Antares: The Stock Price Does Not Reflect the Fundamentals (ATRS, $1.60, Buy)

Introduction

Antares recently updated its corporate presentation on their website. .There were several slides in the presentation that reinforce my confidence in my positive investment outlook which is based on three key components: (1) the Otrexup launch gaining traction, (2) approval of an AB rated generic version of EpiPen and (3) a deep and promising pipeline. The key near term catalyst for the stock is the potential approval of Teva/ Antares’ AB rated generic to EpiPen. I give this event an 80% chance of happening before year end and I believe it could double the stock price.

Key Points:

- Teva and Mylan are giving strong signals that the AB rated generic version of EpiPen will be approved by the end of the year.

- Otrexup has shown strong sequential prescription growth in 2Q, 2015 and the first two months of 3Q, 2015.

- I am projecting 2015 Otrexup sales of $15 million and $24 million in 2016. Antares has indicated that Otrexup will be profitable when sales reach the low $20 million level.

- Otrexup has about two thirds of the market for subcutaneous methotrexate; this is one year after the approval Medac Pharma’s Rasuvo which has the other one-third.

- Otrexup and Rasuvo combined have only 5% of the injectable methotrexate market. This leaves substantial room for growth for both products.

- The launch of the AB rated version of EpiPen could contribute $19 million of royalties and a further $24 million of gross profits from injector sales to Teva in 2016.

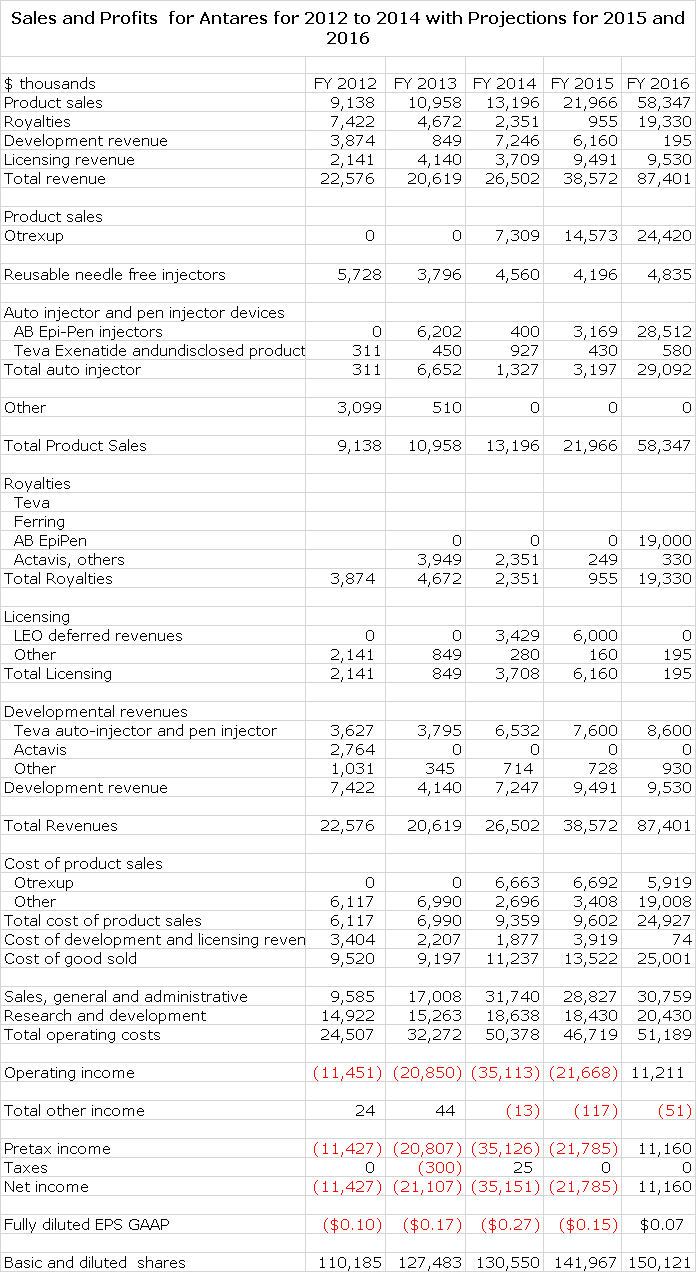

- I am projecting that Antares’ corporate revenues will more than double in 2016 to $87 million from $39 million in 2015 and that Antares will reach profitability with EPS 0f $0.07 (net income of $11 million).

