis (two thirds of prescriptions); this suggests a large market opportunity. In strong marketing hands, I see AzaSite Plus as being a $150+ million product in the US five years after introduction in 2016 and possibly much more. Based on public statements, I think that management sees greater potential than this.

I don't see DexaSite as having much potential in blepharitis if AzaSite Plus is approved. AzaSite Plus provides all of the efficacy of DexaSite with the added benefit stemming from the azithromycin component. However, topical steroids are ubiquitous in ophthalmology and I think that DexaSite would receive substantial off label usage because of the twice a day dosing afforded by the DuraSite delivery system. I see this as a $50+ million product in the US five years after introduction. In the event that AzaSite Plus was to fail in the DOUBle trial and DexaSite were to be successful, the market potential for DexaSite would be much greater.

BromSite Has High Probability for Success, But Commercial Opportunity is Limited

The third product under development is BromSite which is an improved version of BromDay, a product developed by ISTA Pharmaceuticals, which was just acquired by Bausch & Lomb. Both products use the non-steroidal anti-inflammatory drug bromfenac to treat pain and inflammation after cataract surgery. The advantage of Insight's BromSite is that it achieves higher tissue penetration.

BromDay was an $88 million product in 2011. I am not convinced that the product advantages offered by BromSite are sufficient to shift a large part of the market away from BromDay. I see BromSite as a potential $25+ million product in the US five years after market introduction. It will be studied in its own phase III clinical trial with results due in late 2012 or early 2013 at about the same time as AzaSite Plus and DexaSite.

International Substantially Augments the US Opportunity

InSite has stated in its financial releases that the European regulatory authorities have conveyed to them that if the DOUBle trial is successful that these results in combination with the 2008 phase III study might be sufficient for approval of AzaSite Plus and DexaSite. This could lead to a regulatory submission in 2013 and approval in 2014.

Europe requires pricing approval for new drugs and this process effectively delays introduction by a year. This suggests that a full blown launch in Europe could begin in late 2015 or early 2016. I think that international potential for these products might be 60% of the US. This is a rule of thumb that tries to take into account greater unit potential but lower price points.

Sales, Earnings and Cash Flow Models

The revenues created by InSite over the next five years will come largely from royalties on AzaSite and Besivance and the three late stage pipeline products- AzaSite Plus, DexaSite and BromSite. There are a very broad number of sales and earnings scenarios depending on Merck's action on AzaSite and trial outcomes and partnering deals on AzaSite Plus, DexaSite and BromSite.

With all of these moving parts, there is no one scenario that investors can comfortably endorse. There are many different variables for InSite that could lead to sometimes dramatically different outcomes:

-

- Merck could: (1) choose to aggressively promote AzaSite in which case I think that sales could reach $150 million in 2018 or (2) it could continue to not emphasize the product with the result that InSite would lose its ownership rights to AzaSite in North America.

- The DOUBle trial could: (1) be successful but require a second confirmatory trial which would result in an NDA filing for AzaSite Plus and DexaSite in 2015, (2) produce such striking results that a second confirmatory trial is not necessary and an NDA is filed in 2013 or (3) fail and AzaSite Plus and DexaSite might be abandoned. Adding to the complexity, AzaSite Plus might fail and DexaSite could succeed in the DOUBle trial or vice versa. In addition, the trial is designed so that AzaSite might be shown to be effective in blepharitis and lead to approval. This could provide a much greater inducement for Merck to put a major marketing push behind AzaSite

- The BromSite phase III trials could be successful leading to an NDA filing in 2013 or they could fail.

- Even with success in the clinical trials, the FDA might come up with other issues that result in a Complete Response Letters for AzaSite Plus, DexaSite or Bromsite delaying approval for a year or more.

Most Reasonable Scenario

I have come up with my most reasonable scenario based on what I believe will most likely occur with each of these products.

-

- My best judgment is that Merck will choose to aggressively promote AzaSite to general practitioners.

- I think that AzaSite Plus and DexaSite will be successful in the DOUBle trial but that the FDA will require a second confirmatory trial resulting in an NDA being filed in 2015 and with marketing beginning in early 2016.

- I think that the BromSite trial has an excellent chance of reaching success and I look for an NDA filing in 2013 and marketing in 2014.

- Because InSite has successfully negotiated an NDA for AzaSite and Bausch & Lomb was successful in gaining an NDA with Besivance, the DuraSite drug delivery technology that underlies both products has been well vetted by the FDA. I think that this makes it probable that there will be no Complete Response Letters for the three new products.

In this most favored scenario, I project sales as follows for the company's five products:

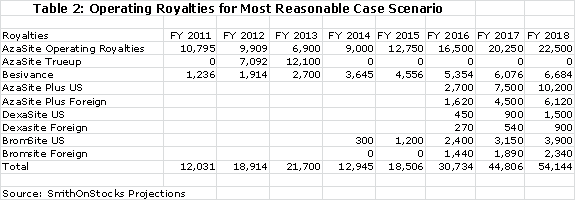

The current royalty rate for AzaSite is 25% of sales and for Besivance it is estimated as 6%. The 25% for AzaSite is too high, in my opinion, for Merck to realize much of a return. I am projecting that the royalty rate will be dropped to 15% to provide the economic incentive for Merck to aggressively promote AzaSite. The quid pro quo would be a commitment from Merck to aggressively promote the product. I am projecting 15% royalty rates for AzaSite Plus, DexaSite and BromSite. These royalty rates applied to my sales projections result in the following operating royalties for each product.

