Agenus: Key Clinical Events are Imminent (AGEN, $3.91)

Key Value Drivers for Agenus Through 2015

I am initiating coverage of Agenus with a Buy. This basic report goes into detail on its two core technology platforms: (1) the heat shock protein technology that is the basis of therapeutic and preventive vaccines for cancer and infectious disease, and (2) the QS-21 Stimulon adjuvant that is being used by Agenus and other vaccine developers to enhance the effectiveness of their vaccines.

Glaxo is Agenus' primary partner for QS-21 and currently has 19 vaccines in development that use QS-21, four of which are in late stage phase III development and are critical to my investment thesis. They are:

1. The MAGE A-3 cancer vaccine that is being used as adjunctive therapy in surgically resected stage IIIb and IIIc melanoma. Topline data on this phase III trial will be reported in 2H, 2013. If the trial is successful, I think the product could be launched in the US and Europe in early 2015.

2. The same MAGE A-3 vaccine is also being developed for surgically resected stages Ib, II or IIIa non-small cell lung cancer. Topline data on this trial will be available in 4Q, 2013 or early 2014. If the trial is successful, I think the product could be launched in the US and Europe in early 2015 at the same time as the melanoma indication.

3. RTS,S is a vaccine for malaria called. Interim results on the phase III trial of this vaccine have been unclear with some positive and some not so positive data. More definitive data will be reported in 4Q, 2013 and in 2014. If this upcoming data is positive, this vaccine could become part of the normal vaccination program in sub-Saharan Africa with this process beginning in 2015.

4. A vaccine is in development for herpes zoster, commonly known as shingles. The vaccine is being developed under the premise that it will be superior to the current market leader Merck's Zostavax and replace much of that product's sales. Topline data for this trial will be available in late 2014 and if the results are positive, marketing could begin in early 2016.

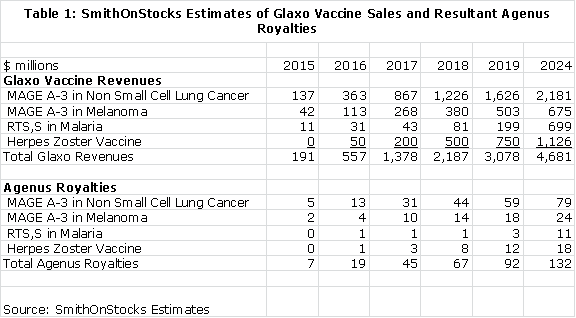

The following table shows my estimates for the sales potential of these four Glaxo vaccines and the royalties that Agenus would receive if these sales estimates are realized.

Moving on to the heat shock protein vaccine programs, initial clinical results have been quite encouraging for the use of Prophage vaccine technology in in recurrent and newly diagnosed glioblastoma. This has resulted in the May 2013 start of a phase II trial in 222 recurrent glioblastoma patients. With strong results, this trial might be sufficient for regulatory approval. Topline results will probably be available in 2015 and in the best case; Prophage could be approved for recurrent glioblastoma in 2016. A phase II trial in newly diagnosed glioblastoma patients could begin in early 2014. Agenus has full rights to Prophage in these indications. Results of a 65 patient phase II trial of HerpV, the Company's vaccine for genital herpes, will read out in 4Q, 2013. If the trial is successful, this program would likely be partnered in 2014.

Price Target Thinking

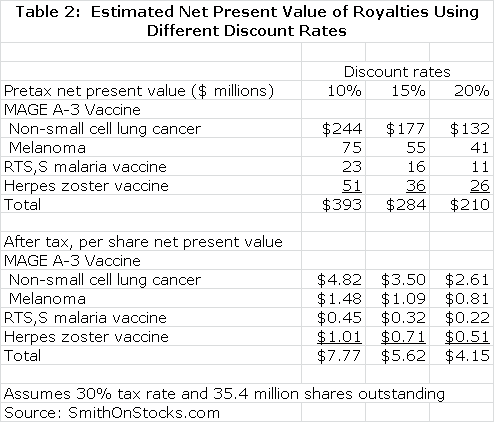

The potential for the stock in 2013 rests overwhelmingly on the outcome of the MAGE A-3 cancer vaccine trials. We will see the melanoma results in 3Q, 2013 and the results in non-small cell lung cancer in 4Q, 2013 or 1Q, 2014. I estimate in this report that the net present value of the MAGE A-3 vaccine in melanoma is $55 million or roughly $1.09 per share after tax, if the results support regulatory approval. I estimate that the net present value in non-small cell lung cancer is $177 million or $3.50 per share after tax. Application of a tax loss carry forward could add another $1.50 or so to net present value.

The net present value estimates are based on discounting the projected royalty stream of Agenus at a 15% discount rate, applying a 30% tax rate and dividing by fully diluted shares of 35 million. The assumption of a discount rate is somewhat arbitrary. I have chosen to use 15% in this report, but some investors might apply a lower or higher rate. I show the effect of using a 10%, 15% and 20% discount rate in the following table.

Using my assumptions, the common of Agenus might be worth about $7.00 per share in early 2014 based on the royalties from the Glaxo vaccines if every other asset in the Company were valued at zero. However, there may be substantial value in Agenus' internal vaccine programs in recurrent and newly diagnosed glioblastoma and the genital herpes vaccine. Based on a comparison to peer companies like Northwest Biotherapeutics and ImmunoCellular Therapeutics, I believe that the internal programs at Agenus currently may be worth $150 million or $4.45 per share. Adding this to the value of the MAGE A-3 vaccine, could produce a stock price of $11.00 in early 2014.

I think that success with the MAGE A-3 vaccine could have a profound, additional effect on the stock price of Agenus from a psychological standpoint. First of all, there are 19 other clinical development programs and 13 pre-clinical development programs underway in which QS-21 is being used as an adjuvant. Investors might attribute considerable value to these programs. Perhaps more importantly, success in the MAGE A-3 trial would bring credibility to the field of cancer vaccines and might lead investors to value the potential for Agenus' heat shock protein cancer and infectious disease vaccines. Currently, these are being largely ignored by biotechnology investors. Agenus could be the subject of speculative fervor if investors rush to determine what other companies are in late stage development of cancer vaccines.

I think that Agenus might decide to issue more equity if one or both of the MAGE A-3 trials are successful. By my calculations, the yearend cash position will be about $9 million, which is less than a year of cash burn. I think that an offering following positive MAGE A-3 results would be well received and would not have much of an impact on the stock price.

Biotechnology investors know that nothing is for sure in clinical trials so what happens if the MAGE A-3 trials fail in melanoma and non-small cell lung cancer? I think the immediate effect of a failure in melanoma might be to knock the stock down to around $2.50 per share. If then MAGE A-3 failed in non-small cell lung cancer, I think the stock might trail off some more bringing the stock to around $2.00 in early 2014. Investors would then be looking at the need for a significant financing in mid-2014 and the anticipation and execution of an offering might drive the stock to the $1.25 to $1.50 range, which is my estimate of downside risk if both MAGE A-3 trials fail.

In thinking about price targets so far, I have ignored the potential for positive results in HerpV phase II trial in genital herpes. Success could lead to a partnering deal later in 2014 that could significantly enhance the value of the Company. For the time being, I am not going to try to factor in what success or failure of this trial might mean to the stock. Similarly, I am not attributing value to potential Agenus royalties from use with other vaccines. This adds some conservatism to my outlook.

I think that there will be some very important clinical data on the Prophage cancer vaccine trials in recurrent glioblastoma in 2015 and newly diagnosed glioblastoma in 2016. Based on looking at valuations awarded oncology companies with successful phase II randomized trials, I could see the valuation put on Agenus heat shock cancer and infectious disease technology as being $500 million to $1 billion per year. The Company currently has about 35 million shares outstanding, but there is the strong probability that share issuance will increase this significantly. I am "guesstimating" that there will be 55 million shares outstanding in 2015 so that success in the Prophage program could potentially create $9.00 to $18.00 in stockholder value.

My estimated upside potential for the stock in early 2014 is $11.00+ if the MAGE A-3 trial is successful and the downside could be as low as $1.25 if all of the Glaxo vaccines fail, the phase II HerpV trial also fails and Agenus is forced to finance at depressed prices. Even in this event, there would remain some hope that the Prophage trials in glioblastoma would succeed and result in some strong price appreciation in the 2015-2016 period. Based on this line of reasoning, I think that the risk reward is favorable for buying Agenus at this level. In order to gage the potential for success in the MAGE A-3 trials, I suggest that readers review the discussion on MAGE A-3 later in this report.

