Northwest Biotherapeutics: Non-Dilutive Financing Provides Major Boost to Investment Outlook (NWBO, $0.25, Buy)

Key Points:

- Monetization of a UK manufacturing facility has brought in roughly $46 million of non-dilutive cash.

- I estimate that payment of debt obligations over the next two years will require about $10 million leaving $36 million to fund operations.

- At the recent quarterly burn rate of $5 million, NWBO can fund operations through mid-2020. This money should allow the company to unblind the phase 3 trial of DCVax-L and if the results are positive complete the registration process in the US and Europe (hopefully with approvals) without having to raise additional funds.

- I am “guesstimating” that another leg to the UK transaction could bring in an additional $15 million or more and warrant exercises another $20 million or more bringing the cash balance available to $71 million or more. I want to emphasize that these are my guesstimates. Management only acknowledges the potential for cash inflows from these sources, but won’t comment on my numbers.

- This strengthening of the balance sheet is a huge, huge positive for investors. I am speculating that the phase 3 trial will be successful. However, the distressed financial situation and a long running, ongoing, coordinated short selling attack left open the possibility that the Company could run out of funds and we would never see the unblinded results. Positive or negative, we now will.

- I believe that Northwest has been the targetof a massive stock short selling/ manipulation scheme led by a group of hedge funds that I have labeled the wolfpack. Shorting is, of course, selling a stock that you don’t own. To execute a short, the broker has to locate shares to borrow from their firm, a customer of their firm, or another broker. Upon execution, the short seller has to pay margin interest on the amount borrowed until the short is covered by buying stock. In the case of illegal naked shorting,the short sell is executed without borrowing shares. The market maker simply creates counterfeit shares for which there is no margin interest. There is no limit to the use of this technique to create sell orders that overwhelm legitimate buy offers in the stock. If there are orders to buy 1,000,000 shares they can counterfeit 1,000,001.

- I am aware of several groups that are monitoring the activity of the wolfpack for several companies that have been attacked. In regard to NWBO, I have heard estimates that there have been 150 to250 million naked shorts which compares to 516 million registered shares outstanding. The wolfpack’s goal was to drive NWBO into bankruptcy (and they nearly did) in which case they would not have to cover these illegal, naked shorts. If the phase 3 trial of DCVax-L is successful, we could see an interesting short squeeze.

Reason for This Report

Northwest has just consummated an important non-dilutive financing.in which it has monetized its wholly owned manufacturing site in theU.K. It will sell part of the property to an as yet undisclosed large corporation for roughly $46 million net of transaction costs. The Company retains an 87,000 square foot manufacturing facility that can provide clinical and commercial supplies of DCVax-L and DCVax Direct in Europe. NWBO has entered into a long term sale and leaseback in which it will pay no rent in the first year and then $634,000 per year (87,000 square feet at 5.76 UK pounds per square foot) for the subsequent four years. This is below the estimated marketrate of about 30 to 35 UK pounds per square foot. The lease runs for 20 yearsand can be extended for another 20 years. The below market lease rate was animportant part of the negotiations and represents an annual cash flow savings of $2.5 million to $3.0 million relativet to the market rate.

NWBO retains 17 acres of land that it intends to change from industrial to residential zoning. The acreage is located near Cambridge in a prestigious residential area. Northwest has said that if this zoning is obtained that it will add substantial additional value. There was no definitionof what substantial means but if the incremental value were 10%, 20%, 30% or 40% of the $46 million already realized, it would bring in $5, $9, $14 or $18million of non-dilutive financing. In checking with a source on the potential value of this land, I am inclined to think that its value is at the upper end of the $5 to $18 million range. Management offers no guidance on the potential value of the property or when it might be realized.

Investment Significance

Northwest has been under severe financial stress for several years as a result of its being targeted by a devastating short sellingattack from a group of hedge funds who I refer to as the wolfpack. Their goal has been to devastate the stock price and force the Company into equity offerings at ever lower prices to cover their shorts with an ultimate goal of bankruptingthe Company. With bankruptcy, they would never have to cover their huge short and illegal naked short positions. The wolfpack according to several estimates,through illegal naked shorting has created 150 to 250 million counterfeit shares. In a following section, I go into more detail on the wolfpack.