Merck is required to pay the greater of $17 million or the operating royalty of 25% of sales to InSite in 2012 and the greater of $19 million or the operating royalty in 2013. By my projections, the operating royalty will be less in each year than the guarantee so that Merck will have to true up the royalty paid by the amounts shown above. The guarantee ends after 2013 and Merck will only be required to pay the operating royalty after 2013.

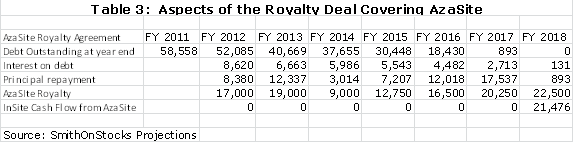

The royalty agreement requires InSite to pay a 16% interest rate on the principal outstanding and to use the remaining part of the net royalty to pay down the principal. Using my assumptions, the following table shows that the principal will be retired in 2018. In the period from 2012 to 2017, the payment of interest on debt and payment of principal will require all of the operating cash flow. Only in 2018, by my model, will InSite actually generate cash flow from AzaSite. From an accounting standpoint, InSite will record the AzaSite royalties as revenues and deduct the interest expense. The calculations are shown below:

I think that InSite is likely to do a royalty deal for Besivance that could bring in $20 million of non-recourse debt. I am assuming an interest rate of 10% on this debt and this results in the following calculation.

InSite has about 131 million shares outstanding and 14 million warrants and 15 million options that have a reasonable chance of being exercised. Hence, I am using a current fully diluted share count of 160 million shares. I am projecting an equity offering in 2014 that will add 43 million shares and 32 million warrants. This would bring the fully diluted share count to 241 million shares at the end of 2014.

The summation of all of the above factors is used in the sales and earnings model that I have put together.

Financial Condition is Reasonably Sound

The next thing to consider is the financial condition of InSite. The company had $22 million of cash at the end of 1Q, 2012. I am projecting a cash burn of $13 million for the balance of 2012 so that without new sources of cash, the company would end the year with $9 million of cash. However, InSite has the potential to execute a deal to monetize the royalties of Besivance that I think could bring in $20 million of non-recourse debt in late 2012 or possibly 2013. This would bring the yearend 2012 cash position to $29 million.

My model further suggests that the cash burn in 2013 will be $16 million with $6 million due to the operational burn and $10 million due to principal repayment on the AzaSite non-recourse debt incurred in the royalty deal. Similarly, the total burn in both 2014 and 2015 is estimated at $13 million. Assuming that AzaSite would want to have a minimum cash balance of $10 million at the end of 2015, it would need to bring in about $33 million of cash in addition to the $29 million of cash that I have projected for yearend 2012.

The company has the potential to raise substantial amounts of cash through frontend payments on partnering deals. I estimate that the upfront for BromSite, AzaSite Plus and DexaSite could be on the order of $7 to $10 million, $25 to $40 million and $10 to $15 million respectively. Hence the total upfront payments could be on the order of $42 to $ 65 million, significantly in excess of the needed $33 million. However, there is a timing issue. BromSite will likely be partnered in 2014, but the company might have to wait for approval of AzaSite Plus and DexaSite in late 2015 before partnering. The company could choose to partner before approval is gained, but this would reduce economic returns.

I think that it is prudent and a bit conservative to build in an equity offering of $15 million in 2014. Assuming that this was done on the same terms as the 2011 equity raise and at a price of $0.35 per share, this would lead to the issuance of 43 million shares and 32 million warrants. This would bring the fully diluted share count to 241 million shares at the end of 2014. I think that it is likely that success in the phase 3 trials of AzaSite Plus, DexaSite and BromSite could lead to a higher share price and better terms, but I am trying to be conservative. There is also the possibility that the partnering deals for AzaSite Plus and DexaSite could be consummated earlier and eliminate the need for any equity offering. My base case for yearend cash through 2018 is as follows:

Appendix

Diseases of the Front of the Eye

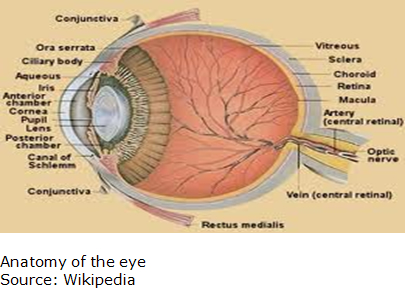

InSite is targeting diseases that affect the front of the eye where the lens, pupil and cornea are located. The back of the eye is where the retina is situated. Its two marketed products, AzaSite and Besivance, are approved for bacterial conjunctivitis. The focus of its key pipeline product AzaSite Plus is blepharitis as it is for DexaSite. However, blepharitis is sometimes linked to other conditions such as conjunctivitis and dry eye. BromSite, the third pipeline product, is indicated for the relief of pain and inflammation that follow cataract surgery. Key features of the anatomy of the eye are shown below as a reference for discussions in future sections:

Blepharitis

Blepharitis is an inflammatory condition of the eyelids that occurs in two forms. Anterior (outer eyelid) blepharitis is usually caused by Staphylococcus bacteria and debris that accumulates in the tear film. Posterior (inner eyelid) is usually caused by a disorder of the oil glands at the base of the eyelids. In both cases, patients can experience red, itchy and swollen eyelids, a gritty or burning sensation in their eyes, excessive tearing, dry eyes and crusting of the eyelids. Blepharitis is usually a chronic condition that affects people of all ages; it is uncomfortable but is not contagious. It generally does not cause any permanent damage to eyesight, but can sometimes lead to more severe conditions such as blurring of vision, missing or misdirected eyelashes, and inflammation of other eye tissue, particularly the cornea.