- My price target of $4.00 to $5.50 in 2016 is based on the stock trading at 8 to 9 times 2016 revenues. However, there is a tremendous amount of acquisition activity in the specialty pharmaceutical space and Antares could be an accretive acquisition for Teva or some other company in which case the price might be higher.

Investment Overview

Antares has performed very poorly in the stock market this year as the stock began the year at a price of $2.59 and currently is trading at a price of $1.60. One of the key factors was concern that the Otrexup launch was sputtering or might have failed. There was reason for concern as prescription growth flattened in 1Q, 2015 (one year into the launch) as compared to 4Q, 2014. I believe that this was largely attributable to the initial competitive impact from the launch of Rasuvo in October 2015 and marketing and reimbursement issues specific to Otrexup.

In response, the Company reorganized and expanded the sales force and implemented new programs to improve reimbursement. Early this year when this was taking place, management said that it might take until 2H, 2015 to determine if these measure were effective. As I will go over in this report, based on 2Q, 2015 and partial 3Q, 2015 prescription numbers, it appears that the Otrexup launch is back on track. We have seen strong sequential prescription growth over the five months ending in August 2015.

Investors have been awaiting approval for Teva/ Antares’ AB rated generic to EpiPen since June 2015. An agreement reached with Pfizer, the holder of key patents on EpiPen, allowed the launch of the Teva/ Antares product after June 15 of 2015. However, an AB rated generic is more difficult to gain approval from the FDA, especially for a drug like EpiPen that is used in life threatening situations. Hence, there has been trepidation that the FDA might not give the Teva/ Antares product the AB rating which is critical for commercial success.

Investment Thesis

If my analysis is correct, there is the potential for a major positive change in investors’ attitudes toward Antares if the Otrexup launch is viewed as being on track and if the AB rated generic to EpiPen is approved; the latter is the key catalyst. As shown in the detailed sales and earnings model presented later in this report, this could spearhead a huge surge in sales. My model shows a launch of the AB rated generic to EpiPen on January 1, 2016. (It could be sooner). I am projecting that 2016 sales will increase to $87 million in 2016 as compared to $39 million in 2015. I am also projecting profitability in 2016 with EPS reaching $0.07. I think that a doubling of sales in 2016 and reaching profitability will lead to a great deal of investor excitement and interest and a strong upward price movement.

Price Target Thinking

I am basing much of my price thinking by comparing Antares to valuations of other specialty pharmaceutical companies. Because Antares is in an early stage of corporate development and is spending heavily on R&D and marketing infrastructure, valuing the company on the basis of applying a P/E ratio to 2016 estimated EPS of $0.07 is not a good measure for valuing the company. I think that looking at the ratio of market value to sales may be a better approach. This is not a rigid valuation approach for an emerging biopharma company (there are none that I am aware of) but it is a way of thinking about the price target. Let me start by looking at what I think might be the most positive and most negative outcomes based on the market value to sales ratio.

The most positive case is that Antares is acquired in 2016; let’s look at the example of Avanir. This Company launched its only product, Nuedexta for pseudobulbar affect, in 2010. The sales growth due to Nuedexta was as follows: $10 million in 2011, $41 million in 2012, $75 million in 2013 and an estimated $111 million in 2014. (I am projecting for Antares 2015 sales of $39 million and 2016 of $87 million). Avanir was acquired by Otsuka in December 2014 for $3.5 billion which was 32 times expected 2014 sales. There are many differences between Avanir and Antares of which the most striking are that Nuedexta has a much better patent position than the products of Antares, but Antares has a much broader pipeline. The 32 times sales purchase price paid by Otsuka seems extremely high, but even half that price (as judged by multiple of sales) would be very rewarding. After cutting out redundant costs, Antares could be an accretive acquisition for one of many specialty pharmaceutical companies with Teva probably being at the top of the list.