To me the major investment point of this transaction is that the wolfpack has been foiled. In this report, I go through an analysis of cash flows to see how much of this $46 million will be needed to pay off debt and after that how much will be left for funding operations. I must caution that there is a significant amount of guessing on my part, but I think that my estimates are in the ballpark. Northwest will need to immediately repay a $10.2 million mortgage on the UK property, but I estimate that there will be no need for cash to repay other debt obligations in the next two years or so. This leaves $36 million for funding operations. The burn rate will be contingent on a number of factors, but using the recent burn rate of $5million per quarter, this $36 million will fund the company through mid-2020. For a company that has been living hand to mouth, this is a huge improvement. Most important of all, I believe it can fund the Company through the scrubbing of the phase 3 data, unblinding of the trial and potential registration without raising any additional capital. The tried and true technique of the wolfpack has beento drive the stock price down and force equity offerings on highly dilutive terms which then further depresses the stock price with the ultimate goal of forcing NWBO into bankruptcy. However, that game is over.

The cash position could improve even more dramatically. I am speculating that the sale of the 17 acres at the UK facility could bring in perhaps $15 million, but this is based on my own research and with no guidance from management. There are also around 300,000,000 warrants outstanding that if exercised, could add something more than $60 million. Meaningful warrant exercises are already starting. So we could see perhaps $15 million from the sale of 17 acres and let’s guess $20 million from the warrants. The cash positionwould then be increased to $71 million under these guesstimates. However, I would further speculate that if this occurs, the Company will expand expected clinical trials of DCVax-L and DCVax-L in a number of cancers as single agents and in combinations with other approved drugs. As a guess, this might drive the burn rate to $8 million per quarter, but would still give the Company a cash runway into 1Q, 2021.

Investors have paid a heavy price in terms of share dilution as a result of the wolfpack attack. Bloggers paid by or closely associated with the wolfpack scream that this dilution was the result of poor management. Au contraire, if and when the full scope of the wolfpack attack becomes known, investors will applaud the valiant efforts of management to scrape together enough financing to complete the DCVax-L trial. The alternative was bankruptcy.

Under the assumption that every possible dilutive security is converted into common stock by 2020, I think the share count could increase to about 1 billion by then as compared to 516 million shares now outstanding. I don’t see the necessity for additional capital to be raised before then. Based on 1 billion shares and the current stock price of $0.25 the market capitalization is $250 million; based on 516 million issued shares, it is $129million. Based only on the expectation of there being a reasonable chance for success in the DCVax-L trial, I would argue that comparisons to peer companies would suggest that the current valuation should be $1, $2, $3 billion or more. As explained later in this report, I consider bluebird bio a comparable company and its market capitalization is $6 billion. In the event of success in the phase 3 trial and approval, I think there is a potential for a takeover valuation comparable to the $12 billion Gilead paid for Kite and the $10 billion Celgene paid for Juno. Based on 1 billion shares, this would translate into a $10 to $12 stock price.