In many cases, anterior and posterior blepharitis can be controlled by keeping the eyelids clean and free of crust. Warm compresses are applied to loosen crust and this is followed with a light scrubbing with water. Blepharitis as a chronic condition requires regular hygiene to prevent recurrences. In more severe cases antibiotics based on topical formulations applied to the eyelids as creams or ointments or sometimes as a pill are used to control the bacteria. Steroid eyedrops or ointments can control inflammation in the eye and the eyelid. For cases accompanied by dry eye, artificial tears such as those available over the counter can be used. Blepharitis rarely disappears completely so that even with successful treatment, relapses are common.

A sty is somewhat related condition which is an acute infection of the oil glands of the eyelid that occurs when these glands become clogged or blocked by an infected hair follicle at the base of an eyelash. It results in a tender, painful red bump located at the base of an eyelash or inside the eyelid. A sty is usually visible on the surface of the eyelid. Treatment consists of a warm washcloth applied to the affected area for 10 minutes, four to six times a day. This can speed rupture of the sty and aid in the relief of symptoms. If a sty persists for several days, a doctor may lance (drain) the infection under local anesthesia.

A chalazion occurs when there is a blockage in one of the small oil glands at the margin of the eyelid, just behind the eyelashes that results in an unsightly lump. The gland can become infected with bacteria, which causes a red, swollen eyelid. Unlike a sty, a chalazion tends to be most prominent on the inside of the eyelid. Most chalazions are treated with warm compresses to the eyelid to promote healing and circulation of blood to the inflamed area. Doctors may prescribe an antibiotic drop or ointment to be used immediately after the compresses. If the chalazion persists and is causing an unsightly lump, it can be removed surgically through the inside of the lid.

According to the Center for Disease Control, blepharitis occurs at prevalence among males of 32.2 per 1,000 and in females at a rate of 20.9 per 1,000. In 2009, there were 152 million males and 158 million females indicating that there were 4.9 million males with blepharitis and 3.3 million females for a total prevalence of 8.2 million.

Conjunctivitis

The conjunctiva is the membrane covering the whites of the eyes and the inner part of the eyelids. Conjunctivitis can be caused by bacterial and viral infections and also by irritants such as air pollution, smoke or noxious fumes. Each type requires different treatment, and bacterial and viral conjunctivitis are highly contagious.

Bacterial conjunctivitis is usually caused by Staphylococcus or Streptococci and is characterized by a thick, white or creamy discharge. The eyelid may swell and itch intensely. It usually starts in one eye, but can spread easily to the other eye if not treated. It usually lasts three to five days and requires antibiotic eyedrops to help the body remove the bacterial infection. Application of warm washcloths to the eye area is also effective in removing discharge.

Infectious cases caused by viruses and will not respond to antibiotics. In these instances, the discharge from the eye is clear and watery and symptoms of a cold may be present. Viral infections last from seven to 10 days.

Blepharoconjunctivitis

Blepharoconjunctivitis is a combination of conjunctivitis and blepharitis. Frequently, blepharitis can cause conjunctivitis. Constant irritation from inflamed eyelids or misdirected eyelashes may cause a sore (ulcer) to develop on the cornea and insufficient tearing can lead to a corneal infection.

Cataracts

Cataracts occur in the crystalline lens of the eye and lead to a clouding of vision. The condition is age related and progresses slowly to cause vision loss and potentially blindness if untreated. It starts as initial opacity in the lens, swelling of the lens and in its late stages to shrinkage of the lens and complete loss of vision.

Cataracts are treated by the surgical removal of the natural lens of the eye and replacing it with an artificial intraocular lens implant. Surgery is usually done in an outpatient setting. Well over 90% of operations are successful in restoring useful vision, with a low complication rate. Antibiotics may be administered before during and after the operation and a topical steroid is often added after surgery. Patients may be placed on an anti-inflammatory drug such as BromSite and antibiotic such as AzaSite for two weeks following surgery.

Keratoconjunctivitis sicca (dry eye)

This disease is caused by decreased tear production or increased evaporation of the tear film. The literal translation of keratoconjunctivitis sicca is dry inflammation of the cornea and conjunctiva. It is caused by the inability of the lacrimal glands to produce sufficient tears to keep the entire conjunctiva and cornea covered by a complete tear layer. This disease usually occurs in people who are otherwise healthy. Increased age is associated with decreased tearing.

