Antares: Xyosted Sales Projections for 2020 Through 2023 (ATRS, Buy, $2.62)

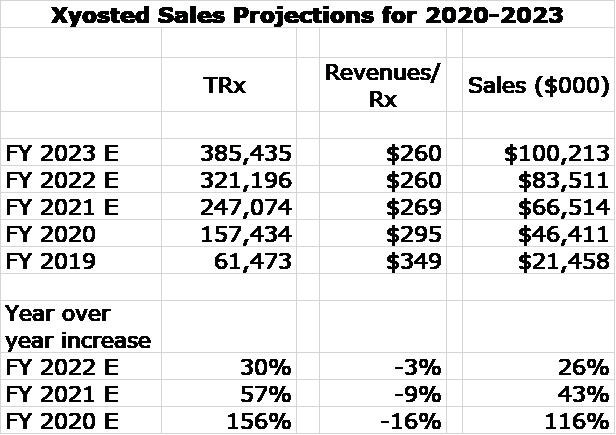

Sales Projections for Xyosted

Xyosted just completed its sixth full quarter of sales since its launch in 4Q, 2018. Almost all product launches are difficult in this managed care environment. It often takes a year or so to get reimbursement issues partially resolved. Just as Xyosted got through this, the launch ran smack into the COVID-19 epidemic. With all of this, the trailing 12 month revenues have reached about $37 million. In 2Q, 2020 total prescriptions increased 11% sequentially from 1Q, 2020 even though countless physicians offices closed and many, many patients were afraid to see their doctor.

I did not know what to expect early in 2Q, 2020, but feared there would be a severe impact on Xyosted sales. Antares did a superb marketing job dealing with the COVID-19 crisis. The Company shifted to a virtual marketing approach in April and May which proved to be quite effective. For a period of time, no reps were vising physicians’ offices. Now about 25% of details are being made in-person.

I think that the product has really caught traction and should be a powerful driver of corporate growth through 2022 and beyond. I am looking for things to improve from here as physicians offices reopen and patient visits are resuming. This report goes over the assumptions that I am using to project Xyosted sales through 2023 which are shown below.

Xyosted in relation to the size of Antares is a major product that could single handedly drive corporate sales and profits for the next few years. The sales force and marketing organization that Antares built to market Xyosted is now a major asset. It affords Antares the ability to channel other products-developed internally or acquired- through an established marketing channel. The COVID-19 crisis has also led to a potentially paradigm changing approach to marketing. As shown in 2Q, 2020, Antares has been very successful with a virtual marketing approach. This could have enormous potential to improve productivity for sales reps as they do not have to drive to several different locations in a day and wait for long periods to see a doctor for a few minutes. They can make significantly more virtual marketing calls per day to augment on site visits. This could very well result in much less marketing spend being needed to drive Xyosted sales than has been the case in the past. This is something I am watching with great interest.

Investment Thesis

As explained in my last report, Antares has been a disappointing stock for the last few years, but I think that its time has finally come. For the next few years, I expect Xyosted to be the primary driver of growth, but there is support from other products. There remains moderate growth potential for the AB rated generic to EpiPen in 2020 and 2021 and the probable launch of the AB rated generic to Forteo should be a significant boost to 2021 sales and profits.

The pipeline story is not well appreciated but it looks extremely promising. Late stage products being develop by Pfizer and Idorsia using Antares injector technology have the potential to be billion dollar plus products if successfully developed and Antares would likely receive royalties in the high single digits on these drugs. These products probably will not reach the market until 2023, but if clinical data is favorable, anticipation could begin to have a very positive effect on the stock price in the 2021 and 2022 time frame. Finally, the sales force now makes it very likely that Antares will acquire products to leverage this valuable asset.

In upcoming reportsnI will discuss these issues, but this report focuses only on Xyosted. I am also working on a detailed sales and earnings model update. Stay tuned.

Xyosted Performance in 2Q, 2020 Was Impressive

The performance of Xyosted in 2Q, 2020 was pretty amazing from my standpoint. Sales of some drugs faltered as patients were afraid to come into doctors’ offices and some offices closed for a time due to the COVID-19 pandemic. This especially impacted products that, like Xyosted, are early in their commercial launch cycle and whose sales results are more dependent on educating doctors and patients. In the case of Xyosted, it is necessary to convince the medical community and patients that it offers important advantages in a field with numerous, established brand and generic competitors; it is highly detail dependent.