Other Value Drivers for Agenus

There are a number of other value drivers that are harder to analyze. AGEN has a net operating loss carry-forward of $624 million. Some part of this could be applied to operating profits that might arise from the Glaxo vaccines and Prophage. Not all of the net operating loss can be applied and there are complex calculations beyond my current ability to calculate to determine how much can be applied. However, every 10% of the operating loss carry-forward that can be used amounts to $1.90 per share. If only 25% can be used, the potential value is $4.75 per share

There are a large number of other potentials for creating value for which I have made no estimates. The MAGE A-3 vaccine is applicable to a number of cancers other than melanoma and non-small cell lung cancer. It is currently in phase II trials for bladder cancer, head and neck, gastric, hepatocarcinoma, and multiple myeloma. Moreover, Glaxo is only enrolling patients in its phase III trials that are high expressors of MAGE A-3 in order to maximize the chances for success. In clinical practice, MAGE A-3 use might expand to a much broader population of patients with lesser MAGE A-3 expression.

Glaxo has 15 other vaccines in clinical development in addition to the MAGE A-3, malaria and herpes zoster vaccines. I have not tried to calculate the net present value of those vaccines.

Also, Agenus is developing a vaccine for herpes simplex or genital herpes that uses Prophage heat shock technology and the QS-21 adjuvant. This disease affects 60 million Americans and is the fastest growing sexually transmitted disease. Agenus' HerpV vaccine will report topline data from a phase II trial in 4Q, 2013. There are no vaccines approved for treatment of this disease and success in the trial could trigger a lucrative partnering deal for Agenus and also validate the potential of Prophage technology to treat many other types of infectious diseases such as malaria, tuberculosis and HIV.

Historical Perspective

Agenus was founded in 1994; it was a pioneer in immunotherapy and bears the battle scars that are inevitable with the development of paradigm changing technologies. Its core technology was based on an understanding of the biological role of heat shock proteins in the adaptive and innate immune response to cancer and infectious disease. The Company initially applied this technology to the development of autologous therapeutic cancer vaccines which are complexes of heat shock proteins with cancer antigens derived from a patient's own tumor tissue.

In 2000, Agenus acquired Aquillo which had developed an adjuvant for vaccines called QS-21. Adjuvants are used in almost all vaccines to rev up the immune response and in doing so they enhance the efficacy of vaccines. Agenus has an extensive collaboration with Glaxo which has incorporated QS-21 as an integral part of adjuvant systems used in 19 separate vaccines in clinical development. QS-21 is also a key component of a heat shock protein therapeutics vaccine for genital herpes in phase II that Agenus is developing. In total, QS-21 is currently being used in 21clinical development programs and 13 preclinical studies.

The heat shock protein cancer program resulted in the development of Oncophage (since renamed Prophage), one of the first therapeutic cancer vaccines. It was progressed into phase III trials in renal cell carcinoma and melanoma. Both trials failed to meet their primary endpoints causing many investors to give up on the product and the company. The stock suffered and Agenus was left in a financial conundrum forcing a series of financings at depressed stock prices.

A retrospective analysis of the Oncophage phase III trials showed very encouraging data for certain patient subsets. I mentioned earlier that pioneers get battle scars and this has certainly been the case with cancer vaccine developers. Many of the pioneers in this space- CancerVax, Favrille, Genitope, Cell Genesis- failed in their trials and went out of business. With the experience of Oncophage and these other pioneer companies, there was a common thread underlying their failures. The conventional way of developing cancer drugs when cancer vaccines first entered clinical development was to add new drugs to standard of care in advanced cases of cancer. If the drugs were shown to be effective in this setting they could then be tested in earlier and less severe cases of cancer. With perfect hindsight, this has proven to be exactly the wrong way to develop cancer vaccines and other drugs based on immune therapy. The clinical experience with two approved immunotherapies, Dendreon's Provenge and Bristol-Myers Squibb's Yervoy, and other work has produced a new consensus view that immunotherapies work best for early stage cancers with small tumor masses.

As a pioneer in cancer vaccines, Agenus was unfortunately locked into this exactly wrong development scheme. Upon analyzing patient subsets, Agenus was able to suggest that the drug seemed to be quite effective in earlier stage cancers. From a scientific point of view, this was an important observation and suggested that Oncophage was effective when used in earlier stages of cancer. However, regulatory agencies for very legitimate reasons will not accept retrospective analysis of patient sub-groups. From a regulatory standpoint, the trials were and remain a failure. A large company would have taken the experience gained in these trials to launch new phase III trials of Oncophage in earlier stage renal cell carcinoma and melanoma patients. However, as a small developmental stage biotechnology company, this was not an option for Agenus. New trials would have taken several years to perform and Agenus was severely cash constrained; indeed, the Oncophage failure threatened its existence.

The last few years have been ones of struggles for the Company financially as it moved from one financing to another and yet never had the financial resources to run the clinical trials needed to test the promise of its cancer vaccines. For a company that was not long on its luck, it found some when a neurosurgeon at the University of California in San Francisco, Dr. Andrew Parsa, became interested in the use of Prophage (previously called Oncophage), to treat both newly diagnosed and recurrent glioblastoma. Dr. Parsa ran investigator led trials in glioblastoma that created data that has led to the start of a 222 patient randomized phase II study in recurrent glioblastoma that has the potential to be a registrational trial. Both Avastin and Gliadel, which are only modestly effective, were approved for recurrent glioblastoma with studies of similar size so that this trial might be sufficient for registration if successful.

The National Cancer Institute has decided to fund most of the estimated $21+ million needed to run the recurrent glioblastoma study. From a shareholder standpoint, the funding for this trial requires minimal cash commitment from Agenus as it is only required to manufacture the product needed for the trial. Without Dr. Parsa, Prophage/ Oncophage would be an historical footnote in cancer drug development. Importantly and interestingly, Dr. Parsa receives no compensation from Agenus nor does he own stock. Now, Agenus has the hope that phase II trials in glioblastoma will lead to success and a potential filing of an NDA for recurrent glioblastoma in the 2015 to 2016 time frame. Agenus will be meeting with the FDA later this year in order to plan for a phase III trial in newly diagnosed glioblastoma. This could start in early 2014 and would take about two years to create topline data in 2016. Funding for this trial has not yet been put in place.

Financial Considerations

Agenus executed a restructuring of its debt in the first quarter of 2013 that significantly improved balance sheet strength. At that time, it had $39 million of senior subordinated debt that was due in August of 2014. The Company had $17 million of cash on its balance sheet and relative to the recent quarterly cash burn rate of about $3.5 million per quarter; it was on track to end 2013 with $7 million of cash. Investors were looking at the bleak prospect that Agenus needed to raise nearly $50 to $60 million of cash in the next year or so which is roughly equivalent to half of its market capitalization. However, raising this amount of money would no doubt have been done at a sharp discount and with substantial (probably 50%) warrant coverage. Shareholders could have seen the share count potentially double causing very substantial dilution.

The Company might have been able to retire the $39 million of debt with a new, extended debt package, but this would have left the substantial debt overhang in place. Agenus took a different tack by offering the debt holders $10 million, 20% of the royalties received from QS-21 partnered programs and 2.5 million shares of stock as a swap for the $39 million of debt. It then separately entered into a senior secured debt transaction with Silicon Bank for $5 million and a separate senior subordinated debt offering with investors for $5 million. This new debt matures in 24 months and can be prepaid at any time without fees or penalties. Also in the second quarter, the company received $2.3 million of sales from an ATM agreement.

Adjusting for all of the above transactions, the Company now has $10 million of debt and on a pro forma basis about $19 million of cash at the end of 1Q, 2013. The fully diluted share count was increased by about 3.6 million shares to approximately 35.4 million shares. At the current price of $4.00, the fully diluted market capitalization is about $140 million.

The current operating cash burn is about $3.5 million so that at this rate by the end of 2013, the cash position might decline to $9 million. Using a comparable rate of quarterly burn ($3.5 million per quarter) in 2014 would result in the Company running out of cash in 3Q, 2014 without additional cash inflows. Remember also that the Company also has to retire or refinance the $10 million of newly acquired senior subordinated debt that it has just incurred before April of 2015.

