How Iluvien May Benefit Alimera and pSivida (PSDV, $3.25)

Investment Perspective on Iluvien

The investment outlooks for pSivida (PSDV) and Alimera (ALIM) in 2013 will be driven by issues related to Iluvien, an ophthalmic implant which has been developed for the treatment of diabetic macular edema. Diabetes can lead to chronically elevated levels of blood sugar that can cause structural damage to the inner lining of blood vessels in the retina that leads to blood vessel permeability (leakage).

The increased permeability can lead to a breakdown of the blood-retina barrier, and allow fluid and proteins to leak into the retina, thickening the macula (the central part of the retina) and distorting nerve cells. This can lead to dysfunction and eventually blood vessel occlusion. The result is a decrease in visual acuity which becomes permanent if left untreated; this is a condition called diabetic macular edema or DME. The most prevalent cause of blindness in adults of working age is diabetic retinopathy DME is the most common complication of diabetic retinopathy.

The incidence of DME is increasing sharply coincident to the diabetes epidemic in the US. Estimates are that the prevalence of DME is as much as 1.3 million eyes in the US. Because this is a chronic disease, prevalence as opposed to incidence should determine usage. Based on talking to physicians and industry sources, I estimate that about two-thirds or 900,000 eyes could benefit from drug therapy. Because Iluvien lasts for three years, the addressable market at steady state would be one-third of 900,000 or 300,000 eyes. Initially, there might be pent-up demand that could make the market opportunity mush larger. Alimera's detailed market research in Europe suggested that 20% of this addressable market for drug treatment or 60,000 eyes is currently treated by injectable steroids. This suggests that the addressable market in Europe is at least the size as that now treated by steroids, i.e, 60,000 eyes. The US market could be of comparable size. Assuming a price of $8,000 per treatment, the addressable market in sales is $480 million in both the US and Europe.

Iluvien will compete in a market in which the primary treatments are laser photocoagulation, the anti-VEGF products Lucentis and Eylea, and steroids that are injected into the eye. There is no question that Iluvien is as effective as any of these therapies, but it does have troublesome side effects such as increasing intraocular pressure (which is what glaucoma does) and increasing the rate of cataract formation. Its eventual role in treating DME will probably be in patients who don't respond initially or no longer respond to laser photocoagulation and anti-VEGF therapy.

One of two major issues relating to Iluvien this year will be whether the FDA will approve the product in the US. Its marketing partner for Iluvien, Alimera, has now received two complete response letters and in the latest one, the FDA asked for two new phase III trials. If the FDA is unbending, meeting its request could mean that the NDA could not be refiled until 2016 or later and it may be the case that Alimera would decide not to do the trials. Alimera has met with the FDA and believes that it can satisfy the agency with a reanalysis and improved presentation of the data in the NDA. Encouragingly, the FDA has accepted the refiling of the NDA and has set a PDUFA date of October 17, 2013. I think that there is a better than 50/50 chance that Iluvien will be approved at that time in the US. However, if it is approved I expect considerable headwinds from managed care and I look for a very slow launch.

The second and equally important issue for 2013 will be the roll out of Iluvien in Europe, where it has been approved in seven countries. In European countries, once a product is approved, a company has to then apply for reimbursement from the national health care agencies. This takes time and is an uneven process from country to country. Iluvien has received pricing approval in Germany and in the private pay sector of the UK which accounts for 19% of the market opportunity. The agency which controls pricing in the UK national health system, an organization called NICE, has stated that at Alimera's requested price Iluvien is not cost effective. While this sounds and may be ominous, NICE frequently takes this tack with new products that ultimately receive price approval.

Investors will obviously focus on initial European sales that will obviously shape expectations for future sales. Second half sales in 2013 will primarily come from Germany and I would expect them to be in the $3 to $5 million range. In an analysts day presentation on July 28, 2013 Alimera presented market research data that it used to make a projection for European sales of about $150 million in 2014 and $450 million in 2017. There have been delays in the rollout in Europe that would seem to make the estimate of $150 million in 2014 unrealistic, but Alimera has not adjusted its guidance. I believe that investor expectations for 2014 are much less than Alimera's estimate and for 2017 may be around $175 to $200 million. I personally find it hard to come up with estimates for 2014 and beyond. I will need to see how trends develop before I have much confidence in any estimates.

The Alimera/ Iluvien outlook reminds me of Dendreon/ Provenge. Shortly after its launch, Provenge was impacted by the new launches of Zytiga and Xtandi that competed for some of the same patients. Iluvien is similarly facing competition in the US from the already approved anti-VEGF product Lucentis and another anti-VEGF product Eylea should shortly be approved for this indication. Iluvien also faces the issue that it is a long acting steroid and ophthalmologists are reluctant to use steroids because of their side effects.

Aside from competition muddying the competitive landscape, Provenge was further impacted by the concern that the product cost $90,000 and there was no way to predict in which patients it might work. Oftentimes, physicians try a drug and if it doesn't work, they can stop the therapy and the patient/ payor incur no further costs. With Provenge, there is no way for predicting which patients will benefit so that treatment failures pay for the full cost of therapy. Iluvien has a somewhat similar situation in that the product is designed to work for three years. The cost of the product may be about $8,000 and there is no way to predict which patients will respond and which will fail.

Injectable steroids as I previously mentioned may be used in as many as 60,000 eyes. They are somewhat cheaper than Iluvien so that managed care may compare prices. The injectable steroids are not approved for DME and there is no data I am aware of that clearly shows efficacy although I think they are effective. This makes it more difficult for managed care to encourage the use of injectable steroids over Iluvien. Still, I expect managed care to throw up initial roadblocks to slow the uptake of Iluvien. Along with the now usual caution on the part of ophthalmologists on new drugs and their concerns with side effects common to steroids, I think the initial launch will be slow as has become normal for new products.

Investment Thinking on Alimera

I think that the uncertainties about the potential for Iluvien in Europe, whether Iluvien will be approved in the US and the probability for a slow launch even if is approved in the US, will present considerable headwinds for the stock price of Alimera. These headwinds will be strengthened by the concern that Alimera will have significant financing needs in the next year or two. In October of 2012, ALIM sold a $40 million convertible preferred offering that it stated would be used to finance the Iluvien launch in Europe. Even with this capital infusion, it ended 1Q, 2013 with only $39 million of cash and it showed cash burn of $10 million in that quarter. In May, it announced a venture debt deal by its UK subsidiary also intended for the European launch that brought in $5 million as a term loan and established a $15 million line of credit. Looking forward, I think that the cash burn will be substantial going based on needs for continued spending on the European launch. The spending will accelerate further and if Iluvien is approved in the US and launched in 2014. Further, Alimera has to pay pSivida a $25 million milestone payment upon US approval of Iluvien.