At the other extreme of valuation is the multiple of sales accorded mature specialty pharmaceutical companies which is roughly 3 times sales. This seems as extreme on the lower end of valuation as the Avanir acquisition is on the high end. Still Antares currently sells at 2.8 times 2016 sales which is a “mature company” multiple of sales. I think that if the story unfolds as I am projecting the multiple could be 6 to 9 times sales (or more) resulting in a stock price of $3.50 to $5.20. Using the Avanir acquisition multiple of sales could result in a staggering price of $19. This seems too high, but in an acquisition, I would expect the multiple of sales to exceed 9 times.

There is still another aspect to Antares that I have not touched on and that is the product pipeline. Investors seem to be valuing this at zero, but an acquiring company might place substantial value on it. Otrexup is the first proprietary product of Antares that is marketed by its own sales force. The next proprietary product is Quick Shot Testosterone which is an injectable testosterone product that I think could be introduced in 2017. I see Otrexup as a $75+ million product and think that QST could be $150+ million. The next and third proprietary product is referred to as Quick Shot M. The active pharmaceutical ingredient in this product has not been disclosed so it is a little hard to estimate sales, but we might guess that it has potential in the Otrexup range.

The Company is expecting approval of an AB rated generic to the anti-migraine product Imitrex (sumatriptan) in 2016. This has about one tenth of the potential of the AB rated generic to EpiPen. Antares is also working on an AB rated version of the diabetes drug Byetta (exenatide); I think this product might come to market in 2018 and has about one-third the potential of the AB rated generic to EpiPen. Finally, the Company has mentioned that it is working on another AB rated product with Teva, an over the counter gel (ingredient undisclosed) with Pfizer and a life cycle extension for an undisclosed drug.

This is a pretty powerful product pipeline that is given almost no value at the current time. If I am right on the sales ramp for Otrexup and the launch of the AB rated generic to EpiPen, I think that investors will begin to focus on and become excited about the pipeline. If so, my price target estimate of $4.00 to $5.50 in 2016 could be too low.

Risks

The obvious risks are that I am wrong on the sales ramp of Otrexup and that the AB rated generic to EpiPen is not approved for some reason. There is another risk to the Antares business model that is a little more subtle and should be understood by investors. Essentially, Antares takes proven generic drugs and uses its engineering skills in injectable technology to create a product with better pharmaceutical properties that enhances the efficacy and safety of the drug. It gains approval for its drugs using the 505 (b) 2 regulatory pathway which only requires that its product is bioequivalent to the generic drug. It does not have to do clinical trials demonstrating efficacy and safety. Under current law, a new drug developed via the 505 (b) 2 regulatory pathway has three years of market exclusivity as opposed to 17 years of patent protection for a drug with a composition of matter patent.

So what happens after three years? The launch of a generic to an oral product usually leads to a quick meltdown of sales if a generic company can establish an AB rating which means that the branded product and generic are interchangeable at the pharmacist’s discretion. Injectable products are much less susceptible to AB ratings in general because manufacturing of injectables is more complicated and expensive to duplicate. In the case of Antares, the differentiation of its product from generics is based on the injector itself. In the case of the AB rated generic to EpiPen every single aspect of the two injectors had to be identical. If this is required for companies trying to get an AB rating to Otrexup, Quick Shot Testosterone and other proprietary products to follow, Antares has patents on its injector designs that may prevent an AB rating. Other companies can come up with injectable methotrexate or testosterone products but they have to promote them as separate branded products rather than generic equivalents. This is a tough issue to figure out with any degree of confidence, but my guess is that it will be difficult to develop AB rated generic equivalents to Antares products.

