Discovery Laboratories: The Surfaxin Launch and Beyond (DSCO, $2.38)

Investment Thesis

We are now nearing the long awaited launch of Surfaxin. During the recent conference call on results for 4Q, 2012, the Company reaffirmed that it is anticipating the launch of Surfaxin in 2Q, 2013. The company through a debt deal with Deerfield Capital recently brought in $10 million of cash and will receive another $20 million with the first commercial sales of Surfaxin, which should occur in 2Q, 2013. This extends the cash runway for the company until mid-2014 before it needs to bring in more cash through a partnering deal or additional financing or both.

Investors are now closely watching three key strategic initiatives. The first is the launch of Surfaxin for which the company has given sales guidance of $8 to $10 million of sales in the first twelve months of the launch, $40 million after four years and peak sales of $100 million. The next is taking Aerosurf into phase II clinical trials in 4Q, 2013. This is an aerosolized dosage form of the active ingredients of Surfaxin, which is given as a liquid instillate. The third initiative is partnering Aerosurf.

Surfaxin has moderate sales potential and I estimate that if the Company were to make the decision to focus all of its efforts on this product and to stop all research efforts that at peak sales of $100 million, it would contribute about $30 million of net profits or $0.40 of EPS. In actuality, the Company is committed to developing Aerosurf and will aggressively move the product forward and incur significant R&D expenditures. However, this is a way of estimating the value of Surfaxin for shareholders. Putting a 15 multiple on "Surfaxin" peak EPS might result in a $6.00 to $7.50 stock price and this could occur in 2020 or so.

Aerosurf is the key to Discovery Laboratories potentially being a very good stock. Let me give you a brief reason as to why I believe this is the case. The currently marketed animal surfactants and Surfaxin are given as liquid instillates that are administered by an endotracheal tube (intubation) directly into the lungs of a premature infant with respiratory distress syndrome or RDS. Through lessening surface tension, they make it easier for a baby's lungs to expand and contract when used in conjunction with a mechanical ventilator. Because of the considerable risks associated with intubation, doctors will only give this treatment to babies with the most severe form of RDS; there are about 50,000 such babies treated each year in this way.

There are an additional 120,000 premature babies born each year who have less severe forms of RDS. These babies are given continuous positive airway pressure through nasal clips or nCPAP to help breathing in and out.. However, about 45,000 babies fail nCPAP and have to be placed on surfactants and mechanical ventilation. The therapeutic goal of Aerosurf is to develop an aerosolized dosage form of Surfaxin that can be given by nCPAP. Discovery believes that the addition of a surfactant to nCPAP will prevent a significant percentage of these babies from failing nCPAP and moving to liquid surfactants plus intubation / mechanical ventilation. Because there is no way of predicting which of the 120,000 babies treated with nCPAP might progress to mechanical ventilation, Aerosurf potentially would be used in most of these patients.

Aerosurf carries a lesser development risk than a drug based on a new molecular entity. The active drug components are the same as Surfaxin, which has been shown to be safe and effective in clinical trials. We know the drug works. Similarly, the manufacturing process has been validated; problems with manufacturing sometimes lead to long delays as was the case with Surfaxin. The key uncertainty is whether Aerosurf can disperse the active ingredients across the lungs to prevent nCPAP failure. The company licensed in a device called a capillary aerosol generator nearly eight years ago and has refined the device significantly. Studies in the lungs of lambs, which are a good animal model, have shown that Aerosurf can deliver a therapeutically effective dose of aerosolized active ingredients of Surfaxin. If phase II and III trials substantiate this, Aerosurf has a high probability of being approved.

Aerosurf targets one of the greatest unmet medical needs in neonatology. It also provides very favorable pharmacoeconomics. Use of mechanical ventilation can lead to lung damage that can last a life time and the treatment is very expensive, costing about $2,500 per day. A common complication of mechanical ventilation is bronchopulmonary dysplasia (BPD), which causes serious lung damage and can cost $100,000 to treat. Aerosurf provides enormous value to infants and cost savings to hospitals. I think that it might be priced at $5,000 to $10,000 per course of therapy which for the 120,000 nCPAP treated babies is an addressable market of $600 million to $1.2 billion in the US with similar market potential abroad

The development pathway for Aerosurf is long as for reasons explained in this report, I am estimating approval in 1H, 2018. However, I think that the promise of Aerosurf will add consistent value to the stock as the drug progresses through development to commercialization. Discovery intends commercialize the product on its own in the US and to partner the product for markets outside the US, an event that is likely to occur in 2H, 2013 or 1H, 2014. The Company is not in a hurry to conclude a partnering deal as favorable early results in the phase II trial planned to begin in 4Q, 2013 could enhance the value of the deal. If the deal is consummated this year, I would expect a modest upfront payment of perhaps $15 million or so because of the lack of phase II data. However, I would expect downstream royalties of several hundred millions tied to clinical, regulatory and commercial milestones. I would also expect that the partner would pick up a good portion portion of the development costs for Aerosurf. I would not expect a stream of financings in future years although there might be the need for one in 2014.

