Celldex: Why Investors Are So Excited About the Company (CLDX, Hold, $24.39)

This post is an excerpt from the report: Celldex: Pipeline Promise Has Been Embraced by Wall Street

Comprehensive reports are now available to paid subscribers and can be found in the Reports section.

Review of Amazing and Volatile Stock Price Performance

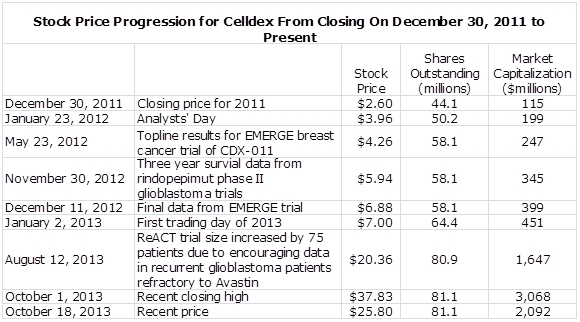

From the closing price on December 30, 2011 through October 1, 2013 Celldex’s (CLDX) stock price increased 15 fold from $2.60 to $37.83; its shares have recently backed off to about $26.00. The number of shares outstanding nearly doubled over this 21 month timeframe from 44.2 million to 81.1 million and the market capitalization increased 27 fold from $115 million to $3.1 billion.

This is a vivid example of what is so compelling about investing in emerging biotechnology companies. While the number of investment failures may significantly exceed the number of successes, there are occasional spectacular successes that can more than offset several failures in a balanced portfolio of emerging biotechnology stocks. It is also a graphic example of the extreme volatility on the upside and downside that can occur with emerging biotechnology stocks.

In the next table, I have pointed out a few key points that were important in this dramatic stock price increase. The analysts’ day presentation on January 23, 2012 may have gotten the ball rolling as the Company explained that there would be important clinical trial data in 2012 on EMERGE, a phase IIb trial of CDX-011 in refractory breast cancer and phase II data on the use of the cancer vaccine rindopepimut in glioblastoma.

Topline results on the EMERGE trial were then presented on May 23, 2012 and final data on December 8, 2012. Wedged in between was three year survival data from phase II trials of rindopepimut on November 30, 2012. From November 15, 2012 until August 12, 2013, the stock price increased by 172%. There were no periods when the stock had a dramatic jump, it was pretty much a steady month after month increase indicating the stock was under heavy accumulation by big institutions. Then the expansion of patient enrollment in the ReACT trial of rindopepimut on August 12, 2013 was followed by a 65% increase in stock price in a little over one month.

Investment Overview of Key Products

Celldex has two products in advanced stage clinical trials. These are the cancer vaccine rindopepimut that is in phase III development for a targeted subset of newly diagnosed glioblastoma patients and is in a phase II trial in recurrent glioblastoma. CDX-011 is a unique antibody-toxin conjugate that is now in phase II development for a subset of metastatic breast cancer patients.

There has also been excitement about two earlier stage products. CDX-1127 is an antibody that increases T cell activity that although somewhat differentiated in mechanism of action can be compared to the checkpoint inhibitors Yervoy and the anti-PD1 antibodies that are in late stage development. (Note that the recent strong move in Bristol-Myers (BMY) has been fueled by excitement about these two drugs.) These products are paving the way to a new immunotherapeutic approach to treating many types of cancer. Also CDX-1135 is a complement inhibitor which can be compared to Alexion’s extremely successful drug for ultra-orphan diseases, Soliris. Celldex hopes that CDX-1135 can be the second coming of Soliris in ultra-orphan diseases.

This note focuses on these four products, but Celldex also has a technology platform in humanized antibodies that has given rise to a large number of other earlier stage candidates. It was a technology spin-off of Medarex which was acquired by Bristol-Myers Squibb a strategic move which vaulted Bristol-Myers into the front ranks of cancer drug development. It was Medarex’s technology that spawned Yervoy (ipilimumab) and the anti-PD-1 molecule, nivolimumab.

Rindopepimut

As a cancer vaccine, rindopepimut is something of an outlier from the Celldex technology platform, but it is an important part of the investment story. It was studied in three separate phase II trials that enrolled glioblastoma patients who were positive for EGFRvIII, a mutation of the EGF receptor. This is a mutation that occurs in about 30% of glioblastoma patients according to Celldex. Rindopepimut is a cancer vaccine that generates an immune response specifically targeted at cancer cells that express this mutation. Reported results were encouraging in three phase II trials and were consistent among the three trials.

The largest of the phase II trials was ACT-III which enrolled 65 patients. Because there was no control group in any of these studies, comparisons were made to a subgroup of 29 patients from a retrospective study who most closely matched the characteristics of ACT-III patients. Against this control group, rindopepimut showed 21.8 months of median overall survival versus 16.0 months in the control, a 5.8 month improvement.

Based on this data, in December 2011 Celldex began the ACT IV phase III trial in patients with newly diagnosed EGFRvIII positive glioblastoma. This trial will enroll up to 440 patients and should report topline results in 2H, 2015. At the same time, the Company began a phase II trial in EGFRvIII positive patients with recurrent glioblastoma called ReACT.

