Antares Pharma: The Xyosted Launch Continues to Look Good (ATRS, Buy, $3.37)

Investment Thesis

The cornerstone of my positive investment thesis for Antares is Xyosted, which was fully launched in January 2019. While it is early, I believe that the prescription trends seen over the last six months strongly indicate that the launch will be a success. In this report, I explain the methodology, I used to build a sales model for Xyosted. This model projects FY 2019 sales of $16.8 million which is almost exactly the same as Wall Street consensus. My 4Q, 2019 sales estimate is $7.5 million or $29 million on an annualized basis. My preliminary estimate for 2020 sales is $40+million. I have tried to be conservative on my estimates for prescription trends and net pricing so there may be upside to my numbers.

A number of analysts who closely follow Antares are projecting peak sales of $200 million. This would represent about 10% of the US testosterone supplementation market as measured on a sales basis. Given the strong points of differentiation for Xyosted such as superior pharmacokinetics, ease of injection and virtually no pain on injection, this seems highly achievable and most likely conservative.

How is the Xyosted Launch Going?

Biotech analysts approach new product launches with trepidation as most prove to be disappointing. This is due to reimbursement hurdles that grow more challenging every year and also slow adoption by physicians. The latter is caused in part by doctors not wanting to get caught up in reimbursement hassles that disrupt their office. Physicians often wait until reimbursement procedures are firmly in place before committing to a new product. They also may take a more conservative wait and see approach because of concerns that clinical trials used to gain approval may be too small to truly establish the benefits and risks of a new drug. Many physicians await broader experience in real life before incorporating a drug into their practice.

These hurdles can be even more difficult for a small and unknown company like Antares to confront. However, physician concern about what they know and don’t know about Xyosted is diminished because the clinical use of testosterone supplementation is well known. They understand that the efficacy and safety profile of these products is all about the pharmacokinetic profile which is the major point of positive differentiation for Xyosted. This suggests that the major hurdle that Xyosted has to confront is gaining reimbursement. The injectable testosterone market is dominated by generic products, but Xyosted is priced competitively to them and rebates and discounts with Xyosted are comparable to generics. This may make the reimbursement hurdle less steep.

Building a Sales Model for Xyosted in 2019

Management’s public statements about Xyosted have been quite encouraging and the prescription trends seem to be building very nicely. It is challenging to project prescription trends and net price this early in the launch. However, the objective of this report is to present a plausible model for projecting 2019 sales. Here are the assumptions I am using.

New Prescriptions Trends:

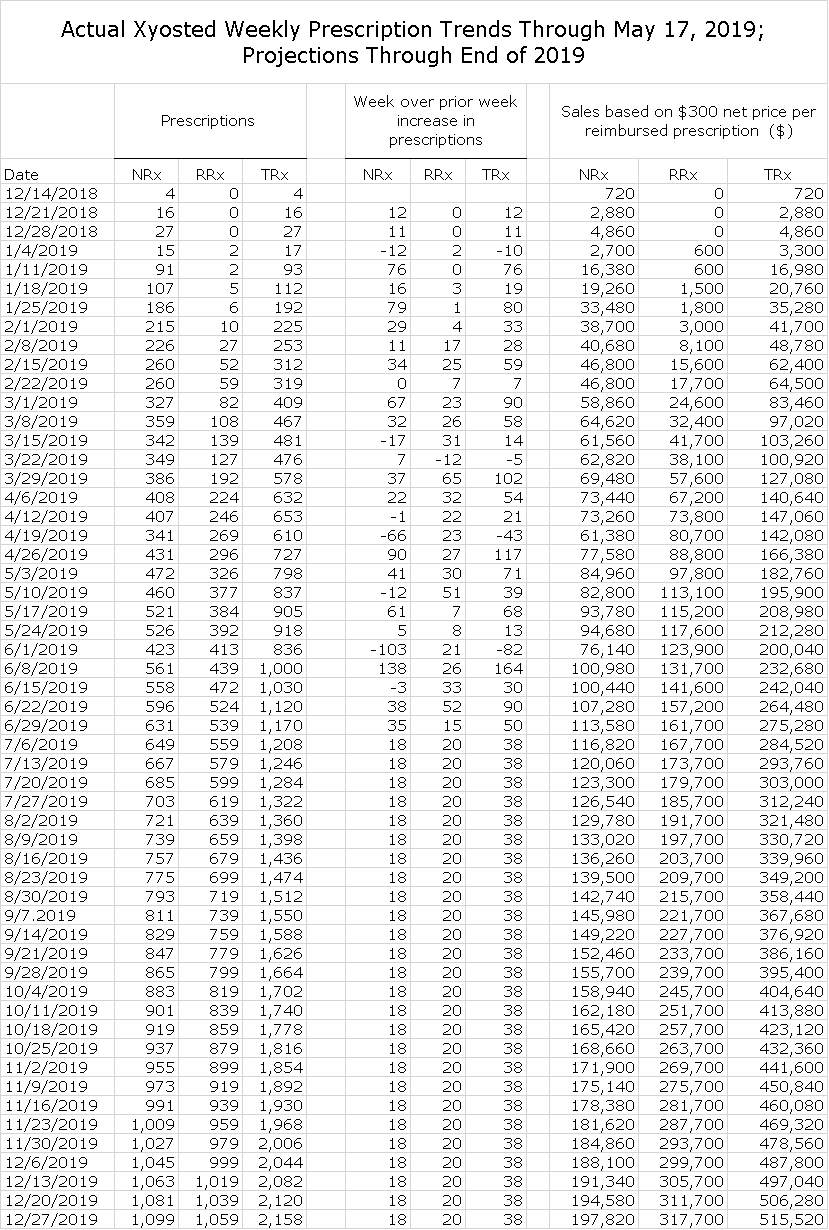

- New prescription trends have been volatile. For example, in the week ending 4/26/2019, there were 90 more new prescriptions written than in the prior week. However, for the week ended 4/19/2019 there was a sequential drop of 66. In the week ending June 1, 2019, there was a sequential drop over the prior week of 103 (this was over Memorial Day) and then for the week ended June 8, 2019 there was a sequential increase of 138.

- If you look at the average weekly sequential increase in new prescriptions for the period beginning 2/1/2019 and ending 6/29/2019, the average sequential increase for each week was 20 NRx.

- My best guess is that the sequential weekly increase will increase steadily as the year progresses. In my model, I hope I have taken a conservative approach as I have assumed a constant sequential increase of 18 for each week over the period ending 12/27/2019.

Refilled Prescription Trends:

- Refilled prescription trends have been somewhat less volatile. Only for the week ended 3/22/2019 was there a sequential decline of 12. All other weeks showed increases.

- The average weekly sequential increase in new prescriptions for the period beginning 2/1/2019 and ending 6/27/2019, was 24.

- In my model, I assume a sequential increase of 20 for each week over the period ending 12/27/2019. As with NRx, my expectation would be for a steady increase in the sequential increase in RRs as the year progresses. I think that 20 is conservative.

- A significant uncertainty in projecting refills is how long patients will remain on therapy. Testosterone supplementation therapy may not be viewed by patients as being as important or essential as say a drug for hypertension. Some patients will drop out after the first or first few prescriptions.

Price of New Prescription:

- The WAC price of Xyosted for a four week supply or four injections is $475. I estimate that Antares will use couponing, co-pay buy downs and other techniques to reduce out of pocket expenses for patients. This could reduce the WAC price by as much as $125 in some, but by no means all situations. This is intended to make the out of pocket cost to the patient the same as for a generic.

- In addition to price reductions for patient support, there will be rebates paid to managed care. It is extremely difficult to estimate what the net price might be, but some knowledgeable sources suggest that early in a launch it could be as low as $300 per prescription and this is the estimate I am using.