I continue to recommend purchase of Discovery Laboratories. Biotechnology investing is a test of will. There are constant surprises on clinical trial outcomes, regulatory decisions, commercialization, patent challenges, capital raising and a host of lesser issues. It comes as no surprise that stock prices are extremely volatile as investors in Discovery can well attest. Investors have to constantly ask themselves why am I investing in this stock and when negative surprises occur (they always do), is that reason still valid. In the case of Discovery, the reason underlying my owning and recommending the stock is that I believe that its KL4 surfactant technology potentially could lead to a paradigm shift in the practice of neonatology.

Surfaxin

Delay in Launch

Discovery announced in October 2012 that it was delaying the launch of Surfaxin from November 2012 until 2Q, 2013 because one of the analytical chemistry methods used to assess Surfaxin's conformance to specification required improving. Without being too specific, management stated that it was a chemistry test. I would speculate that the test might be used to determine whether the amount of one of the four ingredients in Surfaxin was too much or too little. The Company said that the test in question was not the fetal rabbit biological test, which contributed so importantly to the long string of complete response letters from the FDA.

The Company made this decision after a careful review of the test results. Using other tests, management concluded that the product was within specifications and that the test was giving a false positive. However, the Company could not take the risk that the test might render such a reading in the future which could require drastic measures including shutting down production. It never considered a "hope it won't happen again" approach and felt that the only course of action was to improve the quality of the test before launching Surfaxin.

A plan was initiated to improve and validate the analytical chemistry method. The Company then submitted the updated product specifications to the FDA. Discovery has completed its actions and is now waiting to hear back from the FDA; it says that no further discussions are required. Management continues to guide for Surfaxin to be launched in 2Q, 2013.

The Surfaxin Launch

The Surfaxin sales team was brought together prior to the anticipated November 2012 launch and was kept in place during this delay. The primary focus of the sales team is on 400 hospitals in the US and their formularies that account for most of the usage of surfactants in the US. During this delay, the sales team held formulary discussions, much the same as would have been done if the product had been launched in November.

Management has outlined three stages of product adoption. The first will be restricted use, non-formulary purchasing. In this case, a hospital will purchase enough Surfaxin to treat perhaps 20 to 50 children. The objective is to get neonatology personnel familiar with the Surfaxin's dosing, preparation and administration which are somewhat different from the animal surfactants. This is a six to nine month process that will lead to a formulary decision. Initially, the formulary likely will stock Surfaxin and one animal surfactant. The ultimate goal is to make Surfaxin the only surfactant on formulary.

Guidance for Surfaxin

Because of the adoption process described above, the initial sales of Surfaxin will be restrained. The Company reaffirmed prior guidance that sales for the first twelve months will approximate $8 to $12 million. In the fourth full year of sales, the guidance is for $40 million of US sales and peak sales are seen as $100 million.

Aerosurf

The Market Addressed

Aerosurf is a medical device/drug combination that delivers the same active ingredient as Surfaxin through a proprietary aerosolized delivery system. Currently used animal surfactants and Surfaxin are liquid instillates that are administered through an endotracheal tube (intubation). The physician picks up a baby with respiratory distress syndrome, lifts it upside down and then tilts the baby first to one side and then the other to allow the liquid to flow down the tube and coat the lungs with surfactant.

There is considerable risk with current surfactants because they must be given in combination with intubation and mechanical ventilators, which can lead to serious respiratory complications. As a result, surfactants are now used only in the most seriously ill RDS babies, where the considerable risk is acceptable when weighed against the benefits. This is a population of about 50,000 babies.

Continuous positive airway pressure (CPAP) may be able to prevent intubation in some babies with RDS. It uses a mask with an effective seal and must be held on tightly. Nasal CPAP uses clips in the nostrils that hold the mask in place. During inspiration, positive airway pressure forces air into the lungs, requiring less work by respiratory muscles. The bronchioles are prevented from collapsing at the end of respiration; once they collapse, it requires significant pressure to re-expand them. Entire regions of the lung that would otherwise be collapsed are forced and held open. At the end of each breath, the chest and lungs are more expanded and require less work to inspire. Mechanical ventilation does the same, but is much more obtrusive.