As ReACT was originally designed, it was to have 95 patients divided into two groups. The first group was to be comprised of 70 Avastin naive patients and the second group was to have 25 patients. The 70 patients in group one were randomized one to one. Patients in one arm received rindopepimut plus Avastin plus GM-CSF. Patients in the second arm were to receive KLH plus Avastin. The second group of 25 patients was refractory to Avastin and they were given rindopepimut plus Avastin plus GM-CSF. Celldex has guided investors that there will be data from these 25 patients presented at the Society for Neuro-Oncology Annual Meeting in November of 2013.

Celldex announced on August 12, 2013 that it had completed enrollment in the initial cohort of 25 patients who were refractory to Avastin. Based on preliminary evidence of stable disease, tumor shrinkage and investigator-reported response, the Company has decided to add an expansion cohort of approximately 75 patients to better characterize the potential activity of rindopepimut in this refractory patient population. This seems to have given a major boost to the stock.

CDX-011

The data in the EMERGE trial indicated that CDX-011 appeared to have dramatic effects in extremely difficult to treat triple negative, GNMPB positive, breast cancer patients as it showed a 10.0 month median overall survival versus 5.5 months for comparator drugs. While the results were dramatic, there were only 12 patients on CDX-011 and 4 in the control group who were triple negative, GNMPB positive. This was a small number of patients, but the results were still statistically significant and encouraged Celldex to plan a phase II trial (soon to start) that is eligible for accelerated approval. Topline data on this trial will be available in late 2015 or 2016 and could be the basis for approval in the subset of triple negative GNMPB positive breast cancer patients.

CDX-1127

Celldex may be most excited about CDX-1127. The mode of action of this drug bears some similarity to the checkpoint inhibitors Yervoy and the anti-PD1 antibodies, nivolimumab of Bristol-Myers Squibb and lambrolizumab of Merck (MRK). Yervoy was introduced by Bristol-Myers in March 2011 and has current sales of nearly $1 billion. The anti-PD1 inhibitors are among the most exciting new cancer drugs in development with Street estimates of over $5 billion of sales in 2020. The mode of action of checkpoint inhibitors is to block the regulatory mechanism used to turn down the activity of T cells. The result is increased T-cell activity against cancer.

This drug is an antibody that stimulates T-cell activity. The effect of all three drugs- Yervoy, anti-PD1 s and CDX-1127- is to increase the activity of T-cells against cancer. A meaningful difference is that the checkpoint inhibitors need an immune response to be underway to be effective while CDX-1127 actually initiates the immune response. Its mechanism of action is differentiated from the checkpoint inhibitors. This may mean that the products could be used in combination or in sequence. This product is an extremely exciting concept, but it is still in phase I trials.

CDX-1135

The final drug that has gotten the attention of investors is CDX- 1135. It is a soluble complement inhibitor that targets both C3 and C5. This drug was developed by Avant (acquired by Celldex) which called this drug TP10. It is a technology that is similar to that which Alexion (ALXN) used to develop Soliris. Both companies tested their drugs against cardiac ischemia in the late 1990s and early 2000s, but both failed. However, Alexion determined that complement was very important in some ultra-orphan diseases. This has led to extraordinary success for Alexion in ultra-rare orphan diseases with its lead drug Solaris; it was approved by the FDA in 2007, had sales on $1.1 billion in 2012 and Alexion currently has a market capitalization of $21 billion.

Avant had unfortunately shelved their program, but with the acquisition of Avant in 2008, Celldex resurrected the program and has started a program in ultra-orphan disease that bears similarities to that of Alexion. Whereas Solaris has targeted diseases caused by excessive activation of C5, Celldex is going after ultra-rare orphan diseases caused by excessive C3 and dense deposit disease has been selected as the first indication. This parallel with Alexion has excited some investors who hope that Celldex could be the second coming of Alexion.

Investment Considerations

I wish that I could say that I recommended Celldex at $2.60, but that is not the case. My particular approach to analysis and investing requires a considerable amount of due diligence that takes much time. I do not have the bandwidth to cover all or even a significant percentage of publicly traded biotechnology companies. My interest in Celldex really came from the work that I had done on Northwest Biotherapeutics (NWBO), ImmunoCellular Therapeutics (IMUC) and Agenus (AGEN). Those three companies are each developing cancer vaccines targeted at glioblastoma and Celldex’s lead product rindopepimut is a cancer vaccine aimed at the same target.

While my reason for looking at Celldex was based on wanting to understand how rindopepimut potentially fits into the glioblastoma landscape, I was drawn into a deeper analysis and came to understand why investors are so excited about the company. I am not recommending Celldex at this particular combination of time, stage of product development and stock price. However, it is a stock that I plan to be involved with at some future point.

Tagged as CDX-011, CDX-1127, CDX-1135, Celldex Therapeutics, CLDX, Rindopepimut + Categorized as Smith On Stocks Blog