The symptoms are itchy, scratchy and tired eyes and these tend to get worse as the day goes on. Dry eye can cause pain, redness, a pulling sensation and pressure behind the eye. It sometimes feels like a speck of dirt is lodged in the eye. Most people who have dry eyes experience mild irritation with no long-term effects. However, if the condition is left untreated or becomes severe, it can produce complications that can cause eye damage, resulting in impaired vision or rarely in the loss of vision.

Treatments are intended to avoidance of exacerbating factors, tear stimulation and supplementation, increasing tear retention, and eyelid cleansing and treatment of eye inflammation. Purposefully blinking and resting tired eyes are basic steps that can be taken to minimize discomfort. Rubbing the eyes can irritate them further and should be avoided. Blepharitis often co-exists with dry eye.

For mild and moderate cases, supplemental lubrication is the most important part of treatment. Inflammation occurring in response to tears film hypertonicity can be suppressed by mild topical steroids or with topical immunosuppressants such as Optimmune (cyclosporine).

Topical cyclosporine is an immunosuppressant, marketed in the United States by Allergan under the trade name Restasis. It decreases surface inflammation through inhibition of transcription factors required for cytokine production and T-lymphocyte maturation. In a trial involving 1200 people, Restasis increased tear production in 15% of people, compared to 5% with placebo. Restasis is dosed as one drop in each eye twice a day and 12 hours apart.

Glaucoma

Glaucoma is a disease in which the optic nerve is damaged. It can impair vision in the affected eye(s) and can lead to blindness. It is normally associated with increased fluid pressure in the eye although some patients who have intraocular hypertension don't develop optic nerve damage while patients with normal or low intraocular pressure do have optical nerve damage.

The nerve damage involves loss of retinal ganglion cells in a characteristic pattern. There are several different types of glaucoma, but they are all a form of optic neuropathy. Raised intraocular pressure is the most important and only modifiable risk factor for glaucoma. However, as was just noted, some may have high eye pressure for years and never develop damage, while others can develop nerve damage at a relatively low pressure. Untreated glaucoma can lead to permanent damage of the optic nerve and resultant visual field loss, which over time can progress to blindness.

Glaucoma often occurs gradually over a long period of time, and symptoms usually occur when the disease is quite advanced. Once lost, vision cannot be recovered and so treatment is aimed at preventing further loss. Worldwide, glaucoma is the second leading cause of blindness after cataracts.

Product Line

All of InSite Vision's products are delivered in its proprietary DuraSite ocular delivery system. It has successfully developed two products for bacterial conjunctivitis that are approved and marketed; AzaSite is marketed by Merck and Besivance by Bausch & Lomb. It is now enrolling the critical phase III trial called DOUBle that could lead to the approval of AzaSite Plus and DexaSite for blepharitis. This trial should report topline results in early 2013. It will soon enroll patients in a trial for BromSite for treating pain and inflammation that occurs with cataract surgery and it should report topline data at the same time as the DOUBle trial.

DuraSite Sustained Delivery Technology

InSite Vision's core technology is DuraSite, a polymer matrix in which drugs can be suspended. The uniqueness of the system is that polyacrylic acid which forms the matrix is not soluble in the eye and is mucoadhesive (binds to the eye). Some of the outer layer of the polymer system separate with each blink of the eye are released into the tear film and delivered to the cornea and conjunctiva; this results in a more continual, sustained release of the drug in the eye. A principal benefit of DuraSite is improved compliance; this is not trivial as compliance failure can result in sub-therapeutic drug levels and failure of therapy. A lower the number of doses results in improved compliance and efficacy.

Tears produced by the eye are efficient in eliminating foreign substances such as dust and plant pollen and this same mechanism also efficiently eliminates topically applied drugs. Tears are produced by the lacrimal glands which are located above the outer, upper part of the eye. They flow along the eye and eyelids, draining through a duct into the nose and then through the gastrointestinal tract where they are removed from the body. Tears remove foreign material from the eye and also deliver nutrients or drugs as the case may be to the cornea and conjunctiva. Most people blink 600 to 700 times per hour and each blink distributes the eye film over the surface of the cornea and conjunctiva.

About 90% of the amount of most topically applied drugs is eliminated in 15 to 30 seconds or roughly 3 to 6 blinks of the eye. This limits the amount of drug that can be absorbed into eye tissue and creates the need for frequent dosing. The sustained release afforded by DuraSite increases the amount of time that a therapeutic level of medicine remains in the eye. Unused polymer and unabsorbed drug particles are removed via the tear film without impeding normal tear drainage. Because of their high molecular weight, the insoluble DuraSite polymer particles do not penetrate the eye or other mucosal tissue in the nose and other parts of the drainage system. They pass safely from the eye and out of the body without changing chemically.

All of the current marketed drugs and those under development are for ophthalmic applications, but there are also potential for non-ophthalmic uses, for example in mucosal or buccal tissue. With DuraSite technology, the presence of a drug can be sustained for up to six hours as compared to perhaps one to two hours with conventional eyedrops. DuraSite technology:

-

- Improves absorption of the encapsulated drug by the conjunctiva and cornea

- Allows once or twice a day dosing resulting in improved patient compliance.