There are an estimated 120,000 pre-term babies with RDS in the US who are initially treated with nCPAP because doctors want to avoid intubation and mechanical ventilation. However, of these 120,000 about 45,000 will need to be intubated and placed on mechanical ventilation. Physicians cannot predict which babies will progress to mechanical ventilation. This suggests that the addressable market for Aerosurf is the 120,000 patients now treated with nCPAP.

I think that a premium price of $5,000 to $10,000 per course of treatment could be justified if Aerosurf can prevent intubation and mechanical ventilation. The potential addressable market could be judged to be the 120,000 nCPAP babies who go on to intubation and mechanical ventilation. This represents a US addressable market of $600 million to $1.2 billion.

There is additional potential for Aerosurf to be used in respiratory conditions beyond just RDS in pre-term babies. These include diseases such as cystic fibrosis, acute lung injury and chronic obstructive pulmonary disease. It may also have potential for delivering other drugs to the lungs. However, this is in the future and for the present I think that investors should focus on the use of Aerosurf in babies at risk of RDS.

Clinical Trials

In terms of product development, the approval of Surfaxin removes much of the development risk for Aerosurf. Surfaxin has jumped over the hurdles that confront new drugs. It was proven safe and effective in clinical trials and has passed the Chemical, Manufacturing and Controls requirements of an NDA. We know that Surfaxin is an effective drug. What Discovery needs to show with Aerosurf is that its capillary aerosol generator can deliver the drug in a way that effectively and evenly distributes the drug throughout the lungs. This is not trivial, but it is certainly much easier and less risky than trying to demonstrate efficacy with a new molecular entity.

In preparing for the upcoming phase II clinical trial, there are two essential prerequisites. The delivery device and the drug to be delivered through the device must be finalized. Interestingly, the capillary aerosol generator was licensed from Phillip Morris in March of 2005. Phillip Morris was looking for ways to more safely deliver nicotine to the lungs. They established a well-funded and conducted research program that came up with the capillary aerosol generator. This product was developed as a way for making smoking safer, but it was also an extremely effective way for delivering aerosolized drugs to the lungs. Starting from this strong research foundation; DSCO has spent the last eight years refining the device to deliver Surfaxin in an aerosolized form. Altogether, the device has been in development for over a decade.

About nine months ago, DSCO entered into an agreement with Battelle, one of the leading medical device engineering firms. The goal was to get an already extensively tested device to the point that it was ready to enter the clinic. They have also been working with a firm to whom they have transferred their manufacturing process to allow the development of a lyophilized form of Surfaxin,

The programs both for the fine tuning of the capillary aerosol generator and the lyophilized form of Surfaxin will be completed by mid-summer. Discovery is also preparing the clinical and regulatory operations and documentation to allow the beginning of a phase II trial. DSCO will conduct the initial phase of the phase II trial and then turn the later and more complex parts of the trial over to a contract research organization. The company intends to begin the phase II in 4Q, 2013.

The capillary aerosol generator has been in development for quite a number of years and has undergone development changes with regard to some of the fundamentals of its design and the hardware-software interactions. When it was handed off to Battelle, it had already been demonstrated to be effective in animal models. The role of Battelle is to get it ready for regulatory approval and to design the ergonomics for use in neonatal intensive care. Battelle will make this clinic-ready in order to pass certain regulations that govern investigational devices.

Discovery is confident that they will have a fully functional clinical device that can be taken into the clinic and then into commercialization. Battelle has a very well-developed systematic approach and has a very mature quality management system. They have extensive clinical expertise, particularly with aerosolized devices, and that's why DSCO chose them. DSCO is confident that they have a working device. They are verifying the output of the device and compiling all the data and the information that are needed for regulatory filings. Battelle has a well-developed systematic approach and has extensive clinical expertise, particularly with aerosolized devices.

There will be some changes between the clinical device and the commercial device, but they will be largely cosmetic in nature. There will not be any fundamental alterations about how the device operates. Otherwise, DSCO could run afoul of some regulatory issues as other companies have done in the past. The core components of the capillary aerosol generator are locked in. The Company is confident that they have a fully functional clinical device.

Clinical Trial Timelines

Aerosurf has been successfully tested in animal models using lamb lungs, which is accepted as a good model for a human infant's lung. In distressed lamb lung models, they have been able to show efficacy with Areosurf. The results in these animal models have been successful and have encouraged the Company to move into human trials. You may recall that the lamb lung was used in the original phase III program of Surfaxin as a quality control test.

