Northwest Biotherapeutics: An Analysis of Its Transforming Balance Sheet Restructuring (NWBO, $4.14)

Key Takeaway Points of this Report

Northwest (NWBO) restructured much of its debt in 4Q, 2012 and also has raised significant amounts of capital with four equity offerings over the last year that brought in $62 million. In part, because of the weak cash position, it had to issue warrants with each of these deals in order to entice buyers. It can be the case that when a Company goes through a torturous process of balance sheet restructuring and multiple equity offerings that it winds up with hundreds of millions of shares and a similar number of warrants outstanding. As I go through my thinking on the Company, you will see that this clearly is not the case with NWBO.

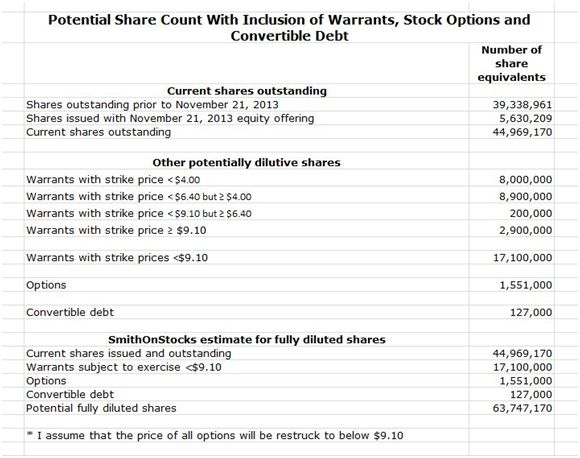

Importantly, my calculations indicate that if one includes all possible shares that can result from the conversion of outstanding warrants, options and convertible debt there are about 64 million fully diluted shares outstanding. Generally Accepted Accounting Principles or GAAP indicates about 45 million fully diluted shares. The difference between GAAP and my estimate is that I assume all warrants and options with strike prices below $9.10 will be exercised. GAAP excludes most of these as being anti-dilutive.

I estimate that NWBO will have about $27.6 million of cash at the end of 2013 (this includes a $5.5 million grant from the German government for partial funding of the DCVax-L phase III trial in Germany). I also estimate that the effective debt will be about $4.3 million (this is primarily accounts payable related to clinical trials enrollment). This $27.6 million of cash and $4.3 million of debt compares to $37 thousand of cash and $52 million of debt at the end of 2011. NWBO has dramatically restructured its balance sheet without flooding the market with stock and warrants.

At the recent price of $4.14, NWBO has a market capitalization of $265 million based on 64 million fully diluted shares. Relative to peer emerging biotechnology companies, this is at the lower end of valuations for companies having drugs in phase III development and important topline results about one year away. Based on GAAP accounting, the market capitalization is $186 million, but this is misleading. (The Yahoo Financial Page uses an approximation of GAAP shares and shows a market capitalization of $159 million.)

Objective of this Report

In order to successfully develop a drug, clinical trials have to establish its safety and efficacy and that it is medically significant. As importantly, a company has to be able to attract sufficient capital to fund development. The inability of a Company to obtain funding to run clinical trials can be a risk comparable to clinical risk.

The objective of this report is not to discuss the potential for clinical and commercial success of Northwest Biotherapeutics’(NWBO) two lead products, DCVax-L and DCVax-Direct. It is to demonstrate that the Company is now in a sound cash and balance sheet position that will allow it to complete the phase III trial of DCVax-L and continue development of DC Vax-Direct.

A Balance Sheet Restructuring Well Done

It is often very hard for emerging biotechnology companies to attract the capital needed to develop a drug. For reasons that I touch on later in this report, NWBO has had a difficult time attracting capital and has been forced to operate with a weak balance sheet and cash position for the last decade. When I first started researching the Company in late 2011 it had cash of $37thousand and total liabilities of $52 million; it was a bulletin board company selling at $0.36 per share.

NWBO also faced the formidable challenge of completing enrollment of the phase III trial for its lead product DC Vax-L. The company was facing a very high prospective operating burn rate for the three years 2012, 2013 and 2014 in order to complete the phase III trial and to fund the remainder of the Company. To say that the financing challenges were daunting would be a gross understatement and understandably kept many potential investors on the sidelines.

Now, nearly two years later the Company is in a much, much stronger financial position. I estimate that it will have $27.6 million of cash at the end of 2013 (this includes a $5.5 million grant from the German government for partial funding of the DCVax-L phase III trial in Germany). I also estimate that effective debt will be about $4.3 million (this is primarily accounts payable related to clinical trials enrollment). This $27.6 million of cash and $4.3 million of debt compares to $37 thousand of cash and $52 million of debt at the end of 2011. As a result of a successfully executed 1 for 16 reverse stock split, the stock is now listed on NASDAQ and sells at current price of about $4.14.