Xyosted performed impressively in the 2Q as TRx increased 11% sequentially from the first quarter of 2020, despite the limitations placed on the sales force when they were unable for a time to physically interact with physicians and their staffs, coupled with reduced number of patient visits. Antares smoothly executed a strategy at the end of the first quarter to shift to a virtual detailing platform that it had been using (experimenting with) in some smaller sales regions. This was leveraged by a social media campaign to reach patients and doctors. Antares focused on a marketing message that Xyosted is an easy to use, virtually painless, once weekly, subcutaneously administered product designed for at-home use. In the case of injectable testosterone products, many require a painful injection that is administered in the doctor’s office. The ability to self-administer Xyosted at home offers a compelling advantage for those hesitant about going to a physician’s office. This COVID-19 issue benefitted Xyosted relative to competitive products which require injection by medical personnel. Management commented that about 50% of new patient starts are switches and 50% are new to therapy.

For a period of time, no reps were vising physicians’ offices. Now about 25% of details are being made in-person although spikes in COVID can have a regional impact. However, reps continue to be effective with a virtual platform. Barring a sharp spike in much of the nation in COVID infections from current levels, the environment for Xyosted is improving. More and more patients are willing to make an office visit. Some physician’s offices that closed in late March and April have now reopened. Physicians’ offices are also more prepared to cope with the pandemic, so they’re now seeing patients on a more regular basis although obviously not at pre-pandemic levels. Management said that their sales reps are now reporting an improving environment for detailing, but in the end, it’s all about patients coming in to see the doctors and less about access to offices. In any event, management is confident that reps can effectively detail the doctors via its virtual platform.

Explaining How I Make Xyosted Sales Projections

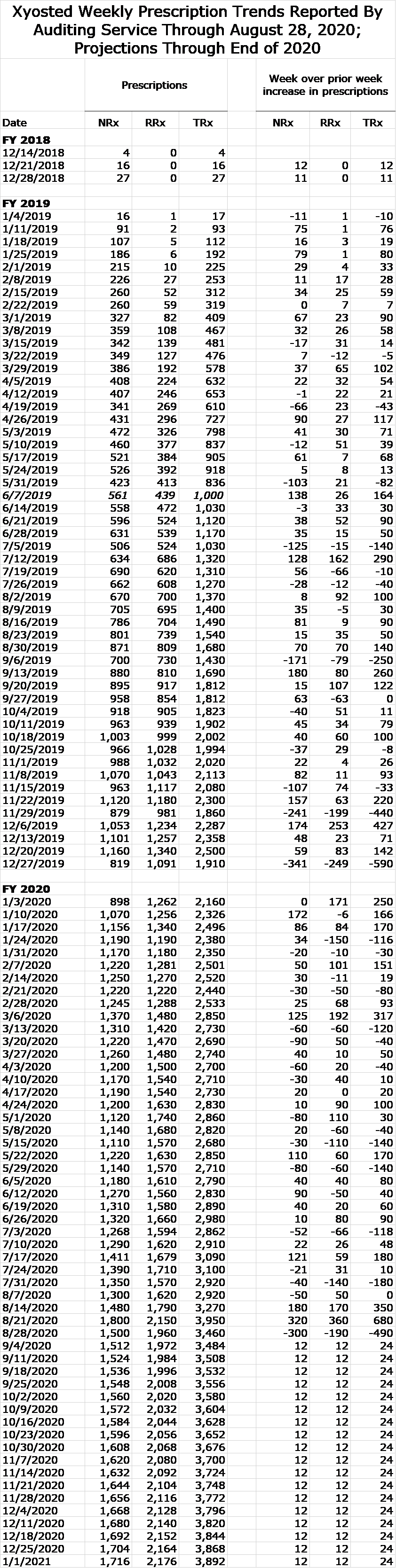

In the appendix of this report, I have included a table which shows the weekly NRx, RRx and TRX beginning for the week ending December 14, 2018 and ending with the week ending August 28, 2020. I have also included my projections through the end of the year. There are a lot of numbers which give the appearance of great precision, but there are flaws in them that must be understood.

- These are not the actual numbers, but rather projections from a sampling of prescriptions filled.

- ATRS says that the numbers consistently understate actual prescriptions.

- Some patients are initially given a sample which is not caught as a NRx. However, these can later result in a RRx.

If you look at the table in the appendix, you can see that the numbers can gyrate wildly from one week to the next. I suspect this is more due to the way the audit is put together than what is actually happening in the field, but I don’t know.

These numbers can’t be taken as exact, but I do think that they are a great starting point for judging the trend and magnitude of Xyosted prescriptions and I have used them to build a quarterly sales model for Xyosted prescriptions. I have focused on TRx in my projections for reasons just discussed. I have compiled TRx for each quarter of 2019 and the first two quarters of 2020 which is a small sample of just six quarters.