From a cash standpoint Agenus probably will elect to raise cash in 2013 if market conditions are favorable. I think that if one or both of the MAGE A-3 vaccine trials are successful and the price increases substantially that it would be prudent to bring in more cash. This could be done with a conventional equity offering in combination with its ATM facility. To provide for the repayment of debt and keep the Company in a reasonably strong cash position. I think that the Company might elect to raise cash of $25 million or more through stock sales. Another possibity for bringing in more cash is a partnering deal on the HerpV vaccine for genital herpes if the phase II data expected in 4Q, 2013 is positive. With good data, I think that Agenus might be able to negotiate a $25 million upfront milestone payment for HerpV in 2014.

Using the assumptions I have outlined for royalties that may arise from the four late stage Glaxo vaccines, I estimate royalty revenues of $7 million in 2015, $18 million in 2016, $45 million in 2017 and $67 million in 2018. If so, the Company could reach profitability in 2017. The royalties would also fund a significant part of the burn rate in 2015 and 2016.

More on the Glaxo Vaccines

The key to the Agenus investment story in 2013 and 2014 is driven primarily by the outcome of the four phase III vaccine trials being conducted by Glaxo. Agenus will receive a royalty of 4.5% on sales of the MAGE A-3 vaccine for melanoma and non-small cell lung cancer and 2% on the malaria and herpes zoster vaccines. As a condition of a debt re-financing, Agenus will pay 20% of these royalties to the financial firm Ingalls and Snyder. Agenus will receive royalties for ten years following commercial introduction. The commercial prospects for each of these vaccines are quite different. In my basic report, I go into considerable detail on these four products, but in this abbreviated form of that report, I only go over my conclusions. Let's start with the MAGE A-3 vaccine in development for melanoma and non-small cell lung cancer.

MAGE A-3 is a very interesting and cancer specific antigen that is meaningfully expressed in up to 66% of melanomas and 35% of non-small cell lung cancers. The Glaxo trials are being conducted only in patients who express high levels of MAGE A-3. These were very large trials as there were 1,350 patients in the melanoma trial and 2,300 patients in the non-small cell lung cancer trial; the latter is the largest trial ever done in this stage of NSCLC. These trials are very different from previously conducted cancer vaccine trials in that they are being done in early stage patients (recall my earlier discussion on why immunotherapies should be tested in early stage and not late stage patients). They are also very large trials that are well powered to achieve statistical significance in their primary endpoint of median progression free survival and secondary endpoint of median overall survival. The trials are targeted at a specific population of high MAGE A-3 expressors who can benefit as opposed to a broader, non-specific patient population; this has been a mistake often made in prior cancer trials.

There is reason to hope that this approach will lead to success in the trials because of the designs of the trials, but what are the chances for success? It has been my experience that a significant percentage of clinical trials fail not because the drug doesn't work, but because the trials are too small or there are flaws in the trial design. Small biotechnology companies often don't have enough money to conduct large trials and may not have the skills to design and execute the trials. This is not the case with the MAGE A-3 vaccine as the Glaxo trials are very large and hopefully the considerable experience of Glaxo in conducting clinical trials will mitigate the design and execution risk.

I do want to take a moment to consider why these trials might fail. When I listen to pessimistic investors, the most often cited reason is the large number of cancer vaccine failures that have gone before. I believe that this was due in part to an inappropriate focus on late stage patients instead of earlier stage patients. However, this is just a hypothesis and there may be other reasons that we have yet to discover that account for these failures. Another potentially negative issue is that the MAGE A-3 vaccine targets a single antigen. It is known that when cancer treatments which target particular cancer antigens in cancer cell, over time cancer cells displaying these antigens are depleted. This leads to the selection or emergence of cells that are resistant to treatment; a process that is known as antigen drift. For this reason most cancer vaccine products- Provenge is an exception -are targeted at multiple antigens.

The risk of failure in these trials is significant and if they do fail it is likely to be due to some unanticipated biological or clinical trial event. This seems to happen over and over again in the pursuit of new cutting edge products. Biology is very complex and it often takes decades to refine new therapeutic approaches as has been the case with cancer in the use of chemotherapy, monoclonal antibodies and targeted therapies. Unexpected things inevitably arise. However, I think that the Glaxo trials in melanoma and non-small cell lung cancer are well planned and conducted and have a reasonable chance for success.

Glaxo has reported two interim results from a phase III trial of its malaria vaccine. This disease is estimated to kill 650,000 humans each year, primarily infants, young children and pregnant women. It is primarily a disease that affects less developed countries and is especially prevalent in sub-Saharan Africa. Perhaps no drug under development has the potential to save as many lives as an effective vaccine for malaria. Initial results reported in 2011 for children aged 6 to 18 months were very encouraging as they showed that Glaxo's malaria vaccine RTS,S was able to reduce the incidence of severe cases of malaria by 51%. However, a subsequent interim look at younger infants aged six weeks to five months showed only a 31% reduction in severe cases of malaria. The results in this younger age bracket are particularly important as they are the group that is at high risk and who routinely receive a program of childhood vaccines that RTS,S could become a part of.

The reaction to the interim report on the six weeks to five month age group was generally disappointment. The World Health Organization has suggested a somewhat arbitrary but accepted goal of 50% or more reduction in severe cases of malaria in order to include a malaria vaccine in routine childhood vaccination programs. Bill Gates whose foundation has poured more than $200 million into treating malaria research called these results disappointing. Andrew Witty, the CEO of Glaxo, said the results were less than the Company had hoped for but that Glaxo remained committed to continuing development of the vaccine.

There will be another look at the phase III data in late 2013 and another in 2014 that will better define the role of the malaria vaccine. The key information being sought is the duration and magnitude of the immune response. There is the hope that the result of a booster shot coupled with a more mature immune system will result in improved efficacy in the six weeks to five month age group. If this does not happen, I am inclined to think that this vaccine will not become a part of the standard vaccination strategy for young African children.

The fourth Glaxo vaccine is for herpes zoster which is more commonly referred to as shingles. Merck has the dominant vaccine in the market with Zostavax, an attenuated virus vaccine; it achieved $650 million of sales in 2012 and appears to be on a path to $1 billion of sales. The Glaxo vaccine is based on a newer technology that uses recombinantly produced antigens from the coat of the herpes zoster virus. Herpes zoster most affects people with compromised immune systems arising from diseases or drug treatments and the elderly. Glaxo believes that its sub-unit vaccine will be more effective than Merck's attenuated vaccine in immunocompromised patients. Glaxo's reason for developing this vaccine is that it believes it will be superior to Zostavax in both elderly and immuno-compromised patients and will largely replace Zostavax sales. If so, the Glaxo herpes zoster vaccine could have sales potential of $1 billion.

The MAGE A-3 trials if successful will define a new standard of care for the adjuvant treatment of early stage, surgically resected melanoma and non-small cell lung cancer patients with high MAGE A-3 expression. These are landmark trials and their success would mean rapid uptake of these vaccines as part of standard of care. The patient population that the MAGE A-3 vaccine addresses in non-small cell lung cancer is about 90,000 patients. However, only 60,000 of these patients are surgically resected and of these patients only 21,000 have sufficient MAGE A-3 expression. Hence 21,000 patients is the addressable market in the US and Europe for non-small cell lung cancer. The comparable numbers for melanoma are 9,000 patients in the US and Europe who are surgically resected and of these 6,500 have adequate MAGE A-3 expression. Hence the target market for melanoma is 6,500 patients.

In thinking about a price potential for these vaccines, a starting point is to look at prices for other immunotherapies. Yervoy costs about $120,000 per year and Provenge is priced at $90,000. Most new drugs for cancer fall into the $60,000 to $100,000 annual price range. Just for the sake of discussion, let's assume that the MAGE A-3 vaccine is priced at $80,000 per year. This means that the addressable market for non-small cell lung cancer for Glaxo is $1.7 billion and for melanoma it is $500 million. However, Glaxo also has phase II trials underway in bladder cancer, head and neck cancer, gastric cancer, liver cancer and multiple myeloma. Success in the melanoma and non-small cell lung cancer trials could lead to rapid clinical development and regulatory approval in these cancers that would further expand the potential. Finally, Glaxo has been very careful to conduct trials only in high MAGE A-3 expressors who are most likely to benefit in order to maximize chances for success in phase III. In actual clinical practice, it is possible that lower MAGE A-3 expressors could be treated which would also expand the market.