In its two recent financings with the convertible preferred and venture debt deals, the Company seems to be trying to avoid directly selling shares. This may be for the purpose of avoiding shareholder concern over dilution. I view these as very risky financing tools for a company that is likely to burn significant amounts of cash for some time into the future.

Alimera is launching Iluvien with its own small sales force in northern Europe and plans to do the same in the US. Based on the slow launches I expect in the US and Europe, I think that Alimera will not be profitable until 2015 or 2016 and possibly longer. I see the need for significant financing in the interim if Alimera follows through on its current strategic plan. Of course, it could elect to go to a partnering scheme or try to sell the company.

Because of the two Complete Response Letters of CRLs that Alimera has received on Iluvien, there is naturally considerable uncertainty as to whether it will be approved following the October 17 PDUFA date. I think that based on the approvals in Europe, which has sophisticated regulators like the US and the recent acceptance of the NDA resubmission that the product has a reasonable chance for approval. I also noted in the last 10-K that Alimera paid a consulting firm to help on the NDA resubmission; it has paid that firm $4 million and will pay another $2 million if the NDA is accepted. This raises the thought in my mind that the earlier NDA submissions were not well prepared and that better organization of the data might give the FDA the information it needs to approve Iluvien.

There is considerable uncertainty on the potential for Iluvien approval and this is a critical ingredient for an asymmetric investment opportunity. However, there are just too many uncertainties about the outlook in regard to financing and the sales ramp if approved for me to consider buying the Alimera based on US approval of Iluvien and I am taking a wait and see approach to the Company and stock. I do see the potential for Iluvien to become a very significant product and that Alimera could be a good investment opportunity if it can navigate the financing and slow initial launch hurdles.

Investment Thinking on pSivida

I think that pSivida offers an interesting way to play the potential approval of Iluvien in the US. Alimera upon approval of Iluvien has 30 days to pay pSivida a $25 million milestone payment or Iluvien rights will be transferred back to pSivida. This makes payment of this milestone the top priority of Alimera and this will be paid before any other expenses in the Company. However, if Alimera somehow did not pay the milestone, Iluvien would be a very valuable asset for pSivida. Of course, I assume the payment will be made.

In terms of economics, pSivida is entitled to receive 20% of net ptofir of Iluvien on a country by country basis. (This is initially reduced to about 16% until Alimera recovers launch expenses.) Net profit is defined as net sales minus COGS minus sales force expense minus launch expense. Because the target audience for Iluvien is a small number of retinal specialists, sales force costs are not that much. I estimate that pSivida will realize about 15% of net sales.

Germany is likely to reach profitability first. On an optimistic basis this could be in 2014, but it is more likely to take longer. The stream of payments could become quite meaningful in the 2016 to 2020 period if Alimera's projections are accurate. Its projection of $450 million for Iluvien revenues in Europe would produce about $68 million of revenues for pSivida and US payments might be the same. This would create $136 million of revenues with no associated costs. I hope that Alimera is right as this would be a major upside for pSivida.

Under the agreement with Alimera, pSivida has the right to develop a product that is essentially the same as Iluvien for a disease known as posterior uveitis. Posterior uveitis is caused by a different mechanism of action than DME. DME is in part a vascular disease that can be addressed by laser photocoagulation and anti-VEGF therapy; it also has an inflammatory component that Iluvien can uniquely address. Posterior uveitis is quite different from DME, it is an auto-immune disease in which steroids and other drugs for autoimmune disease are needed; laser photocoagulation and anti-VEGF therapies are not indicated.

The posterior uveitis market is not that much smaller than DME. Estimated place it at roughly 400,000 eyes. pSivida has branded its product as Medidur and I expect it to be priced at the same price as Iluvien or $8,000 per year. This indicates an addressable market of $360 million in the US, roughly the same opportunity as Iluvien. Posterior uveitis is a more severe disease than DME and there are roughly 30,000 Americans who have been blinded by posterior uveitis. There are two drugs approved for this condition: Retisert in 2005 and Allergan's (AGN) Ozurdex in 2012. Neither drug has done particularly well for reasons I will discuss shortly.

Because Medidur is essentially the same product as Iluvien, its side effect profile should be comparable and, if so, it would be far superior to Retrisert. In its clinical trials, 60% of Retisert patients developed intraocular pressure above 30 mg/mm2. This is considered a serious side effect that is treated by the use of eyedrops normally used to treat glaucoma as compared to 18% of patients in the Iluvien trials. Because physicians usually treat intraocular pressure when it reaches 25 mg/mm2, 38% of Iluvien patients used eyedrops. About 15% of Retisert patients required surgery to relieve the pressure versus 5% for Iluvien. If approved, I would think that this advantage would be a significant incentive for Medidur to replace Retrisert usage. Very importantly, Medidur can be injected into the eye with a syringe whereas Retisert requires a surgical incision for the implant.

The approval of Iluvien could greatly speed the timeline for development of Medidur. A phase III trial for Medidur will begin shortly and will take about one year to enroll and will require a one-year follow-up. If Iluvien is approved, pSivida might be able to gain approval of Medidur based on just this one phase III trial. It could file a supplement to the Iluvien NDA and could reference the safety data in the Iluvien NDA. If the FDA accepts this approach, it would put Medidur on a pathway that would complete enrollment in one year, have a one year follow-up, six months of data analysis, NDA submission and nine month review leading to approval in 2016 for posterior uveitis.

I am basing my recommendation of pSivida on the basis that Iluvien will be approved in the US and highlight the potential of Medidur. This would result in the $25 million milestone payment that could fund the company into 2015 by my estimates. It could also shorten the timeline for Medidur leading to approval in 2016. If Iluvien is not approved in the US, it will lengthen the timeline for Medidur and require substantial future financing. I think that Iluvien can create a significant amount of revenues for pSivida that would be a significant driver for the stock. However, in the near term there will be uncertainty and investors may not attribute much value to Iluvien. However, the relief of the financing overhang and the promise of Medidur could allow the stock to do quite well in 2014 and 2015.

There are other parts to the pSivida story. It has a partnership with Pfizer to develop a surgical implant for Pfizer's highly successful product for glaucoma Xalatan, which is facing a patent expiration. I am not inclined to give much weight to the potential for this product. pSivida management will be focusing most of its basic research on a new drug delivery technology for back of the eye drug delivery called Tethadur, a bioerodible implant. Management believes that it can deliver antibodies (such as Lucentis and Eylea), and other protein based drugs as well as the small organic molecules that it delivers. Lucentis and Eylea are multi-billion dollar products that require 6 to 8 injections per year. If PSDV can develop a product that would deliver the drug via an implant for six months or longer, it could take a large share of these sales. This is an exciting product opportunity.