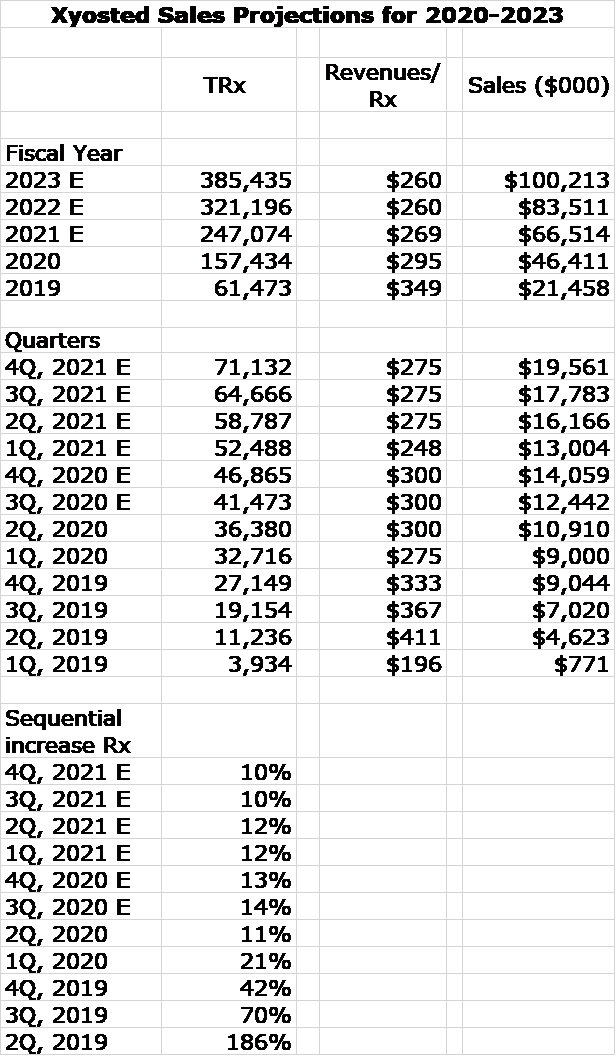

The key to my model is trying to judge the sequential increase in TRx in each of the next six quarters through December 2021. Let’s look at the sequential increase for the last three quarters as follows:

- TRx in 4Q, 2019 increased by 42% over 3Q, 2019. This quarter was totally unaffected by COVID-19. It was a normal business quarter.

- TRx in 1Q, 2020 increased by 21% versus 4Q, 2020. This quarter was affected by COVID-19 in March and this could explain the slower sequential increase in TRx.

- TRx in 2Q, 2020 increased by 11% over 1Q, 2020 even though April and May were very seriously affected by COVID-19.

With the reopening of physicians offices and the greater willingness of patients to visit physician’s offices, we might expect some acceleration in TRx in the 3Q, 2020 and perhaps greater in 4Q, 2020. If you look at TRx trends in June, July and August there seems to be a pickup and management noted during the 2Q conference call that there were seeing an improvement. Could we see a sequential improvement of 21% as seen in 1Q, 2020 or greater? Maybe. Here are my guesstimates for upcoming quarters.

- 3Q, 2020 sequential TRx increase of 14%, a moderate pick up from 11% in the COVID-19 impacted 2Q, 2020.

- 4Q, 2020 sequential TRX increase of 13%. Some slowing from 3Q due to holidays in the quarter.

- 1Q, 2021 and 2Q, 2021 sequential TRx increase of 12% in each quarter.

- 3Q, 2021 and 4Q, 2021 sequential TRx increase of 11% in each quarter.

The list price of a Xyosted prescription is $475, but this is not what Antares actually receives. It has to offer rebates to insurers in order to be eligible for reimbursement. In addition, Antares in most cases will offer coupons to patients to reduce their co-payment or pay part or all of their co-payment. In high deductible plans, this co-payment support can be as much as $125 per prescription. About 65% of patients receive some form of co-pay support. The co-pay support falls disproportionally in the 1Q so that the price per prescription is lowest in that quarter and then rebounds in the following three quarters.

I estimate the actual price received per Rx by Antares by dividing actual sales as reported by Antares in each quarter by TRx estimates for the quarter. You can see that this shows that the revenues/Rx in 4Q, 2019 was $300 and then fell to $248 in 1Q, 2020 with a rebound to $275 in 2Q, 2020. For the latter half of 2020, I project the revenues/Rx to be roughly steady with 2Q.

In projecting revenues for 2021, I am looking for the same pattern of quarterly revenue/Rx trends as seen in 2020. The 1Q, 2020 shows a drop from 4Q, 2020 and a rebound in the next three quarters. For 2021 as a whole, I am projecting a price decline of 9%. This is based on the assumption that as was the case in 2020, Antares will discount Xyosted to gain better formulary access.

Intuitively, I think that all of these estimates are conservative. However, until we get a better idea on how the economy is performing as we end the COVID-19 lockdowns, I think conservatism is called for. The next table shows the resultant sales estimates for the next six quarters of and also for FY , 2020, 2021, 2022 and 2023.

Appendix

Here are the weekly prescription trends since Xyosted was launched and through August 28, 2020. I have also included some projections through the end of the year.

Tagged as Antares Pharma Inc., Xyosted sales projections + Categorized as Company Reports, LinkedIn