Outlook for Otrexup Appears to Be Meaningfully Improving

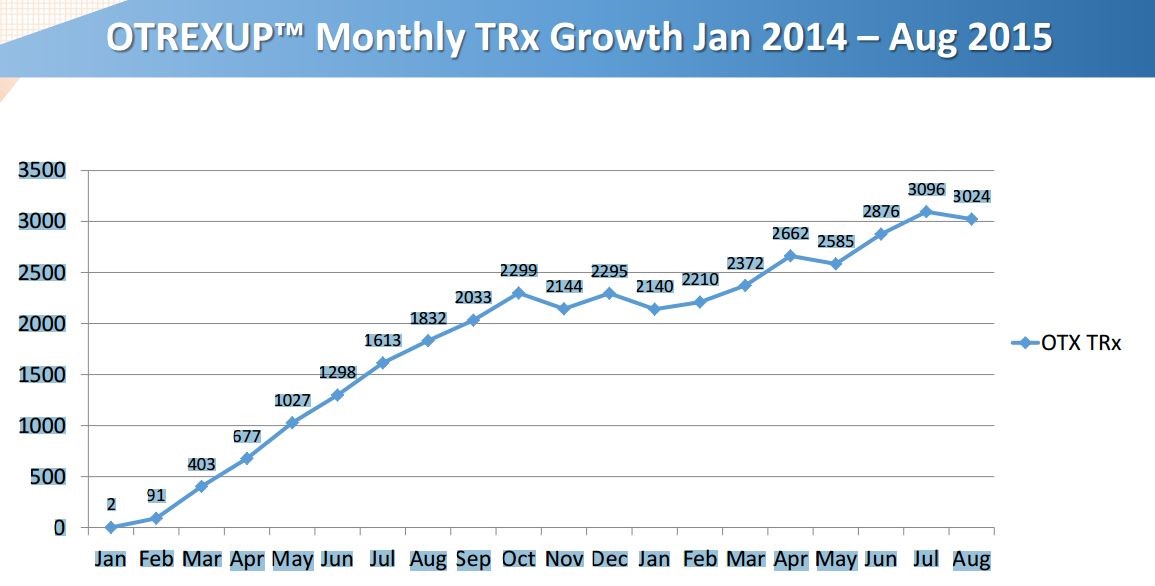

The following chart taken from the recent Antares corporate presentation shows the steps taken to address marketing and reimbursement issues in 2015 with the intent of increasing prescription growth.

Another chart in the presentation suggests that the rubber is finally hitting the road on the launch of Otrexup.

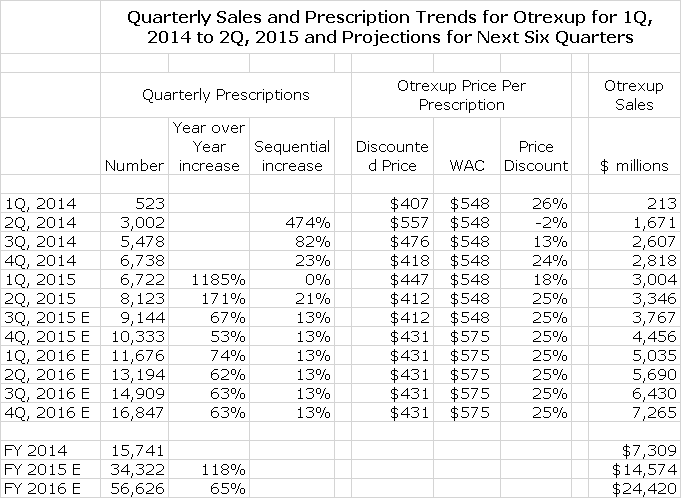

In order to put the above chart in more focus, I broke prescriptions down on a quarterly basis as is shown in the following table.

This shows that prescriptions in 1Q, 2015 were flat with 4Q, 2014 which alarmed investors and was very important in the poor stock performance this year. However, 2Q, 2015 prescriptions increased 21% sequentially over 1Q, 2015. We have not yet seen September prescriptions so that we don’t yet have 3Q, 2015 prescriptions. There were 3,096 prescriptions in July and 3,024 in August. What I did to estimate 3Q, 2015 prescriptions was to assume that the September prescriptions would equal those of August. This would result in 9,144 prescriptions in 3Q, 2015 which would be a 13% sequential increase over 2Q, 2015. However, August is usually a weak month for prescriptions because of vacations and September usually has a strong bounceback so that I would actually expect September prescriptions to be much better than those of August.

In order to project prescriptions for 4Q, 2015 and each quarter of 2016 I have assumed sequential quarterly increases of 13% which seems reasonable when viewed against the prescription trends of April through August of 2015. With this assumption I come up with an estimate of 34,505 prescriptions in 2015 and 57,628 in 2016.