Financial Discussion

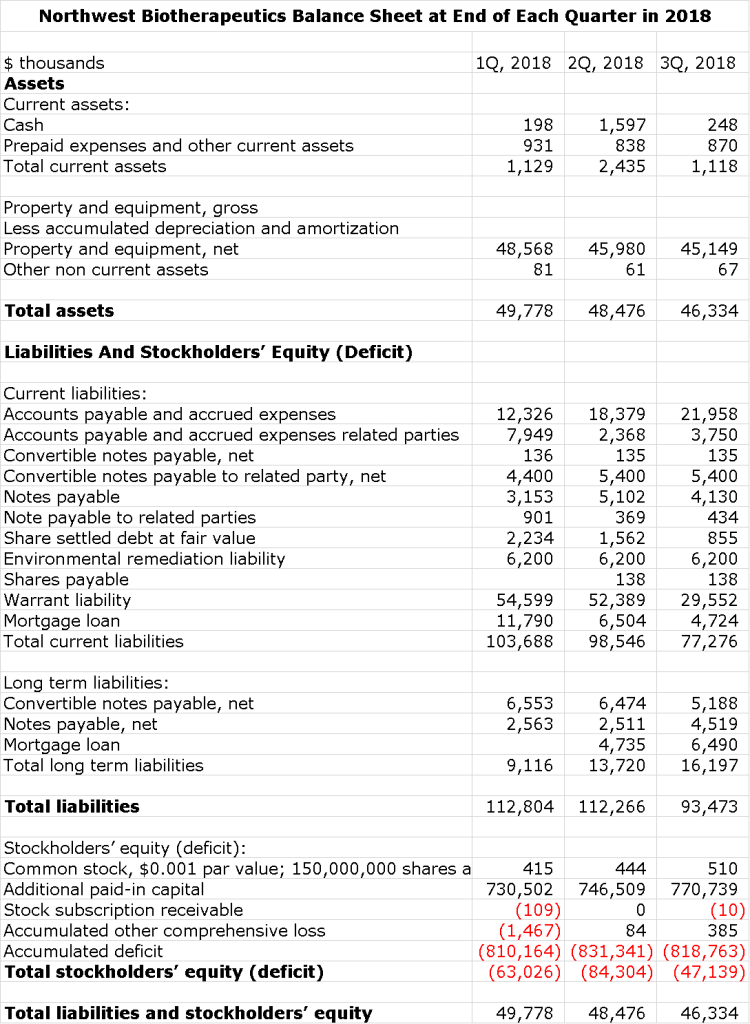

The wolfpack attack has left Northwest Biotherapeutics with one of the ugliest balance sheets I have ever encountered. While wolfpack bloggers attribute this to management incompetence, it really reflects the desperate attempt by management to avoid the powerful effort of the wolfpack to bankrupt the Company. This non-dilutive monetization of the UK facility nowgives the Company a seven quarter cash runway in the worst case. With the exercise of options and the potential further monetization of the 17 acres retained at the UK site, this cash runway could extend much further. Let me first show you the balance sheet as of September 30, 2018.

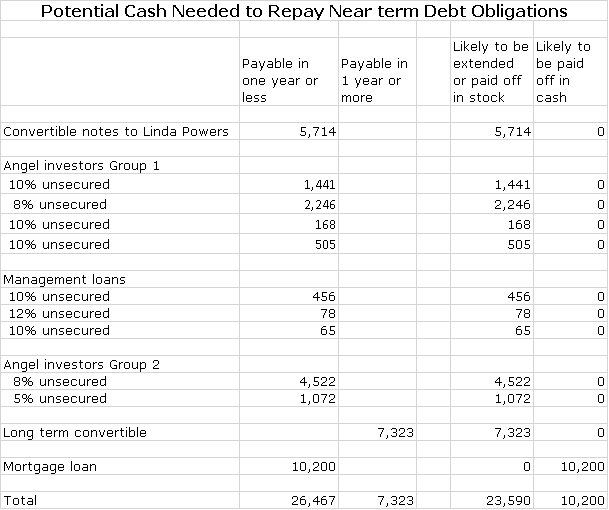

The balance sheet as shown doesn’t give a good insight into what we as investors want to know, that is how much of the $46 million just raised will be required to pay off debt obligations in the next year or two. To address this critical issue, I would refer you to the table on page 30 of the 10-Q for 3Q, 2018. In that table, management details debt obligations that come due in the next two years or so. However, there are a number of adjustments that need to be made to that table in order to better understand the potential demands on cash. In its desperate effort to continue to fund theDCVax-L trial, Northwest had to employ some unusual financing techniques that relied importantly upon management and angel investors to fund the Company. Using the table on page 30 as a starting point, here are my estimates for debt obligations coming due over the next two years or so and the accompnying need for cash:

- Management provided debt or convertible debt is about $6.3 million, most of which is comprised of $5.7 million from CEO Linda Powers.

- The Company was also very dependent on a group of angel investors who generally held major equity stakes in the Company and obviously wanted to keep operations ongoing; this amounts to about $10.0 million of debt.

- A convertible note of $7.3 million is due in June 2020. This is also held by an angel investor.

- Repayment of the mortgage on the UK facility amounts to $10.2 million and will be repaid shortly.

- Management did not provide me with any guidance on these estimates.

By my estimates, it is extremely likely that NWBO will only need to use cash to retire the $10.2 million mortgage on the UK facility overthe next two years and this should be done very shortly. The debt to management and angel investors of $16.3 million is likely to be extended and/or converted into stock. Assuming conversion into stock at a price of $0.25 this wouldresult in issuing 65 million new shares. The $7.3 million convertible due in June 2020 is also likely to be converted into stock. This is summarized in thefollowing table.

Wolfpack is Frustrated

Many of us have watched with dismay as the wolfpack has conducted a long running attack on the Company, key elements of which are:

- Both legal shoring and illegal naked shorting conducted by a group of hedge funds (the wolfpack) and facilitated by market makers (some of which are household name investment banking firms) who knowingly allow naked shorting.