Management has to be given high marks for the improvement in the financial condition over the last two years. This is all the more impressive because this has been achieved while spending heavily to enroll patients in the phase III DCVax-L trial and to begin a large phase I/II trial of another product, DCVax-Direct.

It has also executed a brilliant European strategy in which it has collaborated with two prestigious institutions, Fraunhofer in Germany and Kings’ College in the UK, to manufacture DCVax-L in Europe and to move the phase III trial forward in Europe.Its products are autologous vaccines that require the removal of live cells from the body and the return of these biologically activated cells(antigen loaded) to the body. Because of logistics and regulatory reasons, it is necessary to manufacture the product in Europe that is to be sold in Europe. Without these collaborations, NWBO would not have been able to do this without a very large investment of capital, i.e., it would not have been able to do it at all.

There are two other well-known dendritic cell vaccine companies. Dendreon (DNDN) at the time of US approval of Provenge did not have European manufacturing in place. ImmunoCellular (IMUC) which is in phase II development with ICT-107 does not have its European manufacturing strategy defined. NWBO is in the position that it can manufacture and sell DCVax-L in Europe regardless of what happens in the US. This is important because European regulators tend to be more pragmatic on the approval of breakthrough drugs, it could be the case that DCVax-L is approved in Europe before the US.

The current cash position, while much, much improved will need to be strengthened with a further capital infusion in mid to late 2014. The quarterly burn rate is about $7 million per quarter, so that NWBO could burn through $28 to $35 million of cash from the end of 2013 through the time that topline data on the all-important DCVax-L phase III trial is reached in 4Q, 2014 or 1Q 2015. This cash burn could be ramped up further if phase I/II results for DCVax-Direct are encouraging and the Company elects to accelerate development.However, its financial position now appears highly manageable and should give NWBO much easier access to capital.

Paying Attention to Fully Diluted Share Count

Northwest restructured much of its debt in 4Q, 2012 and also has raised significant amounts of capital with four equity offerings over the last year that brought in $62 million. In part, because of the weak cash position, it had to issue warrants with each of these deals in order to entice buyers. It can be the case that when a Company goes through a torturous process of balance sheet restructuring and multiple equity offerings that it winds up with hundreds of millions of shares and a similar number of warrants outstanding. However, NWBO has avoided this. My calculations suggest that if one includes all possible shares that can result from the conversion of warrants,options and convertible debt there are about 64million fully diluted shares outstanding. GAAP accounting would suggest about 45million fully diluted shares.

The market capitalization based on a recent price of $4.14and 64million fully diluted shares is about $265million, which is not expensive for a company with a promising product in phase III and two pipeline products in addition. I estimate that the Company may need to raise as much as $35 million by the end of 2014. This would allow NWBO to complete the phase III trial of DCVax-L and release topline data in 4Q, 2014 or 1Q 2015, continue to enroll patients in the DCVax-Direct trial and still end 2014 with as much as $20 to $25million of cash. This might be partially or even wholly achieved through the use of non-dilutive financing instruments which the Company is exploring and warrant exercises.

It is important for investors to have an idea of the number of shares that could be outstanding at the time of the topline data release in 4Q, 2014 or 1Q, 2015. In a conservative case, we could assume that all of this $35 million might be raised by selling equity which would add to the share count. In order to estimate this effect, let’s assume that NWBO raises money on the same terms as the November deal, i.e., at the current stock price (which is now $4.14)and with 50% warrant coverage.This would require the issuance of 8.4 million shares and 4.2 million warrants and would bring the fully diluted share count to about 77million shares by the end of 1Q, 2015. At that time, there would be about $22million of cash on the balance sheet by my estimates.

This is only one of many possible scenarios to finance the Company and I believe that this one is reasonably conservative. In an optimistic case, if the stock price were to surge above $9.00, warrant conversion could potentially bring in $35 million, would not require the issuance of any new shares and would not increase the number of fully diluted shares from 64 million. The Company is also looking at a number of innovative financing instruments that would result in much fewer or even no new shares being issued.

Price Target Thinking

Let’s first assume the conservative capital raising case so that at the end of 1Q, 2015 there are 77 million shares outstanding (up from the current 64 million) and that the stock price remains constant until then at $4.14. The market capitalization would be $319 million prior to release of the topline phase III results. With success in the phase III trial, I would expect a significant expansion in market capitalization. Think about how the market would react if the data supported approval of DCVax-L in newly diagnosed glioblastoma. And very importantly, its dendritic cell technology would be validated and open the promise for successful development of drugs for several other cancer types. I think that a $2billion to $3billion market capitalization and perhaps more would be achievable. This would result in a price per share of $22to $39per share or potentially more.

