Cadence Pharmaceuticals’ Ofirmev Launch is Gaining Traction (CADX, $4.02)

Investment Background

Cadence Pharmaceuticals (CADX) achieved the goal of every emerging bio-pharmaceutical company when it received US approval for its first product Ofirmev on November 2, 2010; it was then launched on January 17, 2011. Ofirmev is an intravenous formulation of acetaminophen that was licensed from Bristol-Myers Squibb (BMY). It has been marketed in Europe by BMY under the trade name Perfalgan since 2002. In Europe, it is the market share leader for intravenous analgesics based on units sold.

The first response of investors upon hearing this is to say wait a minute, acetaminophen is the generic ingredient of Tylenol and a lot of other over the counter products and has been around forever. What is the importance of coming up with an intravenous formulation? The primary therapeutic need for Ofirmev is in the post-surgical setting when a patient is recovering from surgery and cannot take pills. These patients are currently treated with opioid narcotics and to a lesser extent with NSAIDs. Both of these classes of drugs have troublesome side effects and actually carry black box warnings. There is a significant medical need for a safe intravenous analgesic that can reduce the usage of opioids and NSAIDs and this is the role that Ofirmev plays in the hospital.

The next question is why hasn’t an intravenous formulation of acetaminophen been introduced before now? It has not been for lack of effort as there have been numerous attempts over the past forty years. However, until Ofirmev all efforts failed to create a stable, commercially viable formulation.

Ofirmev doesn’t carry the side effect baggage of the opioids and the NSAIDS that dominate the hospital pain market. Every hospital is looking to reduce opioid usage which among other things causes constipation. The key for any surgical patient to be discharged is to have a natural bowel movement and Ofirmev through reducing opioid usage can speed the time to the first bowel movement. It can also reduce the mental confusion and grogginess associated with opioids that makes patient care more difficult. It is also cheap. The product is priced at $11 per vial and figuring anywhere from 2 to 6 vials per patient; the cost is $22 to $66 for a patient, barely making a dent in the DRG of $20,000 to $30,000 received by a hospital for a typical surgical patient. I don’t claim that I have made an exhaustive survey of physicians and nurses, who have used the product, but those that I did survey just didn’t like it, they loved it.

Ofirmev has significant sales potential in the US. Perfalgan has obtained 22% of the European intravenous analgesic market as measured by units. Ofirmev currently has just 1.93% of the US market and is annualizing at about $44 million of sales. At a 22% market share sales would approach $500+ million. There is reason to believe that it could obtain an even higher market share in the US.

Investment Thesis

I am reiterating my buy recommendation on Cadence Pharmaceuticals (CADX). As a small, emerging company almost all of the investment focus on has been on its lead product Ofirmev. Like all new products, investors go through a checklist to try to determine Ofirmev’s potential. These are:

- How effective is the product as judged by clinical trials?

- If found effective, will the FDA approve it and how promptly will the FDA act?

- How successful will the launch be?

- What is the patent life of the product?

- What can be the peak level of sales and when will this be reached?

- Then as a corollary, what other products are in the pipeline?

Cadence went through the first two steps very well, but the launch was slower than expected. This is an increasingly common occurrence as pricing and utilization barriers set by managed care and increased caution on the part of physicians about the potential for side effects have produced a number of disappointing new product introductions. I have seen this phenomenon with recent product launches of Dendreon’s (DNDN) Provenge, Human Genome Sciences (HGSI) Benlysta, Auxilium’s (AUXL) Xiaflex and Avanir’s (AVNR) Nudexta.

In the case of Ofirmev, concern by pharmacists that Ofirmev would be used in place of oral acetaminophen created a new wrinkle. Most patients in a hospital have an IV line in place and it is easy to give them a vial of Ofirmev, possibly more so than getting them to swallow a pill. Pharmacists feared that instead of giving Tylenol tablets which cost the hospital pennies, many patients would get Ofirmev at $11 per vial and thereby severely impact pharmacy budgets. This was an unexpected, major factor in a slower than expected launch that prompted many investors to judge the launch as disappointing or a failure.

The second quarter results exceeded expectations and indicate to me that the Ofirmev launch has gained traction although some other analysts are not as convinced. The metrics used to track Ofirmev sales progress were excellent in 2Q, 2012 and suggest strong momentum going forward. However, investors are uncertain on the patent life which obviously has a huge impact on peak sales potential. There are two patents that cover the formulation of the product and the manufacturing process that last until 2018 and 2021, respectively. These patents are now being challenged by a generic company with a trial scheduled to start in May 2013. I think that these patents are strong and defendable, but until the courts rule, there is no certainty.