The capillary aerosol generator and lyophilized form of Surfaxin will be ready for a phase II trial in the summer of 2013. The Company still needs to complete planning for the trial and to gain IRB approval to conduct the trials in various hospitals. The first baby will be dosed in 4Q, 2013. Aerosurf will be compared to nasal CPAP in the phase II trials. DSCO will conduct the first stages of the phase II trials that are intended to establish safety and the effective dose. They have done extensive dose ranging in animal models, but they want to understand in babies the dose necessary for efficacy. They will start with the lowest tolerated dose and move the dose up to levels that pose no risk to the baby. After this first phase, the trial will be conducted by a CRO. Altogether, they will enroll about 200 patients in the trial.

The primary goal of the trial is to reduce the number of nCPAP failures. The phase II trial will probably end in 4Q, 2014 and, if successful, it will then take about one half year to begin phase III trials in mid-2015 that could complete in mid-2016. It will then take a year to follow the babies' outcome, compile all of the data and submit an NDA in mid-2017 which could permit a launch in 1H, 2018.

Afectair

The Medical Device

Afectair is an aerosol-conducting airway connector that simplifies and improves the delivery of inhaled medications, both medical gases and aerosolized medications, in the neonatal intensive care unit (NICU) and pediatric intensive care unit (PICU). The Company engineered this medical device to be used in conjunction with its capillary aerosol generator and Aerosurf, but saw the opportunity for a broader commercial application.

Launch of the Product

This product requires selling experience in the NICU and PICU so that Discovery can use the same field force needed to support Surfaxin. Afectair is an important account access tool that in some cases may open the door to Surfaxin cross-selling. The inclusion of Surfaxin and Afectair in the sales rep's bag, along with the development of Aerosurf, allows DSCO to position itself as bringing solutions to neonatology, a very different perspective versus its competitors.

Initially, the goal is to familiarize the hospital with Afectair based on a user experience program. It is being presented to customers as a commercial product, but is being given away for free. This approach will allow the company to gather sales intelligence for a broader launch. This program will allow DSCO to get experience at the site level in order to understand compatibility with various ventilation circuits and gain experience with a broad array of medications. The Company wants to create a good user experience with the first use that will lead to reorders.

Guidance for Afectair

The Company says that about 10% of target accounts have participated in this early user experience program. It will run through the first half of 2013 and will begin to create revenues in 2H, 2013. The Company reconfirmed prior guidance that sales in the first 12 months of selling will approximate $0.5 to $1.0 million. It sees peak sales of about $10 million in the US.

Partnership

The Company had originally thought that it could conclude a partnering agreement in 1H, 2013. While negotiations continued, potential partners were not willing to go forward with the launch of Surfaxin put on hold. During this time, it became more evident to DSCO that partners viewed Aerosurf as the key focus for partnering. Originally, the Company had thought that it would first advance Surfaxin LS, the lyophilized form of Surfaxin in Europe. However, potential partners felt that Surfaxin LS would be caught up in reference pricing that would hold its price close to the level for animal surfactants and would restrain the economic opportunity.

Management rethought its strategy and has moved Aerosurf ahead of Surfaxin LS in the development timeline. The focus of the company is now on getting Surfaxin launched, moving Aerosurf forward in the clinic and finding international strategic partners. The completion of the financing deal with Deerfield may also affect the timing of partnering Aerosurf as it provided some financial flexibility to retain international rights longer. The further in clinical development that Aerosurf successfully advances, the more lucrative are the potential partnering terms. Management has to weigh this against getting some upfront milestones and gaining the expertise of a larger partner in developing Aerosurf. I previously thought that the partnering deal could conclude in 3Q or 4Q, 2013, but it might be later.

Financials

DSCO ended 2013 with about $27 million of cash. The Deerfield financing will bring in $10 million in 1Q, 2013 and probably $20 million in 2Q, 2013. For the first time in its history, the Company should have product revenues as I estimate Surfaxin revenues at $3.0 million and Afectair at $0.2 million in 2013. I further estimate that the burn rate will be about $36 million resulting in a year end cash position of $23 million.

Without a partnering deal or any further financing, the company would run out of cash in mid- 2014 by my estimates. A partnering deal might bring in about $15 million of upfront cash. I would expect it to be backend loaded with milestones as the company achieves phase II and phase III results. A partner may also pick up its proportionate share of the research spending so that the burn rate going forward could be reduced. Assuming that the launch goes as planned; the Company could probably call on Deerfield for additional financing. It might also use the ATM that it has in place to partially fund the burn rate.

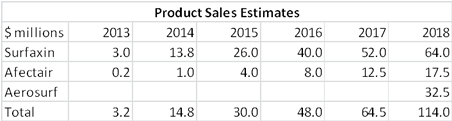

My estimates for product sales are as follows:

Tagged as Discovery Laboratories Inc, Windtree Therapeutics + Categorized as Company Reports