Johnson & Johnson: A Buy and Core Holding for the Long Haul (JNJ, $68.35)

Investment Overview

Johnson & Johnson (JNJ) is a colossus among health care companies with an estimated $68 billion of revenues in 2012 and a current market capitalization of $188 billion. Its sales are divided into three major business categories: Pharmaceuticals (38%), Medical Devices and Diagnostics or MD&D (41%) and Consumer (21%). It is the largest medical device company in the world and the number eight pharmaceutical manufacturer. Its consumer business is focused on OTC medications, skin care and baby care and has numerous iconic brands such as Johnson's baby shampoo, Band-Aids and Tylenol. JNJ is made up of 250 operating companies doing business in 60 countries.

The analysis of JNJ presents a challenge, at least to me. In analyzing a company, I like to start at the microeconomic level and analyze the most important products and then build these pieces one by one in order to gain a comprehensive view of the whole company. This can be done with JNJ's pharmaceutical business, but the other two key business segments defy this analytical approach. MD&D and Consumer, as comprised, could each be divided into five, ten or even more businesses. JNJ does not release the metrics needed to analyze the sub-segments and indeed, JNJ doesn't try to manage these groups as one entity, but relies on a highly decentralized management structure. The best way that I can describe JNJ's MD&D and Consumer businesses is that it is managing a portfolio of companies. Its executive committee allocates capital to each business in a manner similar to how portfolio managers allocate their capital to individual stocks. Analyzing MD&D and Consumer is more like analyzing the performance of a fund manager; there may be one or two key factors that can influence growth, but past performance is usually extrapolated into the future.

There are two broad macro-factors that drive the Pharmaceutical, MD&D and Consumer businesses. The first is the state of the world healthcare economy. There is insatiable demand for healthcare worldwide and the population in developed markets while growing slowly is aging and creating significant demand for healthcare products. The issue is not demand in the developed world, but the ability to pay. In periods like the one we are now in, developed countries are burdened by unwisely accumulated debt loads that must now be paid off by unwilling populations. This has forced budget austerity and healthcare is under pressure as governments try to restrain spending through reducing utilization and price controls. Emerging countries provide far less sophisticated healthcare to their younger, rapidly growing populations and offer tremendous potential, but their national income levels are low and the still nascent economies are dependent on trade with developed countries.

Another issue that makes analysis difficult is the key role that acquisitions play in corporate growth. JNJ is a cash machine that has maintained an AAA credit rating even in the current, horrid economic environment and with the financing of the large Synthes acquisition. In 2012, I expect that the company will have free cash flow after capital spending and dividends of $16 billion. If all of free cash flow were devoted to share repurchase, JNJ could buy back 9% of its outstanding stock each year at current price levels.

The Synthes acquisition is the largest in the company's history even though its scope relative to JNJ doesn't compare to mega-acquisitions undertaken by Merck (MRK) with Schering-Plough and Pfizer (PFE) with Wyeth. The preponderance of deals is smaller, tuck-in acquisitions. An analyst can't accurately predict the contribution that acquisitions will make, but they have been important contributors to growth throughout the company's history and will almost certainly be in the future. It is just hard (impossible) for an analyst to account for this in projecting the role of acquisitions in future results so that analysts will almost always underestimate growth for the company.

JNJ and other healthcare companies are competing in a very poor economic backdrop. This could persist for several years, but eventually the world economy will improve and with it JNJ's business. The slowdown in the world economies is evident in the results of all of JNJ's businesses over the last few years. In addition, all three segments also labored under company specific issues. Pharmaceuticals suffered from patent expirations on key products; the medical device business suffered from the sharp drop in sales of drug eluting stents that caused the company to exit the business and the ASR hip recall; and the consumer business was hit by McNeil OTC product recalls. With all of these issues, JNJ has turned in roughly flat EPS growth over the period 2008 to 2011.

Investment Thesis

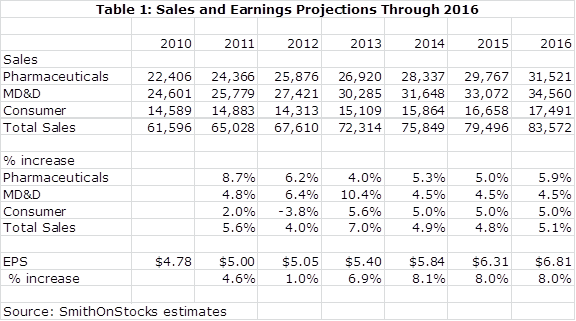

I don't see a vibrant world economy in the next few years that will reduce pressure on healthcare spending and I think that JNJ will probably show growth in operational sales and earnings for in-line businesses in the 3% to 5% range. Acquisitions are likely to increase this rate of growth as a guess by 1% to 2%, but obviously this is not predictable. So we may be looking at a company that grows sales by 4% to 7%. EPS aided by share repurchase and improved operating efficiencies could grow a little faster. Combining this with a dividend yield of 3.6% produces a potential total return of 8% to 10%.