- Vicious attacks on management, its technology and its DCVax products were launched on social media by bloggers, usually inthe pay of or who receive other benefits from the wolfpack.

- Several shareholder law suits were filed againstthe Company that ironically were based on social media reports that were spondored by the wolfpack. There is an apparent close inter-working between some law firms who specialize in instigating shareholder lawsuits against companies and the wolfpack which uses this ploy to further damage investor psychology. All such lawsuits against NWBO were dismissed without the Company paying any money, but the legal expenses for that defence were substantial.

- SEC investigations were spurred by shortsellers using information from social media and law suits. The SEC reliance on this false and circular information flow is extremely discouraging. An objective observer would think that they would be going after the wolfpack instead of abetting its attack on NWBO.

This sophisticated market manipulation scheme used by thewolfpack is not unique to Northwest. Indeed, this criminal activity is pervasive in its use across a broad range of companies, it is just extremely pronounced in the case of Northwest Biotherapeutics. In my view, this is one ofthe biggest criminal enterprises in the US.

The phase 1/2 data created with DCVax-L was extremely encouraging and analysis of the blinded (soon to be unblinded) data from the 331 patient phase 3 trial has also been very encouraging. This does not assurethat the phase 3 trial will be successful, but it surely indicates that there is a reasonable probability for success and reasonable probability for success is about all any investors can hope for with emerging biotechnology stocks. In clinical drug development there are no sure things. Based on following biotechnology stocks for over 40 years, this type of data might very well have led to a current multi-billion market capitalization if NWBO were not in the crosshairs of the wolfpack.

The wolfpack is immensely powerful and very good at what they do. They have created unending social media attacks on NWBO that spin every single event negatively. Almost every attack is then followed by a massive shorting attack which depresses the stock price and in doing so legitimizes the contrived negative blogs. Legitimate investors who look at news which appears to be quite positive are startled to see a decline in the stock price. This shakes their confidence and indeed this is the intent of the wolfpack. For the wolfpack all news is manipulated to appear to be bad. Over a period of several years, they have methodically walked the stock down from prices above $7 to the current price of $0.25.

The scenario for Northwest could have been much different if not for the wolfpack’s successful efforts to disparage its technology and clinical data created by Northwest. Let me show you how. NWBO’s biological hypothesis is based on creating dendritic cancer vaccines that can mobilize the immune system to attack a cancer. It is certainly as elegant as the gene transfer technology of bluebird bio. Both are high risk and paradigm changing technologies and both have at this point only presented data from open label trials. However, the number of patients treated with DCVax-L and DCVax Direct is several multiples greater than that for bluebird’s Lenti-D, LentiGlobin and bb2121. I would argue that the promise of each technology base is at least comparable (actually I prefer NWBO’s dendritic cell based therapy) and that the data from DCVax-L is more substantial than with bluebird.bio and as promising. And yet, bluebird bio has a marketcapitalization of $6 billion and has been showered with vast amounts of money from Wall Street that has allowed them to spend huge amounts on clinical trials and infrastructure. Meanwhile, NWBO has a market capitalization of $129 million based on issued shares and has had to do highly dilutive financings at very depressed stock prices to stay afloat. It may not be a coincidence that some wolfpack firms have substantial venture capital positions in bluebird.

I think that any objective observer would be dumbfounded as to why hedge funds and their social media blogger allies would try to negatively manipulate the price of NWBO to the point that they could destroy the company and prevent completion of the all-important phase 3 trial. Here is a company that is working on what could be a major advance in the treatment of glioblastoma multiforme, the most deadly of brain cancers. Of the 12,000 US patients who are diagnosed with this disease each year, 50% die before 16 months. There have been no advances in standard of care since the addition of the chemotherapy drug temozolomide in 2005. Every person with a soul should be praying for success. Granted that the phase 1/2 data and the still blinded phase 3 data are not conclusive, but they are consistent in that they both point to longer survival for patients. Indeed the two lead investigatorsin the trial have stated that patients appear to be living longer in the trial and both feel this could be a major advance in the treatment of GBM.