- Has a well-established safety profile

- Can be used to deliver numerous drugs ranging from small molecules to high molecular weight proteins

The ingredients in DuraSite are widely used in food and drug products and are classified by the FDA as Category 1 GRAS (generally regarded as safe). It is a component of three approved and marketed products: AquaSite for dry eye syndrome; AzaSite for bacterial conjunctivitis and Besivance for bacterial conjunctivitis. The ingredients of DuraSite are widely available so that the intellectual property protecting it is based on formulation and use patents. The formulation technology that allows adhesion to the eye is a critical aspect of DuraSite. This technology is undergoing its first challenge as the five formulation and use patents protecting AzaSite are being challenged by Sanofi's generics division. InSite management is confident that Sanofi will not be able to break all of the patents. The trial is scheduled for early 2013.

AzaSite

The active drug in AzaSite is the antibiotic azithromycin. This now off patent product was marketed by Pfizer and reached peak sales of $1.6 billion. There are a number of other antibiotics used to treat conjunctivitis resulting from bacterial infections with the most favored being the aminoglycoside antibiotics tobramycin and gentamycin.

The most common pathogens causing eye infections are Staphylococcus aureus and two strains of Streptococci. Infections caused by Pseudomonas aeruginosa are infrequent but can grow rapidly. An ocular antibiotic should be able to control all of these bacteria. This is the case with azithromycin.

AzaSite requires two administrations per day for the first two days of therapy and once a day for the next five versus 6 to 8 eye drop applications per day for competitive bacterial conjunctivitis products. This is an advantage not only in terms of compliance, but also in term of efficacy because the drug dwells in the eye longer and can be more effective.

DexaSite

The active agent of DexaSite is dexamethasone, a generic steroid that is extensively used in other products that treat front of the eye diseases. Dexamethasone is an effective agent for reducing inflammation in the eye. DexaSite requires two administrations per day versus 6 to 8 for other steroid products.

There are a number of topical steroid products used in ophthalmology, especially for post cataract surgery. Dexacite would be the only steroid product with BID dosing. This could allow Dexacite to be tried off label even if it is only approved for blepharitis. This market is about $100 million in the US. Properly priced and promoted Dexacite could be a meaningful product.

Besivance

Besivance which was developed by InSite for Bausch & Lomb uses the flouroquinolone antibiotic besifloxacin. Besavance is approved for bacterial conjunctivitis and is administered twice per day.

AzaSite Plus

AzaSite plus is a combination of azithromycin and dexamethasone. The rational for combining the drugs is that dexamethasone provides a potent, short-term anti-inflammatory effect and the antibiotic azithromycin has a proven, long-term anti-inflammatory effect in addition to its anti-bacterial activity. There are several combination antibiotic- steroid products marketed with the most broadly used being Tobradex (tobramycin combined with dexamethasone) and Zylet (tobramycin combined with loteprednol.) AzaSite Plus also allows twice a day dosing versus 4 to 6 times per day for Tobradex and Zylet.

Clinical Development of AzaSite Plus

In 2006, InSite completed preclinical development of AzaSite Plus and began phase I studies from which preliminary safety data was announced in February 2007. Safety concerns with AzaSite Plus are primarily due to the steroid component. I have included the description of these effects from the label of Tobradex, which lists a number of troublesome side effects with steroids that in order of decreasing frequency are: (1) elevation of intraocular pressure with possible development of glaucoma and infrequently optic nerve damage, (2) cataract formation and (3) delayed wound healing.

The label warns that steroid induced glaucoma may be produced after a week or more of treatment in patients predisposed to glaucoma. Topical corticosteroid therapy frequently induces intraocular hypertension in normal eyes and increases pressure in eyes with existing elevated pressure. The local administration of corticosteroids to the eyes of patients with bacterial, viral and fungal conjunctivitis may mask evidence of progression of infection until sight is lost. Corticosteroids may cause progression of herpes simplex infection, resulting in irreversible clouding of the cornea.

The phase I trial was successful in showing that AzaSite Plus was well tolerated and no serious adverse events were reported. Treatment-related ocular adverse events were minimal in frequency and equivalent between the treatment and placebo groups. There were no significant differences in intraocular pressure between the AzaSite Plus group and placebo group after 14 days of treatment.

In the fall of 2007, InSite conducted a pilot study to evaluate endpoints and time points in preparation for Phase 3 trials for AzaSite Plus. It enrolled 32 patients with blepharoconjunctivitis who completed the double-masked and randomized trial. They received eye drops two times a day for 14 days. The results led to the selection of endpoints for the first Phase 3 trial, which included lid margin redness, lid swelling, conjunctival redness, ocular discharge, and lid irritation in at least one eye. The company then went on to a phase 3 trial involving 417 patients. The dosing regimen consisted of one drop in the eye and one on the eyelid, two times a day for 14 days. The trial design included three treatment arms with the objective of demonstrating the superiority of AzaSite Plus in treating blepharoconjunctivitis over AzaSite and dexamethasone.

AzaSite Plus failed to reach the primary endpoint of this phase 3 trial in 2008 in which it was studied for blepharoconjunctivitis. In this trial, AzaSite Plus (azithromycin plus dexamethasone) showed superiority over AzaSite (azithromycin) but not against DexaSite (dexamethasone). FDA requires that a combination product like AzaSite Plus establish superiority to each of its components in a phase 3 trial. The patient cure rate for Azasite Plus was 27% as compared to 14% for AzaSite which carried a statistical p value of 0.02. Azasite Plus versus DexaSite was 27% versus 25% for a p value of 0.52, indicating no difference in the two drugs.