The difference between having the patents upheld or rejected will be the primary factor determining whether Ofirmev reaches peak sales of perhaps $500+ million or some lesser amount. Investors have been trained to expect a rapid sales meltdown when patents expire or are invalidated. For example, Bristol-Myers Squibb’s (BMY) Plavix lost patent protection late in 1Q, 2012 and I expect it to lose 80% of its sales to generics by the end of 3Q, 2012. Some investors fear that this could be the fate of Ofirmev if Cadence loses the patent case.

The decision of the patent court is not likely before 1H, 2014. Ofirmev has considerable differences from Plavix that suggest to me that in the event that the patents were to be ruled invalid, sales would not be impacted in the same way as Plavix. Injectable products directly enter the bloodstream and any impurities or sterility issues can quickly cause much more severe problems than is the case of drugs ingested orally. Like all digested products, passage through the gastrointestinal tract protects against contamination or sterility issues that are so critical for an injectable. As a consequence, injectables manufacturing requires extensive quality control; injectables are more expensive to manufacture and building a plant or specialized production line takes more time.

To my knowledge, there are only two manufacturers that can make Ofirmev in commercially significant quantities. One is Bristol-Myers Squibb that gave Cadence an exclusive license to Ofirmev in the US. The other is Baxter that Cadence qualified as a second manufacturing source in the US. (Baxter is currently off line because of a manufacturing issue.) I think that neither is available as a source of supply to a generic manufacturer. If the patent suit is lost, it could take around one to two years to build capacity to produce injectable acetaminophen and more time to gain regulatory approval in the US. Assuming the patent case is lost (again, I think Cadence will win) in 1H, 2014, I think it could be early 2016 or possibly early 2017 before significant amounts of generics could enter the US market.

I also think that when generics eventually enter the market, it is likely to be the case that that there will initially be only one or two entrants because of supply issues. If so, history suggests that there would not be the severe price competition such as that now devastating Plavix that results when multiple competitors enter at the same time. Based on historical experience, the entry of one generic competitor might result in a 15% to 20% price decline and loss of 30% of market share. This is not a good outcome, but it is not a catastrophe. Then as the second and third companies enter in 2017 and 2018, the price would continue to drift down and market share would be lost but not to the extent of Plavix.

The new product outlook for Cadence will be dependent on product acquisitions as Cadence does not have strong internal research capabilities. The ability to make acquisitions will be dependent on the cash flow generated by Ofirmev. On the last conference call, management said that it was being approached by almost every small company developing a new hospital based product. If Ofirmev does well, I would expect a steady stream of new product acquisitions.

In terms of business models, I see Cadence as very similar to Cubist (CBST). The success of Cubist over the last 9 years has been almost totally due to their antibiotic for resistant strains of Staph aureus, Cubicin. This is a hospital based product with peak sales potential according to management of $1.2 billion. Cubicin has used the cash flow from Cubicin to build an internal product capability based on in-licensing and outright company acquisitions. The specialty sales model for acquiring new products over time has also worked well for Forest Laboratories (FRX) and Shire Pharmaceuticals (SHPG) which are more mature examples of this business model.

Price Target

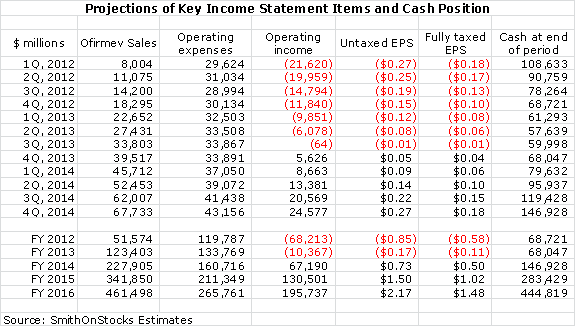

I am estimating that Cadence will reach cash flow break even in 3Q, 2013 and will achieve EPS of $0.73 on an untaxed basis and $0.50 on a fully taxed basis in 2014. In 2015, I project untaxed EPS of $1.50 and fully taxed EPS of $1.02. If I am correct, there will be no generic competition in 2015, but the outcome of the patent trial in 1H, 2014 will have a powerful effect on the P/E ratio placed on projected 2015 fully taxed EPS. If Cadence prevails, investors would be looking at as much as three to six more years of patent life and strong cash flow. Based on a look at comparable companies, I think that in 2H, 2014 investors would pay as much as 15 to 20 times projected 2015 fully taxed EPS. This results in a price target of $15 to $20. My best judgment is that this will be the outcome for Cadence as I think the patents will withstand challenge.