So how do we translate this into Otrexup sales? The current price of Otrexup is $575 per prescription. At this price, 4Q, 2015 Otrexup sales would be $6.0 million and 2016 would be $33.1 million. However, there are discounts (undisclosed) off this list price of $575. It is possible to estimate the actual discounted price of Otrexup by dividing 2Q sales of Otrexup by 2Q prescriptions. This suggests an average actual sales price of $412 which compares to the 2Q, 2015 list price of $548 and further suggests an average discount of 25%. Based on this I am using an estimate that actual sales per prescription going forward will be $431 ($575 retail price discounted by 25%). If so, 4Q, 2015 sales would be $4.5 million (10,500 prescriptions at $431) for an annualized run rate of $18.0 million and full year 2016 sales would be $24.4 million (57.6 million prescriptions at $431). In the past the Company has said that Otrexup would be profitable with sales of perhaps $20 to $23 million. Hence, Otrexup could be profitable in 2016.

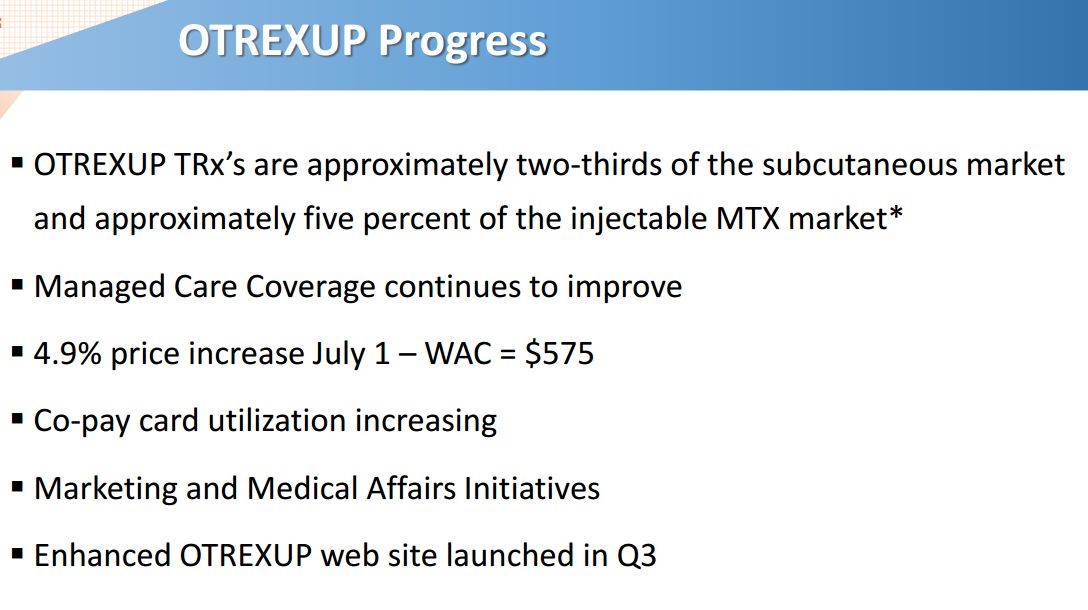

Antares also presented an additional slide to illustrate the progress made in 2015 on Otrexup. The key point of this slide is that Otrexup is garnering about two-thirds of the market for subcutaneous methotrexate products (there are only two, Otrexup and Rasuvo) nearly one year after the Rasuvo launch. Also important to note is that these two products have only captured 5% of the injectable market indicating that intramuscular injections have 95%. This is the key initial target for these products and suggests that there is a lot of upside potential for both.