Why then did the hedge funds and their social media blogger camp followers target NWBO? Here is what I think happened. NWBO came on the wolfpack’s radar screens in 2013 or so as CEO Linda Powers was able to generate enough funding to restart the phase 3 clinical trial. For the wolfpack, the profile of NWBO was perfect. It had no strong investment bank backing. Its dendritic cell cancer vaccine was based on creating an immune response. Previously, several cancer vaccines had failed in clinical development. Also, prior to the introduction of the checkpoint inhibitor Yervoy in 2014, any type of immunotherapydrug for cancer was met with skepticism by key opinion leaders. Moreover, NWBO did not have the support of major investment banking firms for the same reasons that hedge funds were shorting the stock.

But why is the attack continuing in the face of promising data? The wolfpack is just in so deep that it can’t back out. Those 150 to 250 million illegal naked shorts have the potential to cause both huge financial and legal issues. Before they thought that they could force a bankruptcy and never have to cover their shorts. Now their sole hope is that the phase 3 trial fails.

Let’s hypothesize what might happen in a made up scenario in which NWBO had been funded by venture capital firms and had never been a public company and then came to market with its investment credentials. I thinkthat investment banks would be falling all over themselves to participate in an IPO. It would benefit from the enormous excitement with immunotherapy as witnessed by investor enthusiasm for the checkpoint inhibitors Opdivo and Keytruda and the CAR-T products Kymriah (Novartis) and Yescarta (Kite/ Gilead).The dendritic cell is the master orchestrator of the immune system in the body and NWBO’s technology is based on using the dendritic cell to launch a focused immune system attack that is specific to each patient’s tumor. To me, this is a more elegant and promising approach than either checkpoint inhibition or CAR-T.

There is also more than twice the patient exposure to DCVax-L than that of all patients combined for Kymriah and Yescarta when they were approved. Also, these latter two drugs were approved on the basis of single arm trials using objective response as an endpoint while the phase 3 trial of DCVax-L is randomized and includes survival as a much more meaningful endpoint. I think a good case can be made that this hypothetical IPO with NWBO would be at a market capitalization in excess of $1 billion and perhaps $2 billion or more. Ironically, many of the hedge funds now short the stock likely would participate in the offering.

The clear goal of the wolfpack was to cripple the abilityof NWBO to gain access to the equity that it needed and deserved to develop its dendritic cell technology. They have been largely successful as NWBO has been forced into a long series of financings that had to be done at depressed prices and on very dilutive terms. These frequent offerings allowed some hedge funds to cover their shorts in the offerings which is of course illegal, but oh well. The Holy Grail for the wolfpack was to drive the Company into bankruptcy. Inthis case, they would never have to be concerned about the vast number of counterfeit shares they have created through illegal naked shorting.

All of this discussion brings me to the central point ofthis note. The strategy of the wolfpack is now flawed and vulnerable. With this non-dilutive funding, NWBO has enough cash to fund the scrubbing of the phase 3 DCVax-L data and to fund trials on DCVax-L and DCVax Direct over the next two years without being forced to finance in the public markets and there is virtually no chance for the Company to be forced into bankruptcy before thephase 3 data is unblinded. Success in the phase 3 trial would be devastating tothe wolfpack as it would likely lead to either a large collaboration with or an outright sale of NWBO to a major biopharma company. I use the buyout of Kite by Gilead for $12 billion and Juno by Celgene for $10 billion as a proxy for a potential takeover. In this event, it is not clear to me how the wolfpack would deal with the counterfeit shares they have created which some investors put at as much as 250 million shares. This has the potential to create one of the great short squeezes of all time.

Tagged as Northwest Biotherapeutics Inc. + Categorized as Company Reports, LinkedIn

Are you concerned NWBO will use this to prolong their trial?

They have stated publicly that they are about to (or perhaps already have) started to scrub the data.

Your statement regarding a potential short squeeze is interesting: “In this event, it is not clear to me how the wolfpack would deal with the counterfeit shares they have created which some investors put at as much as 250 million shares. This has the potential to create one of the great short squeezes of all time”

Can you give any insight to how investors arrived at 250 million counterfeit shares?

On that same subject, I have a couple of questions.

1. While I completely expect that hundreds of millions of shares have been counterfeited, wouldn’t the short sellers be smart enough to buy back those shares after the stock goes down? Also, isn’t it likely that members of the “Wolfpack” bought back shares by participating in the NWBO offerings?

2. If we have a massive short-squeeze what happens when the front companies the short-sellers use to hold their shares and have the liability for their short shares declare bankruptcy? This isn’t Volkswagon where major institutions were involved.

With the buyer now identified as Huawei Technologies does this influence your thinking at all?