JNJ's businesses are each beginning to improve relative to the trends of the past few years. The pharmaceuticals business suffered a number of key patent expirations, but this is now behind the division and it has a promising number of new products. The Synthes acquisition could add $2 billion of high margin sales to MD&D in 2012 and $4 billion in 2013; the older core business of MD&D appears to be stabilizing and perhaps increasing although surgical procedures, a key driver of results, remain below pre-recession levels. One of the top priorities in the company is to re-launch McNeil OTC products in 2013 that were badly affected by manufacturing issues.

Foreign currency has exerted a heavy impact on 1H, 2012 results and this will continue in 2H, 2012 and 1H, 2013. The impact reduced 2Q, 2012 corporate sales by 4.2%. If the dollar remains at current levels the adverse impact on sales in 3Q, 2012; 4Q, 2012: 1Q, 2013 and 2Q, 2013 could be 5%, 4%, 4% and 4% respectively. On the other hand, the Synthes acquisition could add $0.03 to EPS in 2012 and $0.10 to $0.15 in 2013

Management gives guidance first on the basis of what results would be if the dollar were unchanged throughout 2012. Obviously, the dollar has strengthened dramatically, but this approach is the best way of judging the operational strength of the company. The company estimates that on this basis, operational sales results including the Synthes acquisition will increase to $68.6 to $69.3 billion, up 5% to 6% from $65,0 billion of sales in 2011. It increased guidance for operating EPS for 2012 during the second quarter conference call from a range of $5.18 to $5.25 to a range of $5.25 to $5.32; this was due to the completion of Synthes acquisition which will be accretive to EPS. However, if currency exchange rates remain at current levels, management thinks that reported sales for 2012 could come in at $66.7 to $67.3 billion and reported EPS at $5.00 to $5.10.

The following table summarizes my five year projections for JNJ sales and EPS. As I noted before, these numbers may not accurately reflect the contribution of acquisitions and could be conservative.

I think that at some point the world economy will put its debt woes behind and we will see a resurgence of growth. I think that JNJ is beautifully positioned to take advantage of this particularly in emerging markets. It has established operations that provide low cost older technologies that these countries can now afford. As their economies build over time and national income grows, they will be able to incorporate more sophisticated technologies and JNJ has the infrastructure and innovative products to participate in this growth. I believe that world economic growth will be led by the emerging markets over the next two decades and that JNJ is an investment play on that economic mega-trend.

During the last quarter conference call, the new CEO Alex Gorsky made some interesting comments on emerging markets. He said that "JNJ operates in 60 countries and touches more than 1 billion patients and customers around the world, but helping the next 1 billion people will not be so easy. Many live in the developing world, and have very different needs than traditional customers. Income levels while growing rapidly are lower, unmet healthcare needs abound, indeed demand for healthcare in these markets is growing three or four times faster than developed markets. JNJ continues to see double-digit year over year sales growth in the BRIC markets. In this new world, JNJ's focus will be on expanding its footprint to help more people and on delivering healthcare in economical and sustainable ways."

JNJ is currently selling at a price earnings ratio of 13.5 times 2012 EPS and 12.7 times 2013 EPS. Guessing where P/E ratios may go in the future is a hazardous exercise. However, I think that the macro and micro economic problems of the past few years have battered the P/E ratio to the extent that I don't think there will be a contraction. If so, the stock price would grow in line with EPS at about 7% to 8% per year. This combined with the 3.6% dividend yield would produce a total investment return of 11% to 12% per year.

I know that some investors will yawn at the prospect of a total return of 11% to 12%, even with the potential for acceleration if the world economy revives. However, I think that this will be an above market average return and for those who are running a balanced portfolio with a stable of companies that should be able to provide sustainable earnings growth augmented by some speculative stock choices (my portfolio actually), JNJ can be an anchor in that portfolio.

Pharmaceuticals

The pharmaceuticals business is in the early stages of a turnaround that promises good growth for the next five years driven by a strong line-up of new drugs, limited patent expiration exposure and a valuable infrastructure for taking advantage of high growth in emerging markets. JNJ believes it could launch as many 18 new drugs in the 2009 to 2016 period. Because of the lack of patent loss exposure, management can focus significant cash flow on the product launches without worrying about the need to maintain margins.

The pharmaceutical business is perhaps most notable for what it doesn't have, that is there are no major patent expirations currently or over the next few years in sharp contrast to Bristol-Myers Squibb (BMY), Eli Lilly (LLY), Merck and Pfizer. The absence of this negative is a huge positive.

JNJ is in a very favorable position for acquiring products through licensing or through acquisition as are BMY, LLY, MRK, PFE and other multinational pharmaceuticals. There are a plethora of innovative products being developed by small biotechnology firms. However, the rigors and time required in gaining FDA approval and the increasing difficulty and slow product uptake in product launches makes commercialization a foreboding challenge for most of small companies. Increasingly the business model for these companies is to get their products through phase IIb proof of concept trials and then license the product or sell the company outright. JNJ has a reputation as a highly desirable partner and is looking each year at a veritable smorgasbord of exciting new products. (This also holds true in its other business segments.)