AB Rated Generic to Epi Pen

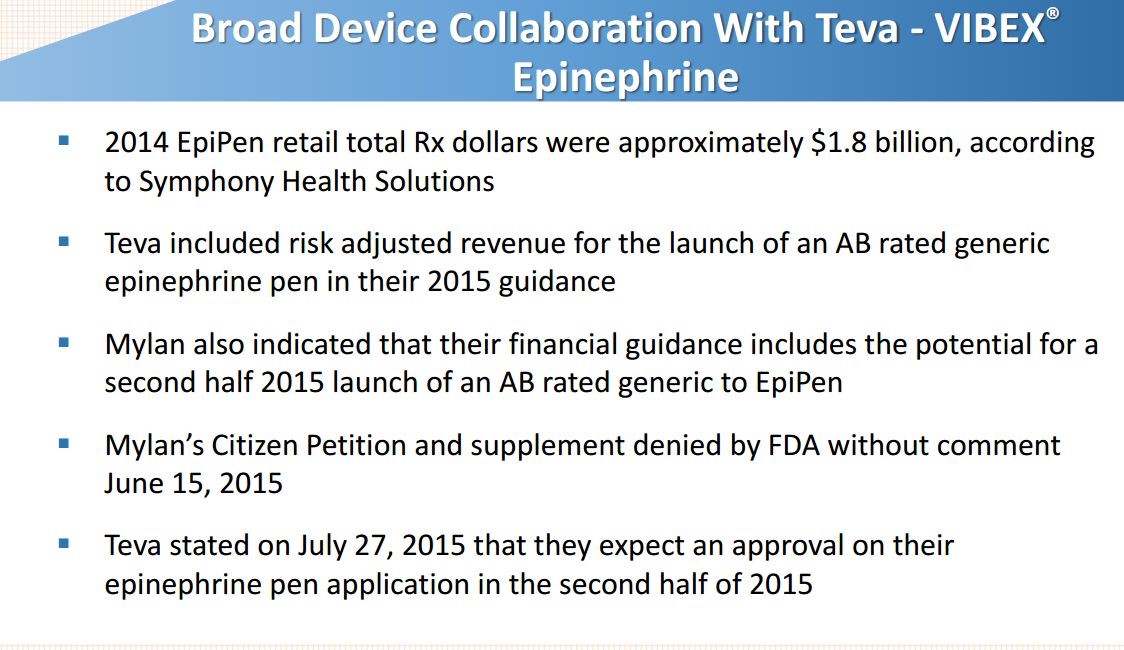

I believe that Antares is trading as if investors believe there is little chance of approval for the AB rated version of EpiPen. However, a chart in the Antares presentation strongly indicates that Teva, Mylan and Antares (the three parties involved) all expect approval before the end of 2015.

In looking at the potential penetration of the AB rated version, it is important to understand that with an AB rating, the pharmacist can substitute the AB rated product when a prescription of EpiPen is presented. This is in turn a function of what the patient’s insurance carrier chooses to reimburse for. Hence, the decision on which product will be used to fill the prescription is a function of decisions by the insurance carrier and the pharmacist, not the physician or patient. It is of course possible for the patient to pay for EpiPen out of pocket rather than accept the substituted product, but this is likely to be rare.

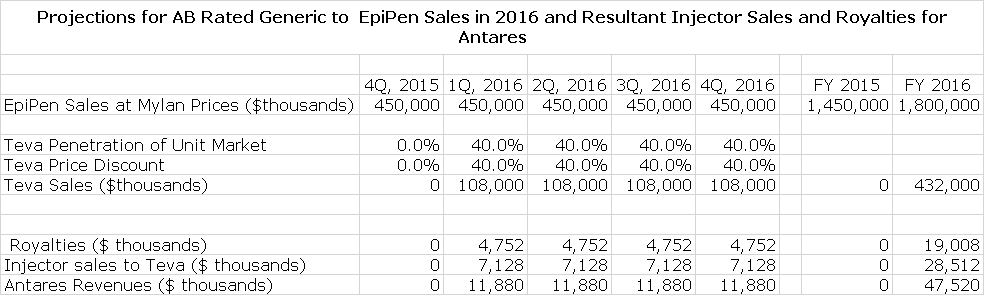

Sales Model for AB Rated Generic to EpiPen

Teva reached a patent settlement with Pfizer (PFE) that will allow the launch of this product on June 15, 2015. Pfizer owns the product, but Mylan (MYL) markets it. An AB rating from the FDA allows pharmacists to substitute Teva’s generic for EpiPen. With an AB rating, the Teva generic could quickly capture a significant share of the market. Without the AB rating, Teva would be forced to market it as a new product and would have to devote considerable resources to establish sales; the commercial potential would be much less.

EpiPen sales are currently at a run rate of $1.8 billion according to Antares as Mylan has aggressively raised prices in anticipation of the AB rated generic launch Mylan has said that if the Teva product obtains an AB rating that it believes that the generic can capture 40% of the market. This is based on the anticipation that Teva will be the only entrant in the market for some time and will not aggressively cut price. With these assumptions, I think that Teva could achieve sales of $432 million in 2016 based on gaining a 40% share of the unit market and offering a 40% discount. Because of the difficulty in obtaining an AB rating versus EpiPen, it may be the case that Mylan and Teva could be the only entrants in this market for some time.