Let’s next consider what would happen if the phase III trial results are a total disaster in which there are no positive results on the primary endpoint, any of the secondary endpoints or the multiple sub-group analyses. This would probably lead investors to conclude that there is no path forward for DCVax-L and that it would be abandoned. The Company would have about $0.30 of cash per share. There might also be some value for its assets and potentially there could be promise for DCVax-Direct which is a significantly different product than DCVax-L. I think that the stock in this disaster scenario might drop to $0.30 to $1.00to$2.00, dependent on how the market views DCVax Direct prospects.

There are a large number of in-between scenarios in which the results of the phase III trial might not be sufficient for registration but there would be a clear path forward such as through conducting a supporting phase III trial or finding a sub-set of patients in which the drug might be effective and conducting a phase III trial in that subset.The existing Phase III trial design has several such sub-group analyses built into it. I am not going to attempt to estimate what the range of possibilities might be. However, I give very small probability that the trial will be a complete failure. In potential scenarios in which there is a clear path forward, the stock price might have a meaningful increase above $4.14.

For those of you who follow my work, you will recognize that Northwest Biotherapeutics falls in my asymmetric investment thesis. Some hedge funds have made enormous returns by looking for asymmetric investment opportunities. These stem from finding upcoming events that are not well understood and which have the potential to cause dramatic stock movements in the case of a positive outcome. The chance for such a positive outcome may be modest, but if it does occur the potential reward dramatically offsets the risk of being wrong. Perhaps the upside opportunity is a several fold increase in the stock price and the downside is losing much of one’s money. These characteristics are similar to an option, but have the advantage that there is much less of a time element. One can be right on thinking that leads to an option investment and still lose all or much of one’s money if the option expires prior to an anticipated event. Asymmetric investing is not devoid of time risk, but it is much less than with an option.

For an asymmetric opportunity to exist there has to be lack of awareness or extreme skepticism that a positive outcome can occur. Small biotechnology companies fit this approach because most Wall Street analyst coverage in biotechnology is focused on larger biotechnology names that are earnings driven. In addition, the large number of trial failures conducted by small biotechnology companies has produced a pervasive skepticism as to whether any clinical trials will succeed. Asymmetric investing does not mean that an investor is smart enough to predict with certainty clinical trial outcomes. The premise is that the event has a reasonable chance of occurring, is unexpected, and if it does occur the upside potential dramatically offsets the risk of losing much or all of the investment if the outcome is negative. This is the basis of my recommendation of NWBO.

A Brief Word on DCVax-L

Before I move on to a more detailed discussion on financial issues, I want to say a brief word on DCVax-L. It is an understatement to say that the development effort for DCVax-L is controversial. It is an autologous (uses the body’s own cells) cancer vaccine that is based on dendritic cell technology. Dendritic cells are the master cells involved in activating the adaptive immune response to fight bacteria, viruses and other disease causing agents. The aim of NWBO is to take monocytes (i.e., dendritic cell precursors) from the body and cause these cells to differentiate into dendritic cells. It loads these cells with antigens that are specific to each person’s cancer; its lead product DCVax-L is targeted at glioblastoma. The cells are then reinjected into the body where they migrate to the lymph nodes. The hoped for result is that killer T cells will be trained to recognize the cancer antigens and attack the cancer in the body much as they attack bacteria and viruses.

This is a paradigm shifting approach to treating cancer and, of course, is unproven. Obviously, pushing the edge of the envelope in drug development is a high risk venture. There is a long history of failed attempts to develop cancer vaccines and this has created a great deal of skepticism among both investors and scientists about ever developing a successful product. However, Dendreon has actually received approval for Provenge for the treatment of metastatic prostate cancer; Provengeis based on dendritic cell technology that it is not as sophisticated as NWBO’s. Because of the problems with the Provenge launch, investors have not viewed Provenge as validating dendritic cell technology even though it has current sales in excess of $250 million.

Past Funding of the Company

The skepticism about NWBO’s technology and its weak cash position created an extremely difficult environment in which to obtain funding for its development efforts. Over the last decade, NWBO has had to scramble from one small financing to the next. The weakness of the balance sheet and the anticipation of future financings created a constant overhang on the stock price. The financing mechanisms that were available to the Company could only bring in small amounts of capital at one time thatcould only fund one or two quarters of cash burn.