Price Target for pSivida

The upside for pSivida is based on the approval of Iluvien in the US. In addition to the longer term potential from its share of Iluvien revenues, which could be very substantial, this would remove the financing overhang and probably point the way for approval of Medidur in 2016. I think that this would give the Company credibility and gain investor attention. The focus might then shift to Tethadur and its potential to develop a product that could deliver a VEGF therapy to the back of the eye. This would give a new product potential on top of the Medidur story and Iluvien story. The current market capitalization of the Company is $74 million. If all of these positives come about, I think that we could be looking at a five to ten fold increase in price.

If Iluvien is not approved, Medidur would remain an interesting product candidate. However, with no milestone payment from the approval of Iluvien and a stretched out timeline for Medidur development that moves potential approval from 2016 to perhaps 2018, the Company would face daunting financing challenges and indeed it might have to outlicense Medidur to stay alive. This is not a pretty picture and I think that the stock could sell off meaningfully if Iluvien is not approved. My guess is that we could see a 30% or more price decrease. There is significant risk in the stock, but I think this is very much offset by the upside. I see this as an asymmetric investment opportunity.

pSivida's History of Technology and Product Development

As with the brain, the eye is protected by barriers from systemic blood circulation. This makes it difficult to deliver systemic drugs for diseases that affect the posterior or back of the eye (most importantly the retina) at effective dose levels and with acceptable side effects. As a consequence, back of the eye diseases usually must be treated with intravitreal injections (directly into the eye). This exposes the patient to pain and potential side effects as well as monthly to bi-monthly office visits for the injections.

PSivida was founded to develop an implant that could be surgically implanted and could deliver sustained release of a drug to the back of the eye over a long period. At the time, the HIV epidemic was raging and cytomegalovirus emerged as a secondary infection affecting the eye that could cause blindness. The Company's founders developed Vitrasert, a surgical implant that could deliver gancicovir to the back of the eye; this was the only approved drug for cytomegalovirus. This product was licensed to Chiron, one of the charter members of biotechnology club. It was introduced in 1996, but never became a big seller as new drugs emerged for HIV that gave better control of the disease and reduced the occurrence of opportunistic infections like cytomegalovirus.

The Company then went on to develop Retisert as a drug delivery vehicle for the steroid fluocinolone acetonide. This was the first approved intravitreal drug implant for the treatment of chronic non-infectious posterior uveitis, a sight-threatening autoimmune disease affecting the back of the eye. (This is the disease target for Medidur.) Retisert is a very small device, about the size of a grain of rice, which is surgically implanted in the eye through a small, 3-4 mm incision and releases precise amounts of medication each day for approximately 2.5 years.

Retisert was approved as an orphan drug by the FDA in April 2005 and is marketed under license by Bausch & Lomb. Bausch then tried to extend use of the product to treat diabetic macular edema. However, they abandoned the clinical development effort after they determined that increased intraocular pressure and increased formation of cataracts were unacceptable side effects when weighed against therapeutic benefit. pSivida stepped in and picked up the project believing that they could develop an improved delivery system that would reduce the side effect issue. This led to the development of Iluvien.

Iluvien is an implant containing the steroid fluocinolone that that is administered through a small 25 gauge needle and can be administered in a physician's office. The eye is anesthetized and the doctor injects the implant about halfway back in the eye. After the needle is pulled out, the sclera seals on its own without the need for stitching. The implant holds about 190 micrograms of fluocinolone and releases about 0.23 micrograms each day giving the product about a three year life. The implant is not bioerodible and remains in the vitreous bed. The material used in Iluvien is poyimide, the same material used in intraocular lenses and which are, of course, permanent; there is nealry and have been used for over 70 years. Of course, Medidur would be delivered in the same way.

Treatment of DME: Where Does Iluvien Fit

Ophthalmologists have the following treatment options for DME:

· Laser photocoagulation has been in use for over twenty years. The laser can be used to seal the leakage from blood vessels. It is effective for perhaps 50% of patients over a two year period. It requires 3 or treatments per year at a cost of $400 per treatment for an annual cost of $1200+. It is an effective initial therapy that is probably best used in combination with drug therapy. Oftentimes the therapy is used for only a year or two in most forms of DME.

· Injectable steroids have been used as a supplement to laser photocoagulation for many years. They work differently than laser photocoagulation and synergistically as they reduce inflammation. However, they have serious side effect issues as they can increase the rate of cataract formation, increase intraocular pressure in 50% of patients and filtration surgery needed in perhaps 15 % of patients to relieve intraocular pressure. They require three to four injections per year at a cost of $300 to $400 per injection for an annual cost of around $1000. They have never been approved for DME and are used off-label.

· The new anti-VEGF therapies, Lucentis and Eylea, have become blockbuster drugs for the treatment of wet AMD and are now extending into DME. Lucentis was approved for DME in 2011 and Lucentis will be approved shortly. These drugs are the drugs of choice to be added to laser photocoagulation. They are probably as effective in a two year period as steroids and are much safer as they do not cause increased intraocular pressure and cataract formation. They require seven or more injections per year at a cost of $2,000 per injection for an annual cost of $14,000 or more.

· Iluvien is, of course, a steroid and it shares their side effect issues. It is probably as effective as Lucentis and Eylea over a two year period. It will probably be priced at $8,000 for one injection that lasts three years resulting in an annual cost of $3,000.

I think that most ophthalmologists and patients initially will choose laser photocoagulation and the first drug they will choose to add will be Lucentis or Eylea. There will be a number of patients who progress or who don't respond to this treatment and at that point physicians and patients might choose to add a steroid. There are no studies showing how Iluvien compares in efficacy to injectable steroids. However, I think that many physicians will believe that the steady, sustained release of Iluvien will be more effective than repeated injections of steroids. Iluvien and the injectable steroids have the same troublesome side effect issues. There will be added concern with Iluvien because it is a non-bioerodible implant that will remain in the eye forever and can't be withdrawn if the patient does not respond to therapy.

It is very difficult to determine the extent of the role that Iluvien will play in DME. The ophthalmologist has to answer some very tough questions and there is little data for him to rely upon. I think that steroids will only be used after photocoagulation and anti-VEGF therapies fail. Then a steroid will be added or will be used alone and the question is whether it will be Iluvien or an injectable. Iluvien has the advantage of only one injection for three years of therapy versus 3 to 4 injections per year. Its disadvantage is the decision to use Iluvien is not reversible and the patient is locked into therapy for three years even if serious side effect issues arise or if the product is ineffective.

There seems to me to be a role for Iluvien in the market, but the question is in how many of the 180,000 DME patients treated annually is the risk benefit acceptable or in which all other options are not acceptable. It and the injectable steroids are likely to be the drug used when patients don't respond or no longer respond to laser photocoagulation and anti-VEGF therapy. Then the question is will physicians opt for injectable steroids or Iluvien and again, I don't know the answer to that question. It may take several years of use before the correct sequencing of these agents is established through clinical experience.