The hypothesis of new management is that azithromycin takes a longer period of time to be effective in blepharitis and was relatively ineffective for the 14 day length of this trial. Hence, the activity of AzaSite Plus was almost all due to the dexamethasone and would not be expected to be better than DexaSite. The new trial is designed to show that AzaSite Plus is superior to DexaSite when viewed over a longer period of time.

InSite carefully analyzed the failure of the 2008 trial as well as other blepharitis studies to understand their shortcomings and designed a new trial. In April 2009, InSite discussed the results of this trial with the FDA and, based on this meeting, developed a pilot study protocol for the treatment of blepharitis that would seek to demonstrate AzaSite Plus's ability to delay exacerbation and/or recurrence of acute episodes of blepharitis. This study served as the basis for revisions to the pivotal Phase 3 clinical trial protocols.

In 2010, InSite met with FDA to discuss a development pathway for this product candidate. This resulted in the planning of the DOUBle trial which is now being enrolled. In looking at the trial design, it appears to me that InSite has come up with a trial design that has a high probability of success. Understanding DOUBle is essential to the analysis of InSite.

The DOUBle Trial of AzaSite Plus and DexaSite

DOUBle stands for dual ophthalmic agents used in blepharitis. AzaSite plus is a combination of two drugs and the carrier drug delivery matrix. FDA guidelines require that AzaSite Plus must be compared to each of its components. This will result in four arms in the trial so that there will be roughly 300 patients in the AzaSite Plus arm, 150 in the AzaSite (azithromycin) arm, 300 in the DexaSite (dexamethasone) arm, and 150 in the DuraSite (carrier matrix) arm.

Trial Design

The trial design will incorporate the traditional blepharitis trial endpoint of complete resolution of symptoms at 14 days. At this time, AzaSite Plus will be compared to AzaSite and DexaSite to DuraSite. Statistically significant results for both comparisons would lead to approval of AzaSite Plus and DexaSite for blepharitis.

The company expects that AzaSite plus will be superior to AzaSite at 14 days because of the short term anti-inflammatory effects of dexamethasone. Azithromycin takes much longer to create an anti-inflammatory response and InSite believes that it will produce little anti-inflammatory effect in the first 14 days so that all of the anti-inflammatory effect comes from dexamethasone. The probability of success seems high as the 2008 trial showed AzaSite Plus as superior to AzaSite at 14 days and a blepharitis trial run by InSpire showed that AzaSite was not effective at 14 days.

InSite also expects that DexaSite will be better than DuraSite (which has no active ingredients) at 14 days. This is based on experience from the prior 2008 Phase 3 study. In that trial, dexamethasone showed an unexpected high level of activity of anti-inflammatory activity. This discovery was the basis for the filing of a patent that may extend coverage through 2029.

The 14 day endpoint is more appropriate for an acute infection like bacterial conjunctivitis in which there is a clear clinical outcome; the infection is cured or not cured. Blepharitis for the majority of patients is a chronic disease that will recur. DOUBle incorporates a new and more appropriate endpoint for AzaSite Plus versus DexaSite. Patients who achieve complete resolution of clinical signs and symptoms at 14 days will be evaluated over a period of up to six months to quantitatively determine when their disease recurs. AzaSite Plus and DexaSite should be comparable over the early part of the trial, but over time the longer to take effect action of the azithromycin component of AzaSite Plus should cause fewer recurrences for the AzaSite Plus patients.

In past trials, a patient who achieved 95% resolution of their clinical signs and symptoms would have been judged a failure and dropped from the trial. For the first time in any blepharitis trial, DOUBle will quantify the degree of change in these patients that will give an entirely new insight into the epidemiology of moderate to severe blepharitis. DOUBle will use two quantitative measurement scales to follow patients over six months: a physician assessment scale and a patient evaluation on quality of life.

The second endpoint will judge the effectiveness of AzaSite Plus and DexaSite beyond 14 days. It is expected that the anti-inflammatory effect of dexamethasone will wane while that of azithromycin will become apparent. For the first 14 days, it is expected that AzaSite Plus and DexaSite will show comparable results. However, in follow-ups over 30 and perhaps up to 90 days, it is expected that AzaSite Plus will be superior as DexaSite patients will relapse faster.

This trial will also be able to compare the results of AzaSite to the inactive, control arm that is comprised of DuraSite. If statistically significant improvement is seen, it could result in the approval of AzaSite in blepharitis. Currently, it is only approved for bacterial conjunctivitis.

Because of the new endpoints and other features that will be discussed shortly, the company sought and received as SPA from the FDA. An SPA essentially says that the conduct and success of the trial is a reasonable basis for regulatory approval. However, it is not an absolute guarantee.

The company is also making a change from prior trials by having a seven day lead in period they can moderate the placebo effect in the control arm. They can also establish a baseline of the disease and only allow the sicker patients most likely to benefit into the trial. Mild cases which would likely clear up on their own and confound results are not allowed into the trial.