- Antares starts each patient with the first weekly injection being administered for free in the physician’s office. The patient then returns to the physician’s office. They are then sent home with another injector for the second week of treatment at no cost. Presumably at this time, a new prescription is written for a month of therapy.

- This give Antares two weeks to try to gain insurance coverage for the patient. If the coverage is not received within two weeks, Antares gives a free sample for one month of drug.

- Antares reported that at the close of the first quarter that about 60% of new prescriptions were being reimbursed.

- This 60% ratio was improving, according to management, as they entered the second quarter. I am assuming that this ratio holds for the balance of 2019. The ratio of 60% of new prescriptions being reimbursed could increase as the year progresses. However, I am using 60% in my model as an effort to be conservative.

- Xyosted now has coverage for 50% of managed care lives and the ratio is expected to increase to 70% by year end.

Price of Refilled Prescription:

- I am assuming a net price of $300 per refilled prescription.

2019 Sales Projections Resulting from the Model

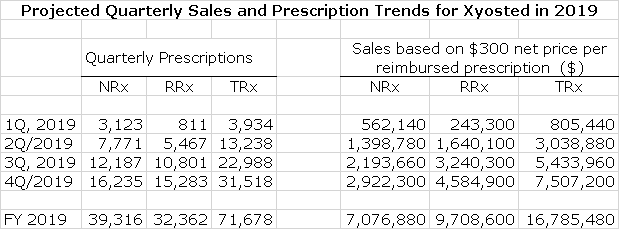

All of these calculations are shown for every week through the end of the year in a table in the appendix of this report if you want to check my calculations. I have summarized the results on a quarterly basis in the following table. Because there are many difficult to make assumptions, there are significant error bars around these numbers and as the year unfolds, I may have to make some meaningful changes in assumptions. However, I have tried to be conservative based on the information that I know. The end result is that I am projecting sales of $3.04 million in 2Q, 2019, $5.43 million in 3Q and $7.51 million in 4Q.

Based on management comments, I think that actual sales of Xyosted in 1Q, 2019 were about $700,000 to $800,000. It is encouraging that my model showed a projection of $805,000.

I am not including any detailed estimates at this time on 2020 sales. However, if you simply annualize the projected 4Q, 2019 sales estimate of $7.5 million, the run rate of annual sales going into 2020 would be $29 million. I would expect sales to be meaningfully larger than this as there should be continued sequential increase in new and refilled prescriptions in 2020. As a guess, I think that if 2020 sales could be over $40 million.

Current and Future Potential Market Share of Xyosted in the Testosterone Supplementation Market

To get an insight into Xyosted’s market position, let’s look at the fourth quarter annualized run rate to gage Xyosted’s market share. The dollar size of the testosterone supplementation market is $2.0 billion and is growing at about 5% per annum with generic, intramuscular injectables accounting for $1.5 billion. The remaining $500 million is principally gels. Xyosted could potentially take share from both. The net price of Xyosted is comparable to generics so that its addressable dollar market is also around $2.0 billion. I am projecting that Xyosted will achieve sales of $7.5 million in 4Q, 2019 which is $29 million on an annualized basis which is a tiny 1.5 % of the addressable market based on sales.

There are 7.2 million prescriptions written annually and the annualized prescription rate for Xyosted based on 4Q, 2019 projections is 30,000 or o.4% of the market. Management has not given guidance but as I mentioned earlier, $200 million is often thrown about as a peak sales number. This would represent about 10% of the addressable market as measured by sales. Given the superiority of Xyosted, this seems quite low.

Appendix

The following table shows weekly prescription trends based on audits for the period ending June 29, 2019. Using the assumptions previously described, I have then made projections through the week ending December 27, 2019.

Tagged as Antares Pharma Inc., Xyosted launch + Categorized as Company Reports, LinkedIn

Yet the stock sells off AGAIN. When Mr. Smith do you begin to question the role of management that has been average to bad to say the least? Since your article the stock again gets on a roll. Selling off 8 out of the 9 previous days. How many of these runs have we seen? Let me tell you….Plenty of them.