Commercialization Prospects in Europe for Iluvien

Commercialization in Europe is a two-step process. First a product has to gain a product approval from a sponsoring country and then that approval is recognized in all member states. That is only the first step as the product then has to get pricing approval, which goes on a country by country basis. It is encouraging that Iluvien was approved broadly in Europe. This shows that the European regulators concluded that there is a patient population in which Iluvien has a meaningful role to play, probably patients who don't respond to laser photocoagulation or anti-VEGF therapy.

Iluvien has gained pricing approval in Germany and is priced at 7,000 euros ($9800). The allowed price is important as Germany and most other countries use a reference pricing scheme. This essentially means that if a new drug is introduced in an established therapeutic category, its allowed price will be no greater than other products in that category. This premium pricing suggests that the Germans view Iluvien as different and presumably better than injectable steroids which carry very low prices.

NICE, the UK's national health pricing authority has stated that the risk to benefit ratio of Iluvien does not justify a price comparable to that in Germany. However, NICE takes this tack with virtually every new drug. Iluvien is approved for use in the private pay segment of the UK market that is about 10% of the total market. Alimera will have to go through these pricing discussions on a country by country basis. The next country up is France for which pricing approval may be gained in 2H, 2013. Other northern European countries should follow in 2014, but the financially distressed countries of Southern Europe are not likely to approve it for a while.

The sales progress in Europe is likely to be slow. As a guess, I think that sales in 2013 could be $2 to $3 million and in 2014 could be perhaps $20 million or so. Alimera has done a market research study in Europe that led it to believe (as of the July 18 analyst day) that sales in 2014 could reach $150 million and sales in 2017 could reach $550 million. The more optimistic Wall Street analysts are currently expecting 2017 sales of about half of that and I might be a little more pessimistic. However, I think that Wall Street analysts, me and the Company are grasping at straws at this point and just making educated guesses.

Alimera decided to go commercial directly in northern Europe. They are delaying a decision on Spain and Italy due to the obvious economic reimbursement issues. They are talking to potential partners in Southern Europe, but remain open to marketing themselves. Iluvien is now approved in seven countries in Europe. It plans to initially concentrate its launch efforts in Germany, France and the UK. Even though these health care systems are under pressure due to the European economic crisis, they are in much better relative condition than the Southern European countries.

To gauge the market opportunity in Europe, Alimera commissioned market research in which over 400 doctors in the EU were contacted. The goal was to identify DME patients that Alimera calls chronic. They are patients who have received laser treatment, VEGF therapy and steroid injections and whose vision is beginning to decline. They have either not responded or are beginning to decline.

They also tried to determine how physicians felt about the risk of steroid therapy in this group. They asked if there is a point at which doctors are willing to take on the risk of increased intraocular pressure and acceleration of cataract formation that occurs in 38% of patients treated with Iluvien. Alimera feels that the risk of steroid induced intraocular pressure is more than offset by the benefit of steroid therapy. The questioning was directed to the level of vision. As a reference, 20/40 corrected vision or better is required to drive a car. Physicians were asked about their risk tolerance as patients approached 20/60 or 20/80.

In the RIDE and RISE trials that led to the approval of Lucentis in DME, 37% of the patients did not receive better than 20/40 even with 24 consecutive monthly injections. The RESTORE trial was used to gain approval for DME in Europe. They injected seven times over 12 months. In this trial, 47% of patients did not get to 20/40 or better. At 20/60, 30% of physicians responded that they would use Iluvien on the first visit after the patient is plateauing and no longer responding. At 20/80, the number was about 40%. In the physicians' minds, about one third of their patients would be candidates for Iluvien. This is what Alimera views as the addressable market.

What Happens to Iluvien Sales in the US If It Is Approved?

I think that there is a good chance that Iluvien will be approved in the US later this year and in looking at Alimera and pSivida that is my working assumption. I see the uptake of Iluvien as being very slow. It will have to work its way through the formulary process and I think that managed care may try to require the use of injectable steroids before Iluvien and make Iluvien the drug of last resort. Physicians will likely have to jump through hoops and go through a lot of paperwork to prescribe the product. Because of this, there will be uncertainty on whether managed care will reimburse Iluvien and physicians may fear that they could be stuck with an uncollectable $8,000 bill which eerily reminiscent of the experience with Provenge.

I see a slow takeoff in the US with minimal sales in 2014 assuming approval later this year. I think that eventually Iluvien may reach peak sales comparable to Europe. This could be anywhere from $100 million to a much higher number. I am not shy about producing estimates, but I am uncertain right now on the potential for Iluvien.

Laser Photocoagulation Treatment of DME

Generally, the first line of treatment for DME is laser photocoagulation therapy in which a laser is used to cauterize abnormal blood vessels and seal sites of leakage. It is estimated that over 50% of DME patients who require treatment receive laser photocoagulation. It and the anti-VEGF therapy Lucentis are the only approved therapies for DME; t provides a good and reasonably durable effect. As an aside, the reimbursement economics for laser photocoagulation treatment are favorable to physicians. The annual market for laser photocoagulation may be about $400 million although estimates are hard to come by.

Laser therapy is usually given every 3-4 months to reduce fluid leakage from vessels into the macula. It is effective in slowing the rate of deterioration over a period of 3 to 4 years in DME patients, but does not restore vision. Most patients receive another treatment regimen.

Efficacy of laser photocoagulation was demonstrated in The Early Treatment Diabetic Retinopathy Study, in which 1,490 eyes affected with DME were randomized to receive either laser photocoagulation or observation. This study demonstrated that laser photocoagulation reduced moderate visual loss by over 50%, with the greatest benefits seen in eyes with clinically significant macular edema. However 12% of eyes in the study still experienced vision loss of 3 or more lines within 3 years, and only 3% of patients experienced a gain of 3 or more lines of vision. While laser photocoagulation generally slows long-term vision loss, it rarely restores vision.

Intravitreal Injections of Steroids

Prior to the recent approval of the anti-VEGF therapy Lucentis, intravitreal injections of corticosteroids (usually triamcinolone) were the usual add-on therapies to laser photocoagulation. They are used off-label as they have never been established as effective through a clinical trial. There are some patients where laser is inappropriate and steroids may be used first line. An example would be in patients with severe edema in which the laser does not penetrate to the retina. This treatment requires frequent injections of somewhere between 3 and 6 per year.

Triamcinolone has potent anti-inflammatory, anti-permeability, anti-angiogenic, and anti-fibrotic effects. Most of the evidence supporting its effectiveness in diabetic macular edema has come from small, physician-sponsored studies, although the Diabetic Retinopathy Clinical Research Network (DRCR.net) is conducting a number of more formal studies to compare triamcinolone with laser treatment. Visual acuity is improved with injected steroids, but they have significant side effects such as elevated intraocular pressure in up to 50% of eyes treated, increased risk of cataract formation, and increased risk of infection. The benefits of triamcinolone injections is relatively short lived and it is usually combined with laser photocoagulation or anti-VEGF therapies.