However, I must acknowledge that there are severe limitations on the ability of outsiders to predict patent case outcome and I have to account for plausible scenarios in which the patent case is lost or Cadence reaches a settlement with the generic company that would allow it to enter the market before 2018. The headline news of loss of the patent would probably cause the stock to plunge to $1.50 to $2.00 per share or even lower and this would probably occur in 1H, 2014. There would probably be less impact from a settlement, but it could still be significant depending on the terms.

However, if I am right that even in the event of generic entry there might not be a sales meltdown, I think the stock might begin to recover as this became evident to investors. My projection for Ofirmev sales in the event that the patent case is totally lost is for sales of $342 million in 2015, $170 million in 2016 and $135 million in 2017. Cadence would likely be profitable and use its cash flow and marketing infrastructure to acquire new products.

In returning to my comments on the steps of scrutiny that companies must go through, the Cadence situation with the final outcome of the patent case in 1H, 2014 will have been substantially de-risked. I think that it will be interesting to watch the three companies with anti-obesity agents, Arena Pharmaceutical (ARNA), Vivus, Inc. (VVUS) and Orexigen Therapeutics (OREX) go through these de-risking steps. There is likely to be very high volatility with these stocks and interesting investment opportunities (perhaps short and long) over the next year. I may write on these.

A Close Look at the Second Quarter

The Ofirmev launch has now gained traction as just reported 2Q, 2012 revenues of $11.1 million (up 38% sequentially from 1Q, 2012) exceeded guidance and Street expectations of $10.0 to $10.4 million. Management guidance for 3Q, 2012 of $13.7 to $14.2 million is better than the previous Street consensus of $13.6 million and implies a sequential increase of 23% to 28%.

My 3Q, 2012 estimate in my last report was $14.2 million, but I was beginning to rethink this with a view toward a slight lowering of my estimate because July is a disruptive month in the hospital as a new group of residents charge onto the floors. Also, August is a vacation month. However, with the strength in the 2Q, 2012 and the guidance for 3Q, 2012 I have decided to stay with my $14.2 million estimate which is at the high end of management guidance.

The metrics for gauging the launch showed impressive sequential increases for the second quarter over the first quarter that suggests strong momentum.

- Sales increased 38% sequentially in 2Q, 2012.

- Vials sold increased 31% sequentially.

- The number of unique accounts that have ordered Ofirmev increased to nearly 3,200, up 17% from the end of the first quarter.

- Approximately 2,500 accounts or 78% of customers placed multiple orders for Ofirmev. This is about a 21% increase in the number of repeat customers as compared to the end of the first quarter.

- The frequency of customer orders in the second quarter increased by 11% with an average of 4.4 orders placed per customer.

- Customers are also placing larger orders. The average order size increased 5% over Q1.

- When compared to available data on comparable new hospital product launches during the past five years that Cadence has reviewed, on average approximately 9 times as many doses of Ofirmev were sold than doses of those products during the first 18 months after launch.

The reported second quarter sales and EPS along with comments on the impressive increases in metrics used to judge the success of the launch goes a long way toward discrediting a bearish view that the company will have to raise more capital. My model shows Cadence reaching profitability in 4Q, 2013 and at that time I project it will have $68 million of cash on its balance sheet. Thereafter, cash should build rapidly.

Cadence has worked diligently with the pharmacists and along with good results and word of mouth from doctors and nurses who are using the drug, the rubber has finally hit the road. My Ofirmev sales projections for 2012, 2013, 2014, 2015 and 2016 are $51.6 million, $123.4 million, $227.9 million, $341.9 million and $461.5 million respectively. I am projecting fully taxed EPS of $0.50 in 2014 (the first year of profitability). The actual EPS that Cadence could report in 2014 could come in at $0.73 as Cadence will have operating loss carry-forwards to offset taxes. The company should exhaust its operating loss carry forward in 2016.

All of the metrics in the 2Q, 2012 report were positive as sequential gains over the first quarter. These metrics point to strong sequential growth in coming quarters. Management sounded confident that it has made great progress in overcoming the resistance of pharmacy by persuading them that Ofirmev is not being detailed for nor being used in place of oral acetaminophen. They spoke of increasing partnerships with pharmacists that would assure that Ofirmev is used appropriately in the hospital. Finally, the company has implemented a 6% price increase, the first since the January 2011 launch. Here is a summary of my model for quarters through 4Q, 2014.

Tagged as Cadence Pharmaceuticals + Categorized as Company Commentary