New Measurement Tools for Evaluation of Patient Responses

Previous blepharitis trials relied on physicians' assessments that patient had blepharitis in order to be enrolled in the trial. Then at 15 days, physicians would assess whether the patient was cured. InSite has developed two new measurement tools that are designed to provide a less subjective, more quantitative measure of the status of blepharitis patients. One is based on an assessment by the physician of the disease and the second is the patient's own assessment of his disease status.

The physician measurement tool is BleSSSED, which stands for blepharitis signs and symptoms scoring for evaluatingdisease. It requires the physician to quantitatively score the patient on four aspects of the disease: irritation of the eye and redness, swelling and debris of the eyelid. Each is rated on a scale of 0, 1, 2 or 3 with 0 being nothing noticeable and 3 being most severe. The scores of these four measures would be zero if there is no disease and 12 for the most severe disease.

BleSSED or any other subjective scoring system carries the risk that physicians may judge the same symptom differently. Inconsistent inter-physician evaluations have been a drawback of previous blepharitis studies. In order to minimize this risk, InSite is providing investigators with a laminated cheat sheet with photographic examples that demonstrate visually the appropriate score for a given severity of disease. The BleSSED scoring is further supported by taking digital photographic images at each assessment of the patient using a standardized digital camera, standardized lighting, and standardized distance of the photography. This allows a centralized reviewer to evaluate any patient and come up with their own scoring; this is something the FDA likes to do in its review process.

InSite is also seeking to avoid a problem with previous blepharitis trials which have accepted all comers. This meant that patients with mild forms of blepharitis who might not need drugs were included. Following the seven day lead in period, patients are evaluated by BleSSED. In order to be enrolled, they must have a total score of 5 to 12 and must score at least 1 on redness and swelling. The trial enrollment criteria also exclude patients with conjunctivitis, blepharoconjunctivitis or dry eye. This enriches the study to include only patients with moderate to severe blepharitis and more closely mimics the way patients are treated in the real world.

The company has also developed a new measurement scale in which the patient does his own assessment on quality of life. This is called BleQOLITY, which stands for blepharitis quality of life in therapy. Upon entering the trial, each patient's baseline quality of life or BleQOLITY score is determined by asking the patient

19 different questions related to overall disease status. This type of measurement has been used extensively in many other therapeutic areas and there is a division of FDA that works on quantitative quality-of-life questionnaires. However, DOUBle is breaking new ground and will be the first blepharitis trial to have such a measurement.

DOUBle started at the end of 2011. They will complete enrollment in 2H, 2012 and topline data could be available in 1Q, 2013 or possibly by the end of 2012. The NDA filing could be in mid-2013 so that if all goes well the product could be approved as early as 2Q, 2014. They would be filing for NDAs on Azasite Plus and Dexacite for blepharitis. The total cost of DOUBle is expected to be about $8 million.

Conduct of the Trial

InSite is also changing the technique for application of the drugs in DOUBle. Previous blepharitis trials applied the drugs topically to the eye. This is probably appropriate for conjunctivitis or dry eye, but blepharitis is a disease of the eyelid. In this trial, patients will administer the blinded agent twice daily for 14 days. After washing and cleaning their hands, each one of these agents will be applied topically to the lids via a clean finger, and then rubbed or massaged onto the lids for penetration. Previous trial applied drops to the eye or to the eyelid.

Patients are observed at 0, 8 and 15 days and every 30 days thereafter. They look for patients who resolve all signs and symptoms at 15 days. Historically this has been the end of the study. However, this would be the way you would treat an acute disease and this is a chronic disease.

There are then scheduled follow-ups at 30 day intervals up to 6 months. At each 30-day period, patients will be scored by investigators, they will be scored on BleSSED and BleQOLITY and the standardized digital photography. InSite is actually going to follow patients, almost like an epidemiology study, to find out when they recur, and how they recur.

Disease recurrence in patients who had realized a complete resolution of all clinical signs and symptoms at day 15 is regarded as having completed the study and patients go off-study. Patients who did not achieve complete resolution of all clinical signs and symptoms at day 15 are also considered as having completed the study if they suffer exacerbations as measured by BleSSED. Finally, any patient who believes they have suffered a recurrence or exacerbation before a scheduled visit can see the physician and if this is confirmed, this is also regarded as having completed the study. The study will follow patients going all the way to cure or to the best response from baseline.

There are several major differences in DOUBle as compared to earlier studies that failed. The first is patient eligibility criteria. Instead of taking all comers, they will only accept those with moderate to severe blepharitis and will also exclude patients with dry eye. It is like an oncology study that selects patients most likely to respond. The dosing is also novel as the drug is going to be rubbed or massaged onto the eyelids instead of applying it directly to the eye. The study has retained the traditional endpoints as well as adding significant and more informative clinical endpoint with the new time to recurrence endpoint that follows patients who achieve the clinical endpoint. In addition, the trial will follow those who do not achieve a complete resolution at 14 days for the first time in past blepharitis trials, they were dropped at day 15.