Alcon introduced Triescnce, a branded version of triamcinolone in 2007 and Allergan introduced a similar product called Trivaris in 2008. They are not approved for DME although they will be used off-label. They are indicated for inflammatory ocular conditions that don't respond to topical corticosteroids. They are priced at about $500 to $1,000 per year.

Ocular Implants

Allergan's Ozurdex is an extended-release biodegradable ocular implant containing the corticosteroid dexamethasone. It is in phase III trials for DME that may complete in 2013 or 2014. It was approved in July 2009 for macular edema caused by branch retinal vein occlusion-BRVO- or central retinal vein occlusion-CRVO. It was approved in 2012 for posterior uveitis. These are much less prevalent than DME. Physicians have initially been disappointed with the duration of efficacy of 3 to 4 months which is comparable to intravitreal triamcinolone injections.

Comparing Lucentis to Intravitreal Steroids and Laser Photocoagulation

There is a strong belief on the part of physicians that VEGF is a major cause of DME. Studies have shown that DME patients with extensive macular leakage have significantly higher levels of VEGF compared with patients showing minimal leakage. The blockage of vessels caused by diabetes may lead to less oxygen delivery to the macula and in response VEGF is upregulated to grow new vessels. However, VEGF induces vascular permeability, causing fluid and proteins to leak into the central retina.

A phase III study conducted by the National Eye Institute was designed to compare the results of Lucentis, the intravitreal steroid Trivaris and sham injections when each were combined with laser photocoagulation. These results indicated that Lucentis improved vision at 24 months, intravitreal steroid injections showed a slight deterioration in vision and laser photocoagulation alone showed a slight positive effect on vision while

After one year, 38% of patients on Trivaris, the injectable steroid, had increased intraocular pressure and 15% underwent cataract surgery during this one year period. Only about 5% of Lucentis patients had elevated intraocular pressure and only about 5% underwent cataract surgery which was about the same as for laser photocoagulation.

The trial enrolled 854 study eyes from 691 DME patients. The study evaluated Lucentis therapy followed by prompt laser photocoagulation (within 3 to 10 days) or deferred laser photocoagulation (24 weeks or more). These two treatments were also compared to Allergan's Trivaris combined with prompt laser photocoagulation or sham injections with prompt laser photocoagulation therapy. The efficacy and safety measures were assessed over 12-months and 24-months.

The 24-month efficacy results favored Lucentis plus deferred laser photocoagulation therapy which showed that patients treated with:

- 0.5mg Lucentis and deferred laser therapy achieved a 10-letter mean BCVA improvement over baseline. This was a net improvement of 7.2 letters compared to laser therapy/sham injections (p<0.001) at 24 months.) 29% of patients in this treatment arm achieved a mean BCVA improvement of ≥15 letters at 24 months.

- 0.5mg Lucentis plus prompt laser therapy demonstrated similar efficacy results: a 7-letter mean BCVA improvement over baseline and a net improvement of 5.0 letters compared to laser therapy/sham injections (p<0.001) at 24 months. 26% of patients in this treatment arm achieved a mean BCVA improvement of ≥15 letters at 24 months.

- 4mg triamcinolone (Trivaris) plus prompt laser therapy demonstrated no mean BCVA improvement over baseline and a net decline of 1.6 letters compared to laser therapy/sham injections (p<0.001) at 24 months. 19% of patients in this treatment arm achieved a mean BCVA improvement of ≥15 letters at 24 months. Based on this, injectable steroid seem to have a negative effect on vision.

· Patients treated with laser therapy/sham injections alone demonstrated a 2- letter mean BCVA improvement over baseline at 24 months. 17% of patients in this treatment arm achieved a mean BCVA improvement of ≥15 letters at 24 months.

The FAME PHASE III Study of Iluvien

The efficacy of Iluvien as shown in the FAME trials is comparable or slightly more efficacious than Lucentis. The low-dose Iluvien at 24-months are equivalent to those for 0.5mg Lucentis plus deferred laser therapy, and the Iluvien data improve significantly through 30 months. Comparable DME efficacy data for Lucentis at 30-months are not available for comparison.

Alimera and pSivida (PSDV) conducted two pivotal III trials, which are referred to as the FAME studies. There were 956 DME patients in the trial who were treated for at least 24 months with two doses of Iluvien (0.2mcg/day and 0.4mcg/day) or a sham injection. The primary endpoint of the study was the difference in best corrected visual acuity or BCVA for Iluvien treated patients versus control. This was designated as an improvement of 15 or more letters on Early Treatment Diabetic Retinopathy Study or ETDRS eye chart, which is comparable to the Snellen chart used in routine eye exams. Control patients were given a sham treatment in which a rounded tip was pushed against the anesthetized eye to simulate an injection. In the following paragraphs, I summarize the results of this trial. In doing so, I have spared the reader from a lot of detail and for those who dissect clinical trials; you may find that I have glossed over a few things.

For DME registration trials, the FDA requires responders to be defined as patients achieving an improvement in best corrected visual acuity-BCVA- of at least 15 letters (three lines) from baseline on the Early Treatment Diabetic Retinopathy Study (ETDRS) eye chart. The FDA-required primary endpoint is the difference in responder rates between treatment and control groups over a 24-month period. The FDA also requires a comparison of response rates at month 18 and month 24 to ensure that response improves over time of treatment. The FAME data showed that about 29% of patients on Iluvien achieved a 15 letter improvement as compared to 16% in the placebo group, which was highly statistically significant at p=0.002.

The control group in this trial was actually not on placebo. Approximately 65% had received laser photocoagulation and another 37% had laser photocoagulation plus an anti-VEGF (usually Avastin) or an intravitreal triamcinolone injection. This is much closer to real life experience of therapy currently being given to patients whom Iluvien will be targeting and suggests a clear superiority to current standard of care.

Further follow-up on the data suggests there is substantial improvement in visual acuity in months 24 through 36 and that improvement tends to peak at about 30 months for Iluvien as the drug effect begins to wear off. At that time point about 38% of patients experienced three lines or better of visual improvement. In the RISE and RIDE trials of Lucentis that led to its approval in DME, at about month 24 months 40% of patients were showing a three line improvement. This suggests somewhat comparable efficacy of Iluvien and Lucentis in terms of efficacy.

The FAME trial was the first phase III trial ever done with a drug in DME. As a result, there was a significant amount of insight afforded about DME as a disease as well as its treatment with Iluvien. All DME patients will have this disease for the rest of their lives so that it is a chronic progressing disease. In the FAME trial an important observation was made that as the disease progresses beyond three years, an inflammatory component of the disease becomes more of an issue. Early on DME is likely primarily caused by vascular leakage so that an anti-VEGF product like Lucentis is probably a good way to treat it. However, as the disease progresses, there is an increasingly inflammatory component that may be better addressed by a steroid.