Agenus struck a deal with Glaxo that gives it a royalty of 4.5% of sales. However, in a debt restructuring agreement, Agenus agrees to give up 20% of this royalty to a creditor in return for debt forgiveness. This makes the effective royalty to Agenus 3.6%. The addressable market for Agenus in terms of royalties payable to Agenus is $100 million for non-small cell lung cancer and for melanoma it is $31 million. I would expect rapid uptake of the vaccine in both indications if the trials are successful. I think that within five years of introduction that the MAGE A-3 vaccine might be used in 75% of its target population. I think that the vaccines will probably be launched in early to mid-2015 and Agenus is entitled to royalties for 10 years post commercialization.

The potential for the malaria vaccine will initially be in ten countries in Africa, if it is successfully developed. It would be included in the package of standard childhood vaccinations which are generally priced at $2.00 per vaccine. There are 180 million babies born each year in these ten Africa countries so that the sales potential for Glaxo for this birth cohort is $360 million per year. Initially, there could be a bulge in sales as children in the age group from six to eighteen months would also be vaccinated. Agenus receives a royalty of 2.0% from Glaxo and again this royalty is reduced to 1.6% due to the debt restructuring. On $360 million of sales the royalties received and retained by Agenus would be $6 million.

The herpes zoster or shingles vaccine is a little harder to model. Merck has first mover advantage in the market and has achieved $650 million of sales in 2012 following four years in which production issues caused sales to fall in the $250 to $275 million range. This should be a $1 billion product for Merck by 2016 when the Glaxo vaccine could come to market. The Glaxo vaccine clinical trials are intended to show superiority to Zostavax in treating elderly and immunocompromised patients who are the patients at highest risk. Phase I and II trials have indicated that it produces a stronger immune response is such patients. With superior efficacy, the Glaxo product could replace Zostavax as the dominant vaccine in the market and aspire to a billion dollars of sales.

Agenus' Prophage Vaccines for Glioblastoma

Topline results on the phase II trial in recurrent glioblastoma could be available in 2015 and the results in newly diagnosed glioblastoma could be a little bit later in 2016. If successful, the trial in recurrent glioblastoma is potentially sufficient for registration because of the severity of the disease and lack of any effective therapy. Avastin and the Gliadel Wafer are approved for this indication but have only modest efficacy. The topline data on the phase II trial in recurrent glioblastoma could be available in 2015 or 2016. However, if the results are not striking, there is some chance that the FDA may require a confirmatory trial for approval that could take another two years to conduct.

Data on an earlier phase II trial in recurrent glioblastoma will be published later this year; I have not seen the results. With the decision of NCI to fund the just started phase II trial in recurrent glioblastoma, I think that we can assume that the data was positive. Interim results in a trial of newly diagnosed glioblastoma patients was just released and indicated that median overall survival was 23.3 months versus 14.4 expected for standard of care. The data is relatively immature and I would expect the median overall survival for Prophage to improve as the patient population is followed.

Investors who have followed my work will quickly ask how I think Prophage will compare to NWBO's DC Vax-L and IMUC's ICT-107 in newly diagnosed glioblastoma; neither of these products in a phase II trial in recurrent glioblastoma so that potentially Prophage could be the first to gain approval in this indication. The data for DC Vax-L in phase I trials showed median overall survival of 36.0 months in newly diagnosed glioblastoma and ICT-107 showed 38.4 months. This compares to 18.8 months for standard of care. Interim data on Prophage showed median survival of 23.3 months is less than this but as I commented the data is still maturing and I would expect Prophage's median overall survival to improve. By the way, this might also apply to DC Vax-L and ICT-107 as well.

Median overall survival is more than encouraging for all three products and is suggestive that each could be a major advance in glioblastoma. The question is how they might compete in the market if each is successful and approved for commercial use. It is too early to say definitively, but I think that because of HLA restrictions ICT-107 would only be applicable in about 40% to 50% of the population whereas DC Vax-L and Prophage can be used in most patients. There are likely to be other factors that might determine that the vaccines might be better in certain populations. However, I think that the potential in glioblastoma is less important than validation of the technology that success would bring. This would represent a significant advance in cancer and infectious disease treatment. Success in the glioblastoma indication would validate potential for immunotherapy in most types of cancer that would, in my opinion, be a significant advance over chemotherapy, monoclonal antibodies and targeted therapies that are the focus of almost all current cancer treatments and development efforts.

Agenus' HerpV vaccine for Genital Herpes

The final aspect of the near term outlook for Agenus is a vaccine, HerpV, that it has developed for genital herpes. This uses heat shock proteins complexed with antigens from the viral coat or infected cells. Unlike Prophage, this product uses synthetic antigens and would be an "off the shelf" product.

Agenus is conducting a phase II trial that is investigating the potential for HerpV to reduce viral shedding which experts generally believe would reduce the spread of this sexually transmitted disease that affects 60 million Americans. This is Agenus' first clinical program using heat shock protein antigen complexes in the treatment of infectious disease. If successful, it could lead to other product development efforts in numerous other infectious diseases. Results are expected in late 2013 and if this trial is successful, could lead to a meaningful partnering program. The upfront milestone payment could meaningfully increase the financial strength of the Company.

Estimating the Value to Agenus of the Glaxo Vaccines?

There is a great deal of complexity in valuing Agenus. For the four Glaxo vaccines, I have used a net present value of the royalties approach to value them. The complete calculations are shown in my basic report, but let me give you a brief summary of the methodology.

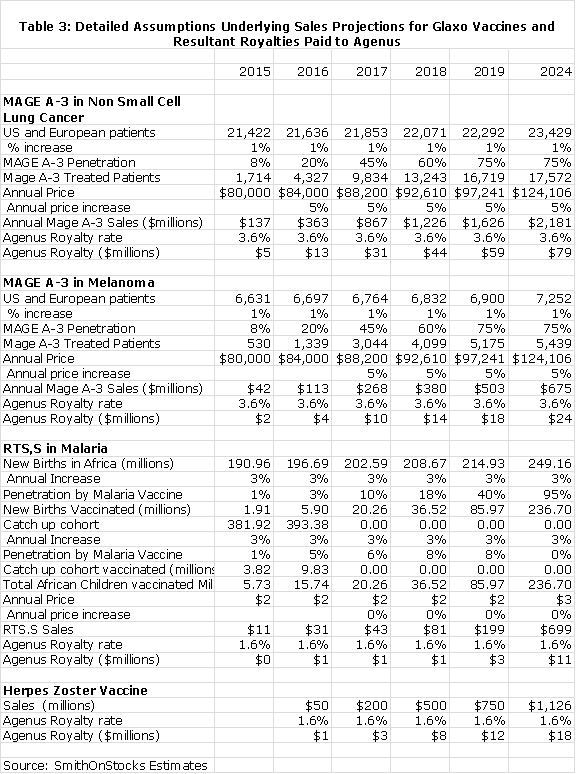

For the MAGE A-3 vaccine in non-small cell lung cancer, I made the following assumptions:

1. The product is introduced on January 2, 2015

2. The addressable patient universe is 21,000 patients and increases at 1% per year

3. The price at introduction is $80,000 per year and increases at 5% per year

4. The MAGE A-3 vaccine quickly penetrates the market with market shares as follows: 2016 (8%), 2017 (25%), 2018 (45%), 2019 (60%), 2020 (75%) and remaining at 75% through 2026 when the agreement ends.

5. Agenus receives royalties of 3.6% of sales

For the MAGE A-3 vaccine in melanoma, I assumed:

1. The product is introduced on January 2, 2015

2. The addressable patient universe is 6,500 patients and increases at 1% per year

3. The price at introduction is $80,000 per year and increases at 5% per year

4. The MAGE A-3 vaccine quickly penetrates the market with market shares as follows: 2016 (8%), 2017 (25%), 2018 (45%), 2019 (60%), 2020 (75%) and remaining at 75% through 2026 when the agreement ends.

5. Agenus receives royalties of 3.6% of sales

The malaria vaccine is more difficult to value. First of all, I think that unless the results in the 6 weeks to five months cohort of the trial improve from the initially reported results which showed a 31% reduction in the risk of severe infection that this product may not be licensed or will be used only in limited way. If efficacy is shown to be better than 31% upon analysis of more mature data and the product is licensed for childhood vaccination, I the assumed:

1. The vaccine is introduced on January 2, 2015

2. The annual birth cohort is the basis for long term sales. I estimate this as 180 million African children and project a 3% annual increase in birth rate.

3. There would also be a catch up for children in the five month to five year cohort, but eventually sales in this cohort disappear.

4. The price is $2.00 per vaccination and does not increase over time

5. Penetration is expected to be slow in the near term as the vaccine is incorporated into the childhood vaccination programs of sub-Saharan African countries. Eventually, the vaccine would be incorporated in perhaps 95% of childhood vaccination programs.