The true believer in the Company was Linda Powers, the CEO of NWBO and also the head of the Toucan venture capital funds. Toucan and she personally provided much of the financing in the period before 4Q, 2012 and together they control 38% of the stock outstanding. Without the conviction of Ms. Powers and her willingness to put her own money on the line, NWBO would almost certainly have failed. If one of your criteria for investing is finding a CEO with “skin in the game”, NWBO has to be near the top of your list on this criterion.

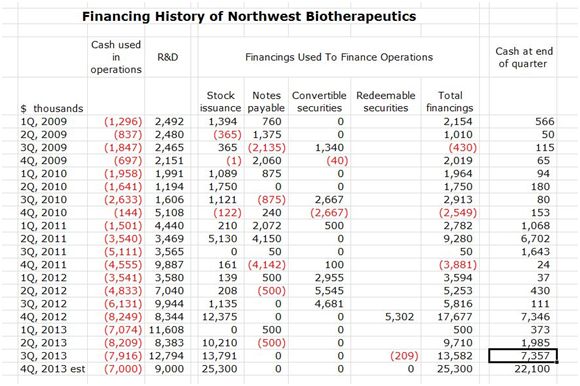

I would have to write a book to go through the tortured financing history of Northwest Biotherapeutics. I have tried to distill this into a table which traces on a quarterly basis from 1Q, 2009 financings, cash burn, R&D spending and cash balance at the end of the quarter. This financial history is divided into the period before 4Q, 2012 and after with the period before being characterized by a large number of tiny financings. A restructuring completed in December 2012 retired $36.4 million in liabilities by converting them into stock and warrants. The financing history since 1Q, 2009 is shown in the following table.

Source: SmithOnStocks; Northwest Biotherapeutics regulatory filings

Some of the key takeaways are as follows:

- Cash balances throughout this period were alarmingly low before 4Q, 2012.

- Until 4Q, 2012, NWBO was literally operating with cash sufficient to fund only one to two quarters of operating cash burn. It could only raise money sufficient for a quarter or two through a large number of small transactions.

- Some degree of investment credibility was gained in the second half of 2012 and in 2013 with the restructuring and trading on the NASDAQ, and this allowed the Company to raise larger sums of money. In the last five quarters, it has raised $62 million through stock issuance.

- The enrollment in the DCVax-L trial and to a lesser extent in the DCVax-Direct trials has resulted in $42million of R&D spending over the last four quarters. This is the kind of serious R&D spending required to complete enrollment of the phase III trial of DCVax-L and to begin thelarge phase I/II trial of DCVax Direct.

- My conclusion is that Linda Powers has done a commendable job of attracting the capital needed to bring DCVax-L to the finish line, allow investors to see topline results in 4Q, 2014 or 1Q 2015 and to get an initial view of the potential clinical profile of DCVax Direct.

How Does The Balance Sheet Look Now?

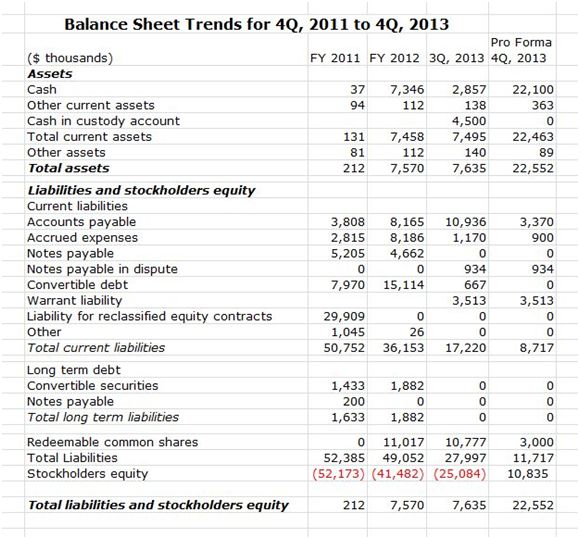

To illustrate the dramatic improvement in the balance sheet, the following table shows a condensed version of the balance sheet for 4Q, 2011; 4Q, 2012; and 3Q, 2013. I have then constructed a pro forma balance sheet for 4Q, 2013 that adjusts for the equity offering in November 2013 and other items. The improvement can be quickly seen by noting that the cash balance at the end of 4Q, 2011 was $37 thousand and total liabilities were $52 million. For pro forma 4Q, 2013 the cash balance is estimated at$22.1million (in addition, there is the $5.5 million German government grant) and total liabilities are$12million.However, the actual liabilities that are subject to cash repayment are about $4.3 million as I will discuss shortly.