However, Iluvien has troublesome side effect issues. Elevated intra-ocular pressure caused the use of eyedrops in about 38% of the Iluvien patients as compared to 3% in the control group. Surgical intervention to alleviate the IOP was required in 4% of the low-dose Iluvien patients. Cataracts occurred in 80% of the Iluvien treated patients as compared to 46% in the control arm. The relatively high rate of IOP requiring surgical intervention, combined with the 36-month life of the Iluvien implant, is a concern to retinal specialists and could impede Iluvien's ability to capture market share.

Will the FDA Approve Iluvien?

The FDA has issued two complete response letters for Iluvien and in the second that was issued on November 11, 2011, it asked for two new clinical trials. Short of outright rejection, this was about the worst possible outcome as it could delay the NDA resubmission by two to three years. Alimera met with the FDA in June of 2012 and based on that discussion, they believe that they can satisfy the issues troubling the FDA by a re-analysis of existing data. I believe that the efficacy of Iluvien is not in question, but the FDA is deeply concerned about the increased intraocular pressure that sometimes requires surgery to relieve.

The FDA is probably asking the question "Can you define a patient population in which the therapeutic benefit outweighs the risk on increased intraocular pressure?" If Alimera can answer that question, then Iluvien will be approved in the US. While the outcome is highly uncertain, I think that Iluvien has a good chance for approval in the US. My judgment is based on the European approval and the belief that the NDA was not well organized in a way that would allow the FDA to answer the question. Alimera hired a group that specializes in NDA submissions and paid them $4 million to help on the NDA re-submission and will pay them $2 million more of the NDA is approved. The FDA has accepted the refiling for review, which is encouraging, has established a PDUFA date of October 17, 2013.

At the FDA meeting in June 2012, Alimera and its consultants went through the complete response letter to try to better understand what they meant by benefit to risk. Of course, the FDA would never give a precise guidance and how they are determining benefit to risk as with ratios or numbers. Coming out of the meeting, Alimera concluded that the most serious FDA concerns were about intraocular pressure increases. There are two safety issues, intraocular pressure and the accelerated formation of cataracts. It is not so much that steroids cause cataracts because as people grow old, they do get cataracts; it is that steroids accelerate the formation. Diabetics are also more predisposed to cataracts earlier in life. In the FAME study in which the average age was 62, about 80% of patients developed cataracts during the three-year trial versus 50% of the control.

The main side effect issue for the FDA is believed to be intraocular pressure based on that meeting. Intraocular pressure rise as seen in glaucoma can result in loss of peripheral vision. In the trial, 38% of the patients had their pressure rise to the level of 30 millimeters or higher, the level at which it is considered a side effect issue. They were treated with the topical glaucoma drug, Xalatan and this brought 90% of those patients' optical pressure under control. About 5% of patients did go on to filtration surgery; these were patients whose pressure didn't go down and the surgeons had to manually reopen the trabecular meshwork to release that pressure. The crux of the issue is this, is the risk that 38% of patients will develop intraocular pressure that requires drug or surgical intervention offset by the benefit of the drug.

There is also risk and quality of life issues in the use of Lucentis and Eylea that require injections every six to eight weeks for life. Iluvien is just one implant that can last for three years. The benefit is the same, but there is the risk that 38% or somewhat more than one-third of Iluvien patients will develop increased ocular pressure versus 5% for the anti-VEGFs. Alimera feels this situation is manageable but the FDA has twice disagreed.

Medidur for Posterior Uveitis

Posterior Uveitis

Posterior uveitis is an autoimmune disease that affects the back of the eye. It causes an inflammation of the uveal tract which is one of the inner linings of the eye. There appear to be many triggers for the disease or it can occur spontaneously, but in many cases, it's idiopathic. It is an orphan disease that affects somewhat less than 200,000 patients in the US. It is the fourth leading cause of blindness that has resulted in 30,000 cases of blindness. The market size is similar to DME in both patients and addressable sales.

Because it is a back of the eye disease, it is difficult to get effective levels of the drug at the site of the inflammation. There are two FDA approved drugs for uveitis. Retisert was developed by pSivida and licensed to Bausch & Lomb while Ozurdex was developed and is sold by Allergan. It is also treated by off label use of systemic steroids; these are effective, but they have significant and dangerous side effects. Immune modulating drugs like cyclophosphamide are also used. None of these drugs are that effective so that patients are managed poorly and many continue to lose their vision.

Medidur is pSivida's Micro-Insert

pSivida has developed a micro-insert that promises to be a major improvement on Retisert. It is the same drug as used in Retisert. However, Retisert has to be surgically implanted while Medidur is administered by an injection using a small gauge needle. It is pretty much the same product that as Iluvien that has been approved for diabetic macular edema in the EU with the exception that it uses a smaller needle for injection.

The micro-insert delivers a tiny amount of the steroid fluocinolone acetonide directly to the back of the eye where it's needed. The device lasts for three years, but the total amount of drug given daily and in total is tiny. It is about half of what is used in an eyedrop and systemic exposure can't be measured. This is the same drug that is delivered in Retisert so that there is evidence that it works in uveitis. There is much reduced risk of encountering the serious side effects that occur with systemic oral steroids.

Clinical trials in DME with Iluvien have shown that the micro-insert delivers the drug and maintains the dosage for up to three years after injection. The micro-insert will solve some of the issues that have challenged Retisert. Number one, Retisert requires a surgery to implant it into the eye. And number two, it can cause some ocular side effects in some patients. The most serious of which is increased intraocular pressure or IOP. The micro-insert was specifically designed to overcome these problems. It is injected into the eye rather than being implanted. The gauge of the needle is the same that is used to inject Lucentis and Eylea. The injection can be done with an office visit.

Planned Phase III Trials

There is good reason to be hopeful that the phase III trials of the micro-insert will show a significantly better side effect profile than Retisert. Data from the two phase III trials with Iluvien, the FAME trials, involved about 1000 patients. Retisert delivered the same drug fluocinolone acetonide as Medidur and it's extremely effective in treating uveitis. Retisert has two main issues. It requires surgery to be inserted and further, it has some significant side effects including increased intraocular pressure. In Phase III clinical trials, over 60% of patients developed increased eye pressure above 30 mg/mm2, and that's a pressure above 30 millimeter. At some point during the trial, another 15% of patients needed a second operation to control this pressure. Alimera showed far fewer elevations of eye pressure less than 18% compared with approximately 60% to Retisert and far fewer pressure lowering surgeries less than 5% compared with 15% for Retisert.

The benefit to risk issues that have resulted in two complete response letters for Iluvien in the treatment of DME are much less of an issue for Medidur as posterior uveitis is a much more dangerous disease that can more readily and rapidly lead to blindness. This makes for a lower hurdle in what is seen as acceptable side effects. The approval of Retisert for posterior uveitis indicates that the FDA was, at least in that case, willing to accept more troublesome side effects as an acceptable trade-off for an effective therapy in the treatment of uveitis. pSivida is hopeful that Medidur will have similar efficacy as Retisert, but with a far better side effect profile, and hence, an even better risk/benefit ratio and as a result, the FDA will find that improved ratio as acceptable.