6. I am assuming penetration rates in the six weeks to five months cohort as follows: 2016 (3%), 2017 (8%), 2018 (18%) and eventually rising to 95%.

7. The penetration rate in the six to eighteen month to group would be much less and I assume penetration as follows: 2016 (2%), 2017 (6%), 2018 (8%), 2019 (8%) and then zero thereafter.

The herpes zoster vaccine cannot be modeled in the same way as the MAGE A-3 and malaria vaccines. I have instead used a model that is based on the potential relationship of the Glaxo herpes zoster vaccines to the market leader Zostavax. If clinical trials show the products as being equivalent, I think that the Glaxo vaccine might not be marketed. If the Glaxo vaccine is superior, I think that sales potential would be $1 billion.

The following table uses these assumptions to formulate estimates for sales of Glaxo's vaccines and the resultant royalties paid to Agenus.

Estimating the Value of Agenus' Heat Shock Protein Technology?

There are similarities of Agenus' cancer vaccines to the autologous dendritic cell vaccines being developed by Northwest Biotherapeutics (NWBO) and ImmunoCellular Therapeutics (IMUC). The heat shock protein- antigen peptide complexes are taken up by dendritic cells and enhance the display of cancer antigens to the immune system by those dendritic cells. The vaccines of NWBO and IMUC directly load cancer antigens into dendritic cells. Both approaches use autologous cells to manufacture the end product. The common thread of these technologies is that they enhance the ability of dendritic cells to display cancer antigens to the immune system and boost the immune response against the cancer.

I think that we can look at the value of Northwest Biotherapeutics and ImmunoCellular Therapeutics as comparators for the cancer vaccine technology of Agenus. While all three employ different technologies, each is trying to increase the efficacy of dendritic cells in displaying cancer antigens. It is too early to judge whether all three technologies will work or if one or two will emerge as the winner. In terms of clinical development timelines, Northwest Biotherapeutics is in a phase III trial with topline results possible in late 2014. ImmunoCellular will report the results of a phase II trial in 4Q, 2013 that could be the basis for a phase III trial to start in 2014. The phase II trial of Prophage in recurrent glioblastoma began in May 2013 and the phase II trial in newly glioblastoma could begin in 2014.

These three companies are comparables and as a starting point in valuing Agenus' heat shock protein technology, I think that we can look at the market capitalization of these companies. On a fully diluted share count basis, the market capitalization of Northwest Biotherapeutics is $160 million and ImmunoCellular Technology is $164 million. These are less than robust valuations that reflect widespread skepticism about cancer vaccines and don't assume much potential for success. If NWBO and IMUC are successful in their trials, I think that their valuations could go up dramatically. My judgment in considering the market capitalizations of oncology companies which have drugs in a similar stage of development, but for which investors attribute more potential for success is on the order of $500 million to $1 billion.

Heat Shock Proteins in Immunotherapy

Heat Shock Protein Biology

Heat shock proteins (HSPs) are among the most abundant proteins found in cells. They become hyper-abundant under stressful conditions such as heat shock to the cell and hence the name. There are ten families of heat shock proteins that are found in all organisms and they are often referred to by their molecular weight; e.g. HSP70, HSP80, HSP 90 etc.

One of their most important functions is helping newly produced proteins fold and unfold properly, to help transport these proteins intracellularly and protect them against stress. This is referred to as chaperoning. Some drug developers are working on inhibition of heat shock proteins as a way of killing cancer cells. As a different role, they also form complexes with peptide fragments within a cell and are important in antigen presentation. This is the activity that Agenus' cancer and infectious disease vaccines seek to take advantage of.

In the 1980s, it was discovered that certain HSP-peptide complexes that occur in cancer cells could produce an immune response while HSP-peptide complexes from normal tissue could not. This insight led to the hypothesis that HSP-peptide complexes isolated from cancer cells or cells infected by pathogens could be the basis for therapeutic or preventive vaccines.

Further experiments showed that HSPs by themselves do not stimulate the immune response sufficiently to be an effective vaccine. They need to be combined with antigens to lead to the activation of CD8+ killer T-cells specific to the antigens and also CD4+helper T-cells.

HSP peptide complexes within cells are escorted by major histocompatibility complex or MHC molecules to the cell surface for presentation to the immune system. Normally occurring molecules are ignored by passing immune cells, but abnormal molecules (antigens) associated with cancer or infectious pathogens trigger an immune response. However, the display of antigens by a cancer cell may not result in and of itself produce a sufficient immune response. In a process known as cross-priming, the HSP-antigen complex must often be taken up by dendritic cells or macrophages that specialize in antigen presentation in order to create a strong immune response.

Certain HSPs (gp96, HSP90, HSP70 and calreticulin) interact with antigen presenting cells such as dendritic cells and macrophages through CD91, a common receptor on antigen presenting cells. The interaction with CD91 leads to an internalization of the HSP complexes of both antigens and normal peptides. They are then processed by the proteasomes in the cytoplasm and then transported into the endothelium reticulum through transporters that are associated with antigen processing. The peptides are then loaded onto MHC class I molecules and presented by the antigen presenting cell to CD8+ T cells.

It has also been found that HSP molecules not complexed with an antigen can stimulate natural killer cells of the innate immune system. This results in a proliferation of natural killer cells in the blood which is also important in eliminating cancer cells. Studies in animal have suggested that the effects of HSPs on the innate and adaptive immune systems are equally effective in fighting cancer.

Manufacturing Agenus' Cancer Vaccines

The development of Agenus' cancer vaccine does not depend on the identification of specific antigens. The antigens of human cancers are individually unique, and it may not be feasible or possible to identify the correct antigens for each cancer patient. HSPs form complexes within the cell with almost all the antigens associated with cancer. Agenus isolates these HSP- antigen complexes and combines them in a vaccine. Whatever antigens occur in a tumor are those that will form the basis of the cancer vaccine.

Agenus believes that there is an important difference between the development of vaccines for cancer and infectious disease. The treatment of cancer has to be individualized due to the uniqueness of the cancer antigens; whereas the treatment of infectious diseases for all patients with a given infection can be achieved using a common set of HSP-antigen complexes. For infectious disease vaccines, Agenus uses a common group of synthetic antigens or those purified from infected human cells. Cancer vaccines are individualized for each patient (autologous) while infectious disease vaccines are not.

The manufacturing of the cancer vaccines begins with the processing of tumor tissue taken from the body. The amount of tumor tissue varies by tumor type and the site of the tumor. Five to seven grams of tumor tissue is usually needed. This yields enough material for four to six injections. The number of doses prepared in in accordance with the amount of available tissue.

Within tumor tissue, there may be billions of HSP molecules that are attached to both normal peptides and antigens. The tissue is dissected and placed in a liquid and the mixture is then centrifuged to separate cellular debris from a liquid in which the various HSP antigen complexes are dissolved. The liquid is then passed through a chromatography column. An affinity agent for a particular heat shock protein (in the case of Agenus this is gp 96) on that column binds gp 96 and its associated peptides. The gp 96 peptide complexes are then harvested from the column and this is the basis of the cancer vaccine; everything else is thrown away.

Having isolated the gp 96 peptide complexes, the remainder of the manufacturing process is really just purifying and processing. This is done at separate work stations that can handle the resultant material from each patient. The technical skills necessary are ones that involve following a standard operating procedure. The manufacturing process is the same regardless of the type of tumor.

This process differs from that used to manufacture dendritic cell cancer vaccines which require a blood draw from a patient. Then monocytes are isolated from the blood and are matured into immature dendritic cells and loaded with cancer antigens. The HSP process does not require a blood draw. It just requires tumor tissue from surgical resection and does not involve working with live cells.

The vaccine product is then packaged in aliquots with saline, frozen on dry ice and sent back to the patient's hospital pharmacy where they were stored frozen until a few minutes before the patient was to be immunized. When needed, the vial can be thawed by holding it between the fingers. The contents are then injected intradermally near lymph nodes that are distant from the tumor. Dendritic cells ingest the HSP components of the vaccine, travel to nearby lymph nodes and present the antigens to passing T-cells in order to activate an immune response.

Phase III Trials Were Unsuccessful or Were They?

The biologic principals of the HSP approach make it applicable to any type of cancer and trials have been conducted in melanoma, renal carcinoma, glioblastoma, pancreatic cancer, colon cancer, lung cancer, gastric cancer and B-cell lymphoma.