Interpreting the Trial Results

DOUBle is repeating parts of earlier trials in which AzaSite Plus consistently outperformed AzaSite. In the 2008 study on the traditional endpoint between AzaSite Plus and AzaSite, AzaSite Plus was better. However, a shortcoming of that trail was that many patients who improved but didn't reach the 100% cure rate could not be counted or considered. For example, a patient whose symptoms improved by 95% was counted as a trial failure. This was the reason for inclusion of measurements that assess patients getting better even if they are not cured at the somewhat arbitrary 14 day time period.

DOUBle is intended to show that the advantage of the tissue penetration and anti-inflammatory effect of azithromycin as it is delivered in DuraSite. The anti-inflammatory and tissue penetration properties of azithromycin in the eye are well established in the peer review literature. It penetrates tissue, concentrates in tissue, in a dose- and duration-dependent manner. And that allows it to persist many days after dosing. Pre-clinical calculations and examinations based on BID times 14-day dosing onto the lids suggest that azithromycin should be detectable in the eyelid for as long as 90 days. This should provide a meaningful difference in the AzaSite Plus versus DexaSite arm in terms of time to recurrence.

Azithromycin has negligible anti-inflammatory effects through 15 days as it takes much longer to work. This means that AzaSite Plus should be no better than DexaSite at 15 days as the azithromycin component has not had time to establish a clinical effect. However, AzaSite Plus should be better than DexaSite in the periods beyond 14 days as the azithromycin anti-inflammatory effect kicks in and the dexamethasone anti-inflammatory effect wanes.

Commercial Opportunity for AzaSite Plus

If the DOUBle trial is successful, AzaSite Plus will be the first product to have an indication for blepharitis. This could provide first-to-market potential which management compares to the situations with Ditropan and Detrol for the treatment of over active bladder and also Restasis for dry eye. These products were the first to define a market in which there was no approved therapy and numerous silent sufferers. With formal approval, no competitive products approved for the condition, availability of reimbursement, extensive off-label prescribing and the ability to promote the products, each of these became a blockbuster.

Many cases of blepharitis can be treated by lid scrubbing the eyelids. Patients who come to the ophthalmologist are the most severely affected patients. However, there are substantial numbers of silent sufferers who have given up on medical care or have not sought it out. There are no products approved for blepharitis but ophthalmologists do a great deal of off-label prescribing of steroids and antibiotics to assist the worst patients. Because of this off-label prescribing, patients may not receive reimbursement and pay out of their own pockets for pharmaceutical therapy.

BromSite

InSite is developing BromSite as an improved version of ISTA's Bromday, whose active ingredient is bromfenac, a non-steroidal anti-inflammatory agent that was originally introduced by Wyeth in 1997 for the short term relief of pain. Following reports of liver failure in some patients, it was withdrawn from the market in 1998. However, the rapid absorption and high degree of tissue penetration in ocular tissue and lower amount of drug needed for efficacy made bromfenac an excellent candidate for treating ocular inflammation and pain.

ISTA Pharmaceuticals (now part of Bausch & Lomb) markets bromfenac as Bromday in the US as a once daily topical application; it was in-licensed from a Japanese company that developed it as an ophthalmic drug. It is indicated for the treatment of ocular inflammation and pain after cataract surgery. Since 2000, it is estimated that it has been prescribed over 20 million times globally. It is generally used for 14 days after cataract surgery and can usually be the only anti-inflammatory drug needed, eliminating the need for steroids.

Bromday recorded sales of $85 million in the US in 2011. It was approved in October 2010 as a follow-up to the ISTA's earlier twice a day formulation Xibrom. Under Waxman-Hatch, it was granted three years of marketing exclusivity through October of 2013. Bromday is the leading product in the topical ophthalmic non-steroidal anti-inflammatory market which has sales of approximately $370 million stemming from total prescriptions of three million annually. The patent on Xibrom expired in January 2009 and in May of 2011; the FDA approved a generic version of Xibrom. Currently, only one ANDA is approved, but other approvals are likely. Bromday has exclusivity until October 2013.

In October of 2011, InSite Announced positive top-line results from a Phase 2 head-to-head pharmacokinetic study of BromSite versus Bromday. Although BromSite has a 25% lower concentration of bromfenac than Bromday, it still achieved more than twice the tissue penetration in the eye of Bromday. This enhanced tissue penetration could lead to additional back-of-the-eye uses and new indications for BromSite beyond the initial post-cataract surgery indication. InSite believes that BromSite is a superior drug and that it has potential exclusivity until 2029.

InSite has reached agreement with the FDA in regard to conducting two 240 patients each Phase 3 studies of BromSite versus the DuraSite vehicle. It is expected that the trials will be fully accrued in 2H, 2012 with results available at the end of 2012 or early 2013. If successful, an NDA for BromSite could be filed in 2013.

Disclosure: The author of this article owned no shares of InSite Vision at the time this note was written. In reading this note, you acknowledge that you have not used it as the sole basis of your decision making and that all investment decisions are based on your own analysis. An investment in InSite Vision carries substantial risk and investors could potentially lose much of their investment. The reader acknowledges that he/she has carefully read the Investment Approach, Terms/Conditions and Disclosures sections in the About Us section of the website. The reader acknowledges that he/she will not hold SmithOnStocks accountable for any investment loss that may be incurred if a decision is made to invest in InSite Vision.

Tagged as InSite Vision + Categorized as Company Reports