Source: SmithOnStocks; Northwest Biotherapeutics regulatory filings

There are four items in the 3Q, 2013 balance sheet that require some explanation: cash in custody, warrant liability, notes payable in dispute and redeemable shares. In September, 2013, the Company and Cognate jointly considered acquiring certain intellectual property that involved biologics and did not involve dendritic cells. NWBO and Cognate established a custodial account to hold funds for the potential acquisition while they pursued further information and analyses. NWBO provided $4.5 million as shown in the cash in custody account and Cognate provided $2.0 million. In October, NWBO decided not to go forward and instead used its funds in custody to repay $4.5 million of accounts payable owed to Cognate for DCVax-L manufacturing.

The warrant liability is a non-cash item that is the result of certain accounting principles. These were applied to 2.1 million warrants issued in connection with the balance sheet restructuring that do not meet the criteria for equity treatment and are recorded as a liability. These are adjusted to fair value at each reporting period and any change is recognized as a gain or loss to operations. This item is not subject to being repaid in cash.

The redeemable shares account also relates to the 4Q, 2012 restructuring of the balance sheet.For some of the conversions of existing debt into common stock, the conversion agreements allowed holders to redeem the shares they exchanged for their debt into cash at a premium of 15% to 25% ($5.52 to $6.00) within approximately nine months of issuance. This was essentially a put option. I can’t explain precisely the arcane accounting rules that govern this transaction, but let me try to convey the gist.

As originally constructed this put was effective in August of 2013 and the holders of the redeemable shares were entitled to receive $10.8million in cash if they put their shares. NWBO has restructured the agreements in 4Q, 2013. This resulted in the elimination of about $7 million of the total, which has brought the outstanding balance down to around $3 million.

NWBO has also delayed the time when the remaining holders may elect to exercise the put on the $3 million of redeemable shares until well into 2014. If the shares of NWBO are in excess of roughly $6.00 by the time the put expires, this liability is removed from the balance sheet and the $3 million becomes part of stockholders equity. The shares have already been issued and included in the issued and outstanding share count. In this case, there would be no effect on any other balance sheet account.

The notes in dispute are a small $900,000 item that relates to a long running dispute with certain small shareholders who were involved in some of the smaller financings before 4Q, 2012. Management is highly confident that they are not liable for the $900,000.

Let me tell you my interpretation of all of this. Relative to the balance sheet reported for 3Q, 2013, the cash in custody account has gone to zero and accounts payable and accrued expenses have been reduced by around $7.8million to $4.3 million. By mid-2014 or sooner, the redeemable shares item probably will disappear from the balance sheet. If the stock moves above and stays above roughly $6.00 when the put option expires, there will be no increase in share count or reduction in cash balances.

While there is some uncertainty based on what happens to the share price, I think that investors should consider that the warrant liability and redeemable shares are not “real debt”. If so, the pro forma balance sheet for 3Q, 2013 could be considered as having $4.3million of debt, all of which is short term. Compared to the $52.3 million of debt on the balance sheet at the end of 4Q, 2011, this can only be considered a tremendous financial achievement.

Fully Diluted Share Count

One might expect that the restructuring of the balance sheet and the need to do several significant financings at depressed valuations and with warrant coverage might lead to a huge increase in shares outstanding and warrants. It is sometimes the case that this leads to the issuance of hundreds of millions of shares and warrants and starts the path to penny stock status. However, this has not happened with NWBO.

Sometimes, investors are not fully aware of the potential share dilution due to outstanding warrants and options. I have tried to take potential dilution into account in the following table and my conclusion is that the fully diluted share count is about 64 million shares. My calculations are shown in the following table.

Source: SmithOnStocks; Northwest Biotherapeutics regulatory filings

In the above table, I adjusted the shares outstanding for potential dilution from warrants and options. I have assumed that all warrants with a strike price of less than $9.10 will be exercised and those above will not. I estimate that this is about 17.1 million warrants. Some of these are cashless warrants that could result in no cash infusion, but exercise of all other warrants could bring in about $35million of cash.

There are also 1.5 million options outstanding, almost all of which are at or above $10.00. I assume that all will be re-struck at lower prices and ultimately issued. And finally there are 127,000 shares subject to conversion of convertible debt.

All of these calculations are shown in the above table in which I show the SmithOnStocks estimate of fully diluted shares as 64million shares. Generally accepted accounting principles (GAAP) would estimate the dilution as close to current outstanding shares of 45 million.

Tagged as Northwest Biotherapeutics Inc., NWBO + Categorized as Company Reports, Smith On Stocks Blog