Agenus conducted controlled, randomized Phase III clinical trials in stage IV melanoma and adjuvant renal cell carcinoma (RCC). Tumors were obtained by surgical excision from individual subjects, and were shipped on dry ice to a central manufacturing facility where recombinant gp96-peptide complexes were isolated. Immunizations were carried out once every week for the first four weeks, followed by an immunization every other week, as long as supplies lasted. The vaccinations could generally be done at an outpatient clinic.

Melanoma Phase III Trial

In the melanoma trial, 322 subjects diagnosed with stage IV melanoma were randomly assigned 2:1 to receive either monotherapy with gp96-peptide complexes derived from each patient's tumor or the physician's choice of dacarbazine or temozolomide or IL-2 or complete tumor resection. Patients in the vaccine arm received a variable number of injections (range, 0 - 87) in part because the autologous nature of the therapy could limit supply.

The trial did not meet its endpoint of overall survival, which was the same in both the vaccine and physician's choice arm. The data was then retrospectively analyzed to see if certain subsets of patients might have done better. Stage IV melanoma is an advanced stage of the disease that involves distant metastasis. The five year survival rate is estimated at 7-19%. M1a is defined as be distant skin metastasis, normal LDH, M1b by lung metastasis, normal LDH and M1c by these plus other distant metastasis and elevated LDH. The prognosis is worse for M1c patients.

This retrospective analysis produced encouraging findings as it showed that subjects in the M1a and M1b sub-stages of stage IV melanoma who received ten or more immunizations survived longer than those in the physician's choice arm. The nominal p value was p=0.03 and the hazard ratio was 0.45 with a 95% confidence interval of 0.21 to 0.96. Such differences were not detected for sub-stage M1c subjects. This suggests that subjects with M1a and M1b disease who are able to receive 10 or more doses of the vaccine would be the candidate population for a phase III confirmatory study.

Renal Cell Carcinoma Phase III

In the adjuvant renal cell carcinoma or RCC trial, patients were randomized 1:1 to receive either the autologous tumor-derived gp96-peptide complexes alone or observation post-surgery which was the then standard of care. Adjuvant RCC patients were stages Ib through IVa were enrolled in the trial and the results were analyzed for the entire population and by the stage of cancer. The trial was conducted in 728 patients in North America, Europe and Russia, with approximately equal numbers of human subjects contributing from each territory.

Progression free survival and overall survival were similar between the vaccine arm and the observation. Retrospective analysis showed there was a strong positive trend associated with the gp96 vaccine in 240 earlier-stage (stage I and II) patients) based on blinded assessment. This group of patients showed a hazard ratio of 0.57 (i.e., patients who received the vaccine were at 43% less risk of recurrence of disease than patients who did not receive the vaccitreatments). This difference was close to statistical significance (p = 0.056, HR = 0.576, 95% CI 0.324 - 1.023).

A stronger trend of clinical benefit was detected in 362 earlier stage patients with prognostic factors indicating intermediate risk for recurrence (stage Ib/II high-grade, III T1/2/3a low-grade). This group of patients showed a hazard ratio of 0.59; patients who received the vaccine were at 41% less risk of disease recurrence than the patients who did not receive the vaccinations. (p = 0.026, HR = 0.589, 95% CI 0.367, 0.944

Not Good Enough for Regulators

The melanoma trial showed a pattern such that subjects in the M1a and M1b sub-stages who received 10 or more immunizations appeared to benefit substantially as compared to those who received physician choice treatment. The RCC trial indicated that stage I and stage II patients appeared to benefit from vaccinations (p = 0.056, HR = 0.576, 95% CI = 0.324 - 1.023), and this pattern was even stronger if one included subjects with T3a tumors (p = 0.026, HR = 0.589, 95% CI = 0.367 - 0.944).

From the perspective of regulators, these clinical trials did not achieve their endpoints. Regulatory agencies will not accept retrospective subset analyses in groups that were not prospectively defined. Statisticians are adamant that post hoc analyses should only form the basis for new randomized clinical trials in an appropriately defined patient population. This regulatory attitude relies on statistical purity as opposed to biological and clinical perspectives.

Regulators Aside, There Were Strong Signals of Efficacy

In the case of the phase III trial in adjuvant RCC, a strong argument for clinical efficacy can be made. A large subset of patients representing nearly 60% of the full analysis population showed a striking difference relative to the control arm (two-sided p = 0.026; HR = 0.589, 95% CI 0.367 - 0.944).

When Agenus began the RCC trial it enrolled patients who met the then accepted criteria for adjuvant therapy as determined by Eastern Cooperative Oncology Group (ECOG). This was patients in stages Ib through IVa. However, after the trial was begun, ECOG changed the definition to stage Ib through IIIa. This was the group upon which the retrospective analysis done by Agenus showed a p value of 0.026. ECOG arrived at this definition independently indicating that the subset is a meaningful patient population and not one that was arbitrarily selected. If Agenus had enrolled patients in the original trial in accordance with the new ECOG definition for adjuvant therapy, presumably the trial might have been successful.

There was no statistically significant improvement in either the melanoma or adjuvant renal cell carcinoma trials. However, strong arguments can be made that clinical benefit was realized in earlier stage disease even though this was based on retrospective subset analyses. Adjuvant RCC patients with intermediate risk disease who were immunized had a substantially reduced risk of recurrence compared with those who did not. Stage IV melanoma sub-stage M1a and M1b patients who received larger numbers of vaccinations (ten or more) survived longer than those who received control treatments. This argument has merit based on a biological and clinical perspective. However, it fails the regulatory test that demands statistical purity.

The Prophage Program Is Now Focused In Glioblastoma

Introduction

Agenus has been a pioneer in immunotherapy and has borne the burden of forging new pathways. From my previous discussion on the Company's effort to develop vaccines for stage IV melanoma and adjuvant RCC, I think that you will agree that there is a strong signal of efficacy. If Agenus had the knowledge afforded by these trials before they were conducted, it would have selected more appropriate patient populations in which to conduct their trials. Their experience and that of other companies working in immunotherapy is that products are more effective in cancers that are in earlier stages.

Conceivably, trials could have been designed that would have been successful and led to the approval and commercialization of Prophage (then known as Oncophage), but that didn't happen. Instead, Agenus was seen as a company whose lead product had failed in pivotal trials and this sharply depressed the price and severely affected access to capital. The Company lacked the resources to follow up on the insights that had been gained in their ground breaking trials.

In an amazing turn of events, a physician investigator Andrew Parsa came forward and forged a program for Prophage in glioblastoma. He conducted investigator studies that provided the data to pursue a glioblastoma program that is now the central focus of Agenus. It is studying Prophage Series G-100 in newly diagnosed disease and G-200 in recurrent glioblastoma. G-200 has completed a phase II investigator sponsored trial led by Dr. Parsa and has just begun enrolling in a large randomized phase II trial. Interim results on a phase II trial of G-100 led by Dr. Parsa in newly diagnosed glioblastoma were just reported and the Company has begun plans to move into phase III.

Dr. Andrew Parsa

Dr. Parsa has almost single handedly moved G-100 and G-200 forward through investigator sponsored trials conducted primarily at the University of California at San Francisco. These were primarily funded by the American Brain Tumor Association, Accelerated Brain Cancer Cure, National Brain Tumor Society, and National Cancer Institute Special Programs of Research Excellence. Without Dr. Parsa's advocacy, it is doubtful that a cash strapped Agenus could have moved the trials forward. It is more than interesting that he does not receive any financial support or travel expense reimbursement for this work or for consulting activities on behalf of Agenus. He does not have an equity interest in Agenus or a financial relationship with the company. He just believes in the technology.

Dr. Parsa conducted these studies while at the Department of Neurological Surgery at UCSF. He has since accepted a position as newly appointed Chair of the Department of Neurological Surgery at Northwestern University. Results on G-100 and G-200 have also been presented at conferences by Orin Bloch, M.D who is at UCSF and Dr. Michael Sughrue, Director of the Comprehensive Brain Tumor Center at the University of Oklahoma. Dr. Sughrue was formerly at the UCSF where he worked closely with Dr. Andrew Parsa. Like Dr. Parsa, neither of these physicians is compensated for their research by Agenus nor do they have an equity interest in the company.