The FDA has allowed the micro-insert to go straight into two pivotal Phase III clinical trials in posterior uveitis. The Company is planning a total of approximately 300 patients in those trials which will have as the primary end point of recurrence of disease at 12 months. The FDA has agreed that pSivida can reference much of the preclinical and clinical data including the human safety data already supplied under the NDA for Iluvien for DME. The ability to access this data both shortens and simplifies the regulatory process. It is possible that if Iluvien is approved that pSivida could file an sNDA for posterior uveitis with just one phase III trial The posterior uveitis insert is pSivida's own product and is not licensed to Alimera or indeed anyone else.

Retrisert Commercial Performance

Retrisert sales are relatively static at about $15 million of sales that leads to about $1 million of annual royalties to pSivida. In the period of 2013 to 2015, most of the investor focus will be on the launch in Europe, the potential for approval of Iluvien in the US and if approval in the US is gained the sales curve in the US. Still, pSivida has an interesting pipeline of drug opportunities beyond Iluvien. It is developing Iluvien for chronic non-infectious posterior uveitis. This is a much more serious disease in which the side effect issues are less troubling relative to the therapeutic benefit.

APPENDIX

Anatomy of the Eye

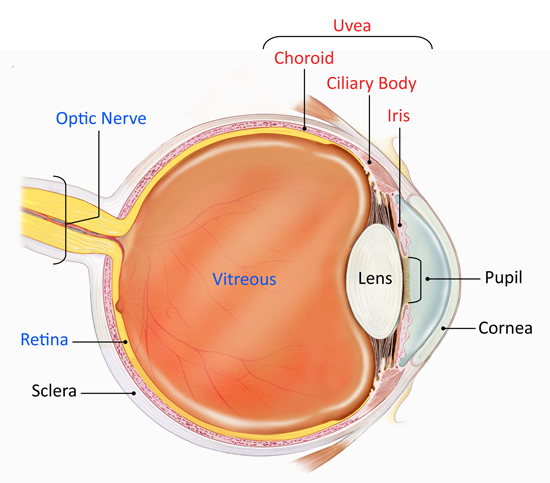

The eye is a complex optical system which collects light from the surroundings, regulates its intensity through a diaphragm and focuses it on the retina through an adjustable assembly of lenses to form an image. This is then converted into a set of electrical signals that are transmitted via the optic nerve to the visual cortex and other areas of the brain. A simple schematic of the eye is shown in the next picture.

Figure 1:

The key components of the eye are:

• Cornea: The transparent front part of the eye that covers the iris, pupil, and front of the eye.

• Pupil: The hole located in the center of the iris of the eye that expands and contracts to allow light to enter the eye and impact on the retina

• Iris: The colored circle at the front of the eye secretes nutrients to keep the lens healthy, and controls the amount of light that enters the eye by adjusting the size of the pupil. It also defines eye color,

• Lens: Transparent tissue that allows light into the eye.

• Retina: The layer of cells located at the back of the eye that converts light into electrical signals sent to the brain.

• Optic nerve: A bundle of nerve fibers that transmits electrical signals from the retina to the brain.

• Vitreous: The space inside the eye filled by vitreous fluid.

• Choroid: A thin, spongy network of blood vessels, which primarily provides nutrients to the retina.

• Ciliary body: It is located between the iris and the choroid. It helps the eye focus by controlling the shape of the lens and it provides nutrients to keep the lens healthy.

• Sclera: The eye's outer white coat

• Uvea: It consists of the iris, ciliary body, and choroid. It contains much of the eye's blood vessels and is one way that inflammatory cells can enter the eye.

The eye like the brain is protected from the systemic blood circulation making it difficult to deliver drugs into the posterior segment of the eye, particularly the retina, with sufficient concentration and reduced side effects. This is the primary reason that diseases of the posterior segment of the eye are treated by intravitreal injections (directly into the eye) intravenous or lateral-bulbar injections exposing the patient to pain and potential side effects. Thus, the mere location of AMD and other back of the eye diseases makes it difficult for pharmaceutical companies to target with their therapies.

Age Related Macular Degeneration

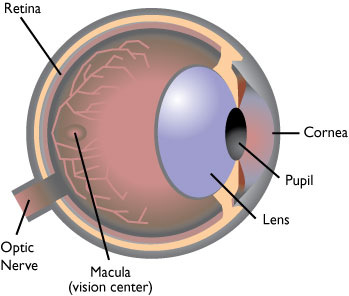

The macula is central part of the retina at the back of the eye that is responsible for detailed central vision. Its location is shown in the next diagram. If the macula begins to degenerate, it can cause loss of central vision. For many people, aging results in a thinning of the macular layers and a gradual loss of vision. This is called dry age related macular degeneration; dry AMD results in severe vision loss in about 25% of people.

Of much greater concern is wet age related macular degeneration or wet AMD which is the growth of abnormal blood vessels in the macula that can cause bleeding within and beneath the retina, opaque deposits and scar tissue. Patients can experience distortion of vision, magnification of images, a blind spot, or frank vision loss.

AMD can gradually destroy central vision function and is the leading cause of blindness in people over the age of 55. The early stages of the disease may be barely noticeable and symptoms can vary. Approximately 15 million people in the US have macular degeneration of whom roughly 85% have dry AMD and 15% have wet AMD. Wet AMD is responsible for 90% of blindness attributable to age related macular degeneration.

Figure 3:

Macular Degeneration

Treatment of Wet Age Related Macular Degeneration

Current treatment options for wet AMD are anti-VEGF therapy, photodynamic therapy and laser photocoagulation. Macugen was approved in 2004 as the first of the anti-VEGF therapies for wet AMD. It is an aptamer that binds to and inhibits activity of the VEGF 165 isoform. Its use quickly eroded as the Lucentis was introduced to the market. It is a fragment of the monoclonal antibody Avastin (bevicizumab) that was originally introduced for metastatic colorectal cancer. It targets all VEGF isoforms and quickly became the standard of care for treating wet AMD. Regeneron's similar product Eylea entered the market in 2011 and is used almost as much as Lucentis.

Laser coagulation focuses a strong light source on lesions to coagulate the diseased tissue. The laser produces a thermal effect that causes necrosis of the lesion's cellular components. This prevents decreases in visual acuity as compared to placebo. However, the thermal effect can damage viable photoreceptor cells, resulting in scarring and loss of visual acuity.