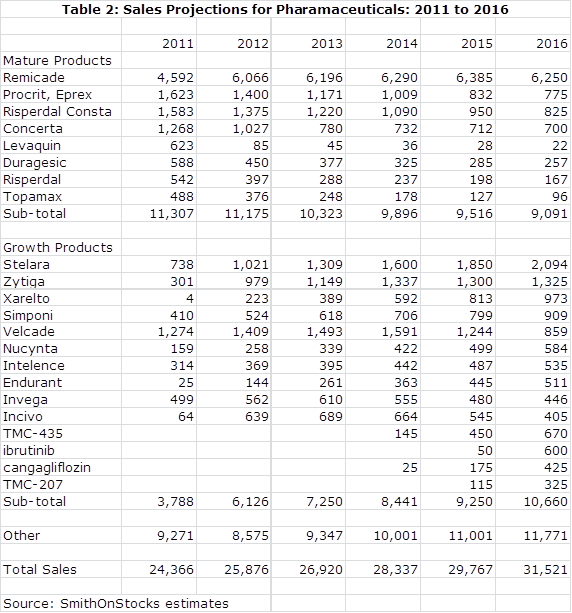

The company came out of its 2008 to 2011 patent meltdown period with some promising new product introductions: Zytiga (abiraterone) for hormone resistant prostate cancer, the anti-coagulant Xarelto (rivaroxaban) and Incivo (telepravir) a protease inhibitor for hepatitis C. Zytiga is off to an amazing start, but competition from Medivation's MDV-3100 may slow growth in the period beyond 2014. Xarelto and BMY's Eliquis, both Factor Xa inhibitors have had their issues with the FDA which is showing extreme caution with these agents. Better clinical trial results have caused most investors to consider Eliquis as the winner in this category, but they may be underestimating Xarelto. Also Incivo (telepravir) got off to a strong start, but very quickly new oral hepatitis C drugs have shown such promise that most analysts look for Incivo to be eclipsed in the period beyond 2014 when they enter the market.

My expectations for Zytiga, Xarelto and Incivo have been downscaled for the period beyond 2014. However, JNJ continues to beef up its pipeline and has a number of new drugs that will be introduced over the next few years. I am particularly interested in ibrutinib, which is licensed form Pharmacyclics (PCYC) that appears to be a breakthrough for hematological tumors. This drug could have more potential then Zytiga and perhaps has the commercial potential of Rituxan (that is saying something as Rituxan is a $5+billion drug). I am also intrigued with its second generation protease inhibitor for hepatitis C, TMC-435; canagliflozin, a member of a new oral drug class for treating diabetes; and the tuberculosis drug TMC-207.

The following table shows the measured decline expected for mature in-line products and the contribution of new, dynamic products. They combine to produce sales growth of about 5% per year over the next five years. However, these estimates do not include any contributions from acquisitions and I think that there will be acquisitions that could accelerate growth. There is also likely to be more of a contribution from new products than I am showing.

MD&D

The MD& D segment has been flattish for some time, but the acquisition of Synthes, which closed on June 14, 2012, should lead to a resumption of growth in 2H, 2012 and into 2013 as it will add $2 billion of high margin business in 2012 and $4 billion in 2013. The withdrawal from the drug eluting stent business and the ASR hip recall have had a negative effect on sales comparisons that is now largely behind the company. There is also some evidence of a stabilization of upturn in surgical procedures, a key driver of MD& D results, which has been declining in recent years and remains below pre-recession levels.

Management is predicting that Synthes will add about $0.03 to 2H, 2012 results and $0.10 to $0.15 to EPS in 2013. This contribution is expected to come from sales growth rather than cost cutting. However, there will be some efficiencies and management noted some operational overlap with DePuy that could provide some cost savings. Management said that the integration of Synthes is going well, but noted some sales disruption as Synthes switches from using distributors to direct sales in line with DePuy. This bears watching.

Consumer

McNeil OTC re-launches have been slower than expected with most of the re-launches expected to occur in 2013 as opposed to earlier expectations for 2H, 2012. This may have reduced 2012 revenues by $400 million, Management stated that it will carefully control launch expenses in 2013 and does not expect this to impact overall corporate earnings.

Disclosure: The author of this article owned shares of Juhnson & Johnson at the time this note was written. This should be taken into account as it may introduce bias into the conclusions and interpretations that are made. In reading this note, you acknowledge that you have not used it as the sole basis of your decision making and that all investment decisions are based on your own analysis. An investment in Johnson & Johnson carries substantial risk and investors could potentially lose much of their investment. The reader acknowledges that he/she has carefully read the Investment Approach, Terms/Conditions and Disclosures sections in the About Us section of the website. The reader acknowledges that he/she will not hold SmithOnStocks accountable for any investment loss that may be incurred if a decision is made to invest in Johnson & Johnson.

Tagged as Johnson & Johnson + Categorized as Company Reports