Glioblastoma

Glioblastoma is the deadliest form of brain cancer with an average survival of six to 14 months from initial diagnosis. The American Cancer Society estimates that approximately 23,000 malignant tumors of the brain or spinal cord will be diagnosed during 2013 in the US and approximately 14,000 people will die from these tumors. Glioblastoma is the most common primary malignant brain tumor and has been associated with a particularly poor prognosis, with survival rates at one and five years of 33.7% and 4.5%, respectively. The current standard of care for patients with newly diagnosed glioblastoma is surgical resection followed by fractionated external beam radiotherapy combined with the chemotherapy agent temozolomide; this results in a median overall survival (OS) of 14.6 months based on data from a randomized, landmark phase III trial. The Stupp trial that was conducted in 2005 was the basis for establishing temozolomide and radiation as standard of care in this patient population.

Results from a Completed Phase II Trial of G-200 in Recurrent Glioblastoma

Treatment of recurrent glioblastoma following the progression of the disease after intial treatment can produce an added median survival benefit of about three to five months. Data from a phase II trial in recurrent glioblastoma conducted by Dr. Parsa, was presented at the 2012 AANS annual meeting. Over 40 patients were treated and the population evaluated for efficacy. Results were compared to those of 86 consecutive patients not enrolled in the G-200 clinical trial who were treated with alternative therapies during the study period. The vaccine and control patients had equivalent entry criteria; >90 percent resection of recurrent GBM, median age of about 53 and a Karnofsky Performance Score (measures the health status of patients) >70.

The last reported results from the trial showed that median overall survival for patients in the vaccine group was 47.6 weeks versus 32.8 weeks in the control group. The six month survival rate for the vaccine group was 93% versus 68% in the control group. Importantly, measures of immune response post-vaccination with G-200 demonstrated a significant localized tumor-specific CD8 +T cell response as well as innate immune responses as marked by a significant increase in levels of circulating natural killer cells. The vaccine was well tolerated, with no related grade 3 or grade 4 toxicities. These results suggest both a survival benefit and improved quality of life. More mature data from this trial will be published later this year in a peer reviewed journal.

Interim Results for G-100 in Newly Diagnosed Brain Cancer

In early May, interim results were reported from a single-arm, phase II trial of G-100 in 46 patients with newly diagnosed GBM which was carried out at eight centers across the United States. Patients were given G-100 along with standard of care which is radiation and the oncology drug temozolomide. Analysis of the data showed that overall survival was 23.3 months for G-100. While there was no control arm in the study, data from the Stupp trial indicated that expected progression free survival with standard of care would be 14.6 months. Median progression free survival was 16.9 months for G-100 which compares to 6.9 months in the Stupp trial. The data is still maturing and it is highly likely that OS and PFS will improve.

Of these patients, 32 were enrolled at UCSF. These 32 patients were tested for expression of the B7-H1 gene in blood samples taken prior to surgery. Glioblastoma related B7-H1 expression has been identified as a strong inhibitor of CD4+ as well as CD8+ T-cell activation and leads to systemic immunosuppression. An exploratory analysis showed that patients with low expression of B7-H1 (53% of patients) had PFS of 21.6 months while those with high B7-H1 (47% of patients) had a much lower PFS of 11.4 months. This promises to be a potentially important bio-marker to help identify a more responsive patient population for future trials.

Newly Started Phase II Trial in Recurrent Glioblastoma

Enrollment began on May 22, 2013 in a phase II trial of Prophage G-200 in combination with Avastin for patients with recurrent glioblastoma; their cancer has recurred one or more times after initial treatment. The trial is estimated to cost $21 million and is being funded by the National Cancer Institute; it is being conducted by the Alliance for Clinical Trials in Oncology (ALLIANCE), a cooperative group of the National Cancer Institute (NCI). Data presented by Dr. Andrew Parsa at ASCO in 2011, which I previously summarized, was the primary basis for this study.

This will be a 222 patient trial in recurrent glioblastoma patients who are surgically resectable. It will have three arms and is intended to determine the effect of adding G-200 to Avastin. Currently, Avastin and the Gliadel wafer (a biodegradable implant that contains the chemotherapy drug carmustine) are the only products approved in the recurrent glioblastoma setting. The three arms are: (1) Avastin only, (2) Avastin with G-200 added at the start of therapy, and (3) G-200 added to patients initially treated with Avastin when their cancer starts to progress. The primary endpoint of the trial will be overall survival.

Agenus has not given guidance on when this trial will be enrolled and when topline data will be reported. My judgment is that we will probably see topline data in 2015. If the data is as good as the earlier phase II trial conducted by Dr. Parsa, this trial might be sufficient for registration and potential approval in 2016.

What About A Phase II or III Trial in Newly Diagnosed Glioblastoma?

Agenus will likely meet with the FDA later this year to discuss the design of a phase II or III trial in newly diagnosed glioblastoma. The Company has not yet decided how it will fund the trial. Assuming the trial begins in early 2014, topline data would probably be available in 2016.

HerpV for Genital Herpes

Introduction

I previously discussed how the mechanism of action of heat shock protein- antigen complexes allows for the development of vaccines for infectious disease as well as cancers. Agenus' initial focus is on HSV-2, the herpes virus that causes genital herpes, but the technology platform can potentially be used to develop off the shelf vaccines for many types of infectious diseases such as HPV, HIV, hepatitis, malaria and tuberculosis. The clinical trial in HSV-2 of its lead product HerpV will represent the first proof-of-concept study for the application of the heat shock protein recombinant series platform in the infectious disease area.

Herpes HSV-2 Virus

HSV-2 is the fastest growing sexually transmitted disease in America. According to the Centers for Disease Control, it affects more than 60 million Americans. The prevalence is about 1 in 6 people between ages 14 and 49 (16% of that population) and there are 1.5 million new cases each year. It is a lifelong and incurable disease that can result in recurrent painful sores in the genital area. The effect on quality of life is onerous. One survey of sufferers reported that 82% of people in the study reported depression, 75% experienced fear of rejection, and 69% cited feelings of isolation and 55% reported fear of discovery.

The majority of people who've been infected with HSV-2 never know they have the disease, because they have no signs or symptoms. However, some patients experience pain or itching beginning a few weeks after exposure to an infected sexual partner. After several days, small red bumps or tiny white blisters may appear which then rupture, becoming ulcers that ooze or bleed. Eventually, scabs form and the ulcers heal. Genital herpes is different for each person. The signs and symptoms may recur, off and on, for years. Some people experience numerous episodes each year. For many people, however, the outbreaks are less frequent as time passes.

Current Treatments for HSV-2

Treatment with antiviral drugs can help people who are bothered by genital herpes outbreaks stay symptom-free longer. These drugs can also reduce the severity and duration of symptoms when they do flare up. Drug therapy is not a cure, but it can make living with the condition easier. There are three major drugs commonly used to treat genital herpes symptoms: Zovirax (acyclovir), Famvir (famciclovir) and Valtrex (valacyclovir). These are all taken in pill form. Severe cases may be treated with the intravenous (IV) drug acyclovir. Patients who present with sores are usually given a 7 to 10 day course of treatment or longer if the sores don't heal.

After the first treatment, intermittent treatment can be used. When there is a flare-up or the patient feels a flare-up is imminent, they may take pills for 2 to 3 days. For patients with more than six outbreaks a year, suppressive therapy can reduce the number of outbreaks by 70% to 80% per year and some patients may experience no outbreaks.

Taking daily suppressive therapy may also reduce the risk of transmitting the virus to a sex partner. Antiviral drugs reduce viral shedding when the virus makes new copies of itself on the skin's surface. A recent study of people taking daily doses of valacyclovir showed that the drug may help protect sex partners from being infected. Half the partners of people taking daily valacyclovir became infected with the virus and half did not. Side effects with these herpes drugs are mild they are considered safe for long term use. Acyclovir is the oldest of the three, and its safety has been documented in people taking suppressive therapy for several years.

HerpV

Unlike cancer vaccines, HerpV is a recombinant, off-the-shelf product, HerpV consists of recombinant HSP-70 complexed with 32 distinct 35-mer synthetic peptides from the HSV-2 proteome. This broad spectrum of herpes antigens is intended to allow for more accurate immune targeting and surveillance, reducing the likelihood of immune escape. The diversity of antigens increases the chance of providing efficacy for a wide segment of the patient population. The HSP peptide complex is combined with the Company's QS-21 adjuvant. It is clinically the most advanced therapeutic vaccine for the treatment of genital herpes.