Visudyne is a photosensitizer that is attached to lipoproteins which tend to accumulate in rapidly proliferating cells as in the case of wet AMD. Visudyne traps energy from light and converts oxygen in cells to a highly energized state that leads to cell death. Visudyne must be activated at the site of desired effect by light. Photodynamic therapy with Visudyne consists of administering the light activated drug by intravenous infusion and then shining a light to the back of the eye to activate Visudyne in the retina. Clinicians must purchase the machinery to administer the high (up to $40,000) and hire personnel to administer the IV infusion. Therapy is repeated every three months if patients continue to have active lesions. Patients generally receive three to four treatments before the lesion is converted to a quiescent scar. Worldwide sales were $100 million in 2012 but are being eroded by the anti-VEGF therapies.

Diabetic Macular Edema

Diabetic macular edema or DME is the most common complication of diabetic retinopathy and the most prevalent cause of blindness in working age adults (under 55). It is a swelling of the retina resulting from fluid leakage in the capillaries of the macula. DME results from chronically elevated blood sugar levels which lead to structural changes in the walls of retinal blood vessels.

There is strong evidence that VEGF is implicated in the pathogenesis of DME. VEGF-A levels are significantly higher in DME patients and DME patients with extensive macular leakage have significantly higher levels of VEGF-A as compared to those with minimal leakage. VEGF causes vascular permeability that leads to a breakdown in the blood retina barrier allowing fluid and proteins to leak into the retina. This thickens the macula and distorts the optic nerve that results in a decrease in vision that becomes permanent if left untreated. The size of the wet AMD and DME populations are about the same. However, only about half of the DME population is under an ophthalmologist's active care.

Historically, the only approved treatment for DME was laser photocoagulation. Lucentis was approved in the US in August of 2012 and the NDA for Eylea is awaiting approval. Laser coagulation is effective in about 50% to 60% of cases. In laser and VEGF refractory patients steroids are often added.

Retinal vein occlusion is a disruption of the blood flow in the retina and is a common precursor condition in patients who go on to develop macular edema. These patients are often asymptomatic and self-resolving and frequently lend themselves to a watch and wait approach. There are two type of retinal occlusion which refers to where in the eye they occur. In central RVO, the blockage occurs in the central or main retinal vein at the back of the eye. In branch RVO, the blockage occurs in inner portion of the eye where the retinal c vein branches out into smaller veins. About one-third of RVO patients are treated by a physician and about one-third of these receive VEGF therapy.

Treatment of Diabetic Macula Edema

Alimera's Iluvien is a tiny non-bioerodible polyimide tube filled with 190 mcg of fluocinolone acetonide suspended in a polyvinyl alcohol matrix. It is injected with a 25 gauge needle into the back of the eye and the fluocinolone is released through a proprietary membrane over the course of 36 months.

On June 28, 2010 Alimera filed the Iluvien NDA for the DME indication. The FDA granted a priority review designation on August 2010. However, on December 23, 2010, Alimera received a Complete Response Letter from the FDA for the Iluvien NDA. At the time, the FDA requested 36 month safety and efficacy study. The NDA was resubmitted in May of 2011 and a second CRL was issued in November of 2011. Alimera has just resubmitted the NDA for the third time.

Allergan obtained Ozurdex in the 2003 acquisition of Oculex. It is an extended release biodegradable ocular implant containing dexamethasone developed for the treatment of macular edema. The bioerodible implant erodes after 37 days. In July 2009, the FDA approved Ozurdex for the treatment of macular edema following the branch retinal vein occlusion or central retinal vein occlusion. The leading cause of macular edema is diabetic retinopathy with CRVO and BRVO being much less prevalent. Allergan is working on a broader indication for diabetic macular edema, but approval is not expected until 2014.

Posterior Uveitis

Uveitis is an inflammation of the eye that can affect the uveal lining in in the front and the back of the eye. PSivida is focused on posterior uveitis because as a back of the eye disease, it lends itself to its delivery technology. Posterior uveitis is an orphan disease that affects somewhat less than 200,000 patients in the US. It is the fourth leading cause of blindness that has resulted in 30,000 cases of blindness.

There appear to be many triggers for the disease or it can occur spontaneously, but in many cases, it's idiopathic.

Treatments primarily try to eliminate inflammation, alleviate pain, prevent further tissue damage, and restore any loss of vision. Posterior uveitis is treated with both injected and systemic steroids.

There are two FDA approved steroids for uveitis. Retisert was developed by pSivida and licensed to Bausch & Lomb and Allergan's Ozurdex is also approved for this indication. It is also treated by off label use of systemic steroids which are effective, but they have significant and dangerous side effects.

Other immunosuppressive agents that are commonly used including methotrexate, mycophenolate, azathioprine, and cyclosporine. In some cases, biologic response modifiers or biologics such as, adalimumab, infliximab, daclizumab, abatacept, and rituximab are used. None of these drugs are that effective so that patients are managed poorly and many continue to lose their vision.

Glaucoma

Glaucoma is caused by damage to the optic nerve resulting in a gradual narrowing and ultimate loss of the visual field. Glaucoma results from a variety of different conditions; elevated intraocular pressure usually is the primary cause. In a normal eye, a watery fluid called aqueous humor fills the void between the cornea and iris, nourishing the cornea and the lens and providing the front of the eye with its form and shape. Chronic simple (open wide angle) glaucoma the most prevalent type results from increasing pressure within the eye. As pressure build, the optic nerves are damaged.

The cornea, a clear transparent layer lies in front of and protects the eye. The iris which is the pigmented circular band within the eye widens and narrows according to various light intensities. Aqueous humor fills the void between the cornea and the iris. Aqueous humor is produced constantly and an elaborate outflow mechanism allows for drainage. Aqueous humor leaves the eye via the canal of Schlemm, but first must pass through a porous group of cells called trabecular. Chronic simple (open wide angel) glaucoma results from increased resistance in the aqueous humor outflow tract and the accompanying increase in ocular pressure. The constriction could lie in the trabecular, the canal of Schlemm or vessels draining the canal. Aqueous humor production continues at a steady rate, despite slowing outflow causing a buildup of pressure within the eye. As the pressure rises, the optic nerve can be damaged leading to impaired vision.

Treatment of Glaucoma

If diagnosed early, optic nerve damage and vision loss from glaucoma can be minimized. Because increased ocular pressure usually precedes the optic nerve damage and vision filed changes by several years, early reduction of intraocular pressure can preserve ocular health and vision. There are several classes of drugs that treat glaucoma. Prostaglandin derivatives, alpha agonists and cholinergic agents increase ocular outflow. Bet agonists, alpha agonists and carbonic anhydrase agents decrease aqueous humor production.

Compliance is a big issue for glaucoma patients and about 40% of patients do not do not take their drops in an adequate manner. Sustained release is achieved via an implant in the eye that lasts about four months for a new delivery form of Allergan's Lumigan. At its R&D meeting in March of 2012, Allergan indicated that it was getting IOP decrease similar to oral Lumigan, but felt that it could increase the dose.

Tagged as Alimera, diabetic macular edema, Iluvien, pSivida Corp + Categorized as Company Reports