Antares has given guidance that through sales of the auto-injector to Teva and royalties that it will achieve sales equivalent to roughly 10% to 12% of Teva’s sales or roughly $48 million if Teva’s sales reach $432 million. Antares has not given guidance, but I estimate that 60% of these revenues or roughly $48 million will be due to product sales and 40% or $19 million will come from royalties. Assuming a gross margin of 50% on product sales, this would result in a gross profit of $24 million. The combination of $24 million of gross profits and $19 million of royalties would produce $43 million of annualized pretax profits for Antares.

All of my assumptions results in the following sales and profit projections:

Antares Sales and Profit Model for 2015 and 2016

The following table shows my detailed sales and profit projections for 2015 and 2016. Of the $87 million of estimated sales, about 80% comes from Otrexup and the AB rated generic to EpiPen.

Tagged as AB Rated Generic to EpiPen, Antares Pharma Inc., ATRS, otrexup + Categorized as Company Reports

Thanks so much for the update. In the last Antares presentation, a question was asked about epipen injectors being sold to teva and the presenter stated that teva had recently said to bring another contract manufacturer online to increase the number of injectors delivered. He stated that teva wants as many injectors as quickly as they can get them. The FDA had a meeting with Mylan in July, if I rember the date correctly. The meeting was titled epipen, two important Mylan corporate management and several Mylan lawyers. FDA had their top people there and several lawyers. The only conclusion for the meeting was to discuss what Mylan would do when FDA approved AB rated generic. Why else would they need a meeting with lawyers, or meet at all, if the FDA was not going to give it an AB rating.

Thanks for the input. I have very high expectations that the product will be approved with an AB rating.

ANTARES / PFIZER AGREEMENT TERMINATION

So Larry:

“.. the product Pfizer was developing failed to meet pre-specified endpoints in a clinical study. Accordingly, the Agreement will terminate on November 5, 2015. ”

Any thoughts to that news?

In my thinking I have attributed no value to the Pfizer product. The critical operating elements of the story are the Otrexup launch trajectory and the potential approval of the AB generic to EpiPen. The key pipeline product elements are QST (testosterone active pharmaceutical ingredient) and QSM (active API unspecified) and AB rated generics to exenatide and sumatriptan. The Pfizer product was not even a smudge on my radar screen.

The stock has also had to absorb on going significant liquidation by their largest institutional holder, Deerfield Mgmt, who, as of 9/30/15, owned 15.45mm shares (~10% of outstanding) – appears as “Beneficial Owner Flynn, James E” – most recent sale 1.83mm shares reported on Sept 30. Back on a May 13, 2015 filing, they owned over 21.5mm shares, likely having participated in the company 23mm share offering on May 11, 2015. In addition, the number of shares sold short since May 29, 2015 has risen by approximately 2.5mm shares. Thus there has been approximately 8.5mm addtional shares available to the market since the May offering by the company. No doubt this supply has been a factor in the stock weakness.

Without further news from the FDA or the company, both Teva and Mylan will be reporting thier Q3 results on October 29 and 30, respectively. I would guess that both will provide updates on thier views of the Epi situation.

Sounds probable

Larry, any speculation as to the product or partner for the LCM product, or when it may be disclosed?

Sorry no

It appears from the most recent TEVA conference call that TEVA no longer expects a formal launch of the generic epipen until the 2nd half of 2016. Furthermore, due to the backlog at the FDA, they expect the FDA to probably issue a CRL by the end of 2015 to give the FDA some additional time to further evaluate TEVA’s ANDA for an A-B rated Epipen, casting more doubt on whether an A-B rating will be issued and when it will be issued. Do you think it is likely that ATRS will need to raise additional cash if such delays occur?

Larry.. can you please help decipher from Teva’s cc?

“Which to all of you mean that the delay in launch will be until probably second half of 2016. Simply we are not far along in the review of EpiPen, but we can expect approval by year end. Nothing new has happened. There’s no negative feedback. But simply based on the review, the status of the review, our assumption is that we will get a complete response letter, which will mean at least a 6 months delay into 2016.”

Are they expecting approval or CRL? I’m confused.