Phase I Study

In a six-arm, Phase 1 study, 35 HSV-2 seropositive patients received: (1) HerpV plus QS-21 at two dose levels 80 and 240 ug, HerpV alone at two dose levels 80 and 240 ug , QS-21 alone or placebo. Patients received three treatments at two-week intervals. All patients who received HerpV and were evaluable for immune response showed a statistically significant CD4+ T cell response (100%; 7/7) to HSV-2 antigens as detected by IFNγ Elispot, and the majority of those patients demonstrated a CD8+ T cell response (75%; 6/8). This study was published in the peer reviewed journal Vaccine.

This was the first evidence that a therapeutic genital herpes vaccine could elicit both CD4+and CD8+ T-cell responses in humans. Results in the published literature indicate that both of these branches of cellular immunity need to be stimulated for successful treatment of genital herpes. This study was the first to demonstrate that heat shock proteins complexed to viral antigens could induce an antigen-specific T cell response in humans. The vaccine was generally well tolerated, with injection site pain as the most common reported adverse event.

Phase II Trial

The phase II study was begun on Oct. 23, 2012. It enrolled 75 HSV-2 positive subjects with a history of frequent disease recurrences. The study will test the efficacy of HerpV vaccine as measured by its effect on genital viral shedding. Leading clinical experts in the field consulted by Agenus believe that a reduction in viral shedding should translate into clinical benefit.

In the study, 65 participants received the active treatment, HerpV and QS-21, and a control group of 10 participants received placebo. Enrollment was completed on May, 2013.

The study will test the biological efficacy of HerpV as measured by effect on genital viral shedding after three injections at two week intervals. A booster injection will be given at six months after treatment to evaluate the durability of treatment effect. The phase I clinical experience demonstrated a strong immune response for both CD8+ and CD4+ T cells in subjects vaccinated with HerpV and QS-21, but not in subjects receiving placebo.

QS-21 Stimulon Adjuvant

Agenus has licensed its QS-21 Stimulon vaccine adjuvant to larger pharma companies that are using it as a key component in 20 investigational trials for both preventative and therapeutic vaccines. Agenus also uses QS-21 in HerpV. In total, there are 21 clinical programs using QS-21 and 13 in preclinical studies. Adjuvants are used to boost the immune response which has been shown to enhance the efficacy of vaccines. QS-21 is based on the saponin class of chemicals that is extracted from the bark of the Quillaja saponaria tree, an evergreen that is native to central Chile. It is used alone and in combination with other adjuvants; clinical studies have suggested that it is one of the more potent adjuvants.

From an investor standpoint, interest in QS-21 is focused on four late stage vaccine candidates being developed by Glaxo that are in phase III trials. GSK's MAGE-A3 cancer vaccine is being investigated for treatment of surgically resected stage Ib, II or IIIa non-small cell lung cancer and surgically resected stage IIIb/ IIIc melanoma patients. Eagerly awaited topline phase III data should be reported from both trials in 2H, 2013 or early 2014. Glaxo has earlier reported results for a preventative vaccine for malaria that produced mixed results; more conclusive data should be available in late 2013 and 2014. Finally, topline data on a preventive vaccine for herpes zoster or shingles should be available in 2014. In this report, I have spent almost all of my time on these four products.

Glaxo's MAGE A-3 Cancer Vaccines

MAGE-A3 Is the Basis for Glaxo's Cancer Vaccines

The body's innate and adaptive immune systems have the inherent ability to target and kill cancer cells, but sometimes this fails to prevent a cancer from occurring. The hypothesis behind cancer vaccines is that they can enhance the immune response and in doing so can effectively treat cancer. This is done through the inoculation of tumor specific antigens that are recognized by the immune system and which then seeks out and kill cells that express that antigen.

Glaxo (GSK) has developed a vaccine for cancer that uses the MAGE-A3 as the sole antigen to elicit an immune response. It is a fusion protein of MAGE-A3 and Hemophilus influenzae protein D that is produced recombinantly in Escherichia coli; it is then combined with AS02, a proprietary mixture of adjuvants that incudes QS-21. It is being tested in phase III trials for non-small cell lung cancer and melanoma and phase II trials in bladder cancer, head and neck, gastric, hepatocarcinoma, and multiple myeloma.

MAGE A-3 has some compelling properties for use as an antigen in cancer vaccines. The normal function of MAGE-A3 in healthy cells is unknown. Importantly, it is only expressed in the testes and the placenta, which do not have HLA molecules that display proteins to the immune system. However, it is widely expressed in a variety of tumors. As a result, the immune system only sees MAGE A-3 on cancer cells and only launches an immune response specific to cancer cells. It is a genuinely tumor-specific target for tumor specific immunotherapy. MAGE-A3 is expressed in up to 76% of melanomas, 35% to 50% of non-small cell lung cancers, 30% to 58% of bladder cancer and 24% to 78% of liver cancers.

Glaxo initially chose to conduct phase II trials in non-small cell lung cancer and melanoma. Results in these trials encouraged GSK to move to large phase III trial. In the following sections, I discuss the phase II trial results.

Phase II Results in Surgically Resected Non-Small Cell Lung Cancer

Design of the Trial

A phase II trial in stage Ib and II non-small cell lung cancer was conducted in surgically resected patients who were confirmed as having MAGE-A3 expression based on a sample of removed tumor tissue. The enrollment criteria required that patients had to have meaningful MAGE A-3 expression in their cancer cells. They also must have been surgically resected four to eight weeks earlier and to have recovered from their surgery with a good performance status.

The vaccine was given by intramuscular injection with the first vaccination given 4 to 8 weeks after surgery. This was followed by four injections at three week intervals and eight more at three month intervals, Hence, there were roughly 8 doses in the first year and 5 in the second

Computer tomography was used to determine if the tumors regrew. The first scan was performed 4 to 8 weeks after surgery, at three month intervals for the next 18 months and then at six month intervals for the next 42 months. The scans were evaluated by the investigator or a radiologist blinded to the treatment assignment. Disease free progression was defined as: (1) the time from the date of surgical resection to the date of recurrence or (2) to the development of a second lung neoplasm. Standard definitions of disease free survival and overall survival in accordance with RECIST criteria were used.

Enrollment in the Trial

A total of 1,089 patients with completely resected non-small cell lung cancer were screened for expression of the MAGE-A3 antigen. Significant MAGE-A3 expression was observed in 363 tumors or 33% of those screened. Of these, 183 patients were enrolled in a trial that started in May 2002. The trial was randomized to 122 actively treated patients and 61 control patients who were just given placebo and observed.

Results in the Trial

Following a median follow-up period of 44 months, there was cancer recurrence in 43 (35%) of the 122 actively treated patients and in 26 (43%) of 61 placebo treated patients. This was a proof of concept trial that was not powered to achieve statistical significance. The p-value was 0.122 and the hazard ratio was 0.75 indicating a 25% reduction in risk of disease recurrence for the drug group. The 25% reduction in the risk along with the drug's good safety profile was considered encouraging and was the basis for Glaxo's decision to move forward into phase III.

The choice to conduct this trial in the adjuvant setting (just after surgery) in the early 2000s was unusually prescient on the part of Glaxo. At the time, most cancer vaccines were tested in the same way as chemotherapy and targeted therapy drugs. They were given late in the disease state and in combination with standard of care. Glaxo elected to conduct studies in earlier stage patients who were not receiving drug therapy. Subsequently, other studies have shown that earlier stage patients with less tumor burden are more likely to benefit from cancer vaccines.

A late divergence was seen between the drug and placebo groups in this study which was in line with studies with Yervoy (ipilimumab) in melanoma and Provenge in prostate cancer. The delay could be the result of a longer time required to induce an immune response and subsequent clinical activity. Alternatively, it could be that only a subset of patients may respond to immunotherapy because of differences in characteristics of the tumor or its immune microenvironment.

A possible reason for tumor cells to escape immune recognition could be due to their loss of tumor antigen expression or antigen drift. This is a significant concern in cancer vaccines that use one or just a few antigens. In this study, the authors said that only a few biopsies (no number given) of recurrent tumors could be obtained and in this group only one patient had lost the expression of the MAGE-A3.

Phase II Study in Melanoma

Design of the Trial

Previous studies conducted with the MAGE A-3 vaccine in melanoma showed only limited immunological and clinical responses. To improve the immunogenicity of the MAGE-A3 vaccine, Glaxo developed a proprietary adjuvant AS02 which combined Agenus' QS-2 with monophosphoryl lipid A (a TLR-4 agonist) in an oil/ water mixture. The combination with AS02 resulted in a more efficient elicitation of humoral and cellular responses, but the clinical benefit remained limited.